Overview

-

Overview

Standard Chartered Bank brings you 360° Rewards, one of the leading loyalty programmes in the UAE. This programme enables you to earn rewards points when you spend using your Standard Chartered credit card* within the UAE and even abroad. Primary credit cardholders will automatically earn 360° Rewards Points for every credit card* purchase made on both the primary and the supplementary cards. The 360° Rewards programme offers an easy and convenient online platform to view, manage and redeem your points. Your Credit Card 360° Rewards Points, can be redeemed for airline mileage programmes, exclusive merchandise, travel and much more. What's more, if you do not have sufficient points for a redemption item, the programme offers you the flexibility of either paying for the merchandise partly using your Standard Chartered Credit Card, or even placing an item on the wish list until you have sufficient points to redeem the merchandise. This programme is free of charge and you will be automatically enrolled.

You can view your 360° Rewards Points balance at anytime from your online 360° rewards profile.

Start using your Standard Chartered credit card(s)* today and earn 360° Rewards Points faster to enjoy more rewards.

* Available only for Manhattan Platinum, Manhattan Rewards+ , Smart Saadiq and Visa infinite/Journey Credits Cards

** Terms and Conditions apply

How to Earn

-

360° Rewards Points Earn Rate

Credit Cards

Credit Cards Earn Rate Journey/Visa Infinite 2 points for 1 USD spent (AED Currency)

4 points for 1 USD spent ( Non-AED Currencies )Manhattan Rewards+* Up to 1 point for 1 USD spent Smart Saadiq** Up to 2 points for 10 AED spent Manhattan Platinum* Up to 1 point for 1 USD spent Simply Cash Up to 2% Cashback Points

Click here for more details.X Credit Card Cashback Points.

Click here for more details.Platinum Cashback Points.

Click here for more details.Platinum X Cashback Points.

Click here for more details.Enjoy the more rewarding credit card programme

USD 1 is defined at AED 3.673

*For transactions made on” Education, “Government”, “Supermarket”, “Petrol”, “Insurance Fees”, “Quick Service Restaurant”, “Rental Housing Fees” and “ Auto Dealership Fees” within the UAE, 0.1 points will be earned for every USD 1 spent. Spends on these categories can be identified through the Merchant Category Code (MCC).

** Earn 1 Rewards point on every AED 10 spent considering a monthly spend between (AED) 1,000-4,999 is met and earn 2 Rewards points on every AED 10 spent considering a monthly spend of (AED) AED 5,000 and above is met.

360° Rewards Points Expiry

Credit Cards Expiry Journey/Visa Infinite, Manhattan Rewards+, Manhattan Platinum , and Smart Saadiq 3 Years from date of earning1 Simply Cash , X Cashback, Platinum, and Platinum X 12 Months from date of earning 1Example: If you earn 100 points in January 2024 and another 100 points in February 2024 on your Manhattan Platinum credit card, the first 100 points will expire in January 2027 and the second 100 points will expire in February 2027

How to Redeem

-

How to Redeem

All Airlines (exclusively on Journey/Visa Infinite credit card)

Purchase tickets through the airline website or the ticketing office of any airline using your Journey/Visa Infinite Credit Card

To claim cash back on airlines ticket purchase on the above mentioned airlines, just call us within 60 days of the purchase

Your points can be redeemed for a cash back up to the amount of the ticket value based on the conversion rate below

Also, you can start redeeming with as low as 10,000 points!

To redeem your 360° Rewards Points, simply call us on 800 4949360° Rewards Category 360° Rewards Points Required to Redeem Value of 360° Rewards Points (What you get) All Airlines Minimum of 10,000 points

For every 1,000 points thereafterAED 200

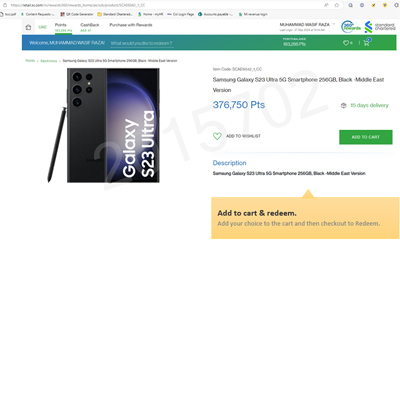

AED 20Example : 10,000+1,000=11,000 AED 220 Online Reward Redemption Portal

To redeem your accumulated Cash Points, simply follow these steps:

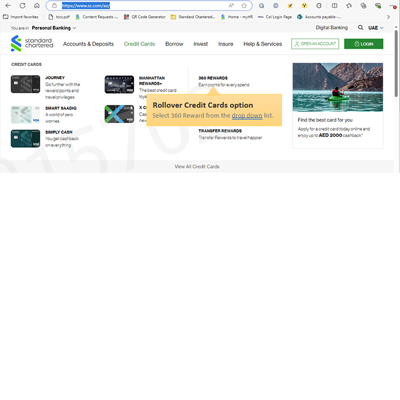

Step 1: Visit www.sc.com/ae/

Step 2: Click on “Online Rewards”

Step 3: Log in with your online username and password

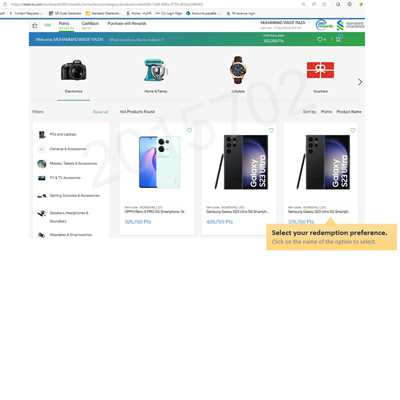

Step 4: Pick a product of your choice

Step 5: Add to cart and redeem

To redeem your 360° Rewards Points, simply log on to your 360 Rewards profile or call us on 600 5222 88 (800 4949 for Journey/Visa Infinite credit card holders), and advise us on the number of points you wish to redeem, and the redemption option you chose

FAQs

-

FAQs

-

Key Features of the Website

- What is this site for?

-

This site enables you to manage your rewards redemption more efficiently. You can check your points balance, view the 360° Rewards & Cashback Catalogue, redeem rewards and view the status of your current or previous order at your convenience. You can also browse the site and obtain necessary information regarding the rewards program, promotions as well as merchant details.

- What are the key features of this site?

-

- Check points balance

- Redeem points & Cashback

- View order status

- View points history

- Access the eShop and Travel portal

- Transfer points

- Does one need to register for using this site / browsing the rewards catalogue?

-

No, you can access the rewards site - browse the catalogue and obtain program information - without registering. However, in order to redeem points you will need to register and login.

- What is the registration process?

-

- If you are an existing Online Banking user, you don't need to register again. You can use your existing Online Banking Username and Password to login. Login now.

- If you are not an existing Online Banking user, you can register for using this site in 5 easy steps:

Step - 1: Enter your Debit/ATM Card Number

Step - 2: Enter your Debit/ATM Card PIN

If you only have a Credit Card with us then please enter your Card Number, Card expiry date, Date of Birth & CVV.

Step - 3: Receive a Temporary Password on your registered Mobile Number

Step - 4: Key in the Temporary Password, personalise your user id and password

Step - 5: And Start banking online

Register Now!

- How do I find/search for rewards that I'm interested in?

-

You can browse for a Reward by selecting a category and then a sub category. This will display all the available rewards in the categories selected. You can also use the Quick Search function to find specific Rewards. Type a keyword into the text box located above the category headings and hit “Enter”. This will bring up all the Rewards in the catalogue which match the keyword that you have entered.

You can also search use the “Advance Search” function to search to find your favourite item:

- By category

- By brands

- By descriptions

- By points range

- What is an eVoucher?

-

This is a voucher delivered to your email. You can print the email and use it at the merchant’s point of sale to make your redemption or purchase. No need to wait for the physical voucher to be sent you via post.

- Can I make copies of the eVoucher and redeem it multiple times

-

You can make copies, however each voucher has a unique code. So the voucher can be utilised only once.

- What is a mCert?

-

This is a unique voucher code delivered to your mobile. You can share the unique voucher code delivered at the merchant’s point of sale to make your redemption or purchase.

- Can I forward the mCert to my friends?

-

The mCert can be forwarded to anyone but it can be redeemed only once at the merchant.

- What if my eVoucher or mCert is accidently deleted or lost?

-

We will be able to resend eVouchers and/or mCerts to the recipient indicated at the point of checkout. Please kindly contact our customer service hotline at 800 4949.

- What is covered under 'Specials'?

-

We continually seek to provide irresistible offers and promotions for you to get more out of your Rewards points. Under specials you will find 'Deal of the day', 'Limited', 'Promo Packs' and 'Coming Soon' promotions.

- What is a 'Deal of the Day' item?

-

These are items at a specially discounted rewards price usually available for a limited time such as one day.

- What is a 'Limited' item?

-

These are items available in a limited quantity. These are usually items in high demand or those that are available at a specially discounted rewards price.

- What is a 'Promo Pack'?

-

These are multiple items available in bundled in a single pack, usually at a better combined price than the individual items.

- What is 'Coming Soon'?

-

These are items that will be added to our catalogue soon. You can show your interest by adding the Awards to your Wait List, and when the Award item is available for redemption you can proceed with checkout. However, adding to your Wait List does not guarantee you the Award item, redemption of any Award is on a first come first serve basis while supplies last.

- What is Points Plus Pay and how does it work?

-

Points Plus Pay allows you to choose the points and cash combination for redemption of the award. If you have the specified minimum number of points you can use an accepted Credit Card to purchase the Awards you want, using a mixture of points and cash.

You can use Points Plus Pay for most Awards. However some Awards are excluded, including all Vouchers, E-Vouchers, MCerts.

You can choose to use Points Plus Pay both when browsing Awards, or when reviewing your Wishlist and in your shopping cart before proceeding with the checkout.

- When browsing Awards if Points Plus Pay is available a slider will be displayed when you are on a product page. This will allow you to choose the mixture of cash and points for the redemption. Once happy, click 'Add to cart'. Your selection will then be displayed in your Shopping Cart.

- When in your Shopping Cart, you can still choose the points and cash combination before checkout.

- Why is Points Plus Pay not always available?

-

Some Awards are available for points only and may not be available using Points Plus Pay. Points Plus Pay is generally not available for specific Awards and all Vouchers, E-Vouchers, MCerts.

- Do I earn points for the pay portion of a Points Plus Pay transaction?

-

No, points are not calculated for the pay portion of a Points Plus Pay redemption.

- I would like to redeem an Award using Points Plus Pay. What are my options for payment?

-

We accept only Standard Chartered Credit Cards for payment of all orders. Cheques or cash payments are not accepted. You will be prompted to select the eligible Standard Chartered Credit Card before you check out.

- Can I use a Standard Chartered Debit card to make the payment?

-

No, only your Standard Chartered Bank Credit Cards can be used to make the 'Points Plus Pay' payment.

- What is a "Promotion Code" and how do I use it?

-

The Bank may have promotions that would allow Members to redeem a specific Award at a discount rate via a Promotion Code. Member must add the specific Award to shopping cart and at point of checkout, key in the Promotion Code given to redeem the Award at the discount rate.

- Can I use the "Promotion Code" more than once?

-

It will depend on the Promotion Code provided by the Bank. Please refer to the Terms and Conditions of each Promotion Code given for use.

- What is a "Wishlist"?

-

You can add Awards of interest in your Wishlist even if you do not have the required points to redeem the item. When you have achieved the required amount of points, a notification will appear on your home page the next time you log in indicating that your Wishlist reward is now ready to be redeemed. You can choose to redeem each item using your points, or with a combination of points and cash.

- What is a "Wait List"?

-

You can add 'Coming Soon' Awards into your Wait List. Once the item is available on the catalogue, a notification will appear on your home page the next time you log in indicating that your Wait List reward is now ready to be redeemed. The “Add to Cart” button will appear once an item is available for redemption.

- What are Popular Rewards?

-

These are popular reward items that are being redeemed by other members.

- What are the Terms and Conditions for using this site?

-

Click here to go to Program Terms & Conditions.

-

Registration

- I'm an existing Standard Chartered Online Banking user... do I need to register again for using this rewards site?

-

You don't need to register again. You can use your existing Online Banking Username and Password to login.

Login now! - I have more than one Credit Card. Do I need to register each one of them for this rewards site?

-

No. You need to register with any one of your valid Standard Chartered Credit Cards (excluding supplementary cards). All points accumulated via all your other eligible Credit Cards will be automatically consolidated to your Online 360° Rewards account.

- Are all my Credit Cards eligible for redeeming points via this site?

-

Only cards that are part of the 360° Rewards Programme are eligible for redeeming points on 360° Rewards website.

The following Standard Chartered Credit Cards are eligible to earn and accumulate 360° Rewards Points.

Credit Card Spend Amount Earn Visa Infinite, Manhattan Platinum and Saadiq Platinum (Ujrah) USD 1.00 1 point - I have forgotten my Online Banking Username and Password, how can I retrieve the same?

-

You can retrieve / reset your existing Username and Password by following a few simple steps. Retrieve your Online Banking Username and Password.

- I'm not an existing Standard Chartered Online Banking user, how can I register for using this rewards site?

-

You can register for online banking in 5 easy steps:

- Step - 1: Enter your Debit/ATM Card Number

- Step - 2: Enter your Debit/ATM Card PIN

If you only have a Credit Card with us then please enter you Card Number, Card expiry date, Date of Birth & CVV. - Step - 3: Receive a Temporary Password on your registered Mobile Number

- Step - 4: Key in the Temporary Password, personalise your User ID and password

- Step - 5: And Start banking online

- Can I have a separate Username and Password for using the rewards site and for accessing Online Banking?

-

No. For security reasons, only one Username and Password can be maintained for accessing Online Banking and for using this site. If you have an Online Banking Username and Password, you can use the same to access both Online Banking and this site.

- I'm not a Standard Chartered Bank customer...

Can I access this rewards site? -

Yes, you can access the rewards site and browse the catalogue, read information, etc. However, you will not be able to redeem points unless you have a Standard Chartered Credit Card that has sufficient points for redemption.

- How do I sign up for a Standard Chartered Bank Credit Card?

-

You can Apply for a Standard Chartered Bank Credit Card by clicking here.

- Do I need to register for this site to view the rewards catalogue?

-

No. You can browse the catalogue without registering or logging in. You only need to register and login in order to redeem your 360° Rewards Points.

-

Login and Password Help

- How do I login to access this rewards site?

-

Login access is provided in top menu across most pages of the site. Login now.

- I'm an existing Standard Chartered Online Banking user:

I have forgotten my Online Banking Username and Password, how can I retrieve the same? -

You will need to follow the Online Banking Password retrieval process for retrieving your password. Retrieve your Online Banking Username and Password.

- Can I register again for using this rewards site if I don't want to use or retrieve my existing Online Banking Username and Password?

-

No, you can only use your online banking credentials to access this site.

- I know my existing Online Banking password but want to change it, how can I do this?

-

Your Online Banking password can be changed via the Change Password link located in the main navigation of Online Banking. Login to Online Banking.

- How do I protect my Online Banking details on this site?

-

To avoid any phishing against your online banking credentials, please follow the instructions in the phishing alert given on the Standard Chartered UAE website.

-

Reward Account Management

- How can I view my reward point's summary?

-

After login, click on Account Summary under 'My Account'.

- Does the point's summary display the points that I have across all my Credit Cards with the Bank?

-

The Account Summary under 'My Account' displays the points available for redemption across all participating Credit Cards in the 360° Rewards Program. The card numbers are indicated next to the points in the Points Summary table. Please note that there may be some Credit Cards which are not eligible for the 360° Rewards Program and are therefore not included in the displayed list.

- How can I view the status of my previous orders?

-

You can view the status via the Order History under ‘My Account’. By clicking on any order number, you will be able to view the specific order details.

- Can I change the Username and Password that I have for accessing this rewards site?

-

The online banking Username and Password that you had set up is tagged to all the applicable Credit Cards that you have with the Bank and cannot be changed. However, if forgotten, you can click the following link Register now! and use the Username and Password to login to the rewards site.

- I've been using my Online Banking Username and Password to access this site, how can I change the same?

-

If you have been accessing this site with your Online Banking Username and Password, you will need to follow the Online Banking Password retrieval process for retrieving your password. Retrieve your Online Banking Username and password.

- How can I know the expiry date on my 360° Rewards Points?

-

Your Points expiry details can be found under the 'Points Expiry' table via Account Summary under 'My Account'.

- Can I change the billing address displayed in my account?

-

No. For security reasons, change of billing address is not permitted via this site. Please contact our customer care for assistance with change in billing address across all your Credit Cards with the Bank.

-

Earning and Redeeming Points

- How can I earn 360° Rewards Points?

-

The following Standard Chartered Credit Cards are eligible to earn and accumulate 360° Rewards Points.

Credit Card Spend Amount Earn Visa Infinite, Manhattan Platinum and Saadiq Platinum (Ujrah) USD 1.00 1 Point To check your Point balance, simply refer to your monthly statement, call our 24-hour Phone Banking numbers or log in to Online Rewards.

- How do I redeem the points that I have earned?

-

To redeem your accumulated 360° Rewards Points, simply call us on 800 4949 and advise us about the amount of 360° Rewards Points you wish to redeem, and the redemption option you chose.

Online 360° Rewards:

We have made redeeming your points easier with this site. Simply follow the steps below to redeem your 360° Reward Points anytime.

Steps:

- Visit https://360rewards.standardchartered.com/ae.

- If you are a First Time User, register with Online Banking and the newly created Username and Password will be used for accessing this rewards site. Click Here to Register.

- Login and Search for your favourite rewards by Product name, Points range or Brands.

- Select your rewards, indicate quantity and add to cart.

- Confirm your order upon Checkout.

By Phone:

Simply call our 24-hour Phone Banking number.

Please allow up to 15 working days for your redemption orders to be mailed to your billing address. Please note that voucher/s issued is not refundable, nor exchangeable for cash, or another reward.

For Miles Transfer Redemptions (Krisflyer, Asia Miles) please redeem online or call our 24-hour Phone Banking number to speak to our customer service agents.

- How do I know how many points I have for redemption?

-

Points available for redemption in your reward account can be seen once you login using your Username and Password in the Account Summary section. After login, the Catalogue Tab on the top of the page also displays your total available points.

- What can I redeem?

-

As a Standard Chartered Bank customer, you can choose from a wide variety of exciting offerings. Please refer to our 360° Rewards Catalogue.

- How do I find/search for rewards that I'm interested in?

-

You can browse for a Reward by selecting a category and then a sub category. This will display all the available rewards in the categories selected. You can also use the Quick Search function to find specific Rewards. Type a keyword into the text box located above the category headings and hit “Enter”. This will bring up all the Rewards in the catalogue which match the keyword that you have entered.

You can also search use the “Advance Search” function to search to find your favourite item:

- By category

- By brands

- By descriptions

- By points range

- What are the Terms and Conditions for redeeming products?

-

Click here to go to the Program Terms & Conditions page.

- How are 360° Rewards Points deducted from my account once I confirm an order?

-

The Bank will deduct 360° Rewards Points based on expiry date, earlier-expiring points will be deducted first. You cannot specify the cards from which the points would be deducted.

- How do I know from which of my Credit Cards will the points be deducted?

-

The Bank will deduct 360° Rewards Points based on expiry date, earlier-expiring points will be deducted first. You cannot specify the cards from which the points would be deducted. You can refer to your Account Summary on this reward site for the balance of 360° Rewards Points.

- Are all my Credit Cards eligible for redeeming points via this site?

-

Visa Infinite, Manhattan Platinum and Saadiq Platinum (Ujrah) Credit Cards are eligible for redeeming points via the 360° Rewards site.

- How do I redeem my Airline rewards cash back and annual fee waiver on my Visa Infinite card?

-

By Phone: Simply call our 24-hour Phone Banking number 800 4949.

- How do I redeem the Cashback that I have earned?

-

Preferred airlines

- Get cashback on tickets purchased online or at the ticketing office of preferred airlines: Emirates Airline, Etihad Airways, Virgin Atlantic Airlines and Qatar Airways

Call our 24-hour phone banking 800 4949 to redeem your cash back within 60 days from date of transaction

- Receive AED 500 cashback on your ticket when you redeem a minimum of 10,000 points

All other airlines

- Enjoy cash back when you make a travel booking on any airline or through any travel agency

Call our 24-hour phone banking 800 4949 to redeem your cash back within 60 days from date of transaction

- Receive AED 500 cashback on your travel booking when you redeem a minimum of 15,000 points

Annual fee reversal

Pay your AED 1,500 annual fee by redeeming 55,000 points.Call our 24-hour phone banking 800 4949 to redeem your cash back within 30 days from date of transaction

-

Earning and Redeeming Cashback

- How can I earn Cashback?

-

Titanium card customers will earn Cashback.

Cashback Points.Click here for more details.

Terms and Conditions:

Payments in supermarkets in the UAE earn CashBack Points up to a maximum of AED 400 per month, subject to meeting the minimum overall expenditure of AED 1,000 per month on your Standard Chartered Titanium Credit Card. Total expenditure includes all spends on your credit card and is not limited to payments in supermarkets only. CashBack Points will be given on supermarket payments made in AED, and can be redeemed by calling us on 600 5222 88 or (+971) 600 5222 88 when outside UAE.

10% Cashback On Utility Payments

Got bills to pay? Use your Standard Chartered Titanium Credit Card to pay for your telephone, Internet, TV subscription, Salik, water and electricity bills and receive 10% CashBack.

Terms and Conditions:

Payments on utility bills (including DEWA, SEWA, ADWEA, Salik, Etisalat and Du) earn CashBack Points up to a maximum of AED 200 per month, subject to meeting the minimum overall expenditure of AED 1,000 on your Standard Chartered Titanium Credit Card. Total expenditure includes all spends on your Standard Chartered Titanium Credit Card and is not limited to payments on utility bills only. CashBack Points will be given on utility bill payments made in AED, and can be redeemed by calling us on 600 5222 88 or (+971) 600 5222 88 when outside UAE.

10% Cashback On School Fees

Receive 10% CashBack on your school fee payments when you use your Standard Chartered Titanium Credit Card.

If the school does not accept credit card payments, just give us a call and we'll offer you a School Fee Monthly Instalment Plan with 0% for 6 to 12 months and no processing fee. We simply provide you with a cheque addressed to the school for the amount requested*, and you can pay the total back in 6 or 12 equal monthly instalments. You will also receive 10% CashBack on the instalment amount.

Example: The school fees are AED 18,000 per annum. If you request our School Fee Payment Plan we will provide you with a cheque addressed to the school to cover the fees. If you choose a 6-month plan, the calculation will be as follows:

- Amount requested: AED 18,000

- Monthly instalment amount: AED 3,000 (AED 18,000 ÷ 6 months)

- CashBack received per month for 6 months: AED 300

You have saved AED 1,800

Terms and Conditions:

School fee payments made with your Standard Chartered Titanium Credit Card earn 10% CashBack in the form of CashBack Points, up to a maximum of AED 400 per month, subject to meeting the minimum overall expenditure of AED 1,000. Total expenditure includes all spends on your Standard Chartered Titanium Credit Card and are not limited to payments on school fees only. CashBack Points will be given on school fee payments made in AED, and can be redeemed by calling us on 600 5222 88 or (+971) 600 5222 88 when outside UAE.

From time to time, there will also be Cashback promotions for other Credit Cards, where Cashback points will be given for certain types of spend or spends during certain periods.

- Does my Cashback expire?

-

Cashback will have a 12 month expiry.

- Why is the Cashback not credited to the statement directly?

-

You can either get the Cashback credited to your statement or use it for an Extra-Value Offers in the Cashback catalogue.

- What is the benefit of an Extra-Value Offers?

-

The Extra-Value Offers is better value as compared to getting the cashback credited to your statement.

For example if you have accumulated Cashback of AED 100, you may be able to redeem a shopping voucher worth AED 120 with the same.

- How do I redeem the Cashback that I have earned?

-

You can redeem your accumulated Cashback in one of the following two ways:

- Call our Phone Banking number

- Redeem Cashback online through 360° Rewards site

Online Rewards:

We have made redeeming your Cashback easy with our 360° Rewards website. Simply follow the steps below to redeem your Cashback anytime.

Steps:

- Visit https://360rewards.standardchartered.com/ae.

- If you are a First Time User, register with Online Banking and the newly created Username and Password will be used for accessing this rewards site. Click here to register.

- Login and view the ‘Cashback catalogue’.

- Select your rewards, indicate quantity and add to cart or chose to credit the Cashback to statement.

- Confirm your order upon Checkout.

By Phone:

Simply call our 24-hour Phone Banking number.

- How do I know how much accumulated Cashback I have

-

Cashback available for redemption in your reward account can be seen once you login using your Username and Password in the top left corner of the Cashback page. You can also, click on Account Summary under ‘My Account' to check your Cashback balance.

- What can I get for my accumulated Cashback?

-

As a Standard Chartered Bank customer, you can choose from a wide variety of exciting Extra-Value offers from our Cashback catalogue. These include everything from shopping to dining vouchers and merchandise. You can also choose to credit the accumulated Cashback to your Credit Card account.

- How do I find/search for Extra-Value Offers that I'm interested in?

-

You can browse through all the offers available on the Cashback catalogue here.

- What are the Terms and Conditions for redeeming Extra-Value Offers?

- How is Cashback deducted from my account once I confirm an order?

-

The Bank will deduct Cashback based on expiry date, earlier-expiring Cashback will be deducted first. You cannot specify the cards from which the Cashback would be deducted.

- How do I know from which of my Credit Cards will the points be deducted?

-

The Bank will deduct Cashback based on expiry date, earlier-expiring Cashback will be deducted first. You cannot specify the cards from which the Cashback would be deducted. You can refer to your Account Summary on this reward site for the balance of Cashback.

- Are all my Credit Cards eligible for redeeming Cashback via this site?

-

Titanium Credit Cards will be eligible for Cashback redemption through the Cashback catalogue. If you do not have a Titanium card you will be eligible to redeem cashback only if you have accumulated Cashback from promotions that we may run on other cards from time to time.

-

Orders and Delivery

- How do I place an order for redeeming my points?

-

Online 360° Rewards:

We have made redeeming your points easier with this site. Simply follow the steps below to redeem your 360° Reward Points anytime.

Steps:

- Visit https://360rewards.standardchartered.com/ae.

- . If you are a First Time User, register with Online Banking and the newly created Username and Password will be used for accessing this rewards site. Click here to register.

- Login and Search for your favourite rewards by Product name, Points range or Brands.

- Select your rewards, indicate quantity and add to cart.

- Confirm your order upon Checkout.

By Phone:

Simply call our 24-hour Phone Banking number.

Please allow up to 15 working days for your redemption orders to be mailed to your billing address. Please note that voucher/s issued is not refundable, nor exchangeable for cash, or another Reward.

- How do I request for Miles Transfer redemptions?

-

For Miles Transfer Redemptions, (Krisflyer, Asiamiles) please redeem online or call our 24-hour Phone Banking number to speak to our customer service agents

You must ensure that the name and air miles membership number which you input for points redemption match the details with the relevant air miles program.

- What is the process for receiving my order?

-

You will receive your redemption order within 15 working days of placing your order either Online or through Phone Banking. The order will be delivered to your communication address. If you wish the order to be delivered to a different address, please update the order fulfilment form accordingly at the time of placing the redemption request.

- If I update the mailing address for delivering the item, will it be updated in the bank's records?

-

No, the address will be used only for that particular delivery request. To change the mailing address in the Bank's records please call our 24-hour Phone Banking number.

- Can I redeem an Award (Merchandise, Voucher, E-Voucher, MCert) for delivery to another person?

-

Yes, the delivery address/e-mail/mobile number you provide can be different from your own information but the address must be within the Country.

- How long will it take for my order to reach me?

-

Please allow us up to 15 working days to deliver your redemption order. You can login to you online account or call our Phone Banking number at any time to know the status of your orders.

- How can I view the status of my previous orders?

-

You can view the status via the Order History under 'My Account'. By clicking on any order number, you will be able to view the specific order details.

-

Using the Travel Site (3rd Party)

- How do I find the travel site?

-

You can find the 'Travel' category in the top menu bar of the rewards catalogue site.

- What benefits do I have on the travel category?

-

You can use your 360° reward points for the following travel related benefits

- Redeem your points at the partner travel site

- Convert points to frequent flyer miles of participating airlines

- Redeem travel accessories

- How do I redeem my points for flight and hotel bookings?

-

You can navigate to our partner travel website by clicking on the link provided here.

- Is the flight, hotel redemption site maintained by Standard Chartered Bank?

-

No it's maintained by our Partner – Asia Travel.

By accepting to navigate to this site you would leave the Standard Chartered Bank website and enter a third party site. Your name and rewards balance will be passed on to the third party site using a one-time encrypted URL. This information and all information that you provide will be subject to confidentiality and security terms of the third party site. Standard Chartered Bank does not take responsibility for the information provided at such a third party site.

- Can I call the Standard Chartered helpline to redeem my points for flight booking?

-

No, you can only redeem online through the third party partner site.

- Can I call the Asia Travel helpline to redeem my points for flight booking?

-

No, you can only redeem online through the third party partner site.

- How do I amend or cancel my travel bookings?

-

Kindly refer to the booking confirmation sent to you by Asia Travel. You have to call the Asia Travel helpline or email Asia Travel.

- Is my travel booking/s managed by Standard Chartered Bank? Whom can I contact for more details on the participating hotels, airlines, etc?

-

No, all travel bookings are managed by Asiatravel.com who will be responsible for all subsequent booking logistics and requests. For enquiries e-mail customerservice@asiatravel.com.

-

Using eShops (3rd Party)

- What is the eShop?

-

eShop provides the following benefits to standard chartered customers through 3rd party partners

- Shipping service to local destinations for online purchases made on US websites

- Additional Cashback or Reward Points for online shopping on certain partner sites

- Is the shopping site maintained by Standard Chartered Bank?

-

No it's maintained by independent 3rd party service providers.

By accepting to navigate to this site you would leave the Standard Chartered Bank website and enter a third party site. All information that you provide will be subject to confidentiality and security terms of the third party site. Standard Chartered Bank does not take responsibility for the information provided at such a third party site

- Does Standard Chartered Bank give a warranty on the quality of products bought from eShops?

-

No, Standard Chartered Bank takes no responsibilities for the quality of products or services.

-

Contact Us

- Contact Details

-

Phone: 600 5222 88 (800 4949 for Visa Infinite credit card holders)

-

Terms and Conditions

-

Terms and Conditions

Please click here for the Arabic version of the terms and conditions.

The Program

- The Standard Chartered 360° Rewards points program (Program) is a bonus points scheme which rewards you with points based on the amount you have spent using your card(s)1.2 You agree to participate in the Program in accordance with these terms, which must be read together with the Customer Terms (see section on bonus points scheme), Credit Card Terms and any documents which forms our banking agreement.

- To participate in the Program, your card accounts must be in good standing, as we determine at our discretion. All benefits accrued under the Program by the principal or supplementary cardholder will be given to the principal cardholder.

- If you are the principal cardholder, you will be entitled to use the points for redemption of goods and services. Your supplementary cardholder will not be entitled to perform the redemption.

- We disqualify you from participation in the Program, if we determine, in our sole discretion that:

- your card account has been blocked, suspended, terminated or closed;

- you face legal proceedings or are under threat of so;

- any of your accounts with us are delinquent or unsatisfactorily conducted for any reason; and

- you are or are potentially in breach of our banking agreement.

- If we disqualify you from the Program, all your unused points will be cancelled and no longer be available for use under the Program.

- If you are the principal cardholder and you terminate your supplementary card, you will still be eligible to participate in the Program. Benefits which accrued up to the date of termination will still be available and passed on to your card account.

- If there is any inconsistency between:

- the Customer Terms and the terms of this Program, the terms of the Program prevail; and,

- the terms of the Program and any specific terms (such as specific redemption promotions), the specific terms prevail; and

- the English version of our banking agreement and any translation, the Arabic version prevails.

- All references to transactions and/or redemption timings mentioned on the rewards website are as per Hong Kong Standard Time (GMT +8), unless stated otherwise.

How the 360° Rewards Program works

- We award you points for each [dirham] that you spend based on the total amount of card retail transactions made on a [daily] basis and rounded down to the nearest decimal point.

Credit Type Points Earned* Journey/Visa Infinite 2 points for 1 USD spent (AED Currency)

4 points for 1 USD spent ( Non-AED Currencies )Manhattan Platinum * Up to 1 point for 1 USD spent Manhattan Rewards+* Up to 1 point for 1 USD spent Smart Saadiq Up to 2 points for every AED 10 spent USD 1 is defined at AED 3.673

*For transactions made on” Education, “Government”, “Supermarket”, “Petrol”, “Insurance Fees”, “Quick Service Restaurant”, “Rental Housing Fees” and “ Auto Dealership Fees” within the UAE, 0.1 points will be earned for every USD 1 spent. Spends on these categories can be identified through Merchant Category Code (MCC).

**Earn 1 Rewards point on every AED 10 spent considering a monthly spend between (AED) 1,000-4,999 is met and earn 2 Rewards points on every AED 10 spent considering on monthly spends of (AED) 5,000 and above is met.

- We do not include the following in the computation of points under the Program:

- Cash Advances or cash withdrawals at ATMs,

- Annual fees charged for the cards

- Interest or finance charges levied on conventional cards and maintenance fee levied on Saadiq Platinum (Ujrah) cards

- Late payment and collection charges

- Fees and charges reversed from card accounts

- Charges incurred but not yet submitted by the merchant or posted to your credit card account

- Amounts which have been rolled over from preceding months outstanding

- Tax refunds from overseas purchases

- Pay portion for a points plus pay reward redemption, where you use points along with paying a specific amount to redeem the reward

- Balance transfer to your card account

- We may vary the conversion rates of the points to the amount charged and we will notify you in writing of the variation.

- Unless we offer you the ability to redeem rewards using our Points Plus Pay feature, you must have the number of points required to redeem the rewards in your accounts at the time their order is made. If you do not have enough points, we reject your request to redeem the reward.

- If we cancel your card and a new credit card account is subsequently opened, we do not transfer points accrued under the previous card account to the new account, unless we agree otherwise.

- We may suspend the calculation and accrual of points to adjust any calculation that we deem appropriate. We need not give you notice or a reason if we do so. For example, adjustments will be made if there are any credits posted to a card account including those arising from returned goods and services or from billing disputes.

- Unless we agree, points accrued under the Program are not transferable, whether by law or otherwise, to any person or entity.

- Rewards Points, unlike Cashback Points, accrued under this Program have no cash or monetary value.

Redemption

General

- You may select and redeem any one or more of the rewards featured in the program catalogue, our website or any other publications in any medium, via any redemption channel we make available to you from time to time subject to sufficient points. The use of any particular channel for redemption will be subject to the terms and conditions then in force. Your redemption will signify acceptance of these terms.

- If you are not making the redemption request in person, we assume that all redemption requests made through electronic banking are made by you in your capacity as the principal cardholder.

- We will process your redemption request within the time frame as specified in the catalogue. The delivery of rewards vouchers or products may vary depending on the actual reward or product redeemed.

- All requests will be processed on a first-come, first-served basis, and are subject to sufficient points, and rewards availability.

- Redeemed rewards are not exchangeable for other rewards, or refundable, replaceable or transferable for cash or credit under any circumstances.

- Once you have confirmed your redemption request, it is irrevocable and you cannot ask for a refund of the points used for the redemption, or reverse your request.

- Redemption and use of a reward is subject to availability and to such conditions as may be specified by the participating merchants. We are not responsible for ensuring that the product or service that you have redeemed for using your reward points will be available. The participating merchant reserves the right to supply alternative products or services of similar quality or price to you.

Wishlist

- You may add a reward to a wishlist to be redeemed at a later date. We remove the item from your wishlist if it is no longer available for redemption.

Waitlist

- From time to time we may introduce a reward that may be available for redemption at a later time. You may add this to your waitlist, and we will notify you when the reward is available. Redemption of the reward is still subject to availability and to the terms and conditions attached to the reward.

Points Plus Pay

- If you choose to redeem a reward using our Points plus pay feature, we allow you the option to redeem using a combination of points and cash payment, subject to a minimum number of points that we may specify.

Pay portion for a points plus pay reward redemption, where you use points along with paying a specific amount to redeem the reward - Where rewards are redeemed through a points plus pay redemption, you irrevocably authorise us to debit your credit card account with the pay portion in the redemption. The charges for the pay portion will be shown in your statement following your redemption. We do not accept any other methods of payment.

- If you return the product and ask us for a refund and we agree, the same number of points redeemed for that product will be refunded to you and the same money amount paid for that product will be refunded to your credit card account.

Rewards Voucher Redemption

- If you choose to redeem a voucher, we issue the voucher in the name and address of the principal cardholder. Redemption of the voucher must be made by the person named in the voucher.

- If you instruct us to issue and deliver the voucher to an address other that the address in our database, the address for delivery of the voucher will not be used to update your address in our database.

- You must use the Rewards Voucher in accordance with the terms stated in the voucher. You must present the original voucher and the card used for the rewards redemption to the merchant as proof of eligibility. The merchant may require you to sign on the voucher prior to redemption.

- If you have to make additional payment in order to use the Rewards Voucher, you have to charge the difference to your Standard Chartered Bank credit card. If the value of goods and services requested through the use of the Rewards Voucher is below the value stated in the Rewards Voucher, we or the merchant will not refund you with the difference.

- You cannot exchange the Rewards Voucher that you have redeemed for another voucher, product or service or ask for a cash refund.

- You have to arrange or make any additional meals, transportation or accommodation arrangement or any other incidental arrangements as may be necessary in connection with any Rewards Voucher.

Product Redemption

- If you choose to redeem a product and once we have confirmed the redemption request, the reward points cannot be transferred back to your account.

- We give no representation or warranty with respect to the products redeemed. In particular, we do not represent or warrant the quality of the products or their suitability for any purpose. Any disputes concerning the goods or services redeemed as products must be settled between yourself as cardholder and the participating merchant or supplier directly. We may assist you in providing you with the details of the supplier or participating merchant of any products that you have redeemed.

Air Miles Redemption (Mileage Transfer Program)

- You may choose to convert your points to frequent flyer miles with our participating airlines. You have to enroll with the participating airlines program before you are eligible to convert your points. You must also join our Mileage Transfer Program and inform us of your frequent flyer membership at the point of redemption.

- We may charge a processing fee every time to transfer reward points to partner airlines.

- Once points are converted into air miles, these cannot be reversed or reconverted.

- Processing of the conversion may take up to [14] working days.

- Use of air miles is subject to the terms of the individual airline/s frequent flyer programs and may be restricted in its redemption of air tickets. We do not control the manner or any additional charges that may be levied by the airline when you use your air miles. Any dispute or feedback is solely between yourself and the airline.

- You must notify us of any errors in the conversion of the points within one month of the transaction date. We are not liable for any loss of points if you do not report this within the timeframe.

- You will not receive any confirmation regarding the transfer. We advise you to check your frequent flyer program account with the airline concerned for an update of the air miles.

- We are not responsible for the miles which have been successfully transferred or for the action of the individual airline in connection with the frequent flyer program.

- We are not responsible for any changes made by the individual airline in connection with the mileage program terms and conditions, including the regulations, benefits, policies, condition of participating or mileage levels.

- You can only convert points to air miles for your own enrolment of the frequent flyer program.

You must ensure that the name and air miles membership number which you input for points redemption match the details with the relevant air miles program.

e-Vouchers

- An e-Voucher is an electronic Voucher which is sent to your registered email address.

- When redeeming an e-Voucher, we will send the e-Voucher to an email address specified/registered by you, at the point of redemption, and as recorded in the Banks system.

- The use of the e-Voucher will be subject to the terms stated therein.

We are not responsible for any delay in transmission of, loss of, or non- receipt of, e-Vouchers redeemed by you, due to any reason whatsoever. - One e-Voucher can only be redeemed once unless otherwise specified on the e-Voucher.

mCerts

- An mCert is an electronic voucher which will be sent to a mobile device via smart messaging service (SMS).

- All mCerts will be delivered to the specified mobile number provided by you and as recorded in the Banks system when you redeem an mCert.

- Receipt of the mCerts is at your risk. We do not replace or resend any mCerts that may not have been redeemed within the validity period mentioned on the mCerts due to whatever reason.

- You are required to use the mCert in accordance with the terms stated therein.

- One mCert can only be redeemed once unless otherwise specified on the mCert.

Points to Cash Redemption

- You may use your points to credit cash back to your credit card statement. The credit cash back will reflect on subsequent cycles.

Accumulated Cashback redemption

- You may also earn cashback for spends on specific Standard Chartered Bank credit cards. You may choose to credit the same on your credit card statement or redeem Extra- Value offers as listed on the Cashback catalog

Products and Services redeemed

No liability

- We are not liable for any goods or services or the quality or performance of such goods or services supplied by the participating merchant, shopping site, travel redemption site, service provider or other authorised agent under the Program. You must direct any complaints or feedback in respect of such goods and services to the respective participating merchant, provider or agent.

- We are not responsible for lost or stolen Rewards Vouchers, e-Vouchers, mCerts or any goods and services redeemed under the Program. These will not be replaced by the Bank.

Disclosure of information

- In addition to the applicable products terms, you consent to our providing your account information to our vendor for the purposes of fulfilling your Rewards redemption request. Your information will also be provided to eShop, which is our partners online shopping website; and direct travel redemption website if you choose to access those websites.

Access

- Any access that we may grant you from our Online Rewards Redemption website, or partner websites, will transport your navigation out of our sites. We are not responsible for, do not endorse, and make no representation or warranty in connection with, any hyperlinked internet sites on our website.

Online Banking Security

To avoid any phishing against your online banking credentials, please follow the instructions in the phishing alert given on the Standard Chartered UAE website. -

eShop

- Our eShop is a website hosted by our vendor. It provides hyperlinks to the websites hosted and/or operated by the online retailers and displays promotions offered by the online retailers to you as our cardholder.

For the avoidance of doubt this website does not include the websites hosted and/or operated by the Online Retailers.

General

- When you access the eShop through our website, a tracking code is transmitted to this eShop website through a one way and one time encrypted message. If you access the eShop, you consent to this tracking code to be transmitted to the mall website. This code is used to credit any benefits such as cash back or reward points back to your account that you may be eligible for by the virtue of transacting on this website using your Standard Chartered credit card. If you do not consent to your details being transmitted, please do not access the eShop.

- The vendor of the eShop or operators of the Online Retailers will not be able to access our website (secured or otherwise) to gather any more information, other than the information that was passed through.

- The Online Retailers appearing on the eShop are independently run and not owned or partnered by us to provide products or services to you.

- You may purchase the products or services on these websites using your credit card.

- We are not responsible for, do not endorse, and make no representation or warranty in connection with, any hyperlinked internet sites on our website. We are not responsible for any lossyou incur in connection with those hyperlinked sites.

Any transactions effected on the eShop through the online retailer are made on your own accord. We are not responsible, and make no representation as to the quality or suitability of the products for their purpose. Notwithstanding any provisions to the contrary contained herein, any dispute concerning the goods and services purchased or redeemed on the Online Retailers website must be settled by you directly with the Online Retailer. We do not take responsibility for resolving such disputes.

Online Travel Redemption ("Travel Site ")

Our online travel redemption website is a website owned and powered by [Asiatravel.com Holdings Limited] which will feature promotions relating to travel, accommodation, packages which you can redeem using your points. You can also purchase any products and services on the website using your card.

General

When you access the Travel Site through our website, your name and accumulated points will be transmitted to this website through a one-way and one-time encrypted message. If you do not consent to your details being transmitted to the Travel Site, please do not access the Travel Site. The operator of the Travel Site will not be able to access our website (secured or otherwise) to gather any more information, other than the information that was passed through.

- All products and services offered on the Travel Site are offered by Asiatravel Holdings Limited. We do not endorse, and make no representation or warranty in connection with the products or services offered on the Travel Site. We are not responsible for any loss you incur in connection with those hyperlinked sites.

- You may use your points to redeem for any of the products / services that may be offered for Travel Site.

- The Travel Site may also offer goods and services which you can purchase directly using our card.

Any transactions effected on the travel site are made on your own accord. We are not responsible, and make no representation as to the quality or suitability of the products or services for their purpose. Notwithstanding any provisions to the contrary contained herein, any dispute concerning the goods and services purchased or redeemed on the Online Retailer’s website must be settled by you directly with the Online Retailer. We do not take responsibility for resolving such disputes.

Meaning of words

You also need to refer to the applicable product terms which also define key words specifically applicable to the product. If a word defined in these Customer Terms is also defined in any applicable product terms, the definition in the product terms applies for the purposes of the applicable product.

card means a debit card, a credit card, a prepaid card or a gift card or all of them, as the context requires.

card association means Visa International, MasterCard International or any other card association.

cardholder means, for an account, each person to whom we issue a card on the account.

credit card means a credit card with the branding of a card association issued by us to you in accordance with credit card product terms.

Credit Card spend means retail transactions charged to the credit card reflected in the statement in any particular month.

Current and/or Savings Accounts means any valid product holdings in current accounts (regardless of denominations) or saving accounts (regardless of denominations) as at end of the month.

Fixed Deposits means any valid product holding in time deposits denominated in local currency and foreign currency as at end of the month.

Investments means any valid product holding in Unit Trusts, Medium Term Notes, Structured Deposits, Retail Bonds, Premium Currency Investment and Equity Linked.

points means the number of points which you will earn in accordance with your credit card spending, or in accordance with PB Rewards.

Program means Standard Chartered 360° Rewards Program.

supplementary card means, for an account for a credit card, a credit card issued to a person you authorise as a supplementary cardholder on your account for the credit card.

supplementary cardholder means each person to whom we issue a supplementary card.

reward means, products and services, including cash back and air miles that may be redeemed by you using reward points issued under this agreement.

you means you, your supplementary cardholder, your joint account holder or your authorised person who are our Private Banking, Priority Banking or Personal Banking customers.

Rewards Catalogue

-

Rewards Catalogue