This webpage contains information about AMUNDI ASIA FUNDS SIGNATURE CIO CONSERVATIVE FUND, AMUNDI FUNDS SIGNATURE CIO BALANCED FUND, AMUNDI ASIA FUNDS SIGNATURE CIO GROWTH FUND, AMUNDI ASIA FUNDS SIGNATURE CIO INCOME FUND (the “Funds”), sub funds of Amundi Asia Funds, an undertaking for collective investment in transferable securities existing under Part I of the Luxembourg law of 17 December 2010, organised as an open-ended mutual investment fund (“fonds commun de placement”). The management company of the Funds is Amundi Luxembourg S.A., 5, allée Scheffer, L-2520 Luxembourg and the Singapore Representative of the Funds is Amundi Singapore Limited (Registration No. 198900774E), 80 Raffles Place, UOB Plaza 1, #23-01, Singapore 048624 (Amundi Luxembourg S.A. and/or its affiliated companies, including without limitation Amundi Singapore Limited, being hereinafter referred to individually or jointly as “Amundi”). Amundi Singapore Limited is regulated by the Monetary Authority of Singapore.

The content on this webpage is being distributed for general information only and it does not constitute an offer, recommendation or solicitation of an offer to enter into a transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration.

It has not been prepared for any particular person or class of persons and does not constitute and should not be constituted as an investment advice or an investment recommendation. It has been prepared without regards to the specific investment objectives, financial situation or particular needs of any person. You should seek advice from a licensed or an exempt financial adviser on the suitability of the product for you, taking into account these factors before making a commitment to purchase any product or invest in any investment. In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should carefully consider whether this product or service described herein is suitable for you.

You are fully responsible for your investment decision, including whether the product or service described here is suitable for you. You should read the relevant prospectus before deciding whether to invest in a unit trust.

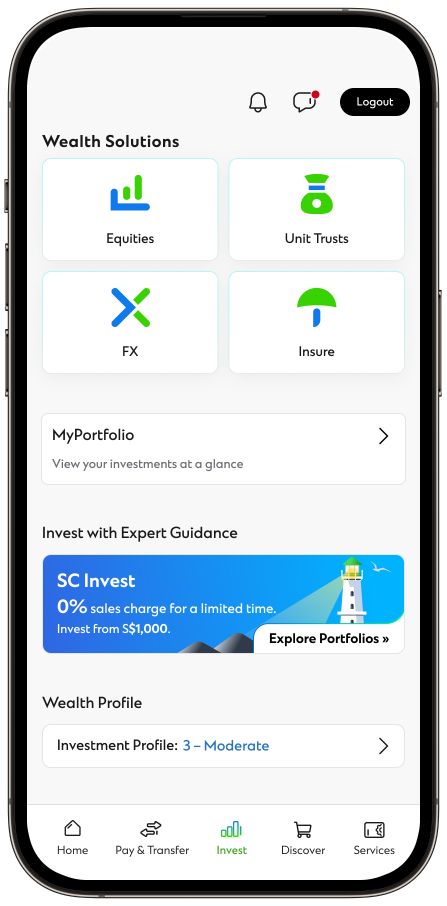

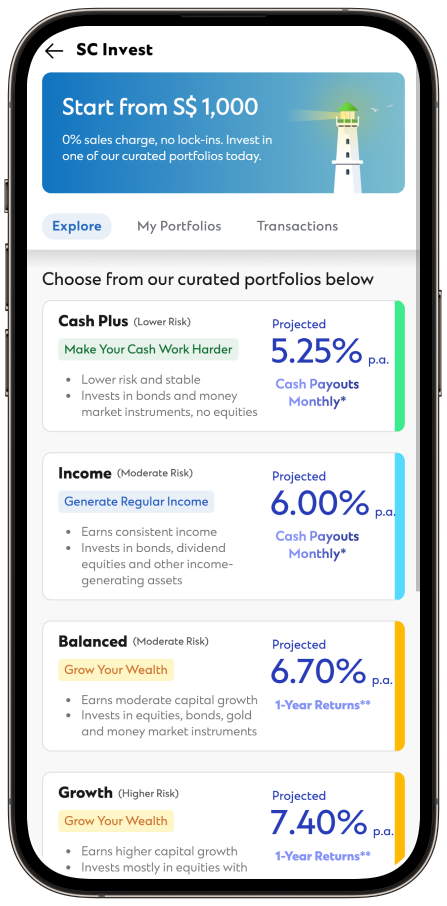

Investments in unit trusts are not obligations of, deposits in, or guaranteed by, Standard Chartered Bank (Singapore) Limited or its affiliates.

An investment in unit trusts is subject to investment risks, including the possible loss of the principal amount invested. The value of and the income from the unit trusts may fall as well as rise.

Foreign currency investments are subject to risks of exchange rate fluctuations and exchange controls may be applicable from time to time to certain currencies.

Unit Trusts are not available to US persons.

Standard Chartered Bank (Singapore) Limited (“SCBSL”) will not accept any responsibility or liability of any kind, with respect to the accuracy or completeness of the information in this webpage. The content of this webpage is for general evaluation only and has not been prepared to be suitable for any particular person or class of persons. SCBSL makes no representation or warranty of any kind, express, implied or statutory regarding this document or any information contained or referred to on the document. This document is distributed on the express understanding that, whilst the information in it is believed to be reliable, it has not been independently verified by us. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. For clarity, this is not a deposit and does not qualify as an insured deposit under the Singapore Deposit Insurance and Policy Owners’ Protection Schemes Act 2011. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Legal Information

This is a marketing communication. Investors should read the applicable offering documents before deciding to invest in the Funds.

Past performance and any forecasts made are not indicative of future performance of the Funds. Please note that distribution/dividends (if applicable) are not guaranteed unless otherwise stated in the dividend policy for the relevant share class contained in the offering documents of the Funds. Any opinion or view presented is subject to change without notice. Where applicable and contemplated in the offering documents of the Funds, the Funds may invest in financial derivatives as part of its strategy, and a material portion of the returns may be generated from financial derivative strategies. In such scenarios, the Funds will be subject to risks associated with such investments as further detailed in the offering documents. Additional risk factors are described in the offering documents of the Funds. Investments in the Funds are subject to investment risks, including the possible loss of the principal amount invested. Such activities may not be suitable for everyone. Value of the shares in the Funds and the income accruing to the shares, if any, may fall or rise. Any forecast, projection or target is indicative only and is not guaranteed in any way. Such information is solely indicative and may be subject to modification from time to time.

It is the responsibility of investors to read the legal documents in force. Subscriptions in the Funds will only be accepted on the basis of their latest offering documents available in English. A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation.

This document is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933 and in the Prospectus of the Fund). The Funds are not registered in the United States under the Investment Company Act of 1940 and units of the Funds are not registered in the United States under the Securities Act of 1933.

Amundi is not responsible for the publication of this material. Certain information contained in this material has been obtained from Amundi which has not been independently verified, although Amundi and its affiliated companies believe such information to be fair and not misleading. Amundi does not accept any liability whatsoever whether direct or indirect that may arise from the publication of this material by Standard Chartered Bank (Singapore) Limited and use of information contained in this material. Amundi and its associates, directors, connected parties and/or employees may from time to time have interests and or underwriting commitments in the investments mentioned in this material. Amundi does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. Amundi does not make any representation as to the merits, suitability, expected success, or profitability of any such transaction mentioned herein.