23 Oct 2024

This article is for informational purposes only.

When cash returns are lower, how to enhance income strategies during the early rate cut phrase?

📈 Good Opportunity when the US bond yield rebounds to 4%

Global central banks has begun their rate cut cycles, and the Fed is likely to cut rates further over the next 12 months. Cash returns may fall significantly. While the U.S. 10-year bond yield recently rebounded to 4%, this provides a good opportunity to average into it.

🎯 Make the most of the early rate cut period

Market volatility generally increases ahead and after the US election, and it is necessary to increase deployment to enhance defensiveness. To reference the economic soft-landing periods of 1995 and 1998, bonds recorded positive returns within 12 months after the Fed cut rates for the first time, while the returns in the first 6 months after rate cuts are higher.

📊 Diversify Bond Portfolio

Within bonds, DM high-yield bonds and EM USD bonds had average returns of more than 15% and 26% within 12 months the first rate cut and the economic soft-landing period. The resilience of the U.S. economy supports riskier credit assets. Investment diversification helps to seize economic soft-landing opportunities.

There is more than one way to earn interest. It’s time to seize rate cut early opportunities, explore methods other than cash to maximise returns!

Income-earning ideas for you:

💡 Check out the list of high dividend fixed income funds available on Fund Library:

| Fund Select |

UT Code |

Fund Name |

Asset Class |

Last 12 months dividend yield |

|

UT3756 | [HY] BGF Asian High Yield Bond Fund A6 (USD) (M Cash Dis) | Fixed Income | 9.80% |

|

UT3597 | Manulife GF Pref Securities Income R (G)(USD)(M Cash Dis) | Fixed Income | 9.44% |

| – | UT2790 | Templeton Emerging Markets Bond A (USD) (M Cash Dis) | Fixed Income | 8.95% |

| – | UT3726 | UBS (HK) Asia Income Bond (USD) A (USD)M Cash Dis | Fixed Income | 7.85% |

|

UT2412 | [HY]AB FCP I Gb High Yld Ptfl AT(USD)(M Cash Dis) | Fixed Income | 7.15% |

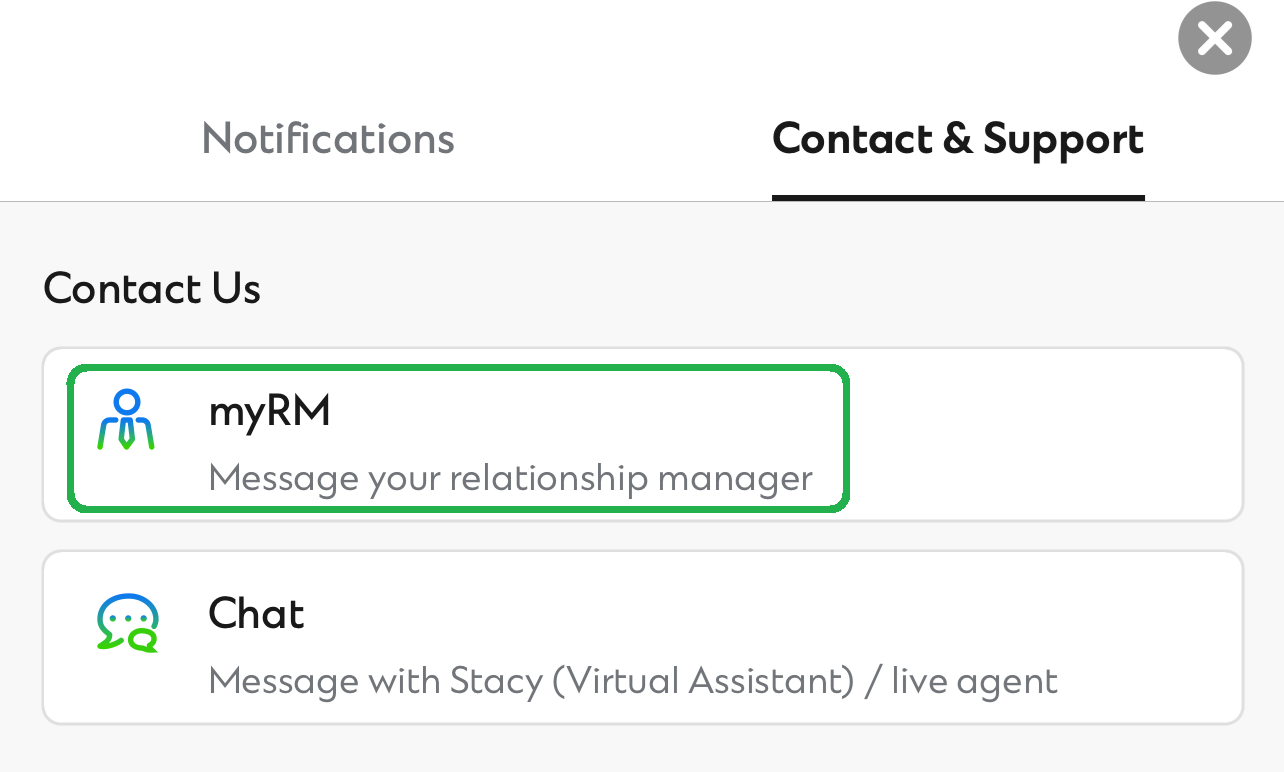

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not currently have an Investment Fund Account, follow the 4 easy steps to start investing now: