16 Sep 2024

This article is for informational purposes only.

Can you achieve financial freedom and live the life you envision sooner? True financial freedom allows you to break free from the usual 9-5 as you continue to generate passive income, even if you are on the other side of the world. This gives you more time to do what you love while also achieving financial independence.

For example, if you invest HKD1 million in a sustainable dividend-paying product with a 5% p.a. dividend rate, your investment will yield HKD50,000 per year. It’s akin to being rewarded with a free vacation! You can also reinvest the earned interest to grow your wealth further. When your assets grow by 20 times your annual salary and your investment portfolio yields around 5%, you can effectively replicate your yearly income, which is enough to cover all your daily living expenses.

For those looking to build a passive income through investing, mutual funds are a worthy consideration. With a minimum investment threshold of just HKD1,000 per month, mutual funds offer a much lower entry point compared to purchasing a single stock or investing in real estate.

The Chief Investment Office (CIO) at Standard Chartered has curated a range of investment strategies tailored to investors’ risk tolerance. These strategies focus on generating regular returns through globally diversified asset portfolios and are dynamically adjusted based on market conditions to ensure optimal asset allocation.

Check out our list of Signature CIO Funds available on Fund Library:

| Fund Name |

| Signature CIO Income Funds

• Aims to generate regular income by investing in a diversified portfolio of income generating securities globally • Aims to generate capital appreciation over a mid to long-term investment horizon by accessing opportunities across multiple asset classes |

| Signature CIO Conservative Funds

• The fund seeks to generate income over a mid to long-term investment horizon. • The fund invests substantially into fixed income securities and money market funds which offers smoother returns with potential downside-risk protection |

| Signature CIO Balanced Funds

• The fund seeks to achieve moderate growth through capital appreciation and income accumulation over a mid to long-term investment horizon • The fund invests a similar amount into equities and fixed income, with a slight tilt to equities. It also invests in commodities and alternatives • Balanced allocation between equities and fixed income aims to provide upside returns while mitigating drawdowns |

| Signature CIO Growth Funds

• The fund seeks to achieve moderate growth through capital appreciation and income accumulation over a mid to long-term investment horizon • The fund invests a similar amount into equities and fixed income, with a slight tilt to equities. It also invests in commodities and alternatives • Balanced allocation between equities and fixed income aims to provide upside returns while mitigating drawdowns |

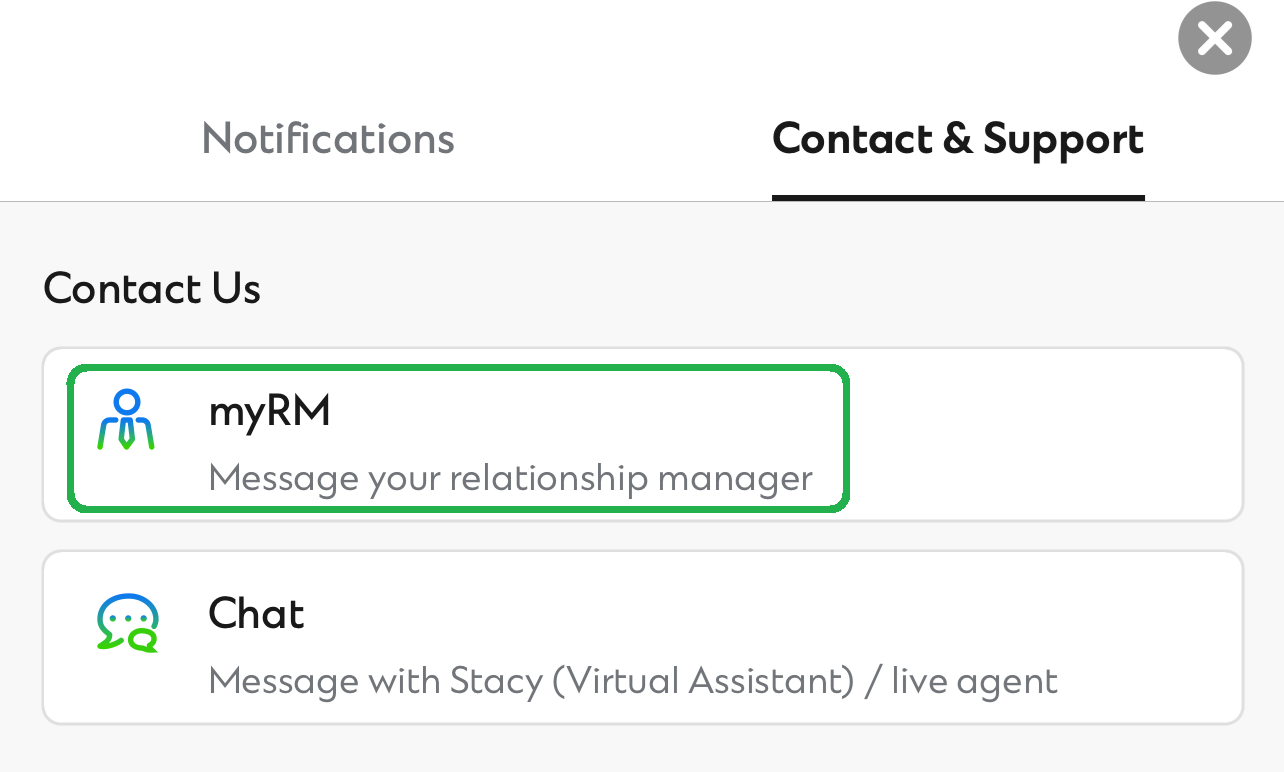

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not currently have an Investment Fund Account, follow the 4 easy steps to start investing now: