Enjoy flexibility from sending money to other local banks

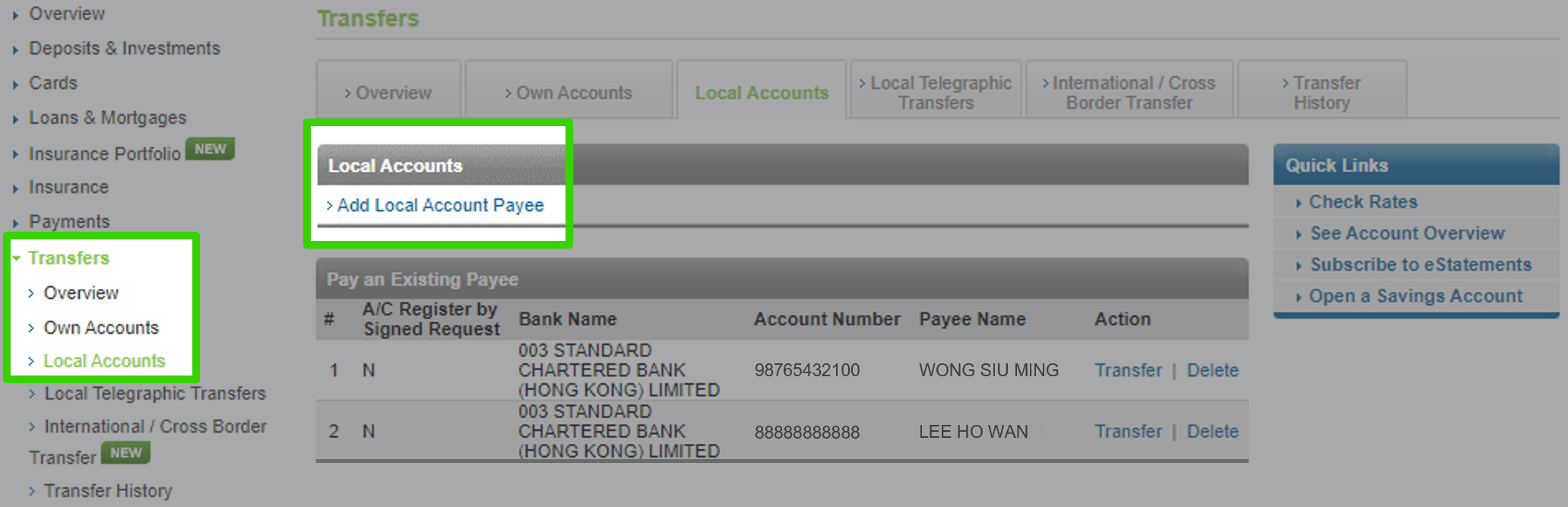

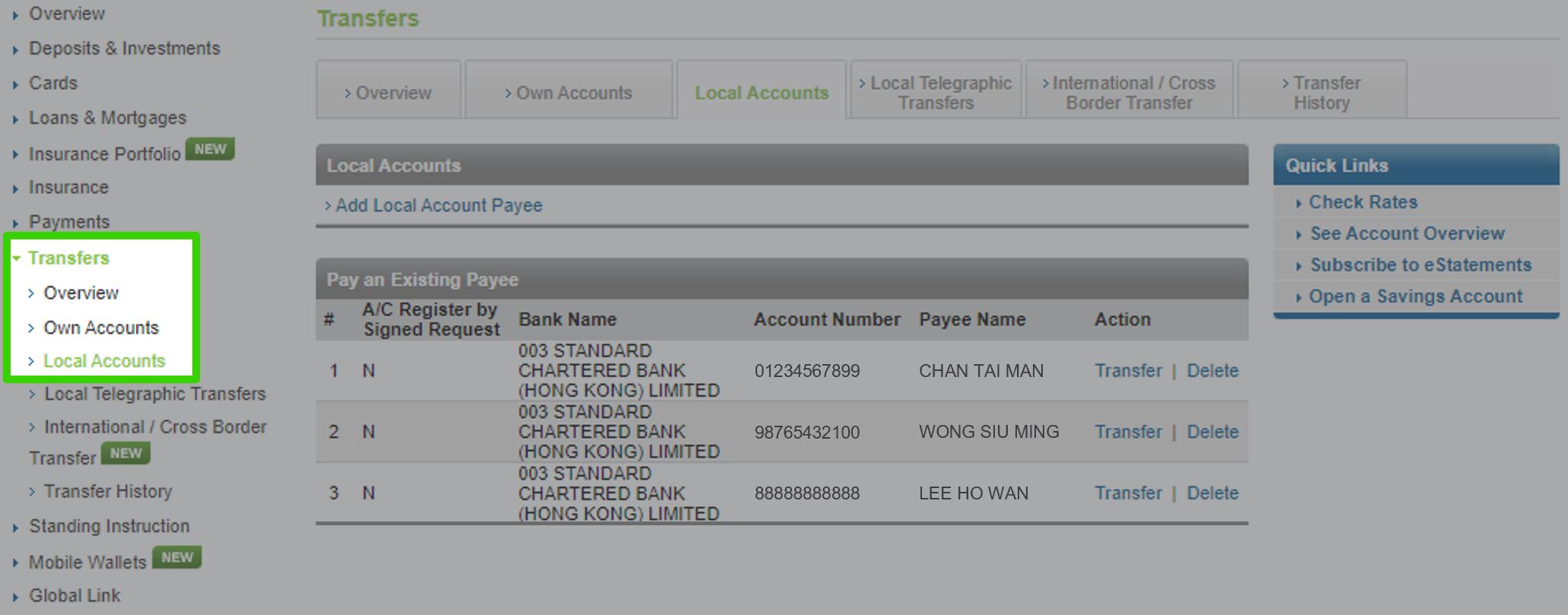

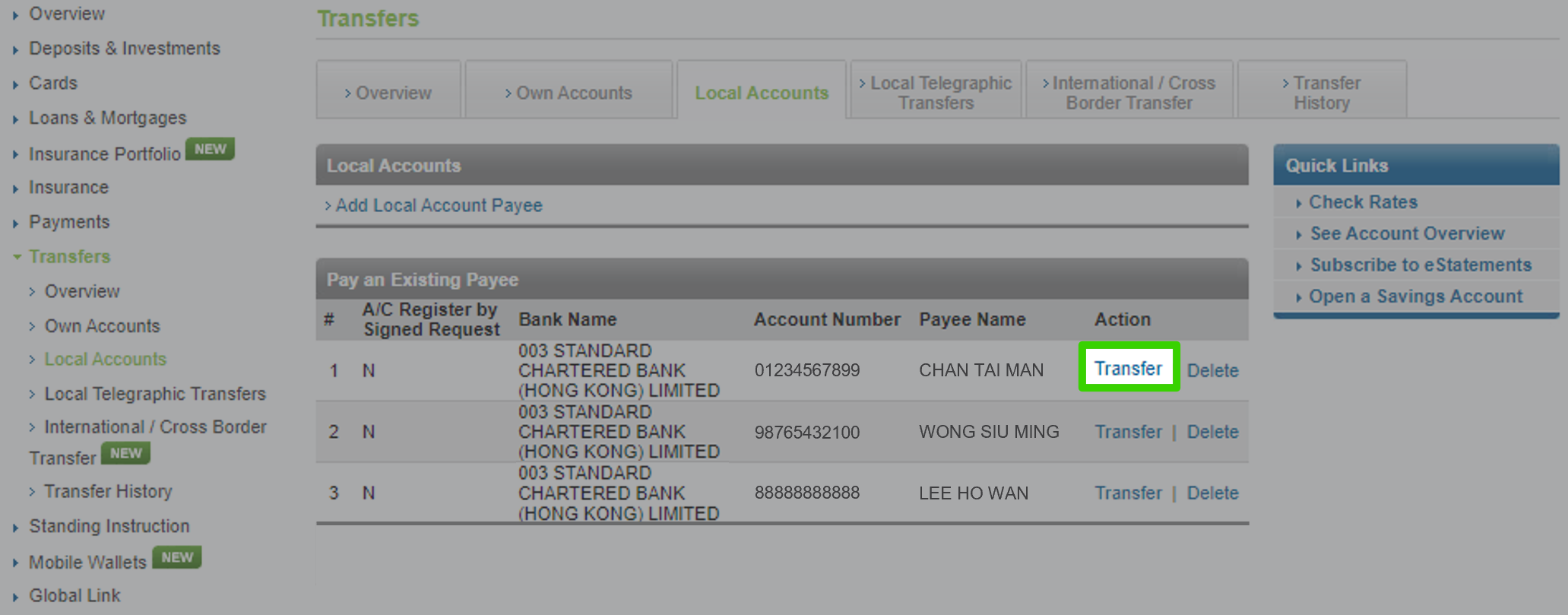

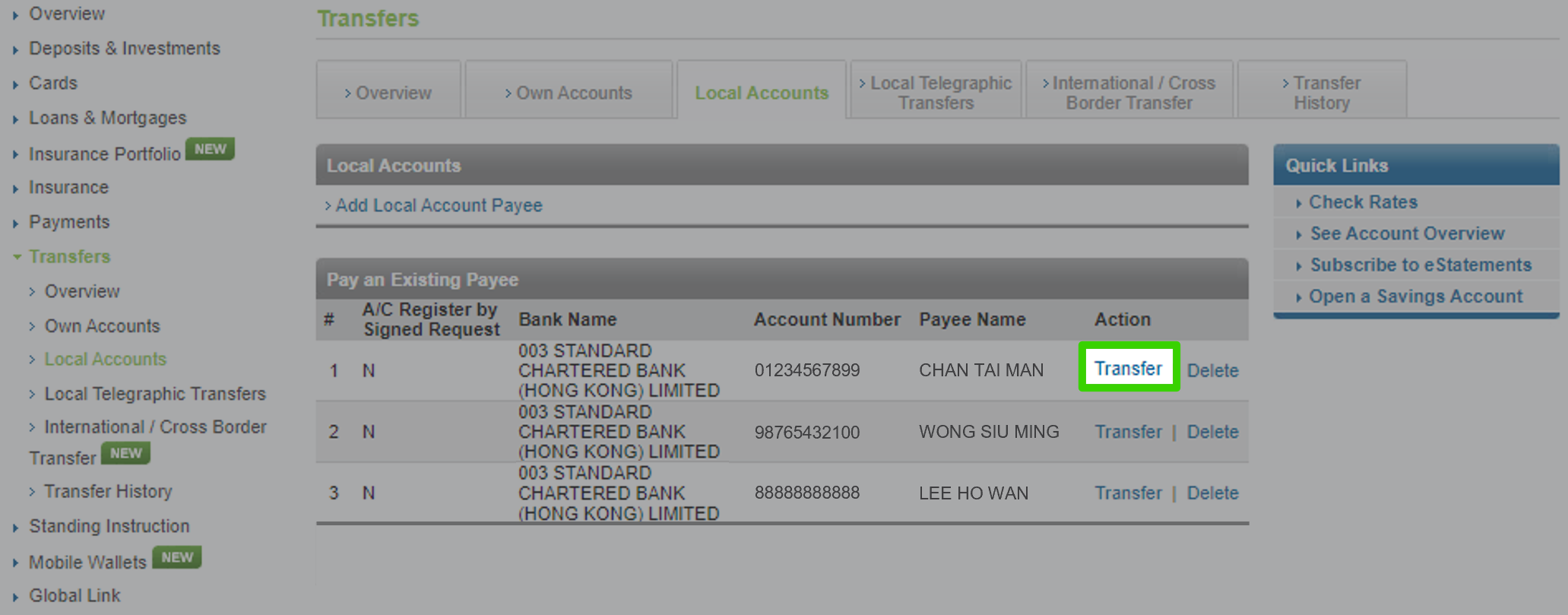

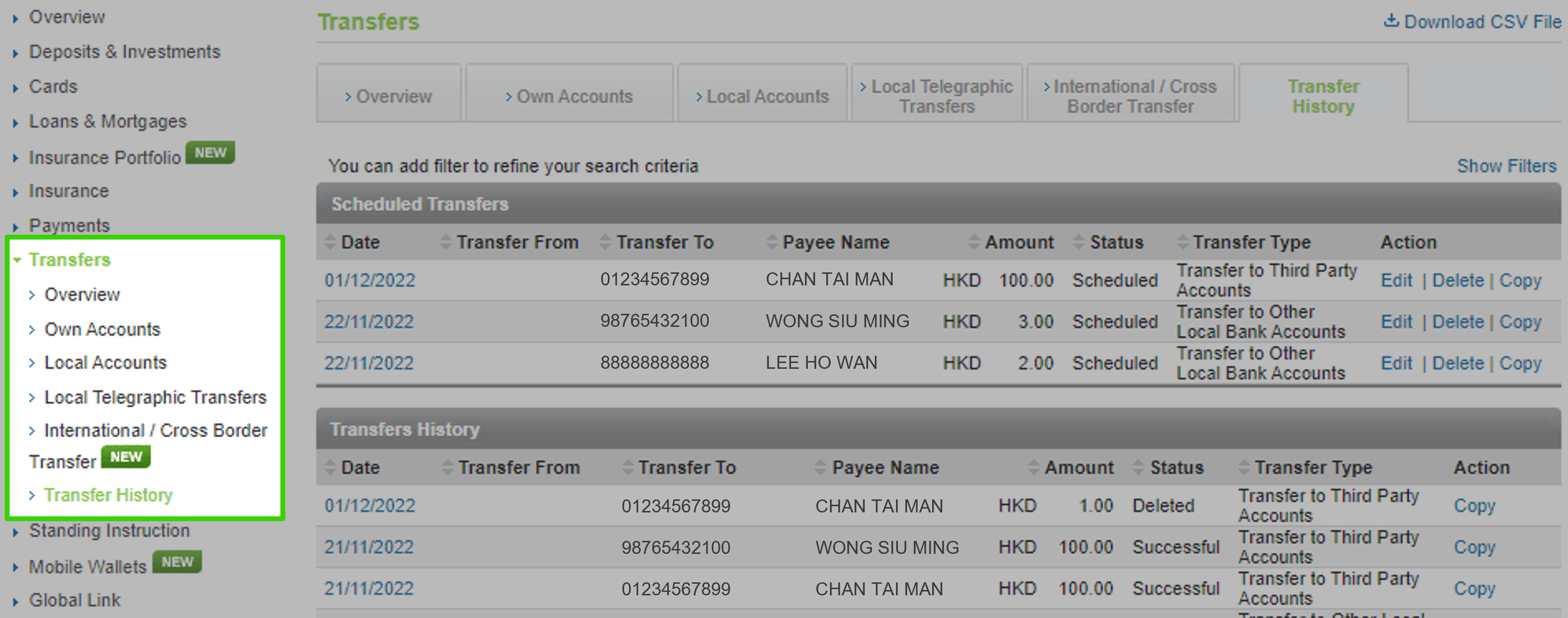

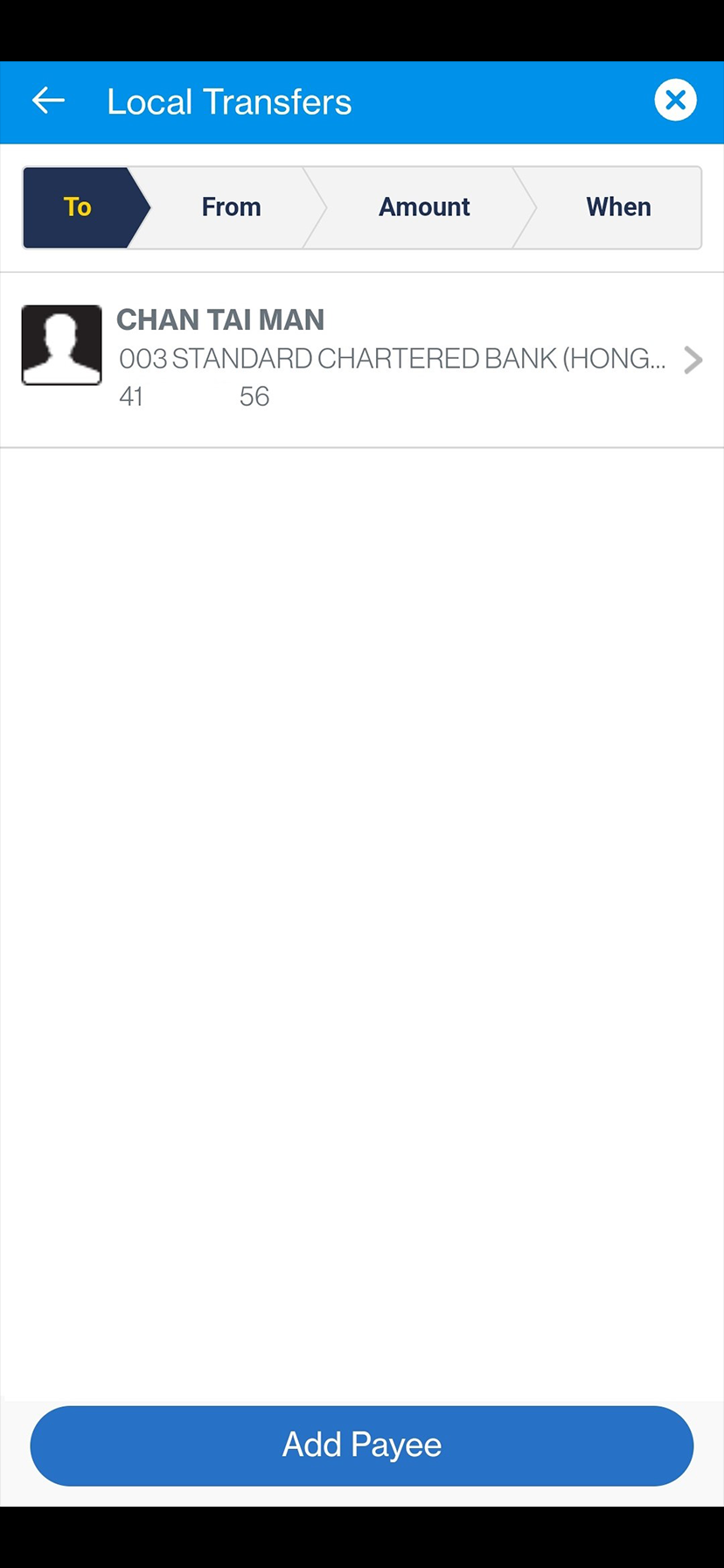

How to make transferStep 1

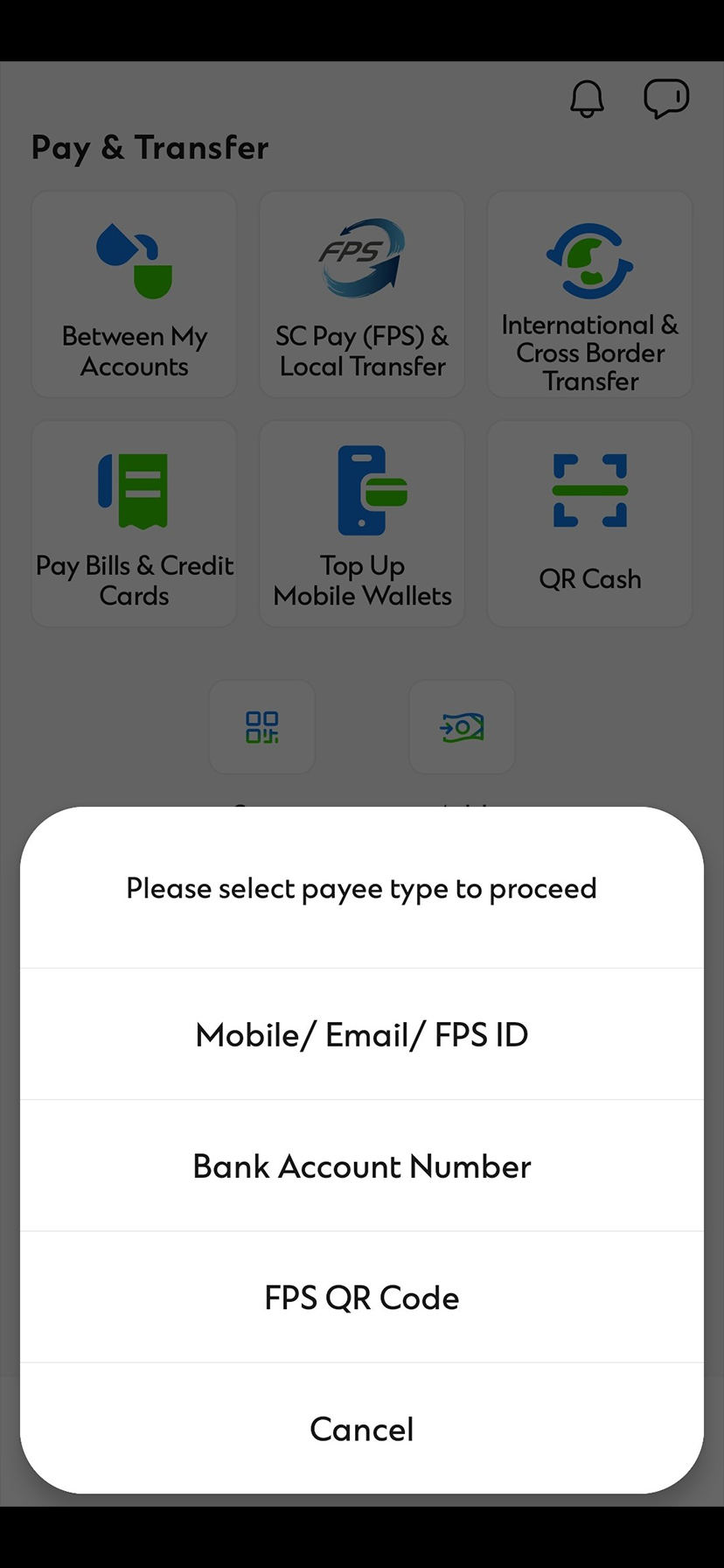

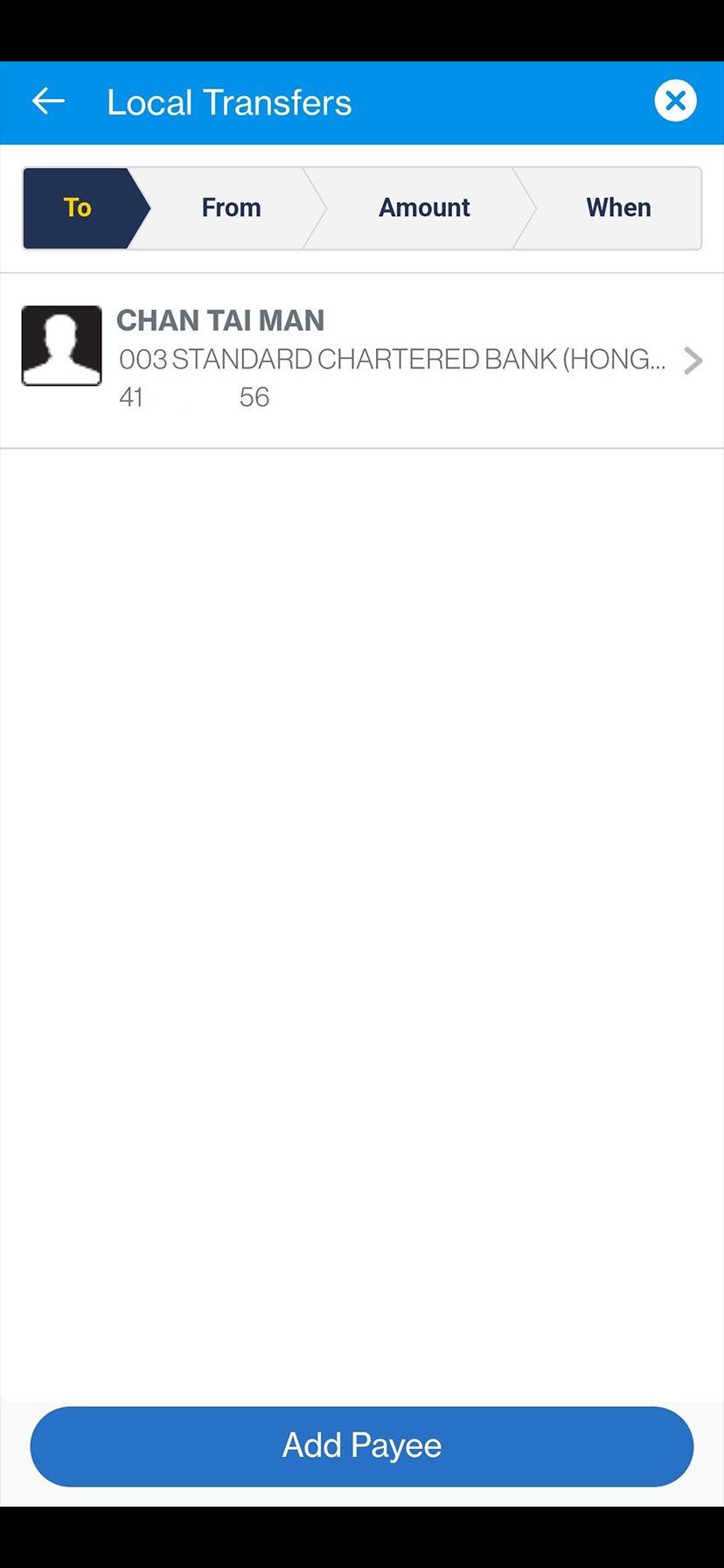

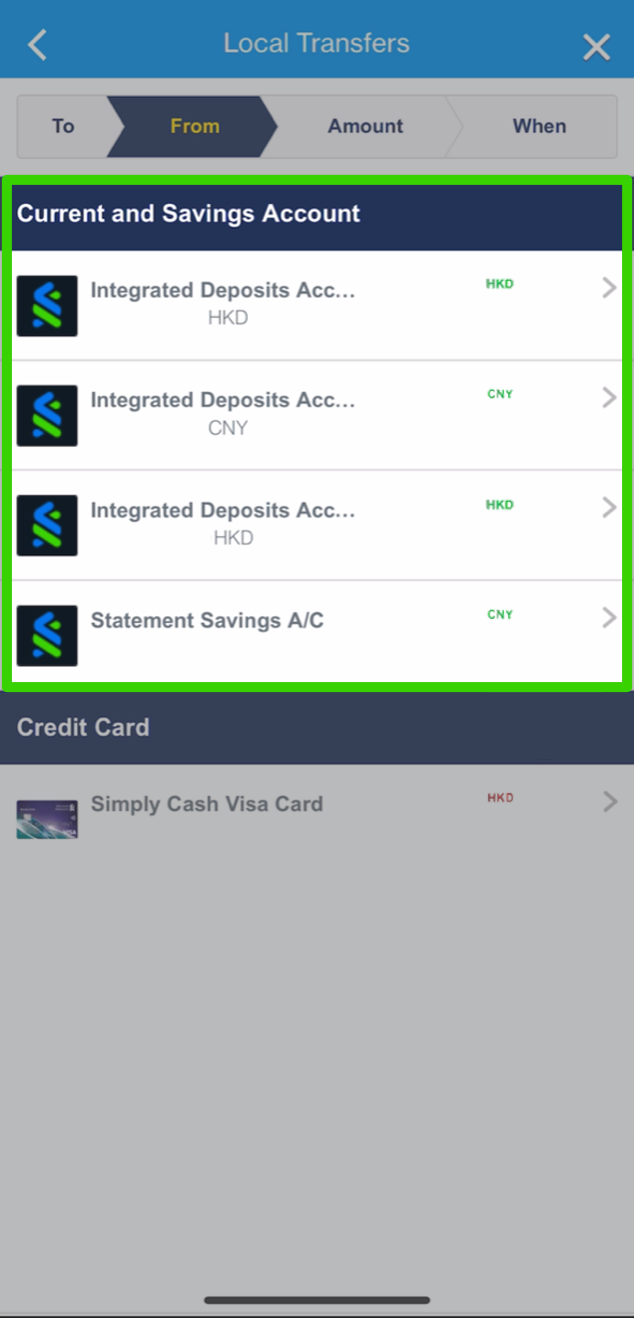

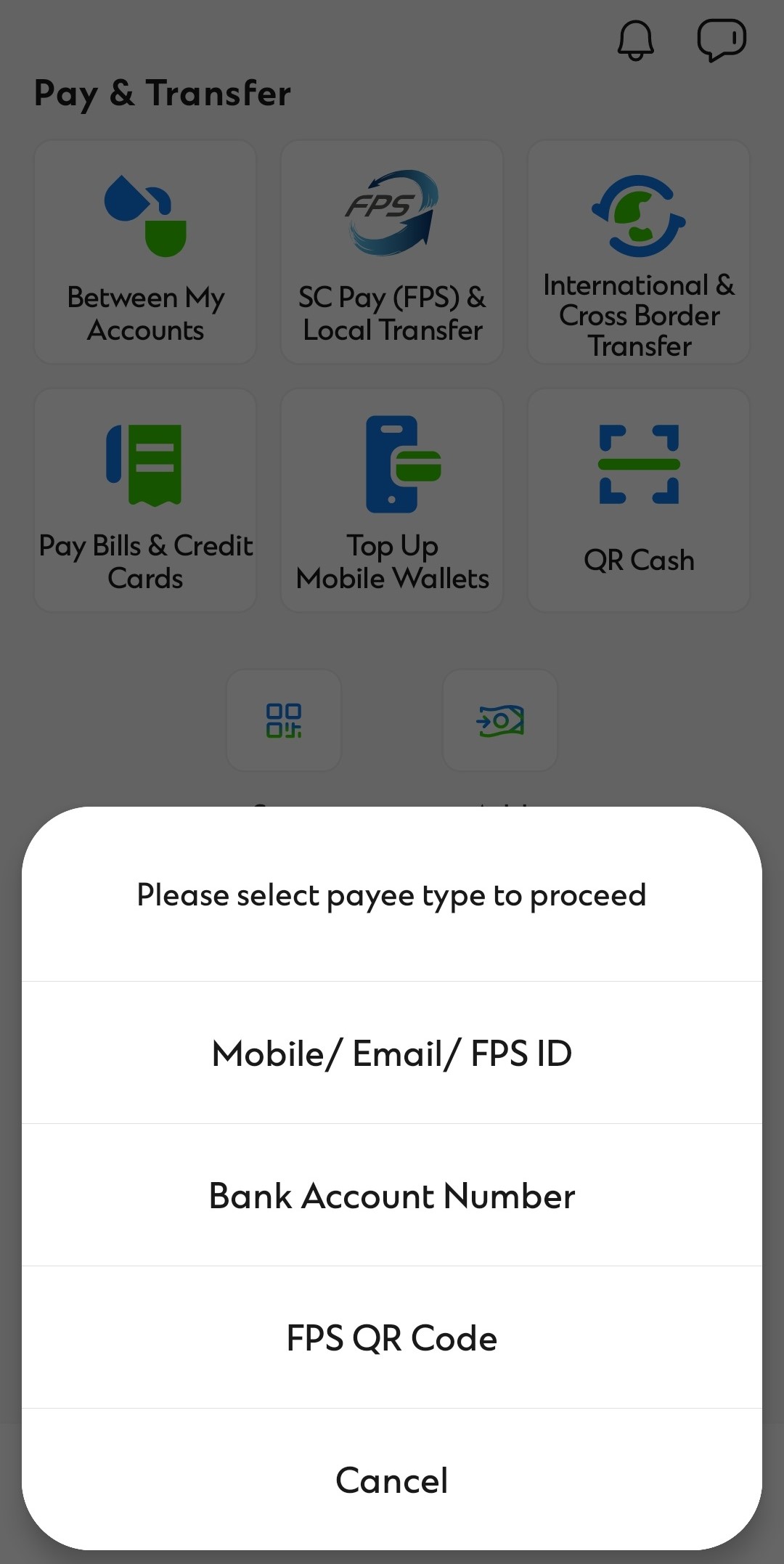

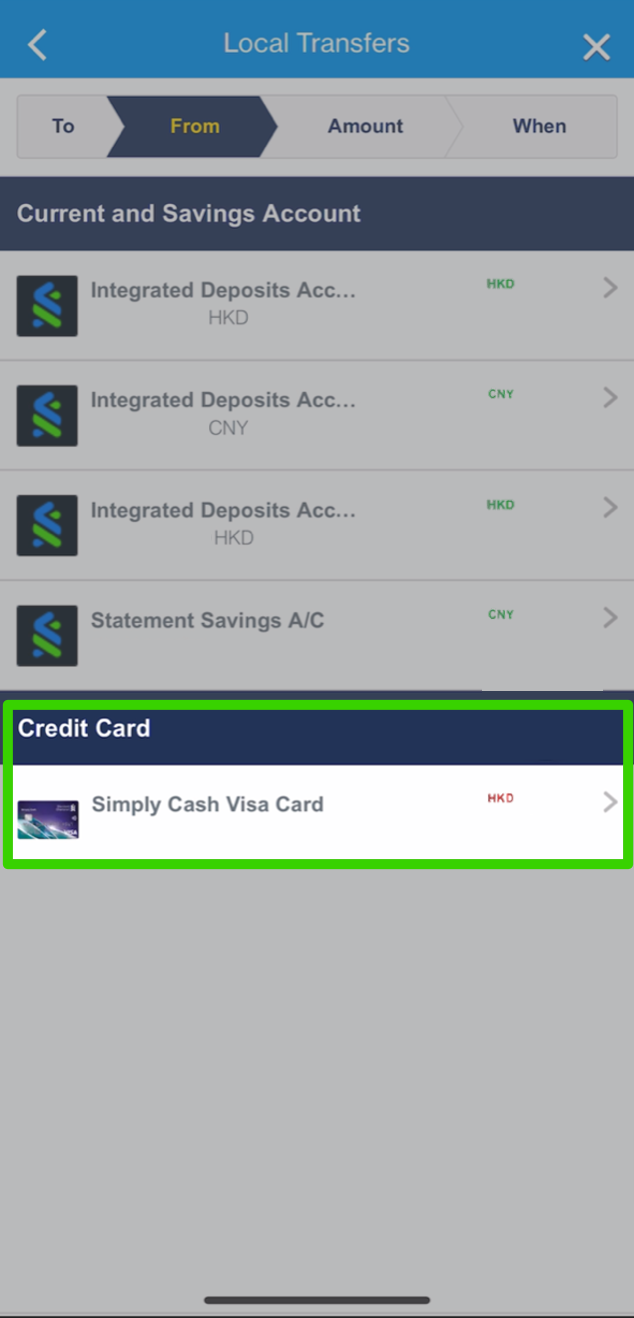

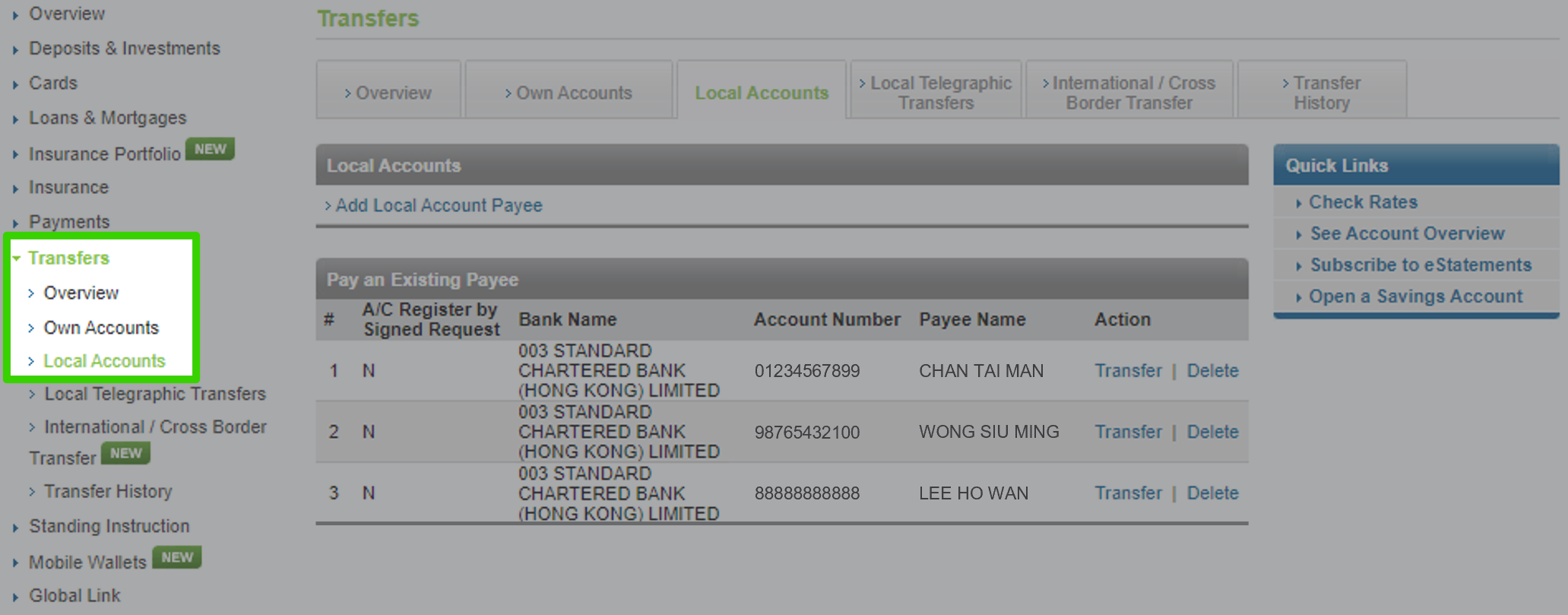

Go to ‘Pay & Transfer’ then select ‘SC Pay (FPS) & Local Transfer’. Select 'Bank Account Number' and then click 'Add Payee' if the payee has not been added before.

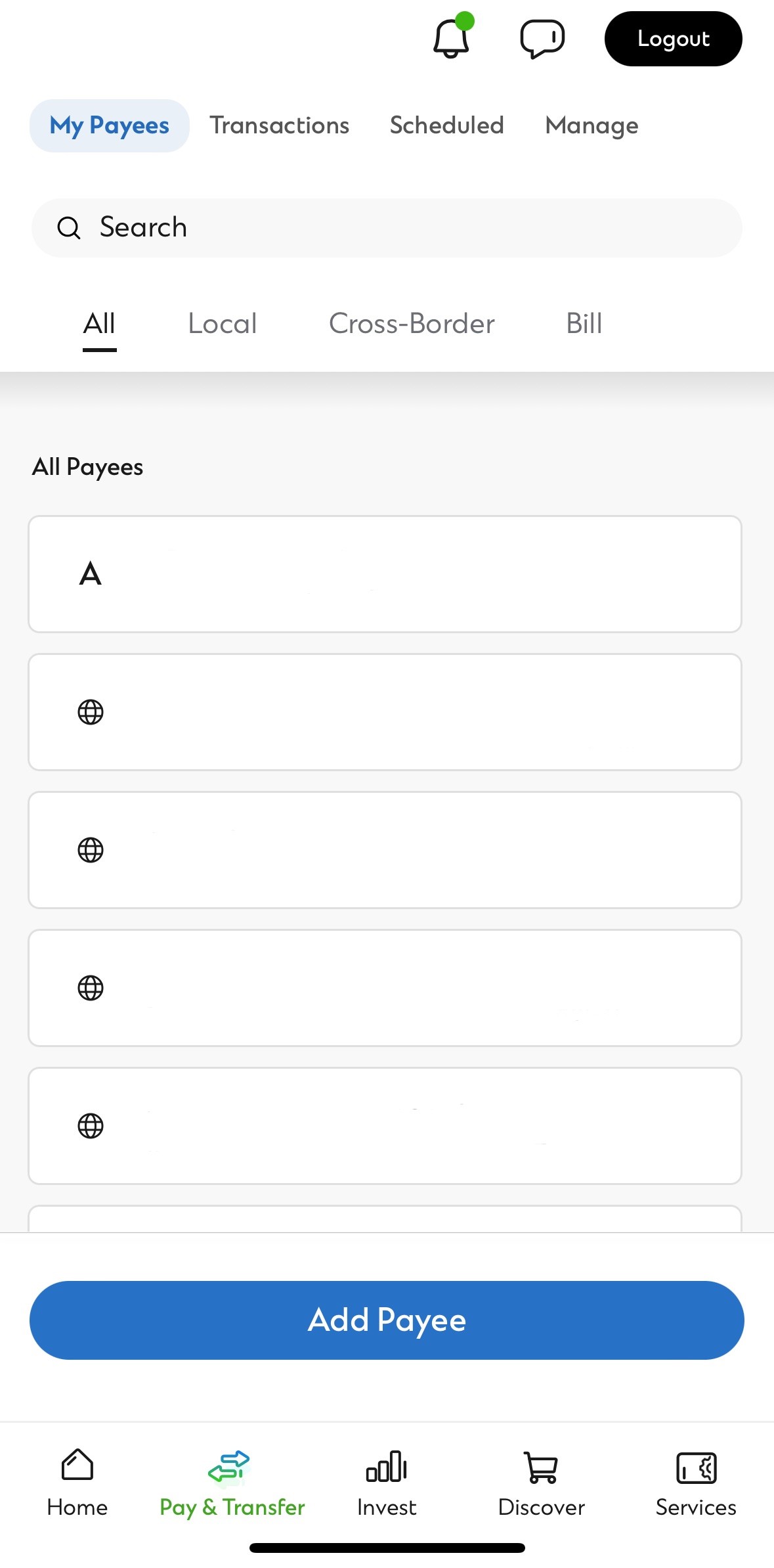

You can also add payee via ‘My Payees’ in ‘Pay & Transfer’. Click ‘Add Payee’ then select ‘Local’

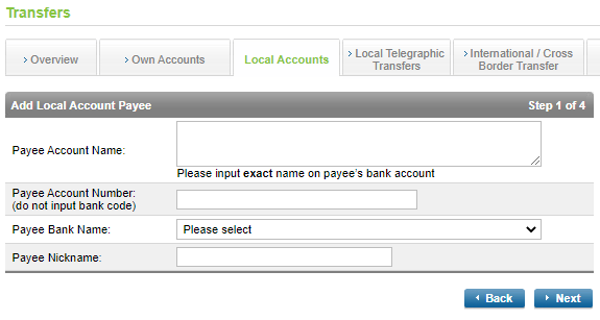

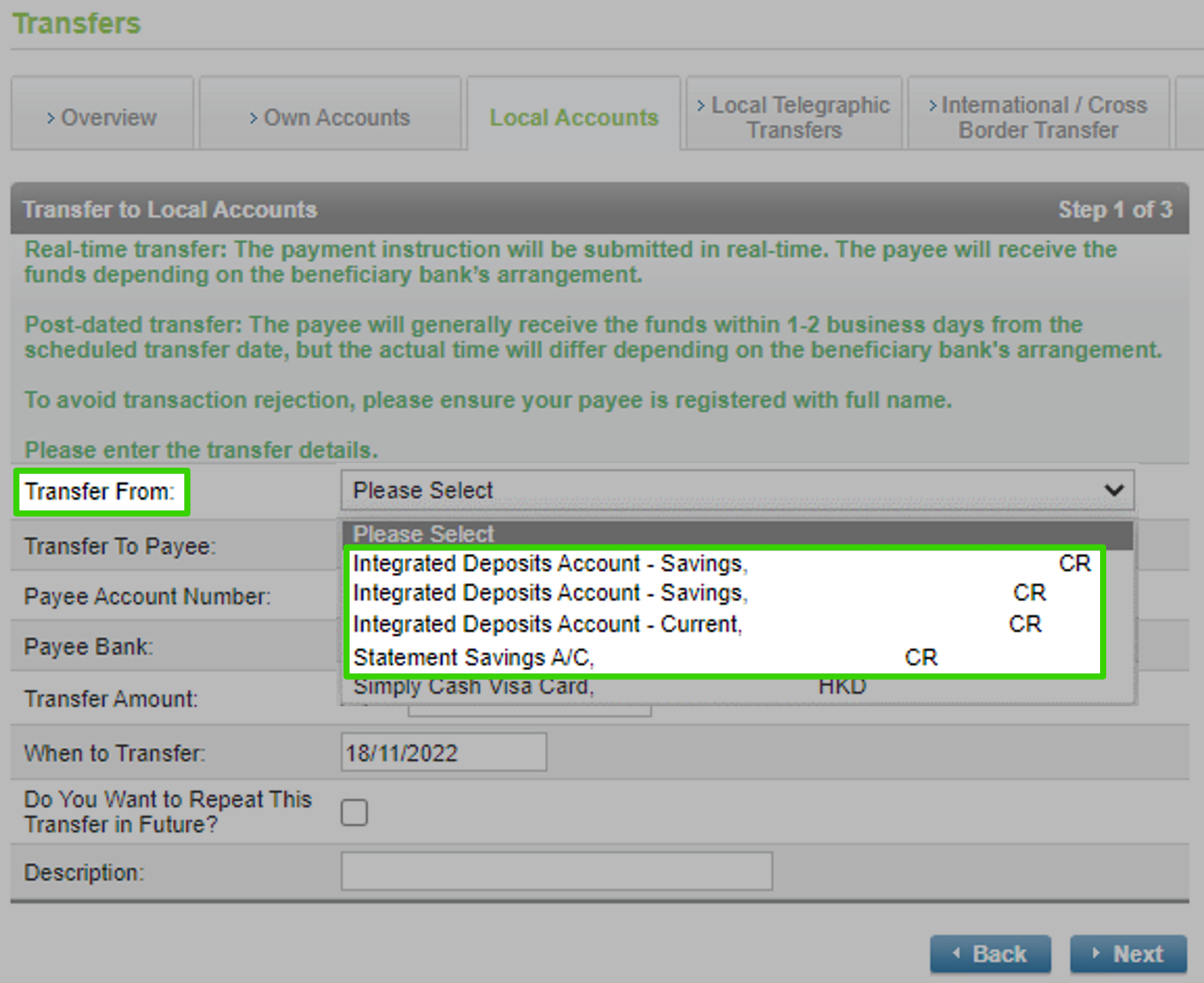

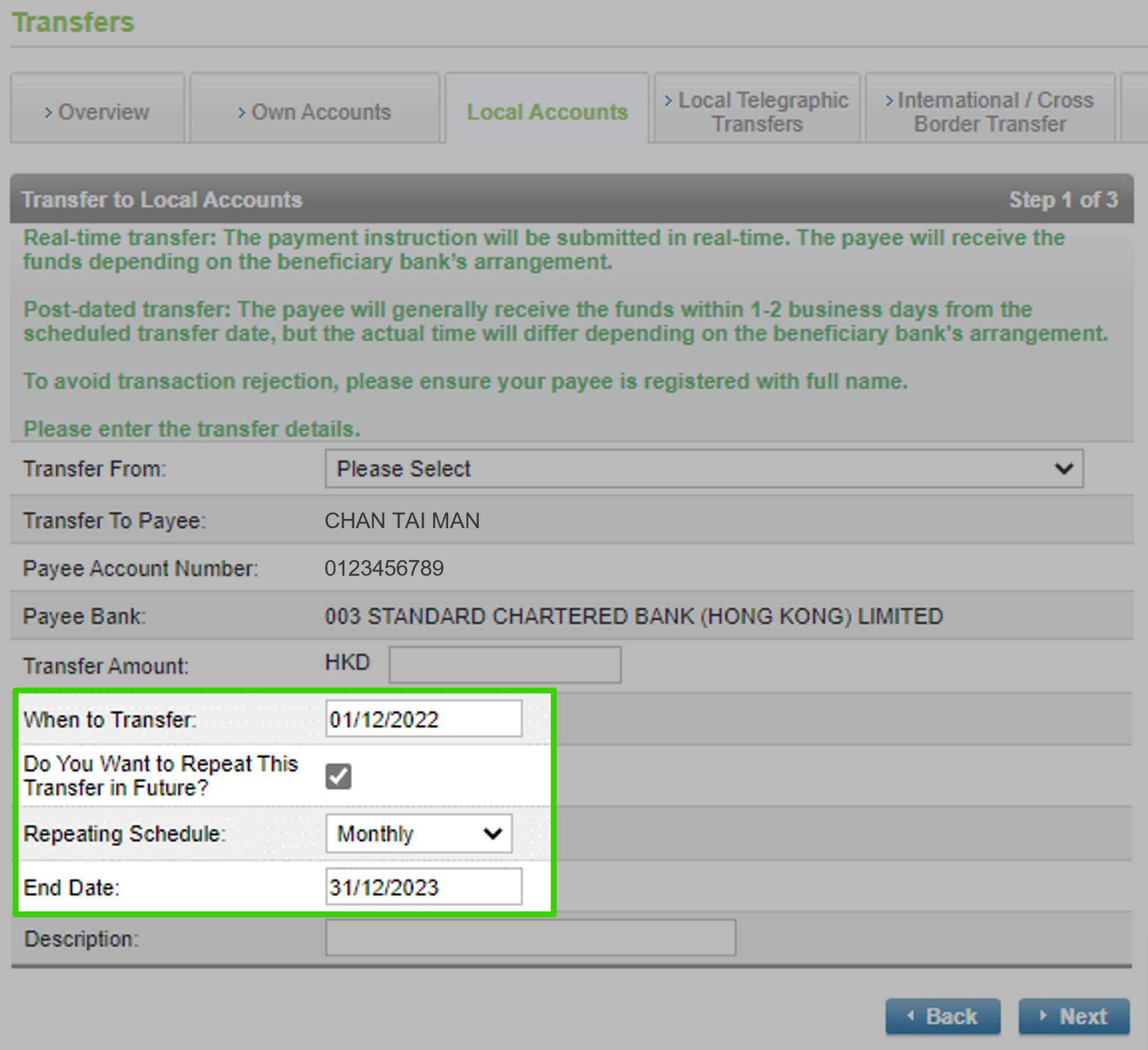

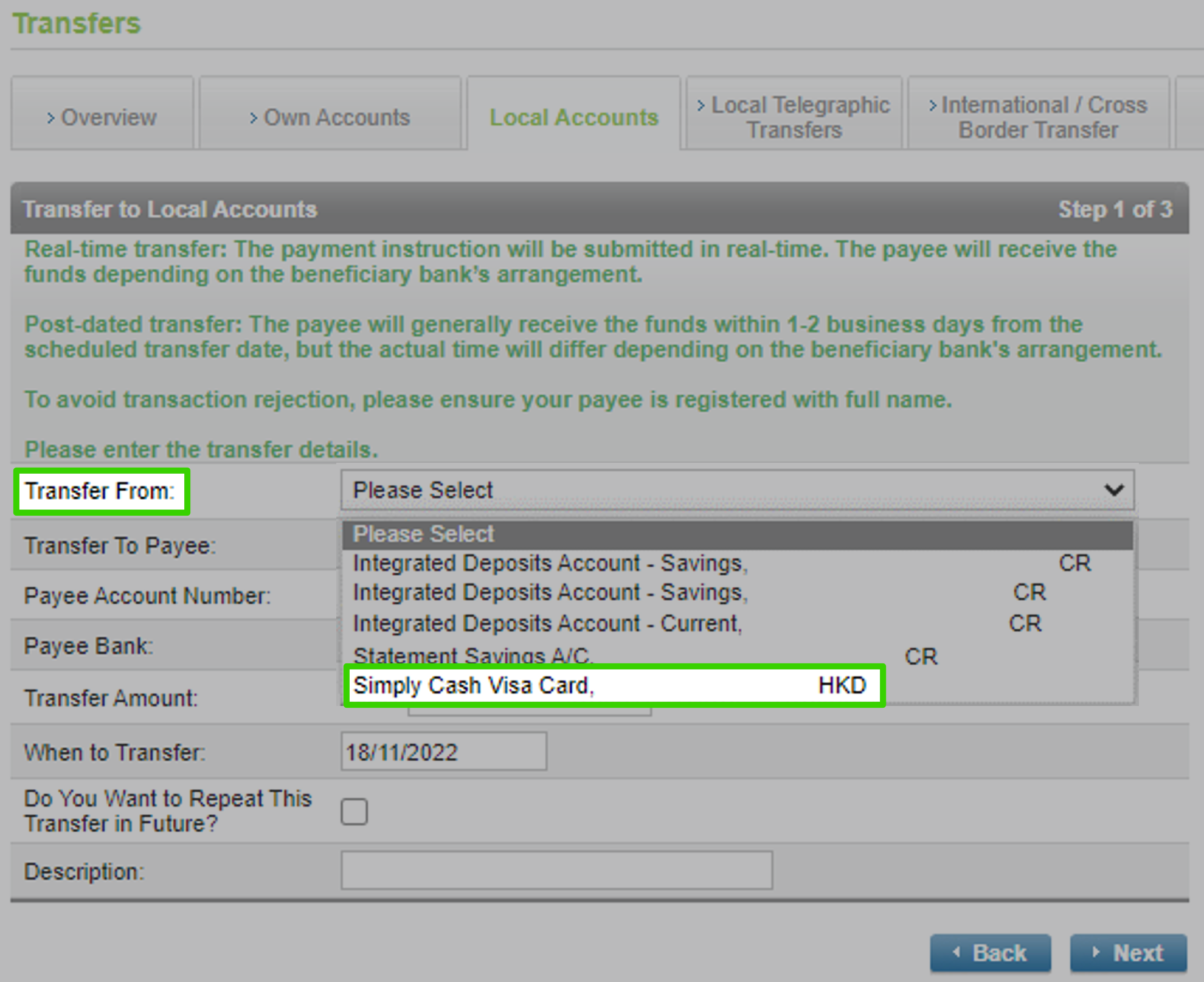

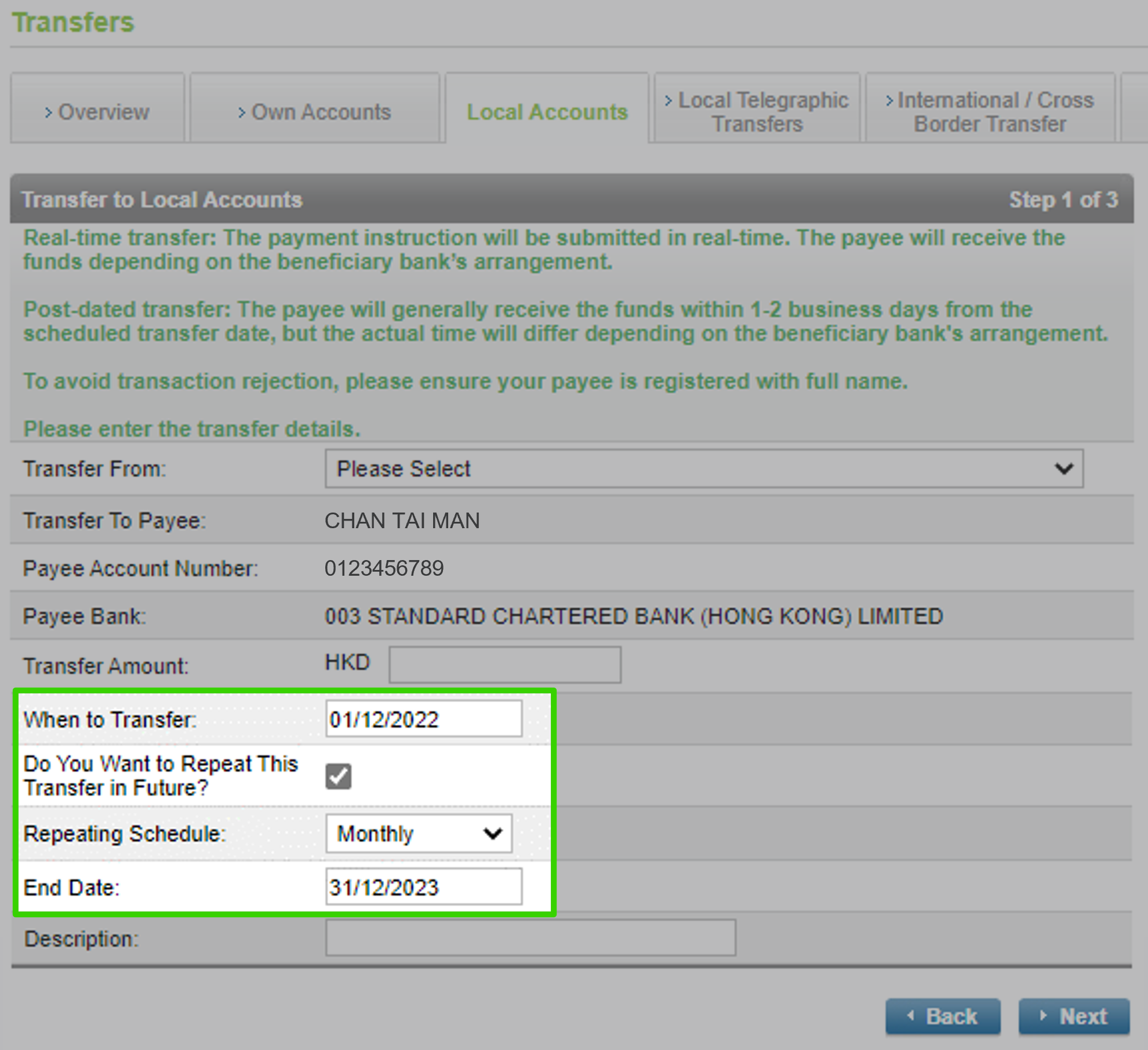

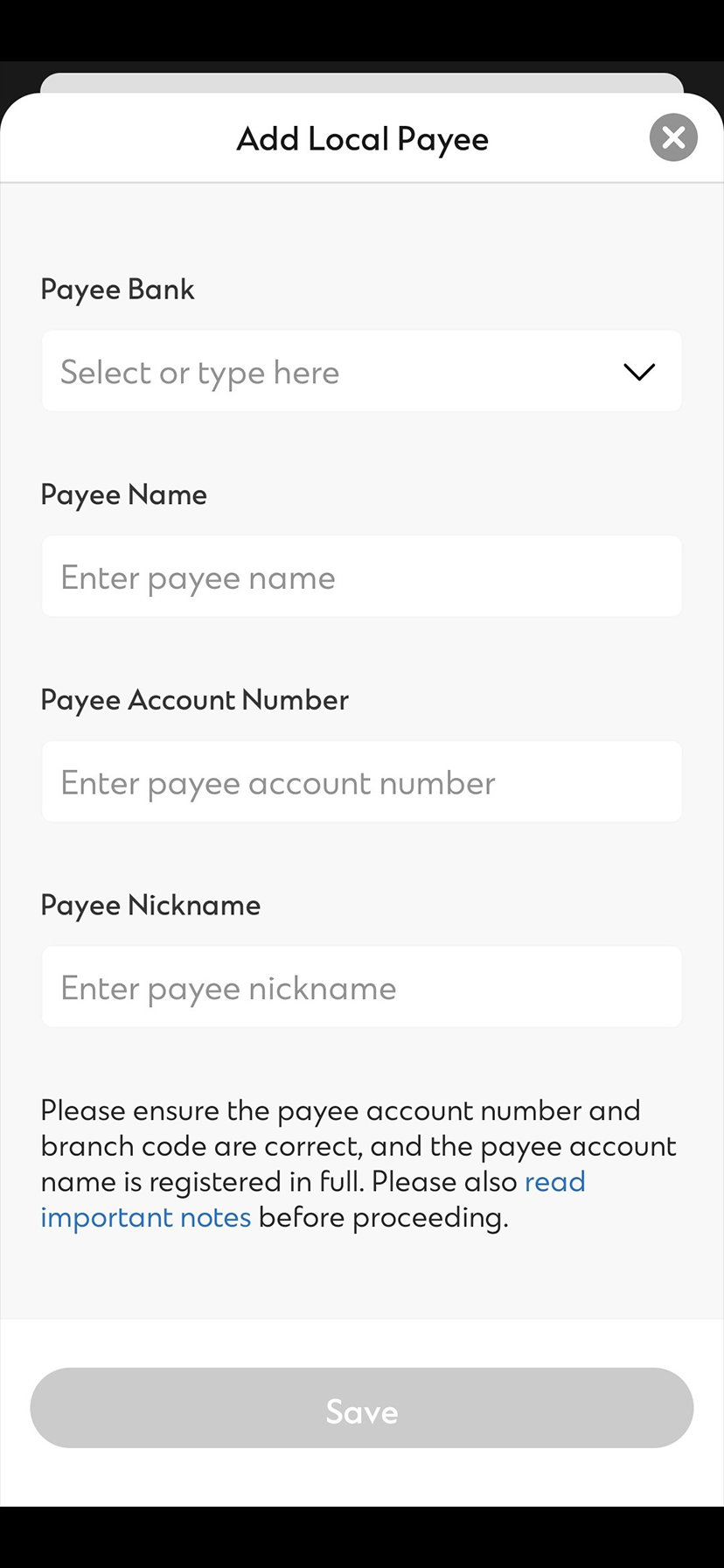

Step 2

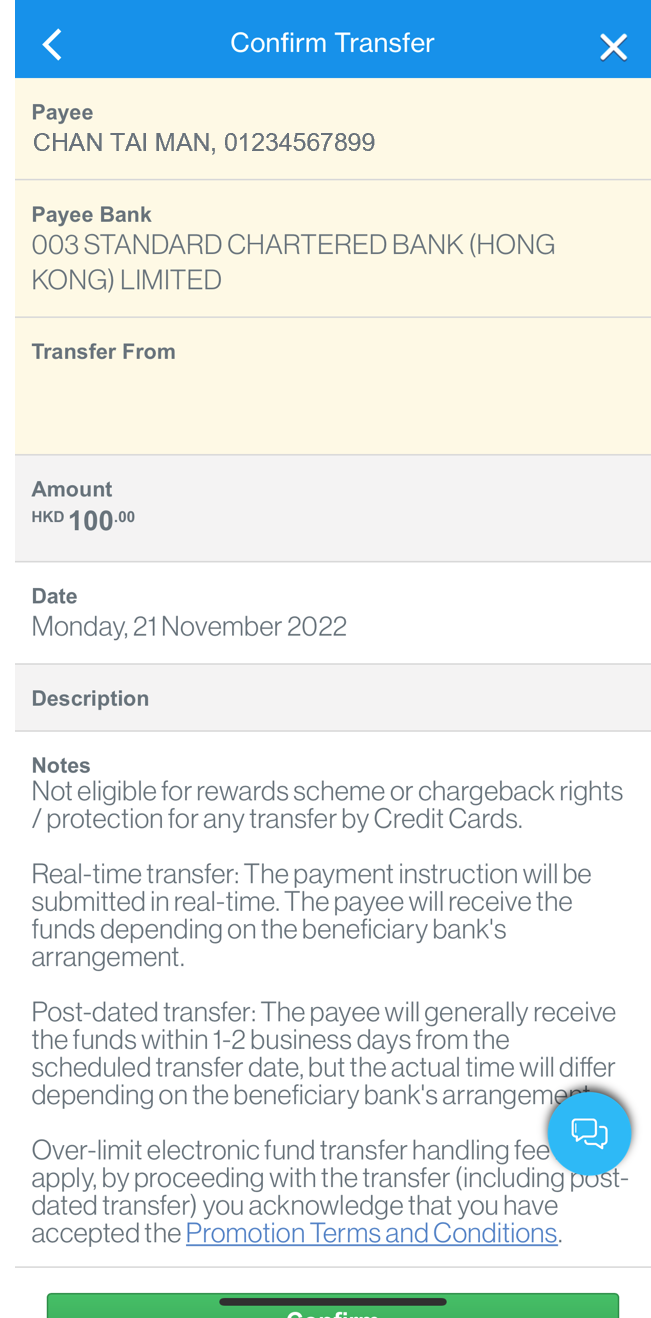

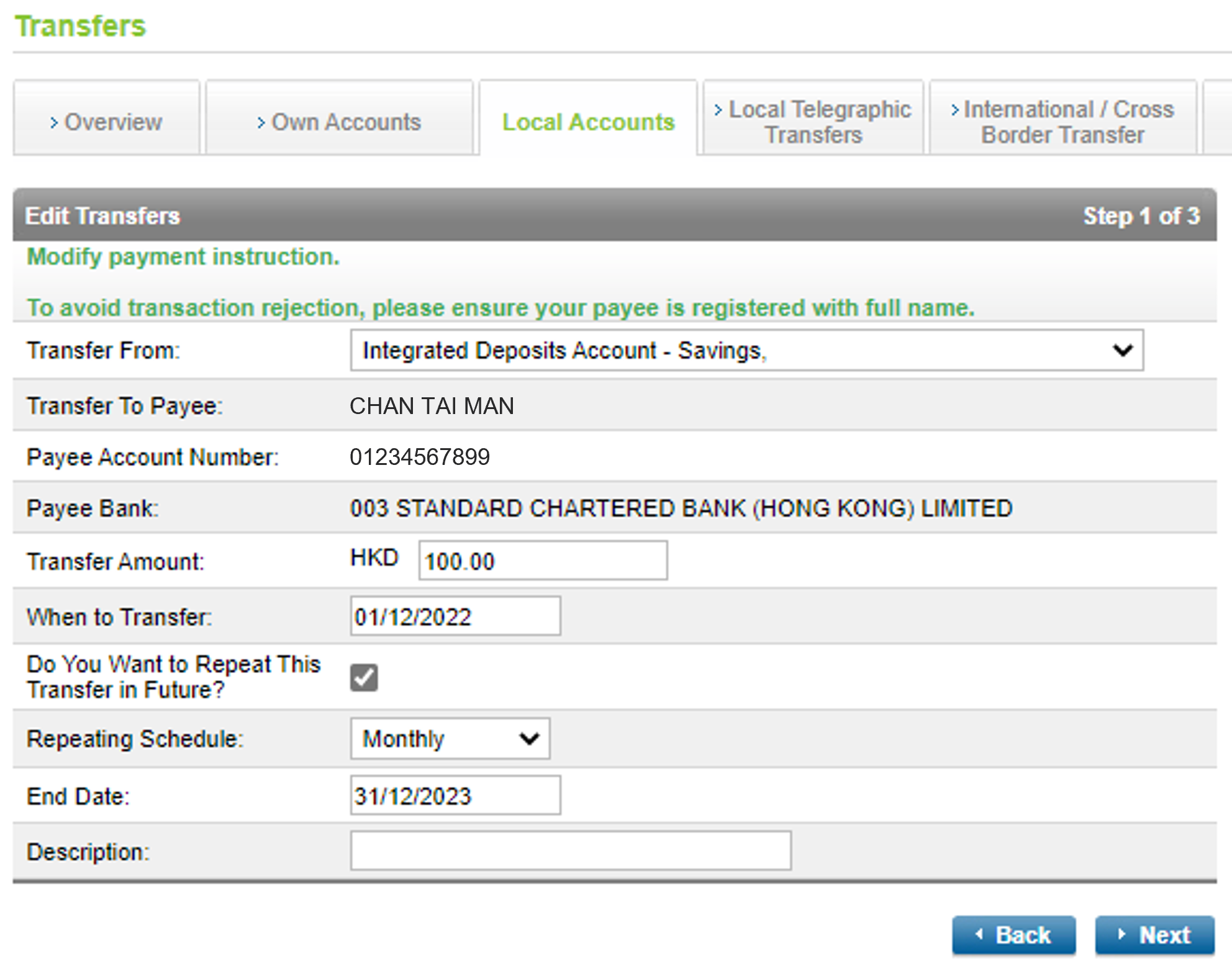

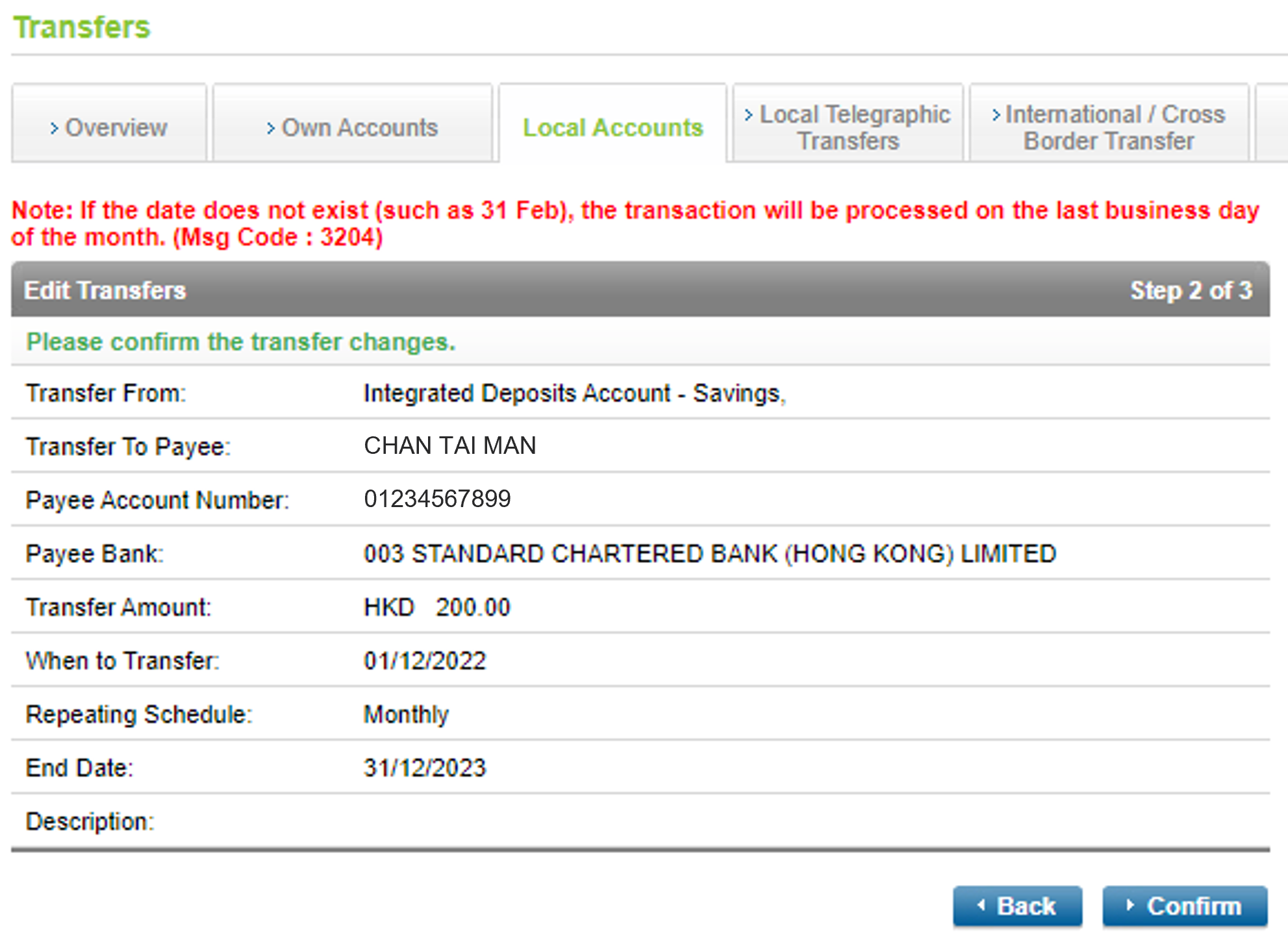

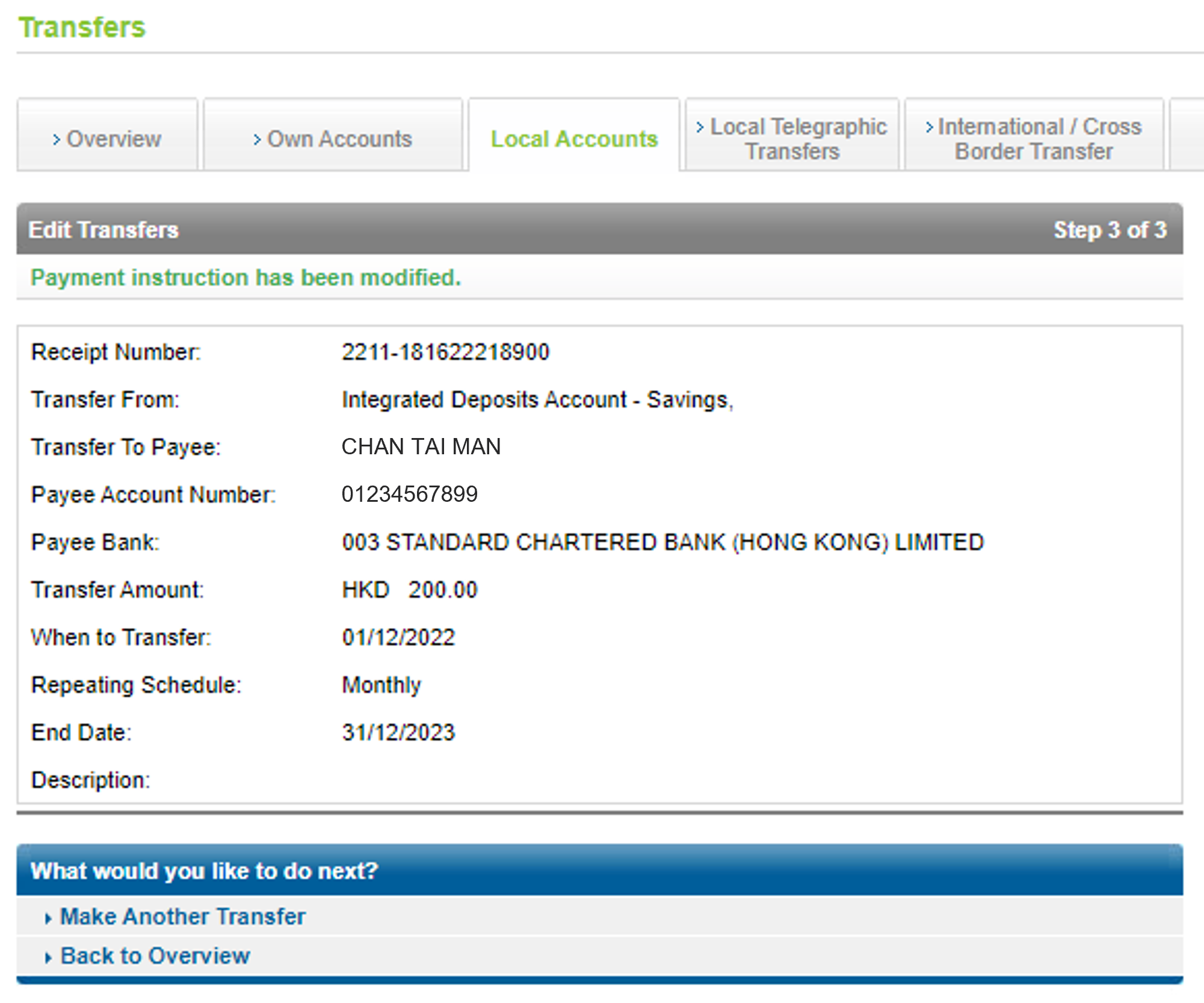

Enter payee account information

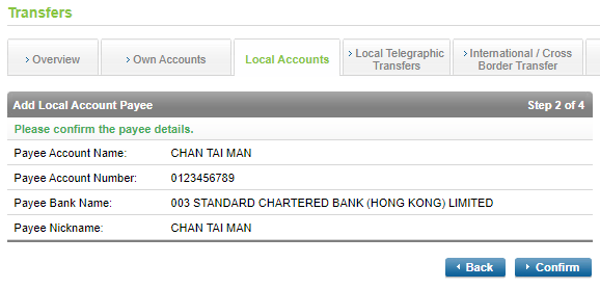

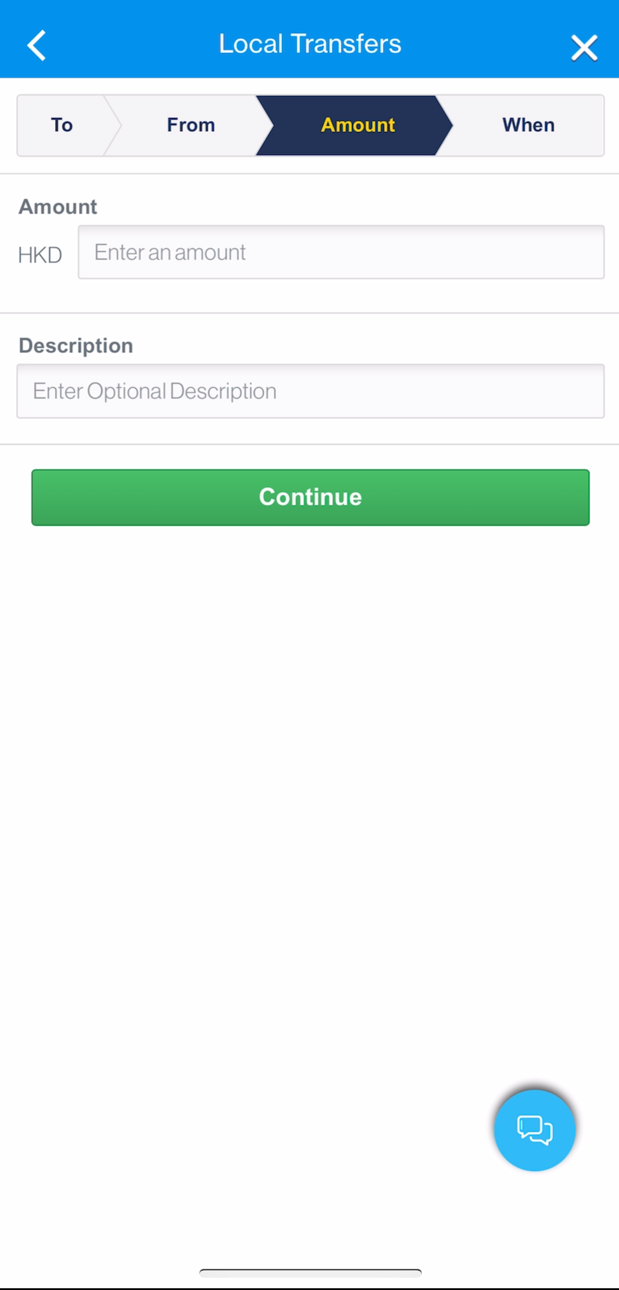

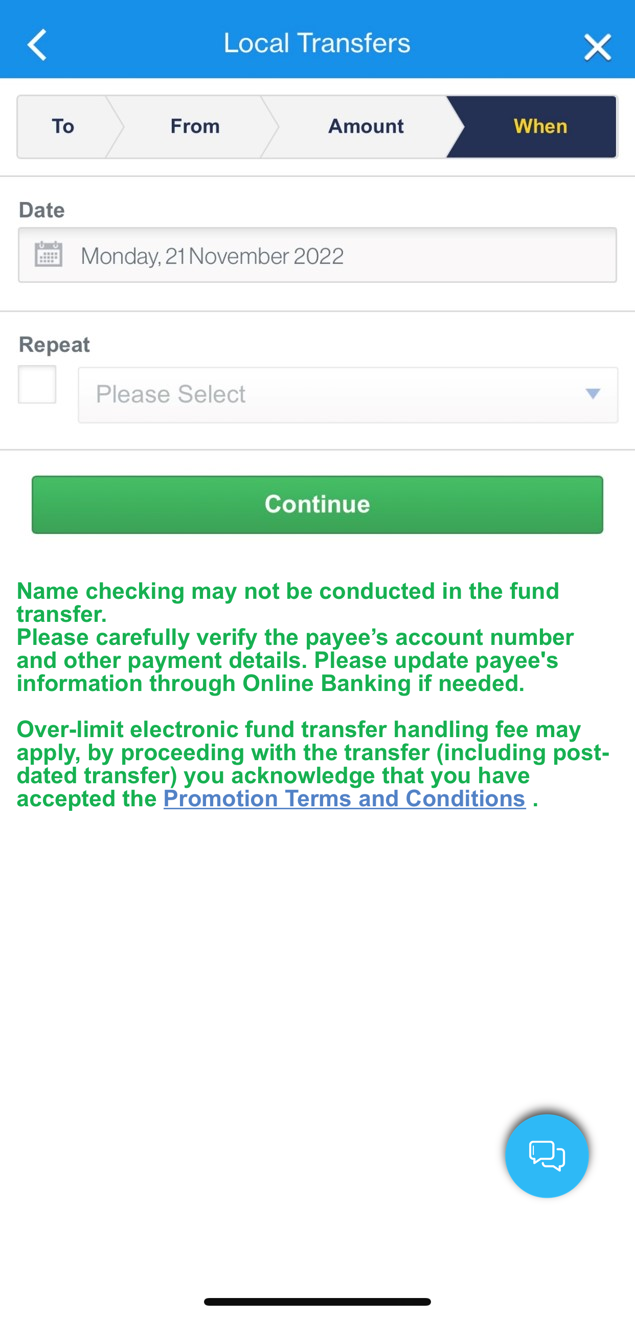

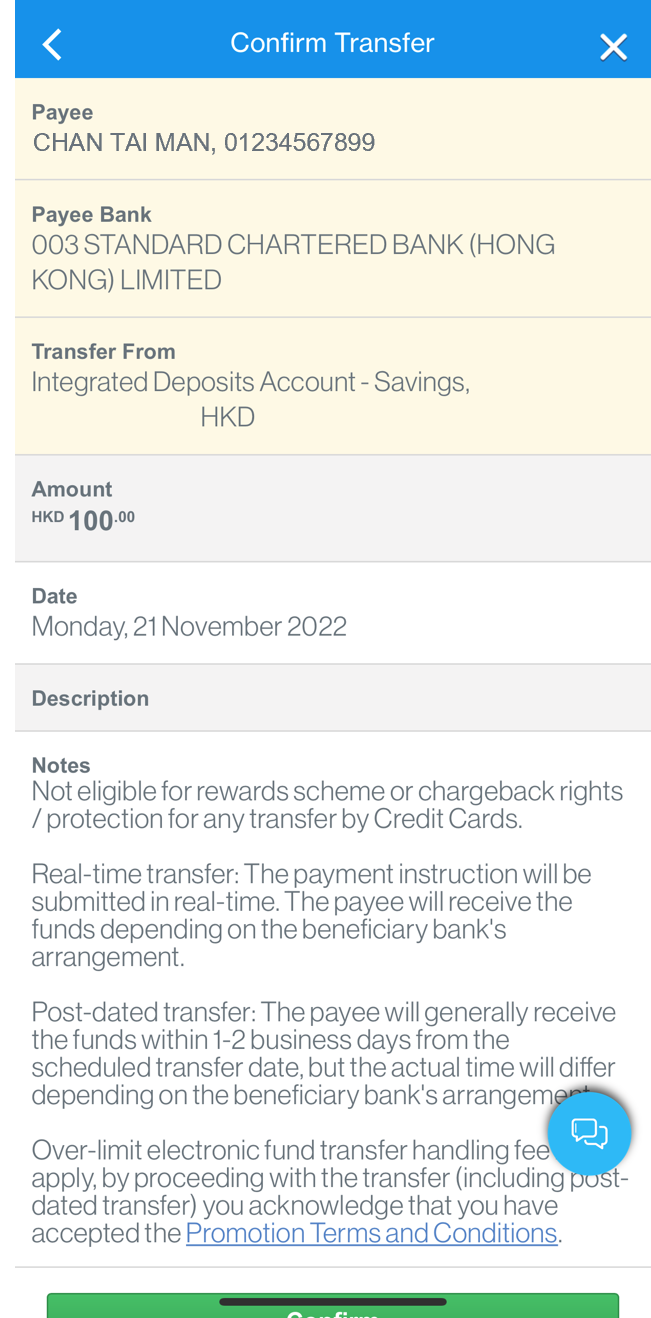

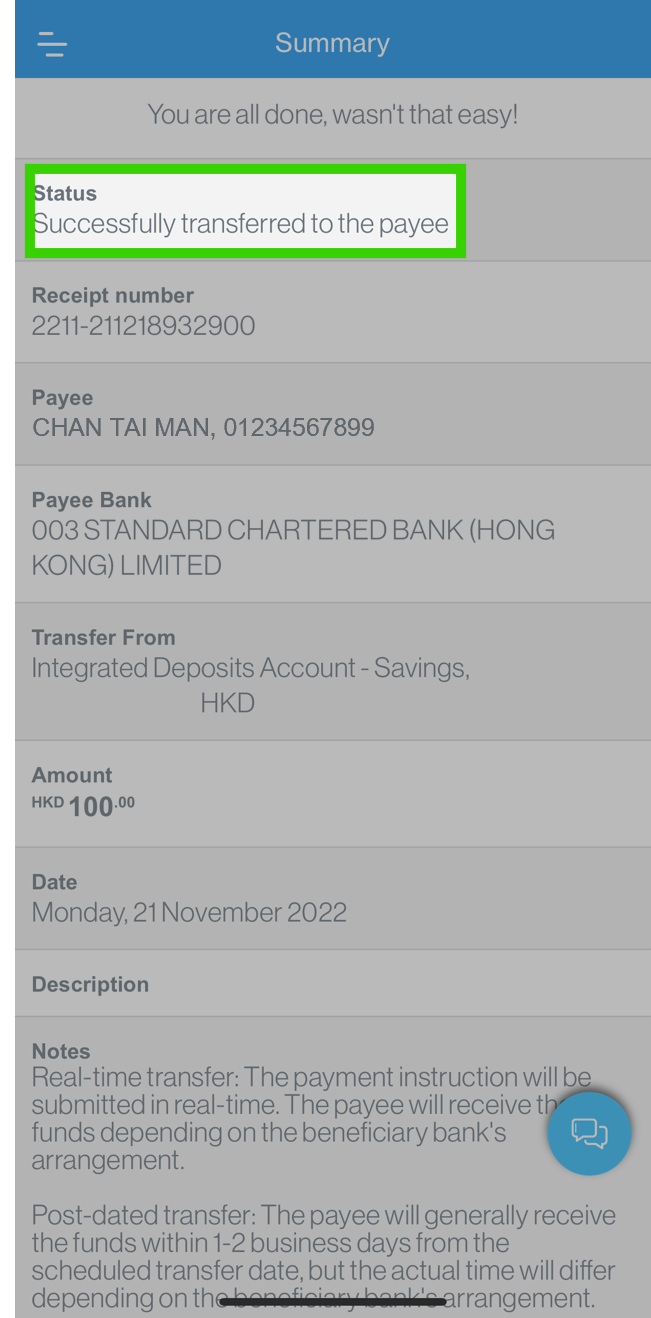

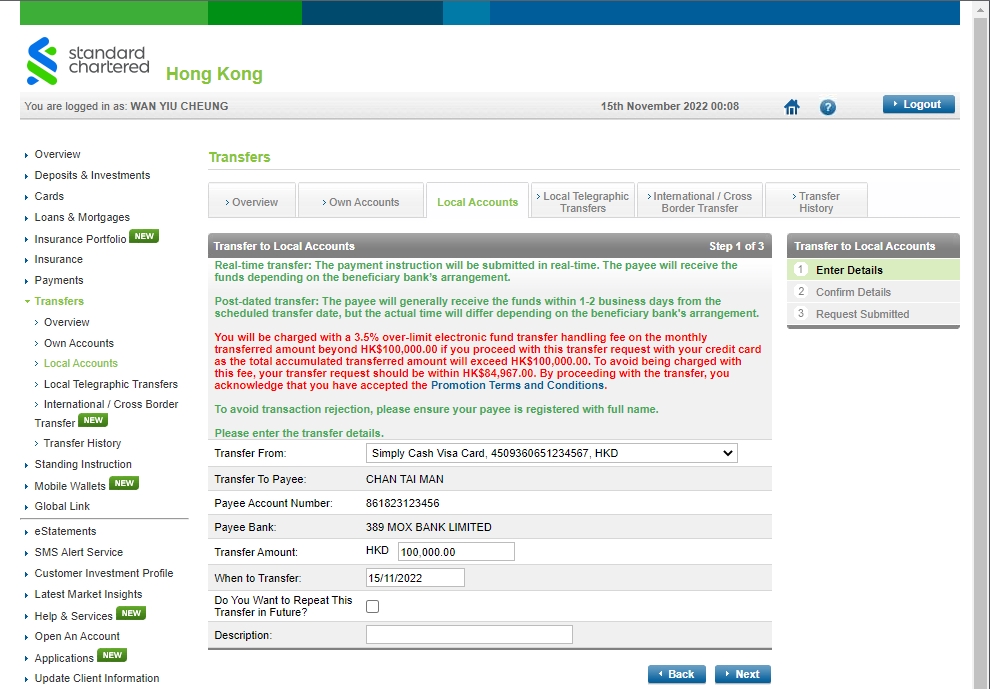

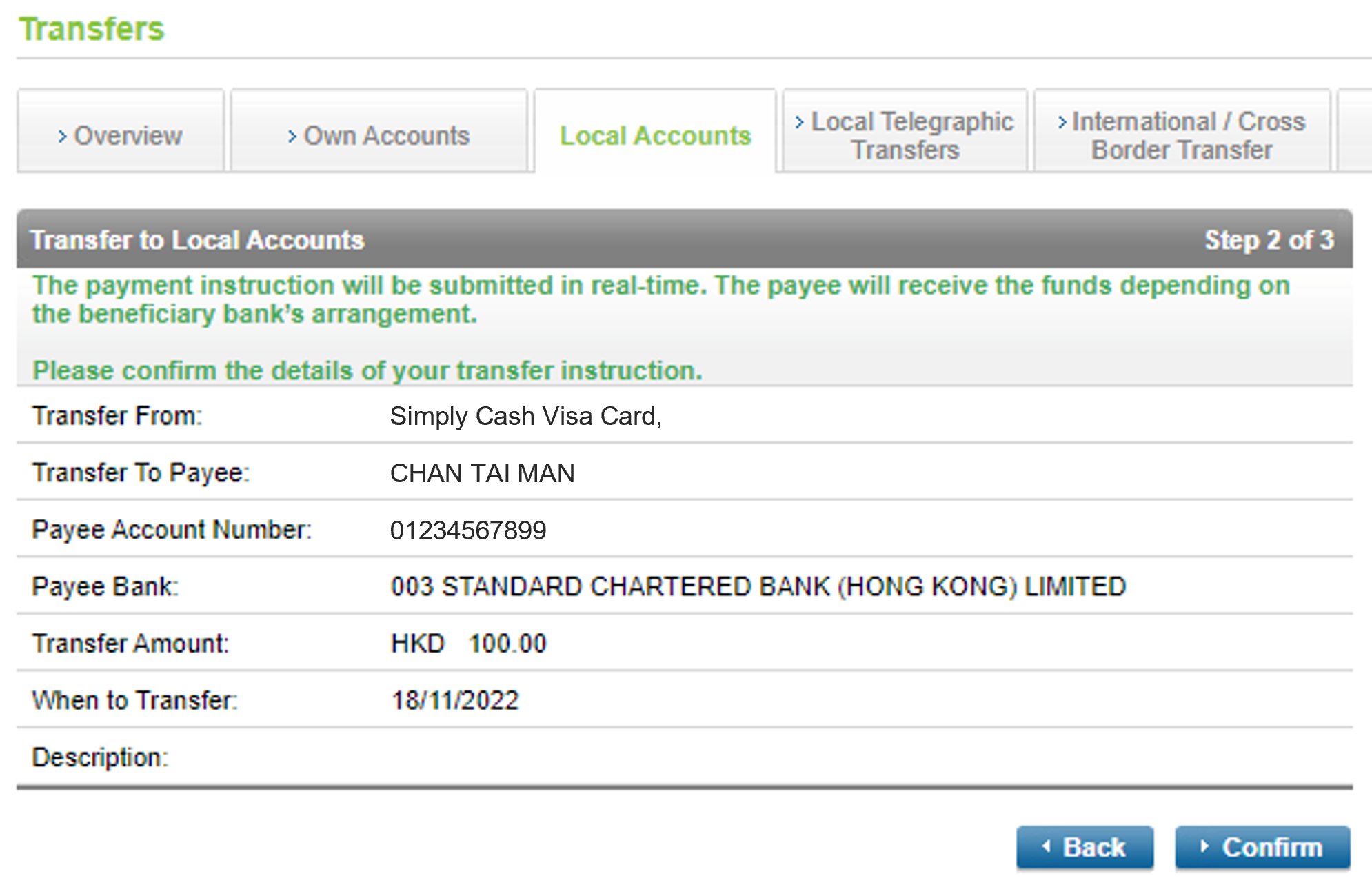

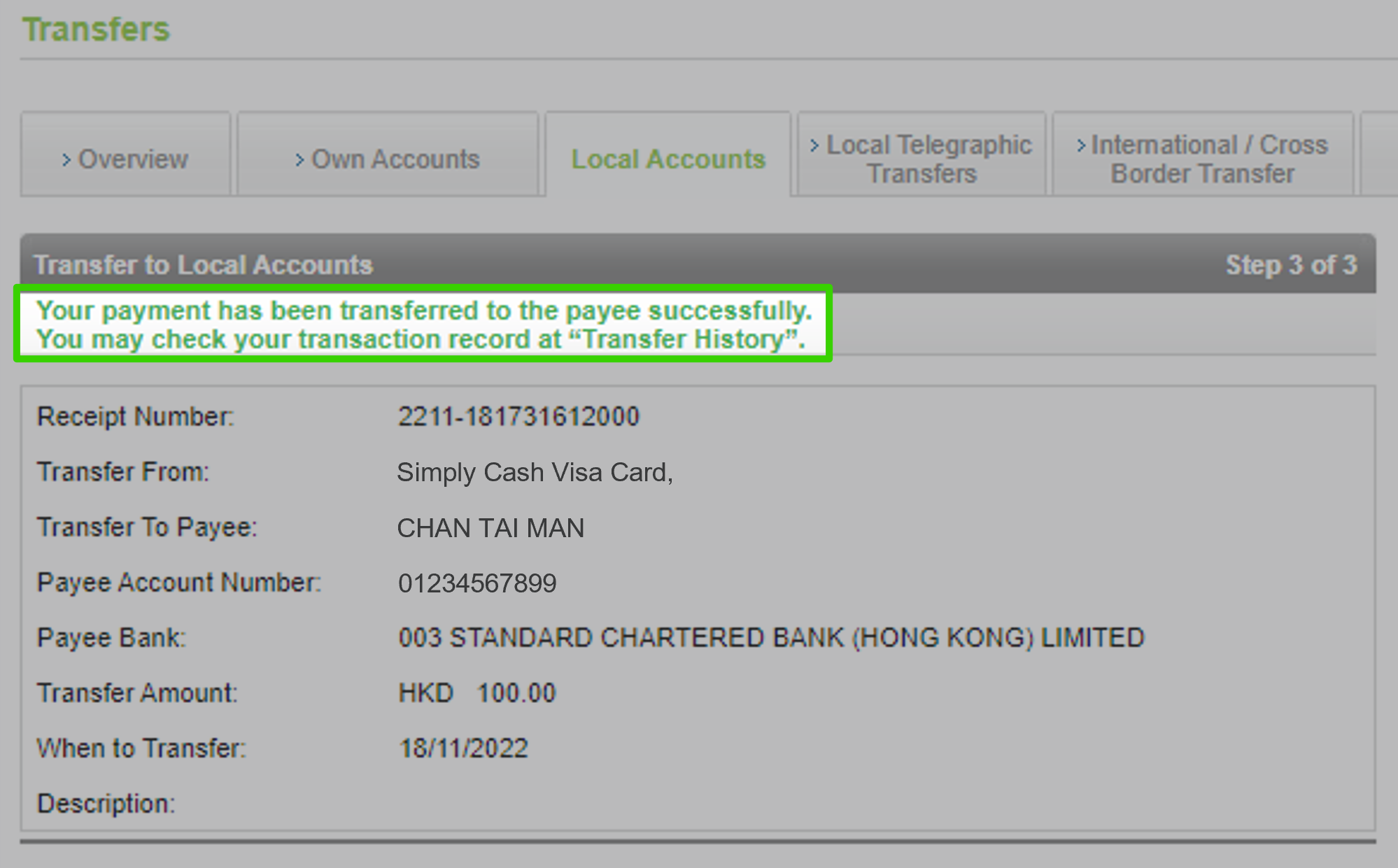

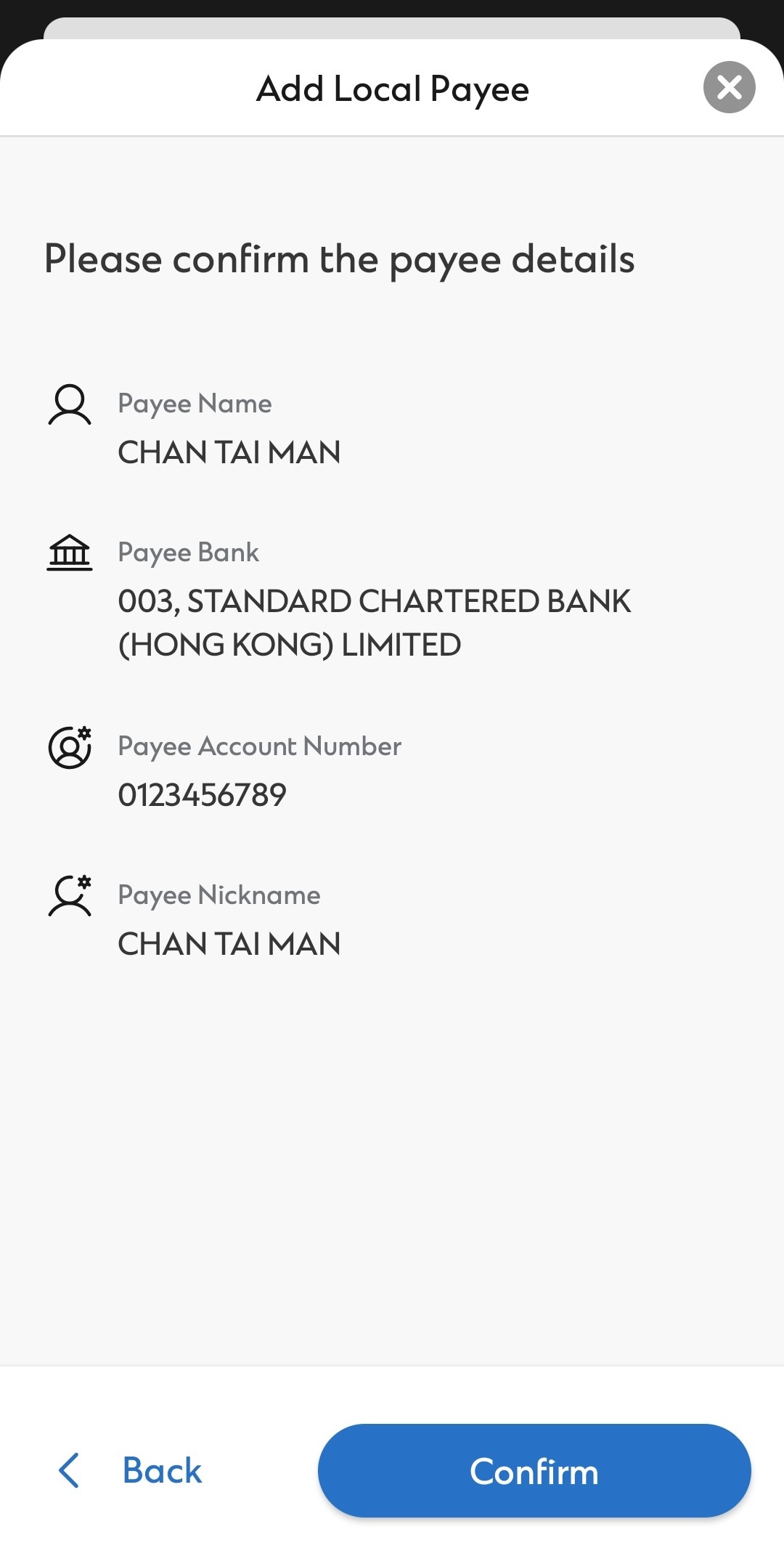

Step 3

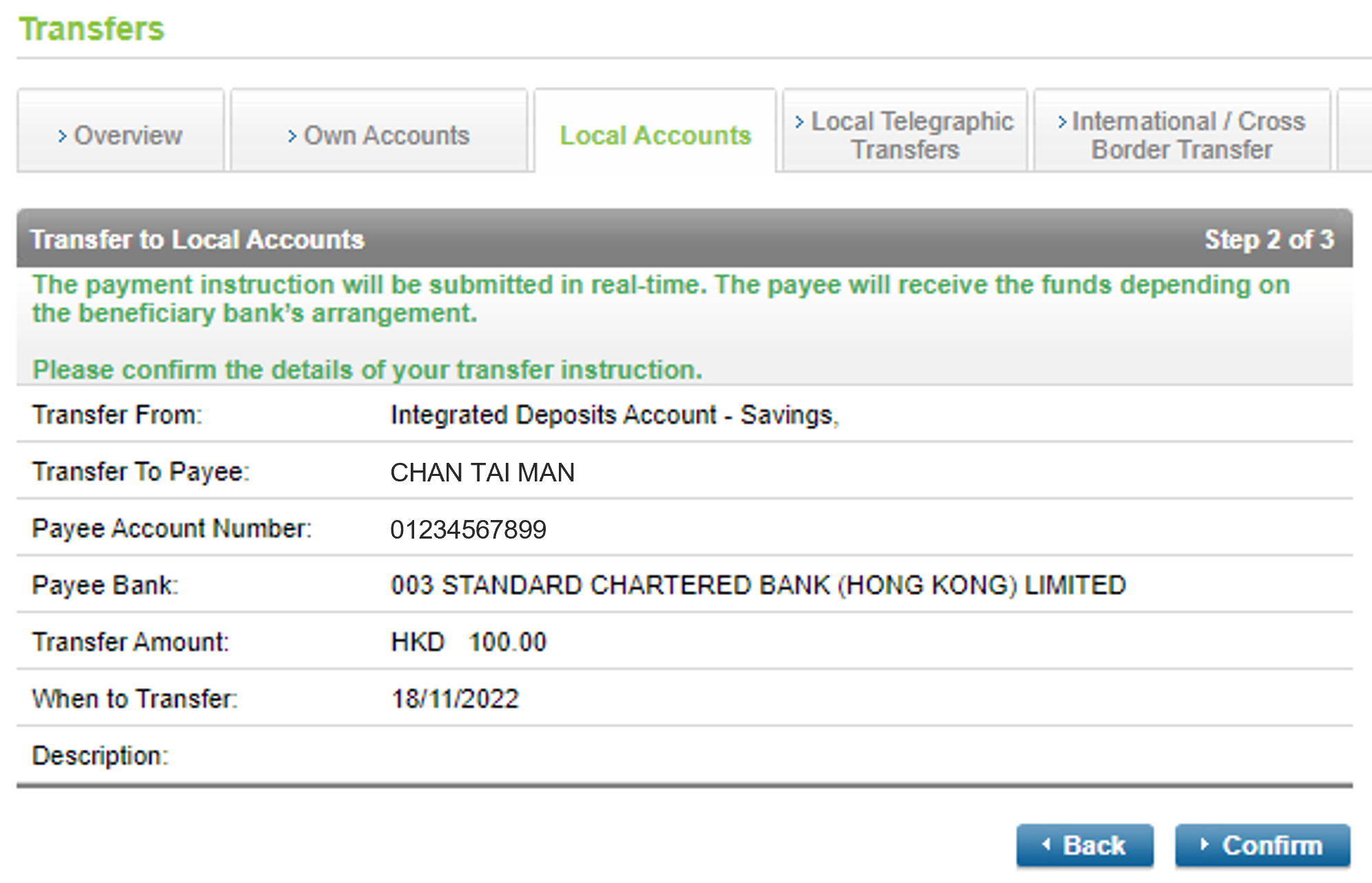

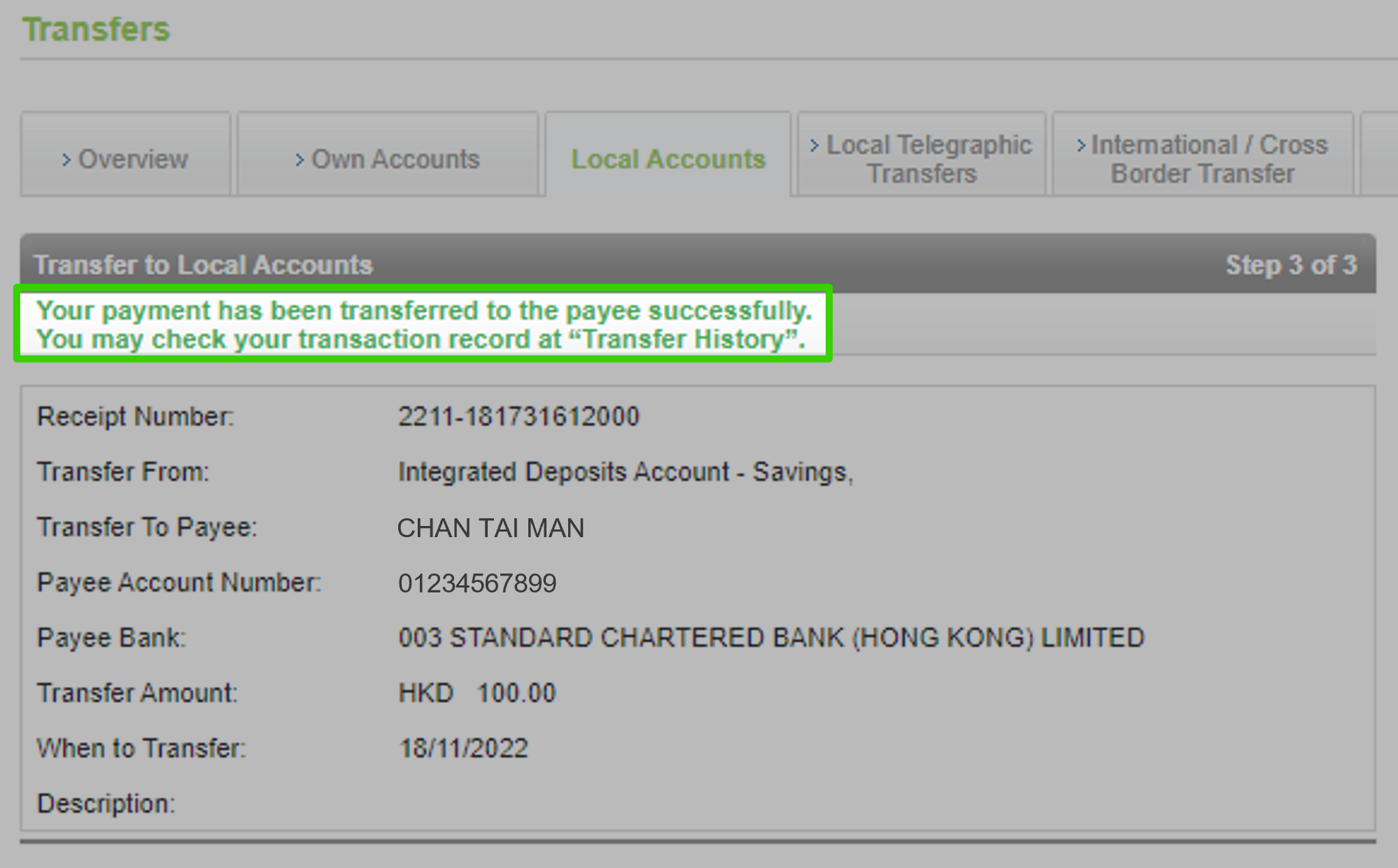

Review and confirm the details are correct (e.g. payee account name should be registered in full)

Step 4

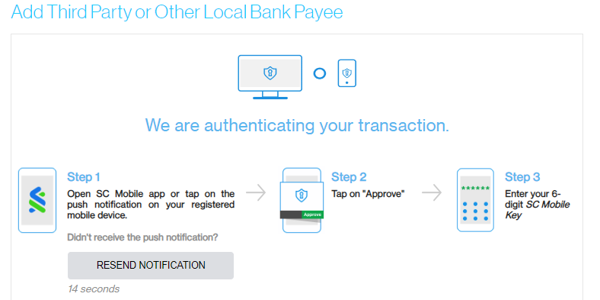

Enter the PIN for your SC Mobile Key to authorize add payee