Your guide to making your first paycheck count

July 6, 2024So you finally received that first paycheck, and it probably went something like this: you wake up on the morning of payday and the first thing you do is to quickly tap that sacred PIN code into your mobile banking app. You smile to yourself as you see that your account balance rose to a number that you’ve probably never seen before. Sheer happiness.

More importantly, what’s next? While it might be tempting to buy a round of drinks for your friends or to cart out all the apparel you’ve kept on your wishlist, it’s good to be mindful of how much of it you are spending at one shot. Remember, this amount of money should be lasting you until the next payday, at least! So here are some tips on what exactly you can do with that first paycheck, and how you can use it to set good financial habits.

Pay off your debt

As the infamous Singaporean saying goes: owe money, pay money. Being in debt is never fun, whether it’s owing your friend money or paying off school loans. It helps to rip off the bandaid as fast as possible, so if you must, portion a larger amount of your paycheck each month to servicing loan payments (as reluctant as you may be), so that you can eventually have one less thing to worry about

Treat yourself right

Even though we talk quite a bit about financial prudence and responsibility, at the end of the day, it is equally important to strike a balance while you can — you might start building resentment towards saving if you restrict yourself too much, which is not something we want. After all, it’s your first ever paycheck. So while you plan for the future, don’t be afraid to live in the present too. So go ahead and treat yourself!

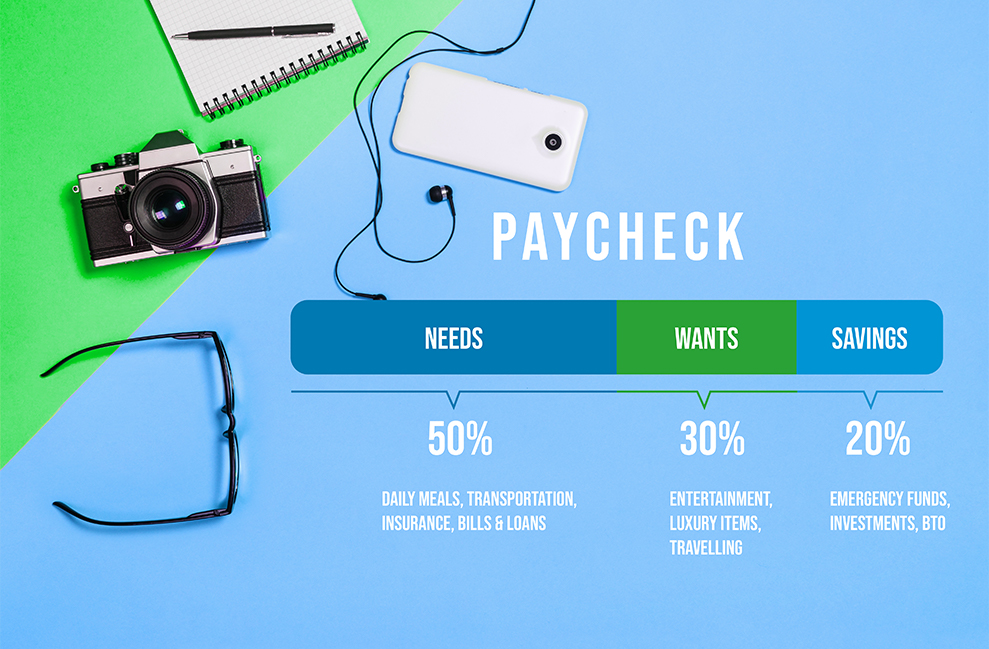

Get acquainted with the 50 / 30 / 20 rule

Now that we’ve gotten the rest out of the way, here’s a simple way to stay on track. Notice how we said get acquainted, and not get into it? The reason is simple. There is no one-size-fits-all savings plan for all the individuals in the world. Some people might not be able to stick to a strict savings plan due to factors out of their control, and that’s okay.

However, the 50 / 30 / 20 rule is a great way to understand how you can potentially split your paycheck up and for what purpose. Popularised by Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, the 50 / 30 / 20 rule essentially divides your paycheck into three categories: Needs, Wants and Savings.

50% to your needs

Accordingly, half your salary should go to helping you live decently. This includes paying for your daily meals, transportation fares or petrol money, insurance, as well as bills and loans.

30% to your wants

Everyone’s favourite part — the budget to spend on the finer things in life! But remember that not all your wants are luxurious and extravagant. They include things such as your Netflix and Spotify subscriptions, a taxi ride on days you’re feeling lazy, along with all those hotpot suppers and midday bubble tea runs. All of a sudden, the 30% doesn’t feel that much, does it?

20% to your savings

Lastly, a fifth of your paycheck should ideally go into your savings. This includes your emergency fund as well as other long-term savings plans you might have, such as money set aside for a BTO, or even investment schemes.

This fund should not be touched unless there is an emergency, which is why it’s so important to accrue interest on it, and try to beat inflation as much as you can, because the value of your dollars will only drop every year if you don’t. Building your investment portfolio might be out of the question for now, but putting your money into a savings account like JumpStart might be a good option. Designed for 18 – 26 year olds, not only is there no minimum deposit, but you also get to enjoy up to 2.5% p.a.* interest on the first $50,000. Now that’s pretty neat.

Since we’ve gotten the basics covered, you can now play around with what type of budgeting works best for you. You can even further break down these numbers into smaller funds, so that you are able to keep track of your savings plan. For instance, within your ‘wants’, you can set aside a small travel fund, a Christmas shopping fund and even a self-improvement fund where you can set a budget to be used monthly, or to accumulate and spend at the end of the year.

Learning how to be a smart saver does not happen immediately. It takes time and a lot of trial and error before figuring out what works best for you. In fact, your savings plan should never stay constant; it’s always subject to change based on the different milestones in our lives. At the end of the day, what matters most is that you can have enough to be prepared for an emergency, live comfortably, stay happy.

Open a JumpStart savings account instantly^ and start earning interest from today.

This article is brought to you by Standard Chartered Bank (Singapore) Limited. All information provided is for informational purposes only.

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

*Please visit sc.com/sg/JumpStart for full terms and conditions of the JumpStart account Product Terms.

^Please visit sc.com/sg/terms-and-conditions/instant-approval/ for Standard Chartered Instant Approval Terms and Condition