28 March 2025

Global Market Outlook

Global Market Outlook

US exceptionalism interrupted

US policy uncertainty led equity market jitters in Q1 25. Amid volatility, maintaining clarity on signal vs. noise is key. We continue to prefer global equities over bonds and cash in diversified portfolios, but modestly trim the size of our Overweight.

We favour a balanced approach between US and Euro area equities, downgrading US and upgrading Euro area equities both to core holdings. While German fiscal spending is a positive, US outperformance appears to have corrected rather than reversed. We favour offshore China equities within Asia ex-Japan.

We would continue to buy any dip in gold. USD and bond yields are likely to remain rangebound, though we expect the USD to rise modestly within this range over the next one to three months.

Is US exceptionalism at risk?

Is Germany’s fiscal stimulus a game changer?

Is your quantitative model still bullish equities?

Strategy

Investment strategy and key themes

|

|

||||

|

12m Foundation Overweights:

- Equities, Gold

- DM HY bonds

Opportunistic ideas – Equities

- US software, communications, major banks

- China non-financial high dividend SOEs & Hang Seng Tech Index

- European banks, industrials

Opportunistic ideas – Bonds

- Global convertible bonds

- US Agency mortgage-backed securities

- Asia High Yield USD bonds

US exceptionalism interrupted

- US policy uncertainty led equity market jitters in Q1 25. Amid volatility, maintaining clarity on signal vs. noise is key. We continue to prefer global equities over bonds and cash in diversified portfolios, but modestly trim the size of our Overweight.

- We favour a balanced approach between US and Euro area equities, downgrading US and upgrading Euro area equities both to core holdings. While German fiscal spending is a positive, US outperformance appears to have corrected rather than reversed. We favour offshore China equities within Asia ex-Japan.

- We would continue to buy any dip in gold. USD and bond yields are likely to remain rangebound, though we expect the USD to rise modestly within this range over the next one to three months.

A growth scare or worse?

Financial markets have had a relatively jittery Q1 25: (i) US equities fell c.10% peak-to-trough, underperforming other major regions, (ii) the US 10-year bond yield dipped over 60bps to fall briefly below 4.2% and (iii) global bonds outperformed global equities. Is the equity dip worth buying?

Underlying macro trends can help answer this question. In the US, a growth scare (or even a stagflation scare) is visible in select data. The high-frequency Atlanta Fed GDPnow indicator dropped sharply into negative growth territory in February. At the same time, the University of Michigan’s five-year inflation expectations indicator spiked to the highest since the early 1990s. This data, alongside heightened uncertainty ahead of the 2 April US reciprocal tariff announcement, helps explain market volatility.

However, we are reluctant to draw a very negative conclusion. A broader sweep of data is more supportive of growth and risky assets. The US lead economic indicator, while still negative, is recovering from last year’s lows, the job market appears resilient to the fear of US government cost cutting and the Atlanta Fed’s GDPnow indicator is likely explained by a one-off factor (front-running of imports). We acknowledge tariff policy uncertainty warrants a modest recalibration and keeping a close watch on high-frequency data, but our central scenario remains one of positive growth, not recession.

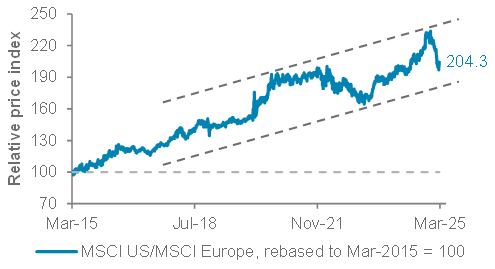

Fig. 1 Europe equities outperformed the US recently, but the long-term US outperformance trend is unbroken

MSCI US/MSCI Europe relative cumulative returns

Source: Bloomberg, Standard Chartered

Favour equities, but narrow regional focus

The positive tilt of macro drivers is why we retain our preference for global equities over bonds and cash. While we have trimmed the size of this Overweight modestly in response to heightened uncertainty on US tariff policy and still-elevated inflation, a possible avoidance of a US recession means we still see room for global equities to rebound once we pass the policy uncertainty event risk in April.

That said, we are narrowing our regional focus. One key question is whether to chase the recent outperformance of European equities relative to the US. In our view, the parliamentary approval of Germany’s fiscal spending package is a step in the right direction, supporting the domestic growth outlook. However, this is not the same as a Euro area-wide removal of debt limits. The USD has also not broken lower, and the speed of the European equity rally leaves investor positioning too stretched to be adding exposure aggressively at this time. Hence, we now hold a balanced view between US and European equities, viewing both as core holdings.

The other debate has been between Chinese and Indian equities within Asia ex-Japan. For now, we believe Chinese equities (we favour offshore China markets) can continue to outperform their Indian peers. While China’s equity rally was initially led by the sentiment boost from the low-cost AI chatbot DeepSeek, and inexpensive valuations, a follow-through improvement in the earnings outlook likely means the rally has legs. This does not take away our constructive structural view on Indian equities – indeed, more moderate valuations mean we see it as an attractive buy-on-dips candidate – but we expect gains to lag those of Chinese equity markets for now.

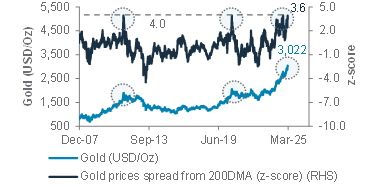

Staying golden

In our view, little has changed on the case for gold after its break above USD 3,000/oz. Central banks remain avid buyers, with heightened US policy uncertainty adding to the supportive case. We also see the precious metal as a potential hedge against the risk of a rise in inflation or stagflation worries. The speed of the rise does mean short-term positioning is now elevated, but we would look to buy any (likely modest) dips, given the positive fundamental outlook.

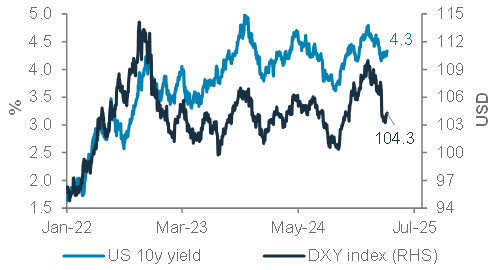

Fig. 2 USD and US government bond yields remain well within post-2022 range

USD index (DXY) and 10-year US government bond yield

Source: Bloomberg, Standard Chartered

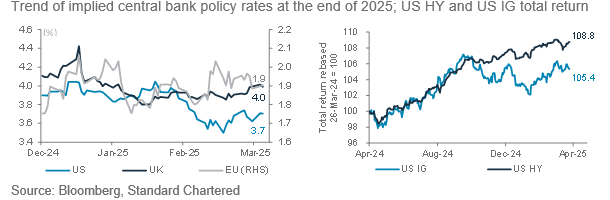

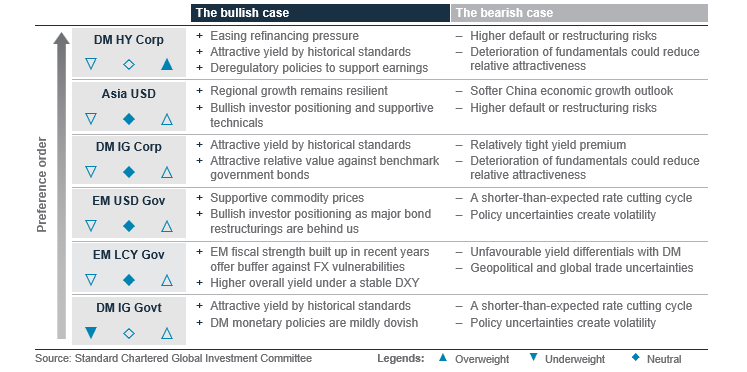

A modest preference for corporate bonds

Our still-constructive view on growth means we hold a modest preference for corporate bonds over government bonds. This is not new when it comes to our preference for High Yield (HY) bonds – muted default pressures across regions means we remain Overweight HY bonds relative to their Investment Grade (IG) peers across regions. This is because we favour exposure to growth-sensitive bonds rather than interest rate-sensitive bonds in the current macro environment.

However, within Developed Market (DM) IG bonds, we now hold a modest preference for corporate over government bonds. While both provide significant sensitivity to changes in interest rates, we believe risk/reward favours a slight tilt towards more growth-exposed (and higher-yielding) corporate bonds. We also close our prior Underweight on Emerging Market (EM) local currency bonds, given our expectations of a largely rangebound USD.

Rangebound USD and bond yields

Despite the recession (or stagflation) scare, the USD index (DXY) has remained firmly within the 100-110 range it has traded since 2022. Over the next one to three months, we expect the USD to rise within this range as markets consider the implications of higher US tariffs. Longer term, though, we expect the DXY index to remain rangebound in the absence of a clear catalyst to break higher or lower.

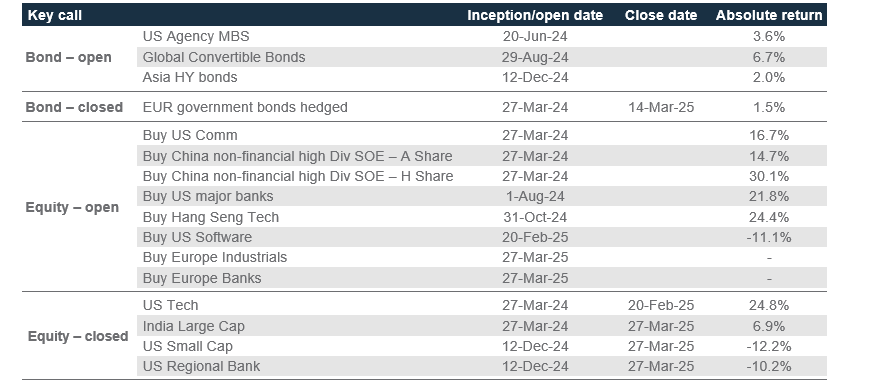

Adding European sectors opportunistically

Our long-term views notwithstanding, we believe there is a case to make opportunistic rotations within equities. In Europe, we open new opportunistic trades on (i) European banks and (ii) European industrials. We believe these two bullish ideas can help capture further short-term European equity outperformance. We close our opportunistic ideas on (i) US regional banks, (ii) US small caps and (iii) Indian large caps to help trim exposure to these markets, consistent with our broader macro approach. In bonds, we closed the Euro area government bonds idea earlier in the month (see Weekly Market View – 14 March 2025) following a surge in European bond yields.

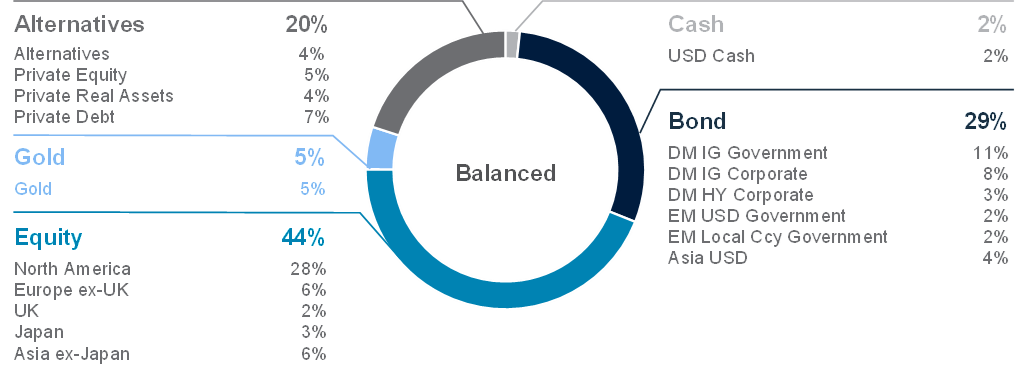

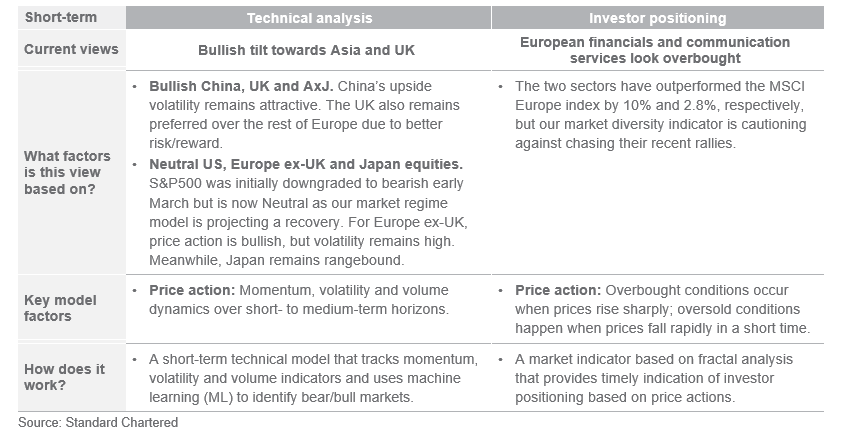

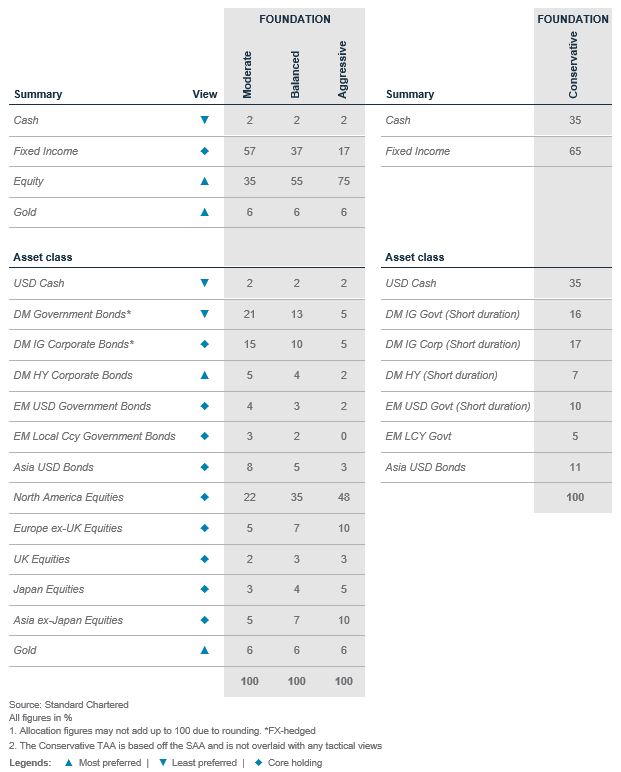

Foundation asset allocation models

The Foundation and Foundation+ models are allocations that you can use as the starting point for building a diversified investment portfolio. The Foundation model showcases a set of allocations focusing on traditional asset classes that are accessible to most investors, while the Foundation+ model includes allocations to private assets that may be accessible to investors in some jurisdictions, but not others.

Fig. 3 Foundation asset allocation for a balanced risk profile

Fig. 4 Foundation+ asset allocation for a balanced risk profile

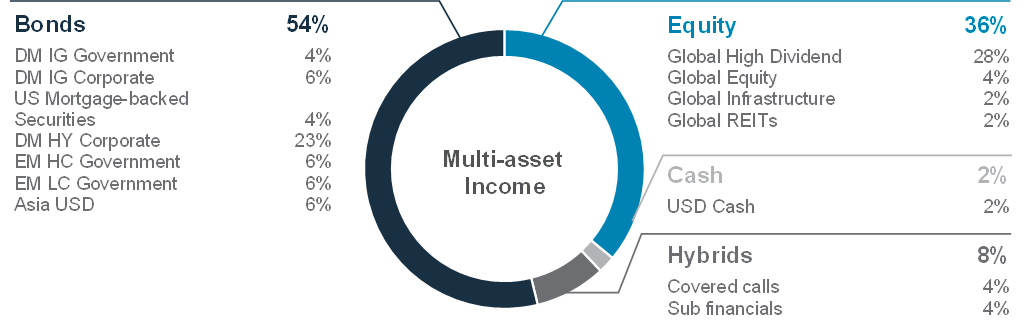

Fig. 5 Multi-asset income allocation for a moderate risk profile

Source: Standard Chartered

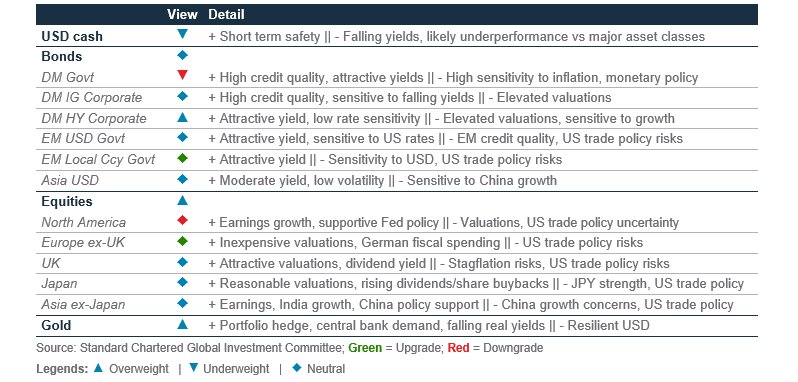

Foundation: Our tactical asset allocation views

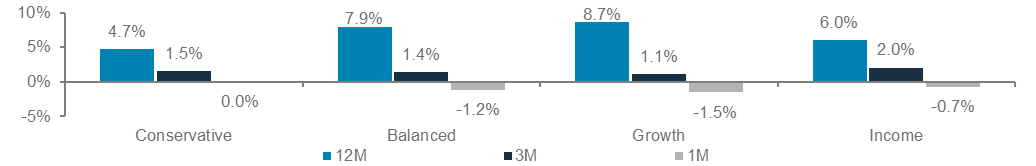

Fig. 6 Performance of our Foundation Allocations*

Source: Bloomberg, Standard Chartered; *12-month performance data from 27 March 2024 to 27 March 2025, 3-month performance from 27 December 2024 to 27 March 2025, 1-month performance from 27 February 2025 to 27 March 2025.

Fig. 7 Opportunistic ideas performance

Foundation: Multi-asset income strategies

|

|

||||

Key themes

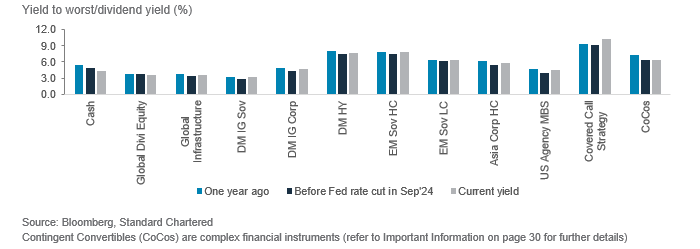

Markets have been volatile due to tariff risks and concerns over a slowing US economy. Despite these uncertainties, our Multi-Asset Income (MAI) strategy has delivered positive returns of 2.1% YTD, benefiting from the stability of income-generating assets such as dividend-paying equities, High Yield (HY) bonds and sub-financial debt. These assets have outperformed equities and thus helped buffer against market volatility in this challenging environment.

Our MAI strategy continues to deliver a steady yield of 5.1%, which remains attractive in the current rate environment. With the Fed expecting to deliver two rate cuts this year, investors should look to lock in higher income, capitalising on yield spikes to maintain steady income from their income portfolios.

In terms of positioning changes, we have reduced our exposure to global equities in favour of covered calls and now hold a balanced view between the two, as we believe the latter offers a better opportunity to capitalise on market volatility. This allows us to earn income from option premia while still participating in equity market upside. We continue to prefer sub-financial debt over Developed Market (DM) HY bonds, and we have added to Emerging Market (EM) local currency government bonds, given the outlook for a more rangebound USD, EM countries strengthening fiscal and current account balances and recent EM inflows, which provide technical support.

Key chart

Reinvested dividends are an important component for investors. Since 1999, reinvested dividends have contributed c.92% of the cumulative total returns

Fig. 8 Reinvested dividends have played a critical role in contributing to total returns

Fig. 9 Yields still offer opportunity to generate attractive income

Resilience of MAI strategies

The performance of our MAI strategy has demonstrated resilience, delivering positive returns of 2.1% YTD. Q1 25 was clouded by tariff risks and a US growth scare that sent markets into a frenzy, with US equities falling 10% peak-to-trough. Our MAI strategy benefitted from the stability of income-generating assets such as dividend-paying equities, HY bonds and sub-financial debt. These buffered market swings and helped the MAI strategy outperform global equities in this challenging environment.

On the back of heightened uncertainty (albeit with a still positive growth outlook), we have pared down some equity risk within our MAI strategy. We have reduced our exposure to global equities in favour of covered calls and now hold a balanced view between the two. The latter offers some downside protection with the income earned from selling of options in the event of a further downturn in markets. Elsewhere, we also added allocations to EM local currency bonds, as we expect a more rangebound USD.

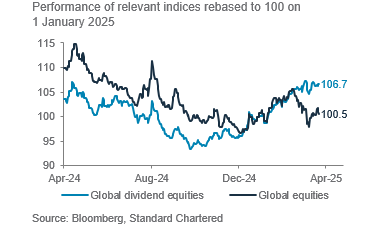

While returns on broad-based global equity indices were flatter since the start of the year, global dividend equities have delivered more robust returns YTD. Compared to traditional global equities, as measured by the MSCI All Country World index, global dividend equities have delivered an excess of c.6% returns. We believe that dividend equities present a compelling alternative to more growth-oriented exposures in the generation of income and thus and play a vital role in income portfolios.

Role of dividend-yielding stocks in MAI

A MAI strategy aims to generate regular income while also seeking capital appreciation. A key component of this strategy is global dividend equities, which make up 28% of the allocations. These stocks provide a steady income stream, reduce downside risk, and offer long-term growth potential, making them a critical component to an income-focused portfolio.

Bonds delivered positive returns across the board in Q3, with Developed Market (DM) Investment Grade (IG) and Emerging Market (EM) local currency (LCY) bonds particularly benefitting from the Fed respectively, in the 12 months after the first cut. In these instances, the resilience of the US economy helped in supporting riskier credit assets.

Fig. 10 Global dividend equities have outperformed global equities after US equities corrected mid-February

Why dividend equities matter in an income portfolio?

Dividend equities consistently generate cash flows, which help cushion portfolios during market downturns. Unlike capital gains, which can be unpredictable, dividend payouts tend to remain stable across different market cycles.

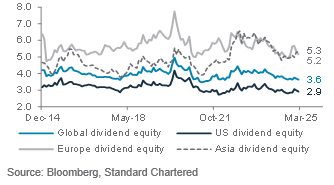

Fig. 11 Global dividend equity yield has remained stable over the past decade

Dividend yields for global and regional dividend equities (%)

Defensive characteristics: Dividend-paying companies often have strong balance sheets, stable earnings and robust free cash flows. Over 30% of dividend equity indices are in defensive sectors such as consumer staples, healthcare and utilities, which tend to hold up better in downturns. Historically, dividend stocks have recovered strongly after bear markets, with an average rebound of 36% (6 months) and 51% (12 months) after corrections.

Expanding growth potential: While dividend stocks were traditionally concentrated in defensive sectors, more high-growth sectors such as technology and industrials are now adopting dividend payouts. As of September 2024, 80% of S&P500 companies paid dividends, with the tech sector’s share rising to 24% from 13% a decade ago. This expansion enhances dividend stocks’ appeal by combining income stability with growth potential.

Inflation protection: Withinflation expectations remaining elevated, dividends can provide an inflation hedge by helping investors to maintain their purchasing power. Dividend growth can also help offset inflation’s impact over time.

Long-term wealth creation: Reinvested dividends significantly boost total returns – since 1999, they have contributed to 92% of cumulative equity total returns. This compounding effect makes dividend equities a powerful tool for long-term portfolio growth.

Over the next 6-to-12 months, market volatility is likely to remain elevated, inflationary pressures will persist and geopolitical risks will remain, in our view. We continue to believe investors should take a balanced approach in riding out the market volatility, seeking growth potential and earning stable income.

Perspectives on key client questions

|

|

||||

Is US exceptionalism at risk?

American Exceptionalism – the belief that the US occupies a unique and distinct place in history and global affairs – has consistently shaped not only geopolitics, but also financial market performance. For decades, investors have benefited from this narrative: since 1987, the S&P500 has outperformed global ex-US equities on an annual basis nearly two-thirds of the time. However, recent tariff uncertainties and emerging US growth concerns have challenged this established theme. So far this year, the S&P500 has struggled, in contrast to notable gains in markets such as Europe and China. This divergence raises the question: is US exceptionalism at risk, and if so, what are the implications for investors?

In our view, the era of US exceptionalism is not over but merely on pause. The fundamental strengths of the US economy, including the ability of US companies to consistently deliver on earnings and stay on the forefront of innovation and technology, have continued to underpin our long-term optimism towards US assets. However, given ongoing tariff uncertainties, a tactical Neutral stance on US equities is warranted as we await clarity on US policies. We continue to emphasise the importance of maintaining a diversified portfolio, with a balanced equity allocation across regions and hedges such as gold to navigate the uncertainties ahead.

Lessons from the past

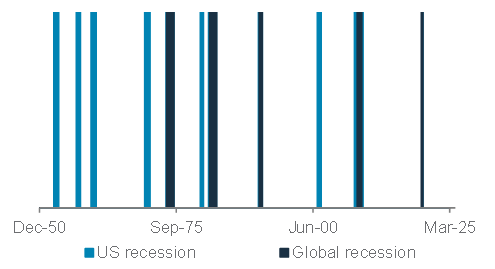

As the global economy grows more interconnected, US-only recessions are rarer but not unprecedented. According to the World Bank, there have been only four global recessions since 1950, each of which has coincided with a recession in the US. However, not every US recession has led to a global recession. In fact, the US has experienced six additional recessions independently since 1950, with the recession following the dot-com bubble burst around 2001 and the initial phase of the global financial crisis the more recent examples.

What happens during periods of US-only recessions?

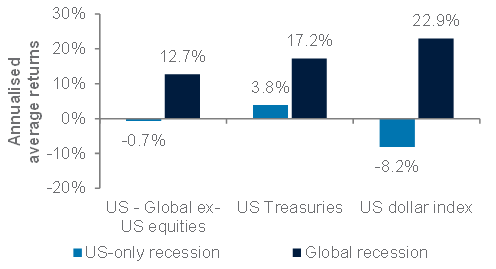

There are clear distinctions in terms of financial market performance during periods of US-only recessions and global recessions. During a US-only recession, US equities underperform their global counterparts. The Fed typically responds by cutting interest rates, thereby bolstering US government bonds.

Fig. 12 US-only recessions have occurred several times since 1950 but have been less frequent in recent years

US-only and global recession periods since 1950

Fig. 13 The USD tends to fall alongside US equities during a US-only recession

Average returns under US-only and global recessions

Source: World Bank, NBER, Bloomberg, Standard Chartered

However, given the absence of flight-to-safety from abroad, the USD typically falls alongside US equities, while gains in US government bonds are also not as material as they would have been during a global recession. Traditional US safe havens are thus not as effective in a US-only recession.

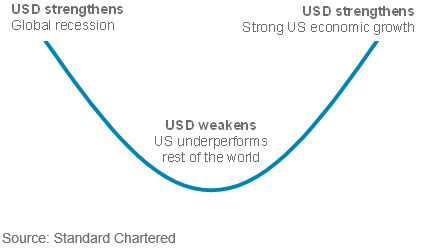

In contrast, during global recessions, although US equities decline, they tend to outperform global counterparts. Global investors typically turn to US assets for stability, thus strengthening the USD and US government bonds. This phenomenon is illustrated by the ‘US dollar smile,’ which highlights the two distinct scenarios where the USD strengthens – severe global downturns and periods of robust US economic outperformance – and the one scenario, the intermediate state of a US-only slowdown, where it weakens.

Fig. 14 The USD weakens in a US-only slowdown

The US dollar smile

Cracks in US exceptionalism?

While tariffs represent a near-term headwind, the broader risk lies in the US’s increasingly isolationist stance. Alienating allies and adversaries alike with tariffs, curbing immigration and threatening to withdraw from key alliances such as NATO are major policy shifts that challenge the foundation of US exceptionalism. Meanwhile, Europe’s reversal of fiscal restraints and China’s resilience despite tariffs underscore the growing competitiveness of other global powers.

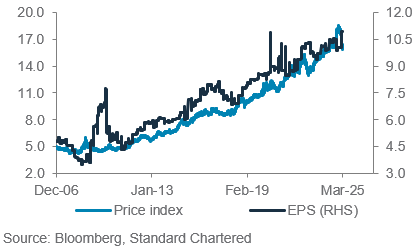

Fig. 15 US earnings have outpaced their global counterparts, justifying their stock outperformance

S&P500 vs global ex-US equity price and EPS ratios

However, it is too early to conclude US exceptionalism has come to an end. The US remains at the forefront of innovation and technology, led by corporations that operate on a global scale. Its flexible labour markets and strong entrepreneurship culture continue to foster economic dynamism. As a result, US corporate earnings have consistently outpaced those of global peers, a trend we expect to persist (Fig. 15). Nonetheless, given the evolving policy landscape, investors should maintain a well-diversified portfolio to navigate the uncertainties ahead.

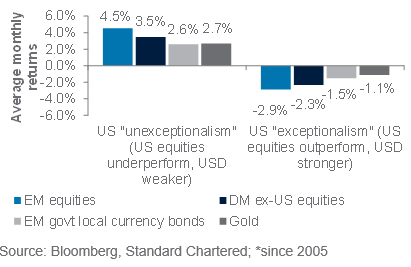

Add EM assets and use gold and JPY as diversifiers

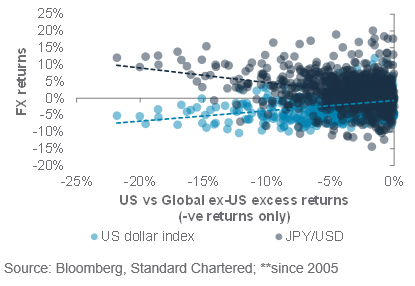

Diversification is not only crucial in a volatile and uncertain environment but also enables investors to capitalise on attractive opportunities elsewhere while waiting for US-related uncertainties to ease. EM equities and bonds stand to benefit from potential USD weakness. Additionally, gold offers effective hedging benefits during periods of US ‘un-exceptionalism’, providing portfolio stability and downside protection. The JPY is also an attractive diversifier and has historically performed well when global investors seek safety away from US assets.

Fig. 16 EM equities and bonds perform well when US equities underperform global peers and USD is weak

Average monthly returns of assets under different scenarios*

Fig. 17 The JPY is a potential diversifier during periods of US underperformance

USD index and JPY returns during periods when US equities underperform global ex-US equities**

Macro overview – at a glance

Our macroeconomic outlook and key questions

|

Key themes

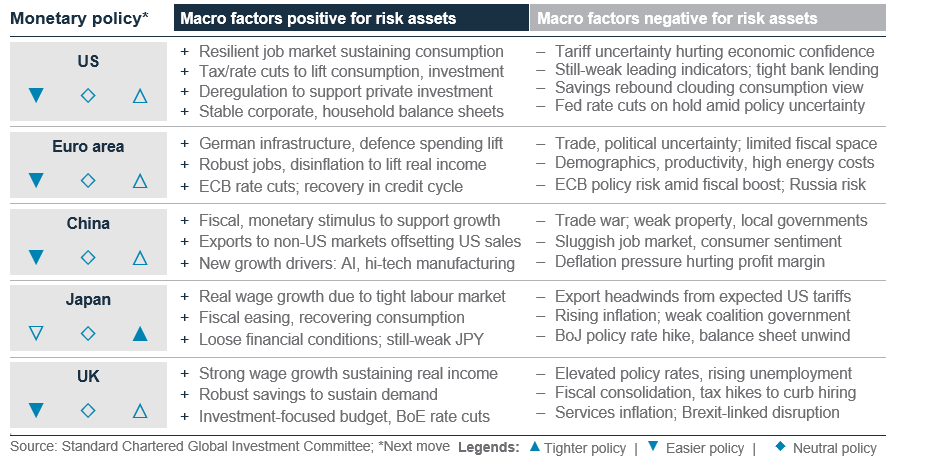

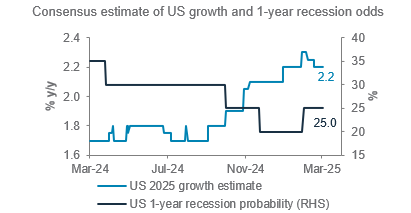

Despite recent concerns, we see only a 20% chance of a US recession over the next 12 months. Elevated policy uncertainty has increased the odds of a US economic soft landing to 50% from 45% at the start of the year while lowering the odds of a no landing to 30% from 40%. President Trump’s flip-flop on tariffs and efforts to cut government waste and immigration have dented consumer and business confidence. Trump’s tariff plan roll-out on 2 April is likely to provide a clearer picture of the trade outlook. Meanwhile, we push back the chances of the next Fed rate cut to H2 as it assesses the impact of Trump’s policies. Consumer inflation expectations have surged lately, but market-based inflation expectations remain within the long-term range.

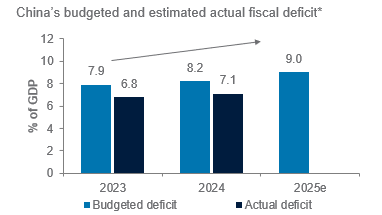

Europe and China outlooks improve on fiscal stimuli. Of the world’s major economies, Europe’s outlook has improved the most this year. Trump’s forceful intervention in ending the Ukraine conflict, potentially to Russia’s advantage, and his aggressive trade policies have led European policymakers to take steps to boost defence and infrastructure spending. The German parliament’s vote to ease constitutional debt limits is likely to lift Germany’s growth by 2% annually over a decade. Meanwhile, China has unveiled a fiscal stimulus that should enable the economy to achieve the government’s 5% growth target this year.

Key chart

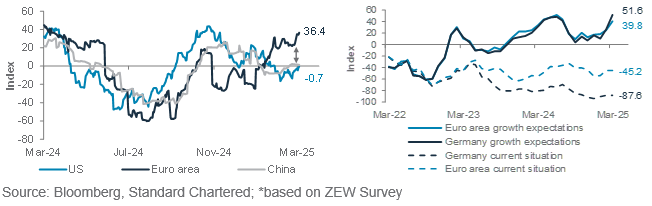

The Euro area’s growth outlook has improved the most this year following Germany’s vote to ease constitutional debt limits to enable greater spending on infrastructure and defence

Fig. 18 Euro area economic data and growth expectations have improved this year

US, Euro area, China economic surprise indices; Euro area, Germany growth expectations*

Top macro questions

Is the US heading into a recession? The question arose after the Atlanta Fed’s GDPNow estimate indicated a contraction in the economy in Q1 after January’s trade and personal consumption data was released in late February.

We see this as a technical anomaly primarily caused by a surge in the US trade deficit in January due to front-running of US imports ahead of Trump’s tariffs (some of which went into effect in February). The trade deficit is likely to ease in the coming months, while inventory data is likely to reflect the surge in imports with a lag, reviving GDPNow growth estimates for February and March. Meanwhile, personal consumption growth has slowed amid policy uncertainty and rising inflation concerns, although we expect this to reverse in the coming months as the job market remains resilient.

Our base case: We do not expect a recession this year primarily because we expect ongoing uncertainty due to Trump’s trade policy and government spending and immigration curbs to be temporary. We believe the policies are likely to be eventually eased as they impact his approval ratings and the stock market. Moreover, the Republican Party base and key business constituents are likely to push back on his tariff policies, especially in the run-up to next year’s mid-term elections, as they disrupt business supply chains.

Near-term risks: US growth is slowing, but only to long-term trend rates. There is a chance Trump sacrifices short-term growth and tolerates a brief equity downturn to achieve his long-term goal of pushing through tax cuts, cutting government waste, deregulating industries and attracting more foreign investments into US manufacturing.

US economic surprises turned negative in February as near-term policy risks hurt confidence. Forward-looking labour market indicators, such as the job vacancy rate, are pointing to a rise in unemployment. Government sector jobs, which propped up payrolls last year, are likely to drop this year. Potential tariffs against key US trade partners in April could hurt sentiment further and revive inflation risks, forcing the Fed to hold rates at restrictive levels longer.

Upside risks: Beyond the immediate risks, the focus is likely to turn to Trump’s proposed tax cuts and deregulation. Lower

bond yields, a weaker USD and slowing growth should ease financial conditions and enable the administration to push tax cuts through Congress, lifting consumer/business confidence and private investment. A recovery in the private sector is likely to take the slack from government spending cuts.

While consumer inflation expectations have risen, hurting sentiment, a resilient job market and five-year low oil prices are supporting disposable income and keeping market inflation expectations within the long-term range. Although we expect the Fed to delay rate cuts due to near-term policy uncertainty, we expect the central bank to resume cuts in H2 if H2 Hemarket-based inflation expectations stay in check.

Is Germany’s fiscal stimulus a game changer? The German parliament’s vote to ease constitutional debt limits is a potential game changer for Germany, as it is likely to boost growth by c.2% annually for more than a decade through greater spending on infrastructure and defence. The next focus is on the nature of the coalition government in Berlin.

The impact on the Euro area is likely to be positive but limited in the near term, given it will take at least a year before the spending plans are implemented. Moreover, unlike Germany, the rest of Europe lacks fiscal space to significantly boost spending amid high debt levels. Besides, a significant part of European defence spending is likely to benefit US defence contractors due to Europe’s limited production capacity. The Euro area also needs to deal with US tariffs expected from 2 April. Any escalation in trade tensions is likely to hurt near-term growth. Hence, we expect the ECB to cut rates further, including a 25bps cut in Q2.

Is China’s stimulus enough to revive growth? As expected, China’s National People’s Congress delivered yet another fiscal stimulus to revive consumer and private sector business confidence and ease deflation pressures. The fiscal stimulus (impulse) for 2025 amounts to almost 2% of GDP, although there is a risk the actual boost falls short of target, as in the past two years. The stimulus should help China achieve close to its 5% growth target, although US tariffs are a risk. The US has already raised tariffs on China to 30%. Although China has reduced exports to the US in recent years, making it less vulnerable to Trump’s protectionist policies, we expect Beijing to implement further monetary and credit easing in Q2 to offset the impact of US tariffs.

Fig. 19 US recession risk remains low, despite policy risk

Fig. 20 China’s rising fiscal spending to support growth

Asset Classes

Bonds – at a glance

|

|

||||

Key themes

We view global bonds as a core holding. Tight yield premia but high absolute yield levels led us to maintain a Neutral stance on global bonds. We continue to expect policy rate cuts from major Western central banks, despite volatility in long-term rates. We view a Neutral bond maturity profile (five- to seven-year average) as the best balance between repricing risks and yield potential.

Our constructive view on growth means a preference for corporate over government bonds. We are Overweight DM High Yield (HY) and Neutral (core holding) on DM Investment Grade (IG) corporate bonds. DM HYstill offers attractive nominal and real yields from a risk-adjusted returns angle while DM IG’s high valuations are supported by solid fundamentals and continued inflows. We have downgraded DM IG government bonds to Underweight on interest rate volatility concerns. DM IG government bonds are also weaker than DM IG corporate bonds from an income generation perspective.

EM USD government and Asia USD bonds are core holdings. While yields are appealing, US protectionism poses risks. In Asia, we prefer HY over IG bonds due to domestic exposure and China stimulus. We upgrade EM local currency government bonds to Neutral, given our view of a relatively rangebound USD long-term and steady fund flows into the asset class

Key chart

We expect DM HY to continue benefiting from a non-recessionary scenario as the market revises its expectations for central bank rate cuts

Fig. 21 In March, the market has been pricing fewer DM central bank rate cuts in 2025

Underweight DM IG government bonds

We are downgrading DM IG government bonds to Underweight and expect this asset class to underperform. Our constructive view on growth suggests that the current risk/reward favours corporate bonds over government bonds, particularly due to the higher yields and greater growth exposure of corporate bonds. Additionally, government bonds are more sensitive to interest rate volatility, especially considering uncertain public policy and inflation expectations.

Neutral (core holding) DM IG corporate bonds

The DM IG corporate bond yield premium remains tight relative to historical averages, with strong inflows continuing to support high valuations. Corporate fundamentals remain strong, supporting credit metrics, while uncertainty brought about by Trump’s polices could bring volatility and test bond yield premia at these tight levels. While DM IG corporate and government bonds are susceptible to interest rate risks, our growth bias leads us to believe that DM IG corporate bonds will deliver better returns than government bonds.

Overweight DM HY corporate bonds

We continue to expect a soft landing for the US economy, with potential fiscal spending relaxation in Europe likely to positively impact economic growth. The collective resilience in economic conditions should help prevent a spike in default rates. While valuations are rich, we believe DM HY yield premia provide a good buffer under a soft-landing scenario. We expect DM HY to deliver superior risk-adjusted returns, and thus, we continue to hold an Overweight view.

Neutral (core holding) EM USD government bonds

Bond yield premia remain tight from a historical perspective, and US protectionism poses challenges, particularly for EM commodity and capital goods exporters. However, a higher yield premium over DM government bonds and an improvement in market technicals from the past two months support the asset class. Improving fiscal strength and current accounts in major EM countries have reduced offshore bond issuance needs, balancing the risks to some degree, leaving us with a Neutral view on EM USD bonds.

Neutral (core holding) Asia USD bonds, with preference for HY over IG

We believe EM Asia faces vulnerabilities from rising geopolitical uncertainty and protectionism. Asia IG bond yield premia are tight, yet these are well supported by robust fundamentals and strong refinancing capabilities in capital markets, alongside significant domestic technical demand.

Asia HY bonds are expected to benefit from their domestic business focus. The peak of defaults in the Chinese property sector and related refinancing risks are largely behind us. The asset class should also benefit from any further policy stimulus from China. Together, these lead us to believe Asia HY bonds are set to deliver improving risk-adjusted returns, leaving us Overweight Asia HY bonds within Asia USD space.

Neutral (core holding) EM local currency government bonds

We are upgrading our stance on EM local currency government bonds from Underweight to Neutral. The higher EM yield and our view of a relatively range bound USD long-term, support this asset class and enhance performance, particularly as EM central banks remain inclined to cut rates. Furthermore, many EM countries have bolstered their fiscal and current account strength in recent years, providing a buffer against FX vulnerabilities. Recent inflows into this asset class have added technical support. However, we acknowledge that EMs remain susceptible to market volatility and geopolitical uncertainty, with weaker US demand and higher tariffs posing significant risks to these economies.

Opportunistic buy: US Agency MBS

We maintain an opportunistic buy idea on US Agency mortgage-backed securities (MBS) due to their attractive yield pick-up over US government bonds. We expect resilience in the US housing market as Fed rate cuts facilitated mortgage refinancing during the pandemic, lowering average mortgage rates. In a more risk-averse scenario, Agency MBS is likely to perform well, given its high correlation with the performance of US government bonds, which are considered a safe-haven asset. Risks include the potential acceleration of inflation in the US.

Opportunistic buy: Global convertible bonds

We retain an opportunistic buy stance on global convertible bonds, as we believe an economic soft-landing scenario and potential deregulatory policies in the US will be supportive of this asset class. The increasing share of Asian issuers that offer higher new issue premia adds a layer of diversification and performance, particularly as economic tail risks are addressed in China. The asset class mainly consists of small- to mid-cap issuers and exhibits a relatively high correlation with equity markets. Rising recession concerns pose a risk.

Opportunistic buy: Asia USD HY bonds

We retain an opportunistic buy idea on Asia HY USD bonds. The China property sector now forms a much smaller portion of this asset class, and we believe that peak defaults are behind us. Asian HY issuers are more domestic focused, reducing their exposure to geopolitical risks. The broadening use of AI applications is likely to stimulate investment in the industrial and technology sectors. A slower growth outlook is a risk.

Note: We closed our opportunistic buy idea on European government bonds on 14 March with a 1.5% gain. Please refer to the Weekly Market View published on the same date.

Equity – at a glance

|

|

||||

|

|

||||

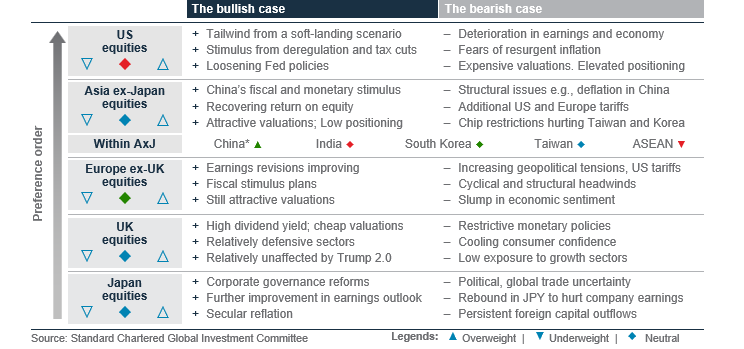

Key themes

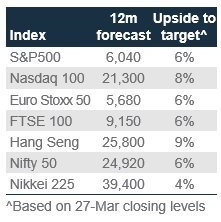

We trim the scale of our Overweight on global equities due to policy uncertainty under the Trump administration.

We downgrade US equities to core holding (Neutral). Valuations have become more attractive after the pullback, and EPS growth continues to lead other regions. However, tariff risks are resulting in prolonged volatility. We upgrade Europe ex-UK equities to core holding (Neutral), supported by fiscal stimulus plans and earnings recovery. However, geopolitical risks and structural challenges could limit outperformance. UK equities remain a core holding (Neutral) as the defensive exposure and an attractive dividend yield will support amid a volatile market, while stickier inflation could hold back the potential upside.

Asia ex-Japan equities are a core holding (Neutral). Within the region, we upgrade China equities to Overweight. We are positive about the technology-related developments and China’s stimulus measures, which likely outweigh the trade uncertainties and structural worries. Meanwhile, we downgrade India equities to core holding (Neutral). We believe in India’s long-term growth prospects, although the equity market has suffered from fund rotation into cheaper Chinese equities. Japan equities are also a core holding (Neutral). Earnings pressure from a stronger JPY and persistent foreign capital outflows could weigh on the market.

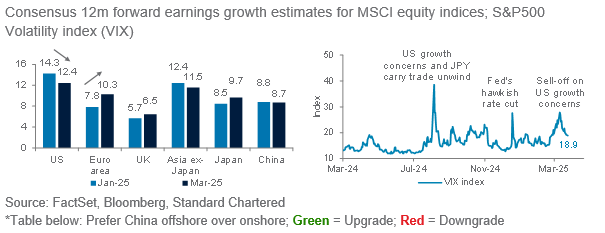

Key chart

Diversifying across different markets in the face of volatility

Fig. 22 US equities’ 12-month forward earnings growth still leads, but estimates have been revised lower. Policy uncertainty is resulting in relatively elevated volatility

Trimming global equities Overweight

We trim the scale of our Overweight on global equities. Our expectations of a soft-landing scenario and Fed easing will likely support equities outperformances over the next 6-12 months. At the same time, policy uncertainty under the Trump administration implies a higher risk premium on equities.

Neutral (core holding) US equities

We are downgrading US equities to Neutral. The return prospects are looking more attractive after the recent correction. Potential tax cuts and deregulation remain as tailwinds. However, policy uncertainties are leading to ‘slower-than-usual’ normalisation in the S&P500 Volatility index (VIX), suggesting prolonged market nervousness. Earnings projections (12-month forward) continue to lead the other regions but have moderated to 12% (from 14% in January).

Neutral (core holding) Europe ex-UK equities

We are upgrading Europe ex-UK equities to Neutral. Earnings growth (12-month forward) in the region has moved higher to 10% for 2025 from 8% since start of year. Besides, Germany’s fiscal spending plans and economic recovery across broader EU countries are likely to bolster investor sentiment. Nonetheless, trade tariffs and escalating geopolitical tensions are near-term headwinds.

Neutral (core holding) Asia ex-Japan equities

Asia ex-Japan equities are also a core holding. The region’s return on equity is recovering and valuations remain relatively inexpensive. Recent inflows into growth areas of the market have further bolstered investor sentiment. However, tariff uncertainties remain a key risk.

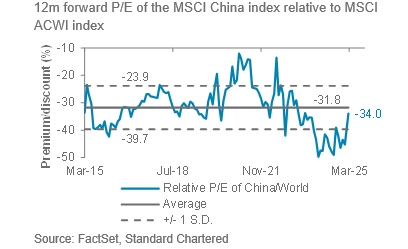

We are upgrading China equities to Overweight within the region. The launch of DeepSeek’s chatbot has increased fund inflows since the start of year. Valuations are still appealing, with the MSCI China index trading at a 34% discount to global equities on a price-earnings (P/E) ratio basis. We believe fiscal policies should support China’s growth and earnings outlook, supporting

Fig. 23 Chinese stocks still trade at significant discount to global equities

a more sustained rally. We are shifting our preference to offshore equities relative to their onshore counterparts, due to the offshore market’s higher growth stocks composition. Structural issues including deflation and weaker consumption act as headwinds.

We are Neutral Taiwan equities, while we are upgrading Korea equities to Neutral amid a positive earnings outlook. 12-month forward earning-per-share growth is forecast at 17% for both markets, ahead of other markets within Asia ex-Japan. Potential import tariffs on semiconductor or AI-related products from the US may dampen earnings growth.

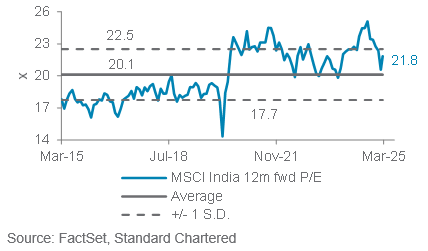

We are downgrading India equities to a core holding. India is relatively insulated from overseas trade tensions. However, its earnings revision index (number of companies with earnings upgrades compared with downgrades) have declined to negative territory in recent months. We believe in the long-term growth prospects of Indian equities, but there has been fund rotation into the relatively cheaper Chinese equities. Besides, we also downgrade ASEAN to Underweight due to US tariffs and the redirection of China exports, which is intensifying competition for domestic ASEAN businesses.

Fig. 24 India equities’ 12m forward P/E of 21.8x is still more expensive than the historical average

12m forward P/E for MSCI India index

Neutral (core holding) UK Equities

UK equities remain a core holding. Equities in the region have a defensive tilt, which means the market may outperform in an environment that is unfavourable for global equities. Receding price pressures and potential policy pivots are expected to support economic growth. These were offset by relatively subdued earnings growth projections compared to other DMs.

Neutral (core holding) Japan equities

Japan equities remain a core holding. Corporate governance reforms remain a catalyst, alongside increased share buybacks and the acceleration of eliminating parent-subsidiary listings. A reflationary environment will likely support growth across cyclical sectors. However, a stronger JPY and rising BoJ policy rate are likely to curtail earnings projections for Japan corporates, given their exposure to foreign earnings.

Equity opportunistic views

|

Opportunity in Europe

- We have seven opportunistic equity buy ideas where we target positive absolute returns. This month, we initiate two ideas on European industrial and European bank sectors, while closing three ideas: US small caps, US regional banks and India large caps.

Changes to our buy Ideas

Opening Europe industrials: We expect the sector to benefit from a fiscal boost in Europe focused on infrastructure and defence spending. Aerospace and defence is the largest industry in the sector at c.25% of index weight: apart from the growth in defence, rising demand for air travel would support the aerospace industry. Meanwhile, infrastructure spending would benefit the sector members selling electrical equipment and machinery. A downturn in Europe’s economy is a risk.

Opening Europe banks: Banks have been among the top performing industries over the last six months, with positive earnings revisions supporting attractive dividend yields and share buybacks. We expect this to continue, supported by a pickup in GDP growth as a result of the fiscal boost in Europe. Significant rate cuts impacting banks’ income is a risk.

Closing US small caps: We are closing at a 12.2% loss, as tariff uncertainty is adversely affecting US consumer confidence and the demand outlook.

Closing US regional banks: Similarly, we are closing at an 10.2% loss amid consumer and business uncertainty. We prefer to maintain exposure to the less volatile large banks.

Closing India large caps: We are closing for a 6.9% gain, as earnings revisions continue to be negative. This may stay as a near-term headwind, even though we remain positive on the long-term structural investment case in India.

Existing buy ideas

US communication services: We continue to see attractive growth in digital advertising, online entertainment and AI applications. Sector valuation remains reasonable, at a discount to the broader market. Advertising softness is a risk.

US major banks: We believe a US soft landing remains supportive. Meanwhile, deregulation benefits lie ahead, with possibly higher share buybacks as regulatory costs fall. A sharp slowdown in the US economy is a risk.

US technology software: We view the recent pullback as an opportunity. China’s low-cost chatbot DeepSeek is lowering the cost of AI tools, which supports software products and development. Software is also less vulnerable to tariff and trade war risks. Weakness in corporate IT budgets is a risk.

China non-financial high dividend SOEs: We continue to like the stability of high-dividend state-owned enterprises (SOEs). Non-financial SOEs are less exposed to the troubled property sector. Adverse regulatory changes are a risk.

Hang Seng technology: We prefer a barbell approach in China, with the technology sector complementing the income stability from high-dividend SOEs. Policymakers’ support for AI and technology development is driving a valuation re-rating, with further re-rating potential as policy stimulus is unveiled. Weaker-than-expected stimulus is a risk.

Fig. 25 Opportunistic buy ideas

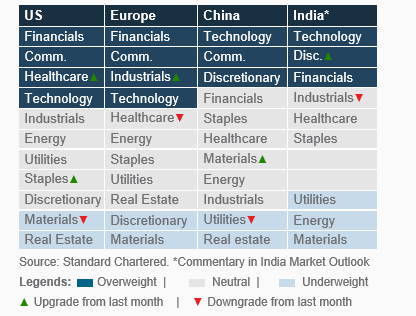

Sector views: technology supported by AI

We turn more defensive in the US, upgrading healthcare to Overweight and consumer staples to Neutral. We turn more pro-cyclical in Europe by upgrading industrials to Overweight and downgrading healthcare to Neutral. In China, we maintain exposure to improving consumption and AI adoption with our preference for technology, communication and discretionary.

Fig. 26 Our sector views by region

FX – at a glance

|

Key themes

The FX market’s focus has been shifting from US exceptionalism to stagflation concerns. We anticipate a short-term uptrend in the USD index (DXY) over the next 3 months, followed by a subsequent decline over the 12-month horizon. The USD is expected to benefit from increased risk aversion in the near term amid rising global economic uncertainty. In the longer term, US government bond yields are likely to cap the USD. FX volatility remains slightly below the five-year average, which is consistent with our small magnitude of expected moves.

We see EUR/USD retreating to 1.06 on a 3-month horizon before rebounding to 1.09 on the 12-month horizon as increased German fiscal spending helps revive Euro area growth. GBP/USD is likely to edge lower to 1.25 over the next three months amid a stronger USD and the UK’s fiscal constraints.

We believe the JPY has the most potential to strengthen further in the short and long term, with the BoJ likely to continue tightening policy given rising wage growth and inflation expectations. Meanwhile, markets expect the Swiss National Bank’s terminal rate to be 0.25%, but we see risks tilted toward another rate cut if economic and currency conditions deteriorate substantially, pushing USD/CHF higher in the near and longer term. The AUD and NZD are likely to stabilise over the next three months amid moderate China growth. Meanwhile, we see CAD weakness on the back of US tariff threats and a soft oil price.

Key chart

The US-Japan interest rate differential has been narrowing since the end of January, supporting the USD/JPY downtrend

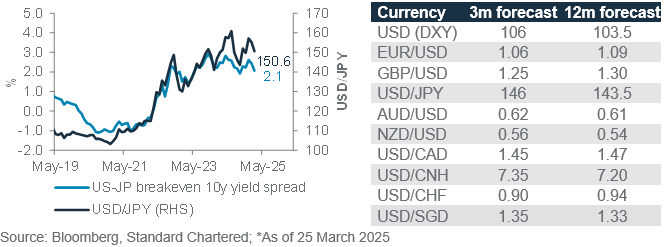

Fig. 27 USD/JPY has been falling in line with the US-Japan real interest rate differentials

US-Japan real differentials vs USD/JPY *; table of forecasts

Fig. 28 Summary of major currency drivers

Looking for a USD rebound near-term

We see the Fed holding rates in H1 this year, supporting further upside in the real interest rate differential favouring the USD in the near term. Fed officials revised their US growth forecast down to 1.7% for 2025 while raising core PCE inflation forecast to 2.8%, suggesting potential stagflation risks. However, Fed rate cuts resuming in H2 should reverse the USD’s yield advantage in the longer term.

We expect the ECB to cut rates by 25bps in Q2 25. The EU-US rate differential and US tariff risk should soften the EUR over the next 1-3 months. However, long-term growth impact from the implementation of German fiscal plans will likely enable the EUR/USD to rebound back to 1.09 in 12 months. Similarly, the GBP is expected to fall to 1.25 over the next three months amid a stronger USD. However, a sustained consumption-driven growth and relative resilience to US tariff risks are likely tailwinds for the GBP, enabling GBP/USD to test 1.30 over the next 12 months.

The BoJ is the only central bank in a rate hiking cycle. We expect the JPY to continue strengthening over both the short and long term. The falling US-Japan real rate differentials and risk aversion amid global growth concerns are in favour of the JPY. We expect USD/JPY to fall to 146 and 143.5 over the next 3 and 12 months, respectively. The CHF, the other popular safe-haven currency, has now become the lowest-yielding major currency after the SNB’s March rate cut, with 3-month yields lower than those on the JPY. However, this

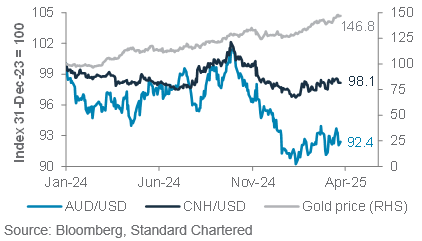

Fig. 29 AUD is closely correlated with the CNH

AUD/USD, CNH/USD and gold price

may not be sufficient to make it the most popular source of funding for carry trades given the JPY is more liquid than the CHF as a funding currency. On balance, we see upside risk for USD/CHF, with the pair likely to test 0.90 in the next 1-3 months and 0.94 in 12 months amid a high risk of the SNB delivering a further surprise rate cut.

AUD/USD is likely to remain well-supported at 0.62 over a three-month horizon by a largely rangebound CNH and higher gold prices. AUD and CNH are closely correlated amid Australia’s heavy reliance on commodity exports to China. The RBNZ is likely to stay dovish to boost New Zealand’s economy given struggling activity and still-rising unemployment. We expect NZD/USD to test 0.56 in the next 1-3 months and 0.54 over the next 12 months. The CAD also faces risks from US tariff threats and softer oil prices.

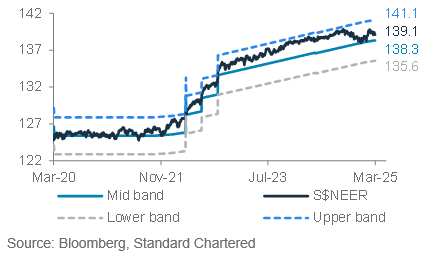

Fig. 30 SGD nominal effective exchange rate (S$NEER) eases on the back of cooling inflation

Singapore inflation and SGD nominal exchange rate

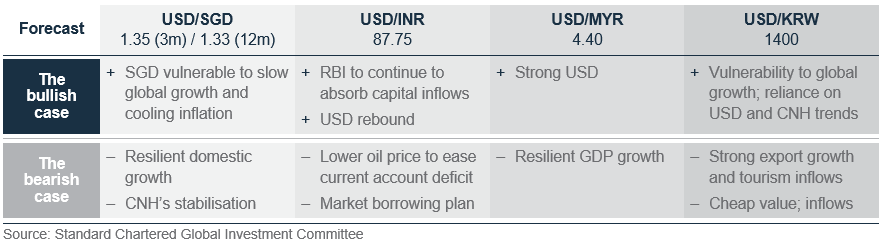

In Asia, the PBoC is likely to cut its reserve requirement ratio to counter US tariffs this year. Fiscal efforts to support consumption also pose upside risks to China’s growth over the medium term. Therefore, we expect USD/CNH to rise to 7.35 in 3 months and then moderate to 7.20 in 12 months, mirroring the DXY. Meanwhile, we expect USD/INR to fall to 87.75 over the next 12 months alongside the USD’s retreat. The SGD’s nominal effective exchange rate (based on policy basket), is c.0.6% above the middle of its band and should fall alongside cooling inflation. Therefore, we expect USD/SGD at 1.35 in 3 months and 1.33 in 12 months.

Fig. 31 Summary of Asian currency drivers

Gold, crude oil – at a glance

|

|

||||

Key themes

We remain Overweight on gold, raising our 3-month price target to USD 3,000/oz and 6-12-month price target to USD 3,200/oz. Gold has surged YTD, posting gains in all but one week and reaching a record high of USD 3,048/oz. Following this sharp rally, we believe gold is poised for a pullback, with prices now four standard deviations above the 200-day moving average, a level that has historically signalled a near-term top in prices. However, any pullback is expected to be modest amid continued US tariff uncertainty. We would use any weakness to add exposure, as structural drivers, such as Emerging Market (EM) central bank gold purchases, remain intact. Meanwhile, we are looking for signs that softer US consumer confidence translates into a higher savings rate, which would fuel further gains in global gold ETF holdings (Fig. 33). The long-term depreciation of gold relative to the S&P500 appears to have also bottomed, an encouraging sign that gold may be in the early stages of a multi-year rally.

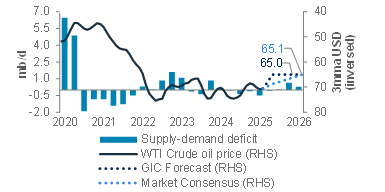

WTI oil prices are likely to stay subdued around USD 65/bbl over 3m and 12m horizons. Strong supply amid still-tepid demand, which leaves global oil markets in a surplus through 2025, remains the key rationale behind our view. On the demand side, a small uptick in Chinese oil demand growth offers a glimmer of optimism, but it is unlikely to trigger a significant shift in the global demand-supply balance without a sharp improvement in domestic growth. On the supply side, OPEC+’s decision to continue unwinding some of its prior supply cuts is likely to exacerbate excess supply. The main risks to our view stem from geopolitics – a tightening of sanctions on Russia and tighter enforcement of sanctions on Iran or a wider escalation pose upside risks to our oil price view. However, significant OPEC+ spare capacity means any price bounds are likely to be short-lived.

Key chart

Fig. 32 Gold has risen to a level above its 200DMA that has historically signalled a top in prices

Gold prices and the spread to the 200DMA

Fig. 34 There are signs that the long-term depreciation of gold relative to the S&P500 may be coming to an end

Gold/S&P500 ratio and US recession periods

Fig. 33 Weak US consumer confidence could lead to a higher savings rate, supporting inflows into gold ETFs

Global gold ETF holdings and the US savings rate

Fig. 35 The oil market is likely to remain in surplus this year, keeping prices in check

Oil supply-demand balance; price estimates

Additional perspectives

Quant perspective

Key models turn Neutral equities vs. bonds

|

|

||||

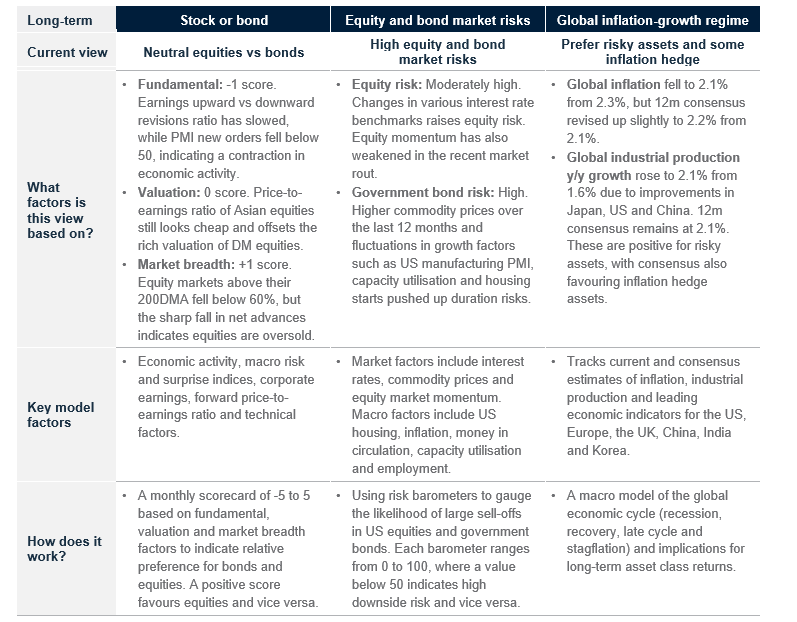

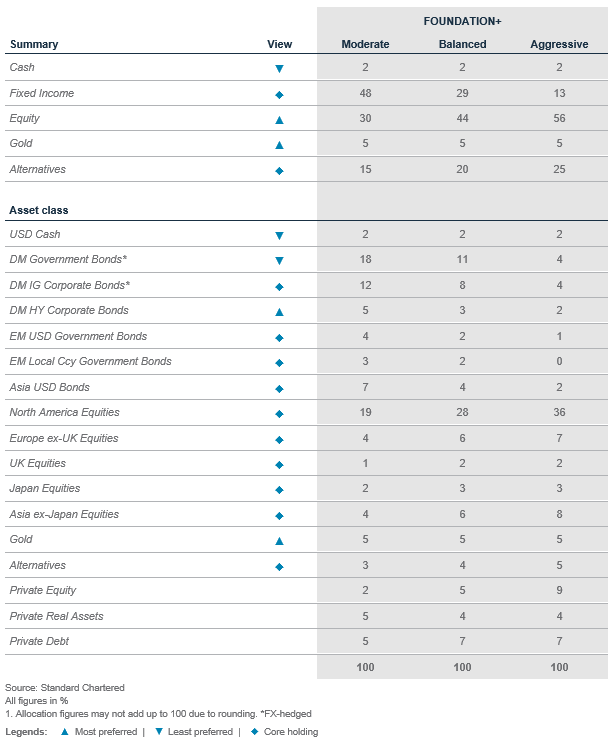

Summary

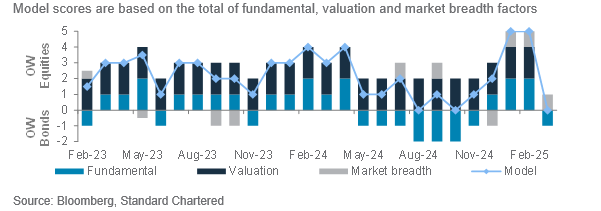

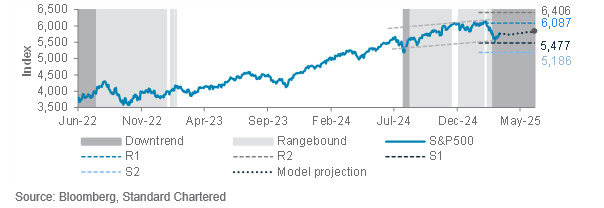

Our stock-bond model swung towards a Neutral stance between global equities and bonds in March after previously being heavily Overweight equities in February. The model score fell from a maximum of +5 to 0, which translates to benchmark holdings across equities and bonds. This rapid shift was mainly caused by a decline in PMI new orders and a slowdown in the upward-downward earnings revision ratio, which led to our fundamental score falling from +2 to -1. Meanwhile, our valuation score for global equities is Neutral or 0, as the rich valuation of DM equities is offset by the still-cheap valuation of Asian equities. Finally, our technical score is slightly bullish equities at +1, as the sharp drop in net advances of stocks triggered a reversal signal to the recent equity market sell-off.

Our technical framework upgraded the US from bearish to Neutral and maintained a bullish view on UK and China. On 3 March, our framework downgraded the short-term outlook for S&P500 to bearish. This capped the drawdown at 4.2% (from the peak on 19 February), as the index sold off into correction territory (>10% drawdown). We then upgraded the short-term outlook for S&P500 on 20 March to Neutral. The reasons are (i) a floor is likely formed at 5,447 as our market regime model is projecting a recovery in S&P500 in the next three months and (ii) our recession model did not show a spike in recession risks that could lead to a 20-30% sell-off. The upgrade in the technical outlook is not outright bullish as near-term volatility remains high. For other markets, our framework is still bullish on China, UK and Asia ex-Japan, and neutral Europe-ex-UK and Japan.

Our market diversity indicators flag stretched positions in European financials and communication services. Germany’s defence spending has led to renewed positive sentiment on European equities, but our indicators are cautioning against chasing the returns in the two sectors. They have outperformed the MSCI Europe index by 10% and 2.8%, respectively.

Key chart

Our stock-bond model score dropped to 0 in March, driven by a deterioration in PMI new orders and earnings revision ratio.

Fig. 36 Breakdown of our stock-bond rotation model’s scores since inception in Feb-23

Our technical framework initially downgraded the S&P500 index to bearish in early March, before upgrading the outlook to Neutral recently as the index is projected to recover over the next three months with a floor formed at 5,447

Fig. 37 Our technical model is neutral on S&P 500

Fig. 38 Long- and short-term quantitative models are neutral risky assets

Long-term models below have a typical time horizon of 3–6 months, while short-term models have a 1–3 month horizon

Performance review

Foundation: Asset allocation summary

Foundation+: Asset allocation summary

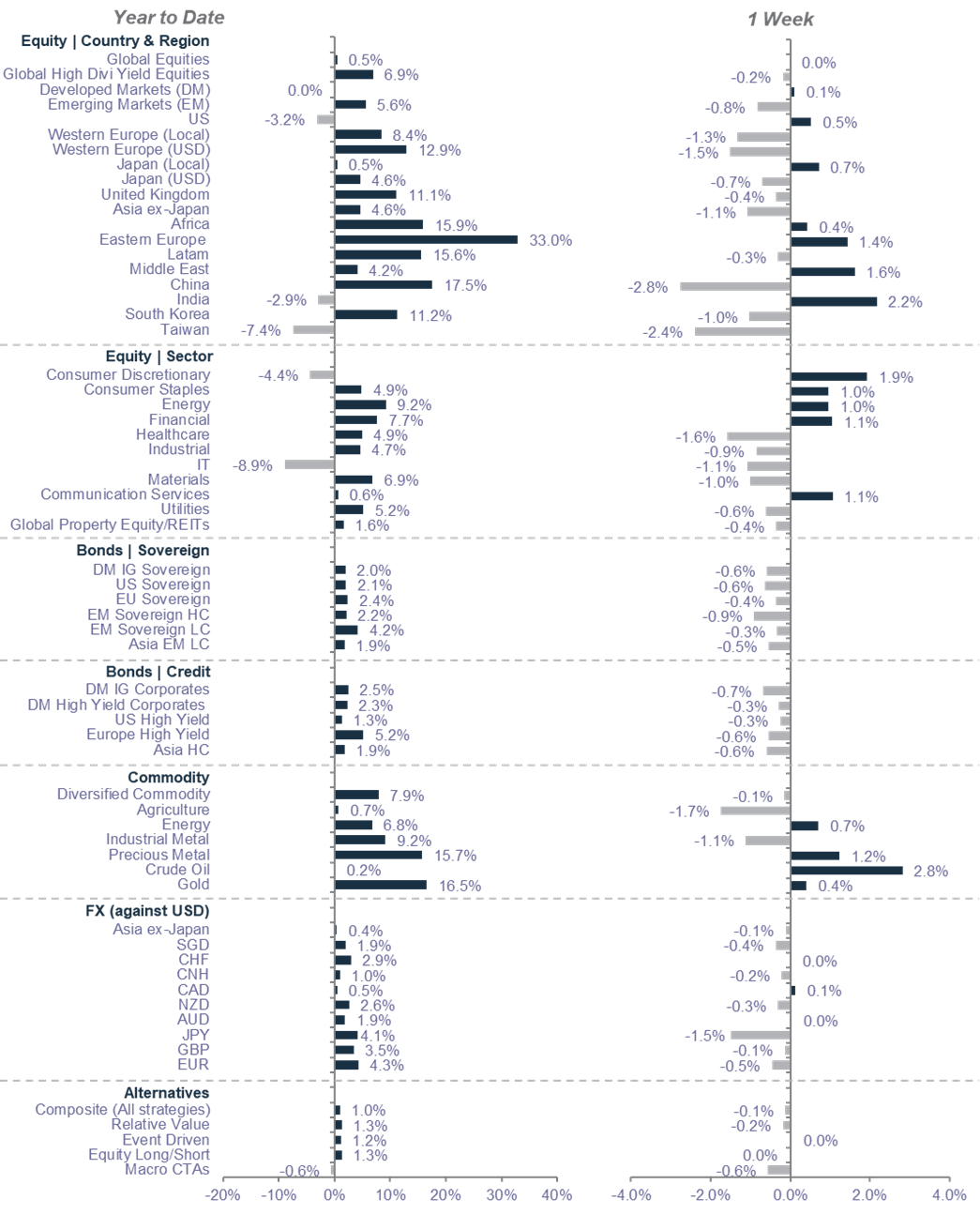

Market performance summary

Source: MSCI, JPMorgan, Citigroup, Dow Jones, HFRX, FTSE, Bloomberg, Standard Chartered

*All performance shown in USD terms, unless otherwise stated

*YTD performance data from 31 December 2023 to 27 March 2025; 1-week performance from 20 to 27 March 2025

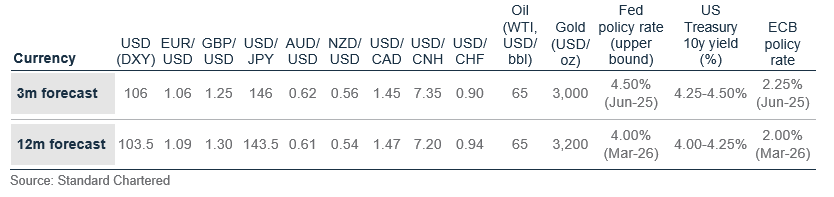

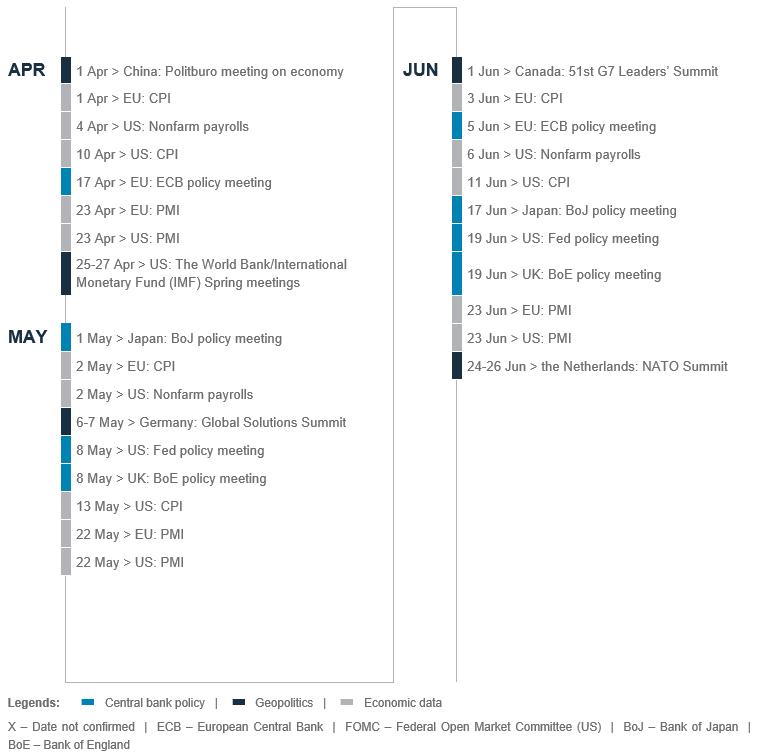

Our key forecasts and calendar events

Today, Tomorrow and Forever

Explanatory notes

1. The figures on page 5 show allocations for a moderately aggressive risk profile only – different risk profiles may produce significantly different asset allocation results. Page 5 is only an example, provided for general information only and they do not constitute investment advice, an offer, recommendation or solicitation. They do not take into account the specific investment objectives, needs or risk tolerances of a particular person or class of persons and they have not been prepared for any particular person or class of persons.

2. Contingent Convertibles are complex financial instruments and are not a suitable or appropriate investment for all investors. This document is not an offer to sell or an invitation to buy any securities or any beneficial interests therein. Contingent convertible securities are not intended to be sold and should not be sold to retail clients in the European Economic Area (EEA) (each as defined in the Policy Statement on the Restrictions on the Retail Distribution of Regulatory Capital Instruments (Feedback to CP14/23 and Final Rules) (“Policy Statement”), read together with the Product Intervention (Contingent Convertible Instruments and Mutual Society Shares) Instrument 2015 (“Instrument”, and together with the Policy Statement, the “Permanent Marketing Restrictions”), which were published by the United Kingdom’s Financial Conduct Authority in June 2015), other than in circumstances that do not give rise to a contravention of the Permanent Marketing Restrictions.

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2025, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments

Any ESG data used or referred to has been provided by Morningstar, Sustainalytics, MSCI or Bloomberg. Refer to 1) Morningstar website under Sustainable Investing, 2) Sustainalytics website under ESG Risk Ratings, 3) MCSI website under ESG Business Involvement Screening Research and 4) Bloomberg green, social & sustainability bonds guide for more information. The ESG data is as at the date of publication based on data provided, is for informational purpose only and is not warranted to be complete, timely, accurate or suitable for a particular purpose, and it may be subject to change. Sustainable Investments (SI): This refers to funds that have been classified as ‘Sustainable Investments’ by Morningstar. SI funds have explicitly stated in their prospectus and regulatory filings that they either incorporate ESG factors into the investment process or have a thematic focus on the environment, gender diversity, low carbon, renewable energy, water or community development. For equity, it refers to shares/stocks issued by companies with Sustainalytics ESG Risk Rating of Low/Negligible. For bonds, it refers to debt instruments issued by issuers with Sustainalytics ESG Risk Rating of Low/Negligible, and/or those being certified green, social, sustainable bonds by Bloomberg. For structured products, it refers to products that are issued by any issuer who has a Sustainable Finance framework that aligns with Standard Chartered’s Green and Sustainable Product Framework, with underlying assets that are part of the Sustainable Investment universe or separately approved by Standard Chartered’s Sustainable Finance Governance Committee. Sustainalytics ESG risk ratings shown are factual and are not an indicator that the product is classified or marketed as “green”, “sustainable” or similar under any particular classification system or framework.

Country/Market Specific Disclosures