23 Aug 2024

This article is for informational purposes only.

While holding cash may seem safe, the reality is that we are all vulnerable to the insidious “cash thief” known as inflation. Rising prices steadily erode the purchasing power of your money – a harsh reality that has become strikingly clear in recent years.

The latest inflation rate in Hong Kong climbed to 2.5%. What’s more, should the annual average inflation rate slightly increase to 3%, the purchasing power of USD 1 million today will further drop to USD 640,000 in just 15 years, reflecting a staggering reduction of over 30%.

Retirement spans decades, during which, inflation can relentlessly chip away at your hard-earned savings. Every aspect of your retirement – from housing to daily expenses to leisure activities – is at risk. Without adequate protection against inflation, your capacity to cover essential costs or enjoy life in retirement will progressively decline.

Therefore, formulating a robust financial plan and enabling your assets to grow steadily through passive income is crucial in defending the purchasing power of your cash and protecting your retirement. Looking for ways to earn stable income?

Explore saving insurance to plan for your future

There are life insurance with savings plans offering guaranteed returns and life protection with features such as the following:

• With just 5 years of premium payment, locking in a 15-year annualised 3.21% p.a. guaranteed return at maturity with peace of mind or up to annualised 3.9% p.a. guaranteed return at maturity when you choose the option to prepay upfront all premiums

• Safeguarding your family with a Death Benefit and different Death Benefit Settlement Options

Get in touch for a comprehensive financial planning

Check out our list of Signature CIO Funds available on Fund Library:

| Fund Name |

| Signature CIO Balanced Funds

• The fund seeks to achieve moderate growth through capital appreciation and income accumulation over a mid to long-term investment horizon • The fund invests a similar amount into equities and fixed income, with a slight tilt to equities. It also invests in commodities and alternatives • Balanced allocation between equities and fixed income aims to provide upside returns while mitigating drawdowns |

| Signature CIO Growth Funds

• The fund seeks to achieve moderate growth through capital appreciation and income accumulation over a mid to long-term investment horizon • The fund invests a similar amount into equities and fixed income, with a slight tilt to equities. It also invests in commodities and alternatives • Balanced allocation between equities and fixed income aims to provide upside returns while mitigating drawdowns |

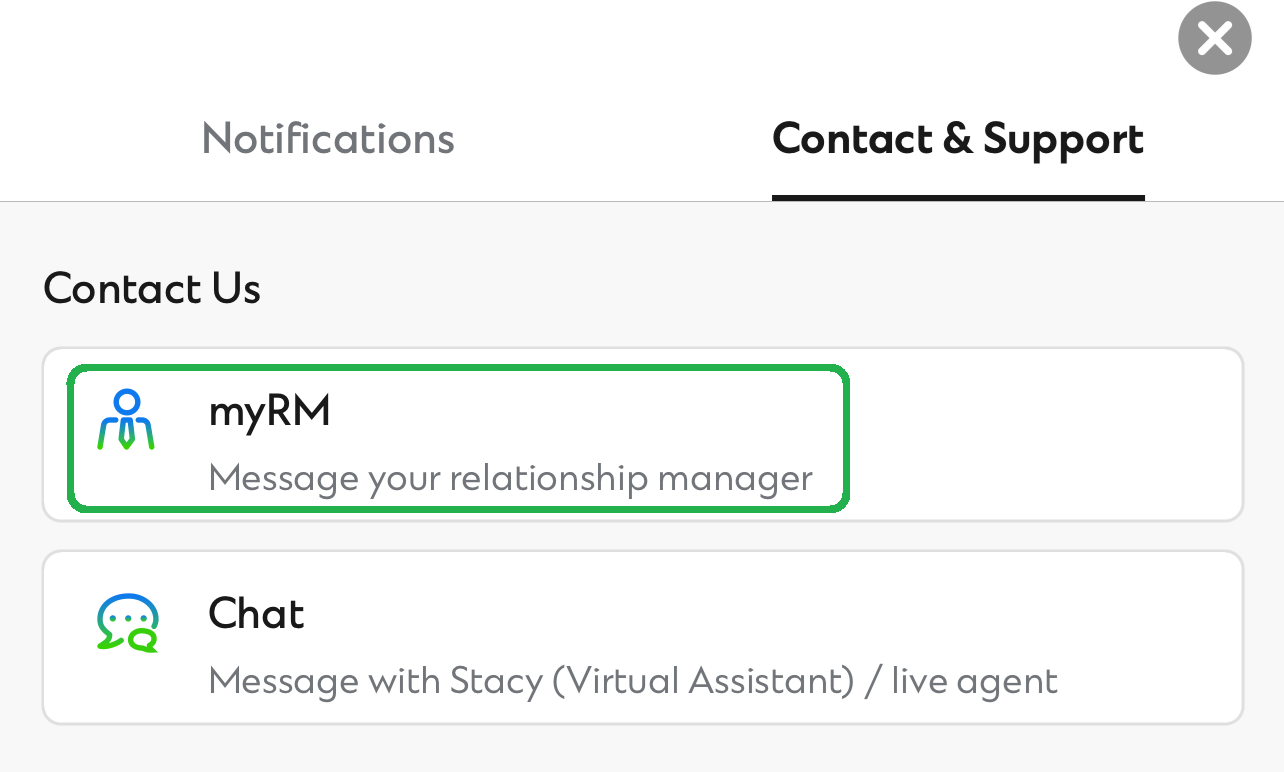

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not currently have an Investment Fund Account, follow the 4 easy steps to start investing now: