16 August 2024

Weekly Market View

Recovery after the tantrum

Global equities have recovered almost all of early August’s downturn as a continued slowdown in US inflation sustained expectations of Fed rate cuts, while strong retail sales boosted hopes of an economic soft landing.

Through early August’s market dislocation, the Fed’s capacity to significantly ease policy was our main reason to stay invested in a moderately pro-risk diversified allocation. The Fed’s upcoming Jackson Hole summit will provide more insight on policymakers’ stance after the recent batch of data.

We still prefer US growth equities due to their structural earnings growth outlook. However, with our technical model still pointing to near-term risk for US and Japan equities, we would prefer to average in only gradually.

We see downside risk for the NZD after the central bank’s surprise rate cut this week. We also have benchmark allocation to gold as a hedge against rising geopolitical risk.

Where are the opportunities in US equities after the shakeout?

How do the mounting geopolitical tensions affect your view on commodities and related currencies?

What are the implications of the latest RBNZ meeting for the NZD?

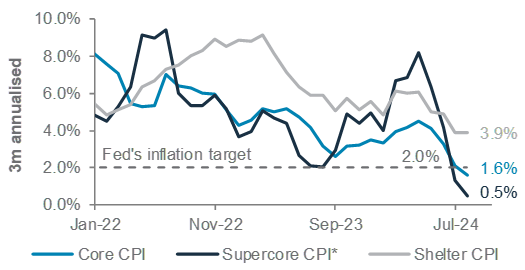

Charts of the week: Green signal for Fed cuts

Continued slowdown in US inflation is paving the way for Fed rate cuts starting in September

US core, supercore* and shelter inflation, 3-month annualised

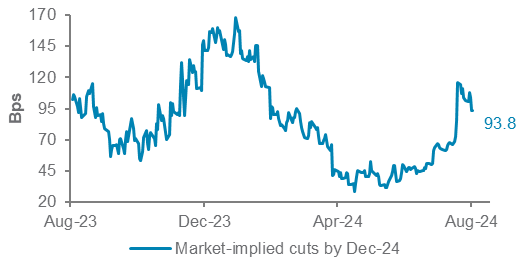

Money market expectations of Fed cuts by December 2024

Source: Bloomberg, Standard Chartered; *core services inflation excluding shelter

Editorial

Recovery after the tantrum

Through early August’s market dislocation, the Fed’s capacity to significantly ease policy was our main reason to stay invested in a moderately pro-risk diversified allocation. The continued softening of US inflation in July provided another signal for the Fed to start easing policy from September, while strong retail sales boosted hopes for an economic soft landing. This, and the near-exhaustion of unwinding of JPY-funded carry trades, has helped risk assets recover from the recent shakeout.

However, since our technical model still points to near-term risk for US and Japan equities, we would prefer to average in only gradually. We still prefer US growth equities due to their structural earnings growth outlook. We see downside risk for the NZD after the central bank’s surprise rate cut this week.

Cooling inflation: US inflation continued to cool in July, helping revive risk sentiment. On a three-month annualised basis, core and supercore inflation (services inflation excluding food, energy and shelter) have fallen below the Fed’s 2% overall inflation target. Although shelter inflation rose to 0.4% m/m from 0.2% in June, accounting for most of July’s 0.2% m/m inflation, and auto insurance accelerated, falling market rents and a slowing job market portend lower official shelter inflation in the coming months. Also, the sharp drop in used car prices points to lower auto insurance inflation later this year.

Jackson Hole summit watch: Cooling inflation and the surprisingly weaker-than-expected monthly employment report for July have turned the spotlight on the Fed’s annual Jackson Hole summit (22-24 August). While markets are pricing almost 100bps of rate cuts this year and a total of almost 180bps of cuts in the next 12 months, they have dialled back the expected size of the first rate cut in September to 25bps, after earlier pricing in a 50bps cut. Fed policymakers will get a chance to push back against

such aggressive rate cut expectations, which in turn could drive the US 10-year government bond yield above 4%. On the other hand, support for more aggressive cuts could drive yields towards early August’s closing low just below 3.8%. We see low chances of the latter happening in the near term unless the job market cracks and weekly jobless claims surge. Nevertheless, we believe investors have an opportunity to lock in high quality US government bonds for the longer term at 10-year yields of 4% or higher as the US economy gradually slows.

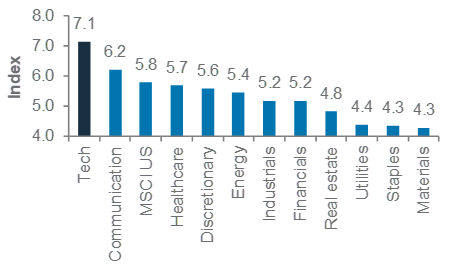

US growth sectors still preferred: We believe the high-growth technology and communication services sectors remain attractive relative to other US sectors, especially because of the sectors’ strong structural earnings growth potential. For instance, the LSEG I/B/E/S consensus expects 18% and 21% growth in technology sector earnings in 2024 and 2025. The growth sector-heavy Nasdaq index also has strong technical support around 18,000, providing a base to add exposure. We also see near-term opportunity in Japan banks (see page 4).

Near-term caution on equities: Our technical model remains bearish on US equities in the near term. Volatility is the key market variable to watch. Average S&P500 index realised and implied volatility has fallen to 2 standard deviations (SD) above its one-year average, from 4.6 SDs on 5 Aug (the height of the sell-off), suggesting the spike in implied volatility was overdone. Assuming the current pace of decline in overall volatility and momentum does not worsen, it should take another week or so for volatility to return to levels that would support an uptrend regime for equities once again. Hence, we would prefer to gradually average into US equity markets, at least for now.

Maintain geopolitical risk hedges: There is a risk of a near-term escalation in tensions in the Middle East and along the Russia-Ukraine border. Although geopolitical risks have historically had a short-term impact on markets, benchmark allocations to gold and energy-related assets offer hedges in the event of any widespread supply dislocations (see page 5).

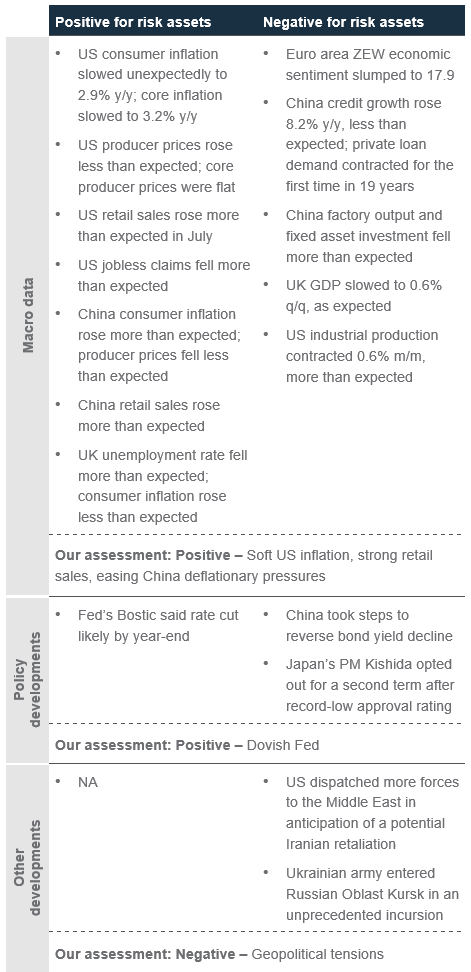

The weekly macro balance sheet

Our weekly net assessment: On balance, we see the past week’s data and policy as positive for risk assets in the near-term

(+) factors: Dovish Fed; soft US consumer, producer inflation

(-) factors: Geopolitical tensions; weak Euro area economic sentiment

US retail sales were surprisingly strong in July, raising expectations of an economic soft landing

US headline and control group retail sales

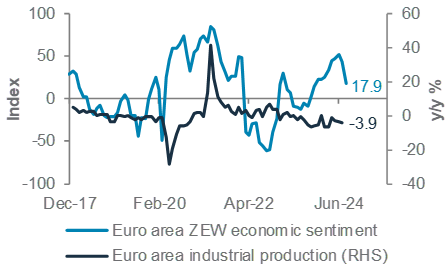

Euro area economic sentiment and factory output slumped, suggesting weaker growth momentum

Euro area ZEW economic sentiment and industrial production

China’s economic activity remained sluggish, with factory output and fixed asset investment slowing more than expected in July

China industrial production, fixed asset investment and retail sales

Top client questions

Where are the opportunities in US equities at this stage?

The most recent US initial jobless claims, retail sales and CPI data has reassured investors. The VIX index, a short-term volatility indicator, dropped to 15 – the lowest level since the sharp equity market sell-off started. Granted, there are still risks from any forced liquidation of global risk assets. However, we believe it is time for investors to gradually scale into attractive areas in equities.

Over the last 10 years, the US technology and communication services sectors have rebounded the most after market sell-offs. Technically, we believe it is attractive to scale into these sectors, when the Nasdaq 100 index is trading between the double-bottom support level at 18,000 and the current level just above 19,000.

These two sectors remain attractive relative to other sectors, in our opinion. Earnings have remained solid in the latest Q2 24 earnings season and should benefit from the long-term structural potential in AI. Moreover, the recent set of data releases has nearly cemented the beginning of a Fed rate cut cycle, starting from September 2024, which should support US equities, especially growth sectors.

— Daniel Lam, Head, Equity Strategy

Technology and communication service sectors have historically rebounded strongly after market troughs*

Magnitude of rebounds in US equities, 10 days after market bottoms (in %)

*More than 7% decline, high to low, in a 30-day period in MSCI US over the past 10 years

What is our tactical view on Japan equities, now that the momentum of the JPY strength is fading?

Key benchmark equity indices in Japan corrected over 20% in the past month, driven by a sharp unwinding of the JPY carry trade, whereby people access cheap JPY funding to invest in assets globally. A pause in the JPY’s appreciation has enabled equity indices to rebound significantly.

We expect USD/JPY to be rangebound over the next three months (support at 140.2, resistance at 151.8), which should allow Japan equities to recover along with global equities. A stronger JPY means exports are less competitive and overseas earnings are worth less in JPY terms. However, we believe these are more than offset by the valuation discount of Japan equities and improving corporate governance, which is resulting in higher dividends and share buybacks. A reflationary environment also supports positive pricing strategies and nominal profit growth for Japanese corporates.

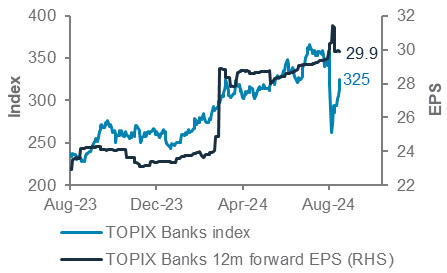

With monetary policy normalising gradually, we see an interesting investment opportunity – Japanese banks. Rising interest rates support higher interest income for banks, and major banks reported strong results for the April-June 2024 quarter, with consensus 12-month forward earnings estimates being revised up. Sentiment remains cautious in Japan, but earnings fundamentals would imply further recovery upside for Japan banks.

— Fook Hien Yap, Senior Investment Strategist

Japan bank stocks corrected along with the unwind of the JPY carry trade, while earnings expectations have been revised up

TOPIX banks index and consensus 12-month forward EPS for TOPIX banks index

Top client questions (cont’d)

How do the mounting geopolitical tensions affect your views on commodities and the related currencies?

Renewed geopolitical tensions in the Middle East and Europe have ignited fears of supply disruptions, adding geopolitical risk premium to the WTI oil price, which topped USD 80/bbl last week. The covering of extended short positioning is another likely driver. Gold also benefitted from the safe-haven demand, rising to a new record-high on Monday.

The longevity of the geopolitical risk premium hinges on whether there is a realised impact to the demand-supply balance.

In Europe, the risk of supply disruption emanates from the fact that fighting is taking place near a key cross-border transit point for natural gas. While there could be a second-order effect, it is likely to be marginal. News reports also indicate that both countries intend to keep the pipeline gas flowing to Europe.

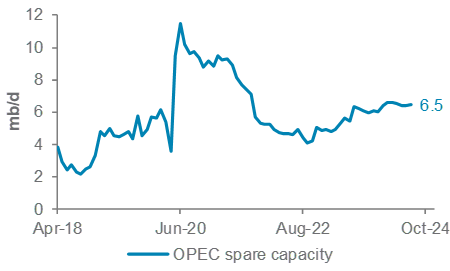

In the Middle East, the US has increased its military presence in the region in anticipation of an Iran retaliation following the assassination of key Hamas and Hezbollah leaders. While it is reasonable to assume that Iran will take some action in retaliation, our base case remains one where the conflict is contained. Hence, the feed-through to oil supply and demand is likely to be limited. Add in OPEC’s high spare capacity (around 4% of world production), and this suggests any upside in oil prices in the event of an aggravated escalation will likely be limited.

That said, near-term volatility is likely to remain elevated as markets remain on alert for a potential Iran response and further developments in the Ukraine-Russia war. Oil prices could overshoot the fair price justified by “pure” economic fundamentals.

Gold has been trading within a range between USD2,350/oz and USD2,480/oz since July. However, if fresh geopolitical risks emerge, we could see a breakout above this range, potentially pushing gold towards the next resistance at USD2,580/oz. We believe it is prudent to maintain some small exposures to gold and the oil sector as hedges against the tail risk of geopolitics, especially on a pullback.

Gold strength might bolster commodity currencies like AUD/USD, which could test resistance at 0.6700. Similarly, if oil prices strengthen, we see USD/CAD test its support at 1.3580.

— Zhong Liang Han, CFA, Investment Strategist

— Iris Yuen, Investment Strategist

The impact of geopolitical developments on commodity prices ultimately depends on the effect it has on supply and demand. Crude oil suppliers have sizeable excess capacity, if needed

OPEC crude oil spare capacity

Top client questions (cont’d)

What are the implications of the latest RBNZ meeting for the NZD?

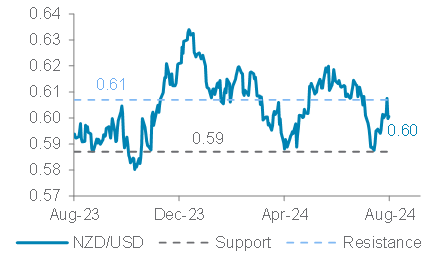

The outlook for the NZD/USD currency pair is increasingly cautious after the RBNZ cut interest rates by 25bps. The move was unexpected, especially with the central bank previously signalling a pause in rate adjustments. The rate cut indicates the RBNZ’s growing concerns about New Zealand’s economic outlook, particularly in terms of growth.

In our opinion, the economic outlook is quite mixed with soft business confidence and a cooling housing market balanced against a resilient labour market. Additionally, New Zealand’s export-driven economy has been impacted by softer demand from China, its largest trading partner. The ongoing challenges in China’s economy have reduced demand for New Zealand’s key exports such as dairy, meat and forestry products, which are likely to further undermine NZD/USD.

Meanwhile, geopolitical tensions are also worth watching. A further escalation in either the Middle East or Europe would likely support the rebound of the USD and act as a headwind for the NZD, which is seen as a pro-risk currency. We expect NZD/USD to trade rangebound with a bearish bias in the next two weeks and test its near-term support at 0.5870.

— Iris Yuen, Investment Strategist

The surprise dovish rate cut by the RBNZ pushed the NZD/USD pair down from a one-month high

NZD/USD and technical levels

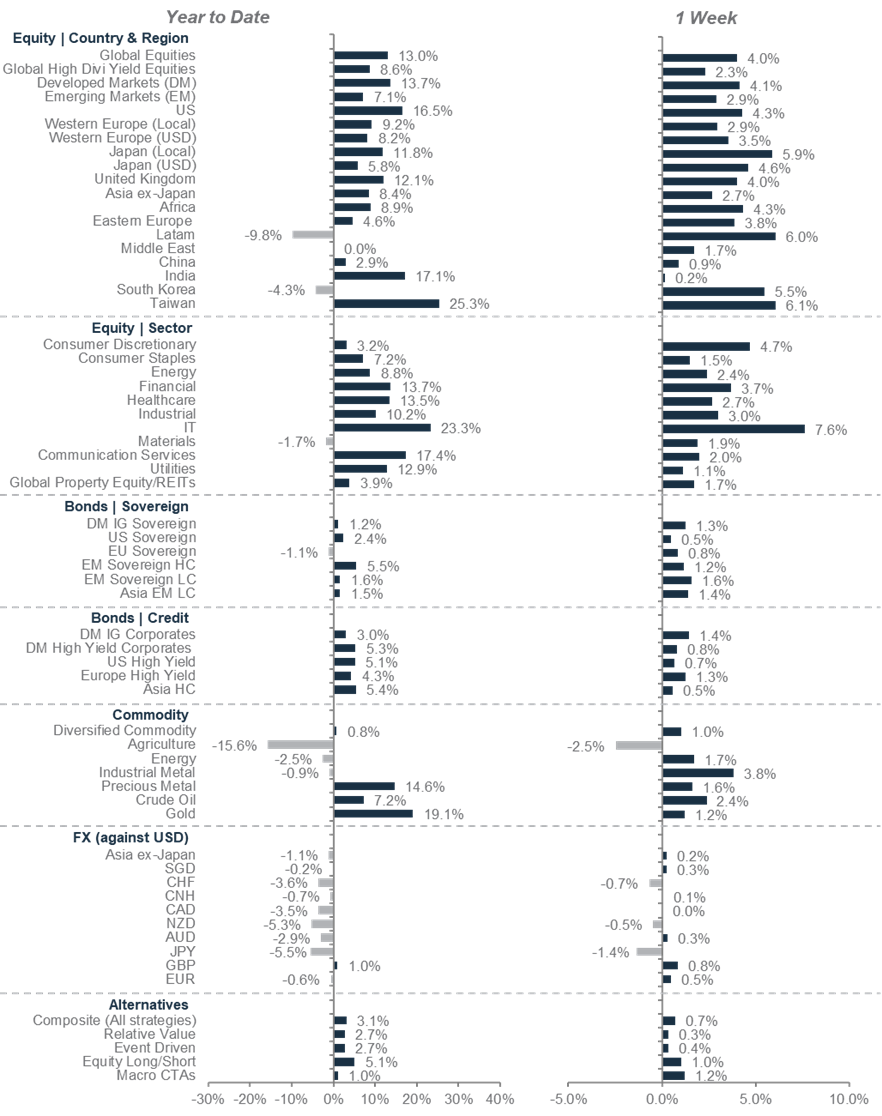

Market performance summary*

*Performance in USD terms unless otherwise stated, 2024 YTD performance from 31 December 2023 to 15 August 2024; 1-week period: 8 August 2024 to 15 August 2024

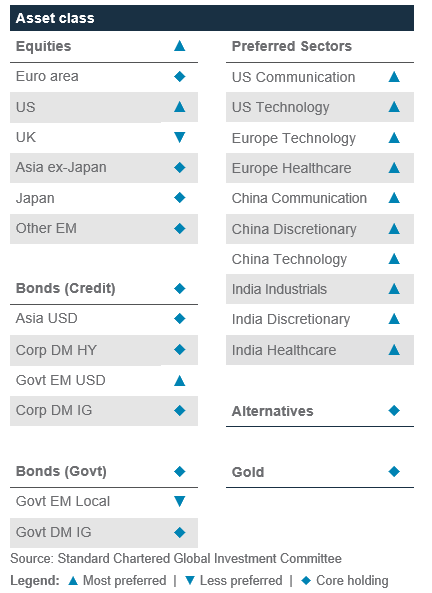

Our 12-month asset class views at a glance

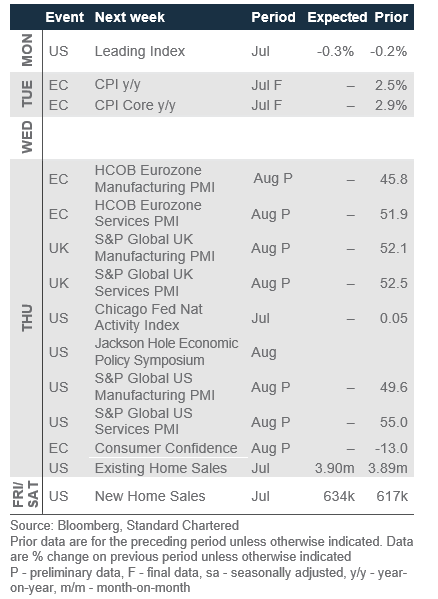

Economic and market calendar

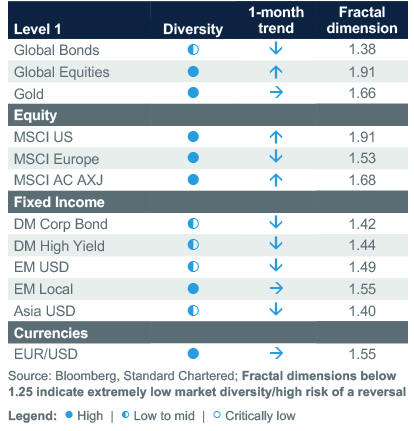

The S&P500 has next interim resistance at 5,769

Technical indicators for key markets as of 15 August close

Investor diversity has normalised across asset classes

Our proprietary market diversity indicators as of 15 Aug close

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2024, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments

Any ESG data used or referred to has been provided by Morningstar, Sustainalytics, MSCI or Bloomberg. Refer to 1) Morningstar website under Sustainable Investing, 2) Sustainalytics website under ESG Risk Ratings, 3) MCSI website under ESG Business Involvement Screening Research and 4) Bloomberg green, social & sustainability bonds guide for more information. The ESG data is as at the date of publication based on data provided, is for informational purpose only and is not warranted to be complete, timely, accurate or suitable for a particular purpose, and it may be subject to change. Sustainable Investments (SI): This refers to funds that have been classified as ‘Sustainable Investments’ by Morningstar. SI funds have explicitly stated in their prospectus and regulatory filings that they either incorporate ESG factors into the investment process or have a thematic focus on the environment, gender diversity, low carbon, renewable energy, water or community development. For equity, it refers to shares/stocks issued by companies with Sustainalytics ESG Risk Rating of Low/Negligible. For bonds, it refers to debt instruments issued by issuers with Sustainalytics ESG Risk Rating of Low/Negligible, and/or those being certified green, social, sustainable bonds by Bloomberg. For structured products, it refers to products that are issued by any issuer who has a Sustainable Finance framework that aligns with Standard Chartered’s Green and Sustainable Product Framework, with underlying assets that are part of the Sustainable Investment universe or separately approved by Standard Chartered’s Sustainable Finance Governance Committee.

Country/Market Specific Disclosures

Botswana: This document is being distributed in Botswana by, and is attributable to, Standard Chartered Bank Botswana Limited which is a financial institution licensed under the Section 6 of the Banking Act CAP 46.04 and is listed in the Botswana Stock Exchange. Brunei Darussalam: This document is being distributed in Brunei Darussalam by, and is attributable to, Standard Chartered Bank (Brunei Branch) | Registration Number RFC/61 and Standard Chartered Securities (B) Sdn Bhd | Registration Number RC20001003. Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. Standard Chartered Securities (B) Sdn Bhd is a limited liability company registered with the Registry of Companies with Registration Number RC20001003 and licensed by Brunei Darussalam Central Bank as a Capital Markets Service License Holder with License Number BDCB/R/CMU/S3-CL and it is authorised to conduct Islamic investment business through an Islamic window. China Mainland: This document is being distributed in China by, and is attributable to, Standard Chartered Bank (China) Limited which is mainly regulated by National Financial Regulatory Administration (NFRA), State Administration of Foreign Exchange (SAFE), and People’s Bank of China (PBOC). Hong Kong: In Hong Kong, this document, except for any portion advising on or facilitating any decision on futures contracts trading, is distributed by Standard Chartered Bank (Hong Kong) Limited (“SCBHK”), a subsidiary of Standard Chartered PLC. SCBHK has its registered address at 32/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Hong Kong and is regulated by the Hong Kong Monetary Authority and registered with the Securities and Futures Commission (“SFC”) to carry on Type 1 (dealing in securities), Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activity under the Securities and Futures Ordinance (Cap. 571) (“SFO”) (CE No. AJI614). The contents of this document have not been reviewed by any regulatory authority in Hong Kong and you are advised to exercise caution in relation to any offer set out herein. If you are in doubt about any of the contents of this document, you should obtain independent professional advice. Any product named herein may not be offered or sold in Hong Kong by means of any document at any time other than to “professional investors” as defined in the SFO and any rules made under that ordinance. In addition, this document may not be issued or possessed for the purposes of issue, whether in Hong Kong or elsewhere, and any interests may not be disposed of, to any person unless such person is outside Hong Kong or is a “professional investor” as defined in the SFO and any rules made under that ordinance, or as otherwise may be permitted by that ordinance. In Hong Kong, Standard Chartered Private Bank is the private banking division of SCBHK, a subsidiary of Standard Chartered PLC. Ghana: Standard Chartered Bank Ghana Limited accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of these documents. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. To unsubscribe from receiving further updates, please send an email to feedback.ghana@sc.com. Please do not reply to this email. Call our Priority Banking on 0302610750 for any questions or service queries. You are advised not to send any confidential and/or important information to Standard Chartered via e-mail, as Standard Chartered makes no representations or warranties as to the security or accuracy of any information transmitted via e-mail. Standard Chartered shall not be responsible for any loss or damage suffered by you arising from your decision to use e-mail to communicate with the Bank. India: This document is being distributed in India by Standard Chartered in its capacity as a distributor of mutual funds and referrer of any other third party financial products. Standard Chartered does not offer any ‘Investment Advice’ as defined in the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 or otherwise. Services/products related securities business offered by Standard Charted are not intended for any person, who is a resident of any jurisdiction, the laws of which imposes prohibition on soliciting the securities business in that jurisdiction without going through the registration requirements and/or prohibit the use of any information contained in this document. Indonesia: This document is being distributed in Indonesia by Standard Chartered Bank, Indonesia branch, which is a financial institution licensed, registered and supervised by Otoritas Jasa Keuangan (Financial Service Authority). Jersey: In Jersey, Standard Chartered Private Bank is the Registered Business Name of the Jersey Branch of Standard Chartered Bank. The Jersey Branch of Standard Chartered Bank is regulated by the Jersey Financial Services Commission. Copies of the latest audited accounts of Standard Chartered Bank are available from its principal place of business in Jersey: PO Box 80, 15 Castle Street, St Helier, Jersey JE4 8PT. Standard Chartered Bank is incorporated in England with limited liability by Royal Charter in 1853 Reference Number ZC 18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. The Jersey Branch of Standard Chartered Bank is also an authorised financial services provider under license number 44946 issued by the Financial Sector Conduct Authority of the Republic of South Africa. Jersey is not part of the United Kingdom and all business transacted with Standard Chartered Bank, Jersey Branch and other SC Group Entity outside of the United Kingdom, are not subject to some or any of the investor protection and compensation schemes available under United Kingdom law. Kenya: This document is being distributed in Kenya by and is attributable to Standard Chartered Bank Kenya Limited. Investment Products and Services are distributed by Standard Chartered Investment Services Limited, a wholly owned subsidiary of Standard Chartered Bank Kenya Limited that is licensed by the Capital Markets Authority in Kenya, as a Fund Manager. Standard Chartered Bank Kenya Limited is regulated by the Central Bank of Kenya. Malaysia: This document is being distributed in Malaysia by Standard Chartered Bank Malaysia Berhad (“SCBMB”). Recipients in Malaysia should contact SCBMB in relation to any matters arising from, or in connection with, this document. This document has not been reviewed by the Securities Commission Malaysia. The product lodgement, registration, submission or approval by the Securities Commission of Malaysia does not amount to nor indicate recommendation or endorsement of the product, service or promotional activity. Investment products are not deposits and are not obligations of, not guaranteed by, and not protected by SCBMB or any of the affiliates or subsidiaries, or by Perbadanan Insurans Deposit Malaysia, any government or insurance agency. Investment products are subject to investment risks, including the possible loss of the principal amount invested. SCBMB expressly disclaim any liability and responsibility for any loss arising directly or indirectly (including special, incidental or consequential loss or damage) arising from the financial losses of the Investment Products due to market condition. Nigeria: This document is being distributed in Nigeria by Standard Chartered Bank Nigeria Limited, a bank duly licensed and regulated by the Central Bank of Nigeria. Standard Chartered accepts no liability for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of these documents. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. To unsubscribe from receiving further updates, please send an email to clientcare.ng@sc.com requesting to be removed from our mailing list. Please do not reply to this email. Call our Priority Banking on 02 012772514 for any questions or service queries. Standard Chartered shall not be responsible for any loss or damage arising from your decision to send confidential and/or important information to Standard Chartered via e-mail, as Standard Chartered makes no representations or warranties as to the security or accuracy of any information transmitted via e-mail. Pakistan: This document is being distributed in Pakistan by, and attributable to Standard Chartered Bank (Pakistan) Limited having its registered office at PO Box 5556, I.I Chundrigar Road Karachi, which is a banking company registered with State Bank of Pakistan under Banking Companies Ordinance 1962 and is also having licensed issued by Securities & Exchange Commission of Pakistan for Security Advisors. Standard Chartered Bank (Pakistan) Limited acts as a distributor of mutual funds and referrer of other third-party financial products. Singapore: This document is being distributed in Singapore by, and is attributable to, Standard Chartered Bank (Singapore) Limited (Registration No. 201224747C/ GST Group Registration No. MR-8500053-0, “SCBSL”). Recipients in Singapore should contact SCBSL in relation to any matters arising from, or in connection with, this document. SCBSL is an indirect wholly owned subsidiary of Standard Chartered Bank and is licensed to conduct banking business in Singapore under the Singapore Banking Act, 1970. Standard Chartered Private Bank is the private banking division of SCBSL. IN RELATION TO ANY SECURITY OR SECURITIES-BASED DERIVATIVES CONTRACT REFERRED TO IN THIS DOCUMENT, THIS DOCUMENT, TOGETHER WITH THE ISSUER DOCUMENTATION, SHALL BE DEEMED AN INFORMATION MEMORANDUM (AS DEFINED IN SECTION 275 OF THE SECURITIES AND FUTURES ACT, 2001 (“SFA”)). THIS DOCUMENT IS INTENDED FOR DISTRIBUTION TO ACCREDITED INVESTORS, AS DEFINED IN SECTION 4A(1)(a) OF THE SFA, OR ON THE BASIS THAT THE SECURITY OR SECURITIES-BASED DERIVATIVES CONTRACT MAY ONLY BE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN S$200,000 (OR ITS EQUIVALENT IN A FOREIGN CURRENCY) FOR EACH TRANSACTION. Further, in relation to any security or securities-based derivatives contract, neither this document nor the Issuer Documentation has been registered as a prospectus with the Monetary Authority of Singapore under the SFA. Accordingly, this document and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the product may not be circulated or distributed, nor may the product be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons other than a relevant person pursuant to section 275(1) of the SFA, or any person pursuant to section 275(1A) of the SFA, and in accordance with the conditions specified in section 275 of the SFA, or pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. In relation to any collective investment schemes referred to in this document, this document is for general information purposes only and is not an offering document or prospectus (as defined in the SFA). This document is not, nor is it intended to be (i) an offer or solicitation of an offer to buy or sell any capital markets product; or (ii) an advertisement of an offer or intended offer of any capital markets product. Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. This advertisement has not been reviewed by the Monetary Authority of Singapore. Taiwan: SC Group Entity or Standard Chartered Bank (Taiwan) Limited (“SCB (Taiwan)”) may be involved in the financial instruments contained herein or other related financial instruments. The author of this document may have discussed the information contained herein with other employees or agents of SC or SCB (Taiwan). The author and the above-mentioned employees of SC or SCB (Taiwan) may have taken related actions in respect of the information involved (including communication with customers of SC or SCB (Taiwan) as to the information contained herein). The opinions contained in this document may change, or differ from the opinions of employees of SC or SCB (Taiwan). SC and SCB (Taiwan) will not provide any notice of any changes to or differences between the above-mentioned opinions. This document may cover companies with which SC or SCB (Taiwan) seeks to do business at times and issuers of financial instruments. Therefore, investors should understand that the information contained herein may serve as specific purposes as a result of conflict of interests of SC or SCB (Taiwan). SC, SCB (Taiwan), the employees (including those who have discussions with the author) or customers of SC or SCB (Taiwan) may have an interest in the products, related financial instruments or related derivative financial products contained herein; invest in those products at various prices and on different market conditions; have different or conflicting interests in those products. The potential impacts include market makers’ related activities, such as dealing, investment, acting as agents, or performing financial or consulting services in relation to any of the products referred to in this document. UAE: DIFC – Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18.The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered Bank, Dubai International Financial Centre having its offices at Dubai International Financial Centre, Building 1, Gate Precinct, P.O. Box 999, Dubai, UAE is a branch of Standard Chartered Bank and is regulated by the Dubai Financial Services Authority (“DFSA”). This document is intended for use only by Professional Clients and is not directed at Retail Clients as defined by the DFSA Rulebook. In the DIFC we are authorised to provide financial services only to clients who qualify as Professional Clients and Market Counterparties and not to Retail Clients. As a Professional Client you will not be given the higher retail client protection and compensation rights and if you use your right to be classified as a Retail Client we will be unable to provide financial services and products to you as we do not hold the required license to undertake such activities. For Islamic transactions, we are acting under the supervision of our Shariah Supervisory Committee. Relevant information on our Shariah Supervisory Committee is currently available on the Standard Chartered Bank website in the Islamic banking section. For residents of the UAE – Standard Chartered Bank UAE does not provide financial analysis or consultation services in or into the UAE within the meaning of UAE Securities and Commodities Authority Decision No. 48/r of 2008 concerning financial consultation and financial analysis. Uganda: Our Investment products and services are distributed by Standard Chartered Bank Uganda Limited, which is licensed by the Capital Markets Authority as an investment adviser. United Kingdom: In the UK, Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. This communication has been approved by Standard Chartered Bank for the purposes of Section 21 (2) (b) of the United Kingdom’s Financial Services and Markets Act 2000 (“FSMA”) as amended in 2010 and 2012 only. Standard Chartered Bank (trading as Standard Chartered Private Bank) is also an authorised financial services provider (license number 45747) in terms of the South African Financial Advisory and Intermediary Services Act, 2002. The Materials have not been prepared in accordance with UK legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. Vietnam: This document is being distributed in Vietnam by, and is attributable to, Standard Chartered Bank (Vietnam) Limited which is mainly regulated by State Bank of Vietnam (SBV). Recipients in Vietnam should contact Standard Chartered Bank (Vietnam) Limited for any queries regarding any content of this document. Zambia: This document is distributed by Standard Chartered Bank Zambia Plc, a company incorporated in Zambia and registered as a commercial bank and licensed by the Bank of Zambia under the Banking and Financial Services Act Chapter 387 of the Laws of Zambia.