The CIP plays a crucial role in helping you have a better understanding of your risk appetite and it will guide you to make the most suitable investment choices to building your wealth.

| Investment Profile Classification | |

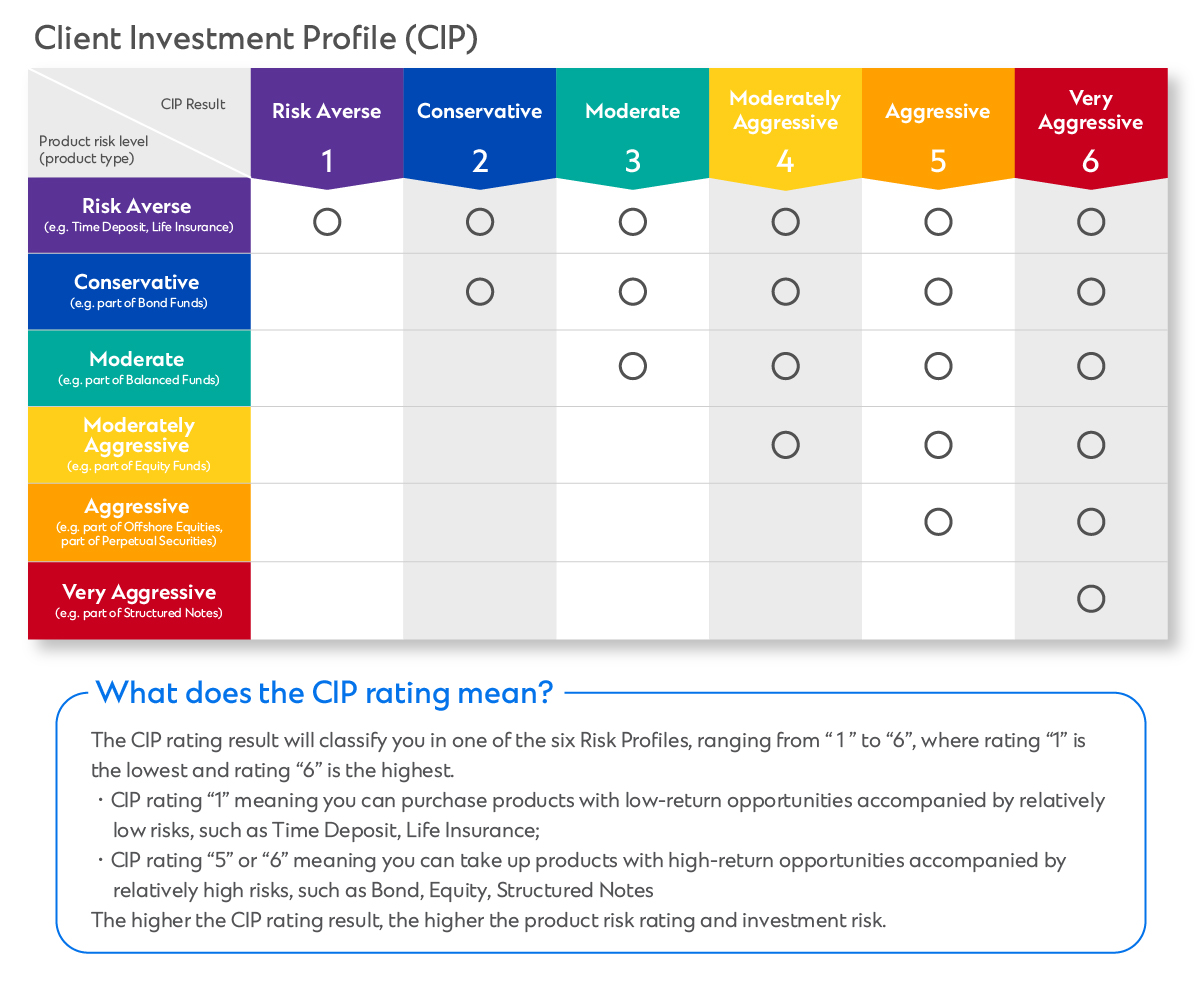

| Risk Averse 1 | Your sole objective is to preserve your capital and achieve returns based on prevailing deposit rates. You are not willing to invest in any products where your capital is at risk at any point in time. |

| Conservative 2 | You seek to achieve above deposit rate returns and protect your capital against inflation. You are willing to accept very low level of investment risk over the medium term. |

| Moderate 3 | You seek to achieve a low to moderate level of capital growth on your investments and you are willing to accept low to moderate level of investment risk over the medium to long term. |

| Moderately Aggressive 4 | You seek to achieve a moderate to high level of capital growth on your investments and you are willing to accept moderate to high level of investment risk over the short, medium and long term. |

| Aggressive 5 | You seek to achieve high capital growth on your investments and you are willing to accept very high level of investment risk over the short, medium and long term. |

| Very Aggressive 6 | You seek to achieve exceptional capital growth on your investments and you are willing to accept extreme level of investment risk over the short, medium and long term. |

You can conduct your CIP by the following means