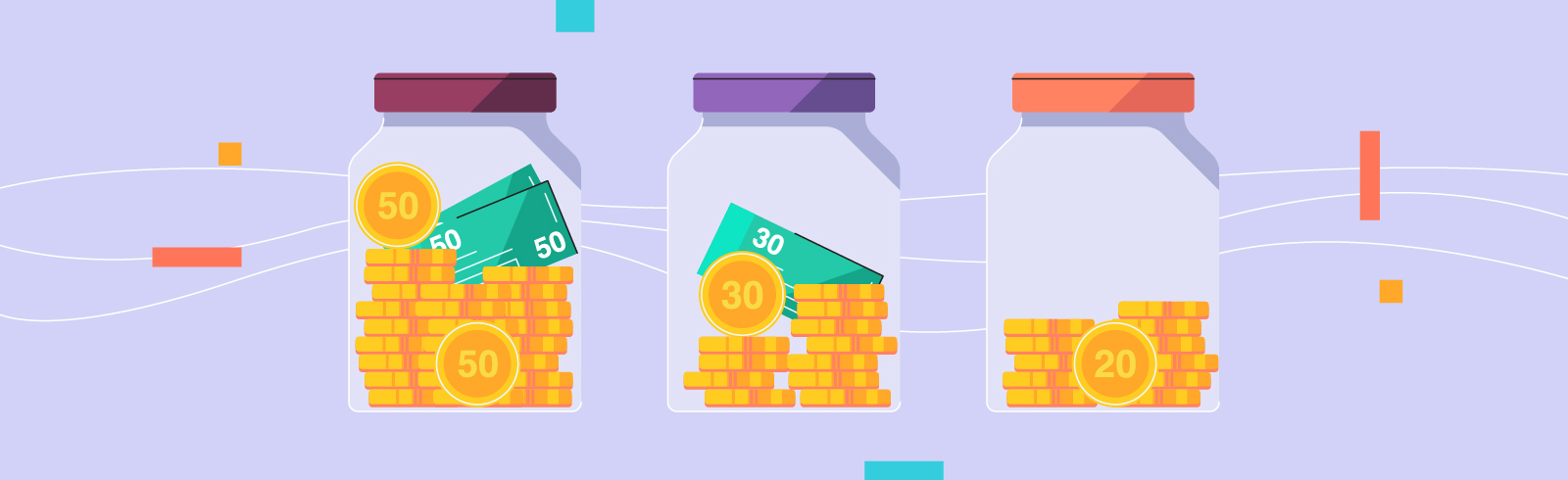

The 50/30/20 rule offers a quick and easy way to divide and prioritise your income for long-term success. To apply this ratio, you would need to apportion your monthly take home pay into the following categories:

– 50% spent on needs

– 30% spent on wants

– 20% set aside as savings

Here are key items that may fall under each of the three categories:

This category includes spending that you may consider necessary for survival and includes anything that falls under food, shelter, utilities, transportation, and insurance. Some examples include:

– Home loan payments

– Rental fees

– Utility expenses

– Groceries bills

– Transportation costs

– Car expenses

– Insurance premiums

– Medical fees

If you find that your needs account for more than 50% of your allocation you may need to adjust your lifestyle to accommodate your savings and retirement goals. For example, if you find that car expenses equate to a large portion of your “needs” budget, you may need to find alternative modes of transportation like public transportation or ride-hailing services, rather than to own a vehicle.

This category includes discretionary spending, which are items you may not require to survive, but may incur costs for enjoyment:

– Shopping bills

– Restaurant meals

– Holiday expenses

– Hobby expenditures

– Memberships fees to country clubs, gyms, and more

– Entertainment expenditures

– Gift costs

Money that you set aside for the future counts as savings. But your savings strategy should not simply refer to the leftover money after expenses. You should set aside funds to cater for your retirement as well as for the rainy days.

a. Build an emergency fund

The first step is to build up your emergency fund.

Typically, emergency funds should be able to sustain you for 3 to 6 months. But in times of economic uncertainty, you may want to save up to 9 months of expenses in case of an emergency. Either way, your emergency fund should be highly liquid (e.g. not tied up in a fixed deposit), so you have the ability to tap on it anytime.

Note: If you have any high-interest debt, work to pay it off as soon as possible. Popular debt reduction strategies include the debt snowball method (External Link, or External Link) and the debt avalanche method (External Link).

b. Consider your long-term goals

Once you have set aside your emergency fund, your next step is to consider your long term goals. Setting saving goals will help to motivate you for the long term. Some common reasons to save include:

– Home purchase or home renovation

– Starting a family

– Saving for your child’s education

– Retirement or financial independence

c. Decide where to keep your funds

The last step for saving is determining where to keep your money. Rather than just stashing your cash in a standard bank account, putting your money to work can compound your earnings and shave off years from achieving your financial goals.

For safer options, placing your savings in bonds, fixed deposits or utilising a high-interest savings account can help you earn more interest while protecting the principal amount.

For larger gains (if you can withstand the risk of loss), you can park your funds with unit trusts or take a chance with the stock market with index funds or individual company stocks.

If your concern is legacy planning, term life insurance, or insurance savings plans can help protect your loved ones should something happen to you.

If you are looking for more investment strategies, see our guide on investing in times of uncertainty.

In the event of a total and permanent disability, your life insurance payouts should cover any nursing and/or health care costs and additional out-of-pocket expenses linked to your personal well-being, on top of avoiding any financial burden which may fall upon your family.

This may include:

- Medical bills: Hospitalisation, medication, doctor’s visits, rehabilitation and physiotherapy.

- Helper or professional caregiver: Live-in or part-time nurse, or domestic helper.

- Transportation fees: Purchase of a car, cost of taking taxis or private hire cars.

- Additional costs and equipment: Wheelchairs and modifications to your home.

- End of life care and funeral costs: Hospice, funeral arrangements, and more.

- Time frame: This depends on your current age and an estimation of the number of years you have left. For instance, since Singapore’s life expectancy at birth is 81.2 years for males, a 40-year-old man might opt for life insurance payouts that can take care of him for at least 41.2 years.

Using the 50/30/20 rule to manage your spending comes with the following benefits:

1. Instills Discipline

The 50/30/20 rule is a great way to to push yourself to stick by your savings goals. By deciding upfront how much you wish to save, you are able to take steps to ensure that you are able to meet your goals every month.

Pro Tip: If you’re still having trouble sticking to your goals, you can automatically divide your salary into three separate accounts or rely on an envelope system to help you spend less.

2. Pushes you to evaluate your spending

By requiring you to define how much you wish to allocate to discretionary spending, the 50/30/20 rule pushes you to have an honest look at what you are spending your money on.

The “wants” category is often the most difficult to keep in check if you do not limit yourself. Having a defined allocation forces you to think about what is most important and meaningful to you.

To keep your spending on “wants” within 30% of your after-tax income, you may wish to prioritise being able to dine out regularly with your loved ones, but give up your country club membership if you do not use it often.

3. Advance planning enables you to reach financial goals more efficiently

Investments take time to bear fruit and starting early can be advantageous. If you can calculate how much you want to retire with, you can determine if the 50/30/20 rule will work out of the box, or if you will need to make adjustments to your ratios to better suit your goals.

Suppose you and your spouse want to retire in 20 years with $2 million, with a combined household annual income of $300,000. You would need to stash away $100,000 per annum if you didn’t already have any savings or assets, which means that you’d have to increase your savings rate to 33% and reduce your discretionary spending to reach your savings goals.

Singapore consistently ranks as one of the most expensive cities to live in. While the average Singaporean household can keep costs down, property prices continue to rise, automobile ownership is prohibitively expensive, and costs to healthcare and education increase year over year. Having a plan can make sure you’re ready to save for your long-term goals.

In addition, Singapore has a vibrant economy, bursting with many lifestyle, dining, and entertainment options. The 50/30/20 rule can help you exercise greater discipline when you’re out on the town.

People working in Singapore also enjoy higher average salaries and lower taxes compared to many of its neighbors. The 50/30/20 rule can help you get the most out of your earnings.

Financial discipline and planning can go a long way for those based in Singapore. Keeping tabs of your cash and allocating your income diligently can set you up for term financial success.

The 50/30/20 rule is ideal for those based in Singapore as financial discipline and planning can go a long way. You can also choose to modify the proportions of the 50/30/20 rule to better suit your financial goals. Finally, do not forget to come up with a plan to invest your hard-earned savings.

Speak to one of our trusted financial advisors today to learn more about how we can help you.