Skip to content

Frequently Asked Questions – IBAN

- What is the IBAN?

The International Bank Account Number (IBAN) is an internationally agreed means of identifying bank accounts across national borders with a reduced risk of propagating transcription errors. IBAN has been standardized ISO 13616-1. Advantage of implementing IBAN is to facilitate Straight Through Processing (STP) of Electronic Payments by minimizing delays and extra costs associated with incorrect account numbers. IBAN implementation will help in bringing more efficiency in remittance related transactions. Approximately 54 countries in total are currently using IBAN mainly member countries of the European Union. In the Gulf region, UAE, Saudi Arabia, Kuwait and Bahrain are using IBAN.

Qatar is migrating to ISO International Bank Account Number (IBAN) standard for numbering of customer bank accounts effective 01 January 2014 as per the directive issued by the Qatar Central Bank.

- Can you briefly explain the QATAR IBAN?

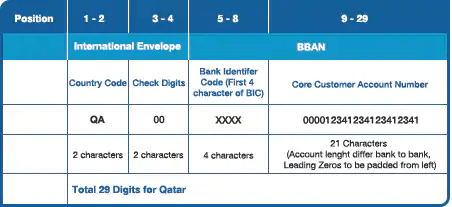

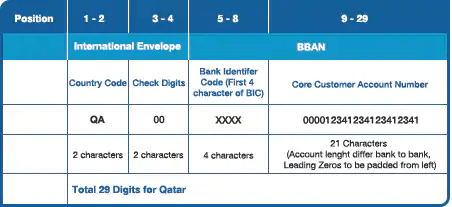

Based on the above the IBAN for the Qatar will be 29 characters. The diagram below shows the various components of the QATAR IBAN.

The IBAN has two main components, the header and the Basic Bank Account Number (BBAN).

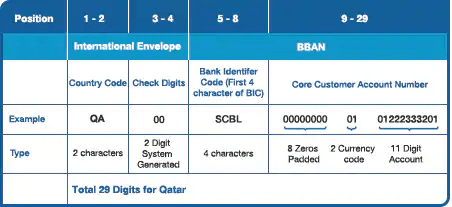

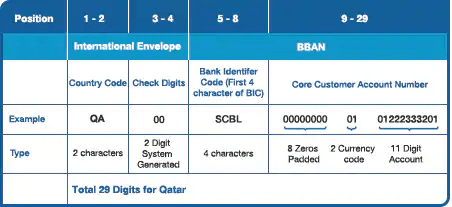

- How is the IBAN formed for Standard Chartered Bank QATAR?

SCB QATAR IBAN Format

IBAN number consists of 29 digits broken down as follows:

Position 1-2: Country Code (two characters)- The country code for Qatar is “QA”

Position 3-4: Check digits (two characters) calculated based on ISO/IEC 7064 (MOD 97-10) and are system generated.

Position 5-8: Bank Identifier (Four Characters) For SCB Qatar is “SCBL”

Position 9- 29: 8 Additional zeros required to match the length of IBAN along with 2 -digit currency code and 11 -digit existing account number.

- How would IBAN benefit me?

The main benefit is that IBAN should provide you with quicker processing of your funds transfer. Since banks are required to check the accuracy of the IBAN at the point of initiating a fund transfer, they can only make the funds transfer which carry the correct IBAN.

- Do I need an IBAN?

All bank customers, who receive or make fund transfers through Qatar, will require an IBAN. If you have multiple bank accounts, you will require an IBAN for each one.

- When can I use IBAN in the QATAR?

You can start using IBAN for your local and international fund transfers from 01 January 2014.

- How can I get my IBAN?

We will communicate the equivalent IBAN for every account you hold with us. You will also see your equivalent ΙΒΑΝ on your bank statement or you can visit our website which has IBAN Generator and Validator.

Standard Chartered is unable to provide you with IBAN details for accounts held with another Bank. Please contact that respective bank for details regarding your IBAN.

- What can I use IBAN for?

IBAN can be used for the following local and international payments:

Making a fund transfer (through a bank) to an account at a bank in QATAR;

Making a payment (through a bank) to an account in a country that has adopted IBAN;

Making a fund transfer (through a bank) to an account in a country that has not adopted IBAN.

Receiving a fund transfer (through a bank) from an account at a bank in QATAR;

Receiving a fund transfer (through a bank) from an account in a country that has adopted IBAN; and

Receiving a fund transfer (through a bank) from an account in a country that has not adopted IBAN.

- What is the difference between an IBAN and a normal account number?

An IBAN can always be distinguished from a normal customer account number by the following:

Two letters at the beginning of the IBAN, which refer to the country code where the account resides; and

The length of the IBAN is 29 characters.

Normal account example: 01222333401

IBAN account example: QA00 SCBL 0000 0000 010122233340 1

- Do my existing account number(s) become invalid with the introduction of IBAN?

No, your existing account number(s) will continue to be valid. IBAN is not a new account number. It simply represents the existing account number in a recognisable ISO standard format. The adoption of IBAN in QATAR does not require changing or replacing the existing account numbers.

- Will the IBAN only be used for international funds transfer?

No, the IBAN must be used for sending and receiving local and international funds transfer

- How will the IBAN appear on my Online Banking account?

You will not be able to see your IBAN on Online Banking. However, you will be able to see your IBAN on your statements and balance reports.

- Will there be any additional charges associated with using IBAN?

Presently, there is no additional charge for using IBAN other than our normal transaction processing fees. We will communicate to you any changes to the fees and charges.

- Can you explain the procedure involved in making a fund transfer using IBAN?

The bank of a beneficiary makes the IBAN available to the beneficiary. The beneficiary’s IBAN is forwarded to the ordering customer by means such as invoice, letterhead; International funds transfer Instruction, Domestic Funds Transfer Instruction (QATCH) etc

The ordering customer submits a local or international credit transfer, which includes the beneficiary’s IBAN that has been validated by the customer’s ordering bank. After receipt of the message by the beneficiary’s bank the beneficiary’s account will be credited.

- Which countries are currently using IBAN?

Details of IBAN in those countries can be obtained from the IBAN Registry at the SWIFT website: http://www.swift.com/dsp/resources/documents/IBAN_Registry.pdf