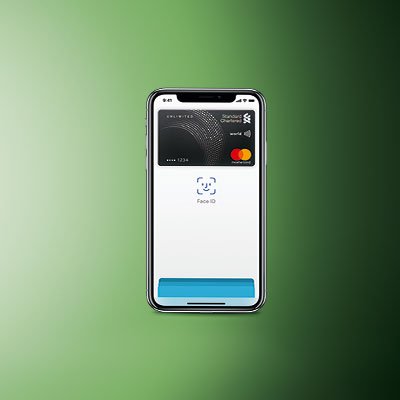

The Apple Pay & Contactless 2019 Promotion (the “

Promotion”) is available from 15 March 2019 to 14 May 2019 (both dates inclusive) (the

“Promotion Period”). The Promotion is valid for eligible Standard Chartered

Credit Cards (“Cards”) issued in Singapore by Standard Chartered Bank (Singapore) Limited (“

Bank”) (cardholders of Cards to be collectively referred to as “

Eligible Cardholders“).

– Registration To be eligible for the Promotion, Eligible Cardholders must successfully register their Card during the Promotion Period by sending an SMS in the following format: “AC19” (Example: AC19) to 77222 or +65 8318 4584 (if the Eligible Cardholder is sending the SMS from outside Singapore) from his/her mobile number that is registered with the Bank (“

Bank Registered Mobile Number”). An acknowledgement of successful Registration will be sent to the Eligible Cardholder’s Bank Registered Mobile Number. Upon successful Registration, all of the Eligible Cardholder’s existing Cards will be registered for the Promotion (“

Registered Cards”).

– Cashback Eligible Cardholders must be within the first 16,000 to make a minimum of 5 Qualifying Apple Pay Transactions or a minimum of 10 Qualifying Contactless Transactions during the Promotion Period

. S$5 cashback will be awarded for every five Qualifying Apple Pay Transactions, and S$5 cashback will be awarded for every ten Qualifying Contactless Transactions. The maximum cashback each Eligible Cardholder is eligible to receive under the Promotion is

capped at S$30. Eligible Cardholders who have qualified for the Promotion will be notified by SMS no later than 14 July 2019.

– Qualifying Transactions and Exclusions “

Qualifying Transactions” refers to: (A) retail transactions charged to the Registered Card via Apple Pay™ only (“

Qualifying Apple Pay Transactions”); and (B) retail transactions: (i) charged to the Registered Card via Samsung Pay™ or Google Pay™ mobile wallet or (ii) charged via a contactless mode (namely, Visa payWave™ or Tap & Go™ with Mastercard) ((i) and (ii) collectively, “

Qualifying Contactless Transactions”) provided that such transaction is not a retail transaction made on the Grab app.

All transactions made on the Grab app will not be considered as Qualifying Transactions for the Promotion. Qualifying Contactless Transactions through Google Pay™ comprise Qualifying Contactless Transactions that are made via a Card that was added and verified, creating a Virtual Account Number, in the Google Pay mobile application. Transactions including insurance premiums, all modes of bills payments (including payments to telecommunications and utilities providers), payment via AXS and SAM networks, payment to government agencies (including LTA, HDB, IRAS, PUB, ICA & MOM), income tax payments, EZ-Link/TransitLink top-up/reload, any transactions pertaining to Merchant Category Codes 6211 (Security Brokers/Dealers) and 7995 (Gambling/Lotto), funds transfers, cash advances, NETS purchases, ongoing instalment payments, any fee and charges, cancelled and reversed transactions and outstanding balances will not be considered as Qualifying Transactions. Click

here for full terms and conditions that apply.