7 Oct 2024

This article is for informational purposes only.

It’s time to rethink cash as the Fed cuts rates

💸 Cash yields are likely to move significantly lower

Yields on cash over the past two years have been among the highest in over two decades. However, this period is now coming to an end. Money markets and the Fed’s own projections argue cash yields are likely to move significantly lower over the coming 6-12 months. Many have experienced the impact of falling rates on returns.

📉 Policy rates may decline to below 3% by end-2025

In September, the Fed cut rates for the first time in over four years, ending the post-COVID hiking cycle. This shift bears important implications for cash. Cash yields, like those on US 1–3-month Treasury bills, tend to follow Fed rates closely, and as markets expect policy rates to decline to below 3% by end-2025, cash yields will likely follow.

⚠️ Reinvestment risk

For short-term securities such as cash, this means the same level of yield will no longer be available once the securities mature and the reinvestment of matured assets will likely return less than before. This is known as reinvestment risk. It is thus imperative to address this risk before yields fall, not after when it is too late.

Time to explore ways to enhance yields and boost passive income!

Passive income ideas for you:

💡 Check out our list of Signature CIO Funds available on Fund Library:

| Fund Name |

| Signature CIO Income Funds

• Aims to generate regular income by investing in a diversified portfolio of income generating securities globally • Aims to generate capital appreciation over a mid to long-term investment horizon by accessing opportunities across multiple asset classes |

| Signature CIO Conservative Funds

• The fund seeks to generate income over a mid to long-term investment horizon. • The fund invests substantially into fixed income securities and money market funds which offers smoother returns with potential downside-risk protection |

| Signature CIO Balanced Funds

• The fund seeks to achieve moderate growth through capital appreciation and income accumulation over a mid to long-term investment horizon • The fund invests a similar amount into equities and fixed income, with a slight tilt to equities. It also invests in commodities and alternatives • Balanced allocation between equities and fixed income aims to provide upside returns while mitigating drawdowns |

| Signature CIO Growth Funds

• The fund seeks to achieve moderate growth through capital appreciation and income accumulation over a mid to long-term investment horizon • The fund invests a similar amount into equities and fixed income, with a slight tilt to equities. It also invests in commodities and alternatives • Balanced allocation between equities and fixed income aims to provide upside returns while mitigating drawdowns |

Take 2 minutes and get to know what Signature CIO Funds are

💡 Explore life insurance plans to protect your love ones and plan for your future

There are life insurance plans offering both regular income and life protection with features such as the following:

• With 3 or 5 years of annual premium, receiving non-guaranteed monthly income up to 4% p.a. of total premiums paid until first life assured reaches 150

• Apart from monthly income stream, total cash value of the insurance plan grows through the policy years for wealth accumulation and family protection

Get in touch for a comprehensive financial planning

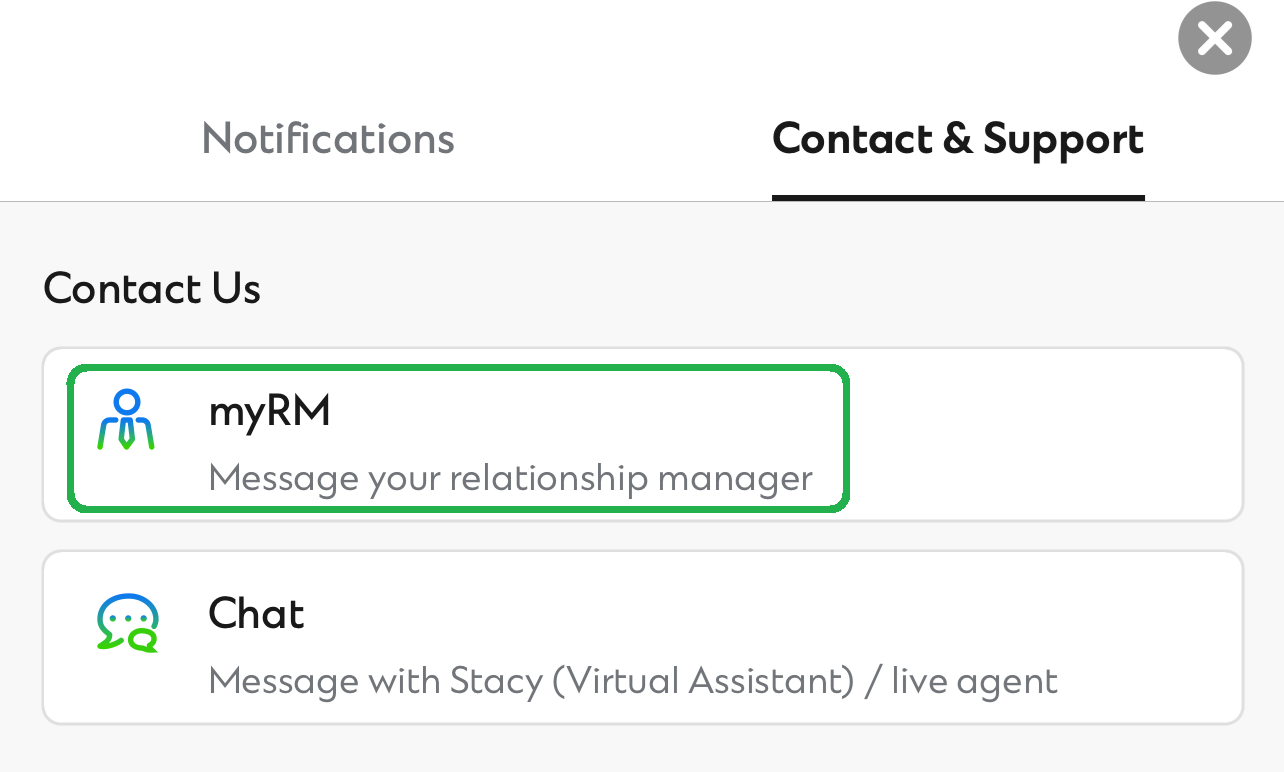

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not currently have an Investment Fund Account, follow the 4 easy steps to start investing now: