Apply via SC Mobile App

For new and existing clients

Other Application Methods

For Existing clients

Apply via Online Banking

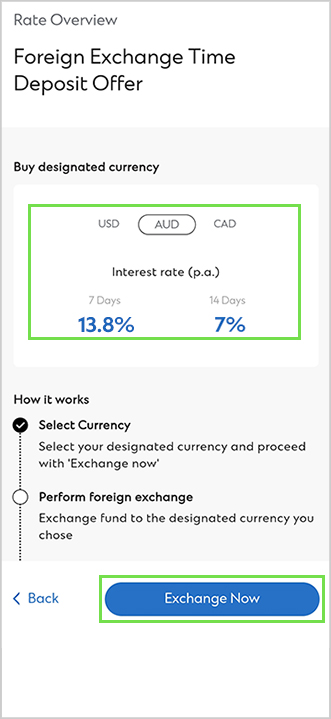

Set up a Time Deposit instantly and exchange foreign currency with interest rates of up to

13.8% p.a.

Flexible tenors of 7 days or 14 days

Open via SC mobile app with 3 steps

Find out how much interest you can earn

Applying From

Customer Type

Buy designated currency

Amount of deposit

Tenor

Maturity Details

Preferential Interest Rate

% p.aEstimated Interest earned

Estimated Principal and Interest

Note: The above interest is for reference only. The final interest will be calculated based on the account sign up date. For FXTD in HKD/GBP, the interest will be calculated in simple interest and on a 365-day or 366-day basis (for leap year). For FXTD in other currencies, the interest will be calculated in simple interest and on a 360-day basis. Account opening is not available on Sundays and Public Holidays.

|

Set up by Priority Private or Priority Banking clients / Platinum Forex Members

|

Others

|

|||

|---|---|---|---|---|

| 7-day APR | 14-day APR | 7-day APR | 14-day APR | |

| HKD | 5.5% | 3.5% | 5% | 3% |

| USD | 8% | 5.5% | 7.5% | 5.4% |

| RMB | 8% | 5.5% | 7.5% | 5.4% |

| AUD | 13% | 7% | 12% | 6.8% |

| NZD | 13.8% | 7% | 12.5% | 6.8% |

| CAD | 13% | 7% | 12% | 6.8% |

| GBP | 13% | 7% | 12% | 6.8% |

How to set up Foreign Exchange Time Deposit via SC Mobile App

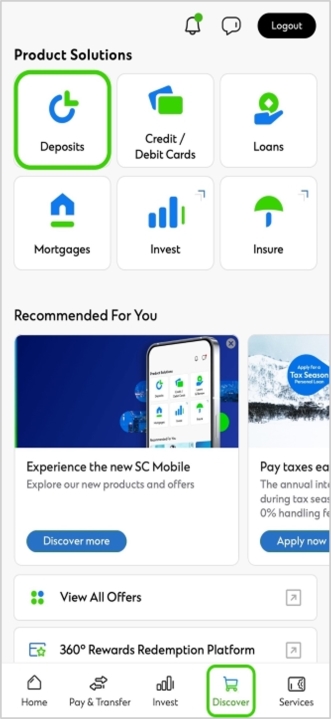

Select “Discover”, “Deposits”, “Foreign Exchange Time Deposit” and click “Apply Now” in SC Mobile App

Review offer details, choose and exchange the designated currency

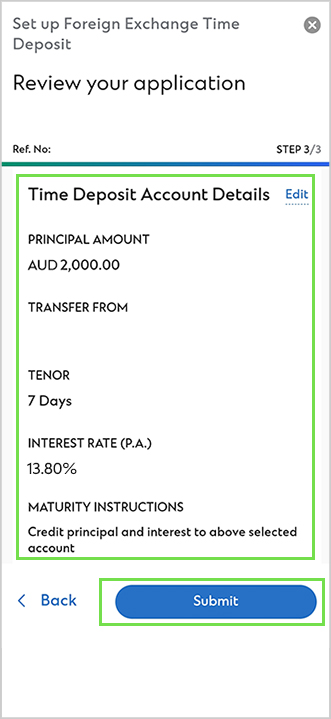

After the exchange, input the deposit amount and select the tenor, then acknowledge the terms and conditions. Review and submit your application

Service hours: 9am-11pm, Monday to Saturday, except public holidays

* Photos are for reference only.

Existing SC Mobile App clients can apply through the QR code to logon and enjoy preferential interest rate. New users can download the App through App Store / Google Play:

or click here to apply via Online Banking

Risk Disclosure Statements for RMB Deposit Services

Foreign Exchange Risk Disclosure Statement

To open a high-interest Foreign Exchange Time Deposit, the minimum deposit in HKD or RMB is HKD10,000, while designated foreign currencies require the equivalent of HKD2,000.

There are two term options for Foreign Exchange Time Deposits: 7 days and 14 days. Clients are required to choose at least a 7-day deposit term to earn high yield on their Foreign Exchange Time Deposit.

In theory, you can withdraw your deposits as and when needed, but it is not recommended as fees or penalties may incur affecting your yield.

Foreign Exchange Time Deposits have shorter deposit terms with only 7-day and 14-day options and higher interest rates. They are suitable for clients who are about to exchange currencies but still have a 7 to 14-day period to accrue interest.

As for Online Time Deposits, the deposit term is longer, divided into 3, 6 and 12 months. Interest rates are relatively lower, but they provide the option to lock in your preferred interest rates for the long term.

You can choose a deposit plan according to your personal and financial needs.

When your deposit matures, your funds will not be considered as new funds. To continue enjoying the high interest rates, you can invest the yield amount in another currency as a Time Deposit.