The complete guide to planning your dream wedding

Your once-in-a-lifetime experience

Whether your dream wedding is an intimate ceremony, a romantic garden reception, or a grand overseas banquet, that day could very well be the most beautiful moment of your life. So, it is worth dedicating your thoughts and efforts to make it a perfect day for you and your partner.

How much budget you need to prepare for a wedding?

Before you embark on your happily ever after, you and your partner must first undertake a major project, planning your wedding. There are numerous items and expenses to prepare for, including venue rental and decoration, bridal attire purchase/rental, wedding rings and jewelleries, makeup and hairstyling, photography/videography, transportation and other miscellaneous items like wedding invitations and gifts.

The budget for a wedding varies based on personal preferences and needs. For instance, for a guest list of around 200, the cost could range from HKD150,000 to HKD250,000 for the banquet alone.

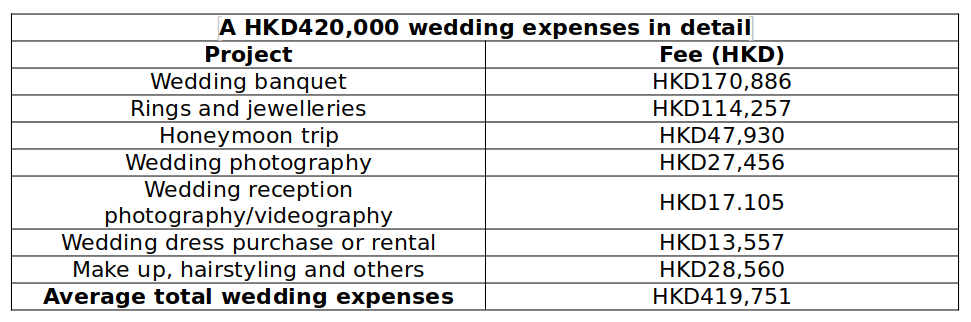

According to a Hong Kong Wedding Expenditure Survey conducted by a major online lifestyle platform in 2023, couples preparing for marriage between 2022 and 2024 had an average total expenditure of approximately HKD420,000, about 10% higher than in 2023. However, hosting a more luxurious wedding or hiring a wedding planner could result in higher expenses.

While ensuring expenses align with your budget, it is essential to set aside some funds for unexpected costs or emergencies. Most importantly, to stay rational when choosing things that are most significant and meaningful to you both. Thus, creating an unforgettable wedding while being prudent.

Source: ESDLife

Personal Loans - A great choice for the present moment

As mentioned earlier, wedding expenses are climbing while salary increments are simply not keeping up. However, you do not have to let the wedding budget disrupt your most important day. A carefully planned personal loan, akin to home mortgages, can open doors for you and your partner.

Our personal loans come with generous CashBack rewards and other promotional offers. Utilise our Personal Loan calculator now to select your preferred repayment periods and insert other personal requirements to calculate your actual monthly payment and average monthly interest. Your repayment period can be extended up to 60 months and the whole loan application process can be completed easily online. Selected clients may be exempted from submitting documents (no proof of income and TU needed). They can also enjoy instant loan approval (in seconds) as well as various other promotional offers.

You may also consider using credit cards to earn rewards and offers to supplement your expenses or opt for instalment payments to ease your burden. Additionally, you can also visit the Investor and Financial Education Council website for more financial tips related to weddings.