15 December 2023

Outlook 2024

Outlook 2024

Sailing with the wind

US and other major economies are likely to witness sharply slower growth and sliding inflation in 2024. Equity and bond markets expected to start 2024 positively, supported by hopes of a soft landing and central bank policy shifting towards supporting growth, but we remain on watch should macro winds shift towards a harder landing.

In Foundation allocations, we are (i) Overweight high quality bonds in Developed Markets as yields continue to grind lower, (ii) Overweight equities as recent performance extends into early 2024, led by the US and Japan. Both are likely to outperform current cash yields.

In Opportunistic allocations, we would (i) Buy communication services, technology and healthcare equity sectors in the US, (ii) Buy consumer discretionary, communication services and

technology sectors in China, and (iii) play the USD range.

How should we diversify portfolios in 2024?

What are your long-term capital market assumptions?

Can investors still earn 6% yield from an income allocation?

Note from our Global CIO

A year ago, in this note, I emphasised the importance of fighting recency bias after a traditional bond-equity portfolio had just experienced one of the worst returns in 150 years. Sure enough, 2023 has seen most assets appreciate in value and our Foundation allocations have posted strong returns this year. This just reinforces my core belief – when a diversified Foundation allocation falls in value, your default setting should be to add to the allocation.

As we step into 2024, some of the questions from 12 months ago remain unanswered. Will the US succumb to a recession? Is inflation really under control? Will central banks start easing monetary policy? How will geopolitical tensions feed into economic outlooks and market performance?

These are important questions for any investor to consider. This publication offers our take.

However, they are not the most important questions. The more important questions are about you.

What are your investment objectives? What is your time horizon? And, most importantly, what is your ability to weather drawdowns in your portfolio? The key to successful investing discipline: don’t be a forced seller, whether it be due to emotional or financial needs, and avoid excessive, permanent losses.

With this in mind, we share our SC Wealth Select framework on pages 25-26. This covers our holistic approach to managing your wealth, focusing on Purpose, Principles and Process. This approach starts with you, because you are the most important and constant piece in the puzzle. That is not to say your objectives don’t change, but the point is we all have specific needs and goals. It is these, not any view on the outlook for a specific market or security, that should be at the core of your investment plan.

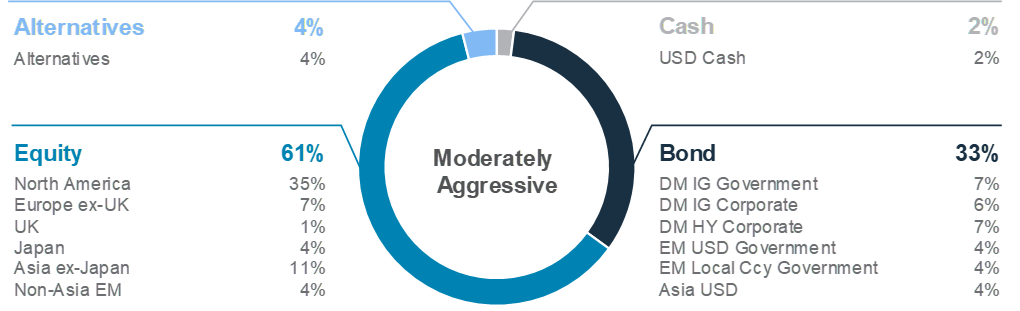

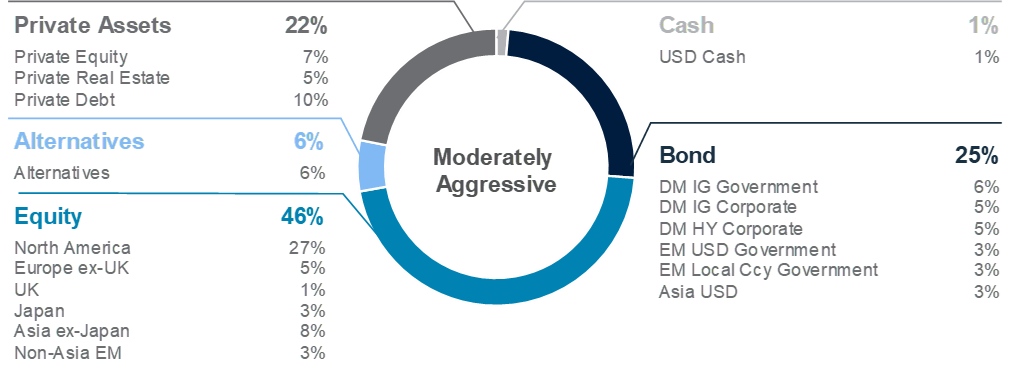

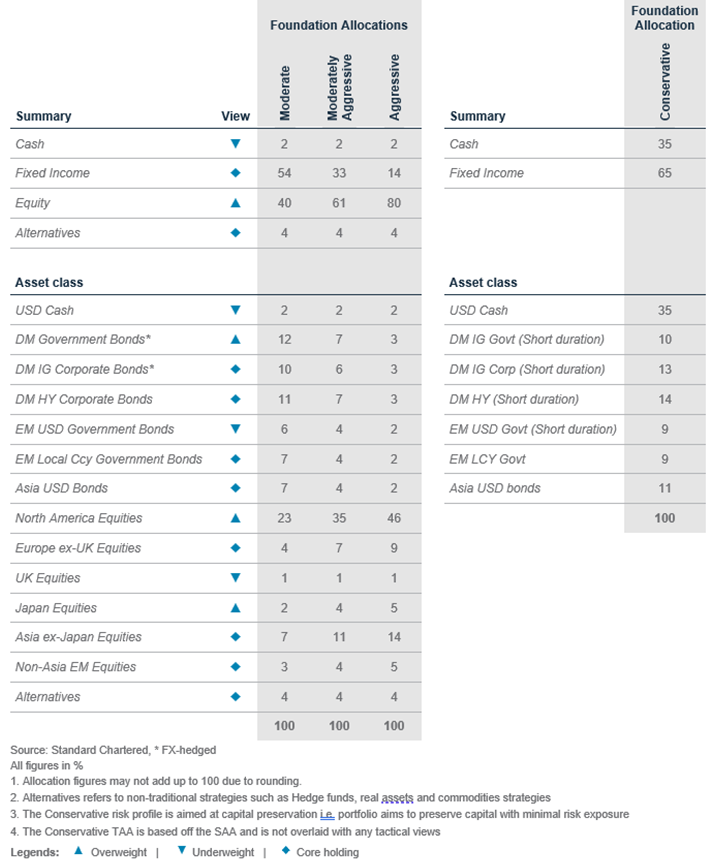

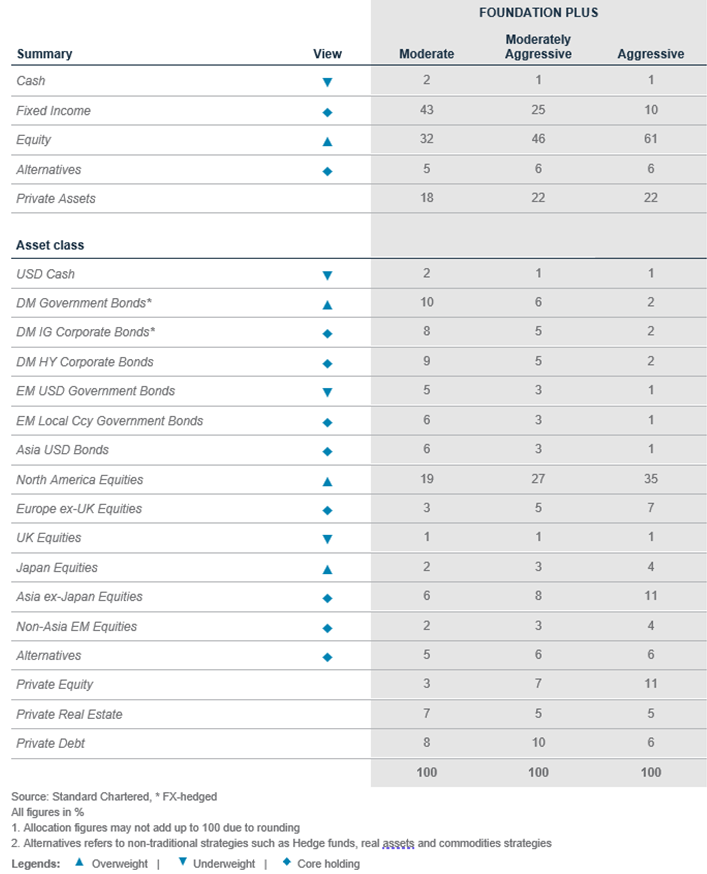

On pages 30-31, we present Foundation allocations that we believe, given the current environment and considering the relevant risks, make sense for investors with specific risk profiles. These should be starting points for a conversation with your financial adviser and can be tweaked to your specific situation or needs.

The Foundation allocations on page 30 are the traditional, global allocations that are accessible to most investors. On page 31, we also share the Foundation+ allocations, which add asset classes, such as private assets, that may be accessible to investors in some jurisdictions, but not others.

I hope you find our 2024 Outlook useful as you move forward on your investment journey. If you would like to stay updated on our latest views or access our financial education materials, then page 34 provides some useful links to stay connected with us through 2024.

Strategy

Investment strategy and key themes

|

|

||||

|

Our top preferences

(12-month outlook)

Foundation overweights

- Global equities, govt. bonds

- In equities: US, Japan

- In bonds: DM IG government

Sector overweights

- US: Comms. services, technology, healthcare

- Europe: Tech., healthcare

- China: Tech, Comms. services, consumer discretionary

FX views

- Rangebound (bearish bias) USD

Sailing with the wind

- US and other major economies are likely to witness sharply slower growth and sliding inflation in 2024. Equity and bond markets are likely to start 2024 on a positive note, supported by hopes of a soft landing and central bank policy shifting towards supporting growth, but we remain on watch should macro winds shift towards a harder landing.

- In Foundation allocations, we are (i) Overweight high quality bonds in Developed Markets (DM) as yields continue to grind lower, (ii) Overweight equities as recent performance extends into early 2024, led by the US and Japan. Both are likely to outperform current cash yields.

- In Opportunistic allocations, we would (i) Buy technology, communication service and healthcare equity sectors in the US, (ii) Buy China consumer discretionary, communication services and technology sectors, and (iii) play the USD range.

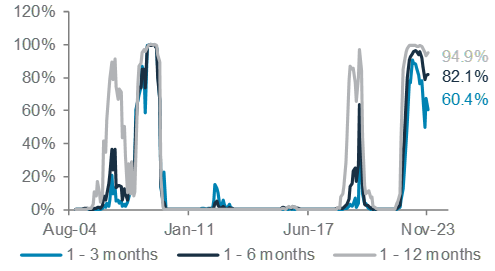

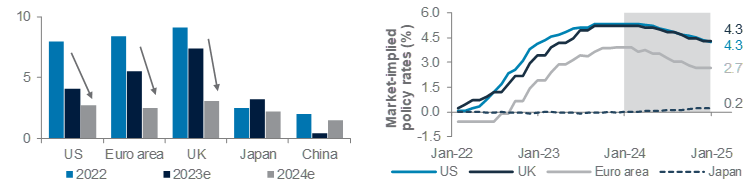

Fig. 2 Chances of an imminent recession are reducing, but risk not off the table longer term

Our US recession probability model

Sailing towards slower growth

Just how much US, and global, economic growth will slow after the rapid policy-tightening cycle remains the key question for 2024. Despite market expectations oscillating between hard landing and no landing expectations through the past year, we believe US growth is set to slow significantly as higher interest rates bite. A potential manufacturing rebound could help the overall economy avoid a hard landing, at least in H1 2024, but the risk of a US recession remains high later in the year. Europe faces a much higher risk of a prolonged recession/stagnation.

In China, growth may initially surprise on the upside given how negative expectations are, but the long-term debate about China’s equilibrium growth level is likely to continue.

On inflation, the main focus is expected to be on exactly how quickly, and how far, inflation falls, particularly in the US. We expect the underlying inflationary trend to keep slowing into 2024, but the last mile to reach the Fed’s 2% inflation target will be challenging. The turning point is likely to come mid-year when inflation will be less of a challenge and signs of weakness in the economy become more prominent, causing the Fed to start a rate cutting cycle. This explains the Fed’s significant shift in its tone at the December policy meeting, where it said the risks to inflation and growth are balanced.

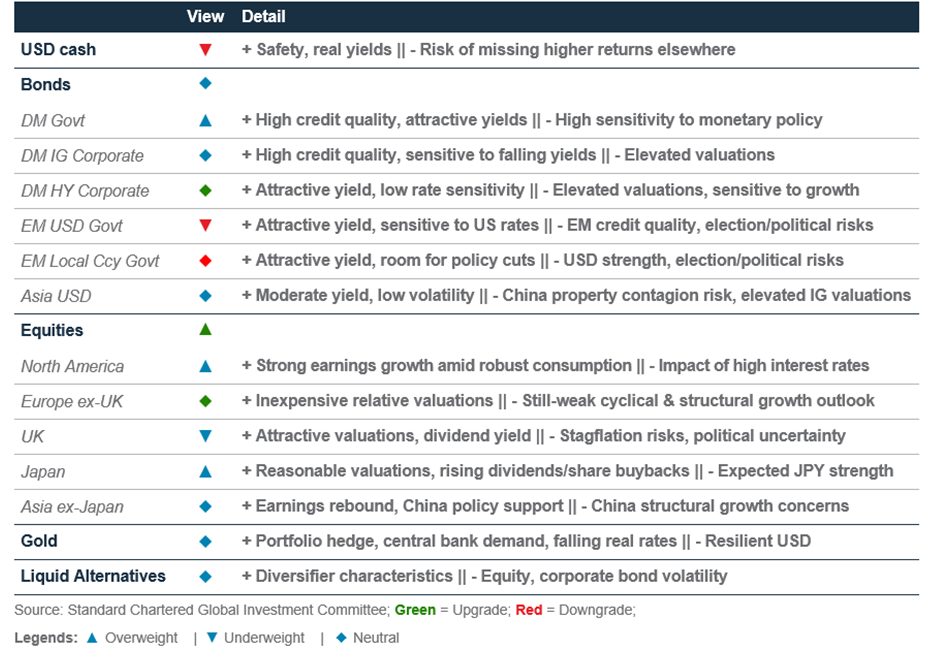

We believe investing in 2024 is likely to be about balancing how this macro scenario evolves, and also spotting where asset class risk/reward appears attractive. For Foundation allocations, our highest convictions are in (i) high quality Developed Market government bonds, particularly with longer maturities, (ii) global equities heading into early 2024, led by the US and Japan, and more broadly (iii) global equities and global bonds, which are likely to deliver cash-beating performance.

Foundation portfolios – Beating cash with stocks and bonds

Our key Overweight is towards DM Investment Grade (IG) government bonds, with allocations to DM corporate bonds also being sizeable.

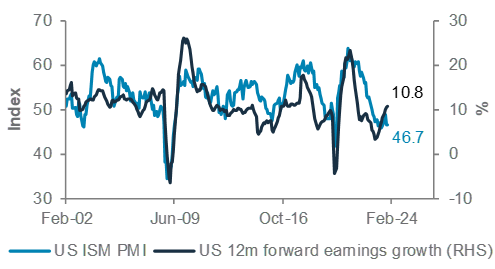

Fig. 3 An upturn in the US manufacturing cycle can extend the rebound in US earnings for now

US ISM mfg PMI vs MSCI US 12m earnings growth

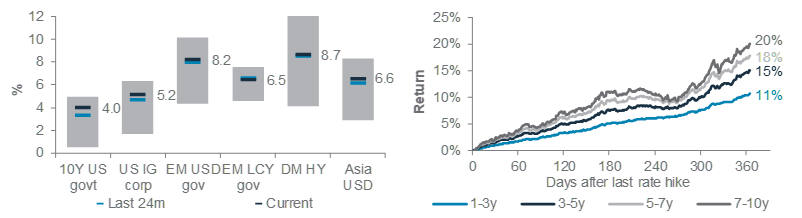

In our view, high quality bonds fit the attractive risk/reward criteria well. The absolute yield remains not far from recent peaks, requiring only modest price gains to beat cash yields. Yields also appear attractive, given the historical track record that bond yields usually peak not far from the final Fed rate hike, a point we have likely passed.

The risk/reward balance is also attractive under a range of scenarios. In our base case scenario, the downside in yields (price gains) may be more modest – we expect the US 10-year government bond yield to fall below 3.5% in 6-12 months’ time. However, we also see them as an attractive hedge against our main risk scenario of a harder landing, when the fall in yield (rise in prices) is likely to be more significant.

In equities, we believe global equity markets will extend gains into the early part of 2024, led by the US and Japan. For the US, in particular, earnings growth appears to be rebounding. Having said that, we would remain nimble as this view faces greater risks from a transition towards a more recessionary scenario later in the year.

We are Overweight US equities on the view that slowing growth helps bond yields to remain capped, but earnings continue to deliver positive growth. We also hold an Overweight view towards Japanese equities, where we believe corporate governance reforms make them another attractive route to gain exposure to an extended equities rally.

A third key view is that global equities and bonds are likely to outperform cash. While the higher cash threshold has presented a significant challenge to investors in 2022 and 2023, we believe even modest gains across both asset classes offer a much more attractive outlook from the current starting point relative to cash. The message from the Fed’s December meeting appears to signal that cash yields themselves are set to fall in 2024.

Opportunistic portfolios – Taking advantage of stock and sector dispersion

In the US, we would buy the technology, communication services and healthcare sectors. We believe the first two sectors are likely to lead in a scenario where downside growth concerns remain contained and bond yields continue to grind lower amid sliding inflation. Healthcare, though, offers some potential mitigation against the main risk scenario of the economy (and hence earnings) tipping into recession. We hold similar sector preferences in the Euro area via Overweights in the technology and healthcare sectors.

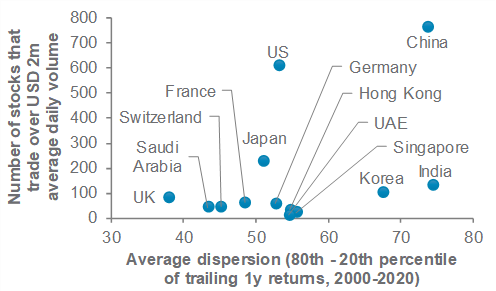

In China, we would buy the consumer discretionary, communication services and technology sectors. Relatively high stock and sector dispersion also means China stands out as a market where the room for stock or sector selection is likely to be much higher than other major markets.

Fig. 4 High stock dispersion in China (and the US) create sector opportunities

Equity market stock return dispersion within MSCI AC World

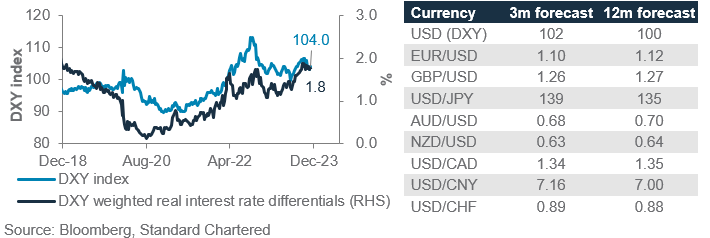

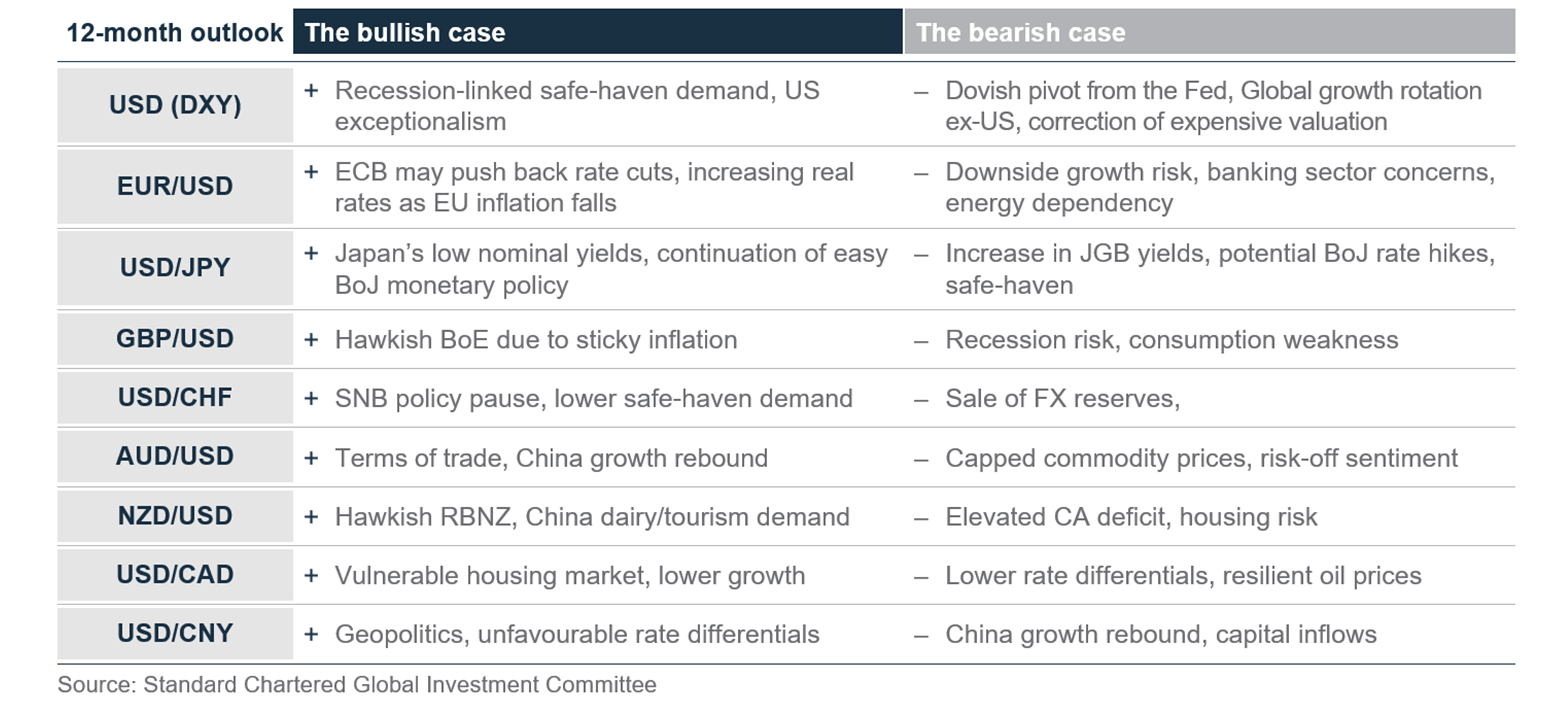

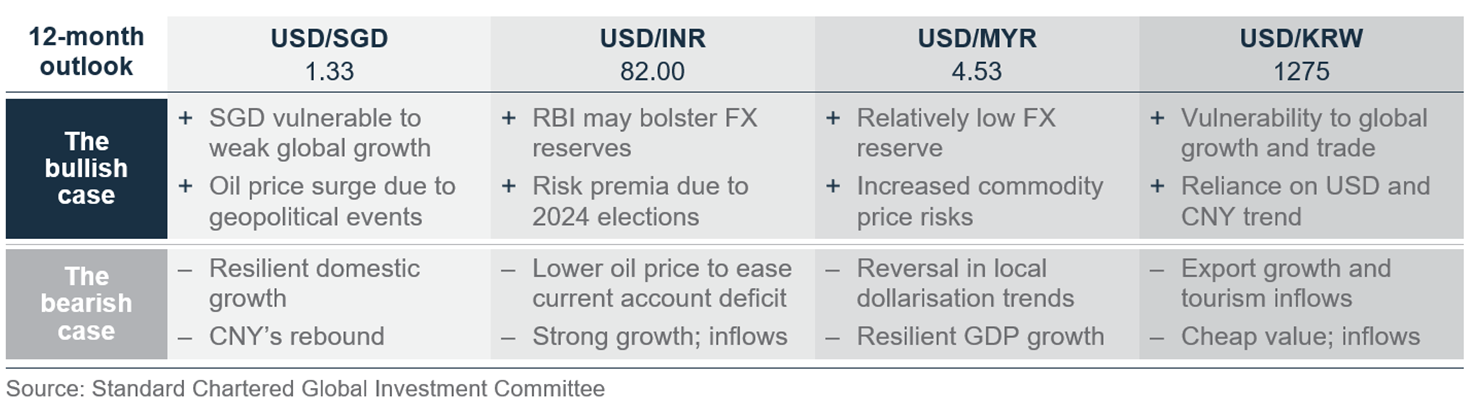

Currency markets are also likely to offer a little more dispersion compared with recent years. We expect the US dollar to be rangebound over the next 1-3m and hold a bearish bias over 6-12m, as it gets caught between downside pressure from falling US yields and upside pressure from US asset outperformance. The AUD and CNY are likely to benefit from a normalisation of China’s macro outlook and market expectations. The JPY should benefit from narrowing yield differentials. Other major currencies, though, are likely to trade in a narrow 6-12-month range.

The role played by Neutral allocations

Is our asset allocation just about high-quality bonds and our preferred equity markets alone? The answer is no – this is where the portfolio-level view becomes important.

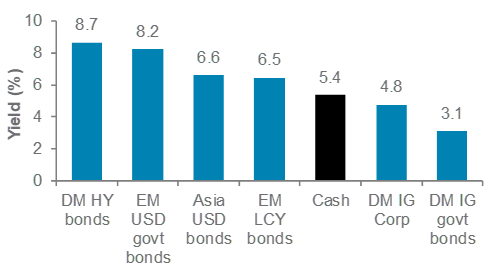

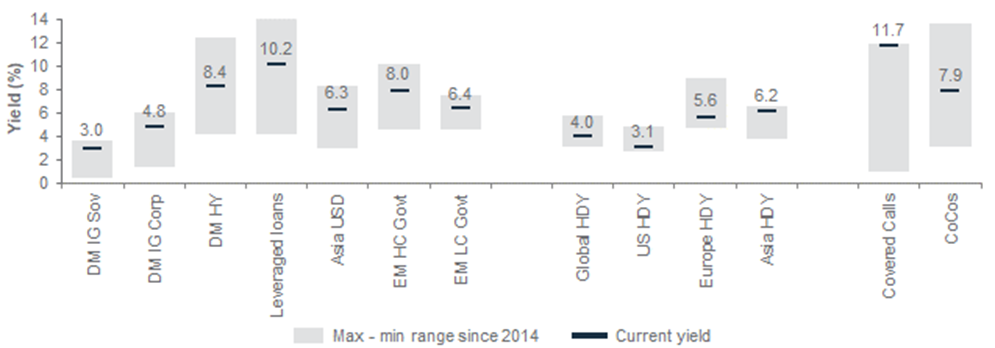

We expect high quality bonds to outperform cash, but the chart above illustrates that allocations towards other major fixed income asset classes are also important for achieving yields well in excess of current cash thresholds, while ensuring risks remain diversified. Thus, our Foundation allocations contain smaller (Neutral and Underweight vs. benchmark) allocations towards riskier credit as well.

Fig. 5 The cash yield threshold is high, but is likely to decline in 2024 as central banks cut interest rates

Yields across major bond asset classes and cash

What could change or go wrong?

A relatively positive view does not take away from the importance of being nimble if conditions change.

The key risk is an earlier or harder-than-expected landing in the US. A failure of inflation to fall significantly even amid slowing growth does raise the risks of a stagflationary scenario, but we see the risk of this as small, unless oil prices surge due to geopolitical risks.

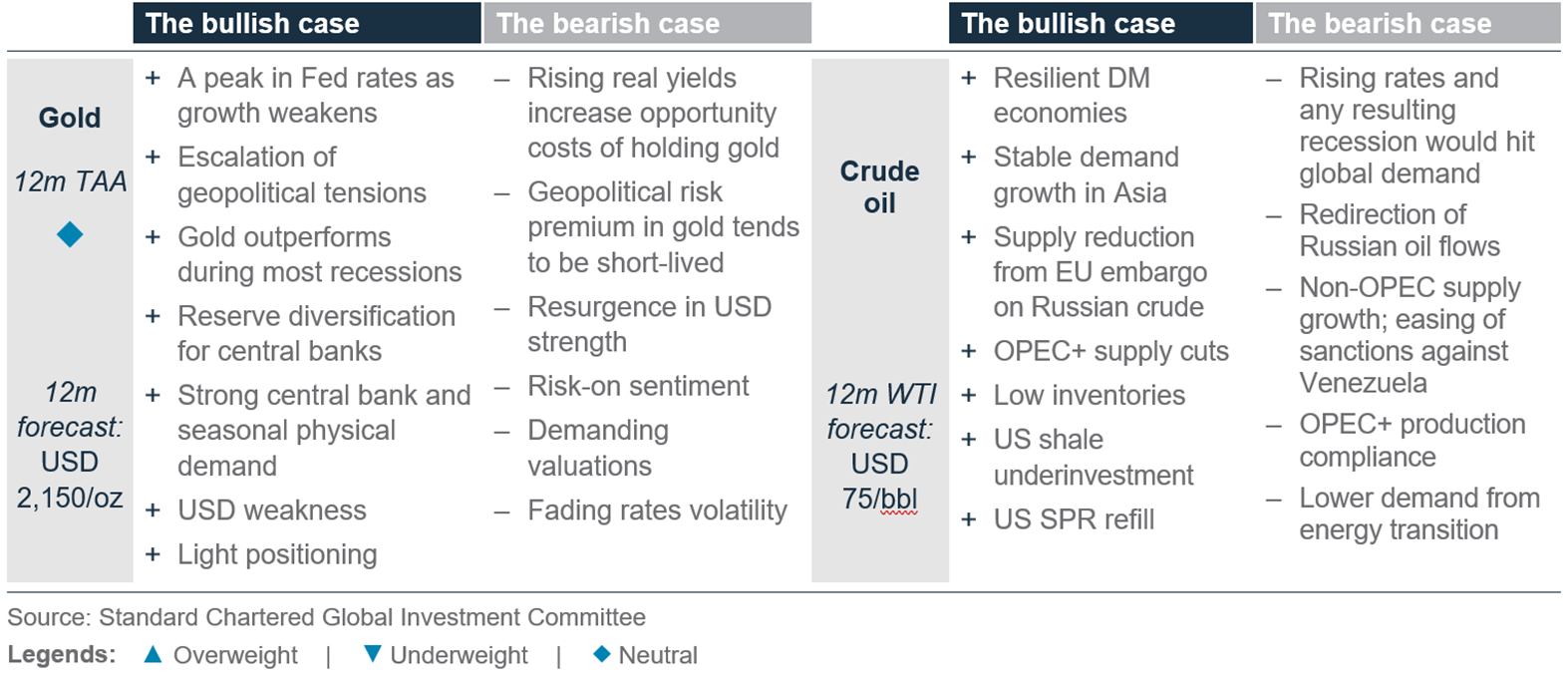

Our positive view on global equities, at least at the very start of 2024, may be at risk if the economy transitions to either a recessionary or a stagflationary scenario. However, our Overweight on bonds should, if anything, perform even more strongly in a recessionary scenario. Historically, stagflation has not been an easy scenario for either equities or bonds. In this scenario, real assets such as gold (we are Neutral and have a small allocation within alternatives in our model allocation), are instead likely to be a better hedge.

Finally, we would remain on watch for any outside shocks. Geopolitics is one potential risk, especially given 2024 is likely to experience an unusually busy election calendar worldwide. Our focus would continue to be on whether geopolitical risks hold the potential to cause a lasting shock to asset prices, or just trigger short-lived volatility. A financial market ‘accident’ is a second potential risk. History shows that something ‘breaks’ when interest rates are high. Finally, we would remain on watch for any potential policy missteps as central banks could turn too hawkish or too dovish.

Foundation asset allocation models

The Foundation and Foundation+ models are allocations that you can use as the starting point for building a diversified investment portfolio. The Foundation model showcases a set of allocations focusing on traditional asset classes that are accessible to most investors while the Foundation+ model also include allocations to private assets that may be accessible to investors in some jurisdictions, but not others.

Fig. 6 Foundation asset allocation for a moderately aggressive risk profile

Fig. 7 Foundation+ asset allocation for a moderately aggressive risk profile

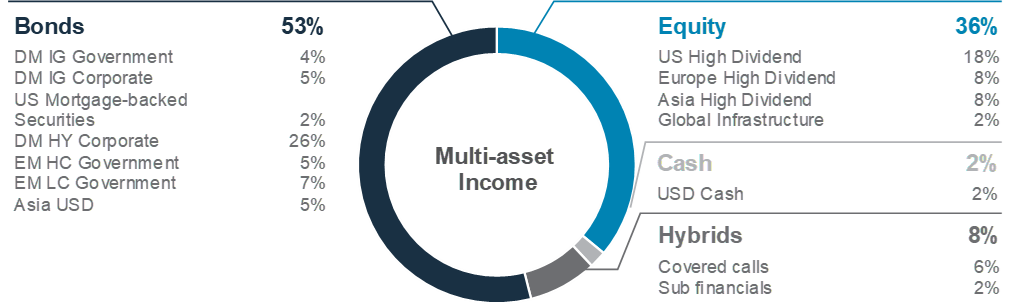

Fig. 8 Multi-asset income allocation for a moderate risk profile

Foundation: Our tactical asset allocation views

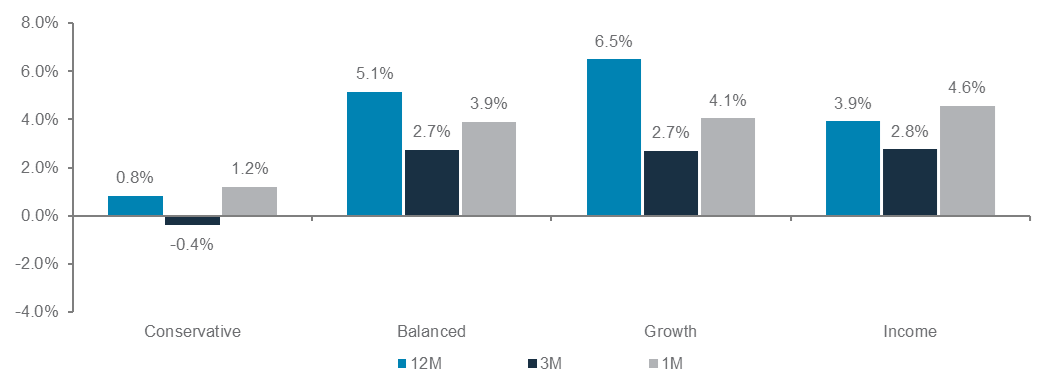

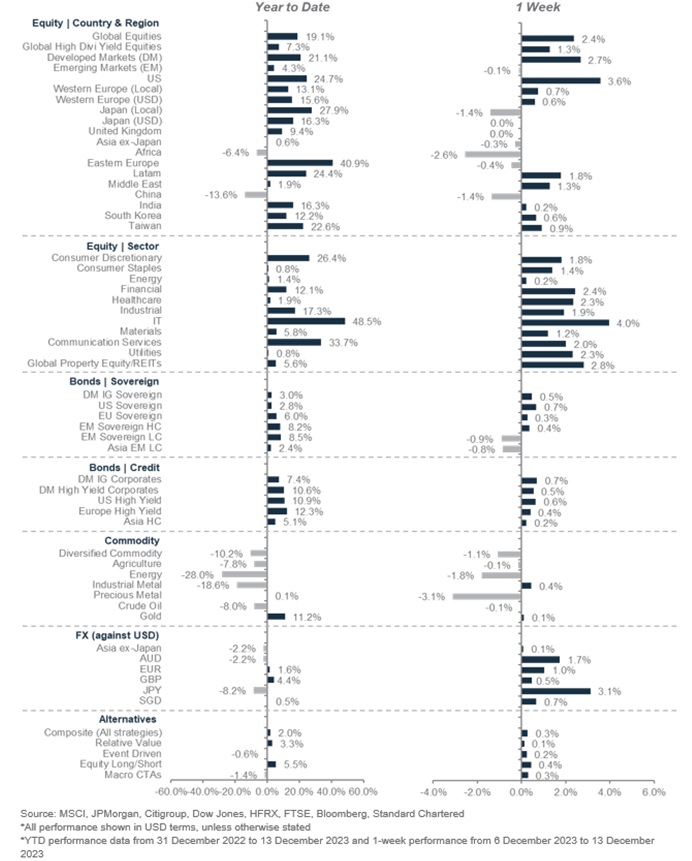

Fig. 9 Performance of our Foundation Allocations*

*12-month performance data from 13 December 2022 to 13 December 2023, 3-month performance from 13 September 2023 to 13 December 2023, 1-month performance from 13 November 2023 to 13 December 2023.

Foundation: Multi-asset income strategies

|

|

||||

Key themes

The Multi-Asset Income (MAI) portfolio has a current yield of around 6.2% for 2023, an attractive level, in our view. This is a stark contrast to just two years ago when traditional bond yields were low on the back of rate cuts by major central banks and investors were on the hunt for yield. We expect yields to fall as central banks shift away from rate hikes and attention turns to the timing of potential rate cuts in 2024. We believe yields are attractive for investors today.

Heading into 2024, we are increasing our allocation to bonds. We have increased our allocation to Developed Market High Yield (DM HY) bonds given their high coupon and modest maturity compared with leveraged loans. This is funded by a decline in allocations to Emerging Market (EM) bonds.

Alongside the recovery in markets, our MAI model allocation has returned c.8.0% YTD. DM HY and EM local currency bonds have been the significant contributors to performance, while dividend equities and covered calls also contributed.

Key chart

Income as a component

of total returns tends to

be significant over the

longer term

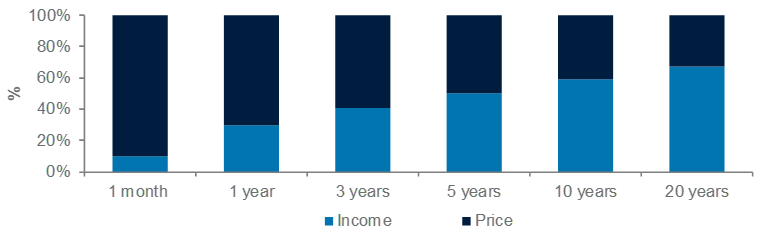

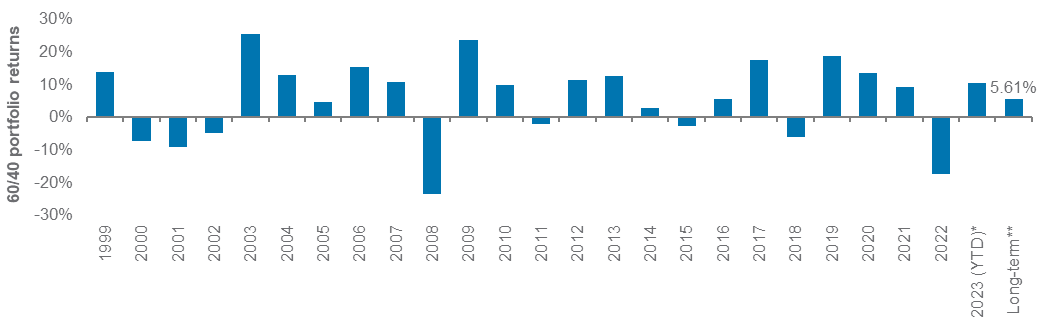

Fig. 10 Breakdown of total returns of a 60/40 Equity/Bond portfolio over various investment time horizons**

Contributions to total returns*

*Total returns on a 60/40 portfolio decomposed into income and price returns across time frames

**Equity represented by MSCI ACWI Index while Bond represented by Bloomberg Global Treasury Index. Monthly data from January 1999 to November 2023

Fig. 11 Yields on income assets still attractive and close to the highs of their historical range

Yield to worst/dividend yield (%), yield range of various income assets since 2014

Contingent Convertibles are complex financial instruments. (Refer to Important Information on page 35 for further details)

How have we done in 2023?

Our MAI allocation has returned c.8.0% YTD. This was largely helped up by our sizeable Overweight to bonds through the year and strong DM HY and EM local currency bond performance. The latter has been one of the strongest performing areas in fixed income in 2023 on the back of attractive income and rate cuts by EM central banks. Covered calls also benefitted from strong returns in equities and contributed positively to the overall portfolio performance.

Positioning for 2024

Within our MAI portfolio, we currently favour bonds over dividend equities due to the appealing yields in certain segments of the bond markets. Although we continue to maintain an allocation to dividend equities, we have adjusted our allocations as the credit markets present opportunities for higher equity-like returns, but at potentially lower volatility.

Upgrading DM HY bonds, reducing exposure to leveraged loans (LLs). The tightening of bank lending standards and increased funding costs have started to strain corporate issuers, making DM HY bonds a relatively more resilient choice in terms of credit quality. Furthermore, as we have likely reached the peak of the central bank rate hiking cycle, the floating rate yield in LLs is unlikely to be sustained and we see this as an opportune time to cut back on exposure to LLs.

We are reducing the allocation to EM, both local currency and hard currency bonds. While EM bonds offer attractive headline yields, we perceive the risk-reward balance to be relatively even. Instead, we see more promising yield-earning opportunities in segments such as DM HY bonds, for coupon clipping, where yields are comparable but have lower volatility.

Lastly, we have reallocated some weights from dividend equities to covered calls. The performance of dividend equities has been a mixed bag, with US dividend equity having delivered positive returns of 5.1% YTD. In contrast, Asia and Europe dividend equities have impressive returns of 17.5% and 11.1% YTD, respectively. Nevertheless, we see better opportunities in covered calls, which can benefit from market volatility. We believe there could be room for potential upside if markets rally, given that covered calls have a broader sectoral exposure with the S&P 500 as the underlying index.

Some considerations for income investing

When putting together an income allocation, there are some considerations that investors should be aware of. First, higher yields do not necessarily translate to high total returns. Higher yielding bonds tend to be riskier and may come with increased credit risks. Companies with higher credit risks are more likely to face financial challenges during periods of high interest rates or economic stress.

It is equally important to manage the sensitivity of a portfolio to changes in interest rates. Bonds with longer duration are

more sensitive to rate fluctuations. As such, investors need to achieve a balance in diversifying the fixed income sleeve of the portfolio across different credit qualities and maturities.

MAI to benefit from soft landing

The yield on our MAI allocation is high relative to history due to elevated yields across various asset classes. This represents a compelling opportunity for investors to consider locking in these high yields and to position for sustained income and potential growth over the coming years, given our view of a peak in central bank rates in the US and Europe.

Total returns important, but income should not be overlooked. Total returns, broadly speaking, can be segmented into two key parts – capital return and income return. Understandably, asset prices tend to drive returns on a short-term basis. However, over a longer time horizon, income represents a larger portion of total returns.

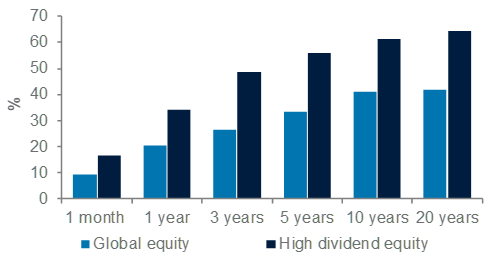

For instance, in a 60/40 Equity/Bond portfolio, income (including dividend income from equities and coupons from bonds) may contribute less than 20% to the total return of the portfolio over a one-year period. However, when we extend the investment horizon to beyond five years, income can contribute more than half of the total return. A similar analysis comparing the contributions of income and capital to returns of global equity vis-à-vis high dividend yield equity also yields a similar conclusion, illustrating the importance of the compounding of income held over a long time period.

Fig. 12 Income contributions to total returns from income generating assets such as dividend equity is much higher than traditional equities

Income contributions to total returns* over various investment time horizons**

*Total returns comprising of both returns from income (dividends and coupon) and price appreciation.

**Global equity represented by MSCI ACWI Index while High dividend equity represented by MSCI ACWI High Dividend yield index. Monthly data from January 1999 to November 2023

Ultimately, the yield on the MAI allocation is much more attractive compared with two years ago. Our income allocation offers a good mix between equity and bond assets, with the bond allocation having a relatively modest maturity of 4.8 years, allowing it to benefit from high yields and capital upside in a soft-landing economic scenario.

Perspectives on key client questions

|

|

||||

How should investors diversify their portfolio in 2024?

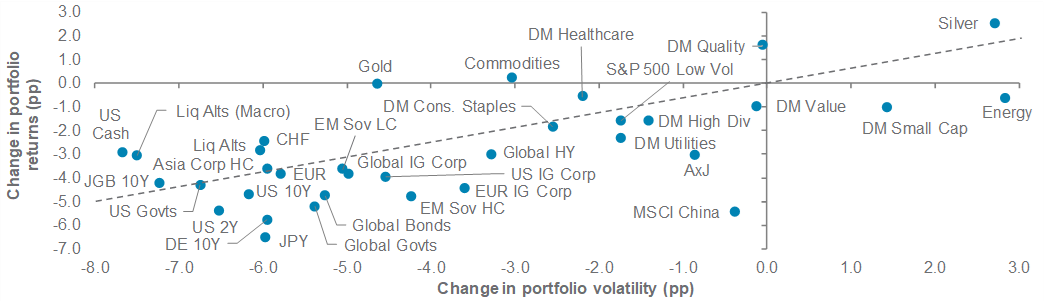

To answer this question, we looked at the two main risks confronting investors in 2024 and assessed the effectiveness of several assets as diversifiers. In the first risk scenario, the last mile of global disinflation proves difficult, and the stock-bond correlation remains positive, hurting the diversification benefits of bonds. In the second scenario, the market’s soft-landing consensus is misplaced, and the US descends into a more severe-than-expected recession. We found that assets that are successful in inflationary environments, such as liquid alternatives and gold, may have reduced effectiveness in a recession. Conversely, diversifiers such as bonds, which face challenges in inflation environments, may once again return to favour.

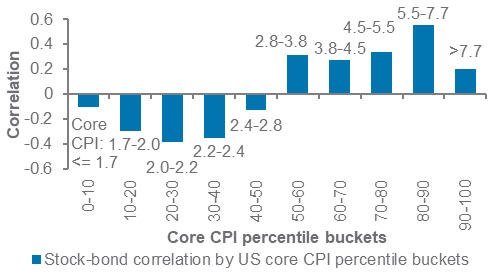

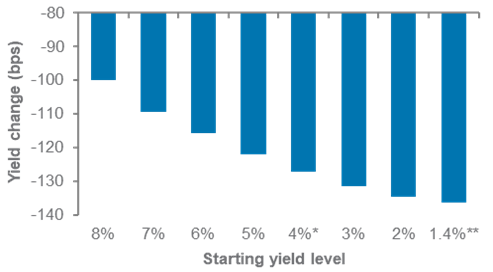

Bonds still viable as diversifiers as disinflation progresses

While the current correlation between stocks and bonds remains high, we expect this to be transitory. Short-term fluctuations are plausible, yet the correlation between stocks and bonds is intricately linked to inflation dynamics. Specifically, the correlation tends to be positive during periods of high inflation, and negative during periods of low inflation. We found that this correlation has historically shifted from positive to negative when core inflation falls below 2.8% (Fig. 14). Additionally, the higher bond yields are, the less they need to decline to offset potential losses in a balanced portfolio (Fig. 15). Bonds can be a cheap source of diversification and should regain their attractiveness as a portfolio hedge if inflation continues to ease.

What if we are wrong and inflation proves sticky?

In this case, the positive stock-bond correlation would persist, and diversifiers that have performed well in recent years should continue to do well. We identify these assets by examining the reduction in portfolio volatility when 40% of the asset is added to global equities. An “indifference line” illustrates the point where investors would be indifferent between choosing US government bonds or the asset. (Fig. 13)

Liquid alternatives and cash stand out

Liquid alternatives and cash significantly reduce portfolio volatility with only a moderate sacrifice in returns, compared with US government bonds. Gold also performs well by lowering portfolio volatility without impacting returns. DM healthcare and quality stocks stand out among equity sectors, either reducing portfolio volatility

Fig. 13 Assets that have been effective diversifiers in recent inflationary years, such as Liquid Alternatives, Gold and Cash, are likely to continue doing well if inflation proves sticky and the stock-bond correlation remains positive

Change in portfolio returns and volatility when an asset is added to Global equities portfolio in a 60% equity/40% diversifier*

Fig. 14 The stock-bond correlation is expected to revert to negative as inflation subsides

Stock-bond correlations per core inflation deciles

without much loss in returns or increasing returns without adding volatility. Global corporate bonds are not appealing.

What if the US falls into a recession?

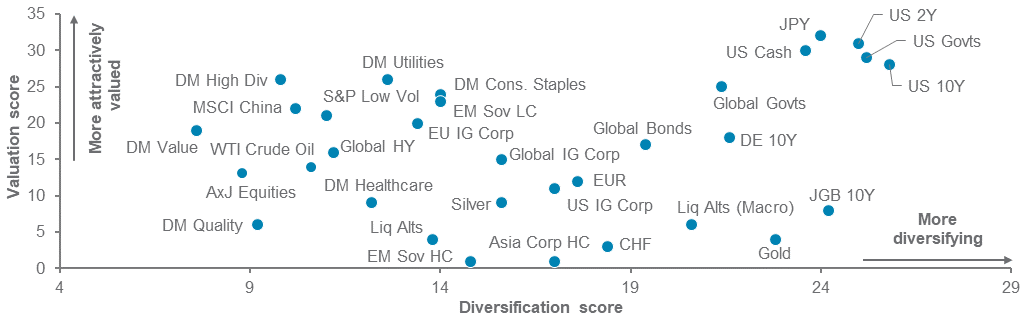

In the event of a recession, an alternative approach is used to assess the long-term diversification qualities of assets. We examined the (i) short- and long-term correlation, (ii) stability of correlation, and (iii) downside beta of key assets to global equities. We then ranked these diversification attributes and compared them to their valuation, producing a different set of insights that would be useful in navigating recession risks.

A return of quality bonds and safe-haven currencies

We have already mentioned that government bonds are poised to return to their role as diversifiers as inflation subsides, but a recession would likely accelerate this process, with central banks cutting policy rates in response to slowing growth. High quality corporate bonds also stand out. They are moderately valued, meaning they are not excessively priced for a soft-landing, and have diversification qualities that lag only the most conservative safe-haven assets. The JPY also looks interesting. It is now at the cheapest it has been in years and a Fed policy easing cycle would potentially set the

Fig. 15 High yields provide a buffer against equity losses

Decline in the 10-year US government bond yield needed to offset a 10% annual loss in equities in a 60/40 portfolio

currency up for significant gains (Fig. 16). While liquid alternatives continue to shine as a diversifier, their appeal from a valuation standpoint pales in comparison. Hedge fund strategies, in particular Global Macro, tend to perform well during periods of high rates volatility, when dispersion between markets provides a rich opportunity set for adept managers. This has served the asset class well in recent years. A global recession, however, could bring about lower interest rates, making it more challenging for managers to produce alpha. Gold, likewise, continues to score well as a diversifier, but it has run ahead of real interest rates. It can still serve as a hedge against geopolitical crises, but its relatively lofty valuation means any upside could be limited.

Investment implications

Navigating 2024 amid a high level of uncertainty is challenging. This makes staying nimble and selecting the right diversifier a crucial step in protecting your portfolio. Government bonds remain the diversifier of choice, but if the stock-bond correlation stays positive, look towards liquid alternatives, gold and cash instead. Conversely, if a recession occurs, traditional safe havens would be appropriate, and high quality corporate bonds can also be considered.

Fig. 16 Over a longer horizon, Government bonds remain the best diversifiers

Asset classes ranked by their valuation and diversification qualities. Data from January 2010 to November 2023.

Macro overview – at a glance

Our macroeconomic outlook and key questions

|

|

||||

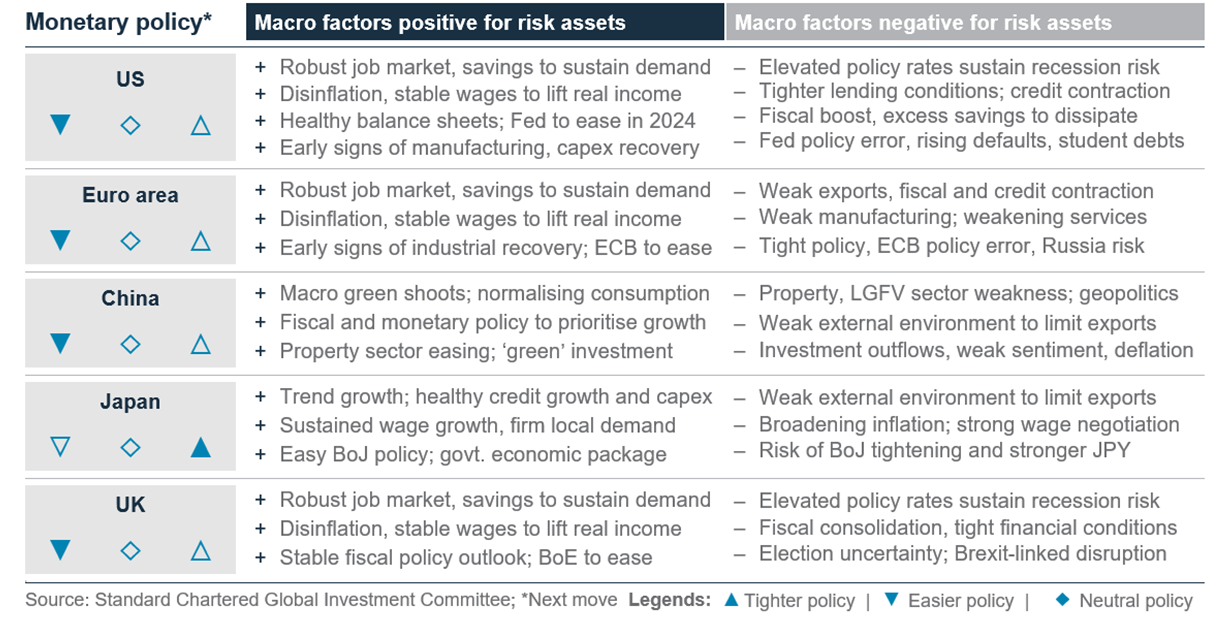

Key themes

We expect the global disinflationary trend to extend into 2024, lifting real incomes. The boost to consumption fuelled by excess savings built during the pandemic is also lasting longer, and there are signs of a recovery in the global inventory cycle. Given this, we see increased chance of a soft-landing in the US, at least in H1 24. However, our leading indicators continue to flag an elevated risk of a US recession next year because of tight policy rates and as fiscal stimulus fades. Although the Fed hinted at a nascent shift in its policy stance from fighting inflation to supporting growth at its December policy meeting, it pencilled in only 75bps of rate cuts next year. We expect the Fed to cut rates 125bps by end-2024 as recession risks rise in H2.

The outlook for Europe and China remains relatively weak. Europe still faces the risk of stagflation (sharply slowing growth with high inflation). An extension of Euro area fiscal policy stabilisers should mitigate some downside risks but record high policy rates continue to tighten financial conditions. In China, domestic consumption is resilient, but business confidence remains weak, despite a series of policy easing steps and support for the property sector. While authorities continue to refrain from large-scale stimulus, focusing on ‘quality’ growth, we expect targeted fiscal and monetary measures to support economic growth in 2024.

Key chart

The global disinflationary trend is likely to continue in 2024, enabling central banks to cut rates significantly. Easing policy rates should help economies avoid a sharp downturn and achieve a soft-landing in H1 24

Fig. 17 Sustained disinflation likely to allow policymakers to ease policy in 2024

Consensus estimates of consumer inflation, % y/y; money market estimates of key policy rates

Top macro questions

Are you still expecting a US recession? Our base scenario has the US economy achieving a soft-landing (below-trend but positive growth) in H1 24, with the risk of a recession, if any, pushed back to H2 24. This view aligns with Fed’s outlook following its December policy meeting. This shift is driven by (i) resilient consumption fuelled by excess savings built during the pandemic and a structurally tight job market; (ii) sustained disinflation boosting real disposable incomes and enabling the Fed to cut rates earlier than previously expected to support growth; (iii) increased investment in factories, amid reshoring of production facilities, and in residential homes, due to a structural housing shortage; and (iv) a rebound in the global inventory cycle. A US recession remains a key risk to our global macroeconomic outlook, most likely in H2 24.

The level of US excess savings built during the pandemic has been the subject of most intense debate. There has been an upward revision to market estimates of excess savings after the US Bureau of Economic Analysis (BEA) revised down the US’s historical savings rate going back 22 years. The boost to estimated excess savings (variously estimated between USD 500bn and USD 1trn) could sustain the consumption-driven expansion longer than earlier estimates.

Meanwhile, a structurally tight job market means employers are unwilling to let go workers in a hurry. The implication is that, in the event of an economic downturn, the US jobless rate may not rise as much as the 3ppt average rise seen in the past eight recessions. A structurally tight job market would also help sustain consumption.

Sustained disinflation, fuelling US real incomes and enabling the Fed to cut rates, is another key driver of our US soft-landing call. There are growing signs that services sector inflation is likely to follow goods inflation lower next year. Shelter inflation has been holding up service sector inflation this year and is likely to turn negative by the middle of next year, according to a San Francisco Fed model. This is also indicated by slowing market rents, which feed through to official data with a 6-12-month lag. Meanwhile, the US has seen a boost in productivity in recent years, which should help bring inflation back towards the Fed’s 2% target sooner.

Finally, the US industrial sector is seeing a resurgence, with investment into manufacturing plants booming due to

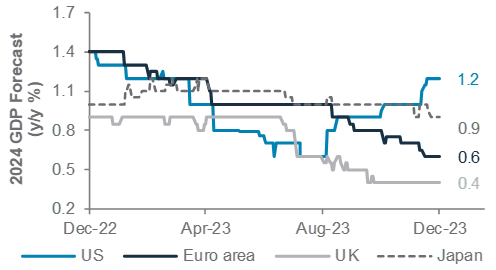

Fig. 18 Recession risks are the highest in Europe

Consensus 2024 growth estimates for major economies

reshoring and because of President Biden’s “green” infrastructure boost. The global inventory cycle is recovering, which should help revive the depressed manufacturing sector.

The positive drivers notwithstanding, a US recession has likely been delayed, not avoided. The Leading Index of 10 key economic indicators (LEI) has reported y/y declines for the past 16 months, a trend that has historically preceded recessions. Additionally, the US government bond yield curve has remained inverted since July last year. Historically, a US recession has started 9-22 months (median: 16 months) after the 2-year yield rose above the 10-year yield (this cycle: July 2022) and 2-6 months after the curve sustainably turned positive again (yet to happen, although in 1982, the curve turned positive nearly a year after a recession had started). Based on this history, there is a still a significant probability of a recession starting sometime in 2024.

Is the Euro area in a recession? The Euro area economy is likely already in recession, having contracted in Q3 23. The latest business confidence indicators (PMIs) show service sector activity has been contracting since August, while the manufacturing sector remains depressed. The ECB’s record policy tightening has led to tighter lending standards. Structurally higher energy costs after last year’s Russian sanction and a tight job market are keeping inflation elevated. However, a recession is likely to drag inflation lower, enabling the ECB to cut rates by 75bps next year. Disinflation is likely to boost disposable real income, while fiscal stabilisers help prevent a sharp downturn. Stabilisation in China’s economy and a recovery in global manufacturing should help exporters.

Is China’s economy recovering? China’s economy is showing signs of stabilising after a series of monetary and fiscal policy support. Consumer spending is resilient, but business confidence remains downbeat. A revival of the global inventory and manufacturing cycle is also likely to revive China’s exports in the coming months. However, the depressed property sector remains the main drag to the economy. The annual Central Economic Work Conference in December has set a pro-growth agenda for 2024. The central government is likely to boost its official fiscal deficit to 3.5-4.0% to support growth, while the PBoC is likely to cut policy rates and bank reserve requirements further next year. Measures to support the property sector will also be in focus.

Fig. 19 China’s domestic consumption remains resilient

China retail sales, exports and property investment growth

Asset Classes

Bonds – at a glance

|

|

||||

|

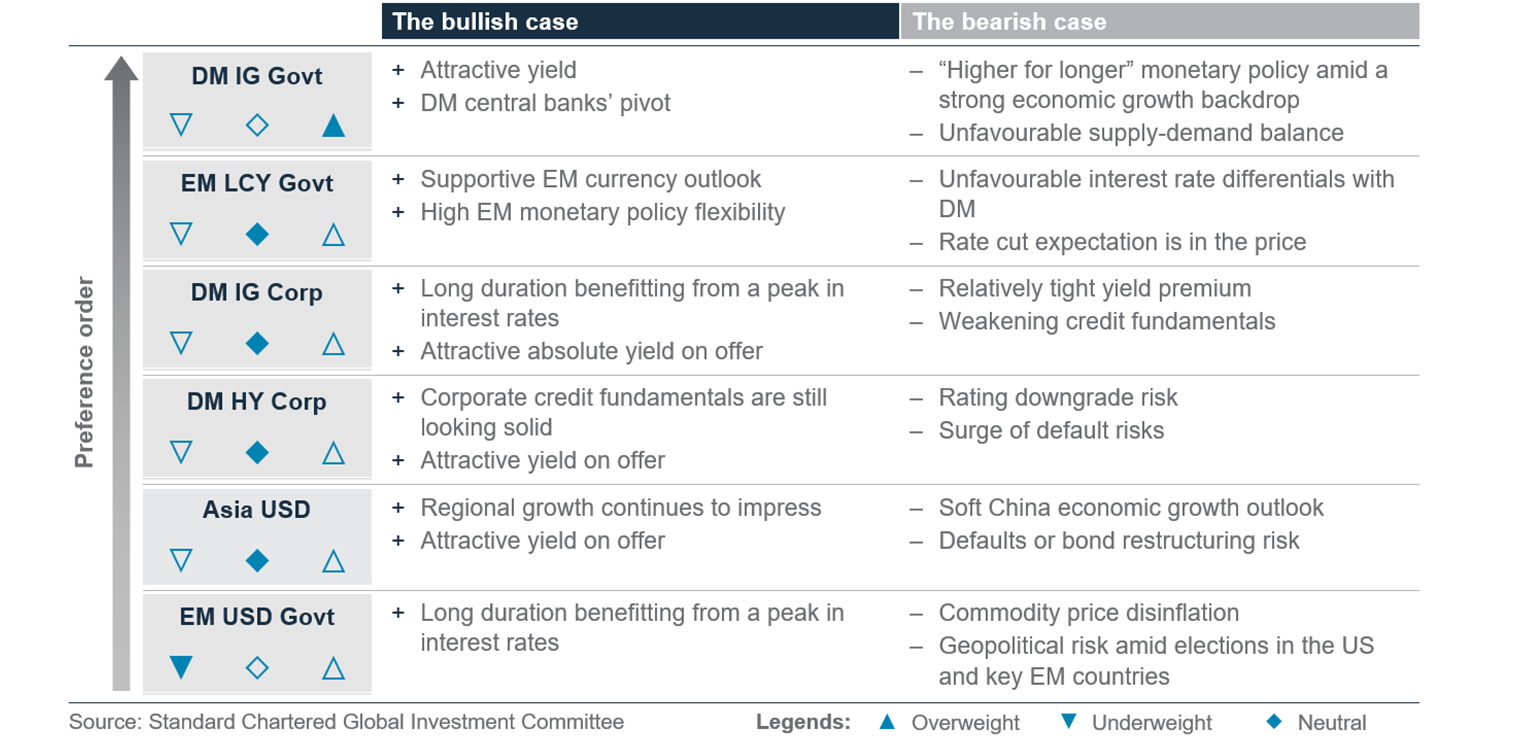

Key themes

We prefer high quality bonds for their attractive yields and the likelihood of prices rising further as Developed Market (DM) economies weaken into 2024, pushing yields lower still. We are Overweight DM government bonds and expect the US 10-year government bond yield to soften further to 3.75-4.00% over the next 3 months and 3.25-3.50% over 6-12 months. The outlook for Emerging Market (EM) bonds is more balanced, despite a constructive outlook for EM currencies, as optimism on EM policy easing is likely already priced in. This leaves us Neutral EM local currency (LCY) government bonds.

In credit, we have a Neutral (core allocation) view towards both Investment Grade (IG) and High Yield (HY) DM bonds. While valuations are elevated, these neutral allocations can be key contributors to achieving portfolio yield goals. We are also Neutral Asia USD bonds and Underweight EM USD government bonds. The ongoing policy stimulus in China is a positive, but decelerating global growth and lower commodity prices are risks. Within Asia, we prefer HY bonds over IG as the sharp fall in the former’s prices, one-sided sentiment and increasingly expensive IG bonds have shifted the relative risk/reward, in our opinion.

Key chart

Yields across bond asset classes are well above their long-term averages; a long maturity profile is likely to perform well as central banks reach peak rates

Fig. 20 DM bonds still offer attractive yields; longer maturity bonds have historically outperformed shorter maturity peers after previous policy rate cycle peaks

Yields vs range since 2010; avg. 12m US government bond returns after last 3 rate peaks

Overweight DM IG government bonds; Neutral EM LCY government bonds

In DMs, we believe rising expectations that policy rates have peaked will be a key driver of DM IG government bond yields. Yields had already started to move sharply lower in Q4 23. However, in our view, valuations still leave room for yields to fall further, with the US 10-year government bond yield still sitting within the top quantile of its historical range on both a nominal and a real (net-of-inflation) basis. We expect the US 10y yield to hover around 3.75-4.00% in 3 months and fall below 3.5% in 6-12 months.

In EMs, our expectation for EM currencies to remain well-supported against the USD should offer support for local currency bonds. In addition, we believe EM central banks, which were one-step ahead of DM central banks in tightening monetary policies last year, are in a better place to pivot towards policy easing in 2024. However, we note that markets are already pricing in several rate cuts for most major EM central banks over the next year. This suggests that rate cut optimism may already be priced in, leaving yield and currency appreciation as the main drivers of returns. This balanced outlook leaves us with a Neutral view on EM local currency government bonds.

Fig. 21 High real yields maintain an attractive risk/ reward for DM IG government bonds despite the late 2023 fall in yields

US 10y government bond yield, breakeven yield and real yield

Neutral DM IG and HY credits

Within DM, we are Neutral both DM IG and HY corporate bonds. Nominal yields are still attractive for both bond classes, making them an important component of achieving overall portfolio yields. However, rich yield premiums over US government bonds relative to history suggest valuations are high. Lending conditions in the US and Europe have tightened and the collapse of Silicon Valley Bank (SVB) in early 2023 was an example of how this can lead to unintended consequences. Today, yield premiums have narrowed to pre-SVB collapse levels, worsening the risk/reward at a time when financial conditions are still tight. In addition, post-COVID rating upgrades are running out of steam. All of this suggests that while riskier credit can enter 2024 on a strong note, a

broader preference for high quality bonds is key, especially if global growth slows significantly.

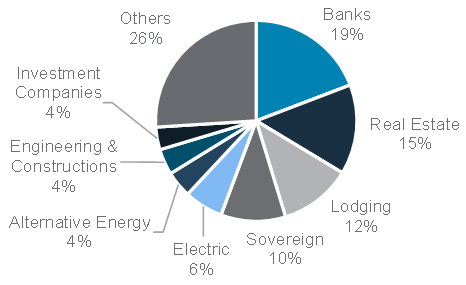

Neutral Asia USD bonds

Defaults and bond restructuring in China’s property sector have weighed on Asia HY performance for most of 2023. However, we believe the risk/reward appears to be shifting increasingly back to HY. We now prefer HY over IG within Asian USD bonds, for two reasons:

- Asia HY bonds are offering a yield of c.15%, which lies among the 95th quantile of the past 10 years. We believe this extreme valuation points to excessive pessimism.

- After several defaults, the China HY property sector’s share of Asia HY bonds has fallen to 6.8%, from 10.9% a year ago. This, we believe, starts to limit room for the sector to drive further asset class underperformance.

Fig. 22 Real estate sector’s share of Asian HY bonds has reduced compared with a year ago, following defaults in the China HY real estate sector

Composition of the Asia Credit Index

Note: Asia HY real estate sector comprises sector exposure from HK and ASEAN regions, in addition to China

Underweight EM USD government bonds

We are Underweight EM USD government bonds. They are sensitive to changes in US rates, which should prove supportive if yields fall in the next 6-12 months. However, this advantage is more than offset by the risk of widening yield premiums. In addition, 2024 also brings elections across several key EM countries, raising geopolitical risk.

Prefer portfolio duration of 7-10 years

Moderating global inflation and likely slowing global economic growth in 2024 lead us to expect that policy rates have largely peaked. Historically, US bond yields tend to peak not far from the peak in Fed rates, a point we have likely passed.

We favour longer maturity bonds and prefer an average portfolio maturity of 7-10 years in USD bond allocations in the context of this historical experience and our expectation for a steeper yield curve (gap between 10y and 2y yields) as 2y yields fall quicker than 10y yields.

Equity – at a glance

|

|

||||

|

|

||||

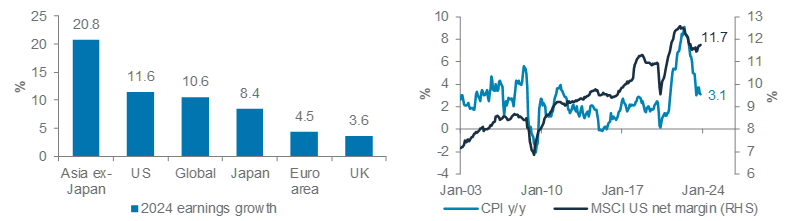

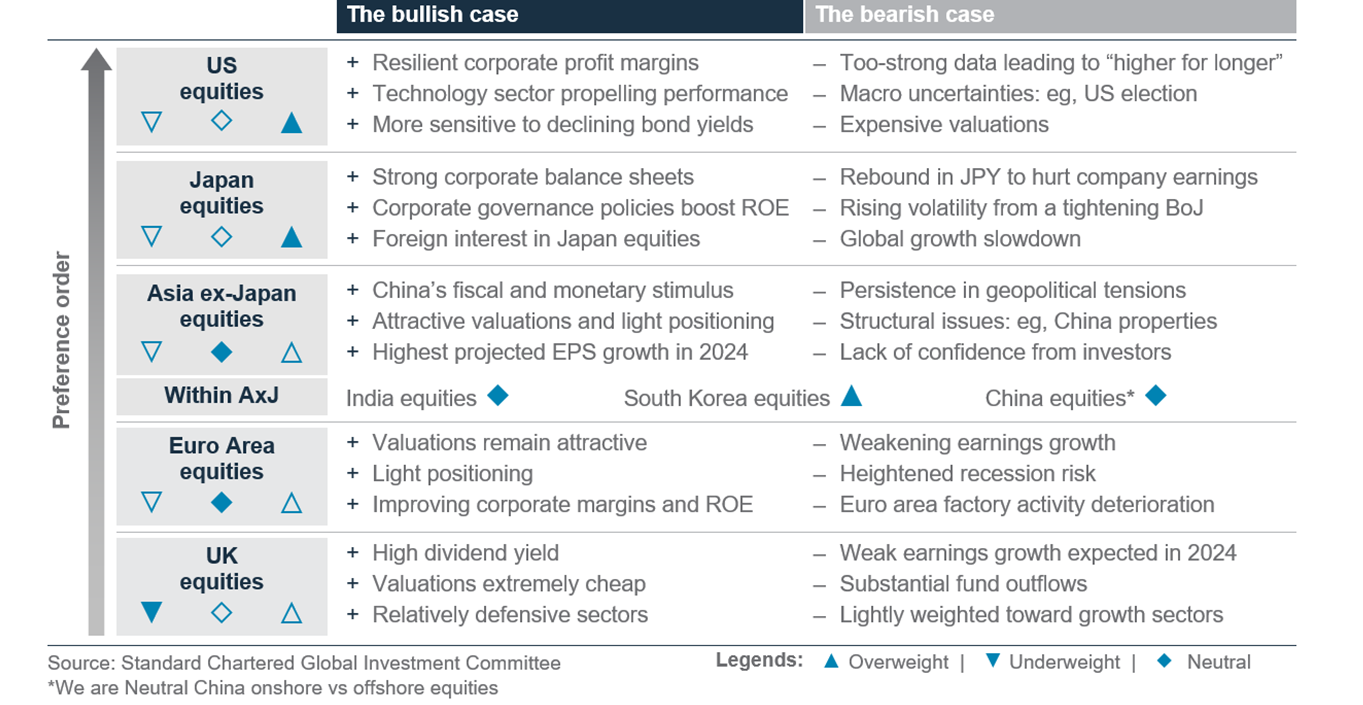

Key themes

We are Overweight equities, and US equities within that, given our central scenario of a soft-landing in the US, at least in the first half of 2024. US companies are displaying strong corporate pricing power, resulting in solid net margins as inflation pulls back. Japan equities is the other Overweight region that continues to display a healthy combination of solid earnings, improving corporate governance and being less expensive than US equities.

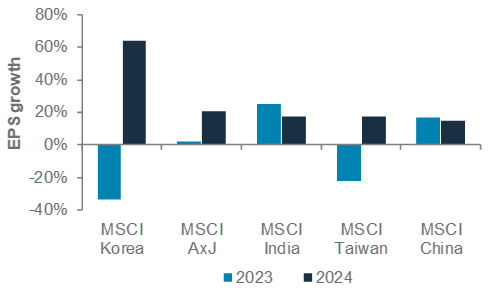

We attach a Neutral weight to Asia ex-Japan equities. The region has potentially the highest earnings growth. We are Overweight Korea – the demand for AI is likely to support earnings. We are Neutral China equities; although sentiment is bearish, the government is supporting the economy via piece-meal stimulus. We are Neutral Indian equities, given the trade-off between relatively strong earnings and high valuations. Within Indian equities, we prefer large-cap over small- and mid-cap.

Elsewhere, we are Neutral Euro area equities. Growth prospects remain lacklustre, but cheap valuations and low positioning are counter-balancing factors. We stay Underweight UK equities – despite cheap valuation, the sector composition could be overly defensive and may underperform as the current global rally continues.

Key chart

Earnings growth favour Asia ex-Japan, the US and Japan; US equities are displaying strong pricing power while inflation retreats

Fig. 23 Earnings growth likely to be strong in 2024; US equities net margin strong

Regional 2024 earnings growth; US net margin vs CPI

Overweight global equities

We are Overweight global equities on a 12m horizon. The global disinflationary trend and expectations of Fed rate cuts is leading to a declining bond yield environment across major economies.

Overweight US equities

We are Overweight US equities, as a technology-sector rebound and delayed economic slowdown are likely to support corporate earnings next year. Following the December Fed policy meeting, we expect 125bps of rate cuts next year from the Fed, which is likely to lend a tailwind to growth stocks, as it alleviates the impact on discounted future earnings. High ROE levels (US equities offer 20.3% ROE, nearly +1.5sd above its historical average) are also likely to justify relatively elevated valuation premiums, in our view. We see continued share buybacks supporting share prices further into 2024.

Overweight Japan equities

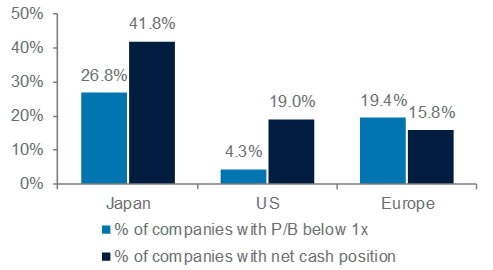

We are Overweight Japan equities. Corporate liquidity positions remain strong – 41.8% of companies are net cash positive, ie, with cash exceeding debt, significantly more than in other DMs. Further improvements in corporate reform initiatives will likely boost company valuations. In addition, robust cash savings among local citizens and the reform of Nippon Individual Savings Account are expected to intensify domestic investments and fund flows. That said, a stronger JPY risks being a headwind to corporate earnings in 2024. Therefore, we believe Japan equity investments should not be on a currency-hedged basis.

Fig. 24 Japan’s corporations are in a stronger cash position than firms in other DMs

Percentage of companies with P/B below 1x and net cash positions in Japan, US and Europe

Neutral Asia ex-Japan equities

We are Neutral Asia ex-Japan equities. On the positive side, 12m forward EPS growth in Asia ex-Japan is the highest among major markets. Diverging monetary policies between Emerging Markets (EMs) and Developed Markets (DMs), and some potential weakness in the USD next year will likely support fund inflows. That said, we see headwinds, including

slowing global growth and poor investor sentiment, that are likely to weigh on the market in 2024.

Our Overweight in Korean equities within Asia ex-Japan reflects our expectations of a rebound in earnings growth next year, driven by a turnaround in the semiconductor industry. Valuations significantly moderated from extreme levels back in Q2 23, providing a more attractive entry opportunity.

Fig. 25 2024 Korea earnings expected to grow strongly

EPS growth in Asia ex-Japan and key individual markets

We are Neutral China equities. Investor positioning is bearish and valuations are extremely cheap. However, structural headwinds, including the property market downturn and demographics, are likely to linger. Any upside policy surprises could trigger normalisation in investor sentiment. Within China, we are Neutral between onshore equities and offshore counterparts.

We are Neutral India equities within the region. Strong EPS growth and relative insulation from China compared with its EM peers are supportive factors. However, valuations (12m forward P/E at 21.3x) remain at elevated levels in both absolute and relative terms. We prefer large-cap equities over small- and mid-cap equities.

Neutral Euro area equities

We are Neutral Euro area equities. While headwinds from higher rates and geopolitical concerns remain intact, valuations are currently at extreme levels, with the Euro area’s 12m forward P/E trading at 25.0% discount to global equities. Positioning is low in Euro area equities vs. historical levels.

Underweight UK equities

We are Underweight UK equities. Its heavy tilt in defensive sectors may lead to underperformance as global equity markets continue to climb. Inflation levels, although cooling, remain elevated, posing additional pressures on household income and spending. Expected earnings growth in 2024 in the UK also remains the lowest compared with other major regions, notwithstanding potential tailwinds including attractive valuations and high dividend yields.

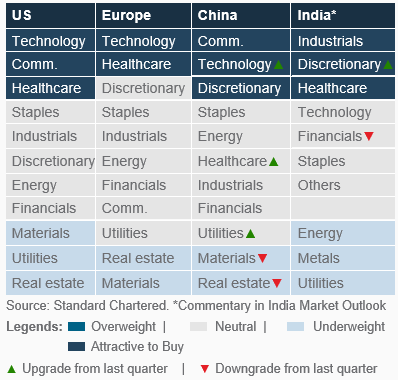

Equity sector views

|

Barbell approach in DMs

Buy consumption-oriented sectors in China

- Our barbell strategy continues in the US and Europe, with a preference for secular growth exposure balanced by a defensive sector.

- In China, we would buy consumption-oriented sectors, such as communication services, consumer discretionary and technology.

US

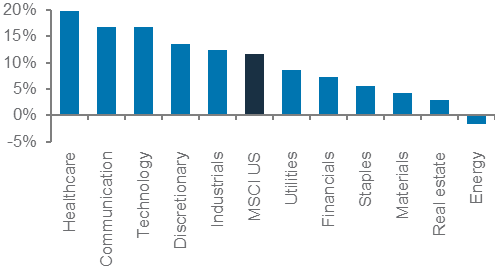

Our view is to buy technology and communication services for resilient growth, along with healthcare to balance out the risk of a growth slowdown. Technology is likely to see an earnings rebound in 2024 following muted growth in 2023. Growth is likely to be driven by a turnaround in the semiconductor industry, recurring revenue streams in software companies and AI investments. Lower bond yields and higher returns on equity support high valuations in the sector.

Communication services also benefit from lower bond yields and a strong earnings momentum. Sector valuations remain below its historical average. Healthcare is our preferred defensive exposure to balance out still elevated risk of a US recession. 2024 earnings should rebound from a weak 2023, with tailwinds from obesity, diabetes and oncology products.

Other views: We are Underweight real estate as property valuations are still adjusting to higher interest rates. However, we are Neutral on US private real estate as it has a higher weight in the attractive segments of rental housing and industrials. We are Underweight utilities as earnings revision has been poor and we see limited upside catalysts. We are Underweight materials as we expect weak demand.

Fig. 26 Our preferred US sectors (healthcare, communication services and technology) are expected to deliver the strongest earnings growth in 2024

Consensus 2024 EPS growth by sectors in the US

Europe

We are Overweight technology, which we see offering the highest earnings growth in 2023 and 2024. Over 50% of the sector comprises semiconductor companies – they are likely to benefit from AI investments and unprecedented equipment demand in China. We are Overweight healthcare to provide defensive exposure in a weak growth scenario. Drug pricing lagged inflation the past year but is catching up now.

China

Our view is to buy three sectors. High dispersion of returns in China points to attractive opportunities in sector selection. Communication services is dominated by media and entertainment companies that benefit from greater consumer spending and further monetisation opportunities in internet platforms. Consumer discretionary would also benefit from policymakers’ priority of boosting domestic consumption and China’s cross border eCommerce that is gaining traction; we upgrade technology to a Buy as the earnings cut in tech hardware over the past two years could reverse in 2024 from restocking. We see volume growth for tech products.

Other views: We downgrade materials to Underweight on downbeat demand from property and traditional infrastructure. We downgrade real estate to Underweight as uncertainty around developer defaults keep investors wary. We upgrade healthcare to Neutral as worries about corruption issues fade.

Fig. 27 Our sector views by region

FX – at a glance

|

|

||||

Key themes

We expect a rangebound USD over the next 3 months. Major pairs are likely to consolidate after the market’s adjustment following the Fed’s December meeting. However, USD/JPY may have further to fall while USD/CHF looks oversold.

On a 6-12-month horizon, we expect the USD to move modestly lower. The Fed’s increasingly dovish tone supports our view that G10 central banks have largely ended their rate hike cycle as global inflation slows. This, in turn, is likely to lead to more rangebound interest rate differentials, creating an opportunity to play the USD range. Rising risks of a hard landing scenario later in 2024, though, pose downside risks to US yield differentials and the USD.

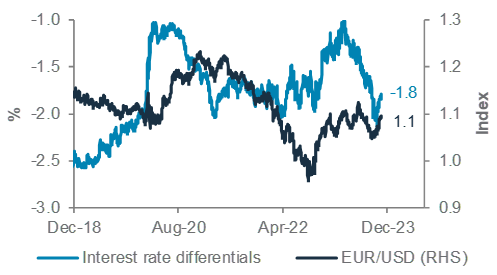

We expect the EUR, AUD and JPY to be key beneficiaries of a softer USD in 2024. Market expectations of sizeable ECB rate cuts arguably limit room for further downside, but sluggish growth is likely to limit how far the EUR rebounds on the back of a soft USD later in the year. We believe the Bank of Japan is likely to further tighten monetary policy in Q1 2024. As such, USD/JPY is likely to move lower as it follows relative interest rate differentials. The AUD, meanwhile, is likely to see support from improving Terms of Trade (the ratio of export prices to import prices).

Key chart

Real (net of inflation) interest rate differentials are likely to support a bearish bias for the USD in 2024

Fig. 28 Stable interest rate differentials likely to drive USD consolidation

USD Index (DXY); table of forecasts

Fig. 29 Summary of major currency drivers

Consolidating rate differentials

Slowing inflation in the Euro area puts the ECB in a position to wait and observe the impact of past rate hikes. This, together with a somewhat more dovish December Fed message, is likely to lead to a relatively muted EUR/USD. We see EUR/USD at 1.10 over the next 3 months. In the longer term, we see greater room for upside economic surprises as sentiment becomes ‘less bad’ and the USD softens. However, sluggish growth and a sizeable number of ECB rate cuts later in 2024 are likely to limit how far the EUR rebounds. Therefore, we expect the pair to rise modestly to 1.12 over 6-12 months.

Fig. 30 EUR could edge higher with yield differentials

EUR/USD and interest rate differentials

Meanwhile, the BoE is likely to start rate cuts later than the Fed as UK inflation remains the highest among G7 countries. However, this is likely to leave real yield differentiations in a narrow range. We have a rangebound view on GBP/USD, expecting 1.26 over the next 3 months and 1.27 over the next 6-12 months.

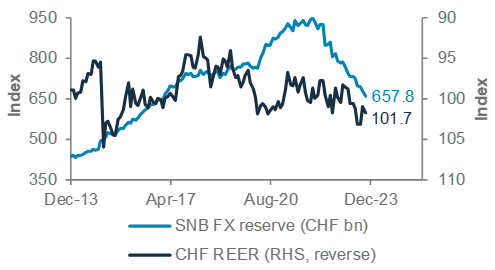

We see USD/CHF rebounding to 0.89 over the next 3 months as it corrects from oversold levels. Longer-term, the Swiss National Bank’s policy of actively selling FX reserves to support the CHF and fend off imported inflation shows little signs of changing. This policy is likely to result in USD/CHF moving to 0.88 over 6-12 months.

Fig. 31 Expected decline in the SNB FX reserves to support CHF valuations

SNB FX Reserve, CHF REER (Real Effective Exch. Rate)

Our expectation for a declining 10-year US government bond yield, tightening BoJ policy and intervention concerns mean we expect USD/JPY to continue to push lower as yield differentials turn increasingly supportive for the Yen. USD/JPY is likely to move to 139 over the next 3 months and push towards 135 over the next 6-12 months.

Commodity currencies should appreciate versus the USD. Expectations of sticky wage growth and inflation should lead the RBA to keep rates elevated longer than other central banks, supporting AUD/USD. The CAD, however, is more likely to consolidate against the USD on the back of slower economic growth and a balanced oil market. We expect AUD/USD to rise to 0.70 in 6-12 months’ time, but expect USD/CAD to consolidate around 1.35.

Asian currencies are likely to deliver modest gains in 2024 as China’s growth stabilises. Near term, we expect USD/CNY to rebound to 7.16 as the recent CNY gains consolidate. Over the next 12 months, a decline in US yields should result in less unfavourable interest rate differentials, helping USD/CNY to fall to 7.00. We expect USD/INR to decline modestly towards 82.00 over the next 12 months. The INR is likely to benefit from broad USD weakness and strong domestic growth. Meanwhile in Singapore, the MAS is likely to keep policy unchanged in early 2024, as Singapore’s core inflation moderates, and then ease alongside other G7 central banks. We expect USD/SGD at 1.35 in 3 months and 1.33 in 6-12 months

Fig. 32 Summary of Asian currency drivers

Gold, crude oil – at a glance

|

Key themes

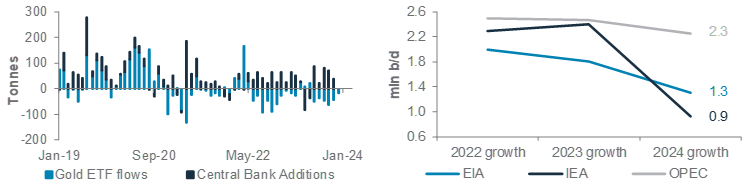

Gold remains a core allocation within our portfolio. While other asset classes offer better return potential, we see gold as an attractive hedge against meaningful recession and geopolitical risks. Moreover, we see gold prices rising further to a record USD 2,150/oz over a 12-month horizon as Fed rate cuts commence, pulling down real yields and the USD. Central bank demand has been a dominant factor bolstering gold prices this year, defying several headwinds such as rising real yields, USD strength and weak investor demand. We expect central banks to remain buyers, lending additional support to the precious metal. In the near term, the continued disinflation, coupled with rangebound bond yields, is likely to lead real yields temporarily higher, capping gold’s upside. Therefore, we expect gold to move to USD 2,060/oz over the next three months.

Crude oil prices are likely to trade at around USD 75/bbl towards the end of 2024, albeit with some volatility, given the potential for oil supply disruptions. Global oil demand growth is likely to slow on the back of a sluggish global economy in 2024, weighing on oil prices. Conversely, thin spare capacity following many years of underinvestment puts a floor on the downside. Furthermore, we expect OPEC+ to react to the price dynamics to keep the demand-supply in equilibrium. Put together, this scenario suggests the oil market stays largely balanced in 2024, barring any exogenous shocks. In the near term, the geographical risk premium has mostly faded, but could return on any escalation of tensions in the Middle East.

Key chart

Robust central bank demand propped up gold in 2023, but this could slow in 2024

Global oil demand growth is likely to slow alongside economic growth

Fig. 33 Robust central bank buying offset weak investor demand; global oil demand growth expected to weaken on slower economic growth

LHS chart: Gold ETF flows, central bank purchases*

RHS chart: Global oil demand growth forecasts from various oil agencies

Additional perspectives

Quant perspective

US risk model bearish on equity markets

|

Model projects higher equity market risks

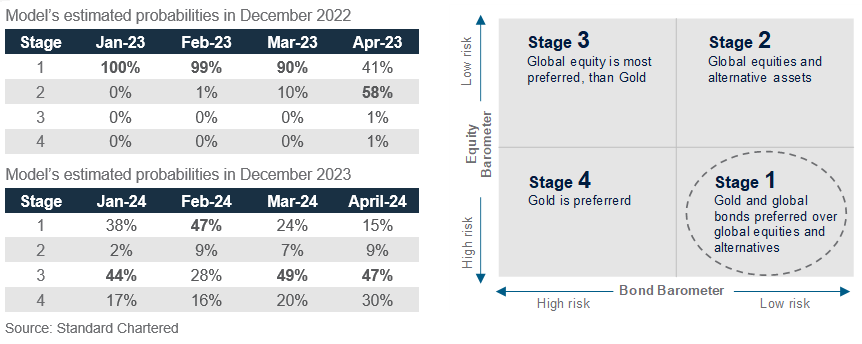

Our US Equity-Bond Market Risk (EBMR) models the downside risks in US equities and the US 10y government bond. It uses 11 economic and market factors to create equity and bond risk barometers. If the value of a barometer falls below 50, it signals higher downside risks and vice versa.

The model remains in Stage 1 since July. This means it continues to signal heightened downside risks for US equity markets, but lower downside risks for US 10y government bonds. The model’s view is based on the slowdown in several economic and market variables, which favours defensive assets such as bonds over equities. Historical data since 1999 suggests gold and global bonds are most preferred assets when the model is in Stage 1. However, the model is signalling increased risk of a shift towards Stage 3 in the coming months, with a probability of 28 – 49%.

Fig. 34 EBMR bearish on equity markets

US equity and bond market risk barometers

Contrasting signals from our other models

Nevertheless, our US EBMR model’s signals are in contrast with signals from our other key quantitative models.

Our global economic regime model continues to signal significantly lower inflation compared with current readings, an outcome that appears consistent with our fundamental view. However, the model’s forecast of global growth remains weak. This is arguably consistent with our US recession probability model. The recent improvement in data means it is signaling the chances of an imminent recession in the next 1-3 months are low. However, the chances of a recession over a longer 6-12-month horizon remain high.

From a market model perspective, our stock-bond model, which uses a combination of equity and bond market inputs to create a near-term equity market signal, is supportive of risk assets over the near term. This conclusion is based on (i) a supportive valuations indicator and (ii) an improving fundamental indicator after the rise in US PMI new orders.

Our ‘fear and greed’ indicator shows we are in a ‘greedy’ market environment consistent with gains in risky assets. Among the six components of the model, market momentum provides the highest score. Having said that, the ‘fear and greed’ model is not suggesting ‘extreme greed’ that would normally signal a high risk of equity market reversal

Fig. 35 Scenarios over the coming months until March 2024 vs December 2022 projections

Probability of the evolution of financial market risk cycle from the current Stage 1 and assets preferred during various stages

Tracking market diversity

|

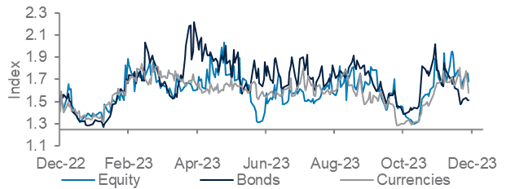

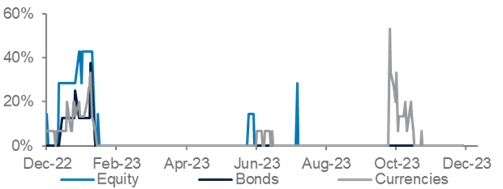

About our market diversity indicators

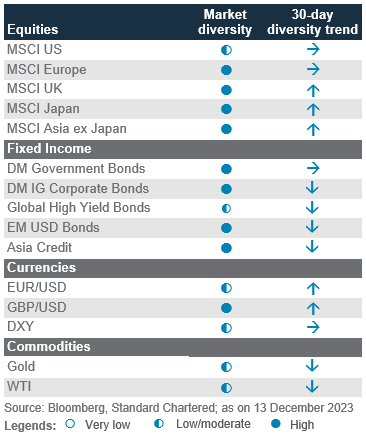

Our market diversity indicators help to identify a potential change in short-term trends due to a fall in market breadth across equities, credit, FX and commodities. When market diversity falls, it implies either buyers or sellers are dominating, leading to a rapid rise or fall in asset prices. This is usually unsustainable and is likely to be followed by a slowdown or a reversal. Our diversity indicator is based on a statistical index called fractal dimension; a value below 1.25 serves as a guideline that prices are rising or falling too fast.

Where is diversity falling or rising this month?

Market diversity across equity, bond and currency markets has increased significantly since mid-October after weaker-than-expected US job market data and dovish policymaker comments. As shown in Fig. 36 and Fig. 37, the average diversity within each asset class has risen sharply above 1.25; there are currently no major assets below the 1.25 threshold.

Within equities, we observed a steep increase in diversity following the recovery from October lows. Most markets have recovered by more than 9% on average since then. The US has led the gains (+14.7%) to a fresh YTD closing high. Currently, the high diversity in equity markets is positive, as it indicates market positioning is unlikely to cause a reversal. US is the best performing major equity market YTD, having outperformed the MSCI AC World index by c. 5% YTD. China, in contrast, is the worst performing major equity market YTD, having underperformed the MSCI Asia ex Japan index by around 14% YTD.

Fig. 36 Average market diversity score by asset class

Diversity across asset classes remains elevated

Fig. 37 Percentage of assets with diversity score <1.25

None of the major asset classes signalling a reversal

For bonds, after a short surge in early November, market diversity has tapered off but remains high on average. In October, we successfully flagged the reversal signals for DM government bonds (+6.9% gains since then) and the US 10-year bond yield (-90bps decline since then). Global high yield bonds have the lowest level of market diversity at 1.44.

For currencies, our diversity indicator also flagged a USD reversal against multiple currencies in October. Since then, the broad USD index, DXY, has fallen 3.5% and the EUR, GBP, AUD and CHF have all appreciated against the USD. Market diversity remains high across currencies, which suggests low risk of an immediate reversal in trend.

For commodities, market diversity for gold has deteriorated to 1.43 from 2.1 in October. Gold has gained 11% since October’s low. We recommend keeping an eye on it in case the diversity score falls below the critical 1.25 level.

Fig. 38 Diversity across key assets

A holistic approach to managing your wealth

Performance Review

Building resilient portfolios

|

|

||||

|

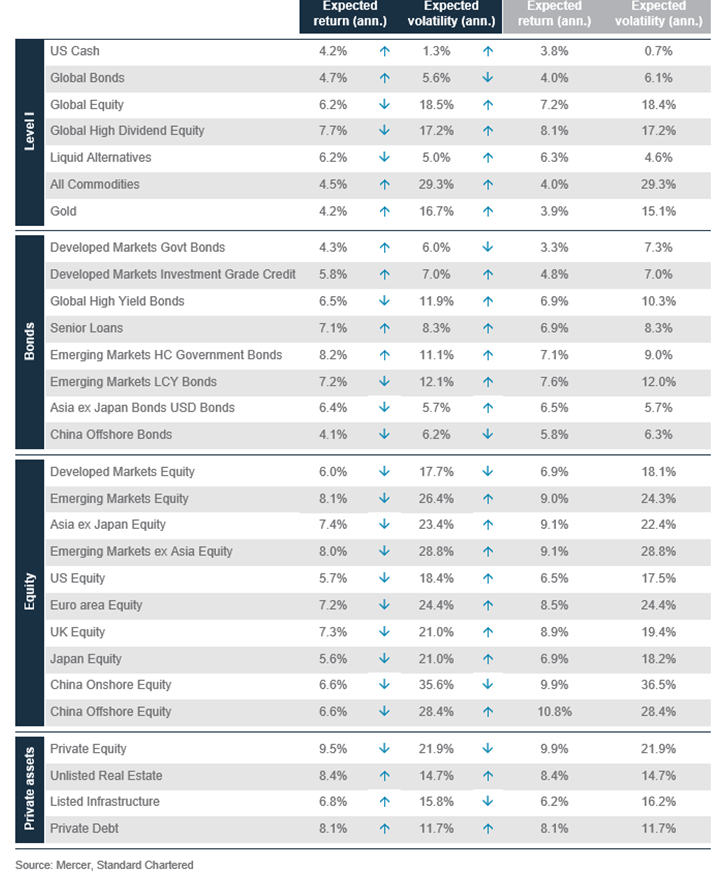

In this document, we present an annual update of our capital market assumptions (CMAs). These estimate the returns and volatility of major global asset classes over a strategic seven-year horizon. The CMAs are best understood as the central tendency of forward returns. We do not view them as forecasts or projected returns; rather, we see them as indicative estimates of direction, quantum and ranking of likely asset class returns around which there are likely to be material deviation over any specific period.

As we present our 2024 long-term CMAs, a significant transformation appears to be unfolding in the economic landscape. The past decades of disinflationary forces appear to be giving way to a new phase, characterised by greater volatility in inflation and government intervention

Inflation is currently receding, prompting major central banks to pause rate hikes. Yet, it remains above target in many G20 economies. There is uncertainty around whether this could lead to a policy mistake. Past lessons caution against premature policy easing as it can hinder progress on controlling inflation. The evolving inflation risk highlights the importance of a thorough assessment, not just on asset returns, but also the principles guiding portfolio diversification. (See Perspectives, page 11)

What changed?

Our expected returns on a 60/40 global stock-bond portfolio stands at 5.6%, a 27bp dip from last year. Despite this slight decline, the valuation of a 60/40 portfolio is roughly in line with its historical norm after hitting a high in late 2021. This represents reasonable value and is still a great starting point for a long-term investor.

Higher bond yields offer greater margin of safety

Expected returns on bonds have significantly improved. The US 10-year government bond yield breached 5% temporarily in 2023. While yields have fallen nominally since then, real yields, which are calculated by subtracting inflation expectations from nominal yields, still stand above 2%.

Fig. 39 60/40 Equity-Bond portfolio still offers a great starting point for long-term investors

60/40 historical performance and expected returns

*As of end November 2023. **Based on seven-year capital market return assumptions of global equities and bonds

Over the past two decades, real yields have lingered above 2.5% less than 9% of the time, making current yields enticing for many investors.

Fig. 40 Higher starting yields point towards higher bond returns in subsequent years

Bloomberg US Aggregate Bond Index returns vs starting yields*

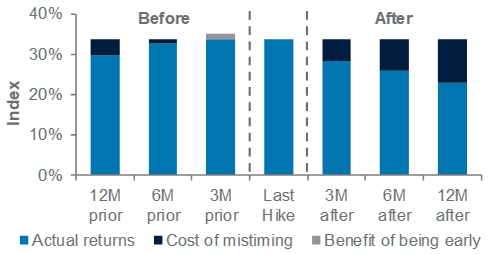

Higher starting yields benefit fixed income assets, offering better protection and portfolio diversification, especially for high quality bonds in the face of growth risks. While there could be concerns whether the rate hiking cycle has peaked, history suggests it is better to start investing in bonds early than late. The longer investors delay in investing past the last rate hike, the greater the opportunity cost and lower the forward returns, once markets price the start of rate cuts.

Fig. 41 There are benefits to investing into bonds early into hiking cycles

Bond returns across different entry points

Credit offers equity like returns, but not without risks

Return expectations of US credit are largely unchanged. For DM Investment Grade (IG) bonds, expected returns are steady at 5.8%, though there are downside risks given the higher-than-normal weight to BBB-rated bonds and the fact that higher financing costs may hit areas with high leverage.

High Yield (HY) bonds and leveraged loans are expected to return 6.5% and 7.1%, respectively. The spread assumption of DM HY was increased by 9bps to take into account potential downgrades, especially risks of potential downgrade from IG to HY rating (‘fallen angels’). This is, however, mitigated by the index’s lesser proportion of lower-rated bonds relative

to history.

Equities offer lower returns, higher valuation

Equity returns have experienced a modest decline across the board due to richer starting valuations and higher interest rates, which have put a cap on multiples. Although valuations are not reliable timing tools, they tend to be powerful drivers of long-term returns. We expect, global equities, overall, to deliver a nominal annualised return of 6.2% (in USDs), with Asia-Pacific (excluding Japan) leading the pack at 7.4%.

Expected returns on US equities have eased lower to 5.7%. Corporate margins have declined, but remain higher than historical averages, particularly in DMs where profitable high-margin companies, especially in the tech sector, dominate. Optimism surrounding AI could further boost productivity and margins, though downside risks, eg, onshoring and higher wage pressures, should also be considered.

We have cut our expected returns on Emerging Market (EM) and Asia ex-Japan equities due on lower long-term growth expectations and slowing globalisation. The premium of EM returns over DM returns continues to decline, driven by lower relative growth differentials between EM and DM and the disappointing transmission of growth to earnings in EMs.

Alternatives remain a bright spot and good diversifiers against inflation risks

Despite ongoing challenges, alternative investments remain valuable for portfolio diversification, return enhancement, and ensuring a resilient portfolio. Real assets, including real estate and infrastructure, are expected to sustain steady returns and contribute to portfolio diversification. While the impact from financial engineering may be limited, net operating income can be supported by inflation linkers or rental growth. Sustainability and criticality are key considerations that could support the valuation and expected return of real assets (8.4%).

Private equity is projected to yield high absolute returns. While high financing costs and still ample dry powder may be detrimental, underperformance of small- and mid-cap stocks in 2023 allows lower entry multiples for firms focussed on taking public companies private.

Private credit is expected to be a source of income enhancement, but the default rate is also expected to creep up. Fund managers’ underwriting discipline, portfolio diversification, and sector and vintage exposures will be key.

Looking ahead, returns on diversified portfolios are likely to be lower than last year due to a narrowing range among major asset classes – lower equity returns and higher bond and cash returns. This implies making top-down asset allocation changes across stocks and bonds is going to be somewhat less impactful than before. As such, investors should focus on seeking opportunistic ideas and the use of skilled managers to enhance their portfolio returns.

Fig. 42 Return assumptions for Equities have been revised lower, while high quality bonds are expected to perform better going forward

Seven-year capital market assumptions of key assets

Foundation: Asset allocation summary

Foundation+: Asset allocation summary

Market performance summary

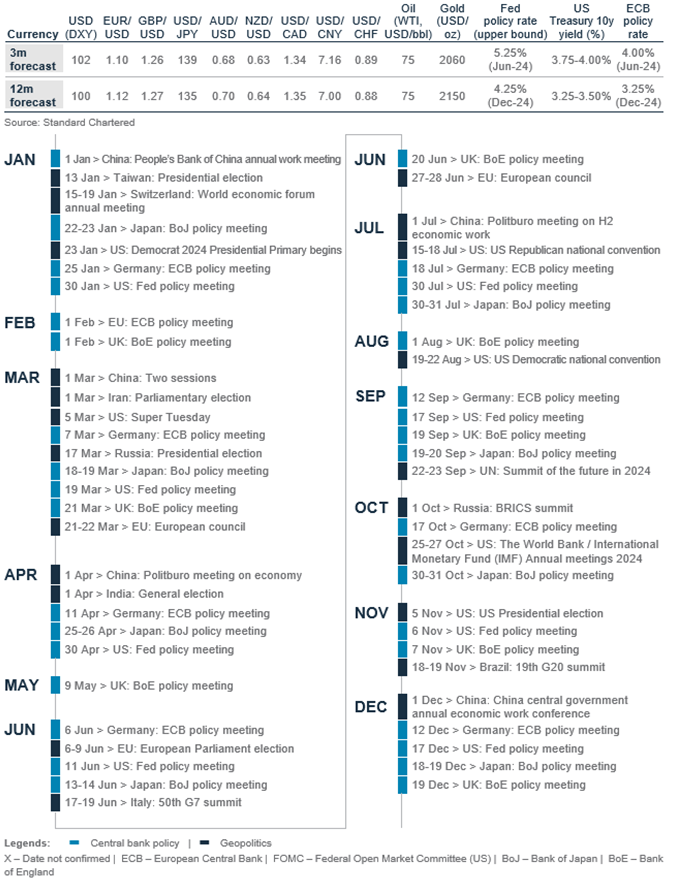

Our key forecasts and calendar events

For more CIO Office insights

Explanatory notes

- The figures on page 7 show allocations for a moderately aggressive risk profile only – different risk profiles may produce significantly different asset allocation results. Page 7 is only an example, provided for general information only and they do not constitute investment advice, an offer, recommendation or solicitation. They do not take into account the specific investment objectives, needs or risk tolerances of a particular person or class of persons and they have not been prepared for any particular person or class of persons.

- Contingent Convertibles are complex financial instruments and are not a suitable or appropriate investment for all investors. This document is not an offer to sell or an invitation to buy any securities or any beneficial interests therein. Contingent convertible securities are not intended to be sold and should not be sold to retail clients in the European Economic Area (EEA) (each as defined in the Policy Statement on the Restrictions on the Retail Distribution of Regulatory Capital Instruments (Feedback to CP14/23 and Final Rules) (“Policy Statement”), read together with the Product Intervention (Contingent Convertible Instruments and Mutual Society Shares) Instrument 2015 (“Instrument”, and together with the Policy Statement, the “Permanent Marketing Restrictions”), which were published by the United Kingdom’s Financial Conduct Authority in June 2015), other than in circumstances that do not give rise to a contravention of the Permanent Marketing Restrictions.

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2025, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. All covering strategist are licensed to provide investment recommendations under Monetary Authority of Singapore or Hong Kong Monetary Authority. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments