1 Aug 2024

This article is for informational purposes only.

Most of us are aware of Warren Buffett’s incredible investment success and put this down to his ability to outperform the market by a wide margin. While this is undoubtedly true, one key factor in his favour is that he started investing when he was 14 years old. Over 99% of Buffett’s wealth was generated after his 50th birthday. Our brains are wired to think linearly, and while we theoretically understand the power of compounding, we struggle to appreciate its power.

Let’s uncover an intriguing market phenomenon. History reveals that significant market drops are often followed by substantial rebounds. Therefore, panic selling during periods of declines and heightened volatility can significantly erode long-term returns. Over the past 50 years, the S&P 500 has yielded over 54 times its cumulative return. However, if you had exited the market and missed the 10 best trading days, your cumulative return would have dropped to 23 times. Missing the 20 best days would have further reduced your returns to just 13 times.

A multi-asset portfolio that creates stable income can help improve the capability of staying invested. Do you wish to earn interest while exploring long-term wealth growth?

Check out our list of Signature CIO Funds available on Fund Library:

| Fund Name |

| Signature CIO Income Funds

• Aims to generate regular income by investing in a diversified portfolio of income generating securities globally • Aims to generate capital appreciation over a mid to long-term investment horizon by accessing opportunities across multiple asset classes |

| Signature CIO Conservative Funds

• The fund seeks to generate income over a mid to long-term investment horizon. • The fund invests substantially into fixed income securities and money market funds which offers smoother returns with potential downside-risk protection |

| Signature CIO Balanced Funds

• The fund seeks to achieve moderate growth through capital appreciation and income accumulation over a mid to long-term investment horizon • The fund invests a similar amount into equities and fixed income, with a slight tilt to equities. It also invests in commodities and alternatives • Balanced allocation between equities and fixed income aims to provide upside returns while mitigating drawdowns |

| Signature CIO Growth Funds

• The fund seeks to achieve moderate growth through capital appreciation and income accumulation over a mid to long-term investment horizon • The fund invests a similar amount into equities and fixed income, with a slight tilt to equities. It also invests in commodities and alternatives • Balanced allocation between equities and fixed income aims to provide upside returns while mitigating drawdowns |

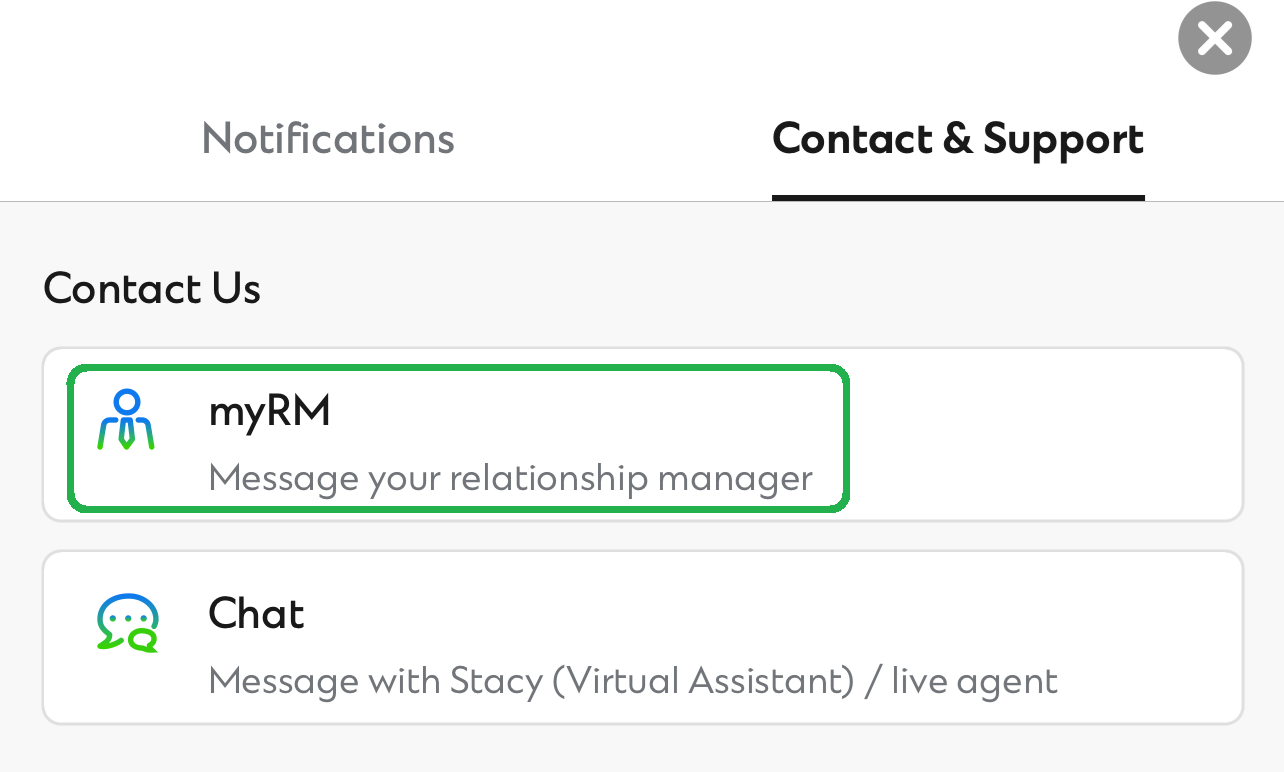

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not currently have an Investment Fund Account, follow the 4 easy steps to start investing now: