[Home Decoration] Low-interest loan with installment payments for a cozy and comfy home

People in Hong Kong are paying more and more attention to their home environment. Minor repairs, design work and revamp of old décor are commonplace. Assuming the decoration costs are entirely based on the market price, how much will it cost? Are installments possible? If you need to do a home makeover, how can you get the finance sorted? This article explains everything for you.

How much does home renovation cost?

There is no consistent pricing in place. According to a report in 2020 by the Consumer Council, even if you ask for quotations from contractors, a detailed breakdown may not be available. Therefore, decoration budgets can only be approximated according to case studies in the market. Based on the projects currently in the marketplace, the most basic improvement work for the whole home, including removal of old furnishings and revamp of the kitchen and toilet, costs about HKD850 per square foot. The budget for a luxury package varies, depending on the requirements of homeowners.

According to the basic rate, a 350 square feet home will cost about HKD297,500 for decoration. A 700 square feet home will cost approximately HKD595,000. Please note that this price is for reference only. The actual costs depend on quotations, and the difference may be significant.

Do I need to pay the home improvement cost in one sitting?

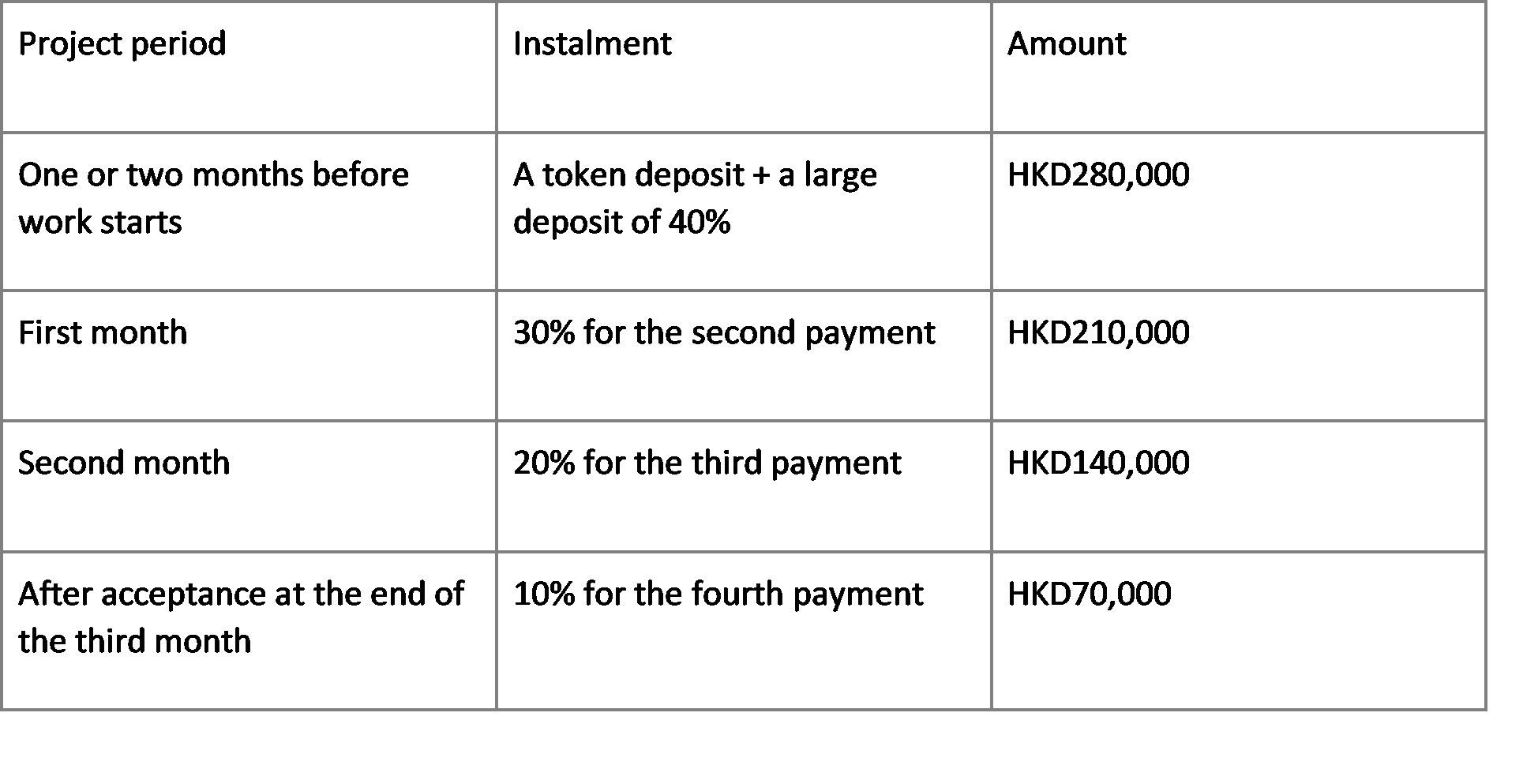

Many design and decoration companies provide installment payment schemes as home improvements cost hundreds of thousands of HK dollars. There are various installment payment schemes. The more frequently seen package is four installments. The first payment is a token deposit plus a large deposit (usually 40%), the second payment (usually 30%) after the start of work, the third payment (usually 20%) during the project period, and the fourth payment (usually 10%) after completion. Different companies require different payment percentages and installments. However, most schemes demand full payments for the first half (the first installment and the second installment) in order to purchase materials and avoid outstanding receivables.

Therefore, this type of installment scheme only allows the extension of the final small payment. You still need to prepare for about 70% of the total cost so that builders and home renovators will commence work. You also need to pay the cost in full when the project is completed. There is no flexibility in payments.

Example of an installment scheme from decoration contractors (based on a total fee of HKD700,000 and over a project period of three months)

Personal loans help you renovate your home sooner by extending the repayment period.

If you would like to have a “real” installment payment scheme, personal loans are a more flexible option. For example, a personal installment loan from Standard Chartered Bank for the same HKD700,000 home improvement over a loan period of 60 months only requires a monthly repayment of HKD12,8591!

The renovation cost may increase every year. If you would like to revamp your home but do not have sufficient cash flows, the quoted price may have gone up much higher by the time you have saved a few years.

1. Calculated at an effective annual rate of 3.97% on a loan amount of HKD700,000 and for a loan period of 60 months. The effective annual rate is a reference rate that annualizes the basic rates and other applicable fees and charges of banking products.