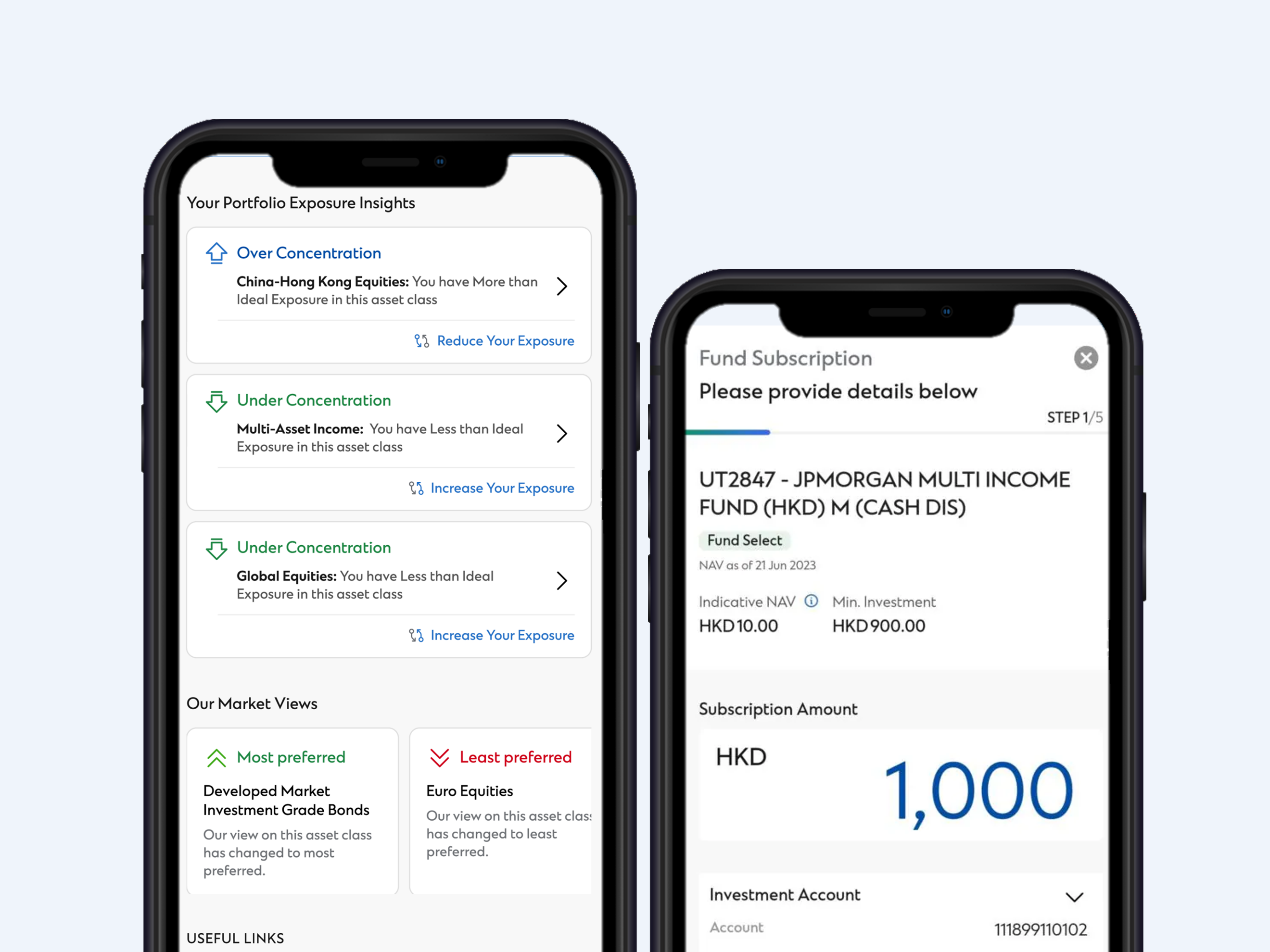

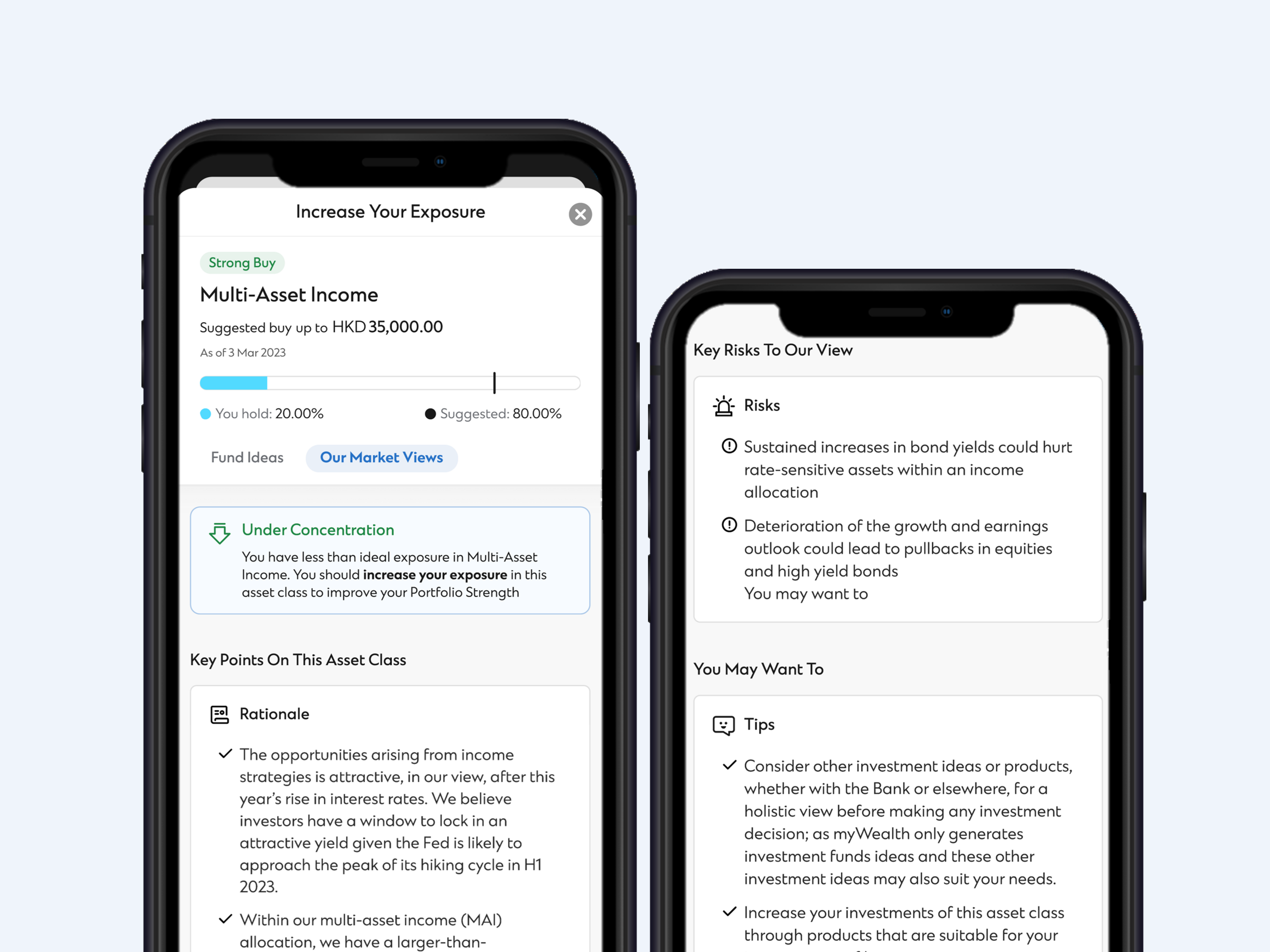

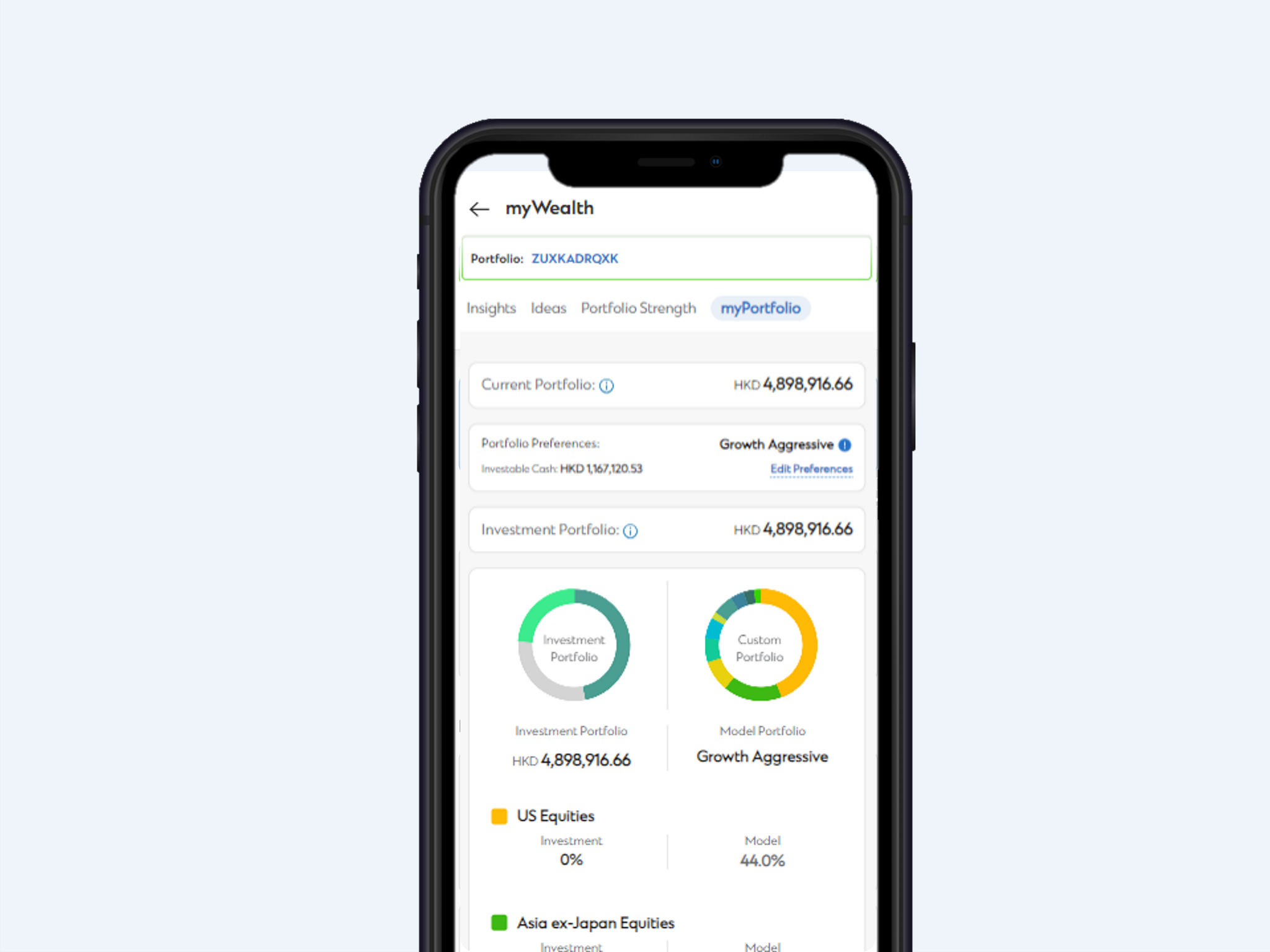

Backed by our CIO’s house view, you can easily diversify your investments across various asset classes to balance potential risks and returns.

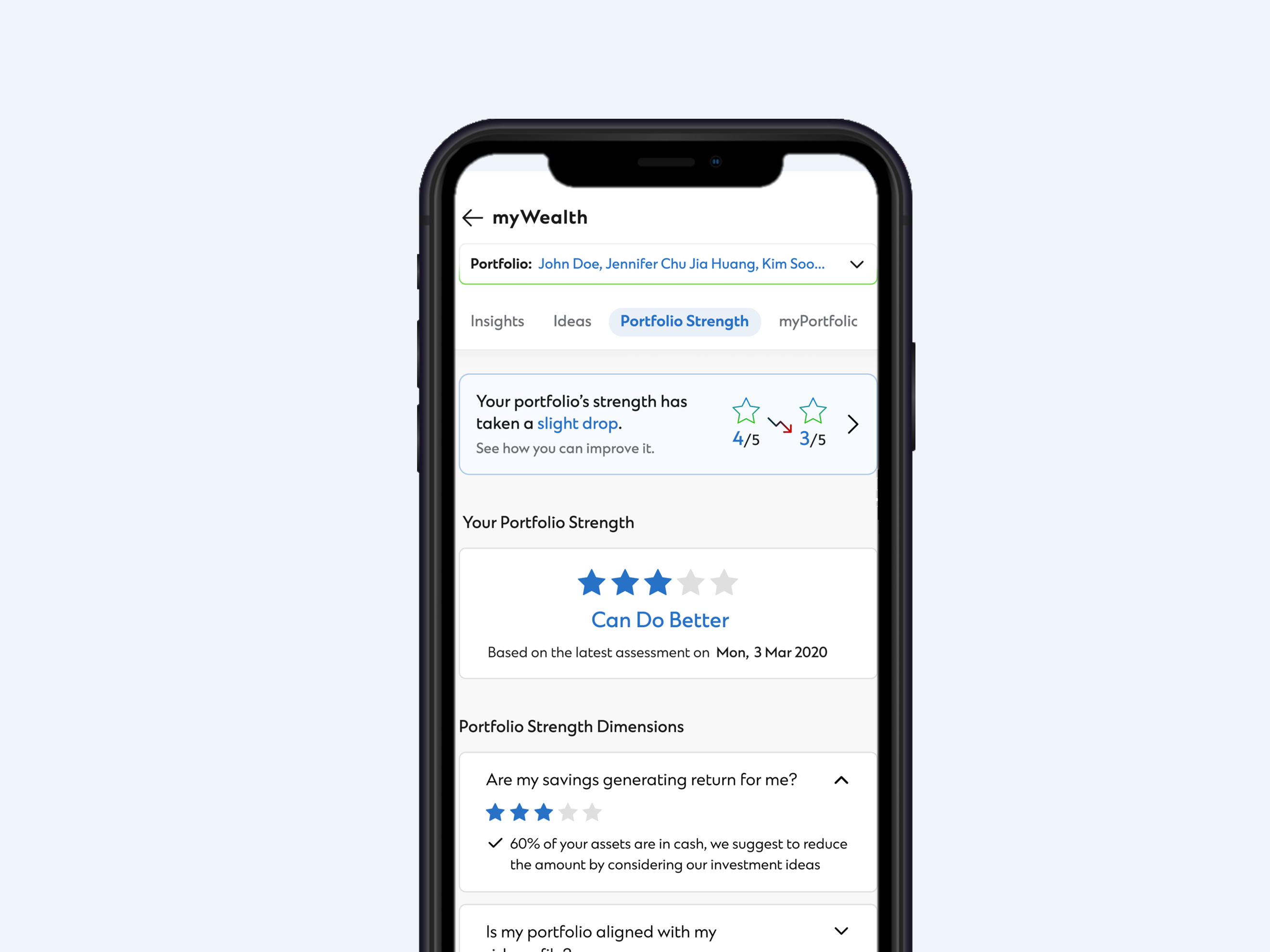

Analyse portions of your investment holdings with the Bank

Categorise your holdings based on underlying asset classes

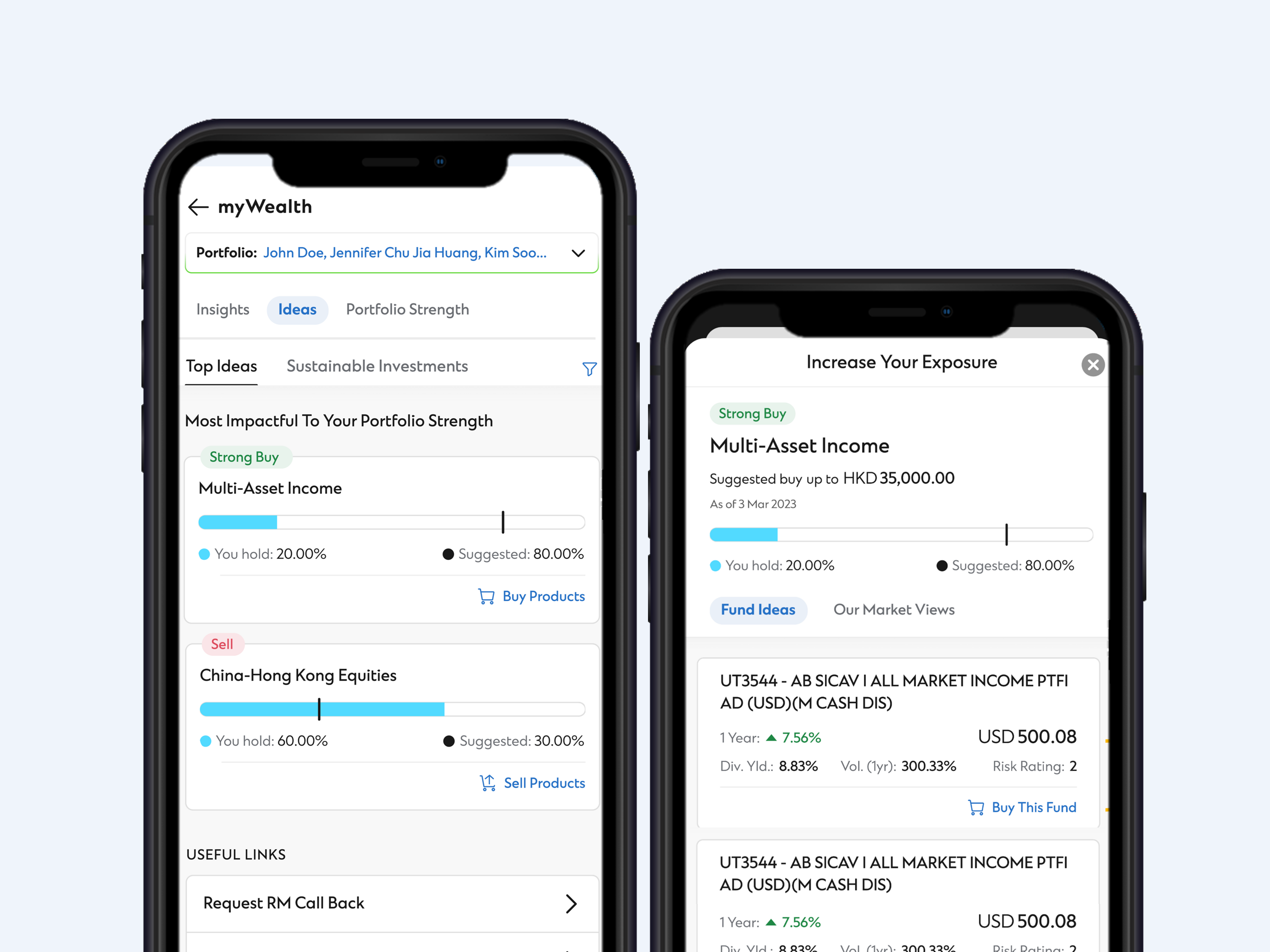

Compare your current asset allocation to the Bank’s model portfolio based on your risk profile

Rate your personalised ideas into multiple categories based on the Bank’s house view on the asset class

SC MOBILE APP

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android, Google Play, and the Google Play logo are the registered trademarks of Google Inc.

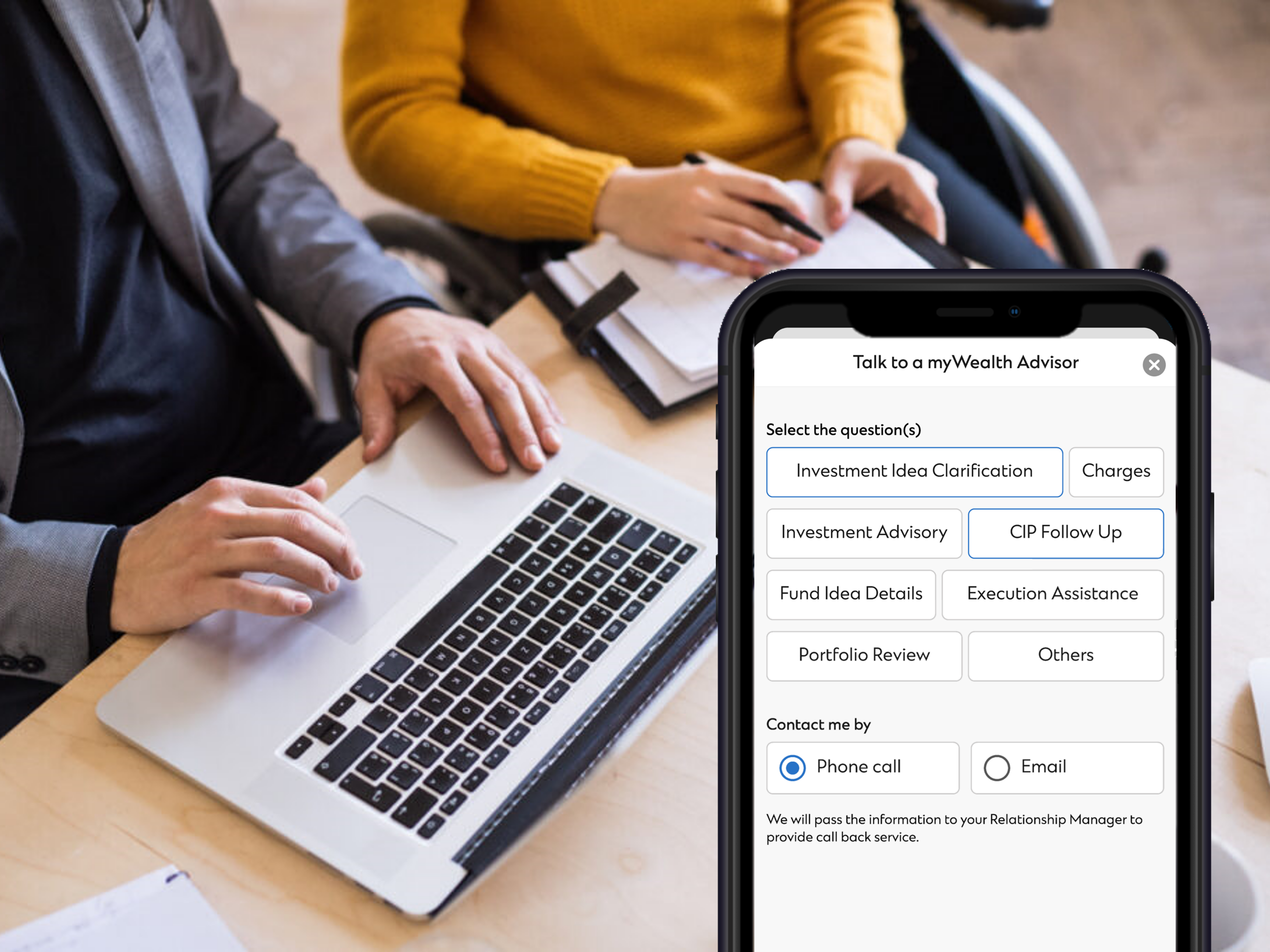

Using myWealth

myWealth service limitations