For existing clients* who have (i) valid single name Debt Securities Account; (ii) valid single name HKD Settlement Account; and (iii) registered for Online Banking service on or before 18 November 2024, you can apply for Retail Infrastructure Bond via Online Banking from 26 November 2024 (9am) to 5 December 2024 (11:59pm) (i.e. one day before the official close day).

*Clients’ eligibility is including but not limited to the criteria specified in the Frequently Asked Questions

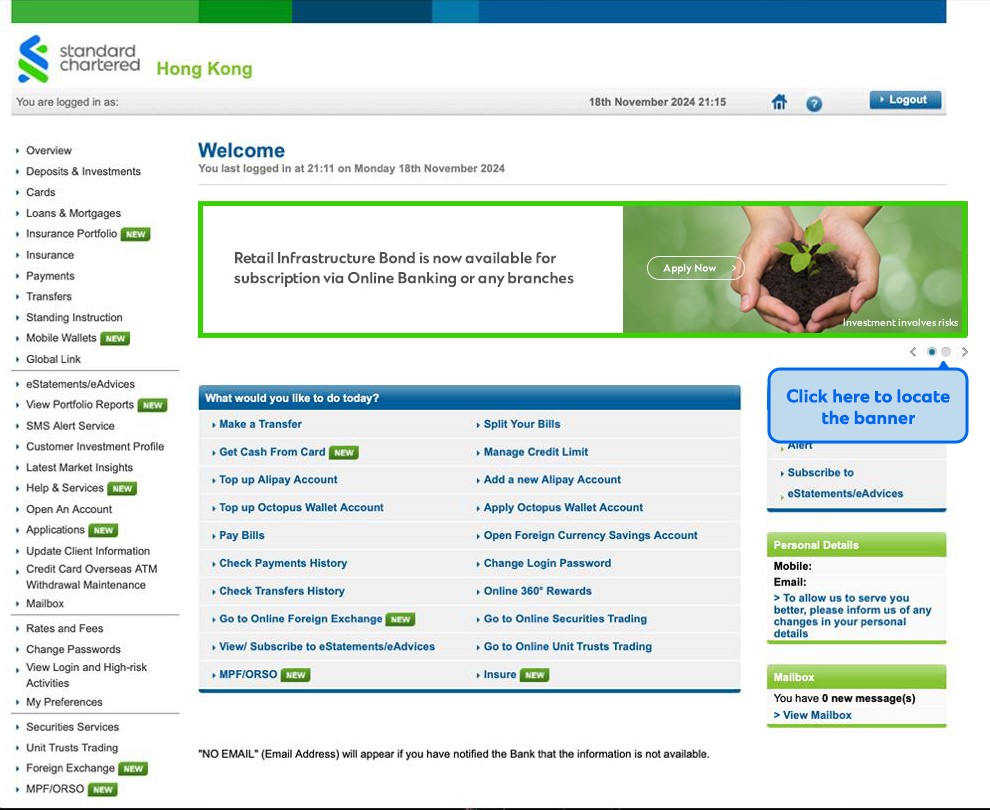

Login and click on the promotion banner as shown below to apply.

If you have not registered for Online Banking or do not have a valid Debt Securities Account and HKD Settlement Account, you can submit your application form to any of our branches from 26 November 2024 (9am) to 6 December 2024 (2pm).

Find out more details of Retail Infrastructure Bond on the Government Bond Programme’s website.

|

Fee waivers

|

|---|

|

Note: Transfer out request is subject to the handling fee of HKD500 per request.

Enquiry hotline: (852)2886-8868 (press “4 > 5 > 3 > 0”) after selecting language

Enquiry hotline service hours:

Monday to Friday: 9am – 5:30pm

Saturday, Sunday and public holidays: Closed

Subject to some selling restrictions, clients who hold a valid Hong Kong Identity Card and aged 18 or above are eligible to apply. This is not limited to permanent resident. The Issuer representative (HKMA) will not accept multiple applications per Hong Kong Identity Card holder (regardless it’s applied via single or joint name account). Therefore, you can only apply through one placing bank or designated securities brokers. If you apply through more than one bank or other channels and multiple applications reach the Issuer, the Issuer will disqualify and reject every application you have made.

If you belong to any of the groups below, you are not allowed to apply for this series of Retail Infrastructure Bond:

i) You are located within the United States or Canada; or

ii) You are a U.S. Person within the meaning of Regulation S under the U.S. Securities Act of 1933, as amended, (which includes any person resident in the United States and any partnership or corporation organised or incorporated under the laws of the United States) or a resident of Canada; or

iii) You are acting as an agent of a U.S. person or a resident of Canada; or

iv) You are not in Hong Kong at subscription

i) A valid single name HKD Settlement Account; and

ii) A valid single name Debt Securities (“DSS”) Account

You need to complete and provide the following documents at branch:

– DSS questionnaire; and

– InvestPro account opening form; and

– Residential address proof

| Subscription Channel | Eligible clients (Subject to selling restrictions mentioned in point 2) |

| Via branches | Clients who (i) hold a valid Hong Kong Identity Card; and (ii) aged 18 or above |

| Via Online Banking | Clients who fulfil the requirements below on or before 18 November 2024:

1. Hold a valid Hong Kong Identity Card 2. Aged 18 or above 3. Have a valid single name Debt Securities Account and a valid single name HKD Settlement Account 4. Have registered for Online Banking service 5. Non-US person or non-Canada resident 6. Address not in U.S. or Canada 7. Able to see the Retail Infrastructure Bond banner after logging into Online Banking

|

You may call our Enquiry Hotline at (852)2886-8868 (Press 4 > 5 > 3 > 0 after selecting language) to enquire the status by indicating your order reference number.

Application will be rejected by HKMA if you have submitted multiple applications through more than one placing bank or designated securities brokers. The fund will be credited to your settlement account within 5 business days after the issue date (i.e. 17 December 2024).

Allotment results will be sent to you via SMS on or before 16 December 2024.

Yes, you can submit the “Retail Bond Transfer Request Form” at branch to request for transferring your Retail Infrastructure Bond holdings to your Securities Account.

The maximum allotment amount is HKD1,000,000.

We recommend using any of the following browsers with Windows or MacOS to submit your Retail Infrastructure Bond application via Online Banking:

• Chrome

• Edge

• Firefox

Disclaimer and Important Notice Statement:

You should read the programme circular dated 30 September 2024 as well as the issue circular dated 26 November 2024, copies of which can be viewed online at the Government Bond Programme’s website before deciding whether to apply for any retail bonds.

Key Risks:

Risk Disclosure Statement for Debt Securities Services:

Notes: