Travelling Professionals

Learn how Angela continue to manage her finances when she was posted overseas

About Us

We’ve got the global network and deep expertise to meet your global ambitions

Grow your Wealth Internationally

Access a full suite of wealth solutions to keep your financial goals on track

Seamless Banking

Bank and transact conveniently wherever you are

Open your account remotely

We simplified our application process to bring convenience to you

Solutions for your unique aspirations

Enjoy bespoke banking experience, exclusive products and preferential services

With Singapore’s robust and diversified economy, low tax regime, excellent connectivity and high standard of living, individual and corporate investors have the ideal landscape to invest with confidence.

With presence in over 50 markets worldwide, we provide a truly global presence, making it easier for you to manage your finances and capitalise on opportunities around the world.

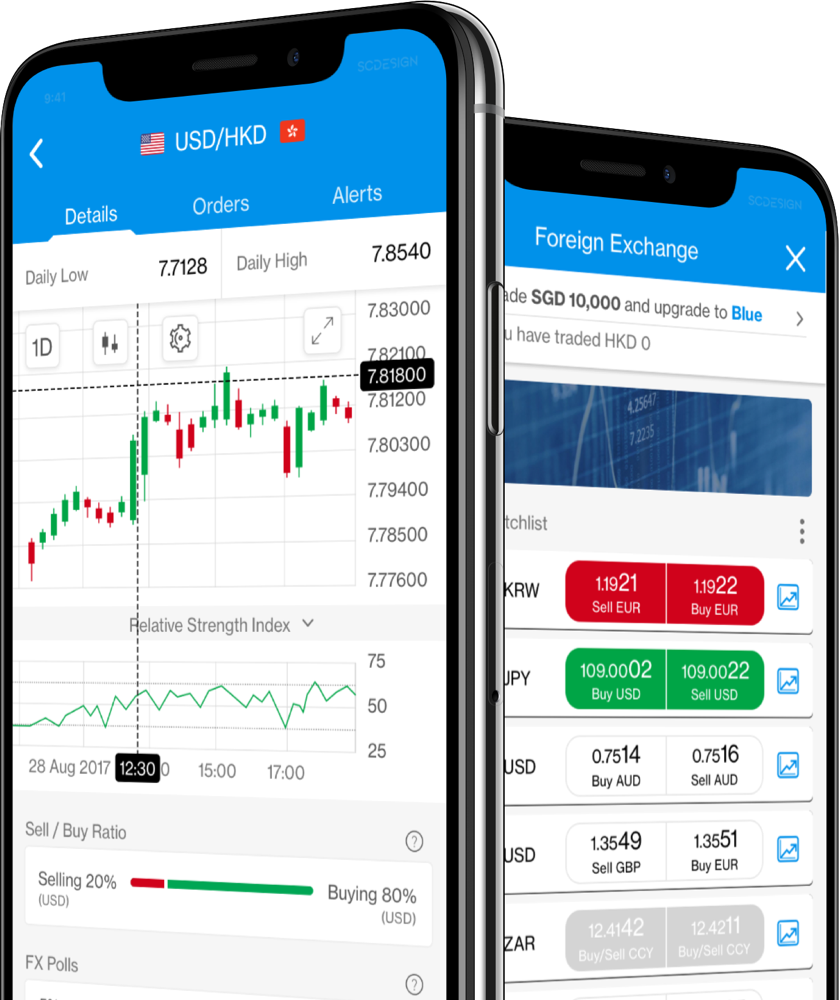

Our suite of smart digital wealth solutions and tools are catered to give you quick and easy access to meet your daily wealth needs wherever you are.

You can connect with our Relationship Managers or Insurance Specialists and receive access to tailored wealth management advice from the comfort of your home.

Tap into our global network and resources to analyse the financial markets around the world to identify investment opportunities.

Accredited Investors (AI) are assumed to be better informed and better able to access resources to protect their own interests. Here is what you may enjoy as an AI client.

Leave a legacy for your loved ones by preserving your wealth for generations to come.

Whether you are travelling, working overseas or even relocating your family, tap on our global network to help you with all your banking and financial needs

myRM

Deposit Accounts

SC Remit

Global Link

Dedicated Relationship Manager

Global Recognition

Access to Priority Private and International Banking Centre

Priority Banking Visa Infinite Card

in value for New-To-Bank customers

Interest with Bonus$aver

Interest with Wealth $aver, equivalent to S$22,500 in interest.

Enjoy a welcome gift

when you sign up for Priority Banking today

| Total value of Fresh Funds placed and maintained in Eligible Deposits and/or Eligible Investments within three (3) calendar months of Wealth $aver Account Opening | Choice of Reward for Customer | |

| Cash Reward | Signature CIO Funds | |

| USD 200k to USD 750k | USD 350 Cash | USD 700 in equivalent in Signature CIO Funds |

| USD 750k to < USD 1.2m and consents to be treated as an Accredited Investor (where applicable and as determined by the Bank in its sole and absolute discretion) | USD 1,800 Cash | USD 3,600 in equivalent in Signature CIO Funds |

| USD 1.2m to < USD 2.2m and also signs up as a Priority Private client and consents to be treated as an Accredited Investor (where applicable and as determined by the Bank in its sole and absolute discretion) | USD 2,800 Cash | USD 5,600 in equivalent in Signature CIO Funds |

| USD 2.2m and above and also signs up as a Priority Private client and consents to be treated as an Accredited Investor (where applicable and as determined by the Bank in its sole and absolute discretion) | USD 3,750 Cash | USD 7,500 in equivalent in Signature CIO Funds |

|

Exclusive Time Deposit Promotion For New-To-Bank Customers

|

|---|

| From 1 to 30 April 2025, enjoy an exclusive promotional interest rate of 2.25% p.a. for SGD (3 months) or 4.35% p.a. for USD (3 months). Minimum S$10,000 in fresh funds must also be deposited into a Wealth $aver account. Do note that this Time Deposit promotion is not stackable with the Q2’25 Priority Banking and Priority Private New-to-Bank campaign. Click here to find out more. |

|

Special Fresh Funds Time Deposit Promotion, with minimum deposit of S$25,000

|

Promotional Interest Rate

|

|---|---|

|

Priority Banking and Priority Private Clients |

2.20% p.a. (6 months) |

|

Be Rewarded when you invest though us* |

Cash Reward

|

|---|---|

|

For every S$50,000 (or equivalent in foreign currencies) investment purchased in Eligible Unit Trust, Bonds and Structured Products offered by the Bank in a single day 2 |

S$100 (#Capped at S$6,000) |

|

Protect yourself with these exclusive insurance promotions

|

|---|

| Enjoy a special 3-month time deposit at 15% p.a. when you purchase an Eligible Regular Premium Insurance Policy with a minimum monthly premium of $3,000 (in the currency of the policy) |

|

Receive $200 cash credit for each S$100,000 block of Eligible Single Premium Products purchased (capped at S$3K cash credit per client)

|

Complete the following data and we’ll reach you very shortly

Name

Phone Number or Email

I am an existing Standard Chartered Bank customer

By submitting your contact information to us, you consent to us, or any other party authorised to act on our behalf, to contact you on the above even if you have registered or subsequently register your contact information with the Personal Data Protection Commission of Singapore’s Do Not Call Registry.

Enjoy a bespoke banking experience and exclusive suite of products and services to achieve your unique aspirations.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Investments

The content of this webpage does not constitute an offer, recommendation or solicitation of an offer to enter into a transaction or adopt any hedging, trading or investment strategy. It has not been prepared for any particular person or class of persons and does not constitute and should not be construed as investment advice nor an investment recommendation. It has been prepared without regards to the specific investment objectives, financial situation or particular needs of any person. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. Investment products are not deposits and each of the investment products mentioned does not qualify as an insured deposit under the Singapore Deposit Insurance and Policy Owners’ Protection Schemes Act 2011

Insurance Products

The content of this webpage does not constitute a contract of insurance and reference should be made to the respective policies for the exact terms and conditions applicable to the insurance policy. It does not constitute an offer, recommendation or solicitation of an offer to buy or sell any insurance product or service, nor is it intended to provide insurance or financial advice. All insurance products described in this webpage are products of and underwritten by the respective insurers and not Standard Chartered Bank (Singapore) Limited. In facilitating insurance arrangements or in referring customers to the respective insurer(s), Standard Chartered Bank (Singapore) Limited is acting in alliance with the respective insurer(s) and not as an agent for customers. Standard Chartered Bank (Singapore) Limited shall not be liable in any manner whatsoever regarding your application or the contract of insurance.

Additionally, in relation to life insurance, buying a life insurance policy is a long-term commitment. An early termination of the life insurance policy usually involves high cost and the surrender value payable (if any) may be less than the total premiums paid.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the LIA or SDIC websites (www.lia.org.sg or www.sdic.org.sg).