How to read your credit card statement?

PAYMENT OPTIONS PAYMENT OPTIONS

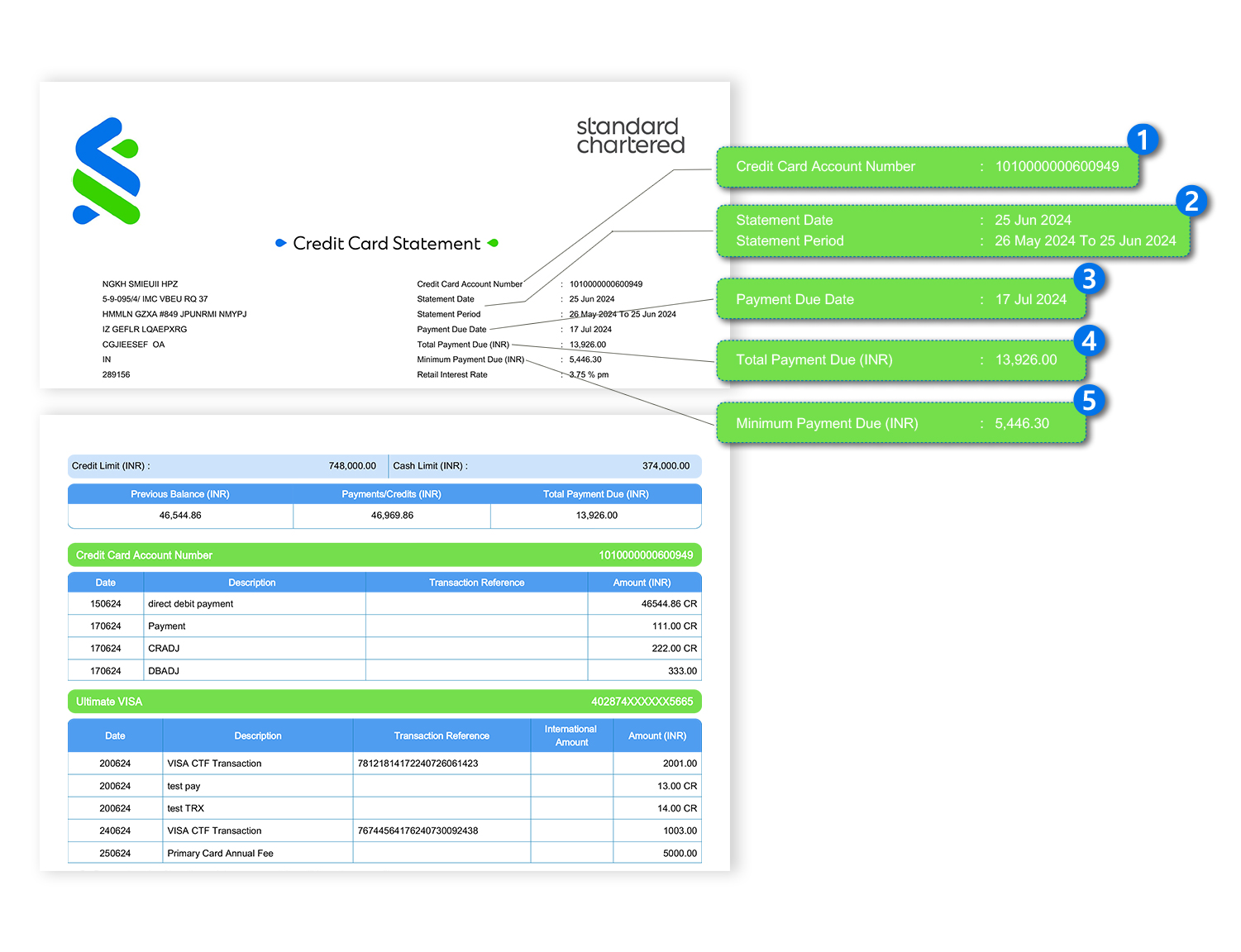

Know your Credit Card Statement

1. Credit Card Account:

Credit Card Account is a 16-digit number which will be available in your statement. It will be unique to every consolidated statement covering all primary and supplementary cards and any instalment facility (EMI or loan availed on your Credit Card) linked to this Credit Card Account.

In case you have a Flexi Loan on Credit Card, a separate Credit Card Flexi Loan Account number will be generated and the same will be available in your statement.

Click here to view the payment options to make payment towards your Credit Card Outstanding balance.

2. Statement Date and Statement Period:

Statement Date is the date on which the current statement is generated.

Statement Period is the date range between your previous statement and current statement.

3. Payment Due Date:

This date refers to the date, by which you need to pay the Minimum Payment Due to avoid a levy of fees and charges. In the absence of a payment by this date your credit score may also be impacted.

4. Total Payment Due:

This is the total amount that you owe to the Credit Card Account and needs to be paid in full on or before Payment Due Date in order to avoid interest charges and fees.

5. Minimum Payment Due:

This is the minimum amount you need to pay by the Payment Due Date to avoid a levy of fees and charges. In the absence of this payment, your credit score may also be impacted. The minimum amount payable will vary every month depending on your Total Payment Due on your Credit Card Account.