IMPORTANT AND LEGAL INFORMATION

This is an advertisement.

This advertisement has not been reviewed by the Securities Commission Malaysia. The product lodgement, registration, submission or approval by the Securities Commission of Malaysia does not amount to nor indicate recommendation or endorsement of the product, service or promotional activity. Please refer to Advertising Standards on https://www.sc.com/my/investments for additional information. Investment products are not deposits and are not obligations of, not guaranteed by, and not protected by, Standard Chartered Bank Malaysia Berhad or any of the affiliates or subsidiaries, or by Perbadanan Insurans Deposit Malaysia (PIDM), any government or insurance agency. Investment products are subject to investment risks, including the possible loss of the principal amount invested.

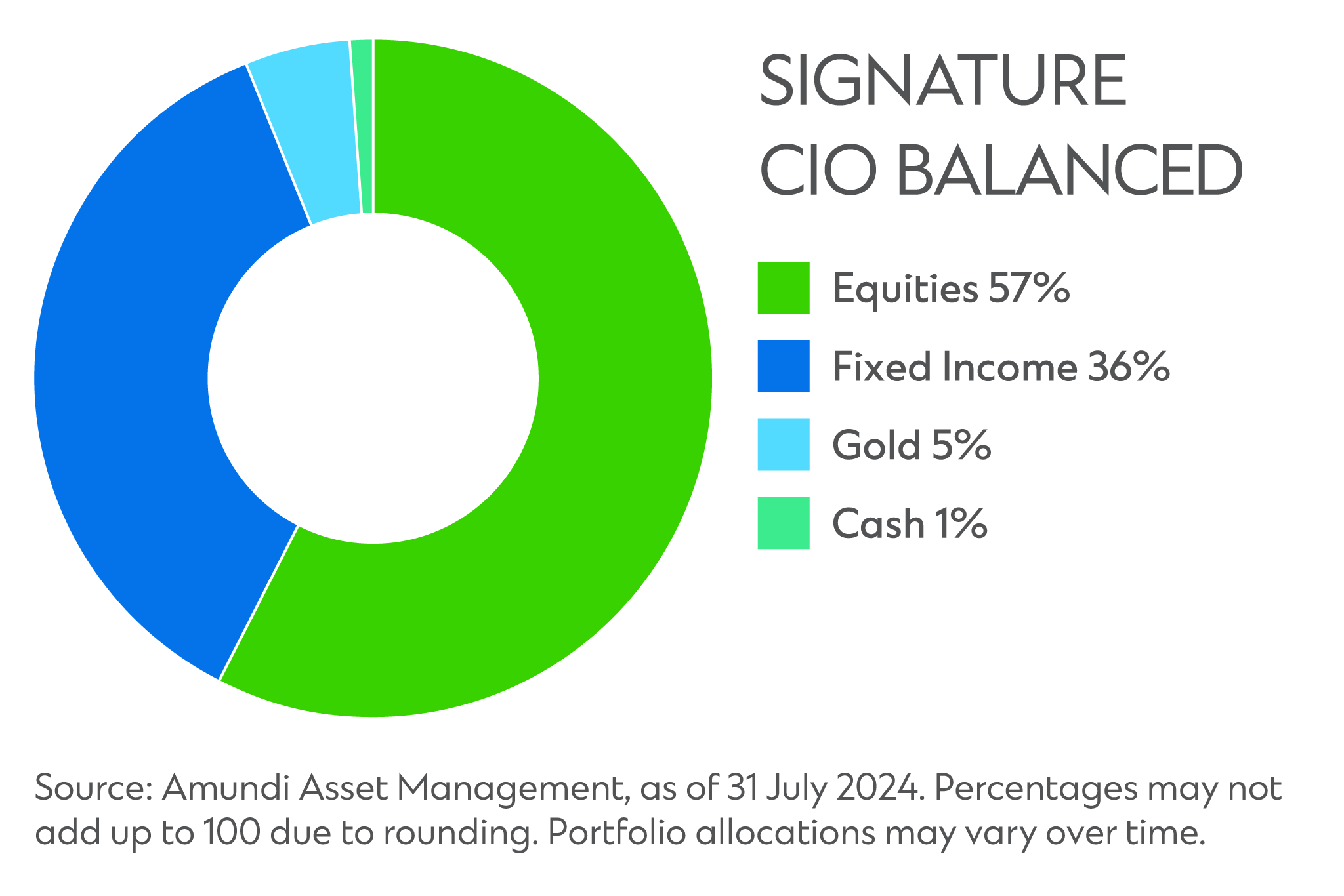

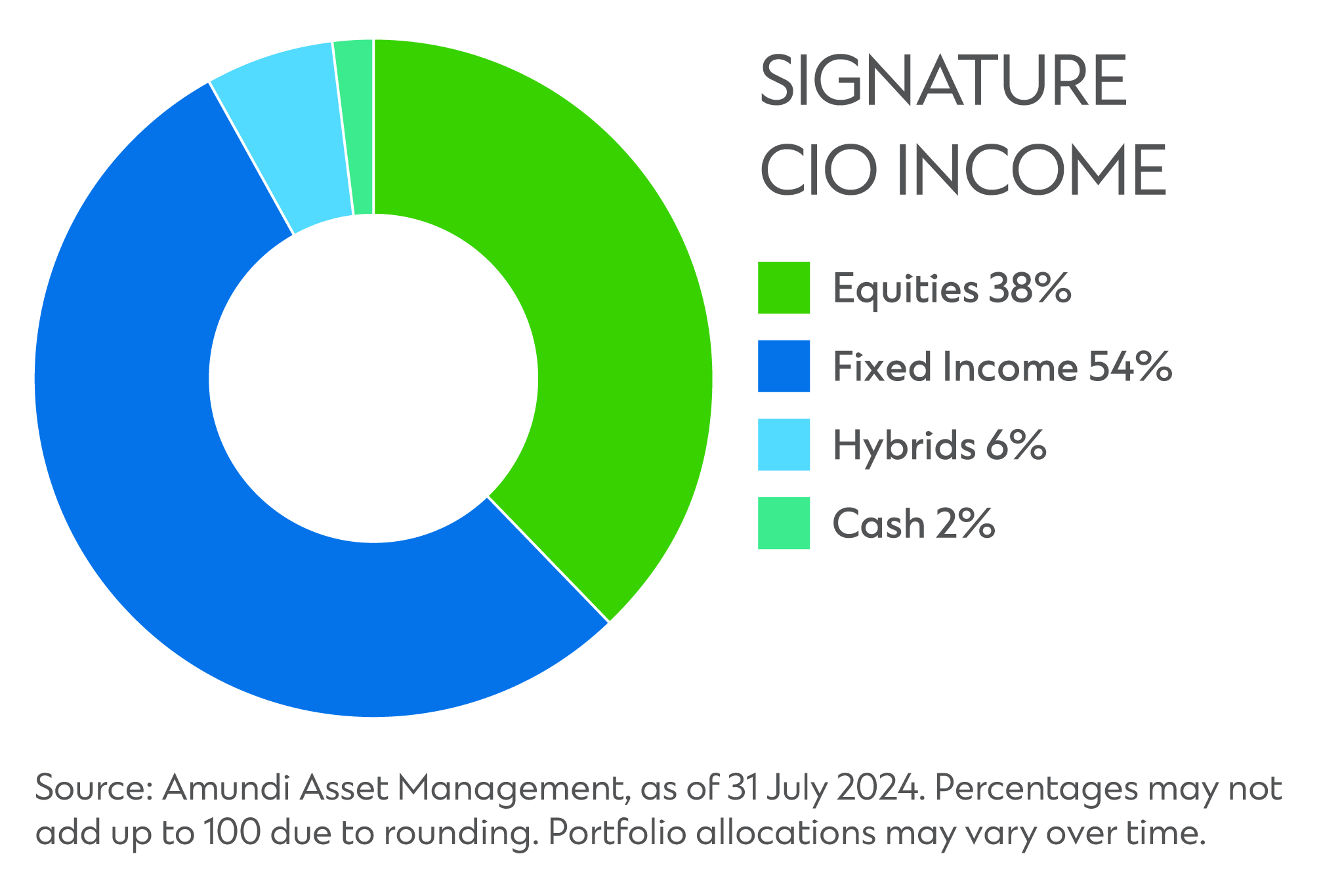

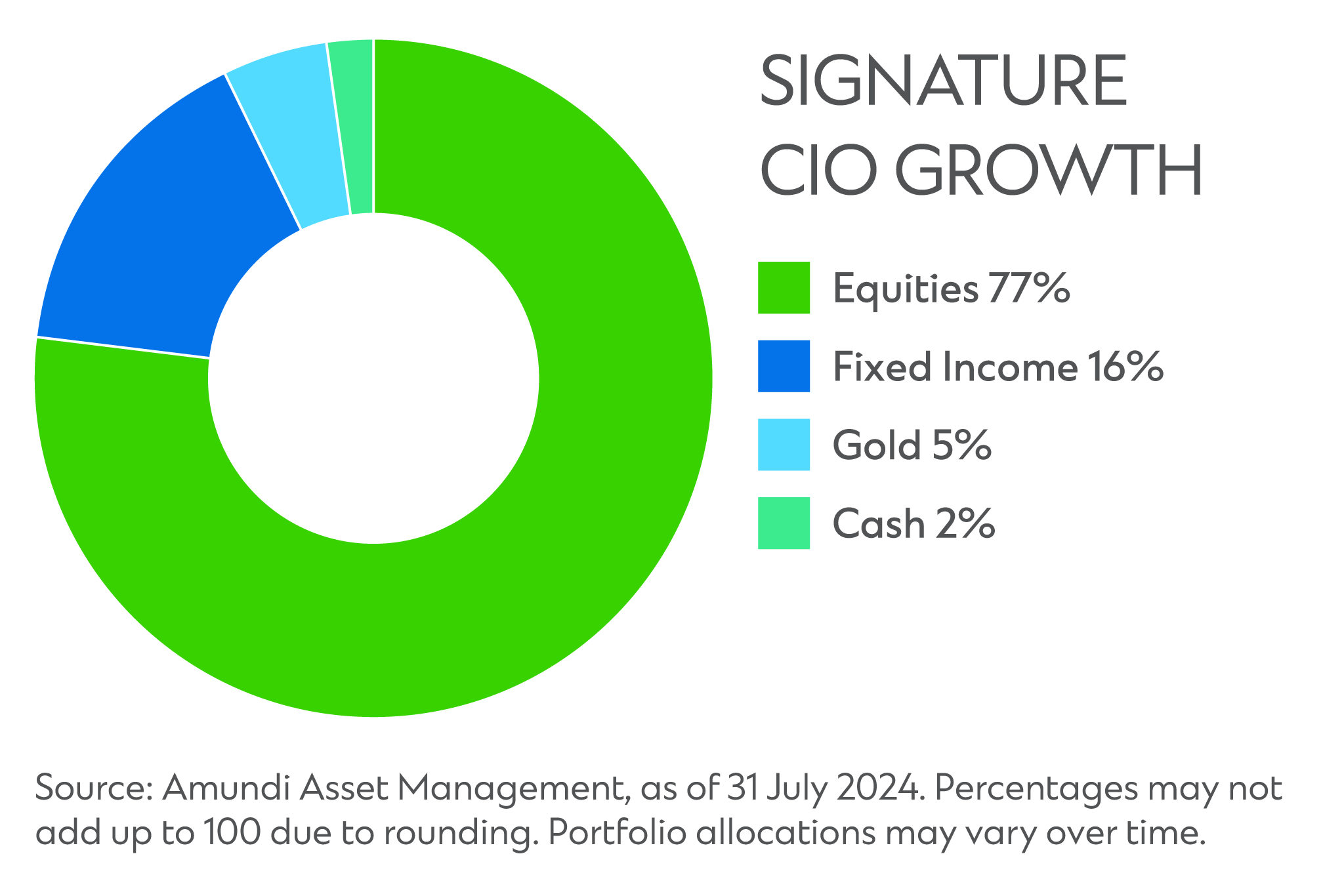

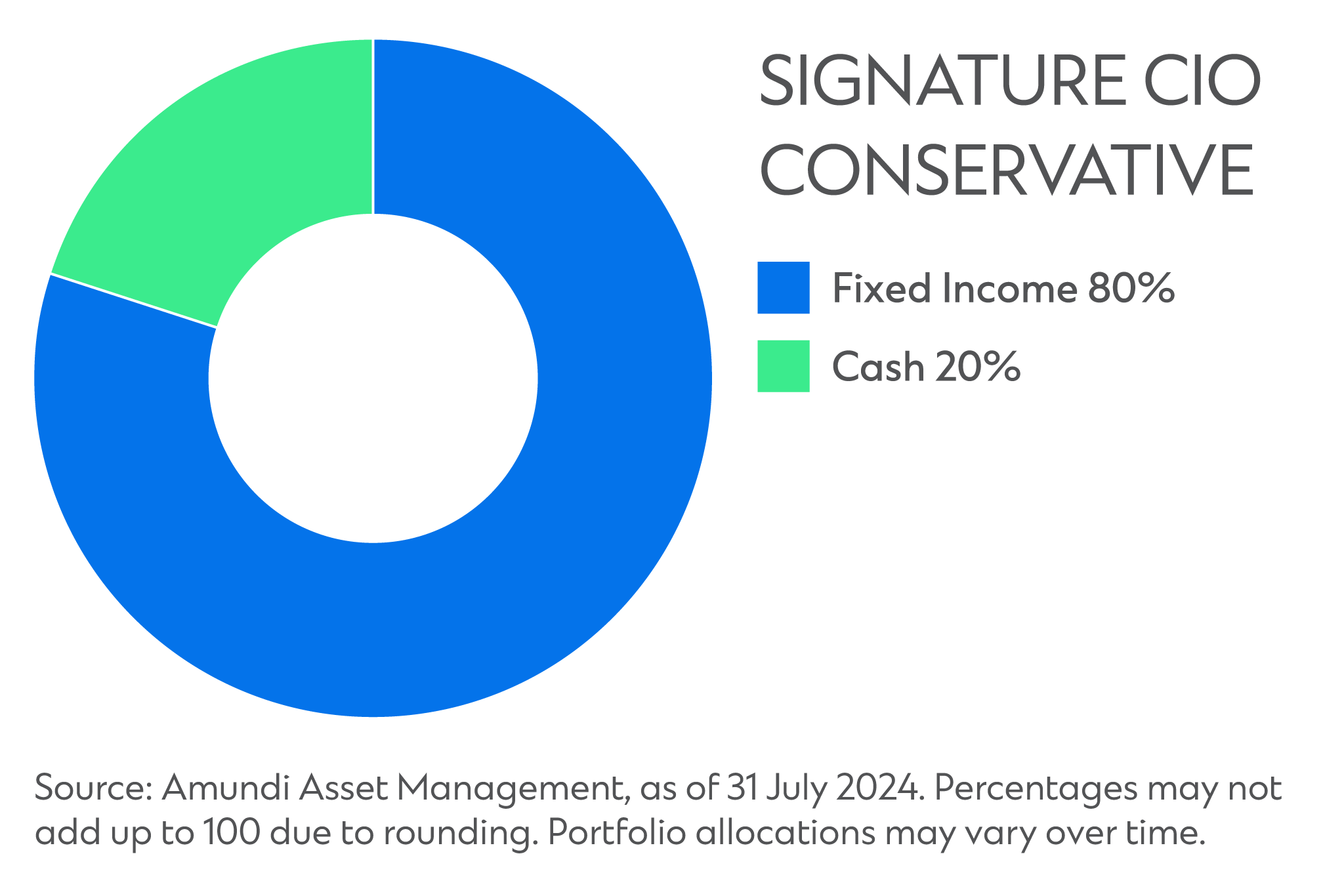

This document contains information about SIGNATURE CIO INCOME, SIGNATURE CIO CONSERVATIVE, SIGNATURE CIO BALANCED and SIGNATURE CIO GROWTH (each a “Fund”), wholesale feeder funds constituted in Malaysia. Amundi Malaysia Sdn. Bhd. (Registration No. 200801015439 (816729–K)) (“Manager”) is the manager of the Funds. The Manager and/or its affiliated companies being hereinafter referred to individually or jointly as “Amundi”.

The descriptions of cover are a brief summary for quick and easy reference. The information provided here is for general information only. It does not constitute a recommendation nor is it intended to be an offer or invitation for product subscriptions and financing and we are not responsible for any loss arising whether directly or indirectly as a result of your acting based on this information. This document is for distribution or to be used solely in jurisdictions where it is permitted and to persons who may receive it without breaching applicable legal or regulatory requirements, or that would require the registration of Amundi in these countries.

A note on Investment Risks: Investments are subject to market risks (and other risks such as default risk, counterparty risk, interest rate risk, country risk, currency risk, taxation risk, income distribution risk, asset mismatch risk, concentration risk, reinvestment risk, derivatives risk and risks elaborated in the relevant Prospectus and/or Information Memorandum) and obtaining financing for investment purpose is a liability. You should not rely on any contents of this document in making any investment and/or financing decisions. You are advised to read the relevant product prospectus, information memorandum and Investment Product Terms and Conditions carefully and consider the investment risks and fees and charges involved in the transaction prior to investing. Past performance is not indicative of future returns. The price of units and distributions, if any, may go down as well as up. An Investor should seek independent advice from his/her financial adviser regarding the investment suitability of the Funds, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the recommendation, before making a commitment to purchase units in the Funds. Where obtaining wealth financing for investment, investors are also advised to read and understand the relevant terms and conditions.

In case of unit split/distribution for any of the funds, investors are reminded that following the issue of additional units/distribution, the NAV per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV..

Qualified or sophisticated investors (“Investors”) are advised to obtain, read and understand the contents of the applicable Fund’s Master Information Memorandum dated 3 July 2023 (“Master IM”) and prevailing Product Highlight Sheet (“PHS”) before deciding to invest in a Fund. The Master IM and PHS have been deposited and/or lodged, with the Securities Commission Malaysia (“SC”), who takes no responsibility for the contents of the Master IM and PHS. The lodgement of the Master IM and PHS with the SC does not amount to or indicate that the SC has recommended, endorsed or is in any way associated with the Funds.

A copy of Master IM along with other relevant documents can be obtained from any of our branches. Investors are reminded that issue of units to which the Master IM relates will only be made on receipt of an application form referred to and accompanying copy of the Master IM.

A note on Suitability Assessment: The funds are only offered to “sophisticated investors” as defined in the Master IM. Please consider your specific investment requirements before choosing a fund or designing a portfolio that suits your needs. Kindly refer to the Fund Prospectus or Information Memorandum for more information. Investment Product Risk Rating (PRR) are rated numerically from 1 to 6 in ascending order of risk; PRR 5 and above is considered high risk. This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial advisor regarding the suitability of the investment products and the financial standing, taking into account your specific investment objectives, financial situation, or particular needs, before making a commitment to invest in such products and use borrowed money for investment.

Certain information contained in this document have not been independently verified, although Amundi, Standard Chartered Bank Malaysia Berhad and their affiliated companies believe such information to be fair and not misleading. Amundi and Standard Chartered Bank Malaysia Berhad do not accept any liability whatsoever whether direct or indirect that may arise from the publication of this document and use of information contained in this document. Amundi and Standard Chartered Bank Malaysia do not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. Amundi and Standard Chartered Bank Malaysia do not make any representation as to the merits, suitability, expected success, or profitability of any such transaction mentioned herein.