A serious illness can strike at any age. Consider something like a stroke. People usually think that these ‘brain attacks’¹ happen only to the elderly. However, that isn’t true, as 8.8 per cent of stroke victims in Singapore are less than 50 years old.²

How will you pay the bills during this period? School fees, payments to utility companies, and if you don’t own a home, dues for rent, will quickly pile up. You may manage with the money you have in reserve for a few months, but what if your recovery stretches for longer than that?

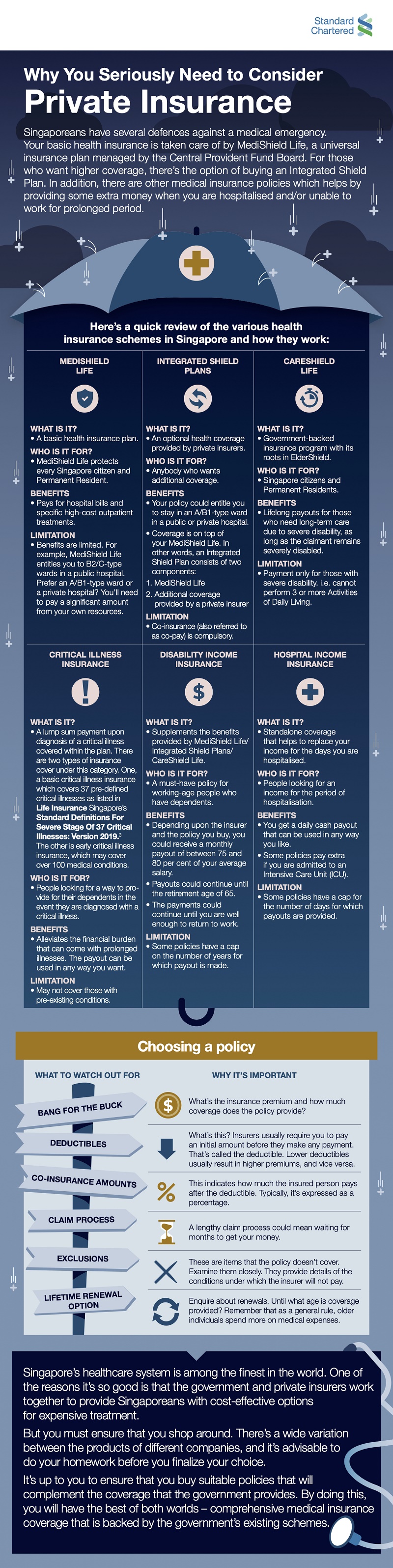

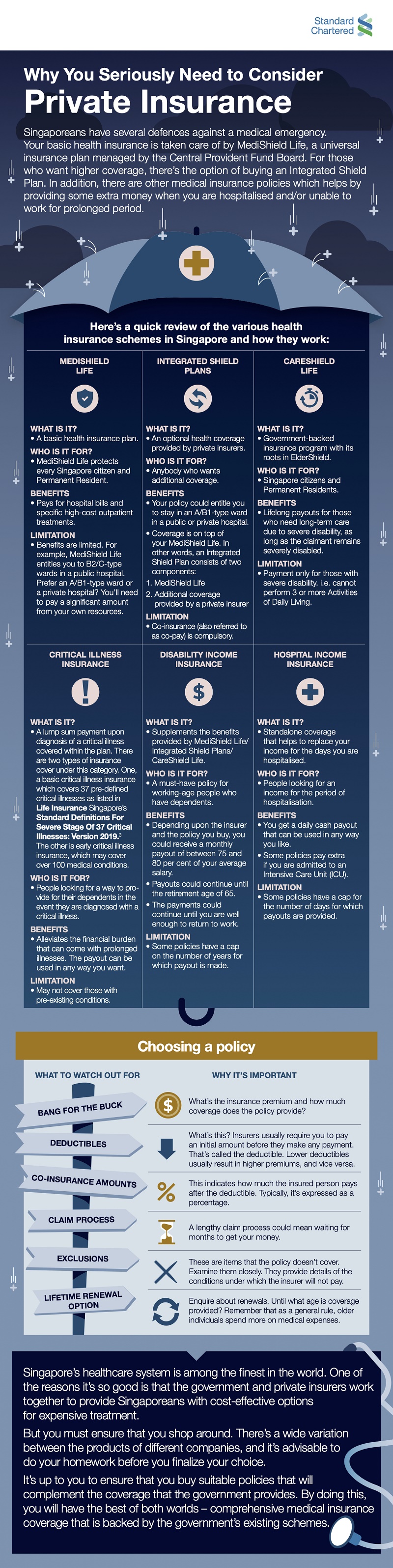

Fortunately, all Singaporeans have basic medical insurance. This is provided under the MediShield Life scheme. However, it makes sense to supplement this coverage. Private insurers in Singapore provide several types of policies that complement the protection that the government provides. These private insurances can help in the form of higher coverages, lump sum reimbursement, monthly pay-outs and/or income for days you are hospitalized.

It’s advisable to review the health insurance that you have carefully. If you or a family member faces a serious health issue, will you have the money to cope with it? Saving a few hundred dollars by skimping on insurance may seem to be the prudent thing to do. However, this approach could prove to be costly in the long run.

Private insurers in Singapore offer a host of health insurance options. Make the time to explore these carefully. You could realise that you are under-insured.

Foot Notes

¹ SingHealth – Stroke

² A stroke can happen at any age — how to recognise the signs and what to do

This article is brought to you by Standard Chartered Bank (Singapore) Limited. All information provided is for informational purposes only.