- DuitNow Payment in Malaysia

- Manage DuitNow ID

- DuitNow Payment Instructions

- FAQ on DuitNow

Overview

With DuitNow on Straight2Bank, you can remit money instantly on a 24/7 basis to mobile numbers, national identification no (NRIC) and business registration numbers. You can send and receive funds instantly anytime, anywhere.

In addition to paying to an account number, DuitNow offers a new service that enables you to transfer funds to your recipient’s DuitNow ID instead. The following DuitNow IDs can be used for DuitNow transfers:

- Mobile Number

- National Identification Number (NRIC)

- Army or Police Number

- Passport Number

- Business Registration Number (BRN)

To receive funds using DuitNow ID, you can register one Malaysian Ringgit (MYR) operating account per legal entity with Standard Chartered Bank Malaysia through Straight2Bank.

Register DuitNow ID

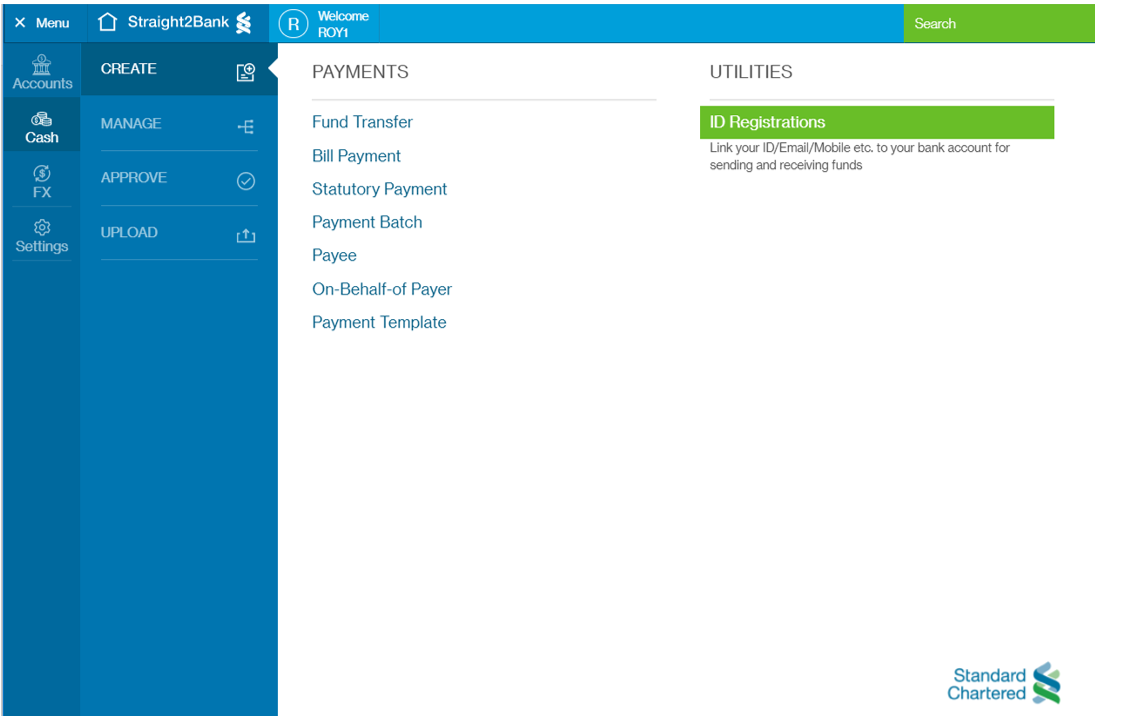

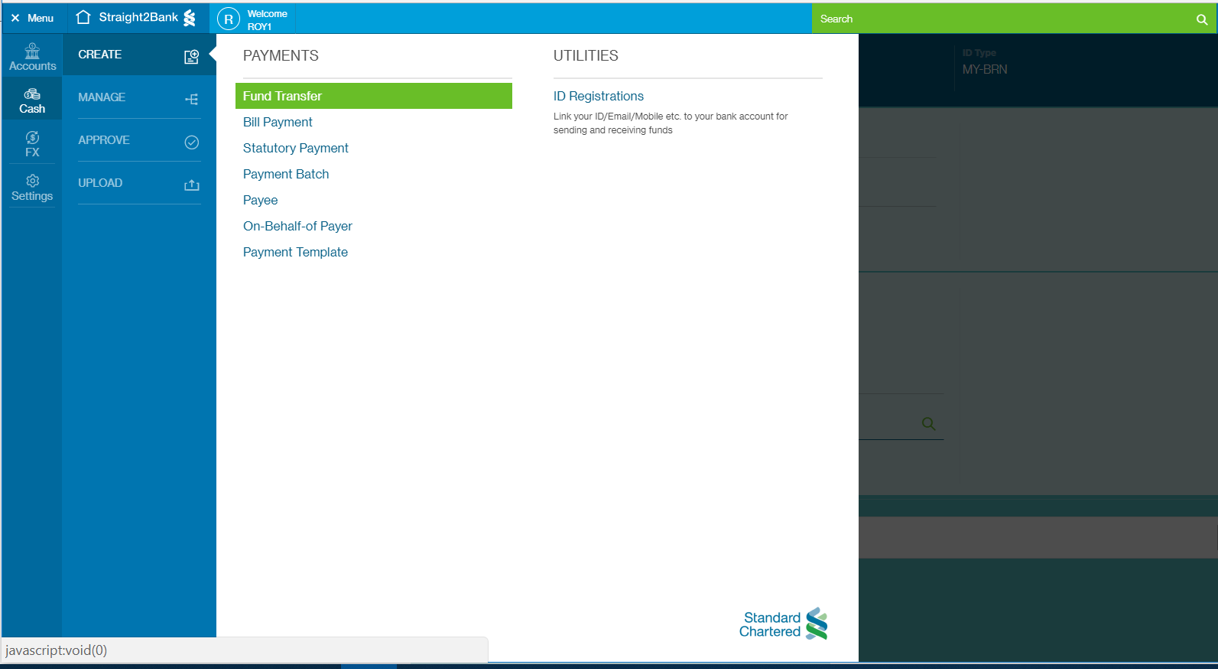

To register your company business registration number for DuitNow ID, start from the options on the left. Go to Menu > Cash > Create and click “ID Registrations”

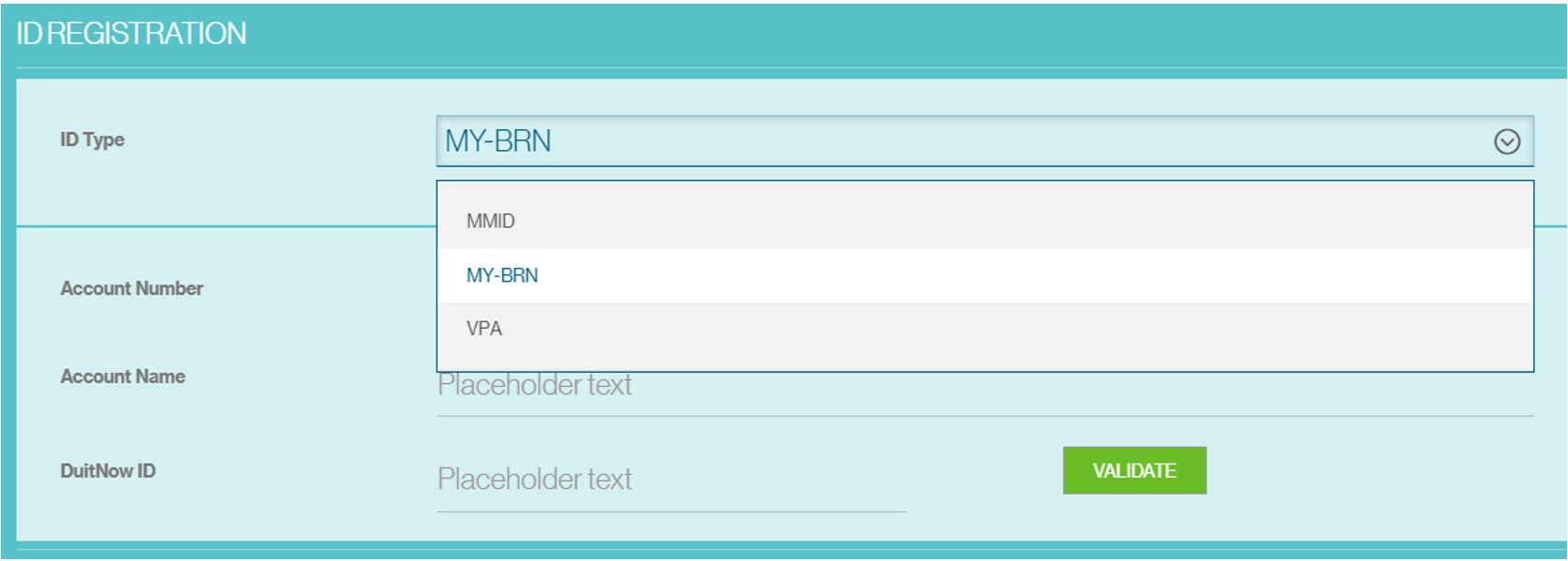

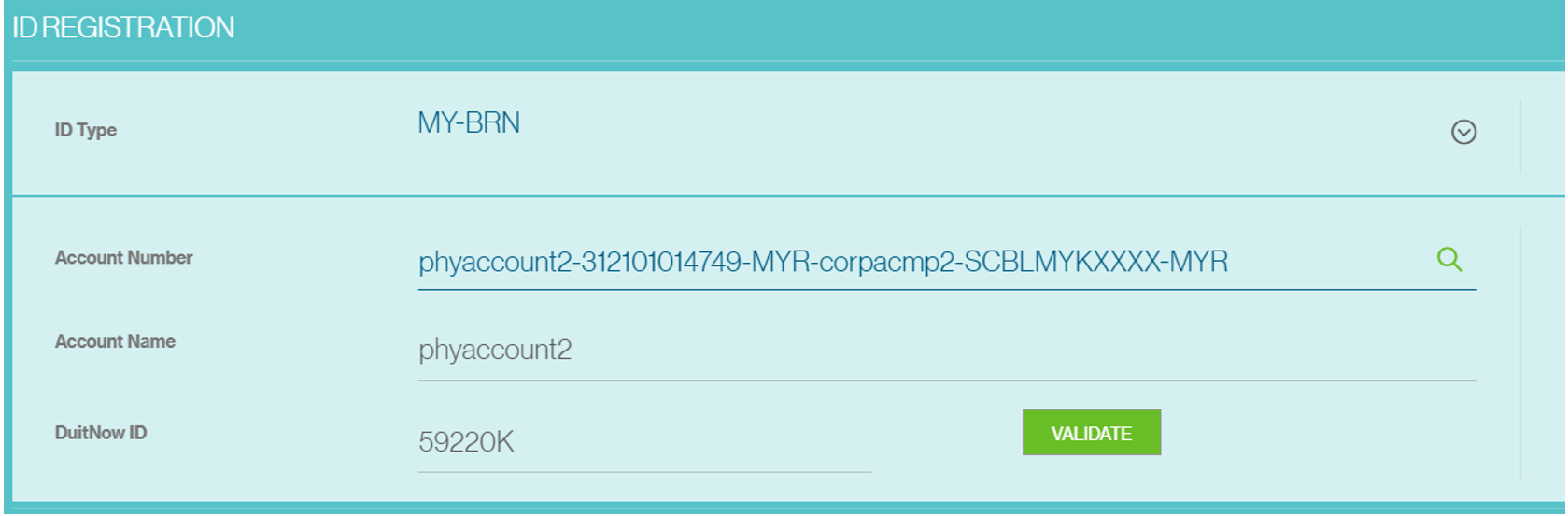

Select ID Type “MY – BRN”

Select a Malaysian Ringgit (MYR) operating account from the dropdown/search box in the “Account Number” field.

Once, you have selected the account number, the legal entity name and business registration number will be shown, then click “Validate” button to perform the online validation.

If the validation is successful, the “Submit” button will be enabled to complete the registration initiation request step. Then, click “Submit” to complete the registration initiation step.

DuitNow ID registration request need to be approved by a designated authorizer before the registration process can be completed. Please request the authorizer to approve this registration request though Straight2Bank.

DuitNow ID registration request need to be approved by a designated authorizer before the registration process can be completed. Please request the authorizer to approve this registration request though Straight2Bank.

Approve / Reject DuitNow ID

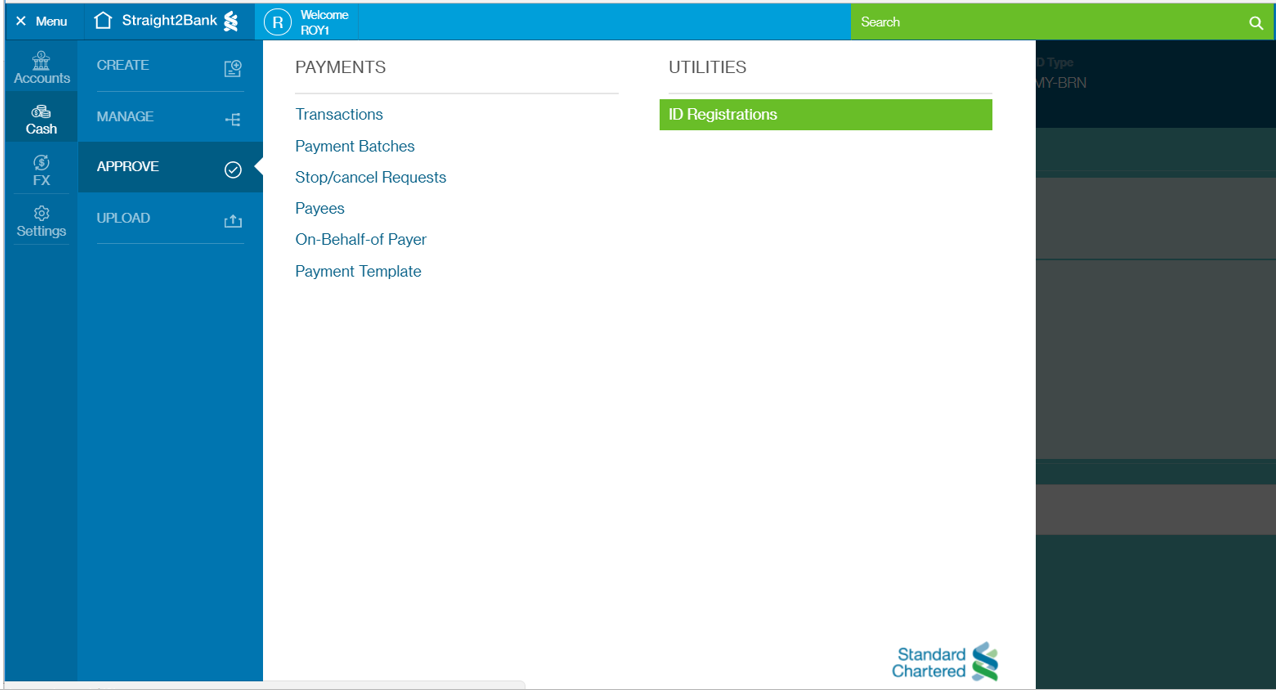

To approve your company business registration number for DuitNow ID, start from the options on the left. Go to Menu > Cash > Approve and click “ID Registration"

ID records with the following status are eligible for approval/rejection.

- Registration Pending Approval

- Amendment Pending Approval

- De-registration Pending Approval

1 Approve DuitNow ID Registration/Update Request

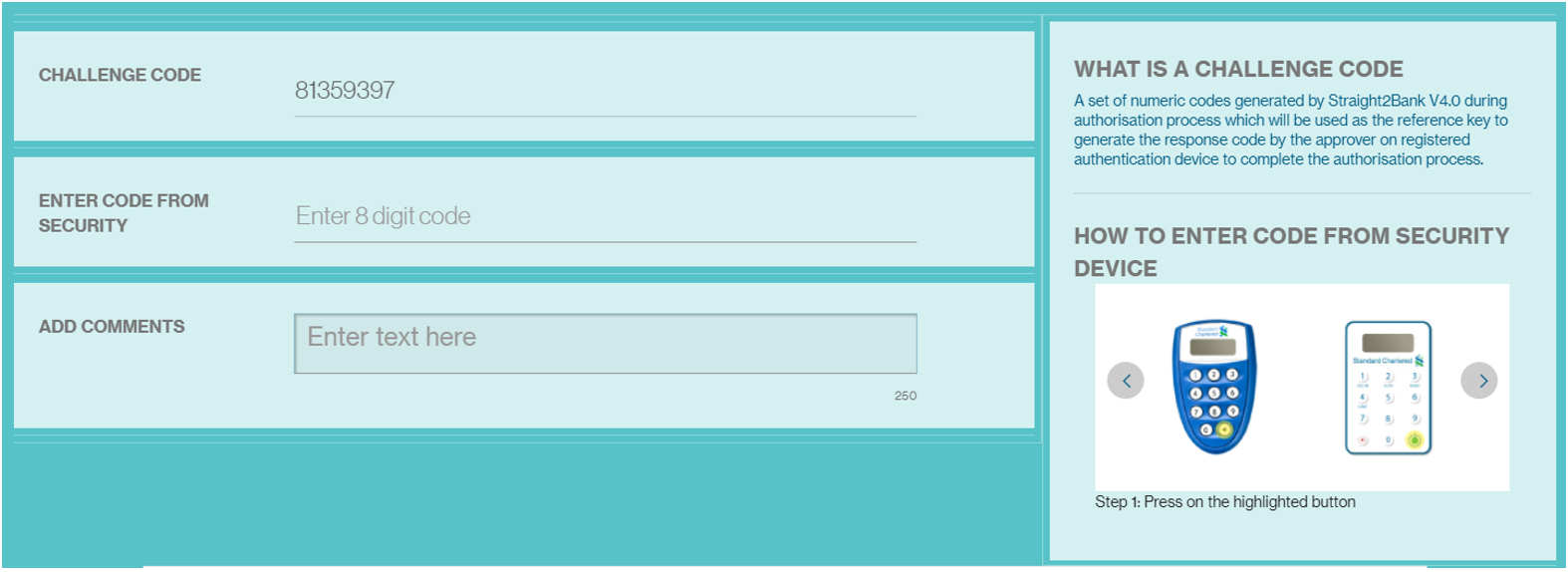

You may select one or more DuitNow ID for approval, then use your Vasco hard/soft token to generate the response for the approval action.

Post approval, if the Proxy New / Modify / Deregister response is pending with DuitNow, the status of the record will be updated as "Response Pending". No modification will be allowed for records under this status.

Once the registration is completed, the ID registration record status will be changed to “Registration Accepted”.

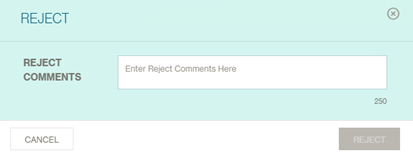

2 Reject DuitNow ID Registration/Update Request

You can only select one record at a time for rejection.

When you select a record, and click on "Reject”, the following pop-up will be displayed to enable you to provide a reject reason.

Provide your comment, then click “Reject” to reject the record.

Update DuitNow ID

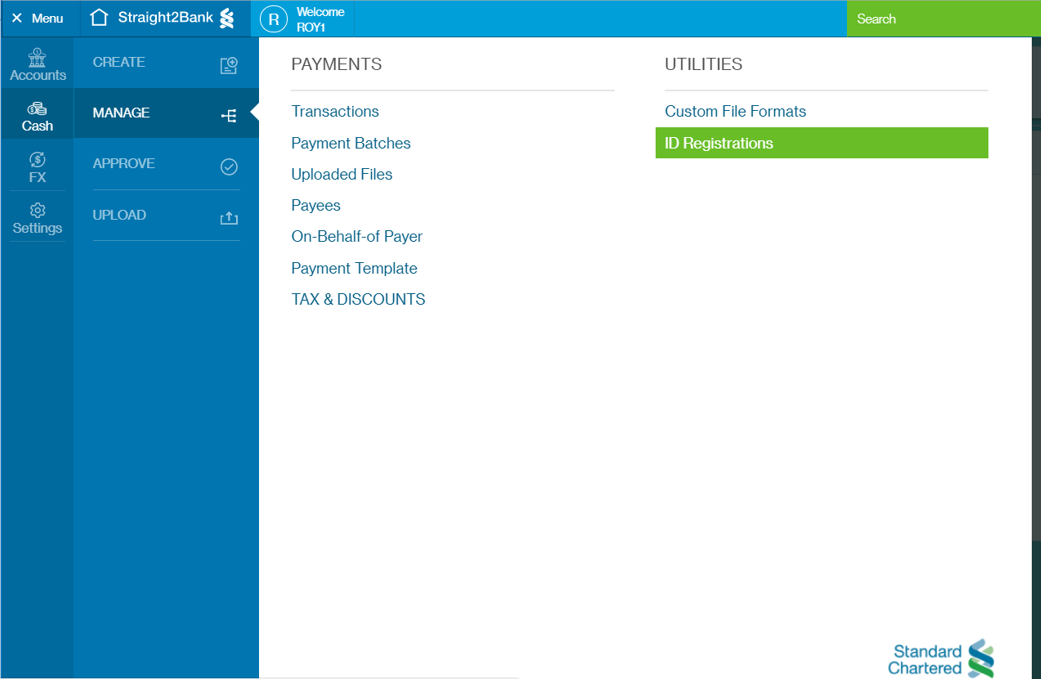

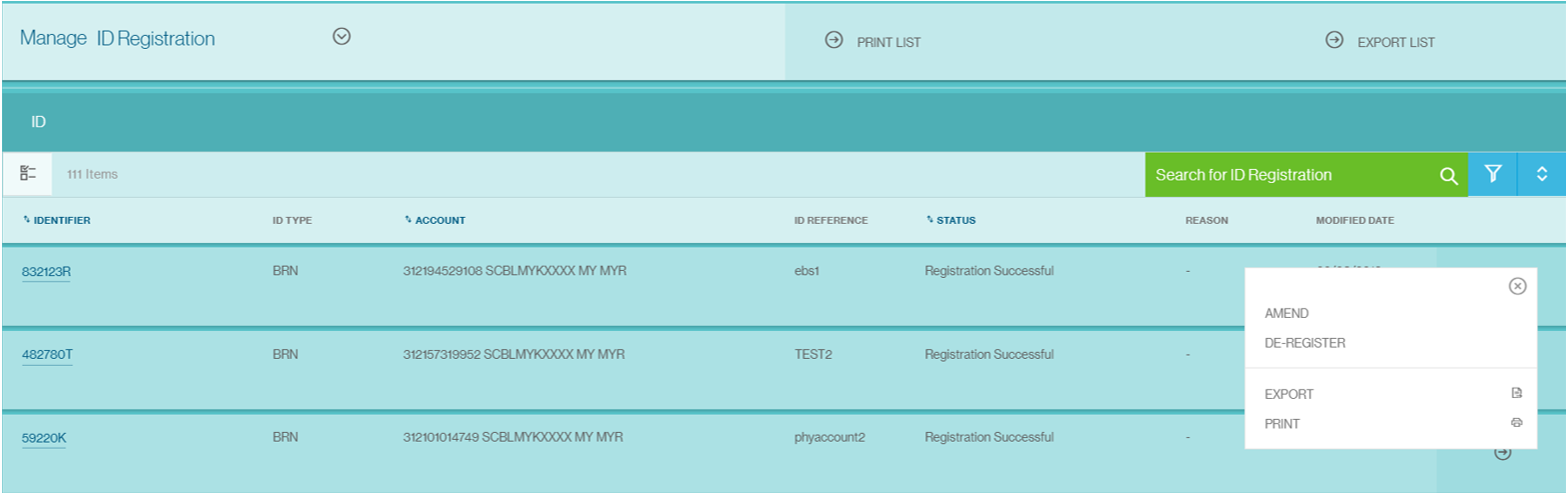

To update your company business registration number for DuitNow ID, start from the options on the left. Go to Menu > Cash > Manage and click “ID Registration”.

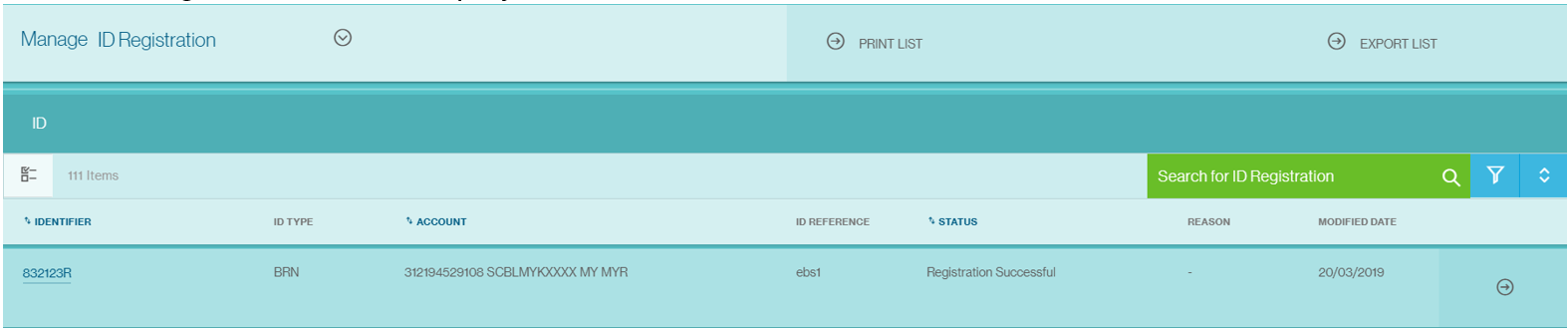

The following screen will be displayed to show the DuitNow ID records.

Only one record under “Registration Successful" status can be selected at one time for update action. Modify registration allows users to perform the following types of update:

- Switch Bank of DuitNow ID

- Change Linked Account Number to DuitNow ID

- Activate or Suspend DuitNow ID

- De-register DuitNow ID

Only one action of the above update action can be performed at one time. You’re not allowed to perform multiple update action at the same time.

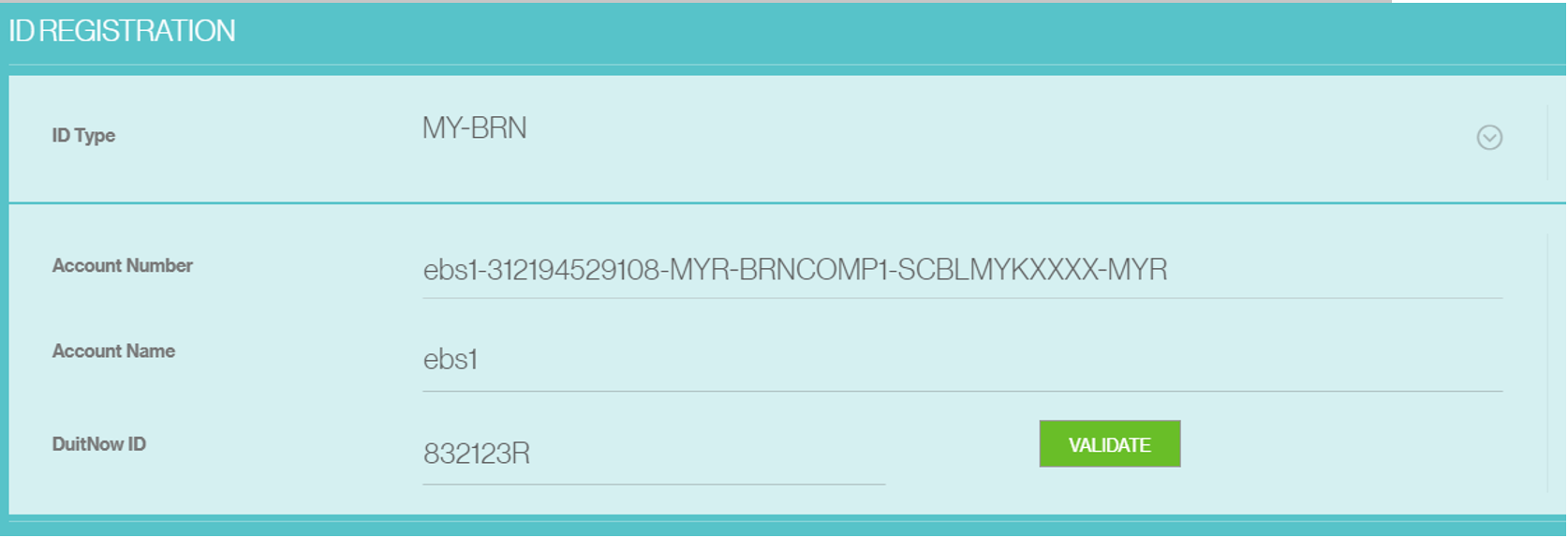

When you select “Amend” option after selecting one of the record, the ID details will be shown.

Click “Validate” to retrieve registration details from DuitNow for this ID record.

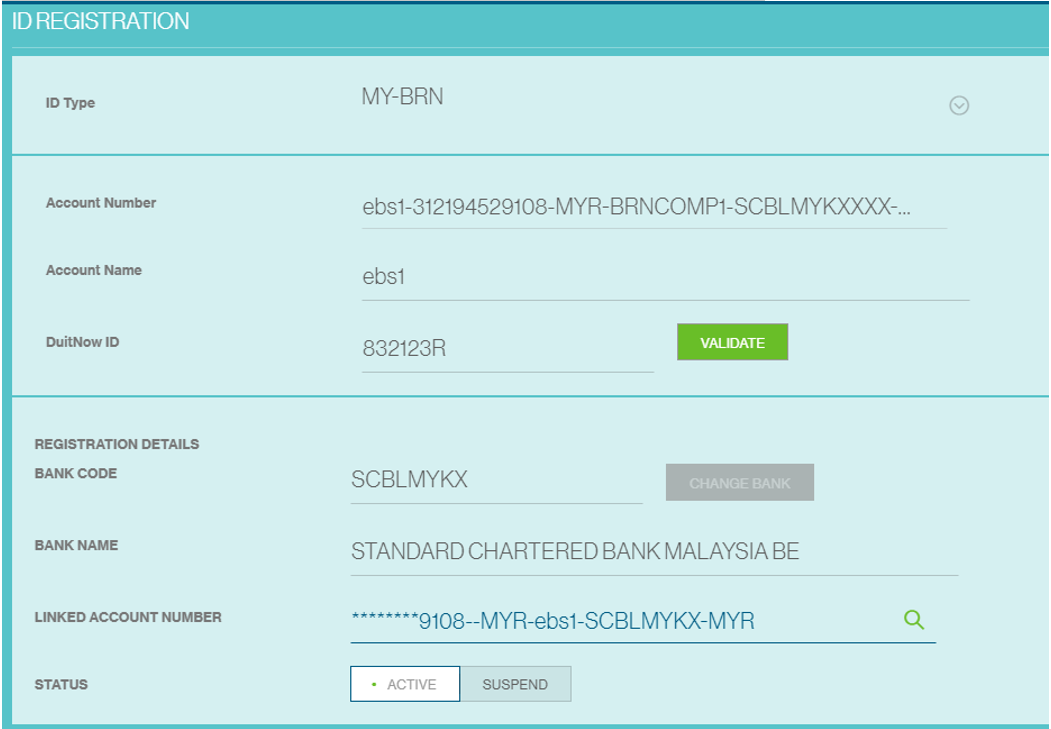

1 Switch Bank of DuitNow ID

Switch Bank is only allowed for DuitNow ID linked to another bank. This option will be disabled if the DuitNow ID is linked to a MYR operating account with Standard Chartered Bank Malaysia.

Click “Change Bank” button and select “Submit” to complete this request.

2 Change Linked Account Number

Change Linked Account Number is only allowed for DuitNow ID linked to a MYR operating account with Standard Chartered Bank Malaysia. The lookup icon ( ) will be disable if the DuitNow ID is linked to another bank.

) will be disable if the DuitNow ID is linked to another bank.

Clicking on the lookup icon will allow you to select your other MYR operating account with Standard Chartered Bank Malaysia. Select one of the listed account number(s) and select “Submit” to complete the request.

3 Activate or Suspend or De-Register DuitNow ID

Activate or Suspend or De-register is only allowed for DuitNow ID linked to a MYR operating account with Standard Chartered Bank Malaysia.

Click “Active” or “Suspend” or “De-register” button and select “Submit” to complete this request.

DuitNow ID maintenance request need to be approved by a designated authorizer before the update process can be completed. Please request the authorizer to approve this request though Straight2Bank.

DuitNow ID maintenance request need to be approved by a designated authorizer before the update process can be completed. Please request the authorizer to approve this request though Straight2Bank.

Create DuitNow Payments

Manual payment creation is one of the ways in which payments can be created on Straight2Bank.

Start from the options on the left. Go to Menu > Cash > Create and click “Fund Transfer”.

On this page, all inputs are mandatory unless stated as optional. Fill in the transaction's details including:

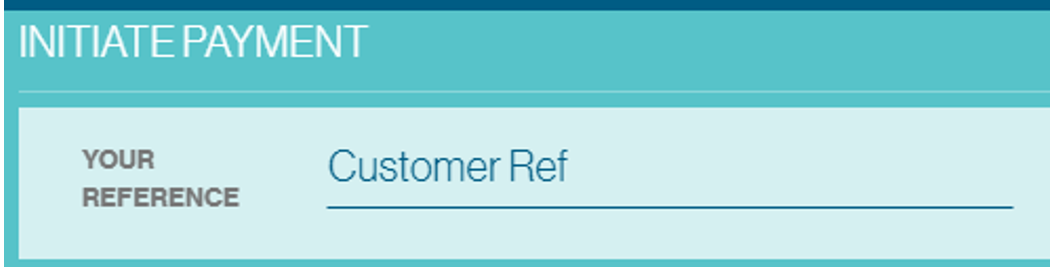

1 Payment Reference

This field is auto-populated. It must be unique and the field accepts up to 40 characters for DuitNow payments.

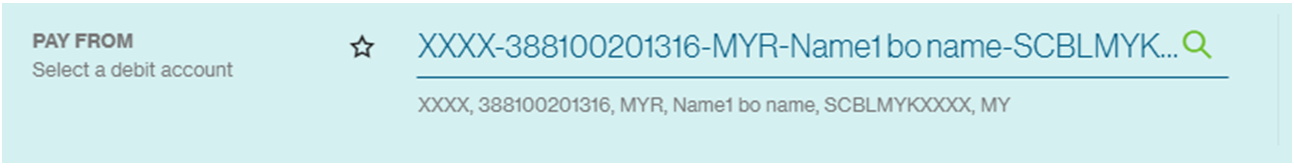

2 Pay From

Select a Malaysian Ringgit (MYR) 'Debit Account' from drop down list.

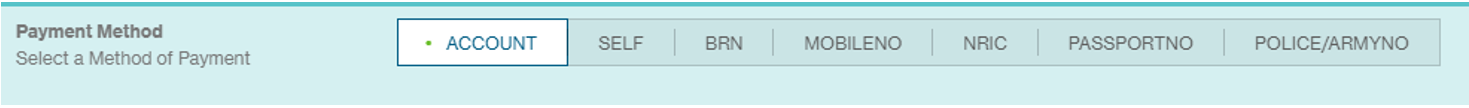

3 Payment Method

Select the desired ‘Payment Method’.

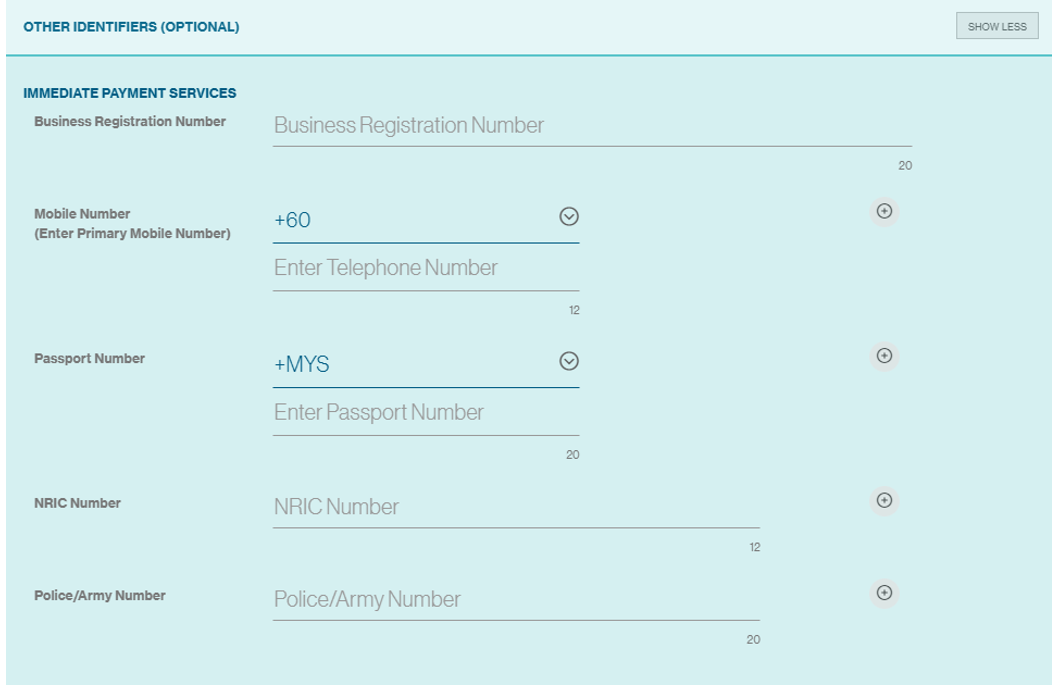

Following DuitNow IDs can be used for DuitNow transfers:

- Account (Credit Transfer)

- Mobile Number

- National Identification Number (NRIC)

- Army or Police Number

- Passport Number

- Business Registration Number (BRN)

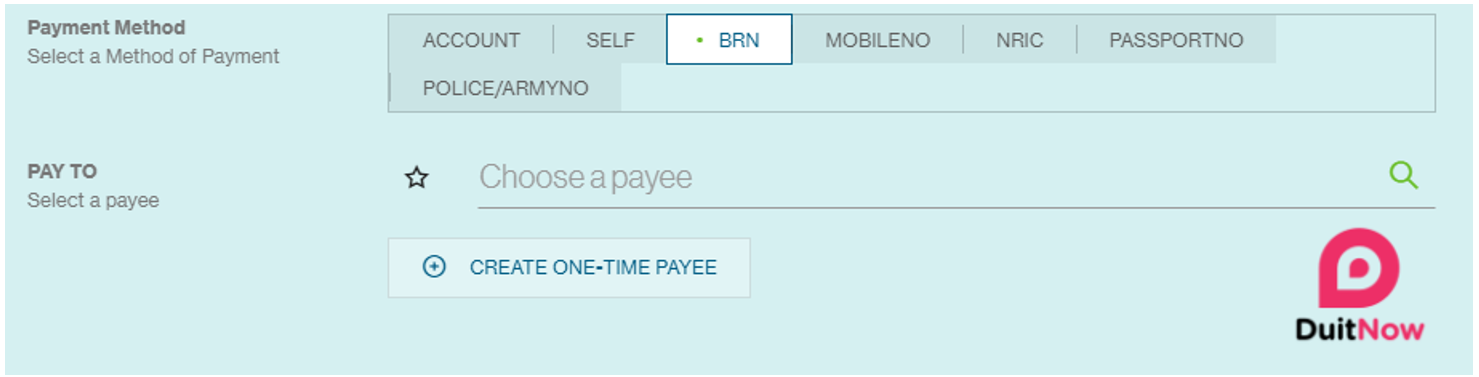

4 Select or Input Payee

You can either choose a registered payee or input one-time payee record for DuitNow payment.

If you select payment method option other than Account or Self, eligible registered payee records with valid DuitNow ID details provided under “Immediate Payment Service” section will be shown for selection. You may also choose one-time payee option to input the payee details.

DuitNow ID detail to be provided in the following ‘Immediate Payment Services’ section under ‘Other Identifiers’ to make payment to a payee using DuitNow ID. There is no need to input details of the Payee’s account number or Payee’s bank code for payment to DuitNow ID.

5 Payment Details

Enter Gross Payment amount, Discount details, Payment Value Date.

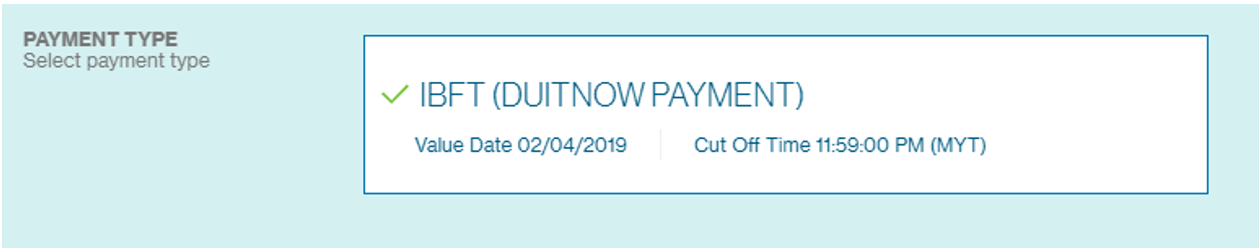

Payment type will be defaulted to IBFT (DuitNow Payment) if you select payment method option other than Account or Self.

At the end of the payment screen, you will have various options pertaining to the payment. The options available are:

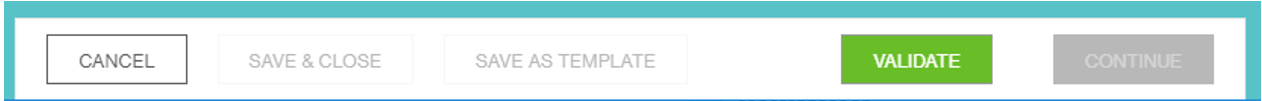

1 Cancel

Allows you to cancel the transaction instruction creation and get back to the previous page.

2 Save & Close

The payment information input will be saved as draft (“Draft” status) and allows you to complete at a later point.

3 Save as Template

This option will let you save the payment as template for future use. It will only be enabled for payments made to a registered payee.

4 Validate

This option will perform online validation of the DuitNow ID of the payee. The Registered Payee’s Name will be displayed upon successful online validation. It is important that you check that the name belongs to the intended recipient before confirming the transfer. This option will be disabled upon successful validation of DuitNow ID.

5 Continue

This option will be enabled once the DuitNow ID has been successfully validated. It will proceed to payment summary page.

Review all the information on the summary page and click on “Submit” when done.

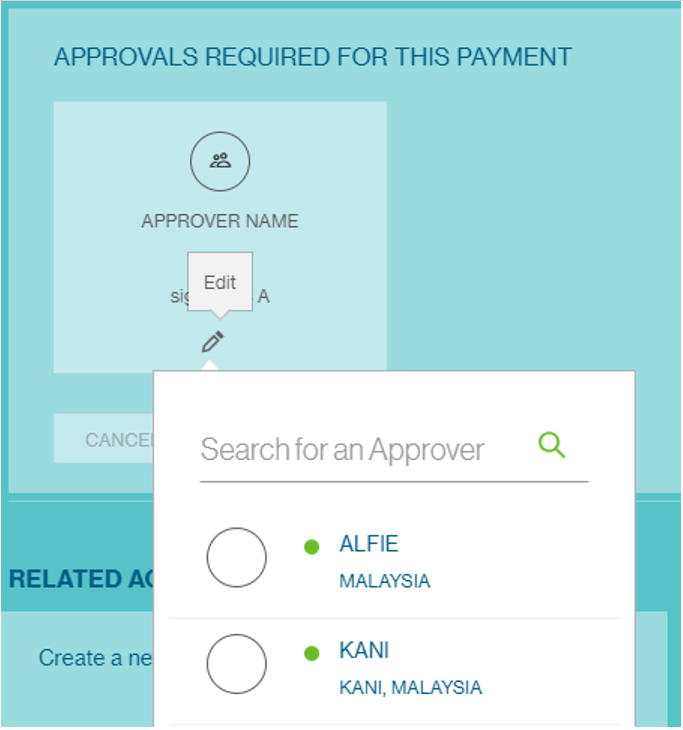

On the next page, you can select and send an alert to the appropriate approver. Refer to the Approve Payments for details on this.

To view the list of payments awaiting authorisation, you can check the Manage Payment list screen . Once approved, the status will change to ‘Fully Authorized’.

Upload DuitNow Payment

You may also upload file in a standard, bank defined format or a template created to process DuitNow payment instructions.

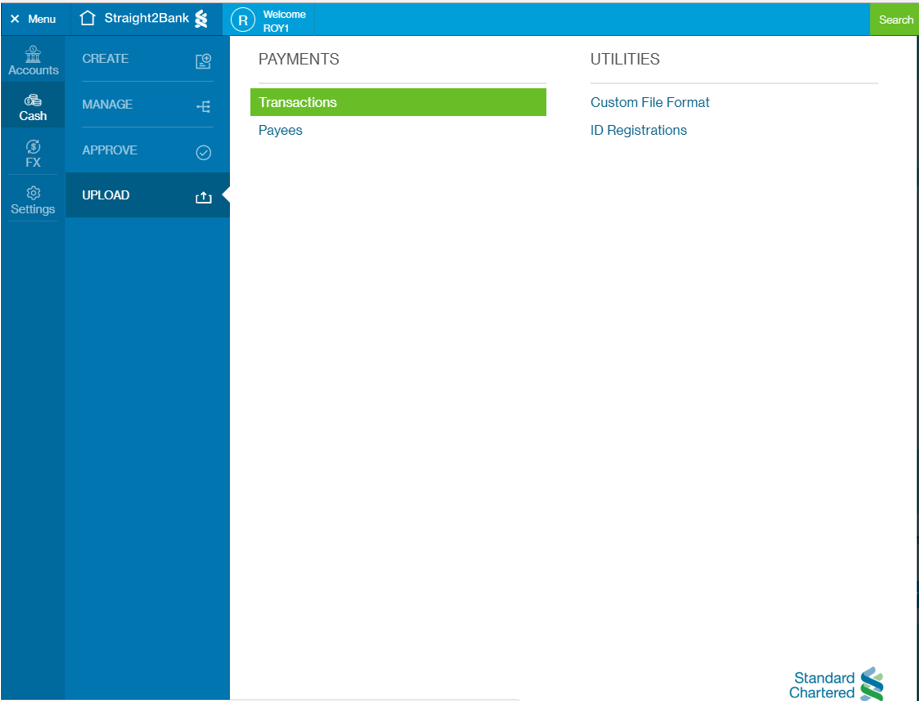

Navigate to “Menu > Cash > Upload > Transactions”

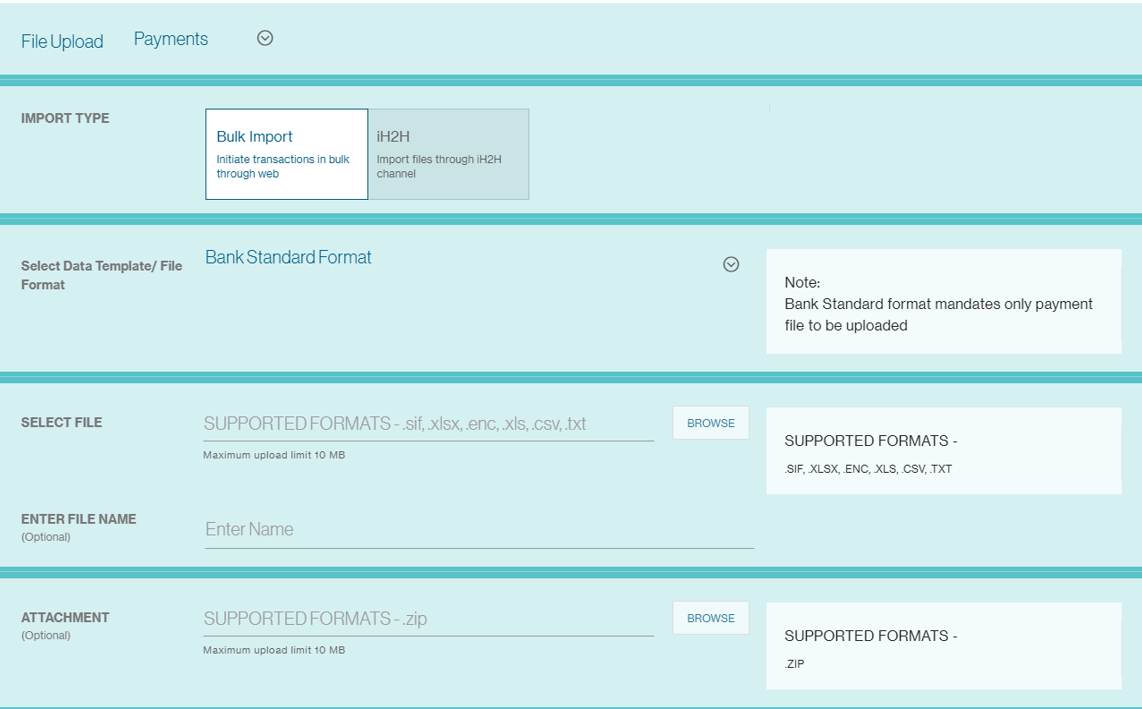

You will see the following screen.

Choose “File Upload”: Payments, SMEPayment, or other Payment file type based on the file that you are uploading. By Default, “Payments” will be displayed.

Thereafter, select from the list of existing “Data Templates / File Format” available. For regular Payment Bulk Import, it is always “iPayment CSV” and the Template Formats shows all the UDA templates available to the user. By Default, ‘Bank Standard Format’ will be displayed.

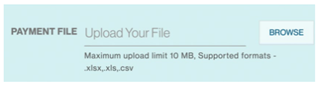

Choose the file and Import (Maximum upload limit: 10 MB. Supported formats: *.csv).

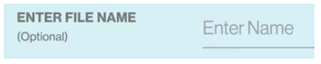

You can provide a relevant “File Name” of the file. For example, “Payments 20170801”.

Click on the “Import” button to process the file.

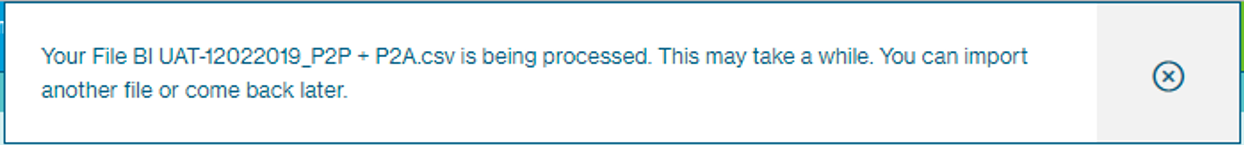

A confirmation message will be displayed once the file has been imported successfully.

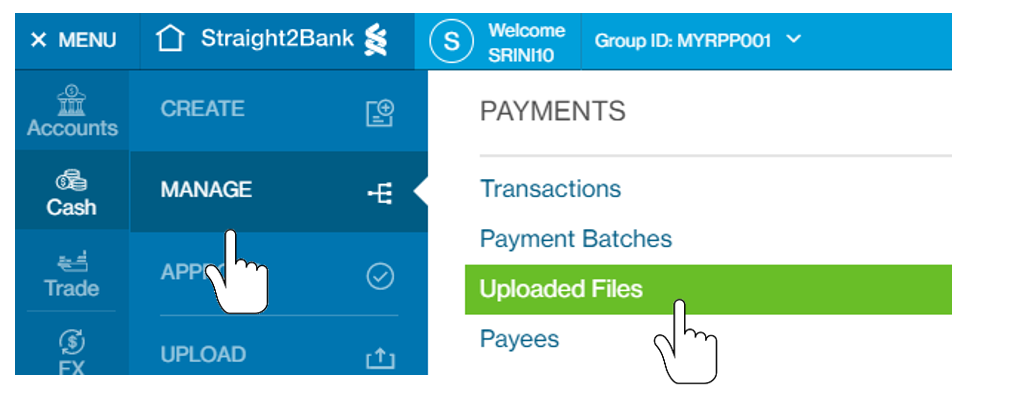

To check whether there are errors or duplicates to your uploaded file, go to Menu > Cash > Manage > Uploaded Files Search for the file by entering the File Reference or File name.

| File Status | Description |

|---|---|

| Upload Successful | The payment instructions have been uploaded successfully and transactions are in “Submitted for Approval” or “Draft” status for further processing. Users can click on the file reference and view the reason for transactions being marked as draft. Users can then edit the transaction online to amend and send to bank. |

| Upload Failed | The file has not been uploaded successfully. The file format is not compatible or is incorrect. User can click on the file reference view / download the error log. |

| Uploaded with errors | The file has been uploaded successfully. Some of the payments uploaded are of incorrect format and hence are “Invalid”. Click on the file reference view / download the error log. The invalid records are not uploaded and hence will need to be uploaded afresh after rectifying the discrepancies |

| Upload In-Progress | It means that the file upload is in progress and you must wait for it to finish. |

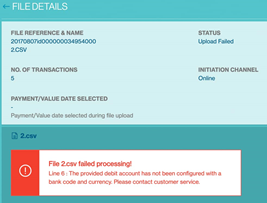

Why did my payment file fail processing?

Your payment file uploaded may be rejected due to errors in your file.

Please check your payment file for these possible causes:

- Invalid field characters

- file name already in use

- duplicate payee nickname / reference

Upon processing, the payments within the file will be available through the “Manage > Payment” screen and further action (e.g.) “Authorise”, “Batch”, “Edit”, etc can be performed.

Refer to the relevant section in this site for any further information relating to batching, editing and etc of these transactions.

Approve DuitNow Payment

There are several ways you can approve DuitNow payments on Straight2Bank:

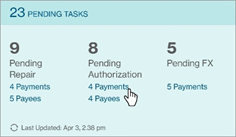

1 Main page - Dashboard

Payments that are pending approval will be available on Individual Task Card and Pending Task Card on main page.

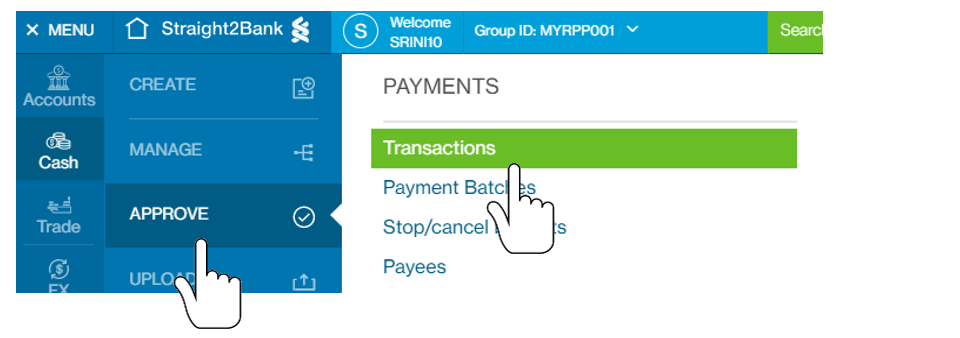

2 Approve Payment List Screen - Action Menu

Payments that are pending approval will be available on the Approve Payments List Screen - from the Menu > Cash > Approve > Transactions.

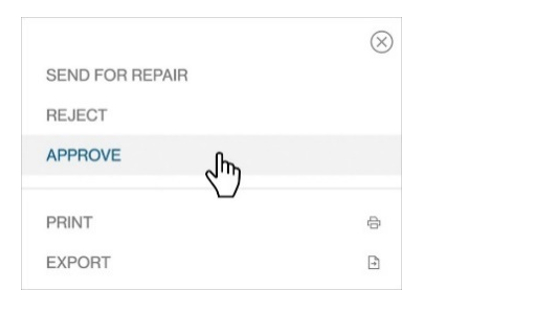

You can approve selected payment by clicking on the Action Menu.

Payment Detail Display

The Approve Payments List Screen will list all the existing transactions that are in “Completed” Status (meaning that payment has been created and submitted for further actions such as Authorisation or Batching). This screen has various data fields that may be customised optionally by clicking on Filter or Sort button.

Frequently Asked Questions (FAQ) on DuitNow

1. Why DuitNow?

With DuitNow, you can send money instantly on a 24/7 basis to mobile numbers, NRIC and business registration numbers. You can also receive money instantly anywhere, anytime.

2. How can I receive payments using DuitNow?

First, you must register your Business Registration Number for DuitNow by linking it to your Malaysia Ringgit (MYR) bank operating account.

Once the registration is completed, payers can direct payment to your company using the registered business registration number (DuitNow ID).

3. How many accounts can I linked with my Business Registration Number to receive money using DuitNow?

You can only link one Business Registration Number to one Malaysian Ringgit (MYR) operation/current account.

4. Can I schedule a future dated transfer with DuitNow?

Straight2Bank supports current business date payment instruction for DuitNow currently.

5. Is there any limit for DuitNow Transfer?

Businesses may transfer up to RM10,000,000.00 per transactions.

This limit may vary depending on your authorization limit setup on Straight2Bank.

6. If I have already registered my DuitNow ID with another participating bank, can I register DuitNow with SCB using the same business registration number?

Yes. You can transfer the business registration number DuitNow ID and link it to an SCB account on Straight2Bank NextGen.

7. Will I be able to perform a transfer to a DuitNow proxy if I have not registered for DuitNow?

Yes. Provided you are on Straight2Bank NextGen and the payee’s proxy is registered with DuitNow, you can make a DuitNow Transfer to such proxy, i.e. DuitNow ID.

8. Are all my accounts eligible for proxy registration?

No. You can only register one Malaysia Ringgit (MYR) account for DuitNow proxy registration. In addition, please note that certain accounts (e.g. time deposit / fixed deposit accounts) are not eligible.