Managing your wealth well is like tending a beautiful formal garden – you need to start with good soil and a good set of tools. Just as good soil has the proper fertility to nourish a plant, having the right foundation in financial literacy should empower you to potentially cultivate a successful investment portfolio. Cultivate an Understanding of Bonds is part of our financial education series to help educate you on the fundamentals of investing as you tend your very own financial garden.

Click here to read our “Beginners Guide to Investing in Bonds“

What is a Bond?

If you are looking to build up a well-diversified portfolio, you will usually be advised to include both stocks and bonds among your investments. While stocks may offer you the potential for capital appreciation, bonds may provide a steady stream of investment income, and play an important role of potentially lowering your overall portfolio risks.

A bond is a debt security where the bond issuer (the borrower) issues the bond for purchase by the bondholder (the lender). It is also known as a fixed income security, as a bond usually gives the investor a regular or fixed return.

When you invest in a bond, you are essentially lending a sum of money to the bond issuer. In return, you are usually entitled to receive

interest payments (coupon) at scheduled intervals; and capital repayment of your initial principal amount at an agreed date in the future (maturity date).

Typical bond issuers include:

- Sovereign entities

- Governments/Government agencies

- Banks

- Non-bank financial institutions

- Corporations

What is Bond Quality?

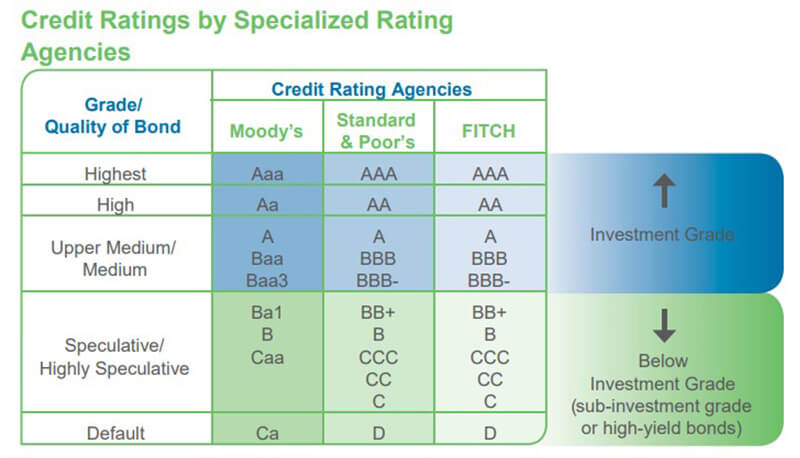

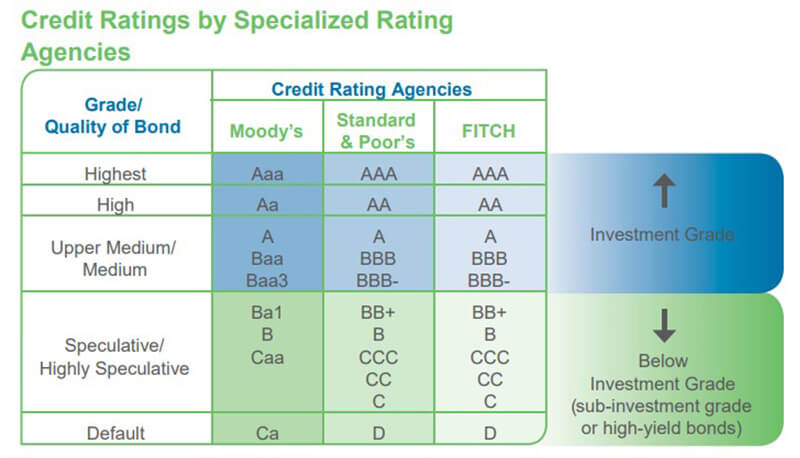

Before you make an investment decision to invest in a bond, it is important to consider the quality of the bond (or the creditworthiness of the issuer). You can do that by looking at its assigned bond rating. This is a credit rating given to the bond by specialized rating agencies, after they have reviewed the issuer’s financial condition and debt repayment ability.

Bonds assigned ratings above a certain threshold are considered investment grade, while bonds rated below the threshold are known as sub-investment grade or high-yield bonds.

Which Bond is Suitable for You?

Depending on your risk appetite, when making your investment decision you may choose to invest in either an investment grade bond, or a high-yield bond.

An investment grade bond is a more secure investment and should give you a stable source of investment income.

A high-yield bond pays a relatively higher return but carries with it a higher risk of default – and will therefore require closer monitoring.

However, in all cases, the repayment of bonds is always subject to the creditworthiness of the particular issuer.

Buy, Hold or Sell?

After you invest in a bond, you can choose to hold on to the bond until maturity. You will receive all the scheduled coupon payments in the intervening period and recover the principal repayment at the end of the term. The rate of return which you will earn from buying and holding the bond to maturity (expressed as a percentage) is referred to as the bond yield.

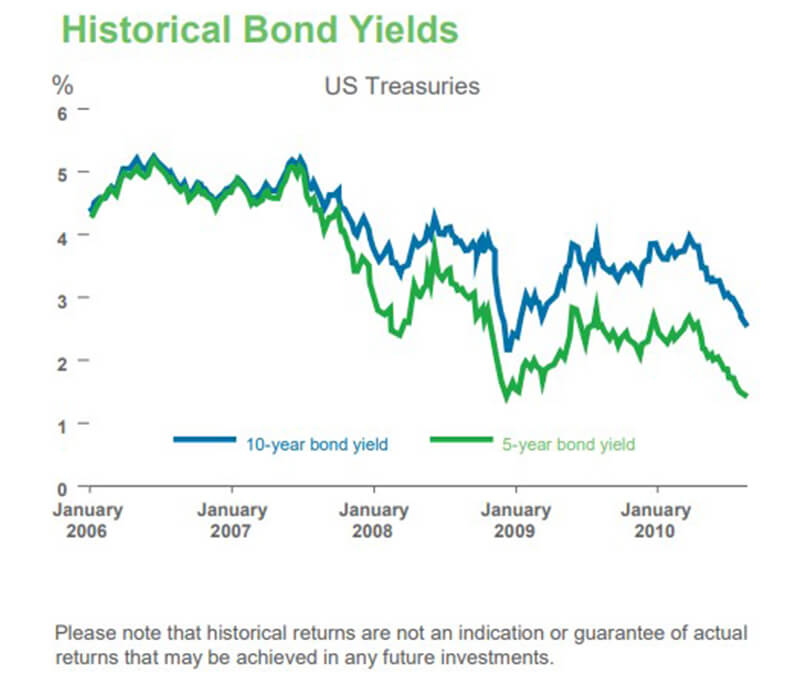

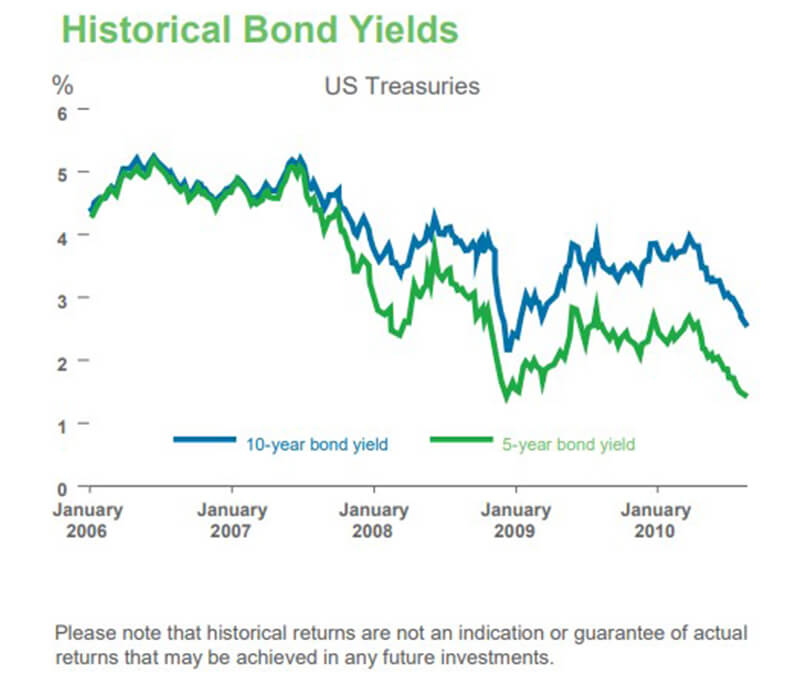

Alternatively, as bondholder you may choose to sell the bond in the open market prior to its maturity date. There are secondary bond markets, where – just as in the stock markets – you can monitor bond prices and trade them to try and realise capital gains. To do so, you will need to understand a key determinant of price movements in the bond market – interest rates.

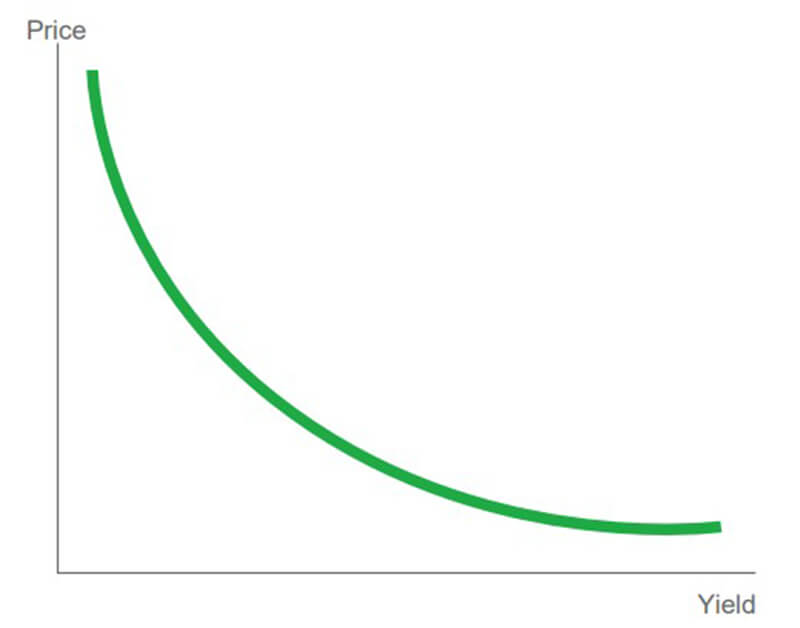

What is the Inverse Relationship?

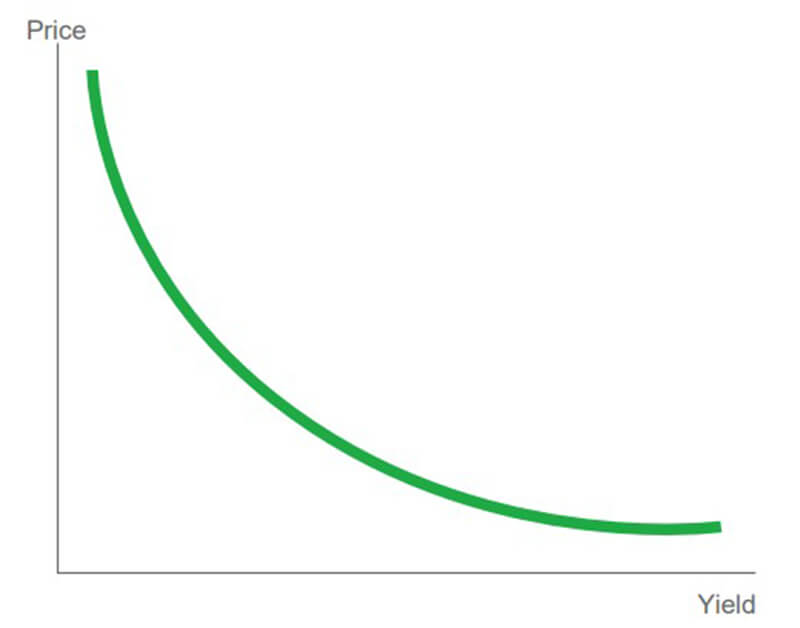

There is typically an inverse relationship between bond prices and interest rates. That is, when interest rates rise, bond prices will tend to fall, and vice versa.

A simple way to understand this relationship is for you to look at various bonds (and their issuers) as competing recipients for your investment funds. When making your investment decision you will tend to invest in the option which earns you a higher return.

When the interest rate goes up, a newly issued bond (Bond B) will yield more than 5% to keep up with the market. The logical thing in this situation would be to sell the original Bond A and buy the new Bond B to earn a higher return. Such selling pressure on Bond A will depress the price of the bond, causing it to trend downwards – in the opposite direction of interest rates. Alternatively, you could also view it as Bond A having to lower its price to make itself a sufficiently attractive investment for investors to own it.

Conversely, when the interest rate goes down, Bond A will seem a more attractive investment when compared to the newer Bond B which is being issued at a lower yield. The buying interest for Bond A will start to push up the price of the bond – causing it again to move in the opposing direction from the interest rates.

As illustrated in the above example, bondholders may potentially benefit in an environment of falling interest rates as the price of their bond holdings will tend to rise.

Please note that this is an example only and any potential returns set out herein are not indicative of actual returns that may be achieved in any investments that you may decide to make.

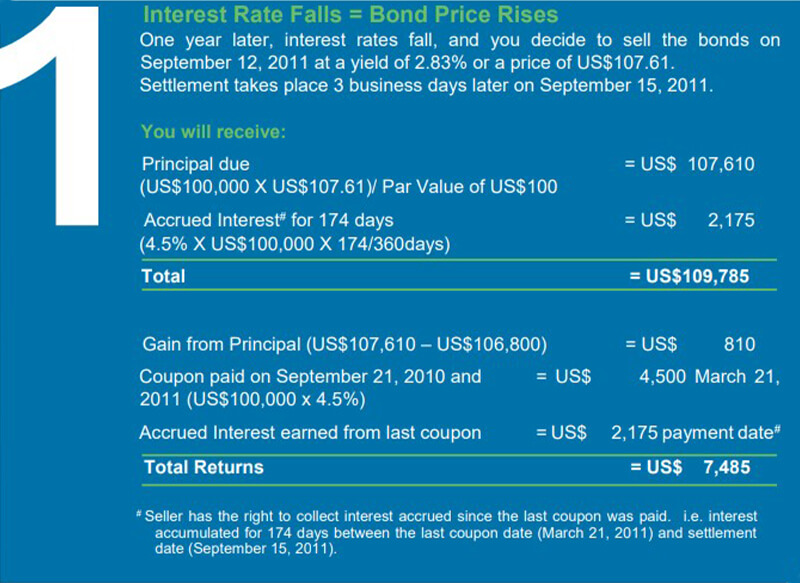

Example

On August 18, 2010, you buy a Company ABC bond for a nominal amount of US$100,000. It has a fixed coupon of 4.50% p.a. twice a year and matures on September 21, 2015.

This means every March 21 and September 21, a fixed coupon payment of US$2,250 [(4.5%x $100,000)/2] will be paid out.

The bond purchase settles 3 business days later on August 23, 2010. The current offer of the bond is at a price of US$106.80 or 3.044% yield to maturity.

You have to pay:

Principal payable (US$100,000 X US$106.80/Par Value of US$100) = US$ 106,800

Accrued Interest^ for 152 days (4.5% X US$100,000 X 152/360days) = US$ 1,900

Total = US$108,700

^ Seller has the right to collect interest accrued since the last coupon was paid. ie. interest accumulated for 152 days between the last coupon date (March 21, 2010) and settlement date (August 23, 2010).

If you decide to hold the bond to maturity, ie. September 21, 2015, you will not be subject to the price fluctuations of the bond. If the issuer does not default, you will receive the full nominal amount of the bond, that is, US$100,000 plus the fixed coupon paid twice a year. However, you may decide to sell the bond before maturity.

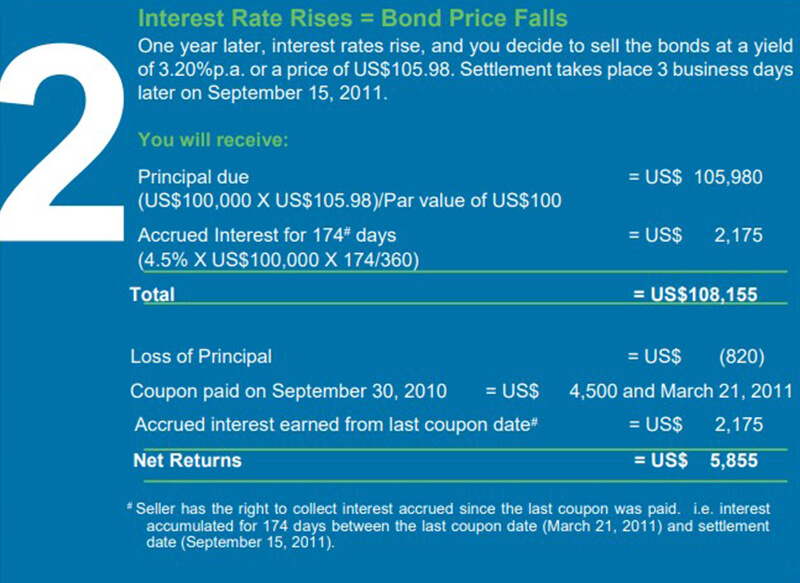

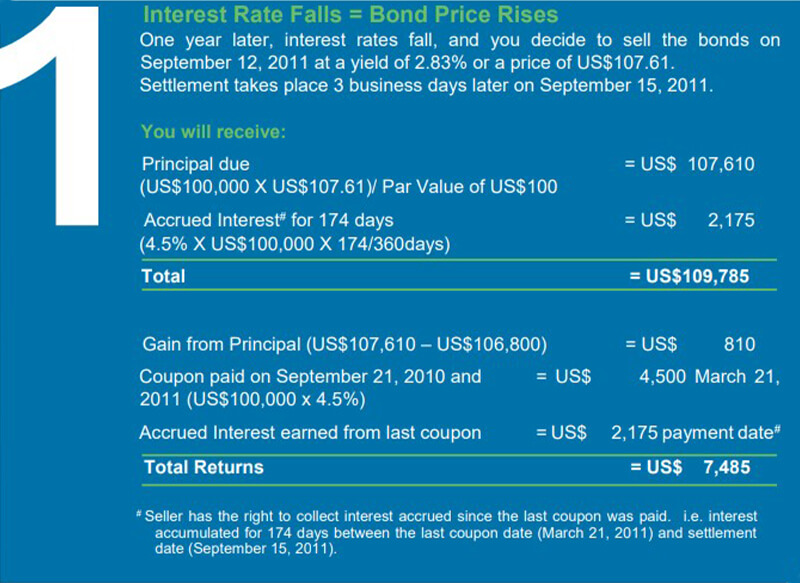

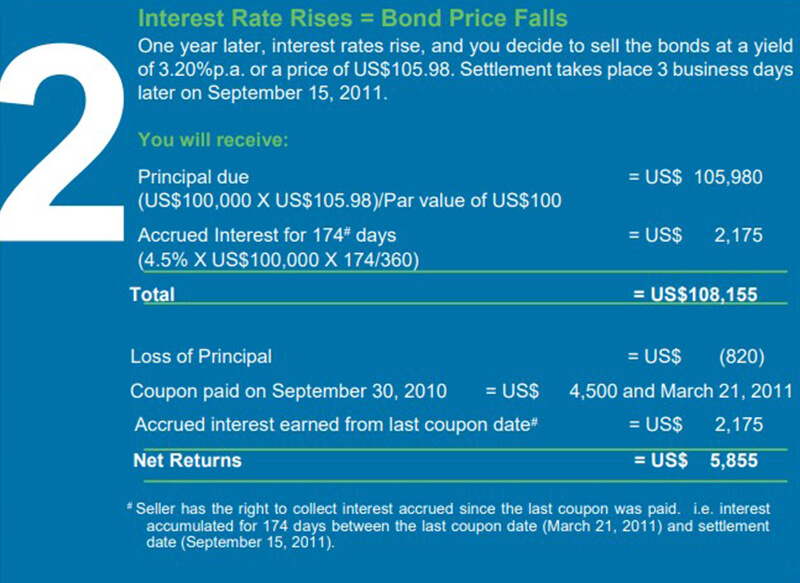

Scenario

Scenario

Please note that these are examples only and any potential returns set out herein are not indicative of actual returns that may be achieved in any investments that you may decide to make.

What are the Risks?

Credit or Default risk

This is the risk that the bond issuer or borrower is unable to meet the coupon or principal payments on any outstanding bonds or debt (not just the bonds you may be holding) when they fall due (for example, due to bankruptcy or insolvency), and go into default.

Interest rate risk

Interest rates and bond prices are inversely related. Should interest rates rise, the price of your bond will tend to fall (and vice versa). The longer the time to maturity of a bond, the greater the interest rate risk.

Foreign Exchange risk

Some bonds are denominated (and the issuer’s payments made) in a foreign currency, which may fluctuate against your home currency. The impact of such foreign exchange movements may offset any interest or capital returns you may receive from the bond investment.

Liquidity risk

This is the risk of having to sell a bond at discounted prices due to the lack of a ready market or buyer. When a bond has a low credit rating (for example, due to the fact that it is part of a small issue or that the issuer’s financial situation is questionable), the liquidity risk will tend to be higher.

Event risk

Events such as leveraged buyouts, mergers, or regulatory changes may adversely affect both (i) the bond issuer’s ability to make payments on the bond, and (ii) the price of the bond.

Sovereign risk

Payment of the bond may be affected by the political and economic events in the country of the issuer of the bond. For example, the issuer may be forced to make payments in the local currency of the issuer’s country instead of the original currency of the bond.

How can we help you further?

Do you have a question on what you have just read?

Would you like to have a further discussion on this subject?

Contact your Relationship Manager, or any of our Standard Chartered Bank locations closest to you for more information.