Dollar cost averaging is investing a fixed amount of money into a particular investment at regular intervals, typically monthly or quarterly. This strategy, with its potential to mitigate timing risk, is most often employed for riskier investments such as stocks and mutual funds (as opposed to bonds or real estate).

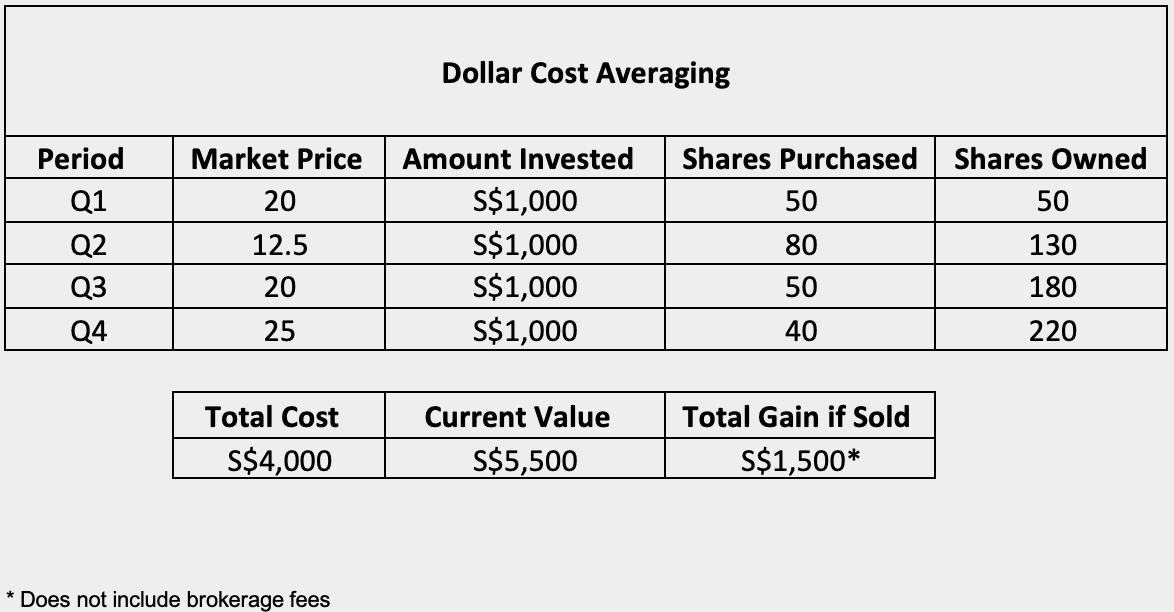

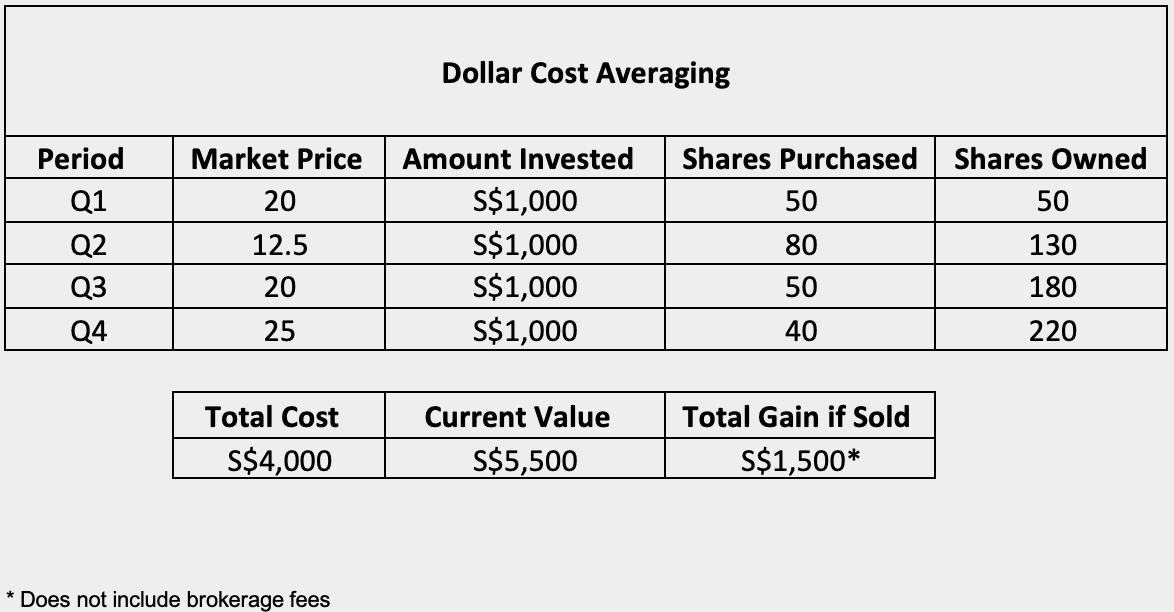

The fear of entering the market at the wrong time can lead to inaction or hasty decisions. Dollar cost averaging smoothes out fluctuations, as you buy more shares when prices fall and fewer shares when they rise. This is the strategy’s cost-averaging effect.

Dollar cost averaging is also a long-term strategy. Barring adverse circumstances, it helps you gradually build up your holdings of a particular investment over an extended period of time.

From an emotional perspective, dollar cost averaging keeps things simple. Regardless of market fluctuations, you invest the same amount of money each month. As long as you have the discipline to stick to it, you will be less emotionally affected by market volatility and less prone to making rash investment decisions.

Let’s say that an investor named Mr. Lee invests S$1,000 per quarter for 1 year into the SPDR Straits Times Index ETF. Now the price of the ETF may change each month, but the amount Joe invests never changes. Theoretically speaking, as long the ETF increases in price over that time period, Mr. Lee will have successfully used dollar cost averaging to see a positive return on his investment.

Most new investors do not have large sums to invest and don’t always know where to begin. Typically, as their earning power increases, they will have spare cash each month to allocate to their investment portfolio. Dollar cost averaging is thus the ideal strategy for new investors looking to build a long-term portfolio. It also provides for a very hands-off approach which can be ideal for the inexperienced investor.

That said, while dollar cost averaging is a simple strategy, there a few caveats to keep in mind before you jump in.

- You must have the discipline to stick to it

When the market is going down, you may feel very tempted to sell — that’s why despite the adage “buy low, sell high”, many investors end up doing the opposite — or not put in your regular investment. However, that would nullify the strategy’s basic idea of buying more of an investment when the market falls.

Following this strategy also means that you can’t fluctuate your position based on the current share price of your investment in terms of increasing the amount you spend on the purchase of more shares when the price is lower and less when it is higher (please see below).

Conversely, you may feel exuberant and want to invest more in a rising market. But you may end up paying a higher average price or buying at the top of the market, which is what this strategy is designed to avoid.

- You still must choose the right investment

Dollar cost averaging does not spare you the work of choosing an appropriate asset to invest in. Dollar cost averaging into a bad investment is still a bad investment.

Many investors use dollar cost averaging as part of a passive investment strategy, meaning they invest in passively-managed index funds that track an entire market. This reduces the amount of personal due diligence that’s required from them compared to researching specific stocks or actively-managed mutual funds.

- Watch out for transaction costs

Regular and frequent investments mean more transactions, which might mean more costs eating into your returns. This is especially true for fixed transaction costs, such as a brokerage that charges you S$10 for every transaction. If you are just starting out and only investing S$500 a month, that represents a 2% transaction fee!

Hence, many investors who use dollar cost averaging prefer to stick to low-cost passively-managed index funds which charge a low percentage-based fee instead.

- You may end up with fewer shares than you think

The share price of an investment may rise over time, which means that you may be getting fewer and fewer new shares with each investment.

There are several alternative strategies to dollar cost averaging, each with their pros and cons. Although they can require a more hands on approach. So remember to choose a strategy that balances the risk with your expectations.

Value Averaging

One such example is value averaging. Unlike dollar cost averaging, value averaging means that if Mr. Lee was purchasing shares in a company, he would purchase less when the price was high and more when the price was low. While this strategy can reap high returns, investors also risk not having enough money to continue with the strategy when more substantial purchases are required in a down market. Dollar cost averaging is a far simpler strategy because it’s passive and doesn’t require larger investments during certain periods of time.

Lump Sum

Investors also have the option of investing a lump sum upfront. This is advantageous if you have a large sum of money ready to invest as theoretically company stocks tend to increase in value over time and money sitting on the side will not be earning as high a return for the investor. However, if the investor doesn’t have the large sum upfront or isn’t comfortable with that strategy, then dollar cost averaging is the better way to go.

There is no such thing as a perfect investment strategy. However, dollar cost averaging is a conservative strategy that helps to build long-term wealth, especially if you are just starting out on your investment journey. Ensure you stick to the plan, so you can reap the rewards.

Do you want to know more about the various investment strategies you can use to help grow your wealth? Speak to one of our financial advisers at Standard Chartered today and let us help you.

This article is brought to you by Standard Chartered Bank (Singapore) Limited. All information provided is for informational purposes only.