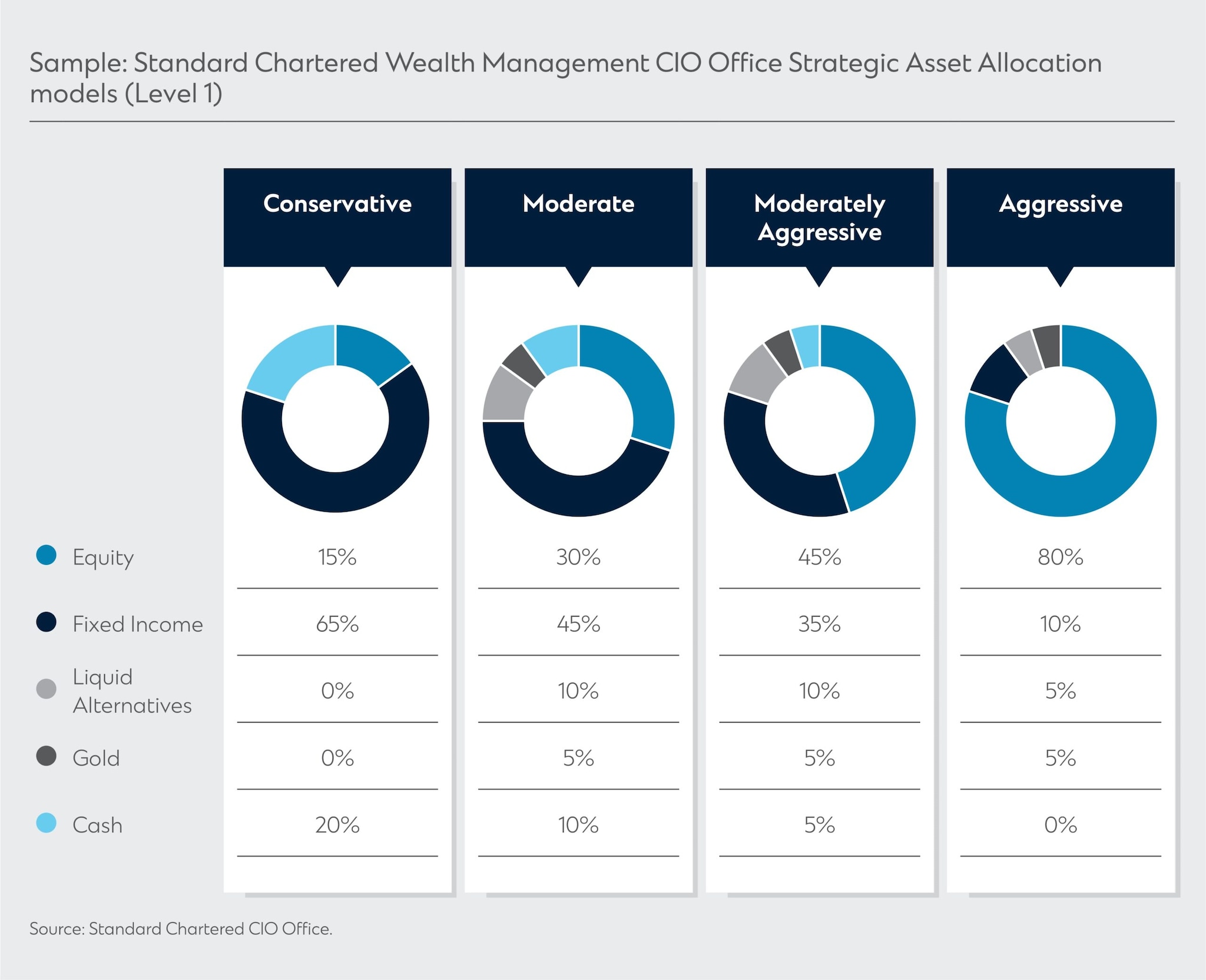

SAA is an important determinant of long-term expected returns, especially in a long-only portfolio. It also offers a structured way to investing, guiding the allocation to each asset class, which helps to mitigate certain behavioural biases, such as over trading, excessive euphoria or pessimism. Our SAA models are diversified with the aim of producing a reasonable risk and return trade-off over a full business cycle. They are targeted to be efficient and produce the highest estimated return per unit of risk assumed, based on the long-term CMA’s risk and return assumptions.

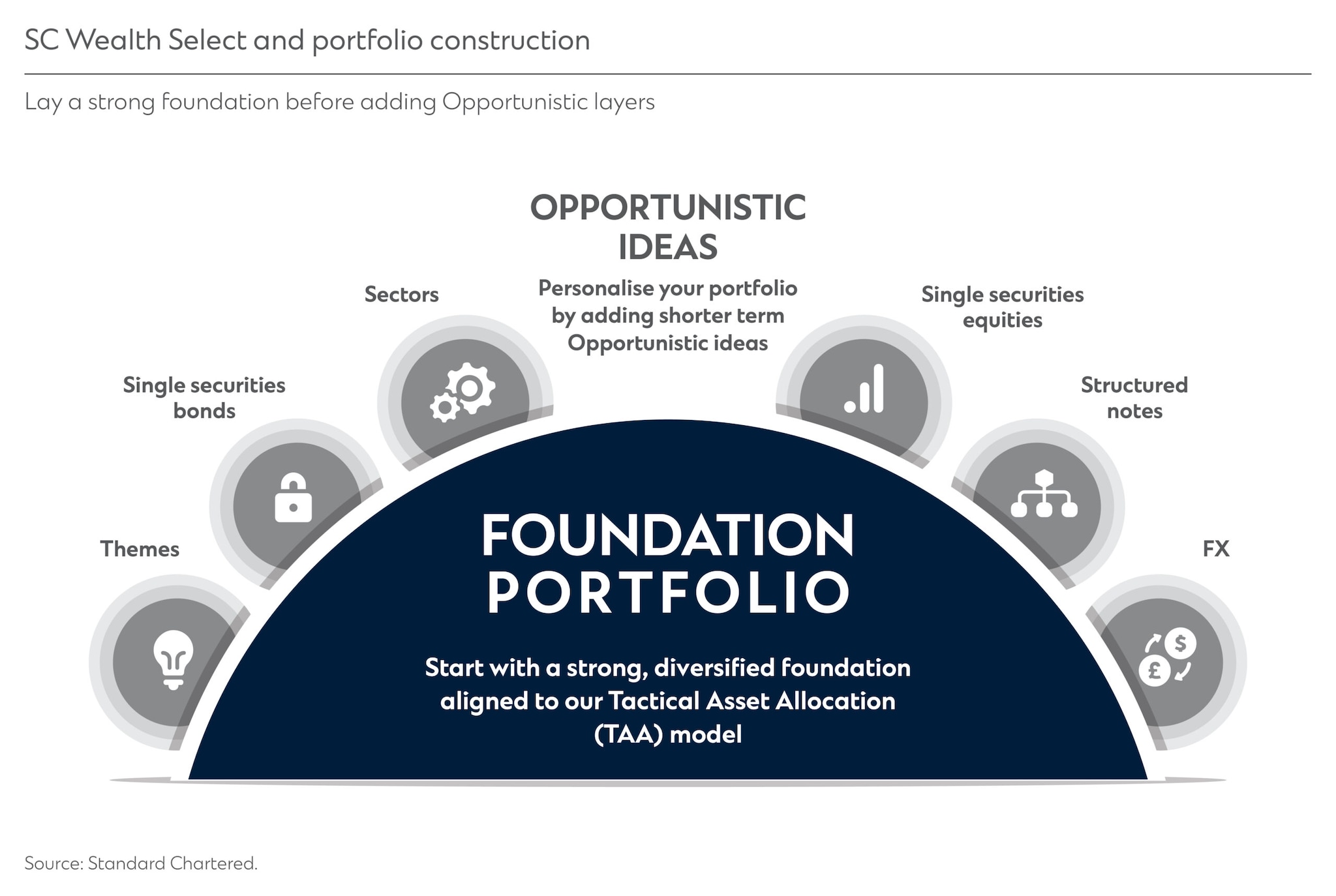

TAA value-adds to enhance returns or reduce portfolio volatility by providing an active overlay to adjust or fine-tune asset allocation, taking advantage of market trends expected to play out over the next 6-12 months. Investors can take advantage of opportunities in assets which are experiencing extreme pessimism to tactically increase allocation, while taking profits during periods when assets are experiencing euphoria.