-

Achieve long-term financial success

Our portfolio approach improves your potential of achieving your wealth and financial goals

Constructing your portfolio

A portfolio approach fosters discipline and avoids key behavioural biases, such as reacting to short-term market moves, which can hurt investment returns. We believe investors should have a diversified portfolio as a starting point in their investment plan.

1. Get your asset allocation right

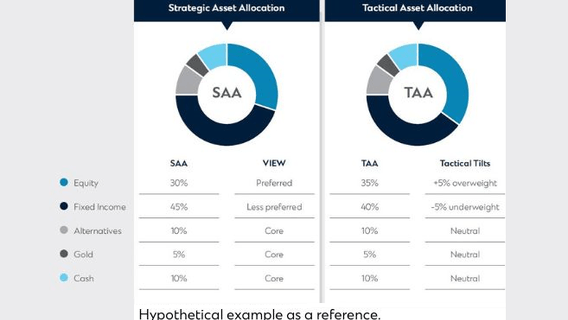

Using 7 year capital market assumptions, we derive optimal allocations to asset classes delivered through our Strategic Asset Allocation (SAA) models.

SAA models are then adjusted to incorporate our 6-12 month CIO house views to form the Tactical Asset Allocation (TAA) models.

Tactical Asset Allocation:

Tactical over or under-weight tilts are made to the SAA to take advantage of market trends or expectations to create our TAA.

This enhances returns and can reduce volatility by providing an active overlay to fine-tune asset allocation.

2. Differentiation between SAA and TAA

SAA is an important determinant of long-term expected returns, especially in a long-only portfolio. It also offers a structured way to investment planning, guiding the allocation to each asset class, which helps to mitigate certain behavioural biases, such as over trading, excessive euphoria or pessimism. Our SAA models are diversified with the aim of producing a reasonable risk and return trade-off over a full business cycle. They are targeted to be efficient and produce the highest estimated return per unit of risk assumed, based on the long-term CMA’s risk and return assumptions.

TAA value-adds to enhance returns or reduce portfolio volatility by providing an active overlay to adjust or fine-tune asset allocation, taking advantage of market trends expected to play out over the next 6-12 months. Investors can take advantage of opportunities in assets which are experiencing extreme pessimism to tactically increase allocation, while taking profits during periods when assets are experiencing euphoria.

3. Create a Foundation portfolio

We believe every investor, when building their portfolio, should start with a strong Foundation Portfolio.

A Foundation portfolio is robust, stable and diversified. It is tailored to your circumstances and goals, and delivers returns through investment cycles.

We build Foundation Portfolio’s using our Tactical Asset Allocation (TAA) as a guide.

4. Add the right mix of Opportunistic ideas

Opportunistic ideas are narrower in focus and shorter term. They are used to add income, diversify or take advantage of short term moves in markets.

- Examples include sector or industry focused investments, single securities, currencies, commodities, structured solutions and thematic ideas

- The higher your risk tolerance or experience, the more comfortable you may be investing in Opportunistic ideas

How much to allocate to Foundation vs Opportunistic ideas is unique to each investor. At different life stages, your risk appetite and investment preferences may change, which our advisory approach is flexible to accommodate.

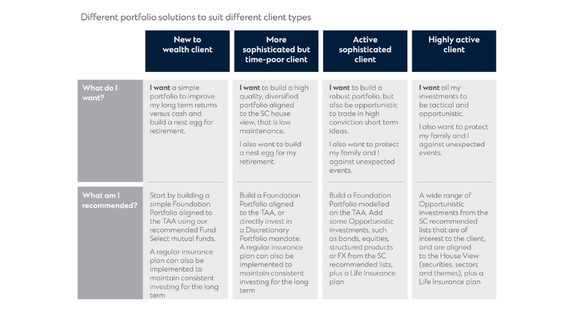

5. How different portfolio solutions suit different client types

We also acknowledge that at different life stages, your risk appetite and preference for certain asset allocations may change.

The decision of how much to allocate to Foundation versus shorter term Opportunistic ideas is unique to each investor.

The table provides indicative allocations & depends on the type of investor you are, level of activity you wish to undertake on your portfolio, risk appetite & financial goals.

Additional considerations when building your portfolio

Access our wealth solutions

SC Wealth Select

Grow, manage and protect your wealth

Purpose

Grow and manage your wealth for yourself, your family and beyond

Principles

Guiding principles to manage, grow and protect your wealth

Get our latest market insights and reports

Explore our breadth of leading unbiased investment insights designed to help you navigate today’s complex investment landscape.