7 June 2024

This article is for informational purposes only.

This year, the Japanese stock market has surged over 10% in just a few months – hitting new highs in over 30 years and outperforming regional stock markets.

Global investment guru – Warren Buffet – raised eyebrows as he made big bets into Japanese stocks last year and publicly stated that they comprise the majority of his equity investments outside the US.

What exactly makes Japanese stocks so alluring?

1. Japanese stock buybacks soared to historical highs

In recent years, the Tokyo Stock Exchange has mandated Japanese listed companies to enhance shareholder returns and actively uplift market valuation. Consequently, Japanese stock buybacks have soared to unprecedented levels – hitting a new high for a second consecutive year in 2023 totaling some 9.6 trillion yen ($65 billion)

2. Japanese companies hold higher net cash

Furthermore, compared to other mature markets, Japanese companies typically boast a significantly higher proportion of net cash — signifying that they hold more cash than debt, thereby having the potential to increase buybacks and distribute dividends to shareholders.

3. Japan residents able to make more tax-free stock market investments

Additional favourable factors include the Japanese government’s move in Jan 2024 to expand the annual investment limits of the Nippon Individual Savings Account (NISA) program and extend the tax-exempt period to an indefinite term. This enables Japan residents to make more tax-free investments in the domestic stock market, thereby injecting further funds into it.

With the Japanese stock market outperforming various regions worldwide, it’s clear that keeping a closer eye on Japanese stocks could yield valuable opportunities for investors.

Check out our list of Japanese Equity Funds available on Fund Explorer:

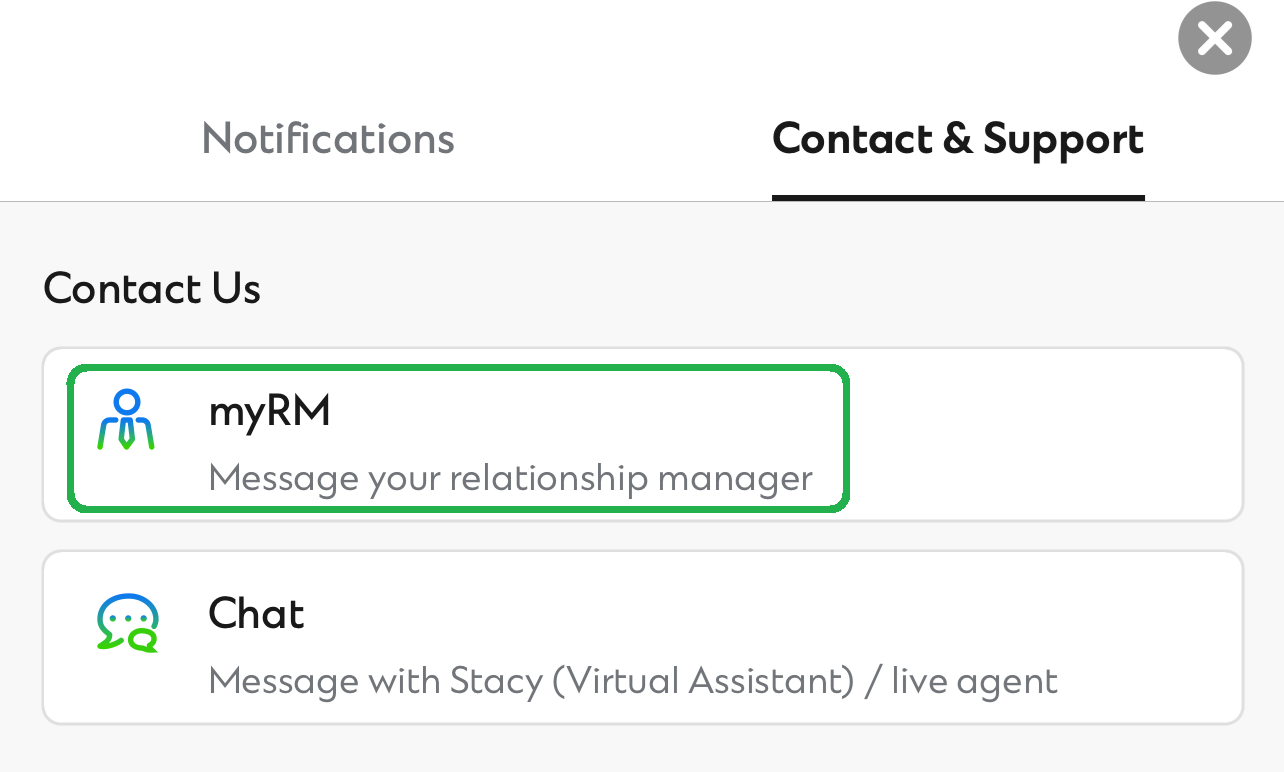

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not currently have an Investment Fund Account, follow the 4 easy steps to start investing now: