The future is uncertain, and you never know what’s around the corner. Job changes might disrupt our career path and earning potential, medical emergencies can affect our ability to work and plunge us into debt, and rising inflation might mean we need to set aside a larger sum than anticipated to ensure a comfortable retirement. You need to plan for this uncertainty.

It’s also important to ensure that you can look after yourself without the financial support of your family and friends. This can give you confidence and a sense of independence as you inch closer to your post-work life. The ideal way to achieve these goals is to plan and start investing early for your future needs.

You are living in one of the most expensive cities in the world. Many Singaporeans already feel the pinch on their pocket, with the cost of daily needs eating up a significant portion of their income. Some wonder about how to retire in Singapore with a comfortable nest egg. A recent survey¹ from The Economist Intelligence Unit (EIU) named Singapore (along with Paris and Hong Kong) as the world’s costliest place to live as of 2019. And it’s likely to remain at the top of the list for years to come. So what does this mean for you? It means you need to plan well and in advance to factor in the rising cost of living in this island nation.

One way to determine retirement nest egg savings is by using our retirement calculator so you can understand how much money you should save now for post-work comfort. Many Singaporeans dream of slipping into retirement early at 55 years old, before fully retiring at the official age of 62 years, as per the CPF Retirement and Health Study survey². Thus, the big question is how much do you need to retire at 55 years old in Singapore? Standard Chartered Bank’s retirement calculator predicts how much you need to put away to retire at a certain age and still maintain your desired lifestyle.

Now that you have an idea how much you need to retire in Singapore, let’s look at how you can build your nest egg. All Singaporeans and Singapore Permanent Residents are likely to be familiar with the Central Provident Fund (CPF). This comprehensive social-security system helps working adults set aside funds for retirement. It includes Special Account (SA) and Medisave Account (MA) dedicated to your retirement needs. CPF interest rates are pegged to risk-free³ market instruments of comparable duration. Hence, it makes sense to start early, as long-term investments tend to yield lower and give steady returns over time.

The SA currently yields an interest rate of up to 5%, making it a strong retirement savings plan. It also allows simple cash top-ups to boost the retirement nest egg. Ordinary Account (OA) account holders can opt to transfer funds to SA and earn risk-free interest.

However, there is more you can do to ensure a comfortable retirement – and the earlier you start, the better off you’ll be. You need to diversify your financial portfolio and look at other options besides social security to live a comfortable life in your golden years. If possible, try to begin with a systematic and sequential series of small investments that will build a significant nest egg over time. This plan can protect your hard-earned money from market volatility and help you capitalise on gains during upward swings in the market.

How? Two words – compounding interest. Think of compounding interest as interest paid on interest. For example, if you take the interest paid on a term deposit, add it to your original principal and reinvest that amount in another term deposit, this larger principal will generate more interest. Repeat this process over a period of time and your original principal will grow significantly, even if you don’t make any further contributions out of your own pocket.

It’s a simple process. You don’t need a lot of money to start an investment portfolio.

Outside your CPF, save as much as you can early in your career. Once you have been working for a few years and have put aside some money, consider a Supplementary Retirement Scheme⁴ (SRS) to help build your retirement funds. The SRS is a voluntary retirement scheme that the Singapore government offers. Singaporeans and PRs can contribute a maximum of $15,300 per year to their SRS accounts.

This is also the right time to analyse and understand your spending patterns and risk appetite – these factors will greatly influence your savings potential as well as your investment strategy. Don’t be caught off guard by underestimating the value of savings early in your career.

When you are young and start your professional journey, it is very likely that your liabilities are few. This makes it an opportune time to start investing in small amounts and lay the foundation for your retirement portfolio. By mid-career, you should have saved a considerable sum that you can now channel into long-term investment options, such as real estate, shares or a managed fund.

Investing outside your CPF is all about understanding and managing risk. Many managed funds, for example, allow you to set your preferred risk profile. An aggressive investment strategy typically targets higher profits but carries higher risks, while a conservative investment strategy is typically safer but usually offers lower returns.

If you have a large appetite for risk, an aggressive investment strategy when you’re young may help you build your investment portfolio quickly and potentially allow you enough time to recover from a market downturn. However, if you wait until later in your career to get serious about your investment portfolio, you may not have time to recover from riskier investments and may need to stick to a more conservative investment strategy.

Finally, late in your career is a good time to increase your personal CPF contributions in preparation for retirement. This may also be the time to consider cashing out one or more of your investments to use as extra retirement income.

Once you determine what you want your investment portfolio to look like, it’s time to understand how you can make your money work for you. Try maintaining up to SGD20,000 in your OA under CPF as this currently yields up to 3.5% interest. Transfer the additional amount to SA to enjoy the 5% in interest. This way you would be able to build a bigger retirement fund when you are 55 years of age.

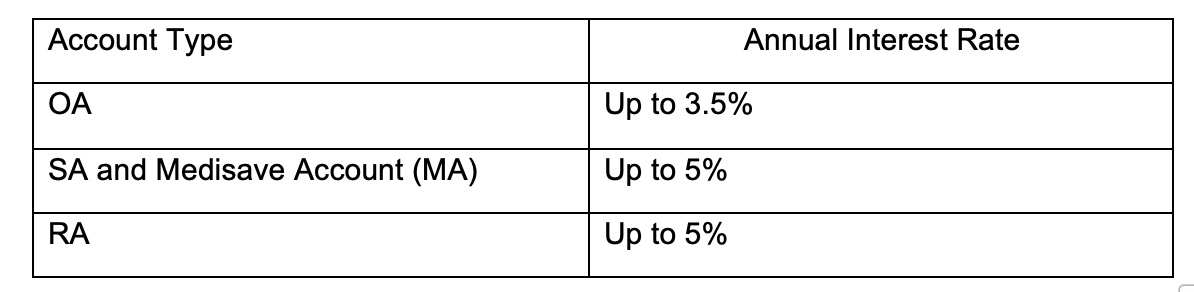

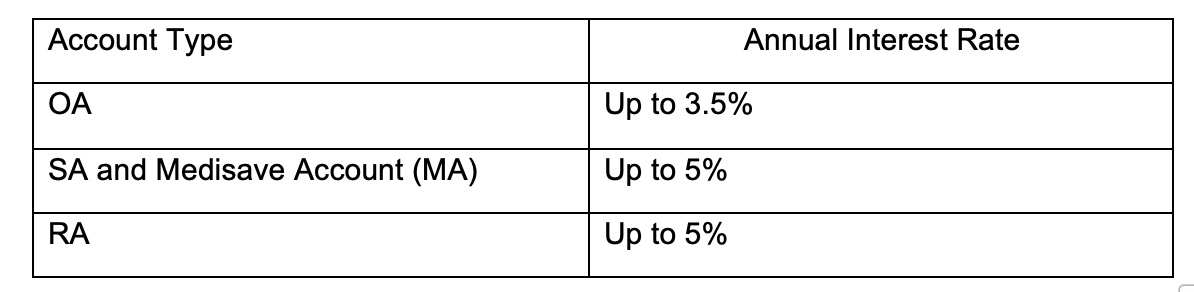

When you turn 55, money from your SA and OA goes into a Retirement Account (RA), which currently offers an interest rate up to 5%. The following table shows CPF retirement account interest rates for various accounts:

You also have the option of investing your CPF savings in the stock market – for instance, through the CPF Investment Scheme⁵ (CPFIS). The CPFIS allows you to put your savings from both your OA and SA into your retirement funds.

This option may give you a higher return but does come with more risk. However, it allows you to dip into your savings to, say, buy a house or fund your child’s education because the money is not locked up as it is with your SA.

As for your investment portfolio, the golden rule is to diversify by investing across different assets. It’s an effective strategy that will help you lay a solid foundation for retirement life. Whether you will need a little or a lot of money at retirement, you need to set aside money today to have it for tomorrow. Seeking professional financial advice may also help you maximise your investments as market conditions change over time.

Ready to start? Talk to our financial advisors today. Get in touch with us.

This article is brought to you by Standard Chartered Bank (Singapore) Limited. All information provided is for informational purposes only.

Sources:

- World’s most expensive cities to live in https://edition.cnn.com/travel/article/worlds-most-expensive-cities-2020/index.html

- Retirement and Health Study https://www.cpf.gov.sg/Assets/members/Documents/RHSNewsletter_Issue1.pdf

- Section IV: Is our CPF money safe? Can the government pay all its debt obligations?https://www.mof.gov.sg/policies/our-nation’s-reserves/Section-IV-Is-our-CPF-money-safe-Can-the-Government-pay-all-its-debt-obligations

- What’s The Supplementary Retirement Scheme And How Should I Use It?https://www.income.com.sg/blog/srs-and-retirement-planning?gclid=EAIaIQobChMItsfJzb7H6QIVh1ZgCh2ZUg07EAAYAiAAEgKJW_D_BwE

- CPF Investment Schemes https://www.cpf.gov.sg/Members/Schemes/schemes/optimising-my-cpf/cpf- investment-schemes