30 Aug 2024

We all love a good roller coaster, but bumpy rides would certainly turn the stomach of investors worldwide⚡. Affected by a chorus of factors, the global market has experienced intense ups and downs recently. How do we hold tight in our seat and not give out to the dicey momentum💰?

💡1️ Seek cover in the turbulence: Traditional risk-averse instruments such as bonds, gold, Japanese Yen and Swiss Franc are all safe havens in a tumultuous market.

💡2️ Phase your buys and get in before the rise: There’s every chance the US stock market will see another shake-up, but imminent rate cuts and great profit potential from the tech sector remain highly attractive. One can mitigate risk and capture long-term opportunities with a phased buying strategy.

💡3️ Diversify to your advantage: Stocks have won massively in H1 while high-quality bonds sustain investment gains in recent months. Diversify your portfolio to benefit from the rapidly changing macro-environment.

🌟 Current customers of Standard Chartered can log in to Standard Chartered Unit Trust Platform to start trading now.

1.Seek cover in the turbulence

Traditional risk-averse instruments such as bonds, gold, Japanese Yen and Swiss Franc are all safe havens in a tumultuous market.

2.Phase your buys and get in before the rise

There’s every chance the US stock market will see another shake-up, but imminent rate cuts and great profit potential from the tech sector remain highly attractive. One can mitigate risk and capture long-term opportunities with a phased buying strategy.

3️ Diversify to your advantage

Stocks have won massively in H1 while high-quality bonds sustain investment gains in recent months. Diversify your portfolio to benefit from the rapidly changing macro-environment.

Current customers of Standard Chartered can log in to Standard Chartered Unit Trust Platform to start trading now

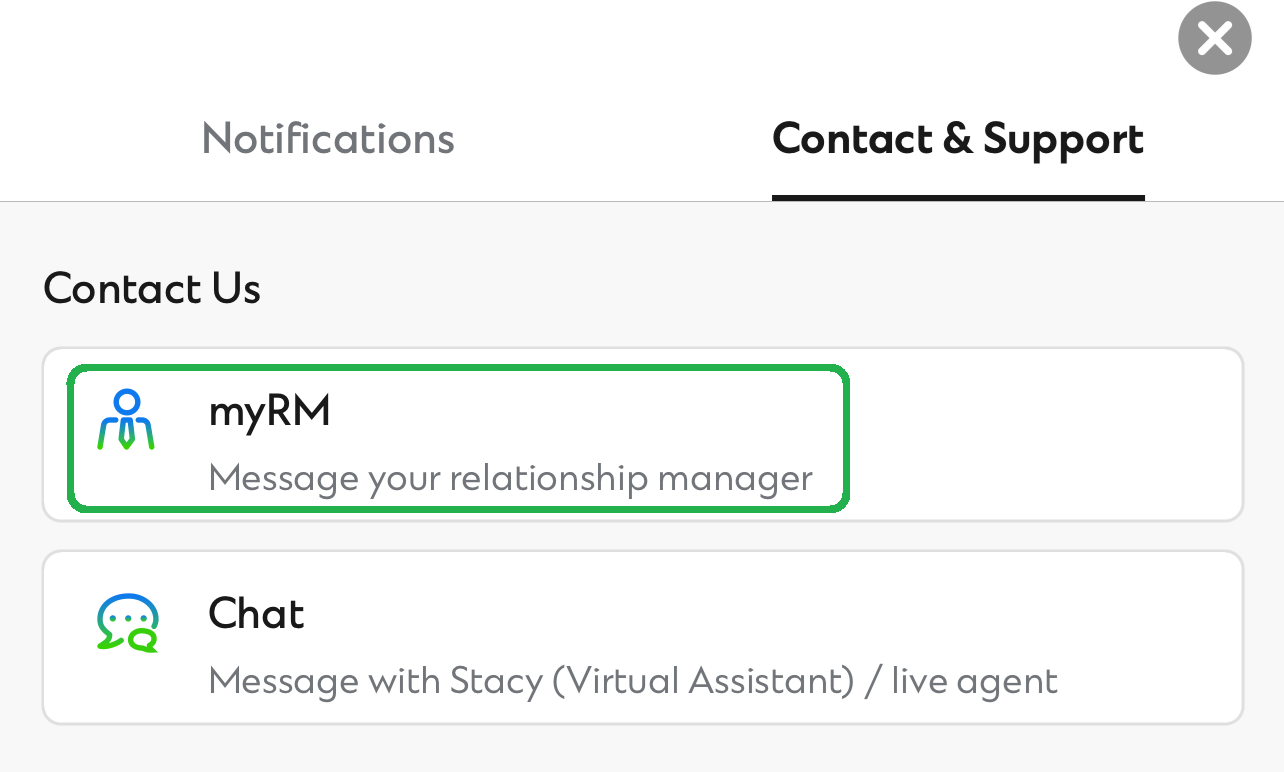

Want to chat with our specialists directly?

Alternatively, you can speak to your RM via myRM* on SC Mobile App to learn more

*Exclusive for Priority Private or Priority Banking clients

If you do not currently have an Investment Fund Account, follow the 4 easy steps to start investing now: