Section 1

Welcome

Welcome to Standard Chartered.

It is important that you read these Customer Terms before applying for or using any of our products.

They set out what you can expect from us, and what we expect from you.

When we talk about "we", "our" or "us" in these terms, we mean Standard Chartered Bank (Singapore) Limited, or other members of the Standard Chartered Group, as the context requires.

When we talk about "you" or "your" in these terms, we mean each person who has applied for, or is authorised to use any of our individual retail banking products. It also includes your joint account holder(s) and authorised person(s).

Words that are printed in italics are known as "defined terms". They have specific meanings which are set out Part I of these Customer Terms.

Need help ?

Section 2

Important information

For your convenience, this section highlights the most important information in our Customer Terms. You should still review our banking agreement in full.

1

Our Responsibilities

Standard Chartered Bank (Singapore) Limited operates in Singapore as a licensed bank.

We provide products to you in accordance with applicable laws and the requirements of our regulators. Our primary regulator in Singapore is the Monetary Authority of Singapore (MAS).

We are a member of the Association of Banks in Singapore (ABS) and adhere to the ABS' Code of Consumer Banking Practice. The Code outlines standards of good banking practice. These are guided by principles of accountability, fairness, privacy, reliability and transparency.

2

How we may communicate with each other

How we may contact you

| Type of communication | We consider them to be received by you: | Electronic banking notifications | immediately after we send the push notification or inbox notification. |

|---|---|---|

| immediately after we send the email. | ||

| SMS | immediately after we send the SMS. | |

| Phone or video call | at the time of the call. | |

| Prepaid Post | 3 business days after we post the letter. | |

| Personal delivery | on the date of delivery. |

-

When we send a communication to any one joint account holder, we’ll consider it sent to all joint account holders.

-

We may also post information on our website, our branches or ATMs, or in daily newspapers.

-

If you update your contact details with us, we may update them across all your banking products. We may send confirmation of the update to both your new and old contact details.

-

If we think your contact details are wrong, we may stop using them to reach you.

Changing your contact details

-

Generally, you may contact us in the following ways:

-

our mobile banking app or online banking inbox

-

our online self-help services on our website

-

SC Chat (chatbot and live chat) on our website

-

(for Priority Banking customers only) via email or designated platforms like MyRM

-

calling our hotline

-

visiting any of our branches

-

On certain matters, we will ask you to contact us in a specific way. If we ask you to contact us "in writing”, this can also include electronic communications.

How you may contact us

Recording our communications

3

What you need to notify us of

-

any of your information changes, including if you change your country of residence;

-

any information you provided to us becomes incorrect;

-

any of the statements in Clause 14(a) is no longer true;

-

you suspect your account, device, card or security details are compromised;

-

you notice errors in statements or electronic alerts that we have sent you; or

-

you receive funds that you're not entitled to.

You must notify us right away, if:

4

How to activate a kill-switch

The "kill-switch" lets you quickly suspend electronic banking services to your account. If you think your account or any security details have been compromised, call (+65) 6747 7000 and press on the option to activate the “kill-switch” immediately.

You will then need to go to one of our branches to reset your electronic banking services.

5

What you may be responsible for when using our banking

products

-

we have agreed to cover such losses;

-

they are caused by our negligence or fraud; or

-

applicable laws require us to cover them.

We will process instructions which we believe to have been given by you, even if you may not have consented to or known about them. Please refer to Clause 31 to understand this in more detail.

Using our products has risks. You are responsible for any losses that you suffer from using our products unless:

If we are responsible, we will only cover your direct losses. We will not cover any of your indirect losses, or any loss of profit or revenue.

6

When your deposits are insured under the Deposit

Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to SGD100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

7

How we may change our terms

We may change our terms and product features (including interest, fees and charges) from time to time. We may make these changes when:

-

we want to improve or expand our product offerings

-

applicable laws change

-

our business, operations or systems change

-

the costs of providing a product change

When we change our terms, we will usually give you at least 30 days’ notice. If you don’t agree with any change, you may close your account or cancel your product. Otherwise, we will take it that you agreed to the change. The latest versions of all our terms will always apply.

8

How our banking agreement may end

We may close your accounts by giving you at least 30 days’ notice. You may close your accounts by giving us at least 5 days’ notice.

9

Complying with laws, sanctions and other policies

You must comply with all applicable laws which apply to our banking agreement and your use of our products. You must not use any of our products for any improper or unauthorised purposes. For example, you must not use any of our products for money laundering, or allow anyone to use your account without our express agreement.

We comply with applicable laws when we provide you with our products. You agree that we may act (or refuse to act) in any way we consider appropriate to comply with or avoid breaching applicable laws.

10

Additional terms that apply to non-Singapore residents

If you are not a resident of Singapore, additional terms may apply. In some cases, we may not be able to provide you with some products, or may need to close your accounts

Section 3

General terms

PART A Your journey starts here

11

Apply for product(s) which suit your needs

You can visit our website to browse all our products, or contact us for more details about them. You then need to submit an application for the products you want to use. By submitting an application, you agree to these Customer Terms, the relevant product terms and conditions, our Privacy Notice, our Pricing Guide and any other terms we may specify.

12

Provide your information

What information do you need to provide

- Please provide us with the information requested in the application form or by our staff. We use this to assess your application and to provide you with our products.

Your information must be correct

- You must provide information that is correct, complete, up-to-date and not misleading. We are not responsible for verifying this. You must also inform us in writing right away if any of your information changes. To ensure accuracy of the information we have on record for you, we may at any time, update such information if we have reason to believe that it is incorrect.

How we collect, use and disclose your information

-

You consent to us collecting, using and disclosing your personal information for the purposes and to the parties identified and described in our Privacy Notice. In addition, you also consent to us collecting, using and disclosing your customer information for the purposes and to the parties identified in our Privacy Notice (as if such customer information constituted personal data for the purposes of the Privacy Notice).

-

Upon your death, mental incapacity, bankruptcy or other incapacity, we may share your information with your legally appointed representatives. We may also share your information with your immediate family member(s) to allow them to make payment on your account before a representative is legally appointed.

-

If any of the information you provide to us includes the personal information or other information of another person, you must get their consent before sharing their information with us.

-

You consent to us or our business alliance partners sending you communications to market our products, and products offered by our business alliance partners. You may choose to opt out of receiving such communications at any time.

-

If you register for or participate in any of our promotions, we may use your information to administer the promotion.

- If you do not provide information that we request, we may not be able to provide you with our products and may end our banking agreement.

What happens if you do not provide the information requested by us

13

How we process your application

We will review your application and inform you if it is approved or not. If we reject your application we do not have to disclose the reasons.

When we approve your application or when you use our products, you agree to our banking agreement. Each time we approve a new application, we will enter into a separate banking agreement. Our banking agreement is made up of:

| Our Banking Agreement |

|---|

| your application: | The application you submit for the product | |

| our approval | our confirmation to you that your application is approved, any letter of offer, facility letter or other document offering to provide you with the product | |

| Customer Terms | These Customer Terms | |

| Product Terms | terms and conditions specific to a product, which are available on our website | |

| Guidelines | guidelines that we issue to you or publish on our website on the use of a product | |

| Pricing Guide | pricing guide setting out applicable fees and costs available here | |

| Privacy Notice | our policy for the collection, storage, use, disclosure and retention of your personal information, which is available here | |

| other documents | any other documents or terms and conditions which we may identify |

If there are inconsistencies between any of the documents in our banking agreement, the specific terms will take priority over these Customer Terms.

If there are inconsistencies between the English version and any translations of any documents in our banking agreement, the English version will apply.

14

Your representations and warranties to us

-

you have the power and authority to enter into our banking agreement;

-

you are not entering into our banking agreement as an agent, trustee or nominee unless we agree otherwise;

-

your obligations under our banking agreement (including any security document and the obligations of any security provider) are valid, binding and enforceable;

-

you (or any security provider) will not breach any law, authorisation, or agreements by entering into or complying with our banking agreement;

-

your authorised person(s) have agreed to the terms of our banking agreement; and

-

you own the assets, and have the right to carry on any business, that you have disclosed to us.

When you apply for a product, and each time you use a product, you represent and warrant that:

You must notify us if any of the above statements are no longer true. We will review each case and may withdraw or impose additional conditions on your products.

Section 3

General terms

PART B Your account

15

Opening your account(s)

We will open an account for you to use our products. We may open separate accounts for different products. You can start using your account and products after completing our activation steps.

-

We will operate your account according to your instructions.

-

If we agree, you can appoint someone else to operate your account on your behalf, and can limit the scope of their authority. This is called an “authorised person”. We will act on their instructions as if they were from you.

-

You are responsible for the acts and omissions of your authorised person(s).

-

You can request in writing for us to change or cancel the authorisation you have given to each authorised person. The change or cancellation will take effect within 7 business days from when we receive your request. Until it takes effect, we will follow the existing authorisation.

-

A joint account is an account that is held in the names of two or more people. Each person is called a "joint account holder". All joint account holders are liable to us jointly and separately for the joint account. This means that each of you may be individually responsible for the whole account including any amounts owed to us.

-

You may choose to operate a joint account with either “single operating authority” or “joint operating authority”. Otherwise, “single operating authority” will apply by default.

-

All joint account holders can use our full electronic banking services

-

We will accept instructions from any joint account holder (however, to remove a joint account holder, all joint account holders must give the instruction in writing)

-

All joint account holders can only use our electronic banking services to view the joint account information

-

All joint account holders must give us the same instructions together in writing (we will not accept instructions from only one joint account holder)

-

If we receive money for any one joint account holder, we can credit the amount to the joint account.

-

We may suspend a joint account if:

-

a joint account holder requests that we stop taking instructions from any other joint account holder;

-

we receive conflicting instructions from joint account holders; or

-

any joint account holder becomes insolvent, incapacitated or loses mental capacity.

-

If a joint account holder is insolvent, incapacitated or loses mental capacity, we will take instructions from the legal representative of that joint account holder on their behalf. We will continue to apply the existing account operating authority.

-

If a joint account holder dies, the surviving joint account holder(s) will obtain title to the joint account. We will then only accept the instructions of the surviving joint account holder(s).

Joint accounts

Single Operating Authority

|

Joint Operating Authority

|

|

|

|

|

Section 3

General terms

PART C Electronic banking services

16

How our electronic banking services work

-

You can use our electronic banking services to access your account, give instructions to us, or get information about your account. Here's how:

-

through our mobile banking app

-

through online banking on our website

-

through our cash deposit machines and ATMs

-

sending us instructions via email or designated platforms like MyRM (for Priority Banking customers only)

-

through any other electronic banking platforms we may provide to you or electronic means that we may designate

-

The types of electronic banking services available to you depends on your account or product. You can access these electronic banking services once your account is opened. You may need to activate some of these services before you can use them.

-

Our electronic banking services may not be available everywhere. For example, you will not be able to access them in countries subject to economic and trade sanctions.

How you can use electronic banking services

Who can use our electronic banking services

- To use our electronic banking services, you must be the account holder or an authorised person. You must also be 18 years old and above. For those under 18, we may offer electronic banking services with limited functions.

Guidelines to using electronic banking services

-

We both agree to follow the E-Payments User Protection Guidelines, including complying with our respective duties. The MAS issues these guidelines to set out our respective responsibilities when using electronic payments.

-

We may also issue separate guidelines on our website for using electronic banking services. You must follow these guidelines.

How we may update our electronic banking services

- We continually update our electronic banking services to provide you with the best quality banking experience. This may involve adding, removing or enhancing functions and features.

When our electronic banking services may be unavailable

-

We try to ensure that our electronic banking services are always available. However, there may be interruptions or delays from time to time, or certain services may have shorter operational hours.

-

We may also perform routine or non-routine maintenance or upgrades to our systems. During these periods, our electronic banking services may be unavailable.

-

Our electronic banking services may also be unavailable for reasons beyond our control. Here are some examples:

-

excess demand on our systems

-

your devices not working properly

-

downtime of third-party providers and communications networks

-

legal or other regulatory reasons

-

We will try to notify you of when our electronic banking services may become unavailable.

17

Risks of using electronic banking services

When you use electronic banking services, you accept these risks:

unauthorised persons may use electronic banking services to give instructions on your account;

communications between us may be delayed, intercepted or compromised; and

malfunctions, viruses or malware may compromise your devices, our systems or third-party communications networks which are used to provide our electronic banking services.

18

How we verify your identity

Before you access your account, use a product, or submit or authenticate an instruction through our electronic banking services, we will verify your identity by checking your security details. For products where we accept instructions via email, we will assume an instruction was sent by you if it is sent from your registered email.

Security details include:

| Security code | any confidential code, such as:

your online-banking username and password

your PINs

the details on a card such as the card number, expiry date or CVV

an OTP that we send to you

a Mobile Key that is generated via our mobile banking app |

| Biometric identification | The fingerprint, face or other unique identification that is registered on your devices or with a government registry |

We may update these identity verification methods as we enhance the security of our electronic banking services.

Once we have verified your identity, we will assume that all communications and instructions we receive were sent by you. You agree that we may then let you access your account or act on your instructions without taking any further steps to confirm your identity.

You may change or cancel your security details through mobile banking, online banking, or by contacting us.

19

Your duties when using our electronic banking

services

It is your responsibility to keep your devices and security details safe. You can do so by taking the precautions below and following your obligations under the E-Payments User Protection Guidelines and any other guidelines that we issue. If you don't, you increase the risk of your account being compromised, and you will be responsible for any losses which result.

You must take these precautions:

Keep your devices secure and ensure that your devices and accounts are protected with strong passwords.

Log out of your account after using online banking or mobile banking.

Keep the software and operating systems on your devices updated.

Only download apps and app updates from official app stores such as the Google Play Store or the Apple App Store.

Do not use electronic banking services on devices that have been modified outside the vendor supported or warranted configurations, including “jail-broken” or “rooted” devices.

Do not share your security details with anyone you don’t know, even if they say they are from Standard Chartered Bank or the authorities.

Do not click on any links or access any links through a QR code in any SMSes or emails purporting to be from Standard Chartered Bank. We will never ask you to click on any links or scan QR codes in our SMSes or emails.

Be aware that there are additional risks if you do the following:

Use public or shared devices to access electronic banking services

Allow others to operate electronic banking services on your behalf

Share your security details and account information even with people you know and trust

20

What you need to do when you face security issues

If your devices, account or security details are compromised, please call (+65) 6747 7000 and press the option to activate the “kill-switch”. This will temporarily suspend your electronic banking services, but you will still be able to access your accounts at any branch or ATM. You can reset your security details and reactivate your electronic banking services by going down to any of our branches.

Section 3

General terms

PART D Cards

21

How we issue cards to you

We may provide you with a debit card or credit card. Please follow our instructions to activate your card before using it.

Each card we give you is our property. You cannot transfer it to anyone else.

If your card is lost, stolen or damaged, you must notify us as soon you can so we can cancel and replace your card to prevent any unauthorised transactions.

22

How you can use your cards

General

- You can use your card to pay for goods and services, withdraw cash, and perform other transactions.

Signature

-

Please sign on the back of your card when you receive it. This helps merchants to verify your signature on the sales receipt when you make purchases.

-

However, we cannot guarantee that every merchant will properly check your signature. You are still responsible for any transactions made on your card, even if it is not your signature on the sales receipt.

-

You can ask us to change your transaction limit or credit limit at any time, but the limits cannot be higher than what we allow. Requests to increase credit limits are subject to our approval.

Transaction and Credit Limits

23

Features of your cards

Cards may have different features and functions, which we may update from time to time. Some features or functions are provided by our third-party partners.

-

You can make contactless payments by tapping your card on a point-of-sale terminal. There may be limits on the amount you can pay using contactless payments.

-

There is a higher risk of unauthorised transactions being made through contact safe and monitor your transaction alerts.

-

ABU and VAU programs apply to MasterCard and Visa debit and credit cards. These programs automatically update any card-on-file information you have with participating merchants who are enrolled to the programs for your recurring and one-time payments.

-

When we reissue or replace your card, your new card details will be automatically updated with the participating merchants. This will allow your recurring transactions with these participating merchants to continue, unless you had reported your previous card as lost, stolen or compromised by fraud.

-

Your card will be automatically enrolled for ABU or VAU. Please refer to this webpage for further details regarding the use of ABU/VAU.

Contactless payments

Mastercard Automatic Billing Updater (ABU) and Visa Account Updater (VAU)

24

What happens when you seek a refund from a merchant

When you ask for a refund for purchases made with a credit card or debit card, the merchant will issue a credit voucher to their bank. We will credit your credit card account or debit card linked account once we receive the voucher or other notification from the merchant’s bank.

25

How debit cards work

- Transactions on your debit card are directly deducted from your debit card linked account. This means that transactions which exceed the balance in your linked account will not be allowed.

- Some merchants are required to pre-authorise debit card transactions. If so, the transaction is processed in the following way:

-

The merchant informs us of the estimated amount of the transaction. This is called a blocked amount. We will place a hold on your linked account for the blocked amount.

-

The blocked amount may be different from the actual transaction amount. When the transaction is processed, we will debit your linked account for the actual transaction amount and release the blocked amount.

-

When you use a debit card overseas, you must comply with exchange controls and other applicable laws in the foreign country.

-

If the overseas ATM does not allow you to choose which account to debit, we will select the account to debit based on our usual business practices.

Direct debit

Pre-authorisation procedure

Using a debit card at overseas ATMs

26

How you can use your cards through a Digital Wallet

When you add your card to a "Digital Wallet", you'll be able to use your smart phone, tablet, smart watch or other compatible device to make contactless payments without your physical card.

-

To add your card to a Digital Wallet, follow the enrolment instructions set out in the Digital Wallet. You must make sure the card is valid and there are no issues with your account. When your card is renewed, it will be automatically updated in your Digital Wallet once you activate it.

-

Not all cards can be used in a Digital Wallet, and we may decline certain enrolments.

-

If you enrol a supplementary card to a Digital Wallet, all relevant transaction and other notifications will be sent only to the principal cardholder.

-

The Digital Wallet is provided by a third-party Digital Wallet Provider and works only on compatible devices. You may need to agree to the Digital Wallet Provider's terms, including terms relating to your privacy.

-

Since we do not provide the Digital Wallet, we will not be responsible for any operational issues.

-

Sometimes, your use of your Digital Wallet may also be disrupted by factors outside of our control.

- There is a higher risk of fraudulent transactions being made through a Digital Wallet. You are responsible for all transactions made with your card in the Digital Wallet, so keep your security details safe and let us know as soon as reasonably possible if your device is compromised.

- If you need to remove your card, use the Digital Wallet's built-in functions or contact the Digital Wallet Provider or us. If you remove your card from a Digital Wallet, you will need to add the card back before you can use it again.

How to add your card to your Digital Wallet

Digital Wallet Providers

Your responsibilities when using a Digital Wallet

How you can remove your card from your Digital Wallet

27

How your cards may be cancelled

You may request to cancel a card anytime. We may also block or cancel a card if we believe that it has been compromised.

Section 3

General terms

PART E Using your account

28

Instructions

What are instructions

- Instructions include asking us to:

-

place, transfer or withdraw money from your account by both electronic and non-electronic means;

-

change any information we have on record for you;

-

take instructions from your authorised person and change or cancel such authorisations;

-

provide account statements or other information; and

-

set preferences for, suspend, or cancel your account or a product.

How you may give us instructions

-

You may give instructions via mobile banking, online banking, in writing, or in person. We may ask you to use a specific method for certain instructions.

-

You may give us standing instructions electronically for some types of transactions. We will follow these standing instructions until you change or cancel them.

-

You must ensure that your instructions are timely, correct and complete. We will not independently check them for you.

How we may act on your instructions

-

You authorise us to act on any instructions that we believe you or your authorised person has given. We are not responsible for conducting any further checks into these instructions before acting on them.

-

If you have any concerns about an instruction, including whether we have received it, please contact us.

-

We will do our best to act on your instructions according to our usual business practices.

-

Sometimes, we may not accept or execute your instructions because of applicable laws or our usual business practices. We will try to inform you when this happens, but some laws may prevent us from doing so, for example, anti-money laundering and anti-terrorism laws.

-

Here are examples where we may act or refuse to act:

We may: |

We may refuse to act on an instruction if: |

|

|

|

- In these cases, we will not be responsible for any losses you may suffer as a result of us executing or refusing to execute an instruction.

What happens if we receive your instructions outside our business hours

- If we receive an instruction on a non-business day or after a cut-off time on a business day, we'll treat it as received on the next business day.

29

Payment instructions

How you may give us payment instructions

-

You may instruct us to transfer funds in ways that we may specify. You may also transfer funds using our electronic fund transfer services.

-

You can ask us to change your transaction limits at any time, but these limits cannot exceed what we allow.

-

We cannot guarantee that fund transfers will be instant. To get your money transferred in time, send us your fund transfer instructions well before the date of your intended transfer.

-

If you schedule multiple transfers or payments, we will decide which ones to process first.

Overdrawing your account

-

An overdrawn account happens when you try to withdraw more money than you have in your account. This can also happen when you exceed your overdraft limit, if you have one.

-

Sometimes we may allow your account to be overdrawn, but we do not have to.

-

It is your responsibility to keep track of your account balance and avoid overdrawing your account. If you do overdraw your account, we will charge you interest on the amount overdrawn.

How you may stop or reverse a payment instruction

-

In general, once you give an instruction, it cannot be cancelled and you are bound by it.

-

We understand that you might on occasion want to stop or reverse a transaction that you have instructed us to perform. If you ask us in writing to stop or reverse a transaction, we will try to do so but it might not always be possible. We may charge a fee for some requests, for example, if you ask us to stop a cheque payment.

30

Monitoring your accounts

Electronic alerts

-

We will notify you whenever a transaction is made on your account, according to your alert settings. You must monitor these notifications and inform us as soon as you can if there is anything wrong. We may send you electronic alerts for your transactions right away, or in batches (if permitted by applicable laws).

-

We will also notify you of other important information concerning your account or products via electronic alerts.

-

We may notify you via:

-

push notifications to your mobile banking app;

-

inbox notifications to your online banking account; and/or

-

emails or SMSes.

-

Ensure that push notifications are enabled on your mobile device to receive them.

-

We are required by law to notify you of certain types of transactions. For other types of transactions, you can choose what notifications you want to receive. For example, you can choose to be notified only for transactions above a certain amount. Please refer to this webpage for more information. However, if you choose not to receive certain electronic alerts, we will not be responsible for any losses you may incur because you could not monitor these transactions.

-

You consent to receiving, and will receive electronic alerts even if you register your contact information with the national Do Not Call Registry.

Account statements and other information

-

We will provide you with account statements and other information relating to each product according to our usual business practices. By default, we will send you account statements electronically. You may request for paper copies but there may be extra charges.

-

The transaction date that appears on your account statement may sometimes be different from the date on which you made the transaction. This is because transactions completed on a non-business day or after the "cut-off" time on a business day may be processed on the next business day.

-

If you think your account statement contain errors, let us know within 14 days of receiving the account statement. Otherwise, we will take it that you've confirmed the account statements are accurate.

-

You may also view details about your transactions and account balances through mobile banking, online banking or at our ATMs (account balances only). However, the information may not always be updated in real-time. This is because there may be transactions which are still being processed.

31

What happens if something goes wrong

What you need to do if there is a transaction you wish to dispute

-

You must check your electronic alerts, account statements and other information as soon as you get them.

-

Let us know right away if there are any unauthorised, fraudulent or erroneous transactions on your account. We will try to help you but cannot guarantee that we will be able to reverse the transaction or recover the amounts involved.

How you can dispute a transaction

- You’ll need to:

-

tell us right away about the transaction, or give us a reasonable explanation for any delay in reporting;

-

prove that you did not authorise or consent to the transaction; and

-

assist us and provide any information that we ask for. Sometimes, we may require you to make a police report and send us a copy.

- Otherwise, we may not consider your claim or dispute.

- If you dispute transactions on your credit card, you can withhold payment for those charges until we complete our investigations. If we find that you are still responsible for these transactions, you will need to pay the disputed charges and any late fees.

You may withhold payments for disputed credit card charges

Your responsibility for transactions

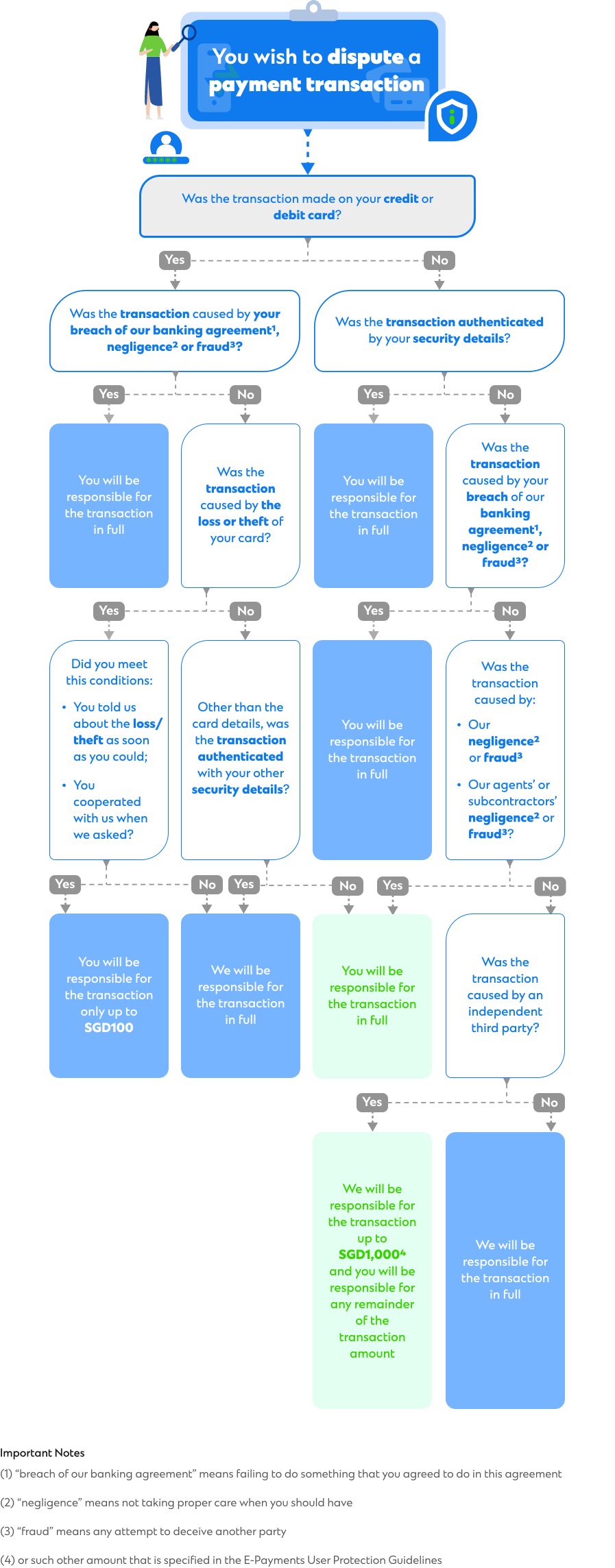

- In general, you are responsible for all transactions made on your account. This includes any transactions made based on instructions which we received according to our banking agreement, or instructions which we verified using your security details. You are responsible for these transactions even if you did not consent to them, or if you were defrauded into making them. However, if you did not consent to, or know about a transaction, there are exceptions and limits on your liability, which we explain below.

-

Unauthorised transactions caused by our negligence or fraud

- We will be responsible for your direct losses if an unauthorised transaction is caused by our negligence or fraud. However, you will still be responsible for the full transaction amount and any other losses if they were also caused by your breach of our banking agreement, negligence or fraud.

-

Unauthorised payment transactions caused by third parties

- We will be responsible for your direct losses if an unauthorised payment transaction is caused by our agents or subcontractors. If the unauthorised payment transaction is caused by an independent third party, we will be responsible up to the amount specified in the E-Payments User Protection Guidelines. However, you will still be responsible for the full transaction amount if the unauthorised payment transaction was also caused by your breach of our banking agreement, negligence or fraud.

-

Unauthorised payment transactions on lost or stolen card

-

If your card is lost or stolen, you will only be responsible for up to SGD100 for any unauthorised payment transactions on the card if:

-

you tell us about the loss or theft as soon as you can;

-

you cooperate with us when we ask (e.g., filing a police report, providing information and documents that we ask for); and

-

you were not negligent and did not act fraudulently.

-

The flowchart below is intended to help you understand who is responsible if there is a disputed payment transaction on your credit card or debit card, or from your account. Please read the terms above to ensure you understand our respective responsibilities.

What happens if you receive money by mistake

-

If you receive any money or other asset by mistake, you must let us know straight away. You may not keep or use any of the money or assets which do not belong to you as it may be an offence under the Penal Code. You must assist us in any investigation or request for the return of funds.

-

You agree that we may cancel, reverse or debit any payment made to your account if we have reason to believe that the payment was made by mistake. We may inform you either before or after such adjustment is made.

You must not take advantage of any mistake

- If there is any mistake in your account, you must let us know straight away. You must not do anything to improperly take advantage of the mistake. If you do so, you will be liable to account to us for any profits that you make, and must indemnify for any costs or losses that we incur.

Section 3

General terms

PART F How we charge for our products

32

Interest, fees, charges and other costs

We provide some of our products to you subject to interest, fees, charges and other costs. You can find them in our Pricing Guide.

If you do not make your payments on time, we will charge you additional fees and interest at the default rate on the overdue amount until it is paid.

When we lend you money or give you credit, we will charge interest at the applicable rate. Interest rates can be based on a benchmark rate. We may change the benchmark rate to another generally accepted rate at our discretion.

If we agree to capitalise interest or charge default interest, we will add the unpaid interest to the principal amount. You will then owe interest on the total amount.

33

How interest, fees, charges and other costs are

paid

Amounts due must be paid in full without set off

- You must pay any amounts due in full and in the specified currency. You cannot apply any set off or deductions to your payment, unless required by law. If any deduction is required by law, you will also need to pay us the shortfall such that we receive the full amount due.

- We may debit everything you owe us from any of your accounts. We can pay these amounts in any order we choose, unless we have specified otherwise.

-

We calculate amounts that you need to pay us without including any taxes or other government charges. You must also pay for any taxes or charges which may apply.

-

If a law requires you to withhold tax from a payment to us, you must pay us any subsequent shortfall so that we receive the full amount due (as if the deduction was not made). You must pay the tax to the relevant authority and give us the original receipts.

We may debit what you owe us from your accounts

Government charges and tax

Payments into a suspense account

- We may place any payments we receive into our suspense account, where the monies will be held temporarily, if we need to protect our rights against other amounts you owe to us.

- When you give us an instruction in relation to a product, we may place a hold on the relevant amounts in your account until the payment due date. We hold these amounts as security for your settlement obligations. You will not be able to withdraw or use these amounts while they are on hold.

We may place a hold on your account for amounts payable

Section 3

General terms

PART G Ending our banking relationship

34

How you may close your account or cancel a product

You can close your account, or cancel any product by giving us at least 5 business days' notice in writing.

35

How we may close or convert your accounts

Termination by us on notice

- We may close your account or cancel a product by giving you at least 30 days' notice in writing.

- We may convert or combine any of your accounts into another type of account at any time. We will give you at least 30 days' notice in writing before doing so. If you disagree, let us know before the notice period ends. We may then have to close the relevant account(s). If you do not object, we will go ahead with the change and issue you a new account number.

Conversion of accounts

36

What happens if your account is closed or product is cancelled

If your account is closed, or if any of your products are cancelled, then:

-

you will no longer be able to use the account or product;

-

you must immediately pay all amounts that you owe to us; and

-

this banking agreement will end with respect to the relevant account or product, but any rights and obligations which arose before this will continue.

37

Other actions we may take

We may suspend your account

- We may suspend your accounts or products, block amounts in your accounts, or impose other restrictions. We may do so at any time if, in our view:

-

your account is inactive for some time;

-

you have acted fraudulently, dishonestly or contrary to applicable laws;

-

you have breached our banking agreement or used our products improperly;

-

you become insolvent or any of your assets are subject to insolvency proceedings;

-

we are required to do so by applicable laws; or

-

we believe it is necessary to prevent any unlawful activity.

- In these cases, we may also withhold or clawback any payments, including interest or cashback, from your account. We will try to notify you before taking such actions, but may not always be able to do so.

We hold your assets with us as security

- We hold all your assets with us as security under a banker’s lien for all amounts that you may owe us.

We may set-off amounts that you owe us

- If you owe us money, we may deduct these amounts from any monies that you have with us or any other member of the Standard Chartered Group, including from joint accounts. We may also sell or deal with your assets to cover any amounts that you owe us.

We may clawback or withhold payments

- We may refuse to pay or clawback amounts from your accounts (including interest, cashback or rebates) if any of the following happens:

-

You have used our products improperly.

-

You have acted fraudulently, dishonestly or unlawfully.

-

We have suspended your account under Clause 37(a).

We may take enforcement actions

- We may take any action we consider appropriate to enforce our banking agreement or our security. This includes engaging third party agents to collect amounts that you owe us, or commencing legal proceedings against you, your security provider, your assets or your security provider's assets. You agree to indemnify us for all costs that we may incur in taking these actions.

Section 3

General terms

PART H Other things you should know

38

We act on business days

We generally act only on business days, unless we say otherwise. If we are asked to do anything on a non-business day, we may do it on the next business day.

39

Currency conversion

We will use our prevailing exchange rates when we convert one currency to another, and the rate we apply is final. You will be responsible for any shortfall from such conversion.

40

Intellectual property rights

All content relating to our products, including any electronic banking software, are owned by us or licensed to us. We grant you a non-transferable license to use this content as far as required to use our products. You can use this content only as allowed by our banking agreement. You must not use or enable any third party to use this content in an improper way or for any commercial purpose.

41

Third party service providers

We rely on third party service providers to help us provide our products. This includes our vendors, sub-contractors, clearing systems and payment networks. We try to ensure that they act in a way that allows us to fulfil our responsibilities to you. However, we are not responsible for any losses that they may cause.

42

Conflicting claims

If there are conflicting claims on your account, we may place a hold on your account while we take appropriate legal steps. We will follow any legal determination that is obtained. We will not be responsible for any losses that may result.

43

Assignment and other dealings

You must not assign or transfer your rights and obligations under our banking agreement to anyone without our consent.

We may assign any of our rights and obligations under our banking agreement. You agree to sign and provide any documents we reasonably require for this purpose. If we do this, you may not claim against the new party any set off or other rights you have against us.

44

Cumulative remedies

The rights and remedies in these terms are in addition to any other legal rights or remedies we may have. We can use any one or more of these rights and remedies at any time.

45

Indemnity

You agree to indemnify us from any losses (including our full legal costs) that we may suffer if:

-

you breach this banking agreement,

-

you use our products improperly;

-

you act negligently or fraudulently; or

-

you break any applicable laws.

46

Waiver

Any waiver of a provision in our banking agreement must be given in writing and signed. It will only apply for its stated purpose.

47

Severability

If any provision in our banking agreement becomes illegal, void or unenforceable, the rest of the agreement will still apply without affecting the validity of the remaining terms.

48

Third party rights

Our banking agreement does not give rights to any non-parties, except members of the Standard Chartered Group and any successor or assignee of this banking agreement. Your rights under this banking agreement are only against Standard Chartered Bank (Singapore) Limited or its successor or assignee.

49

Our records are conclusive

We may keep physical or electronic records of anything relating to our banking relationship, including instructions and communications. We may rely on these records as evidence in legal proceedings. You agree not to challenge the authenticity of any electronic records, or the admissibility of all records as evidence.

50

Governing law

Our banking agreement is governed by the laws of Singapore.

51

Jurisdiction

You may only commence proceedings against us in the Singapore Courts. You agree that the Singapore Courts are the most appropriate and convenient courts to settle any disputes relating to proceedings you commence against us. You expressly submit to the jurisdiction of the Singapore Courts, and you waive any rights to argue otherwise. You agree that we may commence proceedings against you in the Singapore Courts and in any other jurisdiction where you have assets. You further agree that we may commence proceedings in one or more jurisdictions at the same time.

52

Serving documents

We may serve any legal process or document in the following ways:

| Method | Deemed date of service | |

|---|---|---|

| Personal delivery | leaving them at your address last known to us | on the date they are sent |

| Post | sending them to your address last known to us by registered post, or by ordinary post if such address is a Post Office Box | on the following day after they are sent |

| Electronic mail | sending them to your last known email address | on the date they are sent |

| Electronic banking notifications | sending them via push notification or inbox notification | on the date they are sent |

| Social media or other online messaging platforms | sending them via a direct message or post to any of your social media accounts or online messaging platforms known to us | on the date they are sent or posted |

| Publication | publishing a notice in an English newspaper with general circulation in Singapore | on the date it is published |

If we serve you any legal process or document through the above methods in Singapore or outside Singapore, you agree that it will be good and effective personal service even if you do not receive them, or if they are returned to us undelivered.

You agree that we may serve any legal process or document outside of Singapore. You agree that we may also serve any legal process or document on you in any other way that is legally allowed.

53

Complaints

We aim to provide excellent customer service. If you think we have failed, let us know so that we can try and put things right. Your feedback helps us to improve.

If you are unable to resolve your complaint with us directly, you can approach the Financial Industry Dispute Resolution Centre (FIDReC) for an independent review. More information is available at FIDReC’s website.

54

Mediation

Should you wish to commence legal proceedings against us in the Singapore Courts, you must first submit the claim to the Singapore Mediation Centre if your claim amount is less than SGD150,000. We both agree to participate in the mediation in good faith to settle the matter.

Section 3

General terms

PART I Meaning of words

account statement means a statement setting out the details of transactions made on your account, your account balance and any other relevant information about your account

applicable laws means any law, regulation, economic and trade sanctions, regulatory or governmental direction or policy, guideline or code of practice of any government organisation or industry body or association, court or tribunal ruling, or Standard Chartered Group policy applicable to any part of the Standard Chartered Group, whether or not having the force of law.

ATM means an automatic teller machine that accepts the card including machines belonging to the shared atm5 network, which is a shared ATM network operated by us, Bank of China, Citibank, HSBC, Maybank and State Bank of India.

ATM card means the card we issue you to access an account through an ATM using a PIN that you set.

authorised person means any person you authorise and we approve to operate an account on your behalf and includes that person's personal representatives, executors, administrators, successors, substitutes (including by novation) and assigns and our banking agreement binds those persons and the joint account holder, where applicable.

banking agreement means, for a product, the agreement between you and us made up of the applicable documents set out in Clause 13(b).

business day refers to a day when banks are open for general banking business in Singapore excluding weekends and designated Public Holidays.

card means an ATM card, a debit card, or a credit card or all of them.

card association means Visa International, MasterCard International or any other card association.

costs includes any expenses we have incurred in engaging any agents, external advisers or service providers including consultants or legal advisers in the course of providing you with products or exercising any rights we have under this banking agreement.

credit card means a card we issue you with the branding of Visa International, MasterCard International or any other card association that you can use to make payments, cash withdrawals, cash advances or other similar transactions on credit according to the relevant credit card product terms.

customer information includes any information we receive, hold or collect about you, your account, your financial information and your interactions with us and any third parties. Such information includes any “customer information” as defined in the Banking Act 1970.

debit card means a card we issue you with the branding of Visa International, MasterCard International or any other card association that you can use to make payments by direct debit from a linked account. A debit card is also an ATM card.

default rate means the rate of interest we charge on overdue amounts for a product (which is higher than the usual interest rate).

device means any electronic device such as a computer, smart phone, tablet, smart watch which you use to access our electronic banking services.

economic and trade sanctions means any economic sanction or trade control imposed by any governmental or intergovernmental entity or agency with responsibility for imposing, administering or enforcing sanctions and/or trade controls with jurisdiction over the Standard Chartered Group, and any policies we apply as a result of any economic sanctions or trade controls issues by any of the above.

electronic alerts means a notification which we send you via SMS, email, push notification, inbox notification, or other electronic forms of communication to alert you to instructions you have given or transactions you have performed.

electronic banking service refers to any interaction with our banking products using electronic methods that we may allow or enable, and includes anything set out in Clause 16(a).

inbox notification means an alert that is sent to your online banking inbox to notify you of transactions or any important information concerning your accounts or products.

insolvency or insolvent means, for a person, the commencement of any legal proceedings or other step in relation to:

-

suspension of payments, bankruptcy or scheme of arrangement with creditors;

-

the appointment of a receiver, administrator in respect of that person or any of their assets;

-

attachment or enforcement of any security interest over their assets,

-

or any thing which has a substantially similar effect to any of these things happening in any jurisdiction.

linked account means an account which is linked to a card.

mobile banking means the use of the services and functions on our mobile banking app to electronically access, manage and use your accounts and products.

mobile banking app means our designated mobile banking application which you can download on your mobile device to access our electronic banking services.

mobile device means a device on which you download our mobile banking app to use mobile banking.

online banking means the use of the services and functions on the internet banking platform on our website to access, manage and use your accounts and products.

OTP means one time password, a unique randomly generated single use password which we send to you via SMS, email or other electronic mode of communication to authenticate certain instructions or transactions.

payment transaction means any electronic placement, transfer or withdrawal of money, but does not include any transactions on our online trading platforms.

personal information means any information that identifies any particular individual and includes personal details. Such information includes any “personal data” as defined in the Personal Data Protection Act 2012.

product means each facility, product or other service we provide you with under our banking agreement(s). It includes any component comprising the product including an account or promotion.

push notification means an alert generated by our mobile banking app to you on your mobile device to notify you of certain transactions or any other important information concerning your accounts or products.

security means any security interest granted to us for the payment of money or performance of obligations including a mortgage, charge, pledge, lien or guarantee, or indemnity.

security details means any personal identifiers which we may use to verify your identity before we allow you to access your account or take instructions from you.

security provider means each person who provides security.

Standard Chartered Group means each of Standard Chartered PLC and its subsidiaries and affiliates, including each branch or representative office.

tax means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of it).

transaction means any action we take according to your instructions on an account or a product under this banking agreement.

unauthorised payment transaction means any payment transaction initiated without your actual or imputed knowledge and implied or express consent.

usual business practices means our internal policies and procedures which we apply to provide our products and comply with applicable laws. These policies and procedures include our: data privacy policy, security procedures, due diligence and any other policies and procedures that we or the Standard Chartered Group may set from time to time.

The singular includes the plural and vice versa.

Headings in our banking agreement are for convenience only and do not affect their interpretation.

A reference to:

-

a law includes any regulation, rule, official directive, request, or guideline (whether or not having the force of law) of any authority;

-

a document includes any variation or replacement of it; and

-

any thing includes any part of it.