Few people can afford to pay for big-ticket purchases in cash. For the majority, getting a loan is usually the way to go. However, did you know that your ability to get a loan can be affected by your credit score?

In this article, we discuss what a credit score is and how you can maintain and improve yours.

This article is backed by Standard Chartered Bank’s (SCB) Head of Retail Models, Dickon Brough.

A credit score is a statistic derived from a person’s credit history, using data from a range of factors, such as

• a loan application,

• a credit bureau report or

• Performance on existing loans

The score estimates the probability of an applicant repaying a loan that’s been extended to them.

The score is typically a range of values; an example could be a range between 0 to 1000, where

• individuals who score at the lower end of the range are more likely to default on a payment, while

• those who score at the higher end of the range are less likely to miss a payment or default.

To check your credit score, you’ll have to generate a credit report from the Credit Bureau Singapore (CBS)[¹]. You can either

1. Request for a softcopy online or

2. Request for a hardcopy at SingPost outlets, the CBS office or CrimsonLogic Service Bureaus

Price: S$6.42 (incl. GST) + S$2.00 for multiple delivery modes.

You may collect your report within 2 hours at any SingPost outlet for an additional administrative fee of S$17.12.

Tip!

If you’ve just applied for a new credit facility with any CBS member[²], you’re entitled to a free credit report.

A good or bad credit score varies by product and the risk appetite of the lender. This is dependent on the default rate the lender is willing to accept and/or has priced for.

A person’s credit score is an integral part of the loan application process and determines

● the cost of the loan and

● whether or not an application is approved.

Applicants with higher credit scores are typically offered better interest rates. In contrast, those with a lower credit score may not be given a loan at all and, if they are, the interest rate and terms may be more stringent.

At Standard Chartered Bank, “cut-off” or base scores are applied when making lending decisions. Customers whose credit scores are below the “cut-off” will be declined, and those above will be approved, if they meet the additional affordability and verification policy requirements.

The “cut-off” is set at a level that ensures the bank only accepts customers who meet Standard Chartered Bank’s risk appetite for that specific product.

Did you know?

Other than your credit score, lenders may also consider other factors during a loan application, including annual salary, employment period, bankruptcy/litigation information and

number of credit facilities. For SCB’s products, refer to the details covered in the supporting credit risk policy for each product to learn more.

FYI:

CBS does not have a role in the loan approval decision; the decision is fully dependent on the risk appetite of the lenders and their policies.

Instead, CBS only provides factual credit-related information about consumers to the lenders to facilitate their decision.

FYI:

CBS does not have a role in the loan approval decision; the decision is fully dependent on the risk appetite of the lenders and their policies.

Instead, CBS only provides factual credit-related information about consumers to the lenders to facilitate their decision.

Available credit

This is the number of open or active accounts available for credit. Having multiple credit lines may lower your credit score.

Recent credit

If you need to apply for new credit, it’s best to space it out. Applying for credit facilities within a short timespan will give the impression that you’re exhausting your finances.

Enquiry activity

An enquiry is filed every time you apply for a loan. Therefore, a high number of enquiries will reduce your credit score, as it would seem like you’re taking on more debt. To prevent this, minimise the number of credit facilities you sign up for.

Utilisation pattern

This indicates the amount of credit used (or owned) on your accounts. Higher utilization indicates more debt burden which could reduce your score.

Account delinquency data

Late payments will reduce your credit score, as it indicates that you’re spending beyond your limit and prone to debt.

Credit account history

Having a history of punctual payments will improve your credit score, as compared to an individual with limited credit history.

Credit reports reflect your credit history for the past 12 months. This means that you are still able to improve your credit score by adopting the following practices for the next 12 months.

Stay within your existing credit limits

Avoid becoming highly utilised on existing credit cards products.

Manage your credit card payments intelligently

If you only pay the minimum amount each month, the interest on the balance can quickly add up. Missed repayments can also affect your credit score, so aim to pay your credit card balance in full each month.

Manage your total credit exposure as a percentage of your income avoid having many credit cards; even when not using them could create the impression that you have the potential to become indebted.

Demonstrate low risk management of current credit exposure

Have some credit products, such as a mortgage. Proving that you’re managing your existing credit exposure at low risk can strengthen your credit score.

Avoid applying for multiple non-mortgage credit products within a short time period

A customer who makes multiple credit card or personal loan applications to different lenders looks “credit hungry”. This gives the impression that they’re being declined by other lenders.

Always keep in mind to adopt favourable practices; spend within your limit and do not overstretch yourself.

Another thing to note – when applying for loans, it’s important to check how your lender’s loans are priced to ensure that you’re getting attractive repayment terms.

At Standard Chartered Bank, we offer competitive loan packages that keep our customers’ needs at the forefront.

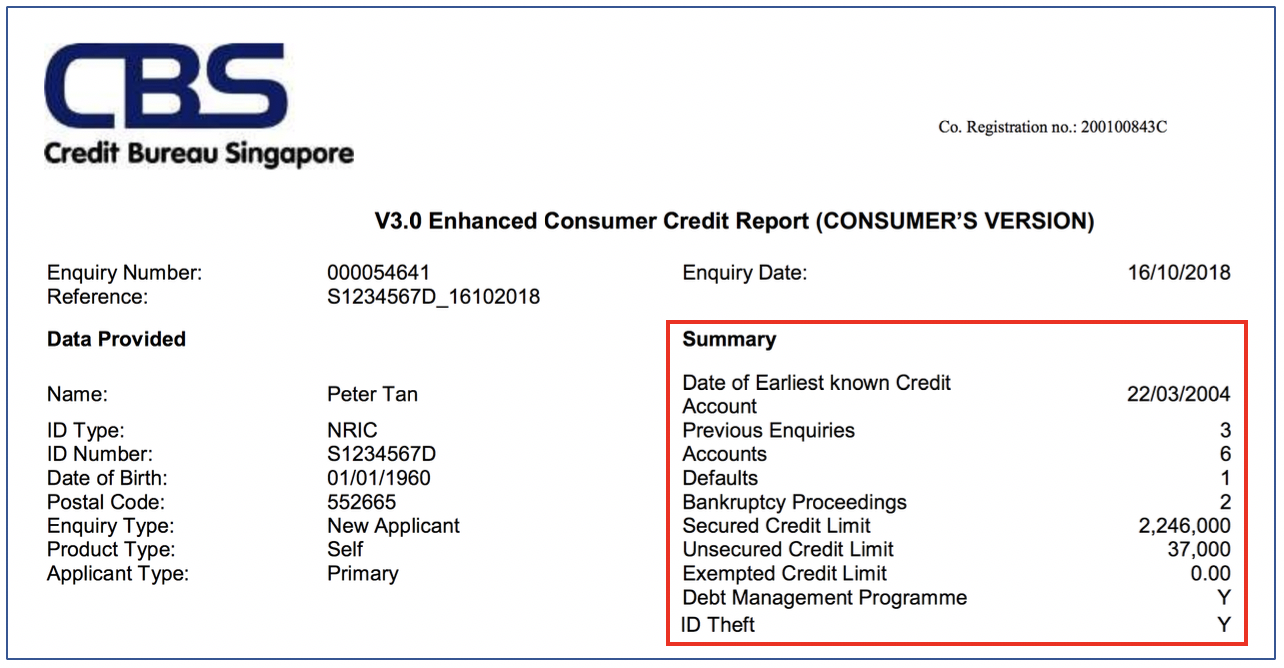

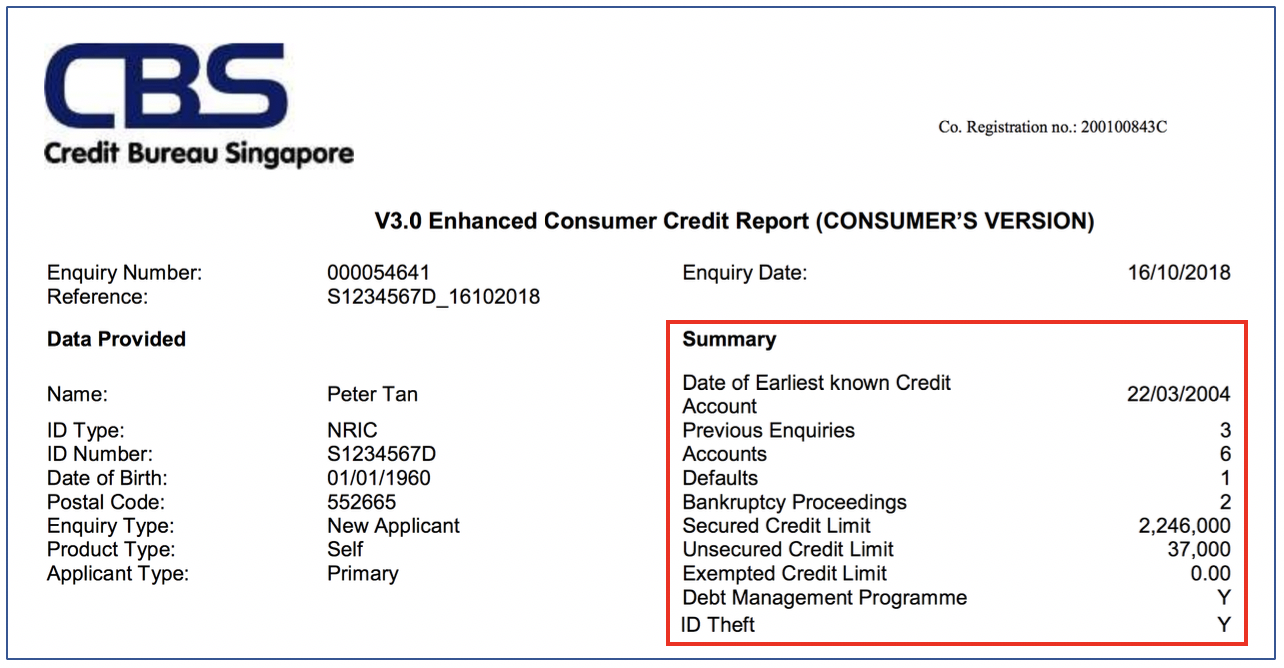

● Date of earliest known credit account

o Date of your first credit account recorded with CBS.

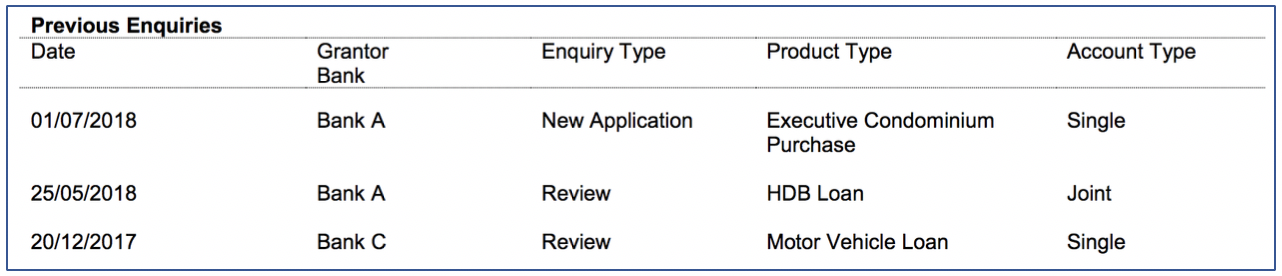

● Previous enquiries

o The number of times your credit file has been accessed by you and reviewed by lenders.

● Accounts

o Number of credit facilities you own.

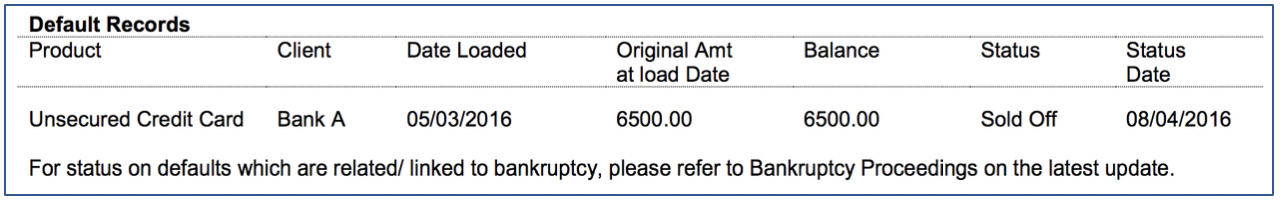

● Defaults

o Number of defaulted accounts.

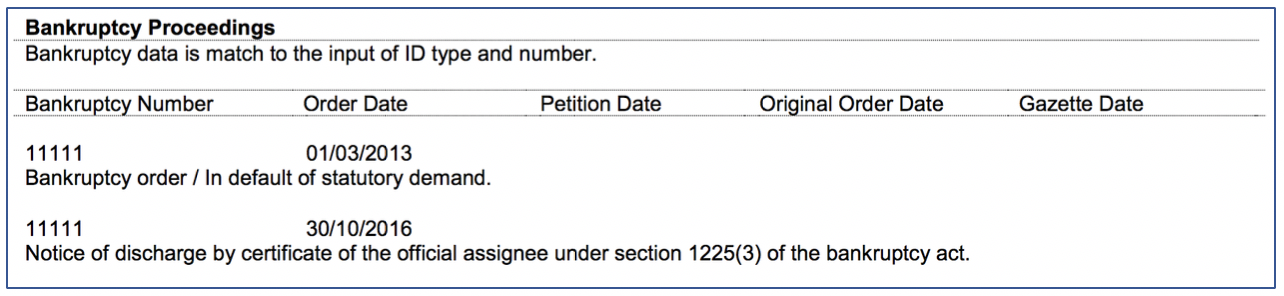

● Bankruptcy proceedings

o Number of times you have filed for bankruptcy.

● Secured, unsecured, exempted credit limit

o Aggregate credit limit[³] determined by your secured, unsecured and exempted credit facilities.

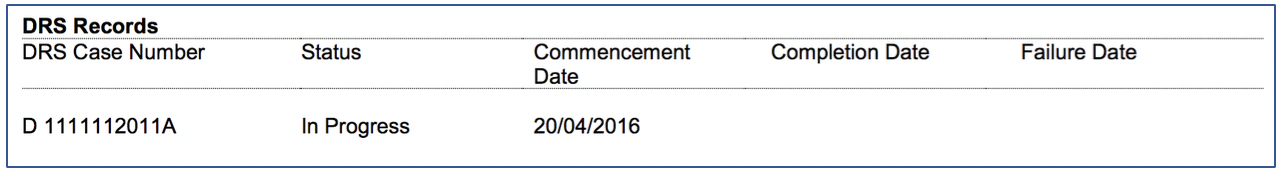

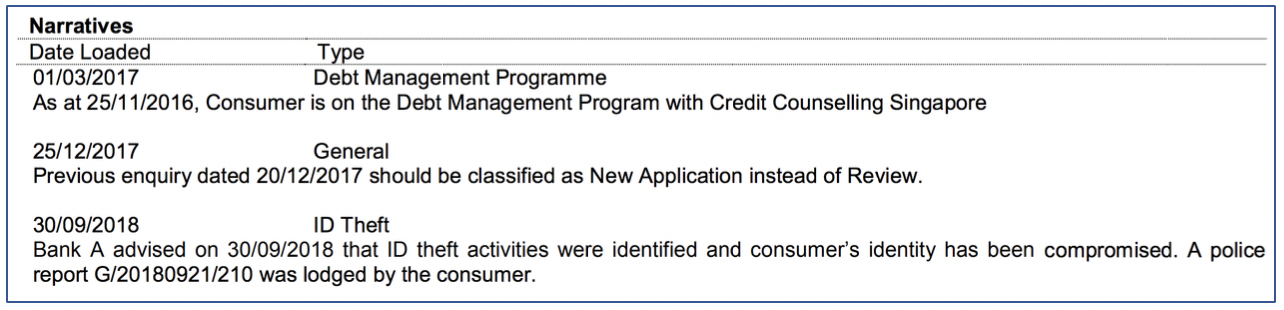

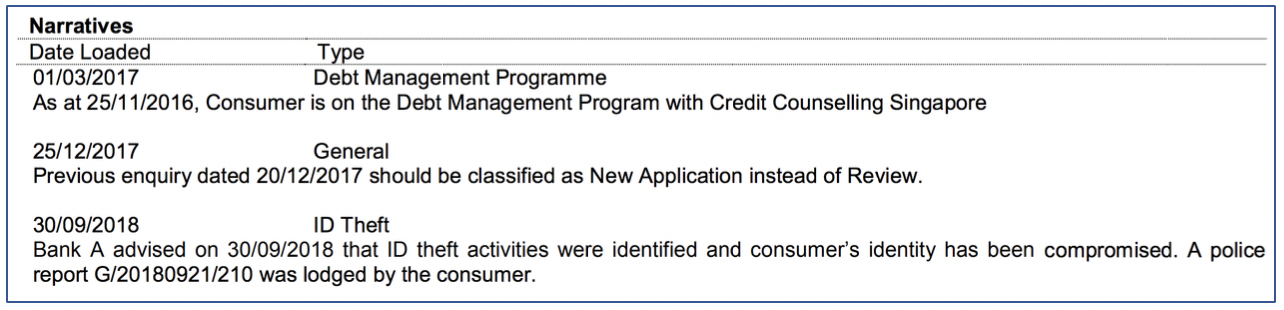

● Debt management programme (DMP)[⁴]

o If you’re part of the DMP, this row will be flagged with a “Y”.

● ID theft

o If you lose your ID, this row can be flagged with a “Y” to inform lenders.

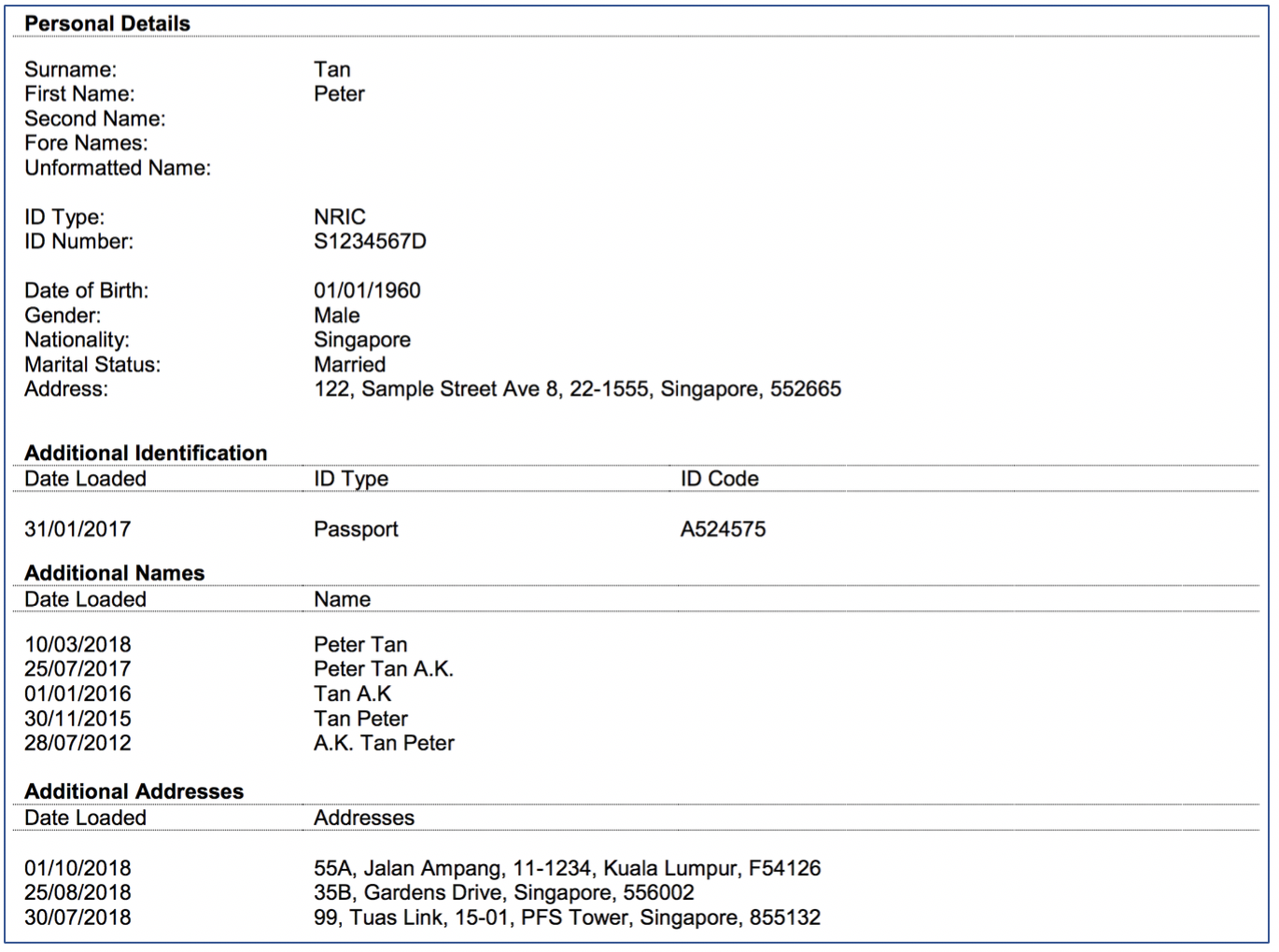

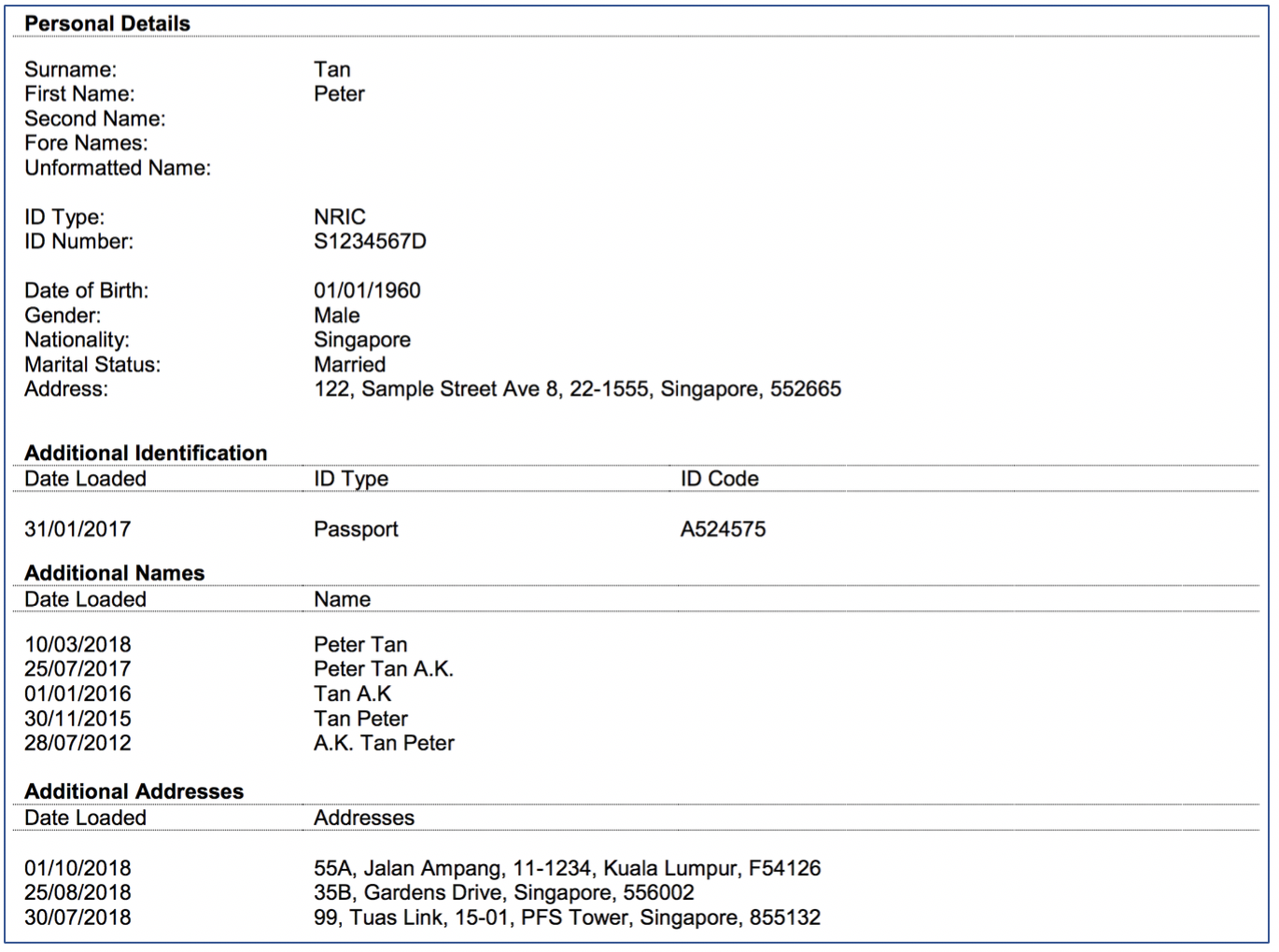

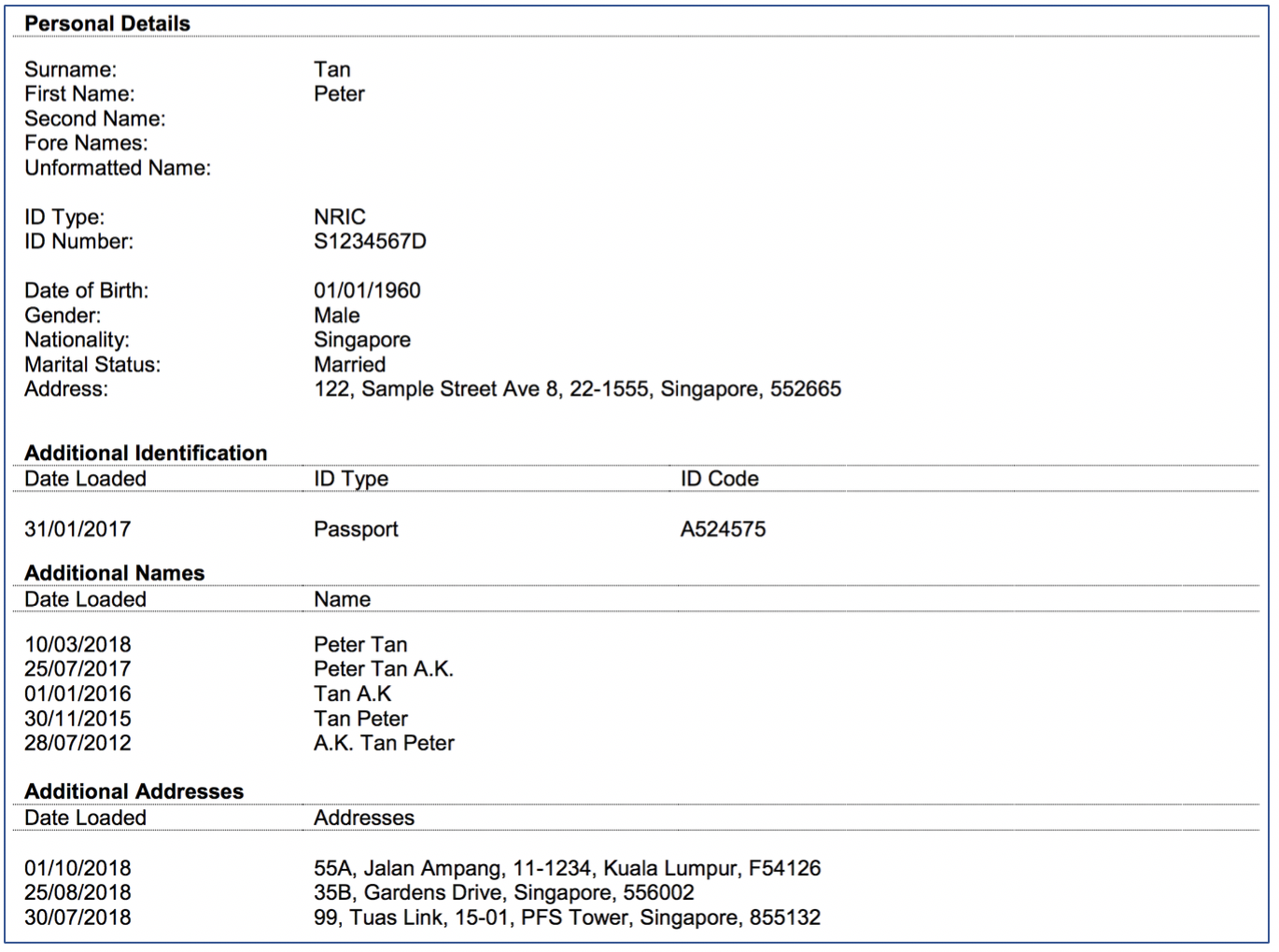

Your personal details and additional identification details are used for verification purposes. The addresses of your previous 3 residences under “additional addresses” are either provided by CBS or yourself.

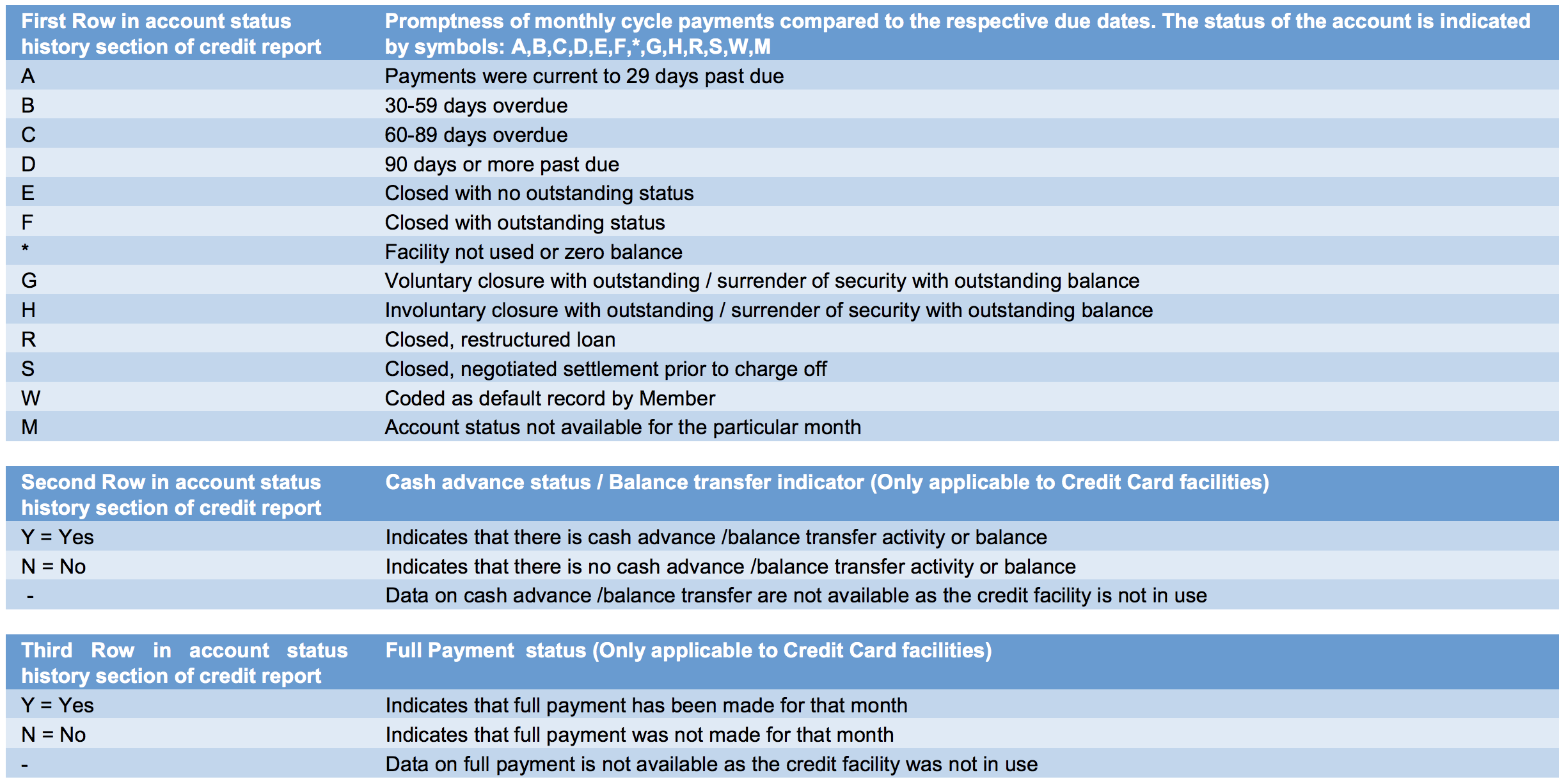

This section displays all the credit facilities that you own and the respective repayment activity in the last 12 months.

For credit card facilities, there will be a

● 2nd row to indicate the status of cash advances or balance transfers and

● 3rd row to indicate status of full payments being made.

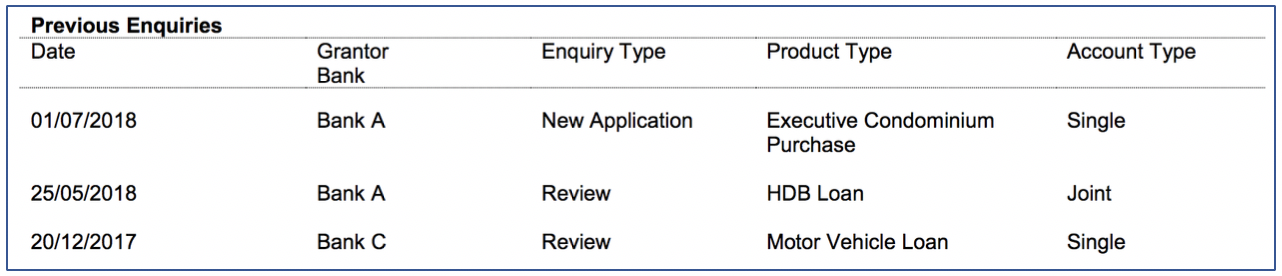

This is a record of all enquiries made by lenders, in response to a loan application. Each record is displayed for 2 years from the date of enquiry.

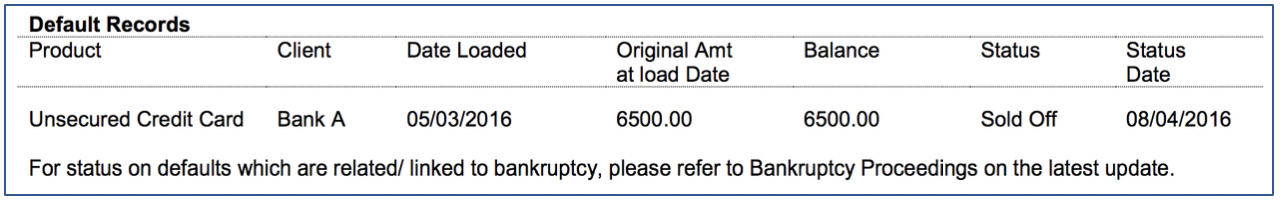

This section is a record of all payment defaults on your credit facilities reported by lenders.

All default records will be displayed for 3 years from the date of Negotiated Settlement or Full Settlement status. However, if a record has an Outstanding, Partial Payment or Sold Off status, it will be displayed permanently.

Note: Statuses are based on the definition of each individual financial institution.

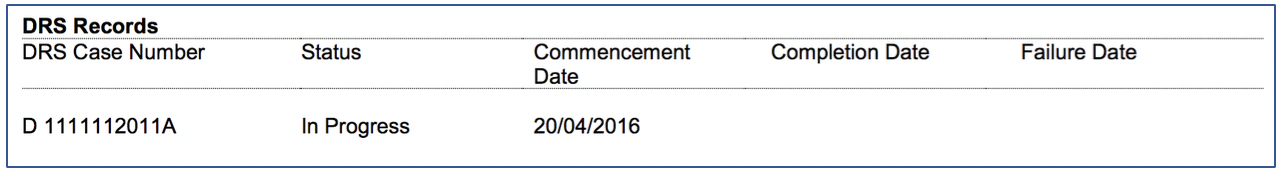

This section records any DRS activity and status. DRS is another option to declaring bankruptcy – a win-win repayment plan is drawn up and debtors are to repay their debt within 5 years.

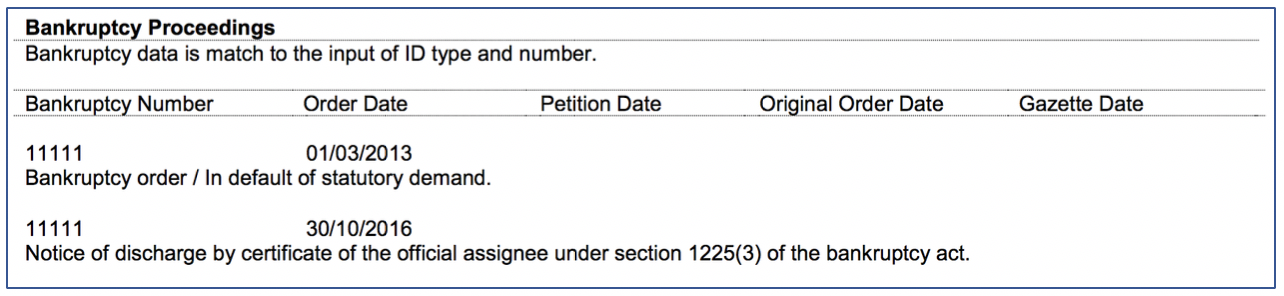

Any bankruptcy records will be displayed in this section for 5 years from the date of discharge from bankruptcy.

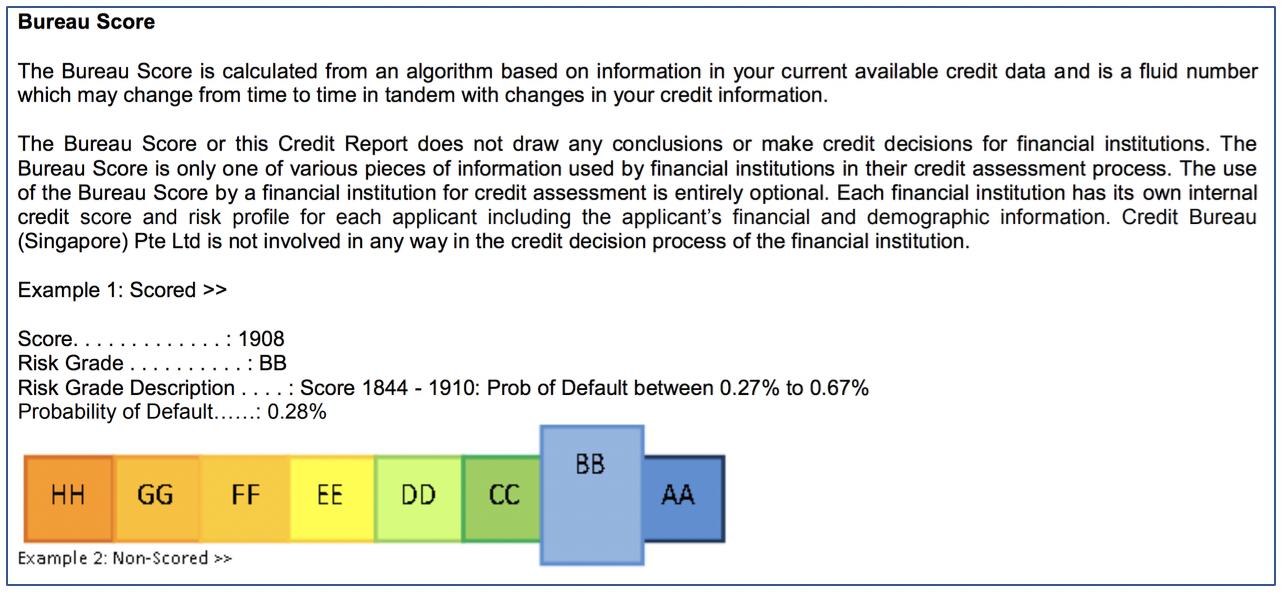

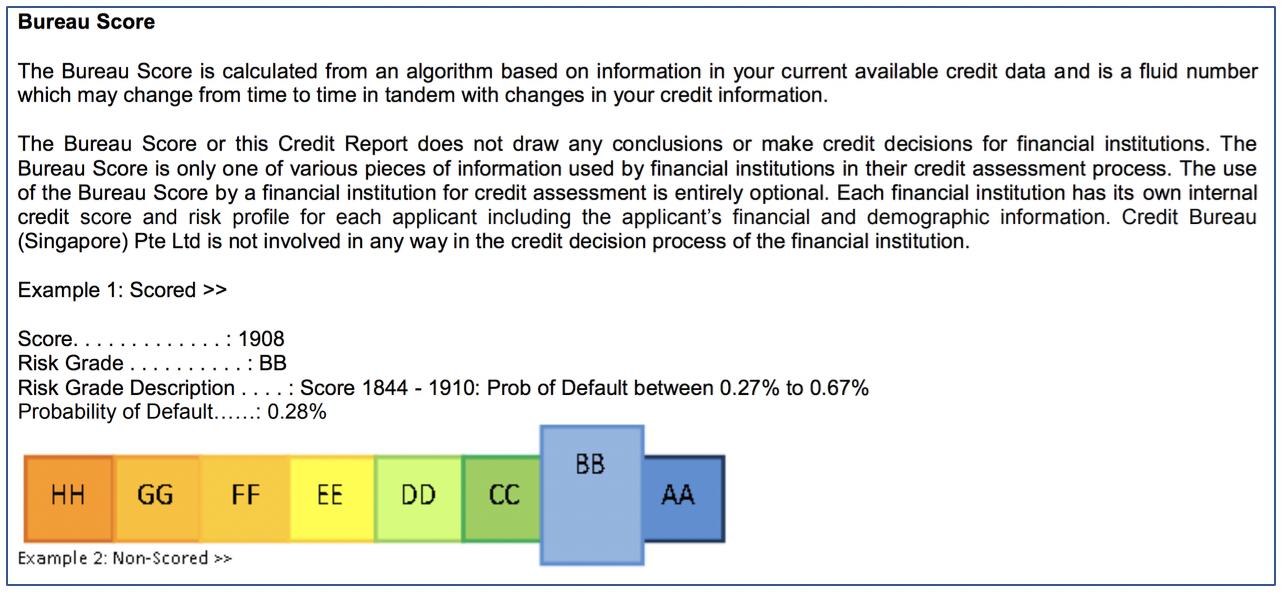

This is where your credit score is displayed.

Miscellaneous comments on the report provided by any third parties.

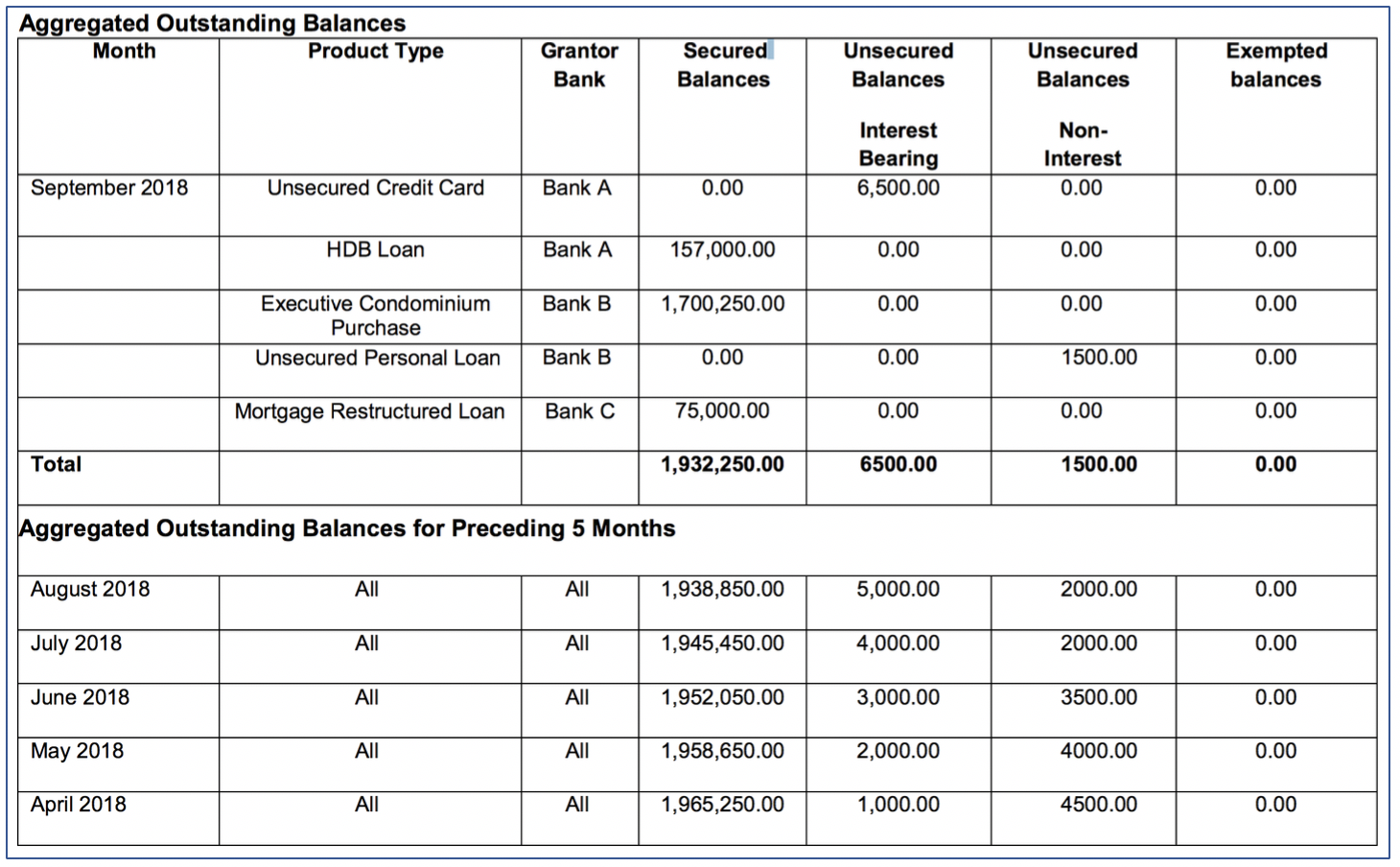

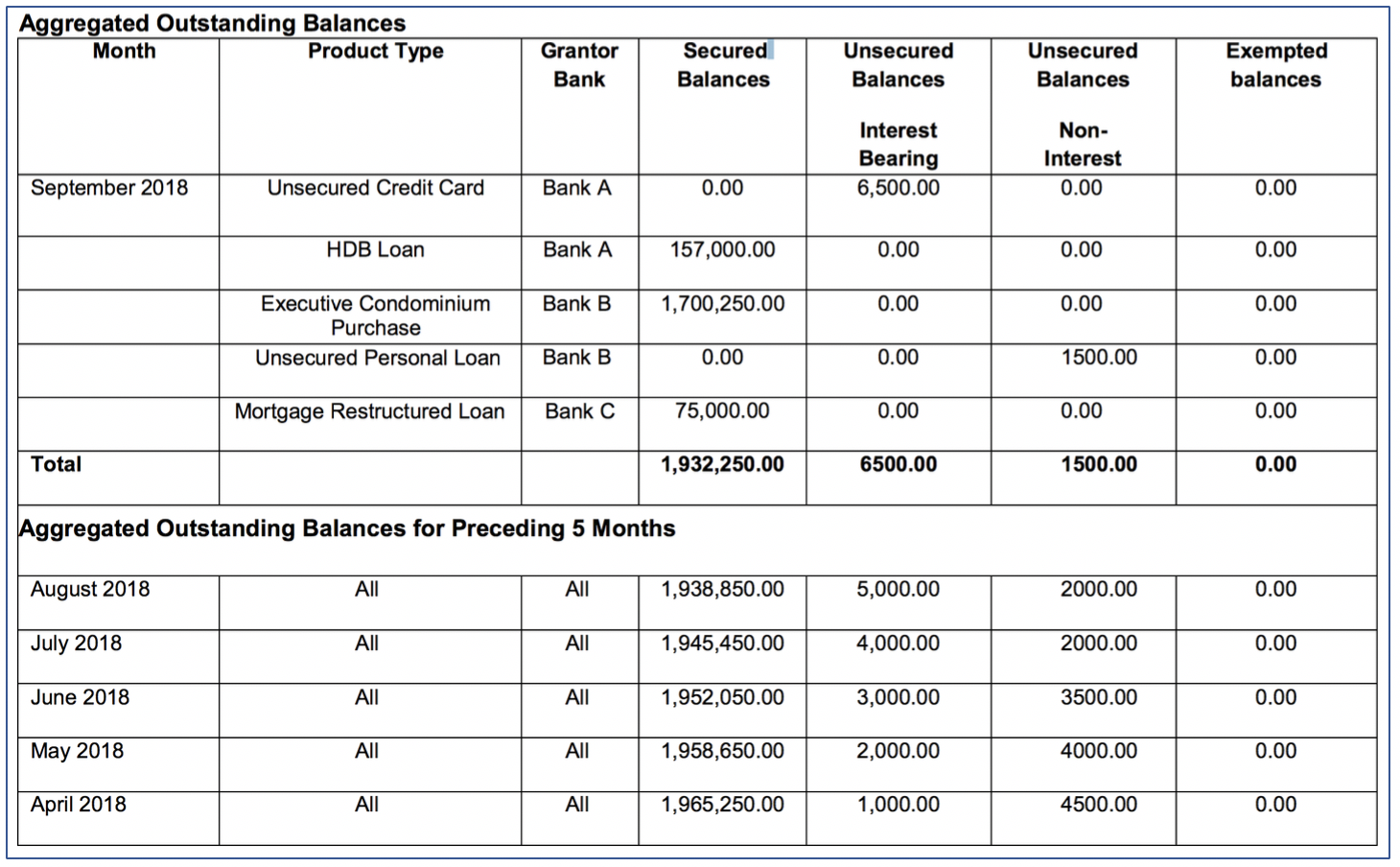

This is a record of any outstanding balances, which are derived based on outstanding amounts that have yet to be paid under your credit facilities.

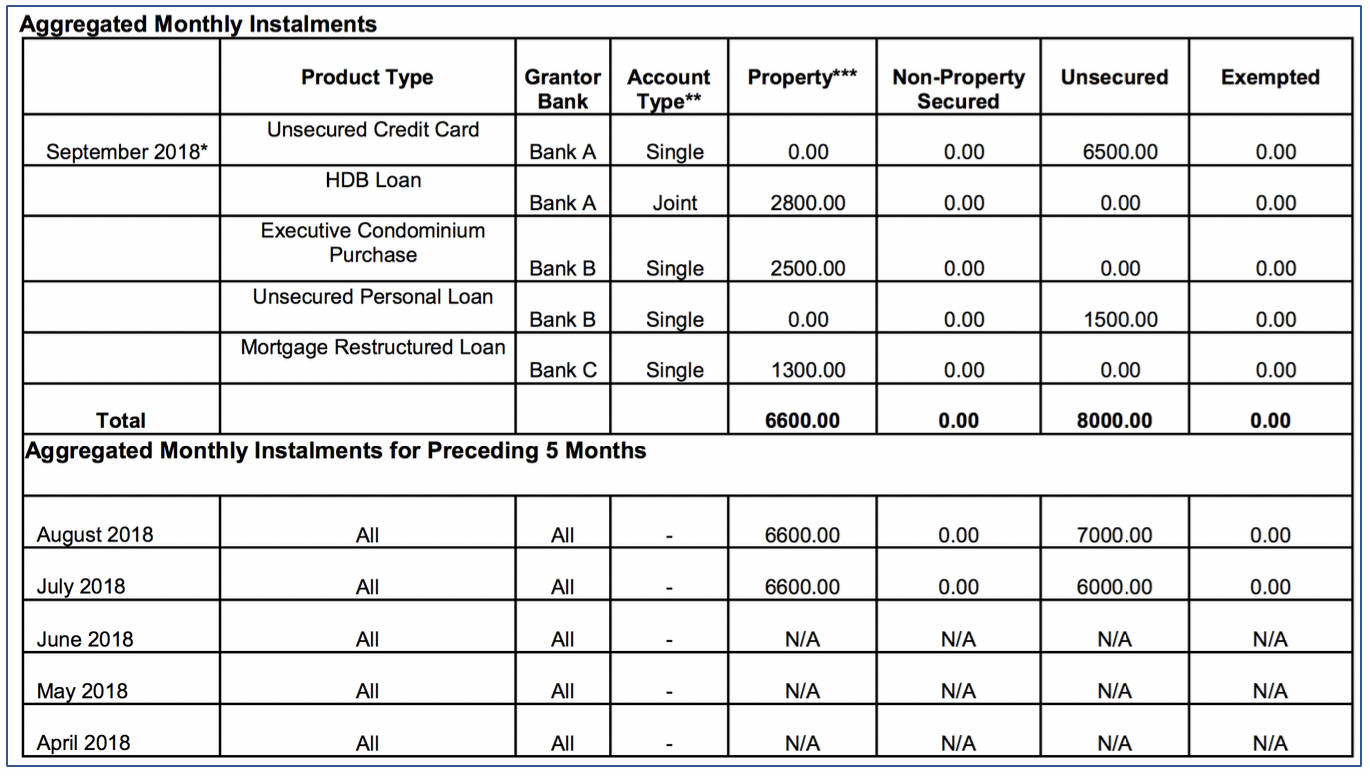

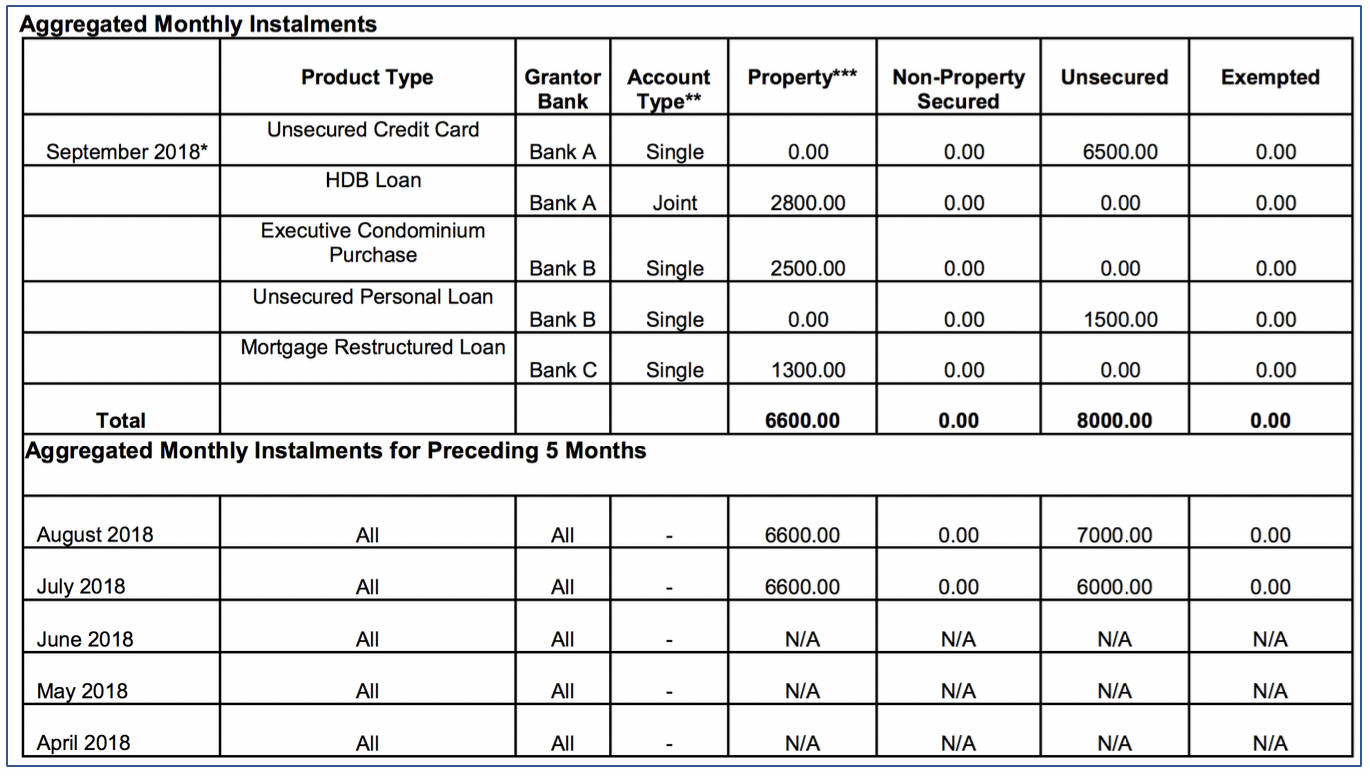

This is a record of monthly instalments for each credit facility for the previous month and the next 5 months.

For more information, refer to this Credit Report Explanation[6] by CBS.