Dow tipping 40,000 milestone – What was the average annual return of US stocks over the past 10 years?

20 June 2024

This article is for informational purposes only.

The past decade has seen the financial markets weathering the Sino-US trade war, a global pandemic, the Federal Reserve’s unprecedented pace of interest rate hikes, and escalating geopolitical tensions. Amidst such turbulence, it may seem prudent to avoid investing.

However, the reality tells a different story. Over the past 10 years, US stocks have delivered an average annual return exceeding 10%. Furthermore, if the dividends received were continuously reinvested, the total return would have surpassed 2.2 times. To illustrate, a $100,000 investment made in 2014, held steadfastly without succumbing to market volatility, would have grown to over $320,000 by 2024. In fact, this year the Dow Jones Industrial Average has reached a historic high above 40,000 points, and we remain overweight the US equity market.

The purpose here is not to encourage exclusive focus on US equities, but rather to convey an important financial principle: the merits of staying invested. By maintaining composure and holding onto investments, coupled with the power of compounding, one can potentially generate surprising results without being unduly influenced by market fluctuations.

Of course, past performance does not guarantee future outcomes. Investing inherently carries risks, and individuals should carefully evaluate their personal risk tolerance when devising appropriate investment strategies.

With the US stock market at its peak, grasp this golden investment opportunity to start trading US stocks! New US securities clients will enjoy unlimited $0 brokerage fee for U.S. securities buy trades in the first month of trading and the subsequent 3 months to reduce the investment cost and capitalise on the US stock boom. Promotional period is limited. Terms & conditions apply. Please click here for more details.

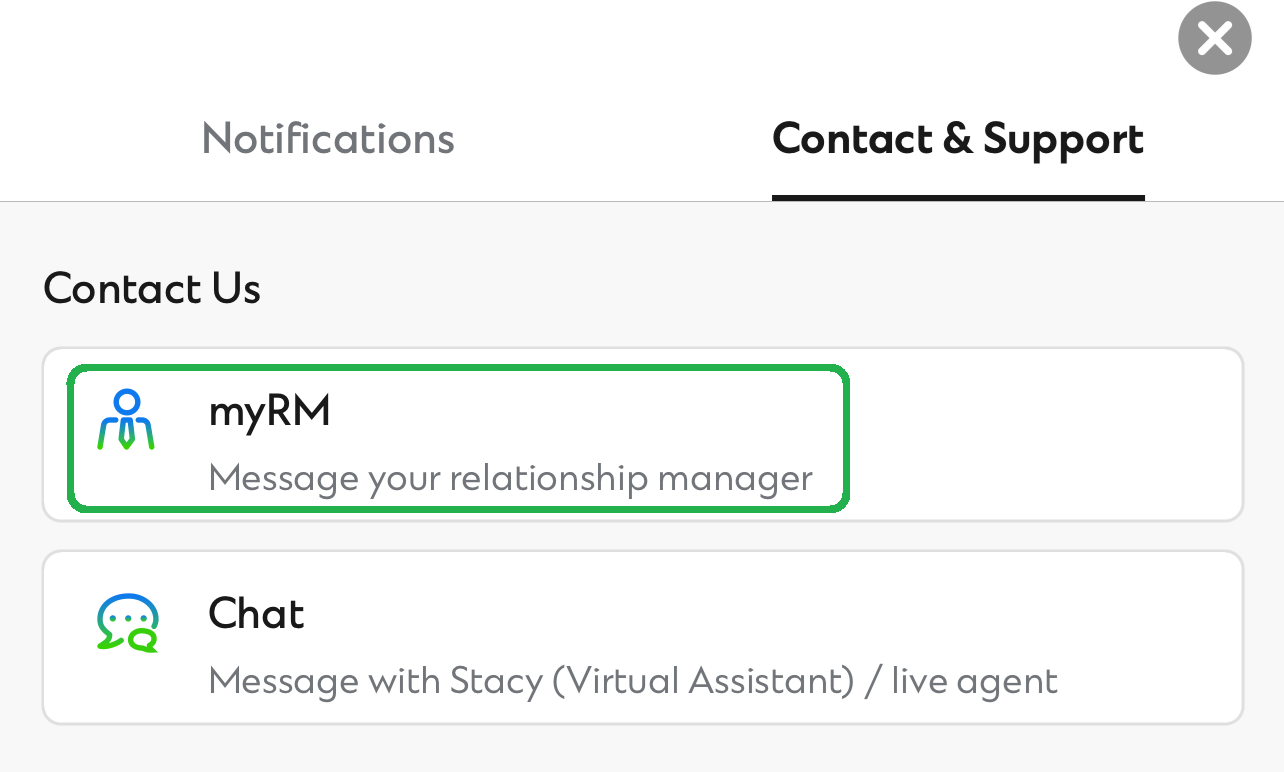

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not currently have a Securities Account, follow the 3 easy steps to start trading in Hong Kong, China and U.S. stock markets. now: