Important and Legal Information

The role of Standard Chartered Bank (Singapore) Limited (“SCB SG”) as the fund’s Investment Advisor is solely advisory in nature while Amundi as the Investment Manager will have the final authority and decision regarding investments of the fund.

The role of SCB SG as the fund’s Investment Advisor does not imply official recommendation, it is not a recommendation or endorsement of a product, nor does it guarantee the commercial merits of a product or its performance.

This material contains information about AMUNDI ASIA FUNDS SIGNATURE CIO CONSERVATIVE FUND, AMUNDI ASIA FUNDS SIGNATURE CIO BALANCED FUND, AMUNDI ASIA FUNDS SIGNATURE CIO GROWTH FUND, AMUNDI ASIA FUNDS SIGNATURE CIO INCOME FUND (the “Funds”), sub funds of Amundi Asia Funds, an undertaking for collective investment in transferable securities existing under Part I of the Luxembourg law of 17 December 2010, organized as an open-ended mutual investment fund (“fonds commun de placement”). The management company of the Funds is Amundi Luxembourg S.A., 5, allée Scheffer, L-2520 Luxembourg and the Hong Kong Representative of the Funds is Amundi Hong Kong Limited, Suites 04-06, 32nd Floor, Two Taikoo Place, Taikoo Place, 979 King’s Road, Quarry Bay, Hong Kong (Amundi Luxembourg S.A. and/or its affiliated companies, including without limitation Amundi Hong Kong Limited, being hereinafter referred to individually or jointly as “Amundi”).

Investors should not only base on this document alone to make investment decisions. Investment involves risk. The past performance information of the market, manager and investments and any forecasts on the economy, stock market, bond market or the economic trends of the markets which are targeted by the fund(s) are not indicative of future performance. Investment returns not denominated in HKD or USD is exposed to exchange rate fluctuations. The value of an investment may go down or up. The offering document(s) should be read for further details including the risk factors. The fund(s) may use financial derivatives instruments as part of the investment strategy and invest in securities of emerging markets or smaller companies, or fix income securities. This involves significant risks and is usually more sensitive to price movements. The volatility of fund prices may be relatively increased. Issuers of fixed-income securities may default on its obligation and the fund(s) will not recover its investment. Additional risk factors are described in the offering document(s). Investors are advised to be aware of any new risks that may have emerged in the prevailing market circumstances before subscribing the fund(s).

Amundi is not responsible for the publication of this material. Certain information contained in this material has been obtained from Amundi which has not been independently verified, although Amundi and its affiliated companies believe such information to be fair and not misleading. Amundi does not accept any liability whatsoever whether direct or indirect that may arise from the publication of this material by Standard Chartered Bank (Hong Kong) Limited and use of information contained in this material. Amundi and its associates, directors, connected parties and/or employees may from time to time have interests and or underwriting commitments in the investments mentioned in this material. Amundi does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. Amundi does not make any representation as to the merits, suitability, expected success, or profitability of any such transaction mentioned herein.

Risk Disclaimer

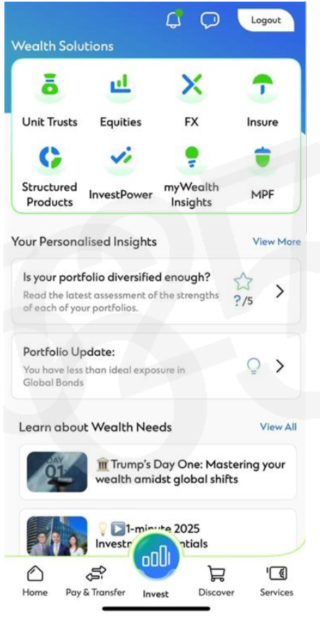

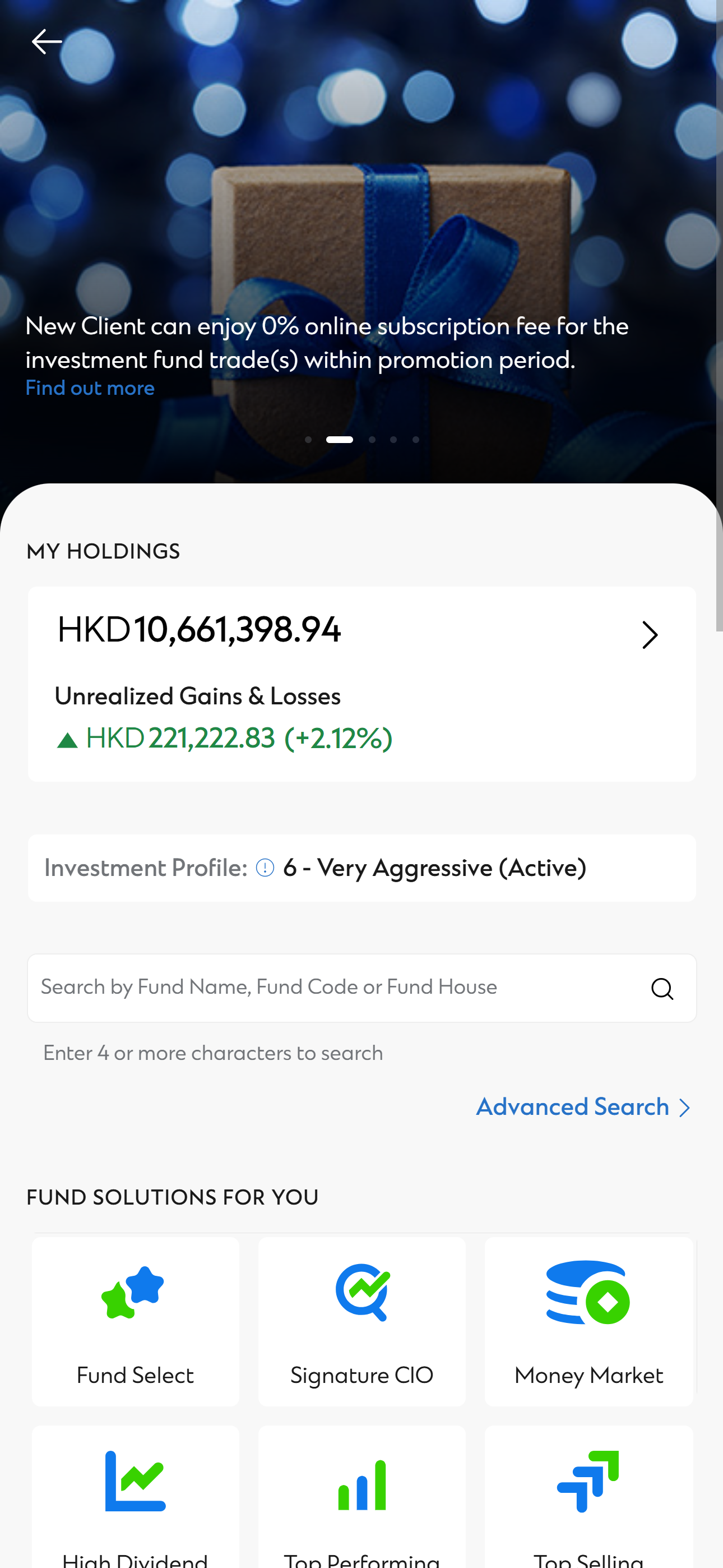

“Top Dividend” lists the Top Monthly Income Distribution Funds among all funds distributed by SCB HK on this platform during the past 12 month counting from the latest update date. The table will only show funds denominated in USD. Dividend yield is the dividend amount declared over the past twelve months as a percentage of the last month-end fund unit price, show in 2 decimal places. The amount of dividend may not be guaranteed by Fund House.

“Top Performance lists the top 10 performing funds within the respective fund categories, which are under SCB HK fund distribution platform. The table will only show funds denominated in USD. Performance statistics are based on bid to bid/ NAV to NAV prices of the funds with dividend reinvested in respective fund class currency.

“Top Selling” funds from each client group are selected among all funds distributed by SCB HK on this platform during the past month counting from the latest update date, based on the total transaction numbers for each fund. The total subscription number includes subscription number for switching-in transactions. The funds shown in the table under this list are without reference to the total subscription amount involved for each fund.

Figures are provided by Morningstar Asia Limited (“Information Provider”) to SCB HK unless otherwise specified. The above result is provided for general information and reference only and is not intended to constitute solicitation, recommendation, or advice.

Important Notice

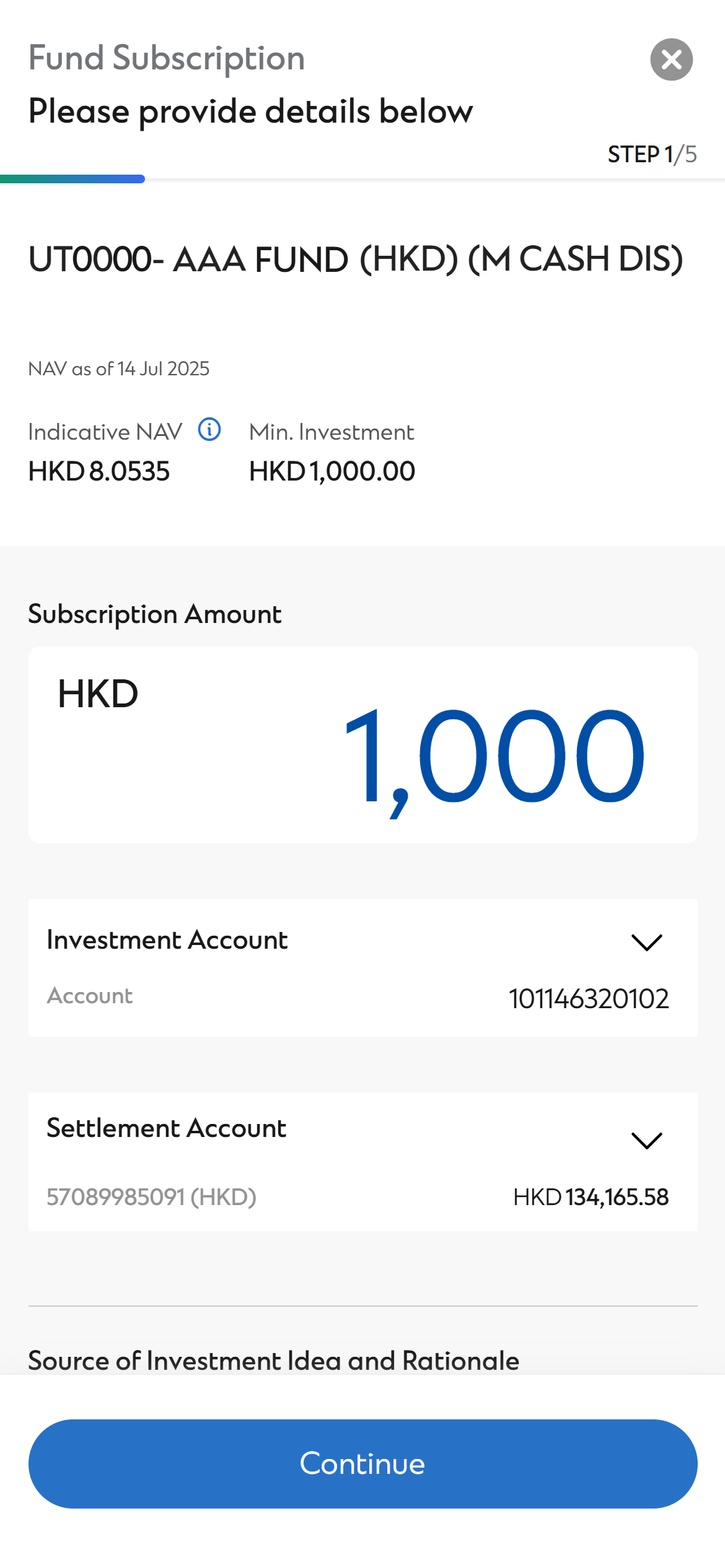

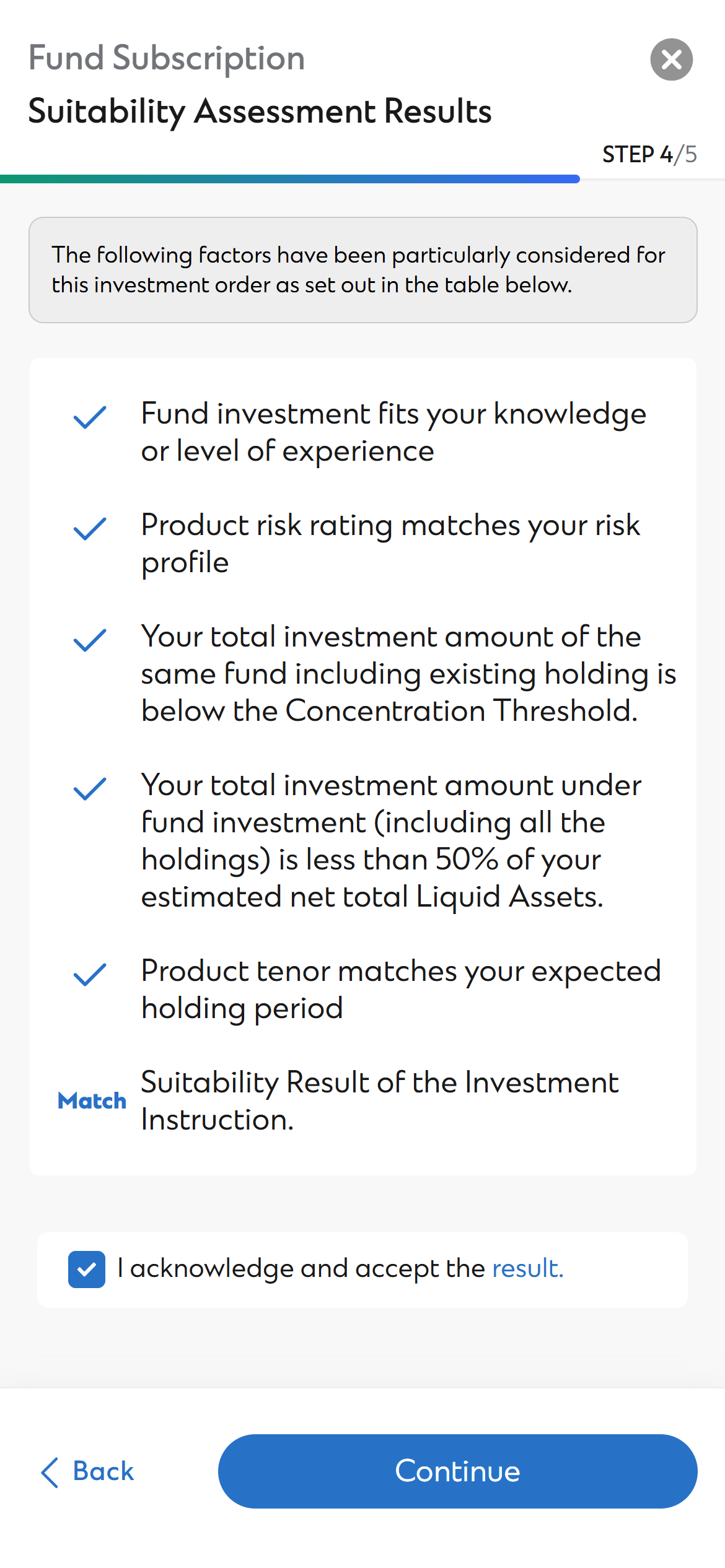

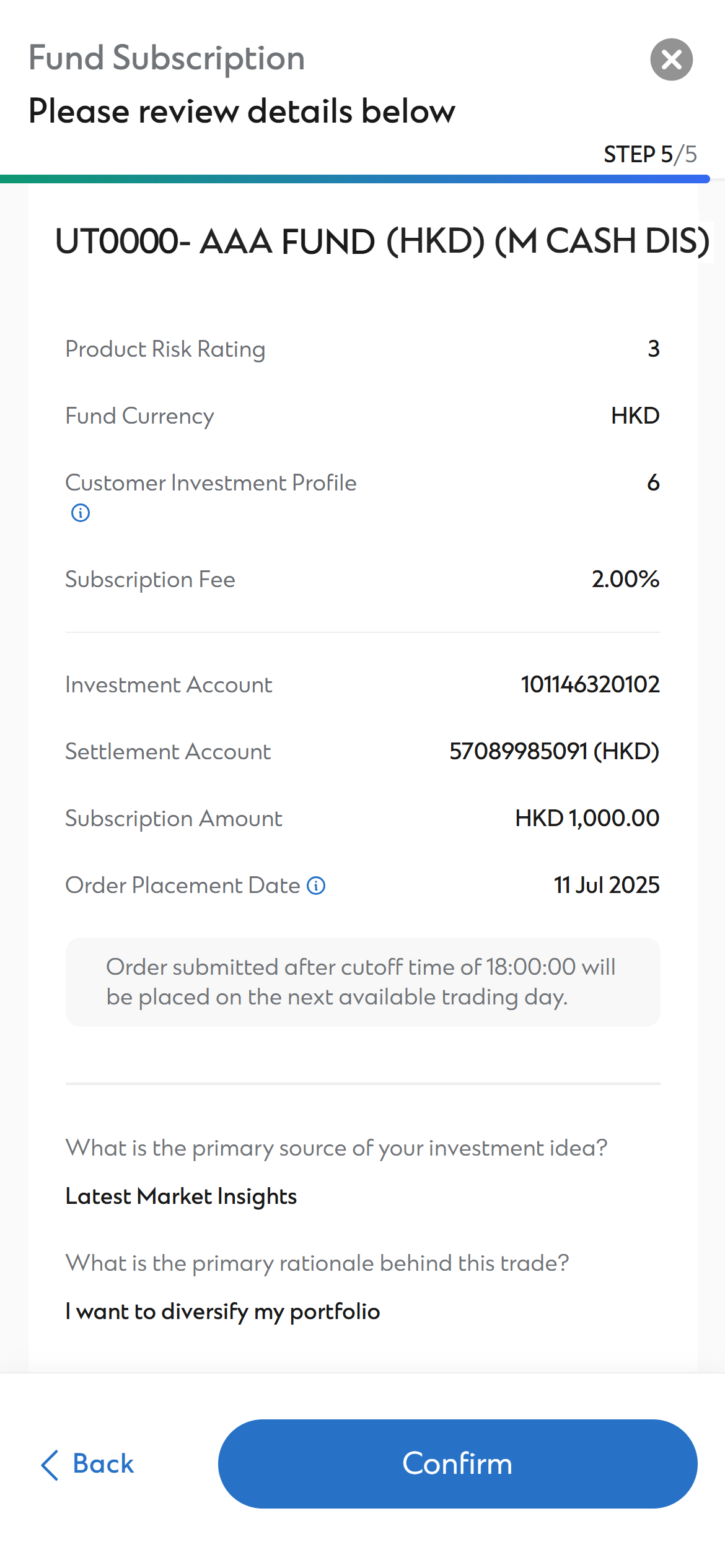

Investment Fund is an investment product and some Investment Funds would involve derivatives. The investment decision is yours, but you should not invest in Investment Fund unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

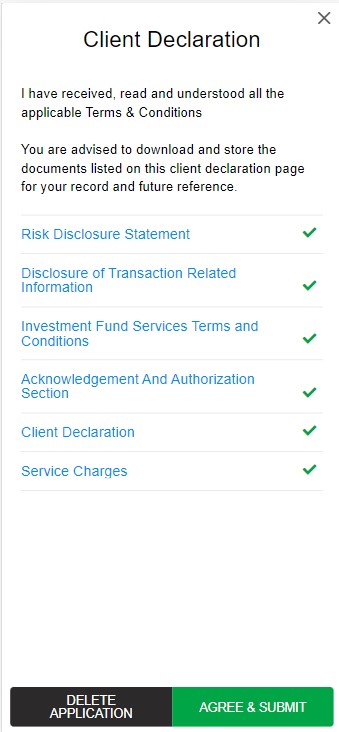

Risk Disclosure Statement

Investment involves risks. The prices of units/ shares of unit trusts or mutual funds fluctuate, sometimes dramatically and the worst case may result in loss of your entire investment amount. It is as likely that losses will be incurred rather than profit made as a result of buying and selling unit trusts or mutual funds. Past performance of any Investment Fund is no guide to its future performance.

Investors should carefully read the relevant offering documents and in particular the Terms & Conditions contained therein, the investment policies and the risk factors and latest financial results information. It is desirable that the Investor seeks independent financial advice with respect to any investment decision.

Investors should ensure they fully understand the risks associated with unit trusts or mutual funds and should also consider their own investment objective, investment experience, financial situation and risk tolerance level before making any investment decision.

Disclaimer

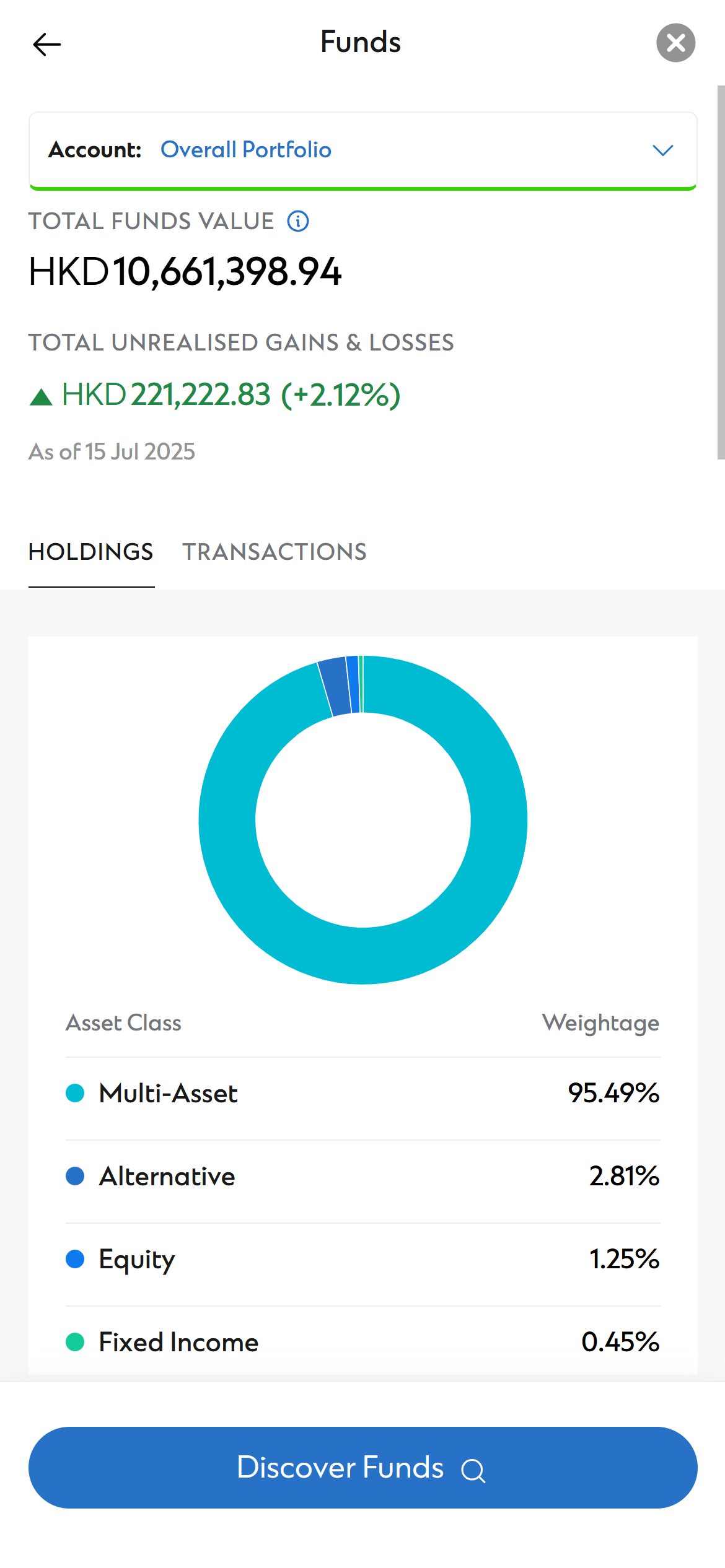

Various funds are described on this website. These may involve market risk, volatility risk, counterparty risk, credit risk, liquidity risk, concentration risk and risk of loss from use of financial derivatives instruments, amongst other risks. Please refer to relevant fund factsheets for details.

Investors should not base on information contained in this website alone to make investment decisions.

This website is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this website is prohibited and it is only intended for viewing by existing investors in the investment products distributed by us which are authorized for sale to the public in Hong Kong. Persons in respect of whom such prohibitions apply or persons other than those specified above must not access this website. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction. By proceeding, you are representing and warranting that the applicable laws and regulations of your jurisdiction allow you to access the information.

Information contained in this website does not constitute investment advice. Potential investors should note that investments can involve significant risks and the value of an investment may go down as well as up. No assurance can be given that the investment objective of any investment products will be achieved.

The page may contain information and material relating to funds that are authorized by the Securities and Futures Commission in Hong Kong, however, such authorization does not imply official approval or recommendation.

This website is prepared and issued by Standard Chartered Bank (Hong Kong) Limited, which is a corporation licensed by the Securities and Futures Commission in Hong Kong to engage in Type 1 (dealing in securities); Type 4 (advising on securities); Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities. The contents of this website have not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

Note

This webpage does not constitute any prediction of likely future price movements.

Investors should not make investment decisions based on this webpage alone.

This webpage has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.