10 July 2024

This article is for informational purposes only.

The Hang Seng Index has gone through a roller-coaster ride in the first half of 2024. The Index plunged 12% to below 15,000 in January, but then reversed course and soared over 30% to 19,636 in mid-May when Chinese authorities supported the property sector with new policies. Will the Hong Kong equities rebound and regain momentum, or remain volatile in the second half of the year?

Since economic trends remain mixed, the Index has been in consolidation of late. With policy boosts providing increased downside support, our base case now projects the index to trade to a range of 18,000 – 20,000 (our prior bull case) in 12 months, against the increasingly challenging geopolitical environment and multiple important elections around the world.

Any significant upside surprise in domestic policy help, more aggressive Fed rate cuts, and/or a less-than-feared escalation of U.S.-China tensions ahead of U.S. elections could lift the index to our bull case range of 20,000 to 22,000.

In this environment, balanced foundation allocations comprising equities, bonds and alternative assets are likely to outperform. Meanwhile, investors can explore multiple opportunities in Asia, including Chinese non-financial high dividend SOEs, Japanese banks, Indian large cap and Taiwanese equities.

Browse our list of Asian Equity Funds to seize market opportunities.

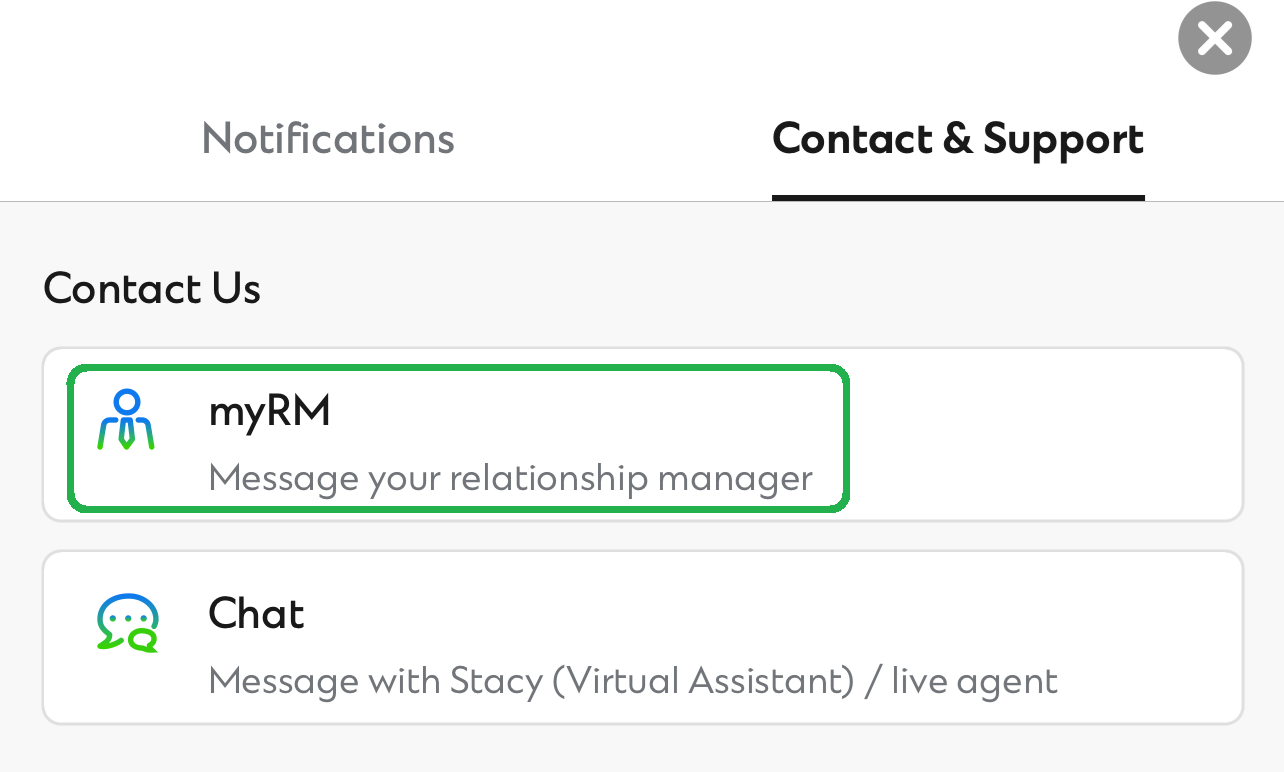

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not have an Investment Fund or Securities Account, follow these 4 easy steps to get started: