Explore with our new Online Structured Products Platform

Explore with our new Online Structured Products Platform

How does Minimum Redemption work?

Minimum Redemption feature

Scenario A: Final closing price is below the minimum redemption price

|

Scenario A

|

Principal

|

Final value

|

Change in value

|

Coupon

|

|---|---|---|---|---|

| Invest in the stock | 100 | 60 worth of stock | -40% | NO |

| Equity Linked Investment (ELI) | 100 | 90 worth of cash | -10% | YES (if applicable) |

Elaboration:

Assuming your initial investment is HK$100,

The above calculations and examples are purely hypothetical and for illustration purpose only. They do not reflect a complete analysis of all possible gain or loss scenarios, and they should not be relied on as an indication of the actual return or duplicated under real investment conditions.

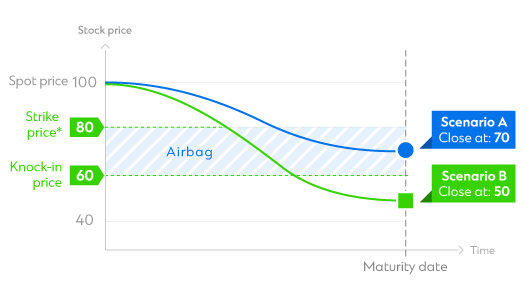

How does Airbag work?

Scenario A: Final closing price is above the knock-in price

Scenario B: Final closing price is below the knock-in price

|

Scenario A

|

Principal

|

Final value

|

Change in value

|

Coupon

|

|---|---|---|---|---|

| Invest in the stock | 100 | 70 worth of stock | -30% | NO |

| Equity Linked Investment (ELI) | 100 | 100 worth of cash (Principal is protected when closing within airbag) | 0% | YES (if applicable) |

|

Scenario B

|

Principal

|

Final value

|

Change in value

|

Coupon

|

|---|---|---|---|---|

| Invest in the stock | 100 | 50 worth of stock | -50% | NO |

| Equity Linked Investment (ELI) | 100 | 62.5 worth of stock (Receive the stock when closing below airbag) | -37.5% | YES (if applicable) |

Elaboration:

Assuming your initial investment is HK$100,

The above calculations and examples are purely hypothetical and for illustration purpose only. They do not reflect a complete analysis of all possible gain or loss scenarios, and they should not be relied on as an indication of the actual return or duplicated under real investment conditions.

Sector

Stock name

Stock code

Financials

HONG KONG EXCHANGES AND CLEARING LIMITED

388.HK

Communication Services

CHINA MOBILE LTD

941.HK

Communication Services

CHINA UNICOM HONG KONG LTD

762.HK

Information Technology

XIAOMI CORPORATION

1810.HK

Information Technology

MEITUAN

3690.HK

Consumer Discretionary

AMAZON.COM INC

AMZN

Financials

THE GOLDMAN SACHS GROUP, INC.

GS

Communication services

ALPHABET INC

GOOGL

Information Technology

MICROSOFT CORPORATION

MSFT

Technology

NVIDIA CORP

NVDA

List above is the popular# HK stocks and US stocks linked to Equity-Linked Investment offered by SCBHK in the specified offer period^.

#Popular Stock Underlyings refer to the HK and US Stocks which are the most frequently chosen as the underlying stocks of Equity-Linked Investment offered by SCBHK during the aforementioned offer period.^ The above information is past sales record and for reference only. It is not and shall not be considered as investment advice. It does not constitute any offer or solicitation of offer to subscribe, transact or redeem any investment products. If you would like to obtain the latest information on the relevant products, please contact our relationship manager. Suitability assessment is required before subscribing for the relevant products.

^Last update and quotation date: 1/4/2025.

Structured Products are investments involving derivatives, with returns linked to underlying assets, such as equities, interest rates, or currencies. We offer a wide range of Structured Products including Equity-Linked Investments, Structured Notes, Structured Investment Series to our investors.

We offer a range of major currencies for Structured Products, including HKD, USD, AUD, CAD, CHF, JPY, NZD, EUR, GBP and RMB.

The return will be determined by the performance of the worst performing underlying equity.

Not all Structured products are principal protected and in extreme cases, you may lose some or all of the investment amount. Please read the relevant documents of the Structured Products you are interested in for more details on product features.

Customer Investment Profile captures your overall general attitude towards investment risks as an investor. We need you to maintain a valid profile if you want to trade via Online Structured Products platform. You may review and update your Customer Investment Profile through Online Banking and SC Mobile regularly.

The minimum investment amount can be different for each product type, please refer to the product details and related documents of the relevant product(s).

Please ensure that a valid W8-BEN form has been submitted to the Bank. You can submit the form by uploading it here.

Our Online Structured Products platform operates 24 hours a day. We will process the orders placed before cut off time which is specified in each product. Please note that the Bank’s acceptance of subscription under a tranche is conditional upon the minimum aggregated subscription amount of the Product subscriptions being reached.

When you try to place a subscription via Online Structured Products platform, you will be assessed by us if this particular instruction is suitable to you based on the available information provided by you to us and with reference a set of “Assessment Criteria”, such as your risk tolerance, investment objective, investment experience or knowledge, financial situation and financial needs.

To protect client’s interest, Online Structured Products platform will NOT accept any subscription instruction(s). You may, however, reach out to our Relationship Managers for further assistance.

You can place Strcutured products (Equity-Linked Investments & Structured Notes) subscription orders via Online Strcutured Products Platform.

No, but please ensure that you have sufficient funds in your selected account so that the order can be executed successfully.

Please ensure you have sufficient fund before and on the trade date. The settlement amount will be placed under lien to support the notes settlement on the Issue Date, and the Bank has the sole discretion to reject this transaction if the settlement account has insufficient funds to cover the settlement amount.

Please ensure that your push notification settings are enabled so you can be notified when there is any update on your order instruction. There will be confirmation on receiving your order and notification on subscription results on SC Mobile and your registered email address. Additionally, a paper format contract note will be sent to you after trade date.

You can cancel your order via the SC Mobile App before the cut off time which is specified in each product. Beyond this cut off time, your order cannot be cancelled. For any related enquiries, please contact Branch Sales Staff.

This webpage does not constitute any offer, invitation or recommendation to any person to enter into any transaction described therein or any similar transaction, nor does it constitute any prediction of likely future price movements. Investors should not make investment decisions based on this webpage alone, This webpage has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

This hyperlink will bring to you to another website on the Internet, which is published and operated by a third party which is not owned, controlled or affiliated with or in any way related to Standard Chartered Bank (Hong Kong) Limited or any member of Standard Chartered Group ( the “Bank”).

The hyperlink is provided for your convenience and presented for information purposes only. The provision of the hyperlink does not constitute endorsement, recommendation, approval, warranty or representation, express or implied, by the Bank of any third party or the hypertext link, product, service or information contained or available therein.

The Bank does not have any control (editorial or otherwise) over the linked third party website and is not in any way responsible for the contents available therein. You use or follow this link at your own risk. To the extent permissible by law, the Bank shall not be responsible for any damage or losses incurred or suffered by you arising out of or in connection with your use of the link.

Please be mindful that when you click on the link and open a new window in your browser, you will be subject to the terms of use and privacy policies of the third party website that you are going to visit.

Proceed to third party website