Standard Chartered Bank launches the first app in Malaysia

with complete banking services through Touch Login

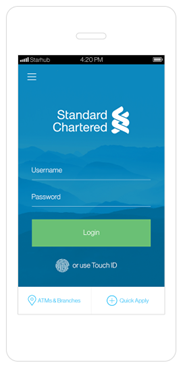

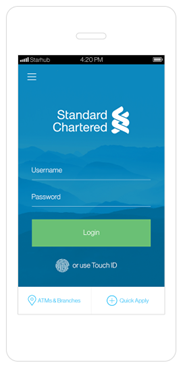

KUALA LUMPUR, 5 December 2016 — Standard Chartered Bank (“the Bank”) introduces the Touch Login biometric security for its all-new Standard Chartered Mobile (“SC Mobile”) app, formerly known as Breeze. The SC Mobile is the first app in Malaysia that uses biometric security to access a complete suite of banking services.

Logging in with just a touch of their fingerprint, customers using the app will be able to swiftly and securely access their bank account balances, perform banking transactions such as payment and transfer funds at their convenience.

Aaron Loo, Country Head, Retail Banking, Standard Chartered Bank said, “The introduction of the Touch Login represents one of the many initiatives the Bank has put in place to make banking convenient to our clients. We are focused on making client experience a positive one, emphasizing on quick and easy logins to a full range of banking transactions that are safe and secure – this represents a first for the banking industry.”

Key features of Touch Login comprise:

- Enhanced mobile banking security – Touch Login uses fingerprints to verify identity, making it more secure than username and password logins.

- Convenience – Through the SC Mobile app, clients using Touch Login can immediately access the Bank’s full range of mobile banking services with a registered fingerprint in place of ID and password – from transferring money between accounts and checking transactions to paying credit card bills and sending electronic cashier’s orders.

- Available on both iOS and Android – Touch Login is available on selected Apple iOS devices with Touch ID sensors (iOS 9.0.2, iPhone 5S, iPad Air 2, Mini 3 and later releases) and Samsung Android devices with fingerprint sensors (Android version 5.1.1, Samsung S6, Samsung Note 5 and later releases). They are available for download on App Store and Google Play.

Touch Login is a step forward in making personal banking simple, convenient and secure. These are the hallmark features of what customers can look forward to on their devices with fingerprint IDs. Alternatively, customers are still able to use the app by entering their ID and password manually, which is useful on devices that do not have biometric verification features.

Customers will also be pleased to note that the SC Mobile app, is more than just a rebranding exercise. Sporting a refreshing look, the app is more fluid, faster and intuitive; enhancing customer user experience.

The Bank’s new Touch Login feature and all-new app are a part of the Bank’s strategy and commitment to deliver the latest in digital banking innovation to its clients across 15 markets in Asia, Africa and the Middle East. This is the most extensive rollout of fingerprint biometric technology by any international bank and a first in most markets, which, to date, has reached over 5 million clients worldwide.

Among the digital initiatives the Bank launched this year was the award-winning Retail Workbench that lets clients open an account in any location and makes banking services such as loan approvals and credit card issuance fast, simple and completely paperless. The digital “bank on an iPad” sales-and-service tool was launched in February. Then in July, the country’s first video banking was introduced. It allows customers to securely interact with banking consultants via video, audio and chat, with the flexibility and convenience of banking from any location using their laptop.

“Standard Chartered is all about enhancing value for our customers when they want to access their bank balances, cards and investments, wherever they are and whenever they want,” added Aaron Loo. “We will continue to invest significantly in solutions that would improve our client experience when they bank with us. Touch Login represents our current effort in this regard and we will be introducing many more initiatives going forward.”

The Bank’s retail banking business serves nearly 10 million individual and business clients across more than 30 markets in Asia, Africa and the Middle East, through cutting-edge digital channels, more than 1,000 branches and 5,000 ATMS.

-ENDS-