The article is an educational piece to introduce Private Credit. For informational purposes only

Defining Private Credit for the layman

We are all very familiar with bonds.

In the context of constructing our own investment portfolio, we know that bonds

- provide us with a regular stream of income,

- tend to bring down the overall volatility of our portfolio, and

- if held to maturity, should give us back the par value1.

The issuer of these bonds could be a government, or a well-known company.

These bonds that you are probably thinking about – for example, a US Treasury bond, or a bond issued by a corporate –are known as tradeable bonds or OTC bonds2.

Investors can buy and sell these bonds – from the time they are issued, to just before they mature – in the secondary market. Thus, during the life of the bond, the price could be pushed up or down, based on demand/supply, interest rate developments or company-specific news3.

FYI: The US bond market is the largest bond market in the world, with the value of USD-denominated corporate, financial and government bonds exceeding US$47 trillion4.

Now imagine that YOU are a business owner, and you need to borrow some money to expand your business. Your company is not yet large enough to issue a bond, but you could do one or more of the following:-

- Borrow money from your bank (bank loan)

- Seek funding from your rich friends or non-financial institutions >> this is private credit

Okay, I’ve definitely over-simplified it. But you get the idea. Private credit is basically privately negotiated loans, which are NOT openly traded on the secondary market.

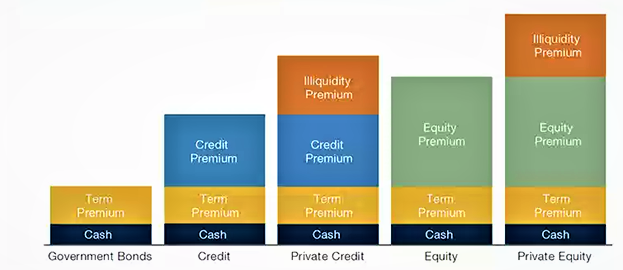

Because it is not as liquid, as a result, private credit tends to come with a higher yield to compensate for what is known as “illiquidity premium”5. See the chart below.

Source: Man FRM. For illustrative purposes only.

Source: https://www.man.com/maninstitute/why-pc-is-the-new-pe

At the moment, the most developed private credit market is also in the US. But Asia is quickly catching on, with nascent signs of growth in countries like Singapore and Australia.6

First, a history lesson

So why should we be interested in Private Credit right now? Well, if you didn’t already know, Private Credit has in fact emerged as an investment buzzword for 2022, having been hailed as one of the important ways a borrower can source for liquidity in the post Covid-19 economy7; and how a sophisticated investor might take exposure to an asset that offers some protection against inflation.

To flesh this out a bit more, we are in the midst of a rate hiking cycle, and obsessive fears of seven (or more) rate hikes this year have sent tradeable bond prices tumbling. Does it shock you to know that the price of the so-called “risk free” 10-year US Treasury bond has fallen 10% since the beginning of this year?

Long-time bond-heavy investors have already been burned once in March 2020 when the bond market imploded, and bond prices were dislocated for almost a good two weeks. Bond traders could not find bids to sell their bonds even if they wanted. It was total chaos and is not a scene that would be easily forgotten.

Since then, many yield-seeking investors have pivoted, shedding their heavy bond portfolios for more risky equity ones. They figured that the risk-return trade off from bonds just wasn’t worth it.

Besides, they were practically getting next-to-no-yield, but with volatility that were looking more and more like equity risk anyway.

Well, the pivot worked well for 2020-2021, but investors are finding themselves yet again in a bind now in 2022. The Ukraine war, runaway inflation and impending rate hikes are threatening to derail equity markets too!

Here’s where private credit comes in:

Interestingly, it is said that private markets tend to perform best in the aftermath of public market volatility.8

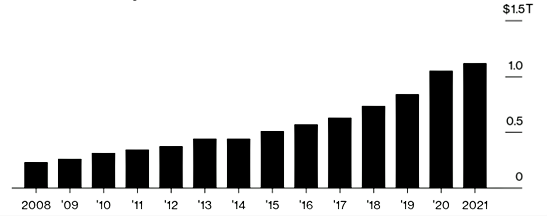

Therefore, it is not a surprise that there has been a huge surge of interest in private credit solutions in recent days. According to Bloomberg Intelligence analyst Paul Gulberg, he believes that private credit’s assets under management could surge about 70% to USD1.5trillion over the next four years.9

Private Debt Surge

Higher yielding private credit has boomed amid low interest rates

Source Preqin.

Note: 2021 as of March. All other years, as of December.

Source:https://www.bloomberg.com/news/articles/2021-12-10/as-rate-hike-risks-grow-so-too-does-the-lure-of-private-credit

The pick-up in demand for private credit also comes as traditional bank lending retreats.

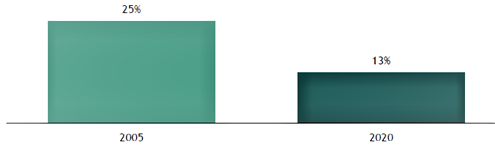

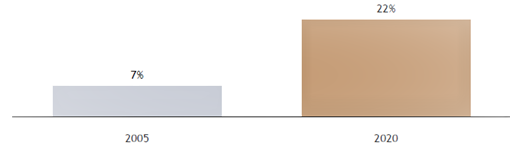

Back in 2005, private credit was just a small sliver of the US credit markets (7%), but today this segment has grown to cover a substantial 22% of the US credit markets. Conversely speaking, bank participation in lending in the US has shrunk from 25% in 2005 to 13% in 2020. (See the chart below)

Bank Lending Has Retreated Since 2005

Bank Participation in U.S. Loans(1)

Private Credit Addressing Financing Needs

Private Credit as a Percentage of the Credit Markets(2)

Source: Blackstone Private Credit Marketing Communication Deck, Standard Chartered

(1) Source: S&P Global Market Intelligence as of December 31, 2020. Reflects banks as a % of U.S. Loans.

(2) Source: Preqin, Credit Suisse as of December 31, 2020. Reflects U.S. Private Credit, % of the Credit Markets. Total credit market defined as the aggregate of the high yield bond, senior loan, and private credit markets. Senior loans refer to broadly syndicated loans. Private credit markets include BDCs.

You might be curious to understand why this phenomenon is happening. I can offer up a few possible reasons.

With stricter banking regulations post Global Financial Crisis, and now, increasing scrutiny on ESG alignment post Covid, banks have become more conservative/selective in their lending, with possibly more onerous procedures for loan application. Companies who require funding may need to go to as many as four or five different banks to get what they need. This can be cumbersome and inefficient from the borrowing company’s perspective. Naturally, this also creates a situation where certain companies would simply be underserved by banks, and research suggests this is particularly true for middle market corporate borrowers.

Thus, with the rise of private “suitors” these days, companies could approach private lenders that offer privately negotiated and flexible debt structures, with certain features that would not be available if one takes the traditional route. In exchange for faster access to liquidity, the borrowing company might find this venture worthwhile, even if it means coughing out a higher interest for their funding.

A quick crash course!

What have we learnt so far?

Private credit is a burgeoning new asset class that is causing a stir especially among sophisticated investors and pension fund managers10.

Private credit is a burgeoning new asset class that is causing a stir especially among sophisticated investors and pension fund managers10.

A word of caution: it is important to note that this asset is not liquid, not tradeable and resultantly fairly opaque. BUT in exchange for the lack of liquidity, lack of transparency and the higher credit risk involved, you are compensated with an attractive yield as compared to what you would normally get from a typical tradeable bond.

Private credit are mainly floating rate loans, so in a rising rate environment it has a better chance of weathering the storm compared to a typical fixed rate bond.

Without becoming too pedantic (there are in fact many different sub-stratas of private credit strategies, each with its own idiosyncratic risks!11), here are just a few more interesting characteristics of private credit:

The typical maturity of private credit generally lands somewhere between 3-7 years, which is not incredibly long.

If you are invested in the more senior parts of the capital structure, these loans would typically be secured against the borrower’s working capital, property or equipment, offering additional security and comfort to the investor. Senior loans may also come with stronger covenants within the loan documentation, which further protects the lender.

But to me, the most interesting aspect to private credit is the direct relationship between the borrower and the lender. Because this sort of lending is bilaterally negotiated and bespoke, it also means that the lender is intimately acquainted with the borrower’s business, and any periods of stress can hopefully be identified early. This provides the space for both parties to proactively engage and address any issues, and it is possible that the individuals working with a business to mitigate the stress might often be the same people who were involved in the initial lending process. While this may not be a fool proof way to avoid defaults, I found this particular detail intriguing to say the least.

Circling back to my layman definition of what private credit is, let’s assume your rich friend (the lender) is a real stand-up guy12, he could not only be supplying you with the funding you need, he might also be tapping on his wide network of relationships with his other business partners to aid in your success. In similar fashion, a good private lender with that kind of clout and reach would do likewise: providing their borrowers with access to their ecosystem, their network, and similarly vested in their success.

As a potential investor, you would be well advised to do your research properly before you put your trust in the right private credit manager, someone with the skillset of managing the complexities of the asset, and someone with the reach and influence to get things done – basically, let’s agree that we all need to choose our friends wisely.

For a deeper understanding of Private Credit, check out these resources:

https://www.cambridgeassociates.com/insight/private-credit-strategies-introduction/

https://www.institutionalinvestor.com/article/b1sh429dtz72v1/Private-Credit-The-1-Trillion-New-40-Opportunity

https://acc.aima.org/asset/F6181F66-10EC-4F82-A118AF4F31FF0FE7/

About the writer

Cheryl Yap, an Investment Advisor at Standard Chartered, is a (hard)working millennial mom with three young kids . She enjoys converting difficult concepts into simple and bite-sized ideas that people can easily understand. In her free time, you will find her nurturing (read: nagging) her three beautiful children towards following the Singapore dream (whatever that means). In this post-Covid world, she often daydreams about the next time she will get to hike in some faraway mountain where the weather is not eternally humid.

References

- You can expect to be repaid the principal amount when the bond matures, provided that the bond issuer does not default.

- Just like stocks, bonds can also be traded between investors on the secondary market. The difference is that while stocks trade on a stock exchange, most corporate bonds trade “over the counter”. https://www.investopedia.com/ask/answers/09/bond-over-the-counter.asp

- These are the main reasons, but this is not an exhaustive list.

- https://www.sifma.org/wp-content/uploads/2021/07/CM-Fact-Book-2021-SIFMA.pdf (page 7)

- https://www.investopedia.com/terms/l/liquiditypremium.asp

- https://www.businesstimes.com.sg/wealth-investing/why-private-credits-time-has-come-in-asia

- https://www.man.com/maninstitute/why-pc-is-the-new-pe;

https://www.ft.com/content/b104940f-bf3b-4090-bcb2-50aef67da564 (Why private capital will benefit from the crisis)

- https://www.bloomberg.com/news/articles/2021-12-10/as-rate-hike-risks-grow-so-too-does-the-lure-of-private-credit

- https://www.wsj.com/articles/pension-funds-chase-returns-in-private-market-debt-11644873517

- Senior Secured, Distressed Credit, Specialty Finance etc.

- An urban slang for a good solid businessman that would do anything needed to help his family and close associates. Check Urban Dictionary for more info.

This article is for general information only and it does not constitute an offer, recommendation or solicitation of an offer to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This article has not been prepared for any particular person or class of persons and does not constitute and should not be construed as investment advice or an investment recommendation. It has been prepared without regard to the specific investment objectives, financial situation or particular needs of any person or class of persons. You should seek advice from a licensed or an exempt financial adviser on the suitability of a product for you, taking into account these factors before making a commitment to purchase any product or invest in an investment. In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should carefully consider whether the product or service described herein is suitable for you.

You are fully responsible for your investment decision, including whether the investment is suitable for you.The products/services involved are not principal-protected and you may lose all or part of your original investment amount.

Standard Chartered Bank (Singapore) Limited will not accept any responsibility or liability of any kind, with respect to the accuracy or completeness of information in this article.

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. For clarity, these investment products are not deposits and do not qualify as an insured deposit under the Singapore Deposit Insurance and Policy Owners’ Protection Schemes Act 2011. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.