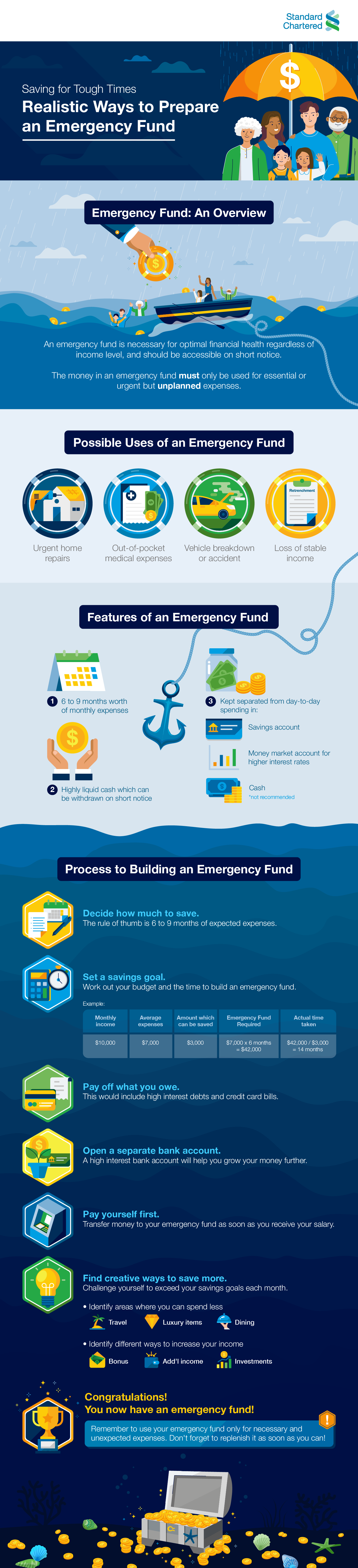

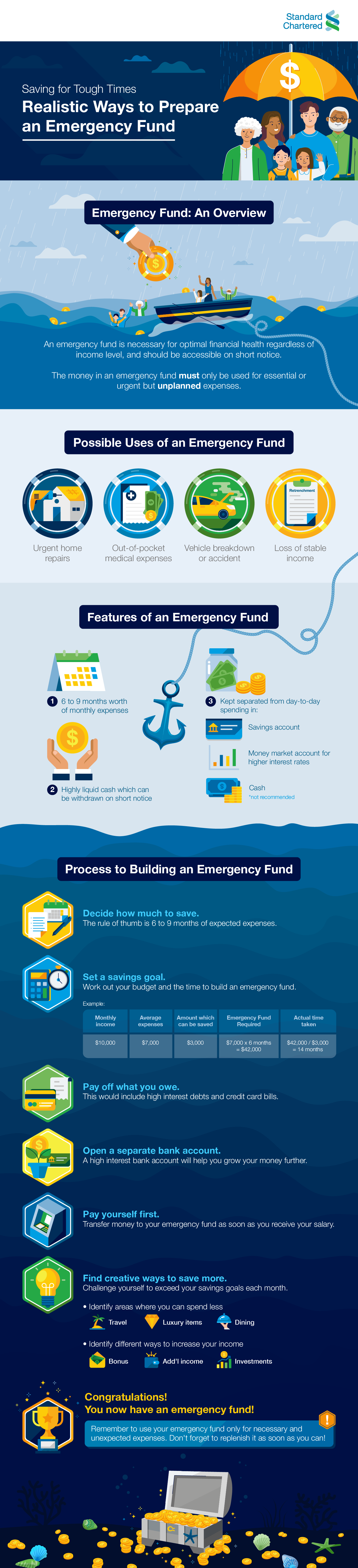

It may seem obvious that an emergency is for emergencies, but if you have had any doubts, let’s put them to bed. Here’s what an emergency fund should look like:

1. Your emergency fund should be relatively liquid

Your emergency fund needs to be accessible on short notice, so keep it in a savings account, a money market account (cash equivalent), or if you must, in cold hard cash (though this is not recommended).

2. Your emergency fund is only for essential or urgent but UNPLANNED expenses

Ask yourself if the expense is (a) something that you need in order to survive and/or function, or is (b) one that you couldn’t have seen coming. If it’s a no to either of these two questions, then you should work this expense into your monthly budget.

Some examples include:

● Unexpected home repairs

● Medical bills for sudden illnesses

● Non-routine car repairs or maintenance

● Living expenses after losing your job

● Family emergencies

Some notable examples not to spend your emergency fund on include:

● Shopping and entertainment expenses

● Holiday expenses

● Routine home and car maintenance costs

● Routine medical and dental check-ups and treatment bills

● Gift purchases

3. Emergency funds are essential for everyone, at any income level

Even if you’re the next up and coming CxO, or if you’ve had the same job since leaving university, an emergency fund should be the foundation of your financial plan as it can save you from having to take on debts with unfavourable terms when things go south. On that note, the “how” and to what extent you build your emergency fund depends on a few factors. Here is a step-by-step guide to building an emergency fund to tide you and your family through the rough days ahead.

While personal finance experts recommend putting aside 3 to 6 months of monthly expenses for your emergency fund, the amount to allocate should depend on your household’s financial situation.

If your job is stable, your expenses are low (say less than 50% of your household income), or if you have multiple streams of income, you can afford to maintain a smaller emergency fund because the risk of financial hardship is lower.

However, if your income varies (e.g. you work on commission, or you work on contract basis), your expenses are high, or if you only have a single source of income for the entire household, you may want to opt for a larger safety net should an unexpected and unfortunate event take place.

You should also consider macroeconomic conditions when determining (or re-evaluating) the size of your emergency fund. In the event of an economic downturn or pandemic, the risk of your income being affected is much higher, hence, it would be prudent to maintain a larger emergency fund.

While there is no limit to how much you can set aside, having too much of a good thing can be a bad thing, even if it is your emergency fund. The opportunity cost of keeping a large emergency fund will be the amount of money you could have earned by investing that money in bonds, unit trusts, or equities.

It may seem overwhelming when you try to save all that cash at once, so putting together a plan can make it easier to reach the requisite sum.

To do this, examine your monthly budget and work out how much you can afford to put aside. For instance, if your monthly income is $10,000 and you typically spend $7,000 a month, you will be able to deposit $3,000 a month into your emergency fund.

Based on your monthly savings goal, you can calculate how much time it would take to build your emergency fund. Using the previous example, to put aside 6 months’ worth of monthly expenses, you would need to save $42,000 ($7,000 x 6). At a savings rate of $3,000 a month, it would take 14 months to build your emergency fund.

It’s never too soon to start building your emergency fund. However, like most who are ‘adulting’, you may already have debt obligations, expenses, and other ongoing savings plans (either investment or insurance) that tie up your income.

If you find that funding your emergency fund takes too long, set your target on a mini emergency fund, consisting of one month of expenses. Afterward, you can focus on paying off any short-term and high-interest debts in order to free up additional cash flow to put toward the remainder of your emergency fund.

Keeping your emergency fund in a separate bank account ensures that you are not tempted to use it for purchases that do not qualify as an emergency. It also ensures that you do not accidentally use the cash in your emergency fund for day-to-day spending.

One way to do this is to automatically transfer money into your emergency fund using your internet banking account at the beginning of each month or once you receive your salary. Automating the process is a hassle-free way to ensure you never forget to save.

Tip: Consider depositing your emergency fund into a high interest savings or current account so the cash can grow.

There are good reasons to build an emergency fund as quickly as possible. The sooner you have an emergency fund, the quicker you can use subsequent savings to build up your wealth.

– Identify areas where you can spend less

Target expenses that are high cost or used infrequently. For instance, if you are subscribing to newspapers that you seldom read or are paying for a gym membership that you hardly use, ceasing your subscription or membership will free up cash every month.

– Identify temporary ways to change consumption patterns in order to save more money.

For instance, if you have been eating out at fancy restaurants often, you may want to reduce frequenting such venues to just once a month or less – make it an occasion, instead of a habit. If you typically spend $1,000 a month on clothes and accessories, why not challenge yourself to go a whole month without shopping?

– Identify ways to increase your income or channel additional income to your emergency fund

Any additional cash you receive outside of your typical wages can be put towards your emergency fund. Contribute any bonuses, directors’ fees, or money from external and additional consulting work, among others, toward your emergency fund to help it grow faster.

An emergency fund is a must-have for optimal financial health. If you do not have one yet, come up with a plan as soon as possible.

The infographic below summarises what you need to know about emergency funds and the steps to take to build one.