Personal Instalment Loans Get You Out of Financial Difficulties

Manage & Reward Your Banking

Under this low-interest environment, personal installment loans may help you resolve cash flow problems such as, consolidate credit card debts, pursue study plans, or decorate your home.

Instalment Repayments Give Flexibility

Personal installment loans are a viable option for urgent financial needs, to achieve financial goals earlier or to resolve immediate financial crunch. This loan product offers relatively high amounts and longer repayment periods, and a flexible way of borrowing.

Borrowing with a Fixed Rate Helps to Control Costs

Most of the personal installment loans in Hong Kong are based on fixed rates. That means, the interest rate will remain the same throughout the repayment period after the contract takes effect. The repayments will be made at the approved rate no matter whether the market rates go up or down.

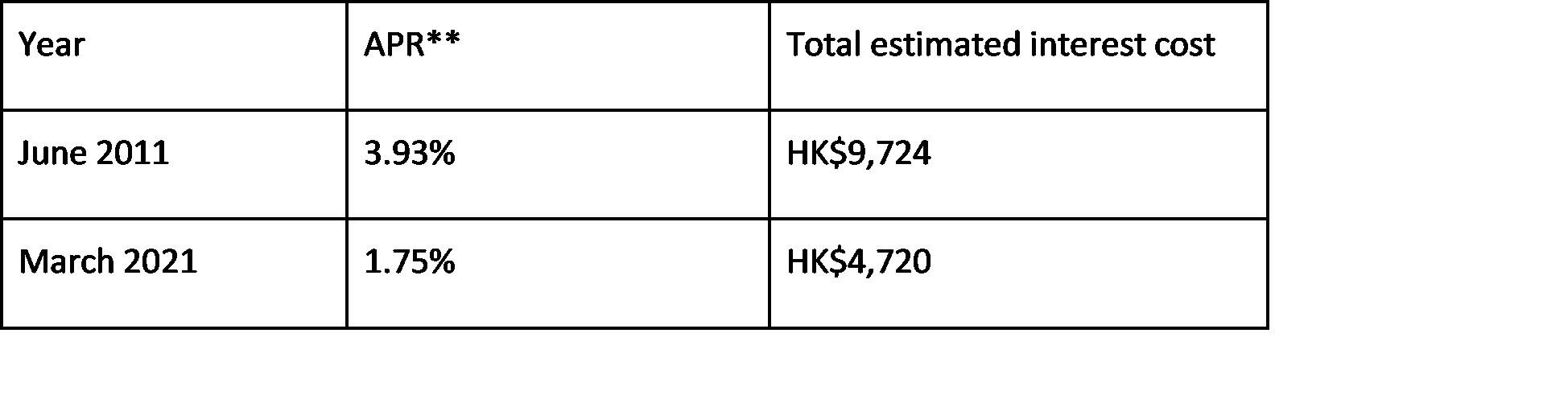

As illustrated in the table below, the Annualised Percentage Rate (“APR”)of a HKD500,000 loan instalment repayment in June 2011 was 3.93%*. The APR is 1.75% in March 2021, almost half of the 2011 level*.

*Calculated based on the effective annual rates of personal loans offered by Standard Chartered Bank (Hong Kong) Limited in June 2011 and March 2021.

Conclusion: Live Your Dream Whilst Rates Are Low

Personal installment loans can resolve personal finance needs such as home decoration, remote degrees, credit card debt consolidation, repayments of previous loans with high interest rates, or starting your own business, studying overseas, and travel plans in the medium to long term after the pandemic.

Above information is for reference only. This article does not serve as advice for borrowing and does not constitute offers, solicitations or recommendations for any loan products.