- Attention on the latest scam alerts!

There has been a rise in credit card fraud, with scammers impersonating health and beauty chain store and a transportation service provider. They send phishing SMS messages at random, falsely alerting recipients that the membership points are about to expire, or there is an outstanding bill to pay. The recipients are then enticed into clicking a hyperlink that leads to the fraudulent website and providing credit card payment information there. Remember to stay vigilant and think before you click! Learn more. - Do not click on links from suspicious SMS, emails, webpages or social media pages/posts, only download SC Mobile App from Standard Chartered recommended sources, carefully consider an App’s requested permissions before installing and ensure the proper configuration of your mobile devices (e.g. keep Apps up-to-date, avoid installing Apps from unknown/untrusted sources, etc.)

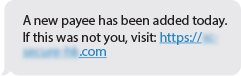

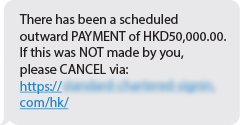

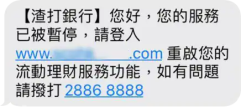

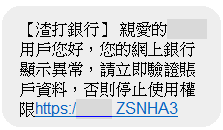

- Please beware of bogus phone calls, fraudulent text messages (including text messages from instant messaging apps, e.g. Whatsapp and WeChat), phishing websites, email, and mobile app purportedly from banks. The Bank does not provide advice and recommendations on individual stocks through any communication channels. Should you have any suspicion, please contact our staff at (852)2886-8888 to authenticate the identity of the caller or sender, or report to Police immediately. Please click here for more information.

- Be cautious of “Stooge Account” to avoid money laundering – Criminal syndicates would offer the benefit of making quick money and lure the public into selling or lending their bank accounts, or use their personal credentials to open bank accounts. The syndicate will then use these “Stooge Accounts” to receive/launder fraudulent payments or other crime proceeds. Selling or lending bank accounts / personal credentials to criminal syndicates would expose oneself to the risk of committing the offence of money laundering of which the maximum penalty is a fine of HKD 5 million and imprisonment for 14 years.