21 June 2024

Global Market Outlook

Global Market Outlook

Adapting to shifting winds

The start of major central bank rate cuts marks a key turning point for investors as policymakers switch their focus towards supporting growth.

We see it as a good time to adapt to these shifting winds by (i) staying Overweight equities over bonds and cash, (ii) favouring US equities globally and Indian equities in Asia and (iii) owning gold and EM USD bonds as diversifiers.

In this environment, balanced foundation allocations comprising equities, bonds and alternative assets are likely to outperform allocations that are solely aimed at generating income.

Our opportunistic allocations continue to favour growth sectors in the US, a barbell-like strategy in Europe and select government policy beneficiaries in China.

How to craft a diversified portfolio for the long-term?

Is the US economy still headed for a soft-landing?

What is the message from your quantitative models?

Strategy

Investment strategy and key themes

|

|

||||

|

Our top preferences

Foundation Allocations

- OW Global equities

- In equities: US

- In bonds: EM USD bonds

Opportunistic Allocations

Equity BUY ideas

- US technology sector

- US comms. services sector

- India large cap equities

- China non-financial divi SOEs

- Taiwan equities

- Japanese banks

Bond BUY ideas

- US inflation-protected bonds

- Europe govt. bonds (FX-hedged)

- INR local currency bonds

- US Agency MBS

FX views

- Bullish bias on USD

Adapting to shifting winds

- The start of major central bank rate cuts marks a key turning point for investors as policymakers switch their focus towards supporting growth. We see it as a good time to adapt to these shifting winds by (i) staying Overweight equities over bonds and cash, (ii) favouring US equities globally and Indian equities in Asia and (iii) owning gold and Emerging Market (EM) USD bonds as diversifiers.

- In this environment, balanced foundation allocations comprising equities, bonds and alternative assets are likely to outperform allocations that are solely aimed at generating income.

- Our opportunistic allocations continue to favour growth sectors in the US, a barbell-like strategy in Europe and select government policy beneficiaries in China.

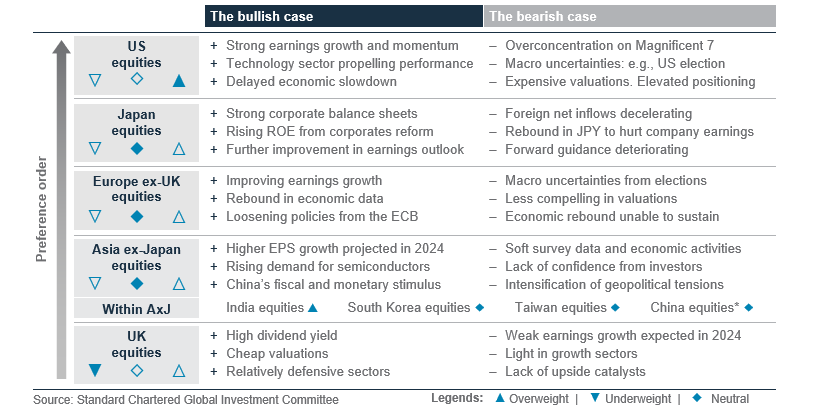

Investment strategies in the face of shifting winds

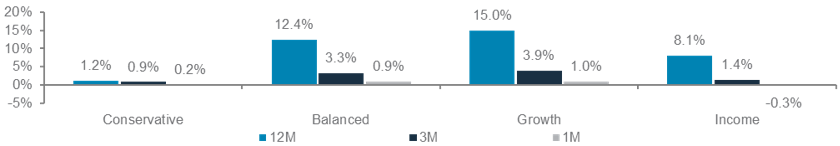

Our 2024 Strategy of ‘Sailing with the Wind’ has performed well on the back of a strong equity market rally. Our Balanced allocation has risen 6.7% year-to-date, outperforming income-oriented strategies.

As we approach a potential inflection point in the form of central bank rate cuts and the US election, we believe it is time for investors to ‘Adapt to Shifting Winds’. We expect: (i) equities to outperform bonds and cash, an outcome likely to result in balanced strategies outperforming income strategies; (ii) US and Indian equities to outperform global and Asian markets, respectively; and (iii) gold and EM bonds to offer diversified sources of return.

Policy inflection point a key positive for equities

Major central bank rate cuts, which started in Q2, are likely to extend into the second half of the year. Europe is the forerunner along this path. The central banks of Sweden and Switzerland and the European Central Bank have already cut rates as growth and inflation slow. We believe the Fed has room to follow suit, albeit later in H2, as slowing rents and softening labour markets drive inflation lower.

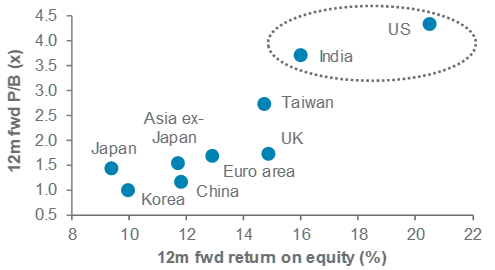

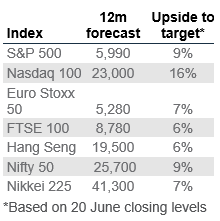

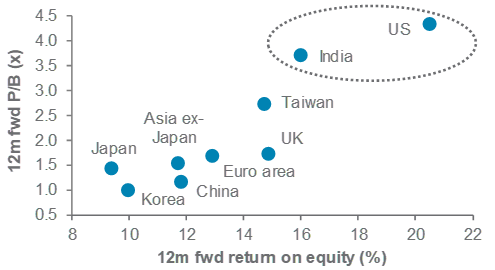

Fig. 1 High US and Indian equity market valuations arguably justified by high return on equity

12m forward Price/Book vs. return on equity

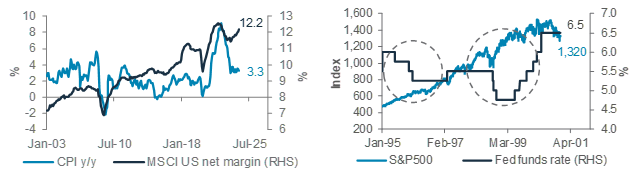

For markets, this policy shift is significant as it creates the conditions for our soft-landing view to pan out. Pre-emptive rate cuts that help avoid a sharp, recessionary slowing of economic growth are likely to support an extended earnings growth cycle. These conditions should result in equities continuing to outperform bonds and cash in H2 24.

US and Indian equities to lead

Regionally, we believe US equities offer a strong case for continued outperformance relative to other major equity markets in H2. US earnings remain a cornerstone of our view – 12-month expected earnings growth remains robust and has been revised higher since the start of the year. More significantly, these expectations show gains broadening beyond the ‘Magnificent 7’ stocks by year-end.

US valuations are undoubtedly high and have been one key pushback against our positive view. However, we believe these are justified by a high return on equity (ROE). In our view, this suggests valuations are unlikely to be a barrier to further gains in an environment where markets remain focused on growth assets amid likely upcoming Fed rate cuts.

After 14.8% gains YTD, though, we would balance our positive view given that further gains are unlikely to occur in a straight line. While our short-term quantitative and technical models are not flashing any warning signs, fund manager surveys note quite low levels of cash, which historically have been an indicator of short-term reversals. History also shows there is a risk of volatility in the weeks around US elections. While both are short-term factors, they warn of greater volatility in H2 than what markets experienced in H1.

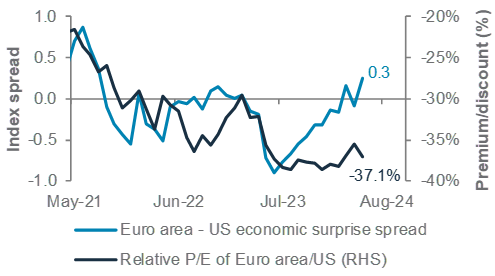

Beyond the US, we have a core holding (Neutral) view on most other major markets. We have upgraded Euro area equities to core holding amid a surprise improvement in high frequency growth data, political uncertainties notwithstanding. We also now see Japan as a core holding (Neutral) as the positive case (share buybacks, shareholder-friendly reform, and higher nominal growth) runs up against an extended negative signal from our short-term technical model. We are Underweight UK equities amid low earnings expectations.

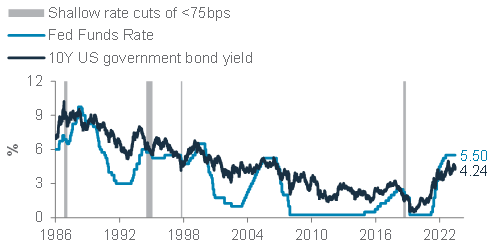

Fig. 2 Bond yields have historically fallen near or ahead of Fed rate cuts

10yr US govt. bond yield vs. Fed policy rate

In Asia ex-Japan, we are Overweight Indian equities. The basis is not dissimilar to that of US markets – the economic and earnings growth outlook remains positive and the completion of elections puts a key event risk behind us. Valuations are challenging, but we note Indian equity markets rank second highest, after the US, among major equity markets in terms of ROE. Our relative preference for large-cap equities also helps mitigate this risk, in our assessment.

We have a core holding (Neutral) view on Chinese equities. Positioning and valuations suggest the easy gains are now behind us as both have moved away from excessively negative extremes. This now puts the onus on earnings growth, which is likely to require greater policy support.

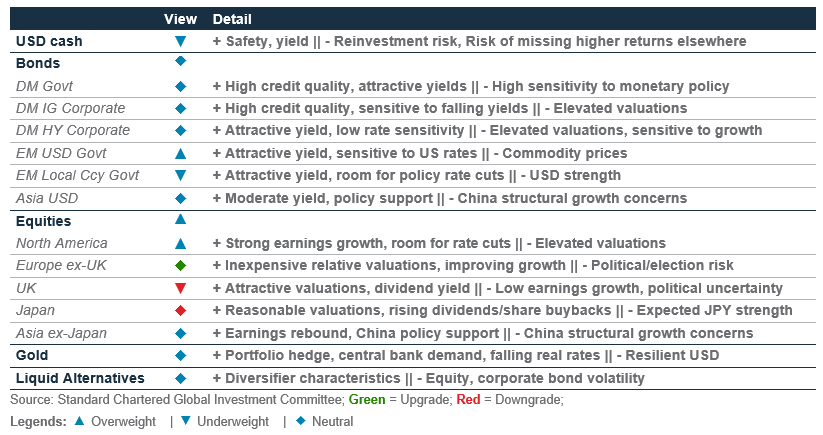

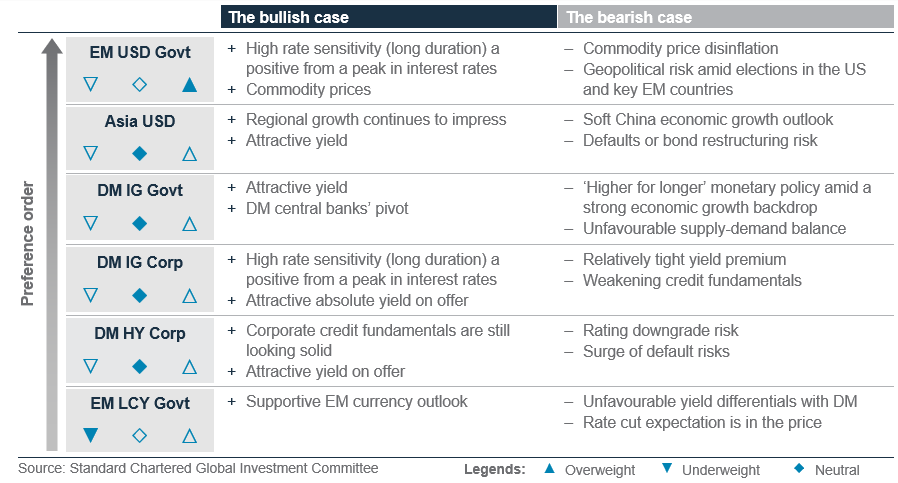

Carry, the key theme in bonds and FX

‘Carry’, or the yield, remains the key opportunity in bond and FX markets. It is, however, much harder to find value. This balance causes us to have a core holding (Neutral) view on global bonds.

History reminds us that US dollar bond yields generally peak not far from when the Fed stops hiking rates and fall near or ahead of Fed rate cuts. While the magnitude of this decline varies depending on the size of rate cuts, history strongly argues for locking in today’s yield. Holding a core allocation to bonds is attractive, especially vs. holding cash, where reinvestment risk is considerably higher as rate cuts bring future yields lower. We have a neutral view between government and corporate bonds – while the latter offers a slightly higher yield, yield premiums over government bonds offer little value.

EM bonds offer pockets of opportunity and risk. We are Overweight EM USD-denominated government bonds as we believe the relatively high yield and better value mean it is likely to outperform global bonds. In contrast, we are Underweight EM local currency bonds as we believe the yield does not compensate for taking on currency risk. Many major EMs are also unlikely to cut rates as deeply or rapidly as Developed Market (DM) central banks, limiting price gains in EM local currency bonds.

Gold a bright spark

Gold has been a top-performing asset class in H1 24, rising 14.4% YTD. What we find most interesting is how the gold rally continues to be driven by a tight demand/supply balance rather than falling bond yields. We see room for this to continue given central bank demand remains strong, while the direction of yields turns more supportive amid rate cuts.

While we continue to have a core holding (Neutral) view on the asset class, H1 has been a lesson on why it is important to build and maintain a core holding in gold within Foundation portfolios.

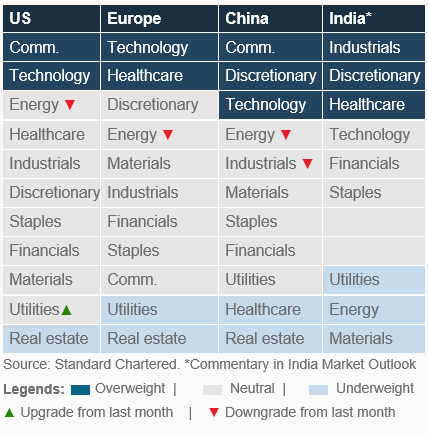

Opportunistic allocations: A focus on growth

In the US, our equity sector Overweights are focused on the technology and communication services sectors. While we like them for their earnings outlooks and sensitivity to falling bond yields, we also like them for being growth-oriented. This, we believe, fits well with the macro and markets environment we expect for H2 24 as the Fed starts to cut rates to manage a soft landing for the US economy.

In Europe, we are Overweight the technology and healthcare sectors. We believe this more barbell-like approach is consistent with the improvement in the growth outlook, while

recognising this trend still has some distance to go, especially with election-related uncertainty in France.

In China, we are Overweight the technology, communication services and consumer discretionary sectors. We believe this more focused approach on sector-specific fundamentals looks increasingly attractive as the easy gains from broader market gains come to an end, with positioning and valuations both no longer at extremes.

We add a new equity Buy idea on Japan banks. With the short-term technical signal remaining weak for the broader Japan market, we believe this idea should offer more focused exposure to an undervalued sector exposed to a longer-term recovery in Japan’s economy and rising net interest margins at banks. We close our Buy idea on South Korean equities, even as we keep our Taiwan Buy idea open, to trim our exposure to the semiconductors sub-sector (see the equity section for more details).

In bonds, we add a new Buy idea on US agency mortgage-backed securities. We believe the risk/reward is attractive given the robust yield, quasi-sovereign credit quality, contained mortgage prepayment risk and the likelihood for yields to move lower (see the bonds section for more details).

How important are US elections for market?

One key event in H2 24 that is firmly on investors’ horizons is the US Presidential election.

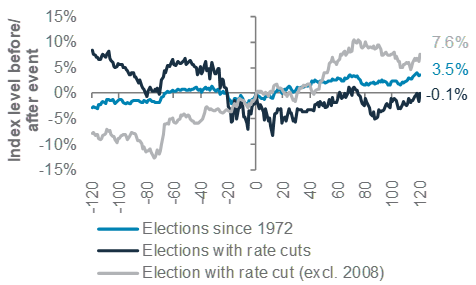

Since 1972, the S&P500 has, on average, delivered positive returns six months before and after elections, with any volatility limited to the weeks around the election itself.

Today, the question is whether the presence of a Fed rate cutting cycle changes this outcome to any degree. Our analysis illustrated in the chart shows that, historically, S&P500 returns were significantly worse than average around elections when the Fed was also cutting rates.

Fig. 3 US equities generally perform well in the 6 months before and after a US election

S&P500 average performance around US Presidential elections across scenarios

However, this average appears to have been heavily influenced by 2008, the only US Presidential election in our period of analysis that also fell within an economic recession. Excluding 2008 from the analysis suggests the impact of whether we are in a rate hiking or rate cutting cycle makes little discernible difference to market returns.

The bottom-line: The US Presidential election is likely to dominate the headlines, but investors should pay more attention to macro and market fundamentals.

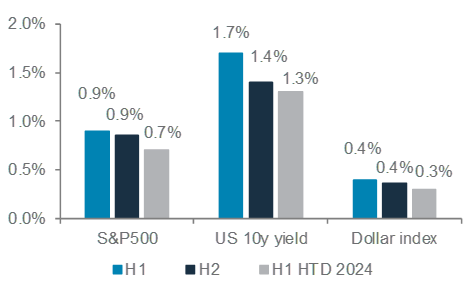

Fig. 4 Equity, FX volatility lower than usual in 2024 compared with previous election years

Average H1 and H2 historical* realised volatility and actual H1 24 volatility for major US assets during election years

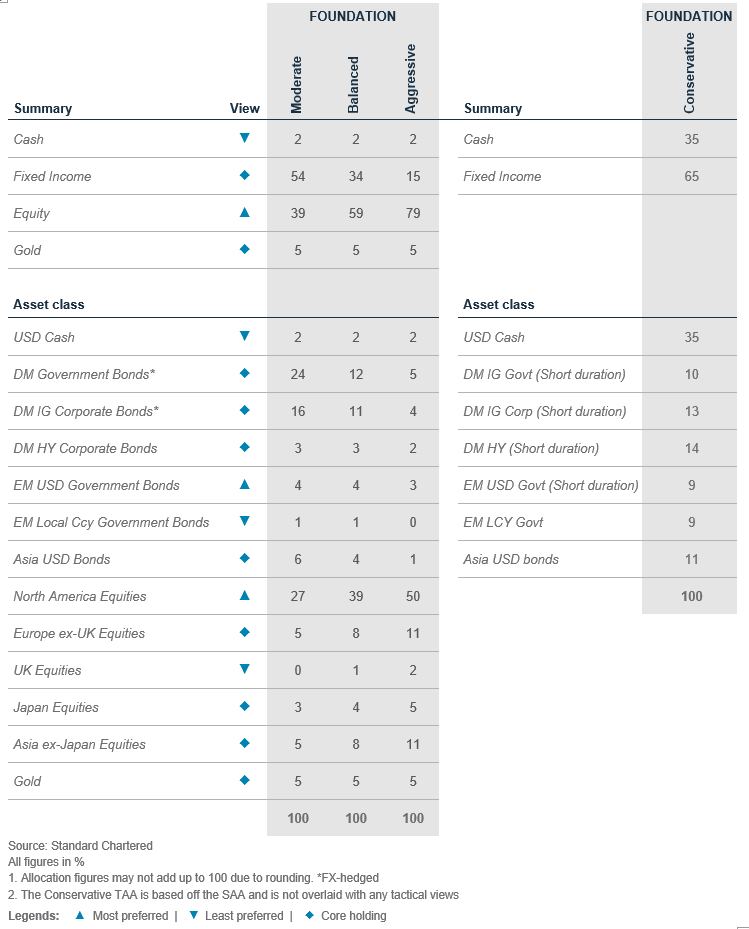

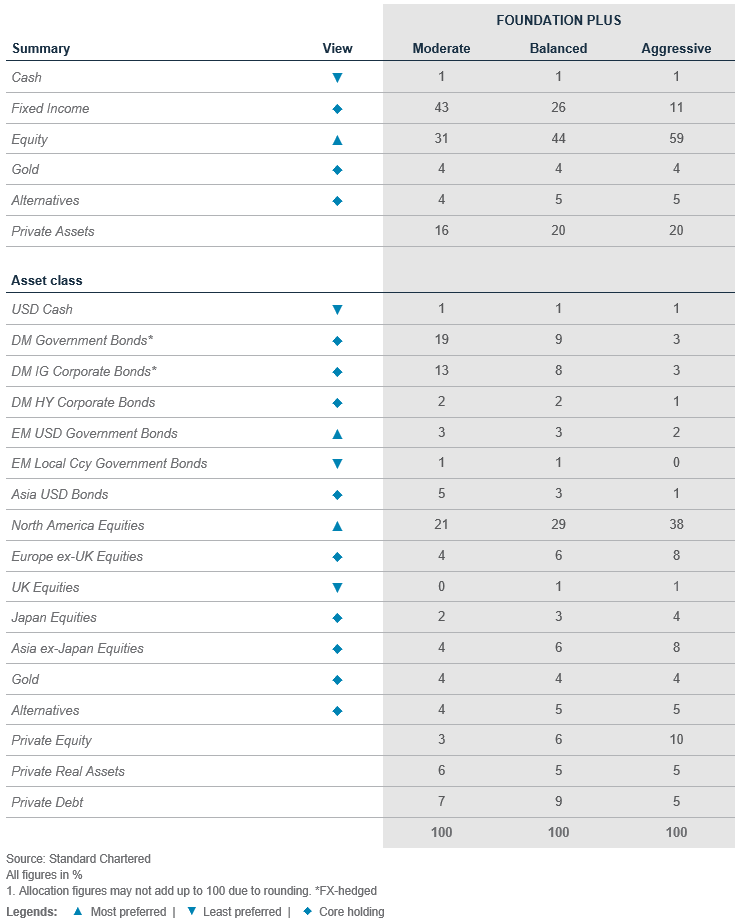

Foundation asset allocation models

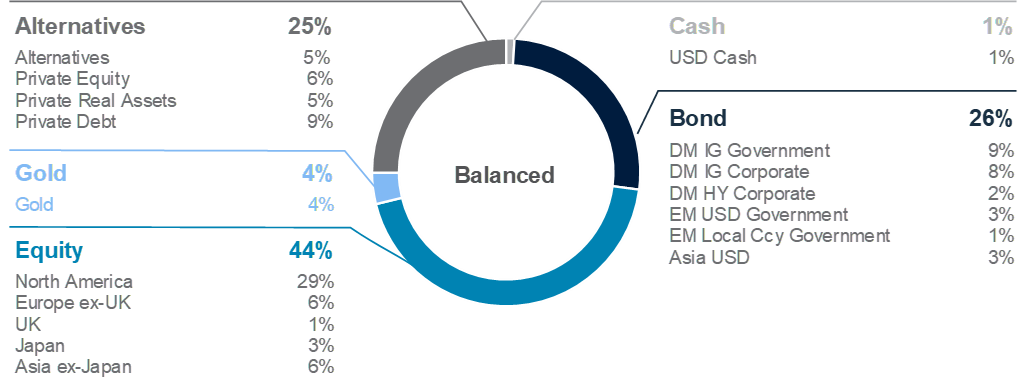

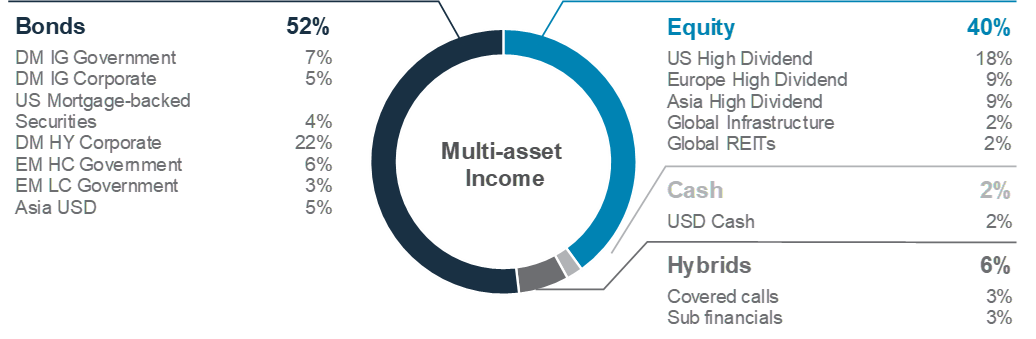

The Foundation and Foundation+ models are allocations that you can use as the starting point for building a diversified investment portfolio. The Foundation model showcases a set of allocations focusing on traditional asset classes that are accessible to most investors, while the Foundation+ model includes allocations to private assets that may be accessible to investors in some jurisdictions, but not others.

Fig. 5 Foundation asset allocation for a moderately aggressive risk profile

Fig. 6 Foundation+ asset allocation for a moderately aggressive risk profile

Fig. 7 Multi-asset income allocation for a moderate risk profile

Foundation: Our tactical asset allocation views

Fig. 8 Performance of our Foundation Allocations*

*12-month performance data from 20 June 2023 to 20 June 2024, 3-month performance from 20 March 2024 to 20 June 2024, 1-month performance from 20 May 2024 to 20 June 2024.

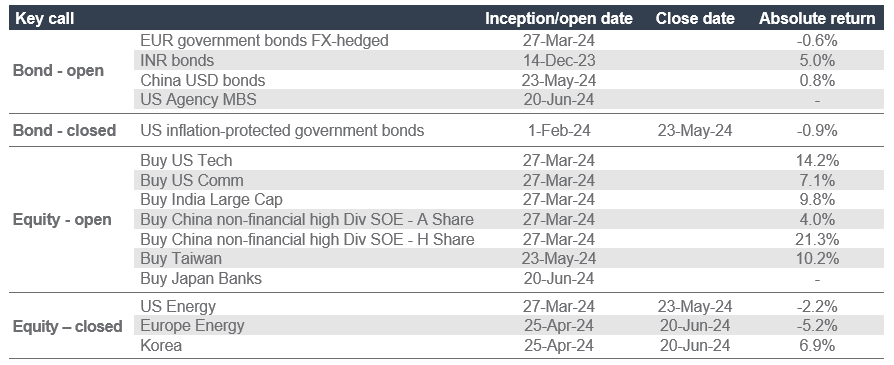

Fig. 9 Opportunistic ideas performance

Foundation: Multi-asset income strategies

|

|

||||

Key themes

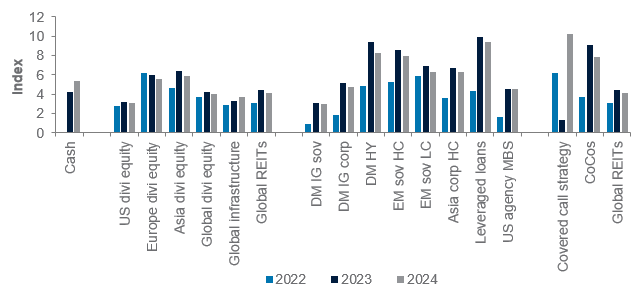

Our Multi-Asset Income (MAI) model allocation has delivered 4.4% YTD return. The model benefitted from optimism surrounding risk assets, and dividend equities also benefitted from a broadening of the rally in traditional equities. Developed Market High Yield (DM HY) and leveraged loans gained from a strong corporate earnings season, while EM USD government bonds benefitted from a decline in US government bond yields.

Our MAI model now yields c.5.8%, dipping below the 6% mark for the first time this year. In recent weeks, major central banks, including the Swiss National Bank (SNB) and the European Central Bank (ECB), have initiated their rate cutting cycle, while the Fed has guided for one rate cut this year. We expect the ECB to deliver more rate cuts this year (see the macro section for more details), and the Fed to be more cautious in order not to loosen financial conditions prematurely while economic data remains resilient. We believe yield levels are attractive for income-focused investors to lock in the current high yield on offer.

Over the next 6-to-12 months, the 2024 US elections will be closely watched by markets. History suggests income assets tend to deliver positive returns during US election years, regardless of whether the Fed is cutting or hiking rates. The only exceptions were REITs and Europe high dividend equities, which delivered negative returns in the 2020 pandemic election year.

Key chart

Yields remain high and attractive across most income assets

Fig. 10 Yield on offer still high, although it is beginning to come off from the peak in 2023

Yield to worst/dividend yield (%)

Contingent Convertibles (CoCos) are complex financial instruments. (Refer to Important Information on page 31 for further details)

Fig. 11 Valuation gap between income and growth equities still makes dividend stocks attractive

P/E difference between MSCI ACWI Dividend Equity Index and MSCI ACWI Growth Index

Balanced allocation to equities and bonds

Our MAI model has returned 4.4% YTD. This has largely been due to the increased allocations to equities earlier in April, which has benefitted from a broadening of the equity rally beyond traditional equities, particularly in AI and technology sectors. DM HY and leveraged loans also added positively, given earnings growth remains strong. EM USD government bonds also saw gains due to declining US government bond yields.

We maintain a balanced allocation between fixed income and equity components within MAI. Solid earnings growth should continue to underpin upside in equity markets and we believe dividend equities have room to catch up to traditional equities given a still-attractive valuation discount relative to growth stocks. In the case of bonds, yields are high and attractive, and we also expect bonds to benefit from impending rate cuts by major central banks.

We anticipate performance in DM HY bonds and leveraged loans to be roughly aligned. DM HY bonds, by nature of their bigger allocation, have been a strong contributor to the overall MAI performance, while leveraged loans, due to their floating rate nature, have benefitted from interest rates remaining high. Given our expectation of an economic soft landing, we believe both asset classes are attractive given their high yields on offer. Also, default risks, while climbing gradually, are likely to remain capped given the strong earnings backdrop.

We continue to prefer sub-financials over DM HY bonds. The former has delivered better performance YTD and the spreads are still modestly wide, giving us comfort that there is scope for continued outperformance over the next 6 to 12 months . We also acknowledge that the French elections might pose some uncertainty in markets, but we view this as a temporary challenge, which is likely to have limited impact to the underlying fundamentals over the medium term.

Lastly, we remain neutral between dividend equities and covered calls within the equity basket. We expect multiple tailwinds for dividend equities moving forward, such as an earnings growth recovery and a valuation catch-up to the broad equity markets. Covered calls will still be a favourable way to generate additional income, while still participating broadly in any equity market rally.

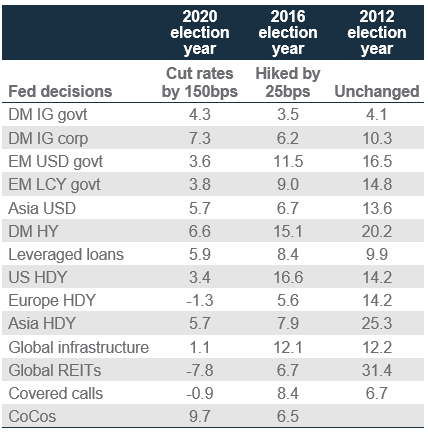

Implications of US elections on income assets

In addition to monetary policy and economic data, investors will also have to grapple with the uncertainties surrounding the US elections. Our analysis covers the last three US elections due to the shorter history of available data for income assets. In each of those election years, Fed policy decisions were different. And if history is any guide, investors can take comfort in the fact that both fixed income and equities had performed well regardless of the change in monetary policies. At a glance, income assets

across the board had recorded positive annualised returns during the calendar years of each US election, with the exception of global REITs and Europe high dividend equities during the 2020 pandemic year. That being said, the 2020 US election year, which saw the Fed cutting by 150bps, generally had poorer returns relative to the earlier two election years.

Fig. 12 Income assets saw positive returns during the past three US election years

Annualised returns during the calendar years of the 2020, 2016 and 2012 US elections

Elections can induce uncertainty into markets, but the key is to also consider other market factors that can potentially impact performance. For instance, 2020 saw the onset of the pandemic, dragging the economy into a technical recession. Both factors were unrelated to the elections itself.

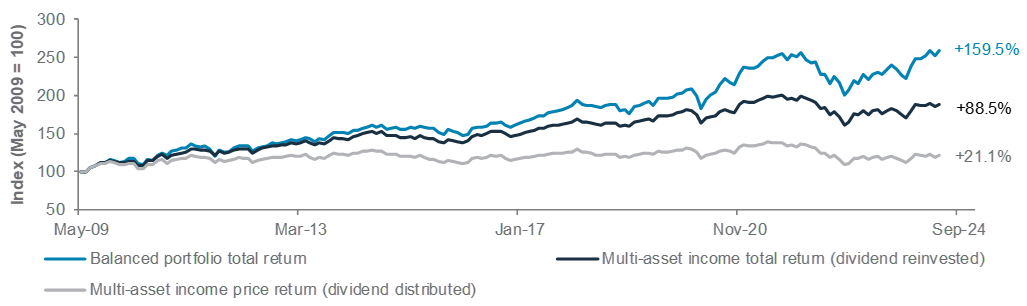

Reinvesting dividends imperative for total returns

While political events can pose short-term volatility risks, long-term investment decisions are still better made based on long-term fundamentals. Income strategy is designed to provide investors with a consistent and stable income stream. On top of that, it offers investors an option to consider reinvesting of dividends that will support capital preservation and wealth accumulation. In other words, to enhance the implementation of the income strategy, investors can consider harnessing the power of compounding over time by reinvesting any unused dividends. Our analysis on the historical returns shows that reinvesting dividends can lead to as much as c.67% outperformance as compared to when dividends not reinvested.

In our Perspectives section on page 10, we compare balanced and income strategies.

Perspectives on key client questions

|

|

||||

How to craft a diversified portfolio for financial longevity?

Investing is a deeply personal journey, shaped by each individual’s financial goals and risk tolerance. In the quest for financial gains, many investors are drawn to high-income strategies for their immediate cash flow. Yet, this focus may not be optimal for long-term growth. Income portfolios, rich in bonds and dividend yielding stocks, offer consistent cash flow appreciated by retirees and those seeking stability. However, for investors aiming to grow their assets, having a balanced allocation, which includes a good amount of growth assets – such as stocks that might not pay much dividends but have potential to significantly increase in value – is crucial. In this piece, we explore the merits of both strategies and the optimal income level for a sustainable long-term withdrawal rate for portfolios.

Understanding income portfolios

Income portfolios, typically heavy in bonds and dividend-yielding stocks, are engineered to deliver a steady cash flow. They are popular among those needing regular income. Despite their appeal, traditional income portfolios often trail behind their more balanced counterparts, which combine income generation with growth potential. Without substantial growth, they struggle to beat inflation and maintain purchasing power. Historical data since 2009 showed that a balanced stock and bond portfolio (Fig.13) handily outperformed an income portfolio from a total returns perspective, highlighting the importance of including growth assets into the investment mix to capitalise on market upswings and compound wealth over time.

The hidden cost of not reinvesting income

A critical aspect often overlooked by income investors is the long-term impact of not reinvesting their income. While income portfolios provide regular cash flows, they can suffer in terms of compound growth if dividends and interests are regularly withdrawn instead of being reinvested. This factor can significantly diminish the portfolio’s potential to grow over time. While an income portfolio caters to immediate financial needs, investors need to weigh the opportunity cost of forgoing the powerful effects of compounding, which is central to long-term wealth accumulation.

Fig. 13 Total returns key for long-term wealth accumulation; for income strategies, reinvesting income is imperative. Not reinvesting income will result in lower total returns long-term

Cumulative returns of total return and price return of a diversified income allocation* vs. total returns of a balanced allocation** (May 2009 to May 2024)

Total returns: A key measure of success

Total return, which encompasses interest, dividends, and capital gains, is an important measure of financial success. Focusing solely on income can be misleading as it does not consider the potential for losses in asset value. Having a holistic view of portfolio performance, considering both income and growth, when evaluating success is key.

This concept of total return is not only crucial for investment performance but also for retirement planning. For example, as investors approach retirement, the focus often shifts from accumulation to preservation and distribution of wealth. In this phase, understanding the interplay between total returns and withdrawal strategies becomes paramount.

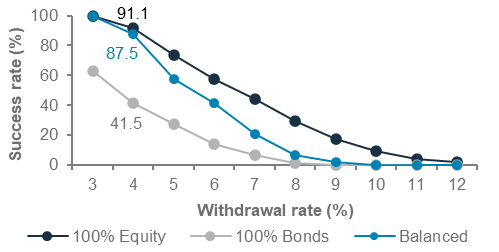

Fig. 14 Balanced and equity investors have greater odds of success with a 4% withdrawal rate

Success rate* of simulated portfolio with varying withdrawal rates

The 4% rule: A guideline for sustainable withdrawals

A balanced portfolio provides a robust foundation for implementing sustainable withdrawal. This 4% rule is a time-tested principle that offers a benchmark for sustainable withdrawal. It is predicated on the premise that an investor can withdraw 4% of their portfolio in the first year of retirement, and then subsequently adjust the amount for inflation each year, without facing a significant risk of depleting their retirement funds over a typical 30-year period.

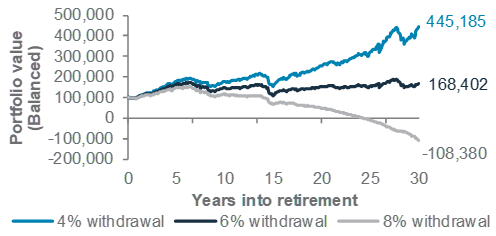

Fig. 15 Withdrawal rates over 6% could be hazardous, especially given risks from inflation and longer expected retirement periods

12-month forward returns and investor positioning*

At higher rates of withdrawal, the risk of depleting the portfolio prematurely increases significantly. For example, if a retiree withdraws at a higher rate, say at 8%, they may initially have a more comfortable standard of living. However, this comfort could be short-lived if the market experiences a downturn or if inflation rises unexpectedly. A higher withdrawal rate would accelerate the depletion of the portfolio’s principal, potentially leading to a situation where the portfolio may run out earlier than expected. Moreover, higher withdrawal rates also limit a portfolio’s growth potential. Since a large portion of the assets is being used for current expenses, less is left to invest and compound over time. This can be particularly detrimental during the early years, as the effects of compounding are most potent over long-term.

Striving for balance in our stock-bond mix

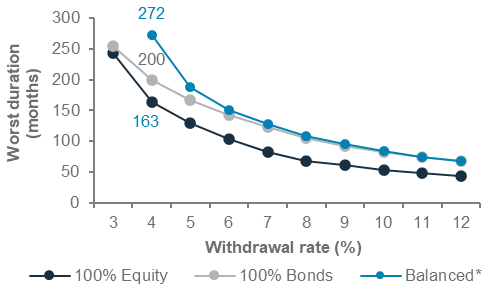

A portfolio that is entirely allocated to either stocks or bonds is rarely optimal. Fig. 14 suggests that a higher allocation to equities typically provides better growth, while a 100% bond portfolio fared the worst due to lower returns. However, a 100% equity portfolio carries higher risk due to greater volatility. Given two options 1) a 90% chance to last 30 years, but a chance of running out of money after 7 years, and 2) a 90% chance to last 30 years, but a chance of running out of money after 25 years, the latter is better. Stocks increase the odds of success but are subject to the sequence of return risks and market cycles, while bonds will significantly reduce the chance of a portfolio failing too early. Hence, balance is key.

Fig. 16 Balanced strategies have historically done better in safeguarding against failure and holding value

Number of months before the first dip into negative value by simulated portfolios

Navigating market volatility with a balanced portfolio

Achieving financial success involves more than simply choosing between income or growth. It requires a thoughtful blend of both, tailored to individual needs and goals. Income portfolios have their merits, especially for retirees who value predictable cash flow. For those with no immediate income needs and a substantial investing horizon, a balanced portfolio, comprising a judicious mix of income and growth assets is essential to chart a course towards substantial long-term wealth accumulation.

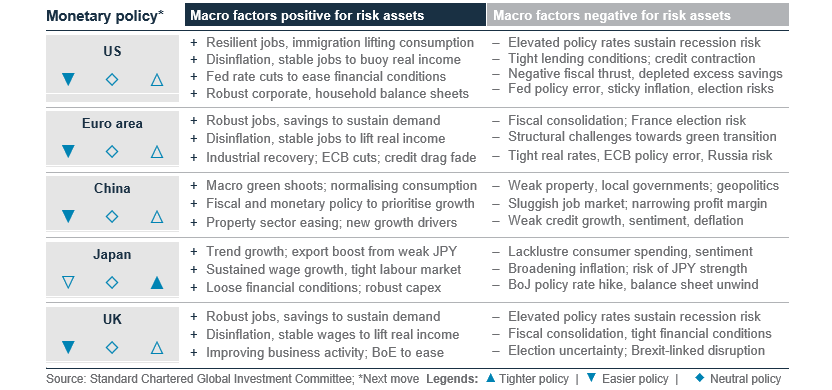

Macro overview – at a glance

Our macroeconomic outlook and key questions

|

|

||||

Key themes

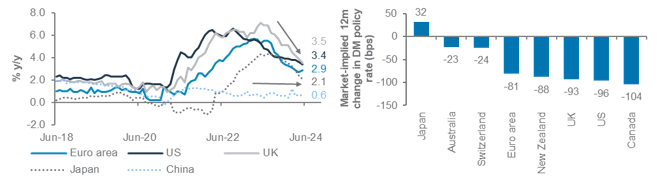

More rate cuts likely amid renewed disinflation. We expect renewed disinflation to enable major central banks to cut rates in the coming months as they shift their focus towards supporting growth. Given this, we now see a 55% chance of a US economic soft-landing and a 25% chance of a no-landing in the next 12 months. The US expansion is benefitting from increased immigration, which is sustaining job creation and consumption, while subduing wages. Risk scenario: The Fed expects to cut rates just once this year, in H2, while some other central banks have already started easing. The Fed could be too late in easing, leading to overly tight financial conditions. Therefore, we assign a 20% probability to a hard-landing scenario.

Europe, China to ease policy further. Both economies are benefitting from an upturn in global manufacturing. Nevertheless, the Euro area faces structural challenges in its ‘green transition’ and political risks, while ECB policy remains too tight. The ECB was among the major central banks to start cutting rates in June. We expect it to cut rates by another 50bps by year-end and 50bps more by June 2025 to support growth. Meanwhile, China’s deflationary forces point to further targeted policy easing. Risks: Upcoming French elections could result in a far-right party gaining significantly in parliament, reigniting EU fiscal risks.

Key chart

We expect inflation to ease further across major economies in the coming months, enabling central banks to cut rates as they shift their focus towards supporting growth and extending the economic expansion

Fig. 17 Except BoJ, major central banks are likely to cut rates as inflation subsides

Core CPI inflation for major economies; Money market estimates of 12m policy rate changes

Top macro questions

Is the US economy still headed for a soft-landing? We assign a 55% probability to a US economic soft-landing over the next 12 months and a 25% chance to a no-landing scenario. The primary drivers of a soft-landing are likely to be: i) the resumption of disinflation lifting household real disposable incomes, thus sustaining consumption, as excess savings built during the pandemic fade; ii) lower inflation enabling the Fed to start cutting rates in H2 to support growth and extend the business cycle; iii) residual impact of the immigration boost of the past couple of years (despite President Biden’s executive order seeking to deter illegal migrants) helping to reduce the post-pandemic shortage of workers, and sustaining the job market and consumption; iv) robust balance sheets shielding companies against two-decade high interest rates, supporting earnings and profit margins; and v) boost to household net worth (mainly among high income households) from house price, equity gains over the past couple of years to sustain discretionary spending.

Of the above, the resumption of disinflation has lifted the chances of an economic soft-landing in recent months. In May, US inflation cooled for the second straight month, reversing increases in Q1. The so-called ‘supercore’ inflation (core services ex-shelter) contracted (-0.1% m/m) for the first time in over three years. The data highlights that, barring shelter inflation, which remains sticky (0.4% m/m), broader inflation is slowing again. Falling market rents suggest shelter inflation is likely to decline in H2, while falling new and used car prices point to further declines in auto insurance and repair costs. Also, forward-looking labour market indicators (declining job vacancy, hiring and quits rates) point to continued deceleration in ‘supercore’ inflation in the coming months, given wages are a key component of the latter. The recent burst of immigration should also subdue wage gains.

The other important driver of the US soft-landing thesis is the Fed’s surprise decision in May to slow the pace of its balance sheet drawdown. The decision revealed, inflation permitting, the Fed’s preference for easing, rather than tightening, policy, in our view. Although Fed policymakers subsequently revised their median projection for rate cuts this year to one cut from three, we believe they are being cautious against communicating an easy monetary policy too early, lest it

Fig. 18 A softening US job market points to lower wages

US job vacancy rate, wage growth tracker, core PCE inflation

leads to easing financial conditions, in turn defeating the Fed’s objective of cooling inflation. Nevertheless, sustained disinflation (a few months of 0.2% m/m or lower core PCE inflation) would raise the chance of more rate cuts. We expect 75-100bps of Fed rate cuts over the next 12 months.

Risk: We assign a 20% probability of a recession over the next 12 months. The Leading Index of 10 key forward-looking indicators and the US government bond yield curve continue to signal a high risk of a recession. Historically, a US recession has started 9-22 months (median: 16 months) after an inversion of the 10-year vs. 2-year curve (occurred in July 2022). Also, US manufacturing and new orders PMIs and consumer confidence are again signalling increased recession risks. We are also watching a key metric of the US job market – the unemployment rate of permanent job losers. When the 3-month moving average of this rate rises more than 20bps from the past 12-month’s low, a recession has historically started. The indicator was around 18bps in May.

Will the Euro area avoid a recession? The Euro area is benefitting from an upturn in global manufacturing and stabilisation in China’s economy. While inflation surprised to the upside in May, the broader disinflationary trend remains, lifting real incomes. The ECB was among the first G7 central banks to start cutting rates in June. We expect cooling inflation to enable another 100bps of ECB rate cuts in the next 12 months. Meanwhile, a record low Euro area jobless rate and high household excess savings are likely to support consumption. Risk: Any gains by the far right in July French elections may lead to clashes with the EU on fiscal policies.

What to expect from China’s Third Plenum? China’s ruling Communist Party will hold its third plenary session in July. Past ‘Third Plenums’ have made significant changes to economic policy. This time, we expect the plenum to address key issues such as rising local government debt, oversupply of properties, accelerating the pace of technological innovation and re-orienting global supply chains amid mounting trade tensions. In May, authorities took steps to reduce the property sector inventory overhang. We expect more such targeted measures in the coming months to lift consumer and business confidence. Risk: Escalating trade tensions and retaliatory tariffs vs. the US and Europe.

Fig. 19 China to ease policy further to avoid deflation

China property prices, money supply, Li Keqiang index*

Source: Bloomberg, Standard Chartered; *A measure of China’s real economy, comprising of power consumption, rail freight, long-term loans

Asset Classes

Bonds – at a glance

|

|

||||

Key themes

Developed Markets (DM) Investment Grade (IG) government bonds remain a core holding. The risk-reward of US government bonds appears fair, with market rate cut expectations being in line with our own expectations for one 25bps Fed rate cut this year. Absent significant catalysts, we anticipate the US 10-year government bond yields to stay within recent ranges in the near term. Our expectations over 3-month and 12-month are unchanged at 4.25-4.50% and 4.00-4.25%, respectively.

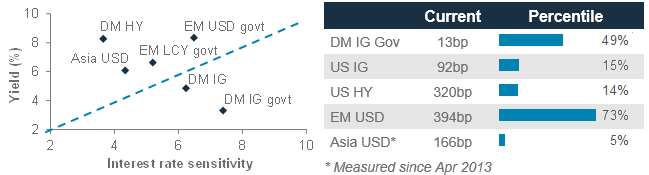

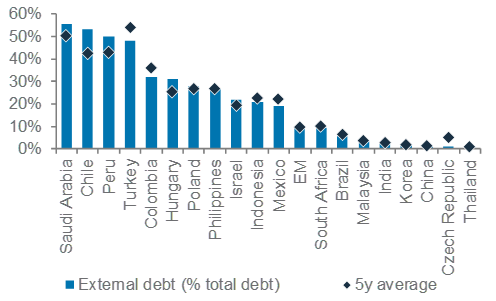

We are Overweight Emerging Market (EM) USD government bonds. Valuations, in our view, remain attractive given a yield premium that continues to exceed historical averages. Despite heightened geopolitical concerns, the fundamental strength of emerging economies remains bolstered by strong foreign exchange reserve, increasingly healthy fiscal balances and greater access to external debt than in recent years. We are Neutral DM IG and High Yield (HY) corporate bonds. Their narrow yield premiums are expected to be sustained by strong fundamentals and healthy supply-demand dynamics. We are Neutral Asia USD bonds as weak China growth outlook and geopolitical concerns are fairly compensated by the yield premium. We are Underweight EM Local Currency (LCY) government bonds on worries of EM FX volatility.

Key chart

We are Overweight Emerging Market USD government bonds given an attractive risk-reward balance and solid fundamentals

Fig. 20 Emerging Market USD government bonds offer attractive yields and yield premiums relative to other major bond asset classes

Yield and duration for major bond asset classes; Yield premium and percentile (last 20-year)

Overweight EM USD government bonds

We continue to Overweight EM USD government bonds, supported by attractive valuations and fundamentals. Although persistent geopolitical tensions and softening commodity prices are risks, we continue to derive comfort from the attractive risk-reward, given current yield premiums are still above historical averages. Additionally, we assess EMs’ fundamentals as fairly supportive. Although a higher-for-longer rate regime in DMs is likely to maintain some pressure on fund flows, these markets have improved foreign reserves in recent quarters.

Fig. 21 External debt as a proportion of total for most EMs is below their 5-year average

External debt (% total debt) and 5-year average

Neutral DM IG government bonds

We remain Neutral DM IG government bonds. We assess the risk-reward of US government bonds to be fair, as rate cut expectations by both financial markets and the Fed (the dot plot) are now aligned to our own expectation of a single 25bps cut this year (and 2-3 next year). This is consistent with our estimate of 55% odds of the US economy achieving a soft-landing. As such, we see the US 10-year government bond yield staying within 4.25-4.50% for the next 3-month, followed by 4.00-4.25% over the next 12 months.

Neutral DM IG and HY corporate bonds

DM IG and HY corporate bonds yield premiums remain at the tighter end of historical averages. Strong quarterly earnings have provided support to the rich valuation. Additionally, a soft-landing scenario should keep default rates relatively contained. In addition, DM HY corporates are not facing significant refinancing pressure this year, which should support performance. Although these DM bond assets offer good carry, we stay Neutral to both as value looks hard to be justified.

Neutral Asia USD bonds, with preference for HY over IG

We remain Neutral on Asia USD bonds. The asset class has performed largely approximate with DM HY corporate bonds and outperformed DM IG corporate bonds YTD. The outperformance was largely driven by Asia HY bonds, in line with our expectations. We continue

to prefer Asia HY bonds over IG bonds due to the following observations:

- Although Asia HY bonds remain dominated by Greater China issuers, we believe geographical and sector exposures are now more well-balanced.

- Asia HY bonds have now likely priced ongoing defaults from the property sector, leaving less room for more downside surprises. For example, we note that strong asset class performance has continued despite a significant Chinese property developer default this year.

Underweight EM LCY government bonds

We expect a largely flat USD over the next 6-12 months. While EM FX is likely to stay moderately weak in the short term, higher EM FX volatility remains a key risk. Additionally, we see risk-reward valuation unattractive when EM central bank rate cuts are largely in the price.

We retain our duration preference to Neutral (5-7 years)

We believe the higher likelihood of a soft-landing scenario for the US economy suggests poorer risk-reward from excessively long-maturity US government bonds. Given the greater alignment today between market expectations and the Fed’s ‘dot plot’ summary, we believe a Neutral (5-7 year) duration offers an attractive balance between yield (term premium) and reduced capital gain prospect from lower yields.

Keep tactical buy EUR government bond, INR bonds and China USD bonds

We retain our tactical buy EUR government bonds. Recent economic data in the Euro area continue to look sluggish with disinflation remaining on track. French election turmoil has driven French government bond yields and volatility higher. However, this volatility is likely to be temporary and also mitigated by the potential for a rally in other European bonds. We would await conclusion of the French election process.

We also keep our tactical buy on INR bonds. We continue to believe the asset class offers attractive risk-reward balance in the backdrop of structural growth and lower-than-peer currency volatility. Missing high regional growth expectation is a key risk.

We keep our tactical buy on China USD bonds. While China’s macro outlook remains challenging, we continue to find attractive valuation and supportive government policies.

Add tactical buy US agency mortgage-backed securities (MBS)

This month, we initiate a tactical buy idea on US agency MBS, an asset class that offers a reasonable pick-up over US government bond yields and largely comparable fundamental exposures. While mortgage prepayments are a risk, we see the risk as relatively low as many homeowners used the post-COVID-19 years to refinance their liabilities at very low rates.

Equity – at a glance

|

|

||||

|

|

||||

Key themes

We are Overweight equities over bonds and cash, with US equities our most preferred region. We are positive on US earnings growth, particularly in the growth sectors. We downgrade Japan equities to core holding (Neutral). Improving corporate governance is still a plus but deteriorating earnings revision is likely to limit the upside. We upgrade Europe ex-UK equities to core holding (Neutral) amid an earnings recovery, even though the French snap elections may lead to volatility in the near term.

We have a core holding (Neutral) view on Asia ex-Japan equities, but we are Overweight Indian equities. Expensive valuations are justified by high return on equity and rapid economic growth. We trim Taiwan equities to core holding (Neutral); tailwinds from the AI themes and strong GDP revision are offset by the expensive valuations and high geopolitical uncertainties. We also downgrade Korea to core holding (Neutral) – we see fading effect from the government’s ‘Value-up’ programme and quietening foreign interests. We are core holding (Neutral) China equities. Challenges of long-term economic growth and the property sector remain the key risks, supported by the piece-meal government policies. We remain Underweight on ASEAN, which is overly defensive in a global environment favouring high-beta stocks. Lastly, we downgrade UK equities to Underweight. Despite cheap valuations, the region is similar to ASEAN – overly defensive.

Key chart

Equities in sweet spot, with falling inflation, high margins

Fig. 22 Falling inflation can help sustain expanding margins for US corporates. In late 1990s, equities continued to rally when the Fed successfully cut rates mid-cycle

US net margin vs. CPI; Fed rate cut cycle and equity performance in 1995-2001

Overweight global equities

Our expectation of a soft-landing scenario in the US and projected resiliency in global economic growth support our Overweight on global equities relative to other asset classes. We see further upside on robust corporates’ pricing power, broadening of earnings to non-growth sectors and favourable governmental policies in select markets.

Overweight US equities

We are Overweight US equities. On the macro front, cooling inflation supports corporate margins. A potential Fed rate cut in H2 ‘24 continues to support growth stocks by alleviating the impact on discounted future earnings. High ROE levels (US equities offer 20.5% ROE, over +1sd above the historical average) justify relatively high valuation premiums, in our view. The S&P index has historically performed well during election years. According to LSEG I/B/E/S, estimated earnings growth for 2024 and 2025 have also been revised higher since the start of Q2, to 10.7% and 14.2%, respectively.

Fig. 23 US and India equities are expensive, but justified by their high return on equity

12m fwd P/B vs. ROE

Downgrade Japan equities to core holding (Neutral)

We downgrade Japan equities to core holding (Neutral). While we continue to like catalysts, including improving shareholder returns via the Nippon Individual Savings Account reform and robust cash savings among local citizens, extended negative signals from our short-term technical model may suggest an extended pullback on share prices. We view the recent stagnant growth in the market to extend near term, especially upon a rapid re-rating since late 2023. 12m forward P/E for MSCI Japan is now at 15x, around its historical average.

Core holding (Neutral) Asia ex-Japan equities

We have a core holding (Neutral) view on Asia ex-Japan equities. We see the region to benefit from global fund rotations from Developed Markets. However, intensifying geopolitical tensions provide near-term headwind.

We are Overweight Indian equities within the region. Election risks are largely behind us for now, and we believe the medium-term outlook for Indian assets remains strong, given its robust economic outlook and corporate earnings growth. ROE for MSCI India at 16% more than offsets the country’s high valuation. We prefer large-cap equities over small- and mid-cap equities given their stronger balance sheet to cushion the impact of tighter financial conditions.

We are Overweight Indian equities within the region. Election risks are largely behind us for now, and we believe the medium-term outlook for Indian assets remains strong, given its robust economic outlook and corporate earnings growth. ROE for MSCI India at 16% more than offsets the country’s high valuation. We prefer large-cap equities over small- and mid-cap equities given their stronger balance sheet to cushion the impact of tighter financial conditions.

We downgrade Taiwan equities to core holding (Neutral). While we see further opportunities as the AI-theme plays out near term, the longer-term outlook is largely clouded by geopolitical tensions and high valuations. We also downgrade Korean equities to core holding (Neutral) within Asia ex-Japan on the regions’ vulnerability towards an elevated interest rate environment in the US.

We have a core holding (Neutral) view on China equities. Policymakers’ tone remains supportive as depicted from its property sector measures and the ‘nine-measures’ to enhance shareholder returns. However, structural headwinds, such as the property market downturn and disinflationary woes, will likely linger, in our view. Within China, we are Neutral between onshore and offshore equities. That said, high geopolitical tensions are long-term headwinds against the offshore equities. We are Underweight ASEAN as its overly defensive growth environment will limit equities return, in our view.

Upgrade Europe ex-UK equities to core holding (Neutral)

We upgrade Europe ex-UK equities to core holding (Neutral). We see the latest ECB rate cut and improvements on manufacturing data to boost market sentiment, given the region’s significant exposure to the global industrial cycle. The region is also trading at a significant valuation discount vs. its developed market peers. That said, high interest rates, geopolitical concerns (e.g., French snap elections) and energy costs may continue to weigh on corporate earnings.

Fig. 24 Euro area equities inexpensive, despite outperformance in economic data over the US

Economic surprise and valuation difference between Euro area and the US

Underweight UK equities

We are Underweight UK equities, as the region’s defensive sector tilt may lead to underperformance as global equity markets continue to climb. 12m forward EPS growth of MSCI UK index of 5.7% is also the lowest among major economies and compares with 12% for global equities.

Equity opportunistic views

|

Focus on earnings growth

- We target positive absolute returns in our Opportunistic buy ideas. This month, we close two ideas (Europe energy sector and Korea equities) and add a new idea on Japan banks.

Changes to our buy ideas

Closing Europe energy: We close this idea after almost 2 months (25 April to 20 June) for a 5.2% loss. Momentum in the sector softened since we initiated the idea and it has been underperforming crude oil YTD.

Closing Korea equities: We close this idea after almost 2 months (25 April to 20 June) for a 6.9% gain. We continue to like the exposure to semiconductors and prefer to gain exposure through US technology and Taiwan equities.

Japan banks: We add this new idea as an expected rise in Japan’s interest rates would support banks’ interest income and high capital market activities could boost fee income. The profitability outlook is further enhanced as banks reduce unprofitable shareholdings and reinvest into higher profitability businesses. Major banks also have share buyback tailwinds on top of dividend yields of 2.5-3.5%. A slowdown in Japan’s economic recovery is a risk.

Existing buy ideas

US technology: We believe the market environment favours strong earnings growth with good visibility, such as growth driven by AI spending and cloud computing. We expect a slowdown in inflation to support the valuation of growth stocks. Any weakness in AI spending is a risk.

US communication services: The sector offers strong earnings momentum from digital advertising and the demand for online entertainment. Similarly, we expect this growth sector to benefit from slowing US inflation and lower bond yields. A downturn in digital advertising is a risk.

China non-financial high dividend SOEs: We continue to see investor demand for high dividend yielding state-owned enterprises (SOEs). SOE management teams continue to work on improving their market value and we focus on non-financial SOEs due to the lack of clarity on the financial sector’s support for the distressed property sector. Adverse regulatory changes are a risk.

India large cap stocks: We expect policy continuity from the new coalition government that remains pro-growth. A reduced mandate for the ruling NDA alliance is likely to lead to a sharper focus on rural, infrastructure and green

Fig. 25 Opportunistic buy ideas

energy spending to boost job creation. We expect India’s superior growth to continue. A risk is weaker-than-expected growth.

Taiwan equities: Momentum has been strong and we expect this to continue. Semiconductor manufacturing has a large weight in Taiwan equities and it benefits from global AI adoption and cyclical tailwinds in non-AI demand. Any weakness in semiconductor demand is a risk.

Sector views: Growth in technology

While technology in the US and Europe benefits from AI demand and cloud computing, China’s technology sector is seeing strong EM demand for its tech hardware. We downgrade energy to Neutral across the regions as momentum is weak. We upgrade US utilities to Neutral as the narrative of AI electricity demand helped the sector recently.

Fig. 26 Our sector views by region

FX – at a glance

|

Key themes

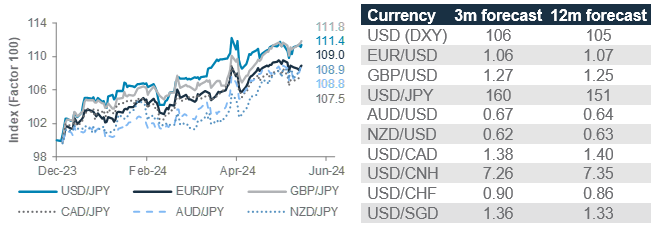

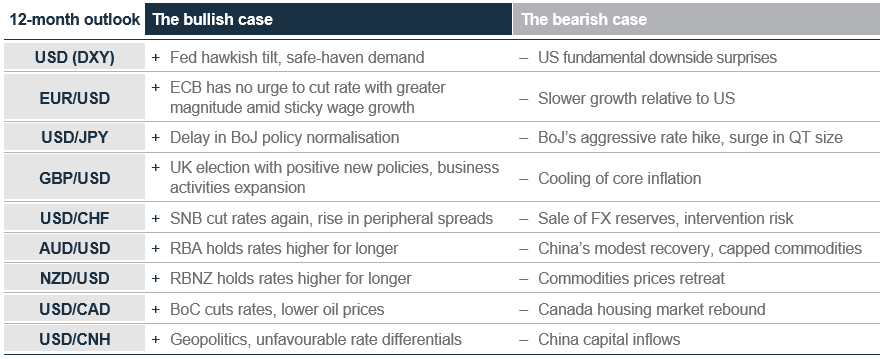

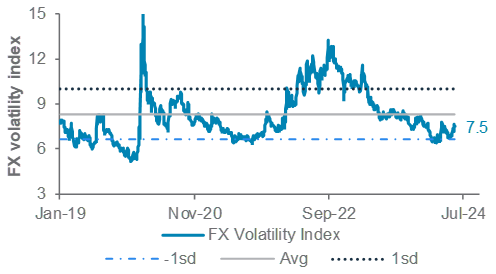

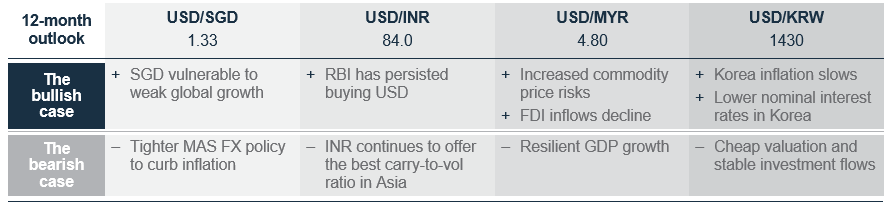

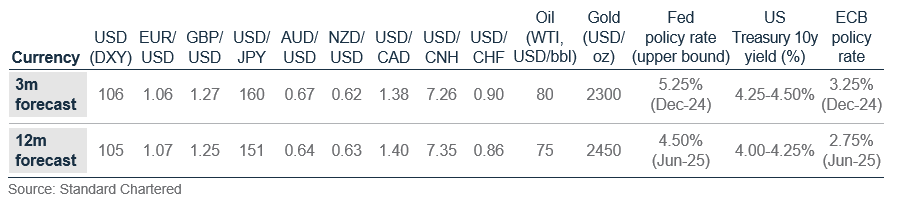

Under our base scenario, the US economy achieves a soft-landing and the Fed cuts rates, albeit only once this year. We believe this will result in the USD Index (DXY) initially rising slightly to 106 in 1-3 months, as it stays within an ascending channel and the Fed holds rates for longer than other major central banks. We expect the USD to only soften towards 105 once the Fed starts cutting rates, which we expect before year-end. Overall, this means we hold a bullish bias on a 3-month horizon and a rangebound view with a bearish bias over a 12-month horizon.FX volatility remains quite low, which is consistent with the small magnitude of expected moves.

We hold a bearish bias on the EUR over a 3-month horizon as the ECB stays ahead of the Fed in cutting rates; though the EUR weakness is likely to reverse once the Fed starts to catch up. GBP/USD is likely to consolidate above its 6-month average at 1.27 over the next 3 months as the BoE is likely to keep rates flat until UK elections are over. In Asia, the BoJ’s gradual approach to quantitative tightening means the JPY is likely to stay soft near term, while policy efforts to stabilise China’s growth expectations should lead to modest appreciation for CNH.

Key chart

Interest rate spreads likely to favour the ‘JPY carry trade’ for now, making a test of 160 possible over the next 3 months. However, intervention risk and policy tightening can result in a sharp reversal over the next 12 months

Fig. 27 A ‘carry trade’ environment could lead to further JPY weakness for now; watch out for sudden reversals

JPY vs. major currencies; YTD performance

Fig. 28 Summary of major currency drivers

Preparing for a narrow trading range

We expect EUR/USD to depreciate modestly towards 1.06 over the next 3 months as the ECB cuts rates ahead of the Fed and amid a resilient greenback. We expect the ECB to cut rates further by 50bps over the next six months, which should add downward pressure on the EUR. Meanwhile, we believe the Fed will deliver a 25bps cut by the year-end. This should ultimately limit EUR/USD depreciation and lead to modest EUR appreciation over 6-12 months, especially if it is accompanied by upside surprises in Euro area’s economic sentiment.

Fig. 29 Currency trading ranges are likely to remain narrow amid low FX market volatility

FX volatility index with 5-year average and 1st standard deviation levels

We see GBP/USD consolidating above its 6-month average at 1.27 over the next 3 months as the BoE holds rates until the UK election is over. However, the BoE will likely cut rates by more than the Fed in the long term as the UK labour market and production growth cool. This exposes GBP/USD to downside risk towards 1.25 as UK yields fall.

The SNB’s surprise rate cut in June, balanced by an upturn in May inflation, is likely to keep USD/CHF rangebound for now (we expect 0.90 over a 3-month horizon), especially given a Fed rate cut is likely to be delayed till further in H2. However, upside inflation and growth risks are likely to keep the SNB from easing significantly further in the long-term. This, together with a likely start of Fed rate cuts by mid-2025 mean that downside risk to USD/CHF is likely to rise in the long-

term (we expect 0.86 over a 12-month horizon). USD/JPY moved higher for much of 2024, contrary to our expectations, as the BoJ took a very gradual approach to tightening policy. Over the next 3 months, our modestly bullish USD view and lack of aggressive BoJ tightening are likely to push the pair towards 160. However, the likelihood of a widening policy divergence between the Fed and the BoJ over a longer horizon leads us to expect USD/JPY to decline towards 151 over the next 12 months.

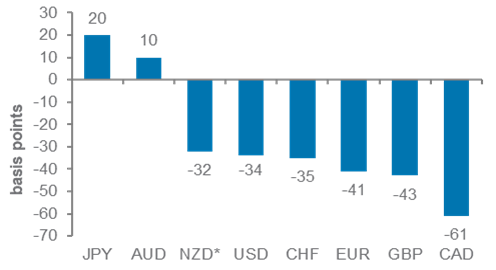

Fig. 30 The Fed is expected to cut rates faster than the RBNZ, RBA and BoJ, which should lead to NZD, AUD and JPY appreciating vs. the USD long-term

Market-implied policy rate changed till December 2024

We expect the CAD to be a loser relative to other major commodity currencies as it is undermined by a dovish BoC, softening wage growth and slowing retail sales. Meanwhile, expectations of a modest recovery in China may result in AUD trading largely sideways over the next 3 months, but modest weakness is possible long-term as commodity price gains slow and the RBA softens its stance.

USD/CNH is likely to move towards 7.26 as the PBoC focuses on stability. However, a move towards 7.35 is likely over the next 12 months as we expect more RRR cuts. We see USD/INR continuing to trade in an ascending channel towards 84 over the next 12 months, with persistent RBI purchases of USD limiting INR gains. Finally, the Monetary Authority of Singapore (MAS) is likely to leave policy unchanged and maintain the prevailing rate of appreciation of its policy band. We see this resulting in a relatively stable SGD, with USD/SGD trading at 1.33 over the next 12 months

Fig. 31 Summary of Asian currency drivers

Gold, crude oil – at a glance

|

Key themes

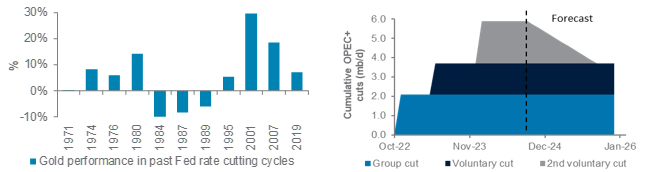

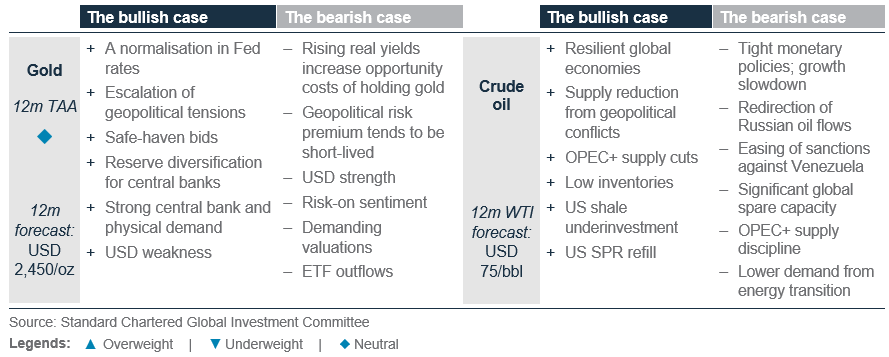

We upgrade our 12-month gold price forecast to USD 2,450/oz. Gold remains a Core Holding within our portfolio for its portfolio diversification benefits. We expect official sector demand to remain robust as central banks diversify their reserves. The start of the G7 rate cutting cycle, which we expect will broaden out to the Fed, is also supportive of the gold appetite. Both investor positioning and ETF flows are likely to improve as Fed rate cuts emerge. Physical consumption, especially in China and India, would continue to be supported by jewellery and alternate-fiat demand. In the next 3 months, the volatile Fed rate expectations and the slowdown in PBoC buying are likely to shift the market sentiment from being outrightly bullish to more balanced, suggesting that gold prices are likely to trade rangebound at around USD 2,300/oz.

We revise our 12-month WTI oil forecast lower to USD 75/bbl on higher supply expectations. OPEC+’s surprise move to gradually taper down the third round of cuts (2.2mb/d) after Q3 is likely to ease the supply tightness. Though, we believe the bloc could reverse the decision should market conditions deteriorate, putting a floor to crude oil prices. On the demand side, while the recent data are largely bearish, it is unlikely to collapse outside of a recession – not our base case. In the near term, we maintain the view that the oil markets are likely to be in a deficit with the extension of all three rounds of OPEC+ rate cuts. Coupled with the stretched short positioning, this suggests a higher WTI oil price at around USD 80/bbl in the next 3 months.

Key chart

A Fed pivot to rate cuts would provide a tailwind to gold prices

Supply tightness in the oil markets is likely to ease on the gradual phase out of OPEC+ production cuts

Fig. 32 Fed rate cuts were more effective in boosting gold prices in the recent easing cycles due to lower level of interest rates; OPEC+ has communicated a clear timeline to gradually phase out the existing output cuts

LHS chart: Gold performance in past Fed rate cutting cycles

RHS chart: OPEC+ cut timeline

Additional perspectives

Quant perspective

Retaining a bullish tilt towards equity

|

|

||||

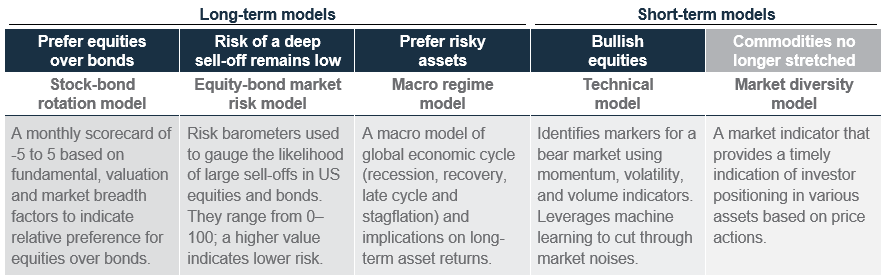

Summary

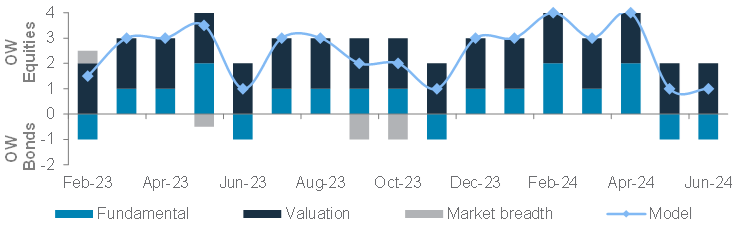

Fundamental factors for equities weakened but our long-term models remain bullish on equities. Our stock-bond rotation model retains a small Overweight in equities over bonds despite weakening macro (ISM manufacturing new orders contracted for two straight months) due to the recovery in earnings upgrade and still-manageable valuation. With equities rallying strongly since April lows, the YTD return of the stock-bond rotation model reached 9.6%, outperforming a 60/40 equity-bond benchmark by 3%. The risk of a sharp sell-off in equities is also currently deemed to be low by our equity-bond risk model, and our global economic regime analysis is also bullish equities as inflation continues to taper.

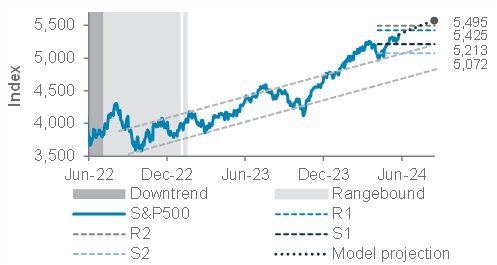

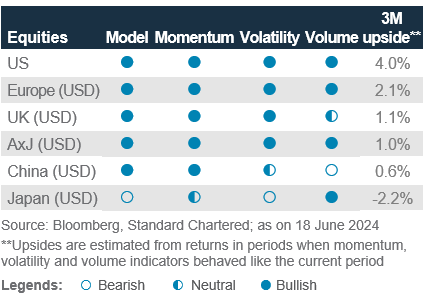

Our technical models remain supportive of equities over the next 1 to 3 months. The S&P500 hit an all-time high of 5,487 after rebounding strongly from its low in April. This, in turn, strengthened our model’s bullishness, with momentum, volatility and volume indicators all remaining positive. These bullish signals are also shared by European equities. Japan remains the only developed equity market with a bear market signal and it is down 7.9% (in USD terms) since its peak in March. Lastly, our model remains bullish on China. Despite deteriorating volatility and volume dynamics, it will require further sell-off from current levels for the China technical model to switch back into a bear market regime.

Commodities no longer look stretched given investor positioning. Our proprietary investor diversity indicator no longer indicates stretched positioning in gold, copper, silver and commodity index, after a peak-to-trough declines of 5.4%, 13%, 9.8% and 5.6%, respectively. Indonesia’s equity market is currently the only market flagged by the indicator for extremely pessimistic investor positioning following its recent sell-off.

Key chart

Valuation factors remain pro-risk despite weaker fundamental drivers

Fig. 33 Breakdown of the stock-bond rotation model’s scores since inception

Model scores as the sum of fundamental, valuation and market breadth factors

Fig. 34 Long- and short-term quantitative models remain bullish risky assets

Long-term models below have a typical time horizon of 3–6 months, while short-term models have 1–3 months horizon

Stock-bond model: Smaller OW in equities

The model score remains at 1 in June, after falling from 4 in April due to weaker fundamentals. This means a smaller OW of 8% to equities given a 60/40 equity-bond benchmark. With global equities rebounding by 8.5% from April-low, the stock-bond model generated an YTD return of 9.6%, or a 3% alpha.

Fig. 35 Weaker economic data is partially offset by an increase in earnings upgrades

Citi economic surprises index, earnings revision ratio change

Fundamentals: Bearish equities. ISM manufacturing new orders and economic surprise index fell for the second straight months. Recovery in earnings upgrades partially offset these negative shifts, netting a slightly bearish score of -1.

Valuation: Bullish equities. Global and Asian equities are trading within 1 standard deviation of their 5-year historical average of forward price-to-earnings ratio. We lagged these factors by 12 months to capture the momentum effect.

Market breadth: Neutral. Majority of equity markets have participated in the equity rally this year, but our contrarian indicator, which measures net-advances in stocks, was signalling limited room for an upside as it was trading at 2 standard deviations above the historical average. This indicator has recently turned less negative.

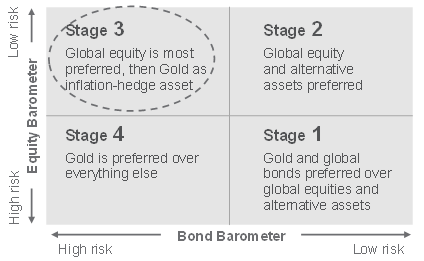

Equity-bond risk: Deep sell-off unlikely

Our equity and bond risk barometers are currently indicating low risk in US equities, but higher risk in US government bonds. The equity barometer (above 50) is supported by the strong equity market momentum and falling inflation. Still-high interest rates are a counter-factor, but this is likely to change as we approach the start of the US rate cutting cycle.

Meanwhile, our bond barometer (below 50) views the US government bond market to be at a higher risk as increased commodity prices (compared with 12 months ago) can cause inflation to fall at a slower pace, leading to interest rates staying higher for longer. This risk has been reflected in the fluctuation of the US 10-year government bond yield this year.

Based on a quadrant analysis of the equity and bond risk barometers, we are in the Stage 3 environment, where global equities and commodities have historically performed well.

Fig. 36 EBMR expects low equity market risks

US equity and bond market risk barometers

Technical: Bullish equities for next 3 months

Our technical model uses learnings from the past behaviours of momentum, volatility and volume indicators to identify a bear market. The model remains most bullish on Developed Market equities, except for Japan. Japan remains the least attractive, as the price trend and momentum are weak, and its volatility has risen closer to past bear market levels. Meanwhile, the model remains bullish on Chinese equities despite an 8.3% pullback since May. Momentum remains the key factor behind the bullish signal.

Fig. 37 Model now projects S&P500 to break above its 2nd resistance line in the near term

S&P500, with channel-line support

Fig. 38 Technical model’s 3-month view across equities

Today, Tomorrow and Forever

Performance Review

Foundation: Asset allocation summary

Foundation+: Asset allocation summary

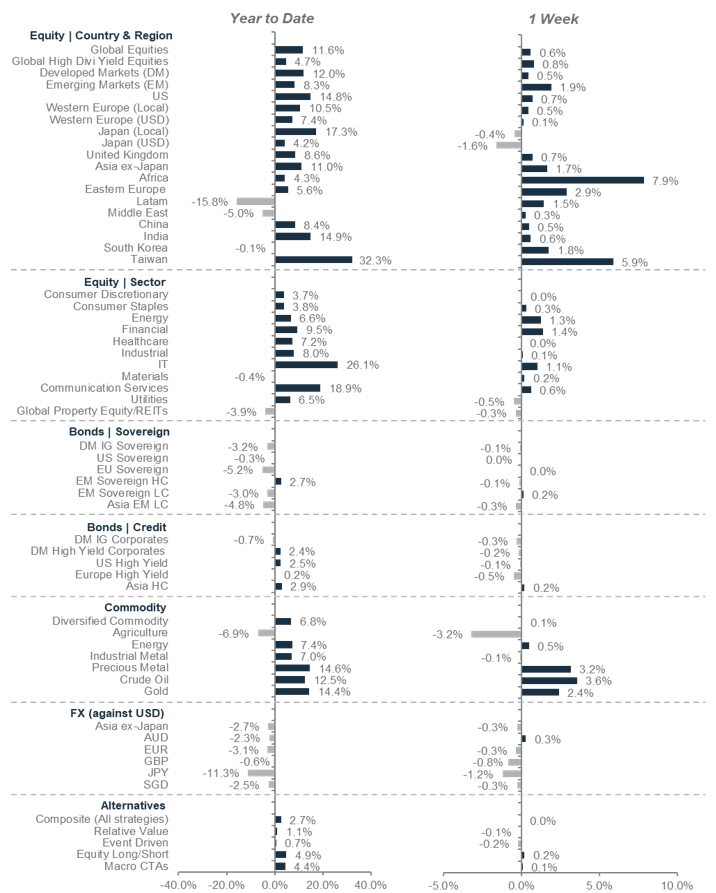

Market performance summary

*All performance shown in USD terms, unless otherwise stated. *YTD performance data from 31 December 2023 to 20 June 2024 and 1-week performance from 13 June 2024 to 20 June 2024

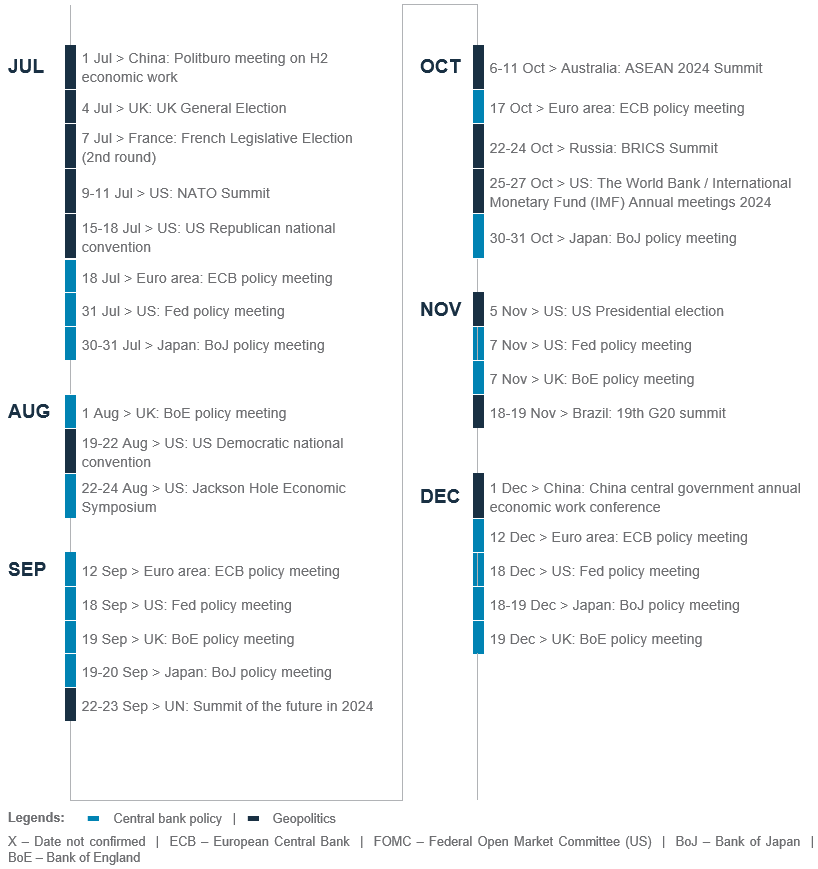

Our key forecasts and calendar events

For more CIO Office insights

Explanatory notes

1. The figures on page 6 show allocations for a moderately aggressive risk profile only – different risk profiles may produce significantly different asset allocation results. Page 6 is only an example, provided for general information only and they do not constitute investment advice, an offer, recommendation or solicitation. They do not take into account the specific investment objectives, needs or risk tolerances of a particular person or class of persons and they have not been prepared for any particular person or class of persons.

2. Contingent Convertibles are complex financial instruments and are not a suitable or appropriate investment for all investors. This document is not an offer to sell or an invitation to buy any securities or any beneficial interests therein. Contingent convertible securities are not intended to be sold and should not be sold to retail clients in the European Economic Area (EEA) (each as defined in the Policy Statement on the Restrictions on the Retail Distribution of Regulatory Capital Instruments (Feedback to CP14/23 and Final Rules) (“Policy Statement”), read together with the Product Intervention (Contingent Convertible Instruments and Mutual Society Shares) Instrument 2015 (“Instrument”, and together with the Policy Statement, the “Permanent Marketing Restrictions”), which were published by the United Kingdom’s Financial Conduct Authority in June 2015), other than in circumstances that do not give rise to a contravention of the Permanent Marketing Restrictions.

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2024, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments

Any ESG data used or referred to has been provided by Morningstar, Sustainalytics, MSCI or Bloomberg. Refer to 1) Morningstar website under Sustainable Investing, 2) Sustainalytics website under ESG Risk Ratings, 3) MCSI website under ESG Business Involvement Screening Research and 4) Bloomberg green, social & sustainability bonds guide for more information. The ESG data is as at the date of publication based on data provided, is for informational purpose only and is not warranted to be complete, timely, accurate or suitable for a particular purpose, and it may be subject to change. Sustainable Investments (SI): This refers to funds that have been classified as ‘Sustainable Investments’ by Morningstar. SI funds have explicitly stated in their prospectus and regulatory filings that they either incorporate ESG factors into the investment process or have a thematic focus on the environment, gender diversity, low carbon, renewable energy, water or community development. For equity, it refers to shares/stocks issued by companies with Sustainalytics ESG Risk Rating of Low/Negligible. For bonds, it refers to debt instruments issued by issuers with Sustainalytics ESG Risk Rating of Low/Negligible, and/or those being certified green, social, sustainable bonds by Bloomberg. For structured products, it refers to products that are issued by any issuer who has a Sustainable Finance framework that aligns with Standard Chartered’s Green and Sustainable Product Framework, with underlying assets that are part of the Sustainable Investment universe or separately approved by Standard Chartered’s Sustainable Finance Governance Committee. Sustainalytics ESG risk ratings shown are factual and are not an indicator that the product is classified or marketed as “green”, “sustainable” or similar under any particular classification system or framework.

Country/Market Specific Disclosures